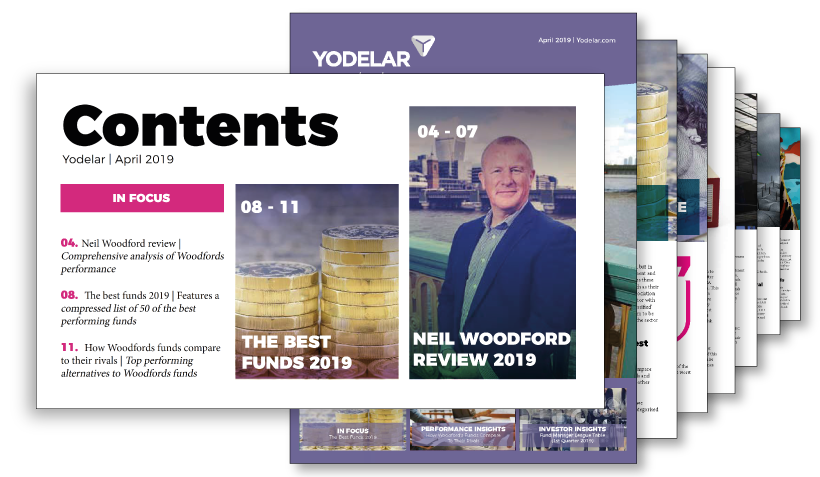

IN FOCUS

NEIL WOODFORD REVIEW

At one time Mr Woodford could do no wrong, yet a tumultuous few years has seen his star dim to a flicker. His battered funds languish near the foot of their sectors for growth, and with no sign of improvement, even his most ardent supporters are beginning to question his strategies as investors jump ship in their masses. In this article we analysis factually how his funds have performed and how the future looks for Neil Woodford?

Our analysis of the 5 funds currently managed by Neil Woodford identifies that 4 have made a loss since their inception, with the remaining fund returning growth that was among the lowest in its entire sector.

Access this edition plus all premium features. Subscribe today for £1*.

IN FOCUS INCLUDES

- A guide to the 6 different types of ISA's currently available

- 15 ISA funds, ETF's, and Investment Trusts that have consistently excelled.

- The 1, 3 & 5-year growth and sector ranking for each of the 45 funds featured.

.png)