- 80% of St James’s Place unit trust funds rated as poor performing

- High charges and poor performance across their entire range of funds

- 80% of SJP funds performed worse than half of same sector over 10 years.

- 15% of all St. James’s Place funds returned losses over 10 years

- 75% of SJP funds yielded returns below the sector average over 5 years

- St James’s Place initial fee more than twice the industry average

- £100 billion managed by St James’s Place is held in poor funds

- Restricted advice with no onus to provide comparative performance.

In this updated St. James's Place review we provide an independent assessment on the performance of all St. James’s Place funds and their range of portfolios, comparing there performance against all other same sector funds available to UK investors.

Also included is a detailed analysis of St James's Place fund and portfolio charges. We analyse the monetary impact that SJP charges and its business model has on investors, as one of the most expensive propositions available to UK investors.

What is Included In This Article

Some of the key topics covered in this article:

-

Are St James's Place any good? - SJP manages over 10.3% of the UK investment market but does that mean they are any good?

-

SJP value assessment report - Why their performance is worse than they claim

-

Long term underperformance from their funds

-

St James’s Place performance summary - We identify each funds rating based on their performance

-

SJP client money invested in poor performing funds - We explain why 84% of SJP Client money is invested in poor performing SJP Funds

-

SJP charges erode portfolio returns - How SJP fees reduce a portfolio’s value

-

The risks of investing with SJP - Why investing more than £85,000 with SJP can add more risk to your portfolio

Yodelar Reviews: The Background

At Yodelar we review close to 4,000 main stream unit trusts and OEIC's on a monthly basis, we asses over 80,000 pension, Investment Trust, Life and ETF funds, and make this information readily available to UK and non UK investors. On a monthly basis we also review the overall performance of over 100 fund management brands, including St James's Place.

SJP are unique in the respect that they are a fund management brand, and an advice/distribution business model, meaning they distribute their funds via their St James's Place Wealth Management Partners, all of whom have made the choice to offer clients a restricted only service.

Most Independent Financial Advice or whole of market advice firms, which make up the largest proportion of the market, are not tied to a particular fund manager. Their role is to asses the market and ensure their clients are invested suitably to meet their objectives and are using the most suitable funds.

Yodelar.com and our advice business Yodelar Investments receive more emails and calls from unhappy SJP clients than any other company, that said we do recognise they are the biggest restricted firm in the UK.

SJP clients that question our research with SJP are provided a stock answer that is complicated and distracting. We would encourage all investors to evaluate their specific St James Place portfolio directly using our free portfolio analysis service.

To access the latest fund managers analysis (100+ fund managers including St James's Place updated monthly), please register for free access to Yodelar's Investor Hub

Click Here To Register For Investor Hub

Are St James’s Place Any Good?

St James’s Place is the largest investment adviser firm in the UK. They currently manage 10.3% of the £1.39 trillion currently invested in UK retail funds. This has been achieved by an aggressive adviser recruitment program spanning back 3 decades. Over the last 10 years, consumer awareness has increased due to online access to fund information, and the value to clients has been questioned by Yodelar, The Times and many others.

Independent reviews of St James’s Place over the past years have continuously highlighted that a large proportion of their funds perform poorly when compared to all other same sector funds. Combined with the poor performance of their funds, the costs to run their model has resulted in a fee structure that is among the most expensive in the industry.

The majority of SJP clients are unaware of this poor long-term performance and high charges. Those that are aware are often tied in with hefty exit penalties or trust vehicles making it difficult to leave.

SJP understand, that their advisers/partners form relationships with clients, and most investors will require that relationship to navigate in what they feel is a complicated arena. However, the pandemic coupled with information available online has increased investors acceptance to deal with an advice firm remotely. The result is consumer investors are more focused on investing efficiently while managing costs and risk.

For St James's Place business model to continue to be financially successful for shareholders they must continue to acquire more advice firms who transfer clients and funds to their restricted model, often questionably coming from a whole of market investment model.

The model is reliant on the pressure/financial success of their partner advisers, the comparative performance of their unit trust managers and the financial success of St James's Place PLC, all of which come at a cost to SJP clients through high initial charges.

The SJP Value Assessment Report

Why their performance is worse than they claim

The FCA requires fund management companies to complete an annual value assessment report of the fund range they offer consumer investors.

How they conduct this assessment, and the criteria used is unfortunately left up to the company. Despite high charges and poor performance SJP have labelled the majority of their funds as ‘good’ or ‘broadly delivering value’, which has led to the industry questioning the real value of such reporting.

SJP criteria is as follows:

- 40% -how funds compare to benchmarks or other similar funds

- 40% - how well a fund meets its objectives

- 20% - based on whether risk has been managed properly, and to what extent the funds manager has considered ethical and sustainable issues

This criteria gives SJP a wide net in conducting their self analysis of funds, and to an astute reader the 30 changes to fund managers and funds admittedly made over the last 3 years is self evident in itself.

SJP has concluded that only three of its funds performed unsatisfactorily and were not offering value for money. These are the Gilts, Global Emerging Markets and Japan funds. The rest were rated as good, broadly delivering value, or having a new management team in place so it is too early to say.

When assessing performance, SJP has previously said in response to criticism that they believe a fund has 'outperformed' if it ranks better than 50% of benchmark funds. Yet it is broadly recognised across the other 90% of the industry that a top performing fund is a fund that continues to perform better than 75% of their peers( i.e. Top Quartile).

23 of the 31 unit trust funds with 5 year history have performed worse than at least half of their sector peers, yet from these 31 funds, SJP have rated 24 as either 'good' or 'broadly delivering value'. For example, the £2.89 billion SJP Global Quality fund has a ‘Good’ rating for performance in SJP’s value assessment report. But the fund has ranked in the bottom half of its sector over the past 1, 3 ,5 & 10 years.

SJP have put a ‘too early to say’ marker on a further 3 funds due to recent change in their management but each of these funds have consistently ranked among the worst in their sectors for performance. Only 3 of the 31 funds have been placed on the watchlist by SJP.

Although value assessment reports were introduced by the FCA to help investors identify value from providers their real value is questionable as they are published by the provider themselves who can determine the criteria for the grading.

In our review we analyse and clearly identify how each St James’s Place fund has performed against all similar options available to UK consumer investors.

Long Term Underperformance From SJP Funds

10 Year Performance Facts

- 91 SJP funds with a 10 year history.

- 47 have ranked in bottom 25% over 10 years

- 26 have ranked in bottom 50% over 10 years

- 13 ranked in the 2nd quartile

- 5 have outperformed at least ¾ of their sector over 10 years.

- 80% of SJP’s funds performed worse than at least half of their competitors within the same sector over the past 10 years

5 Year Performance Facts:

- There are 126 SJP funds with a 5 year history.

- 51 have ranked in bottom 25% over 5 years

- 36 have ranked in bottom 50% over 5 years

- 14 ranked in the 2nd quartile

- 25 have outperformed at least ¾ of their sector over 5 years.

- 69% of SJP’s funds performed worse than at least half of their competitors within the same sector over the past 5 years.

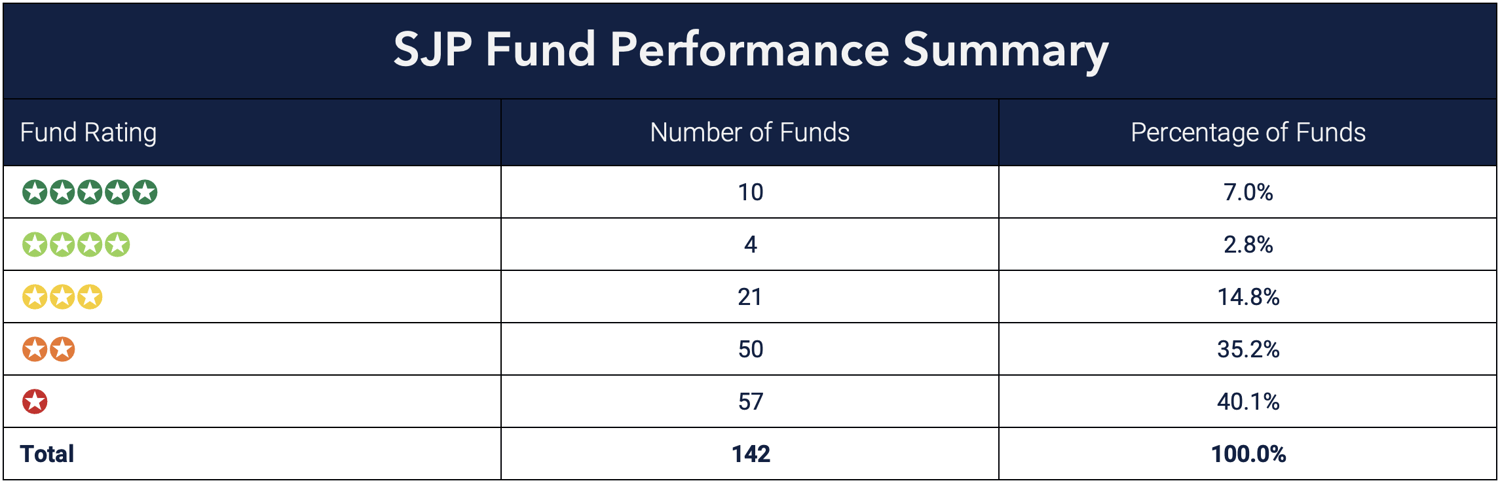

St James’s Place Fund Performance Summary

133 of the 142 SJP funds analysed returned negative growth over the past year. However the recent years performance should not hold too much weighting due to the worst market volatility experienced in most sectors.

In our analysis we do asses the latest 1,3,5 and 10 year performance figures. Over the last 5 to 10 year period, our analysis shows that widespread underperformance remains for a large portion of SJP funds.

Without even taking into account inflation, 15% of St. James’s Place funds have returned losses over the last 10 years, in fact 80% of their funds produced returns that were worse than at least half of their competitors within the same fund sector.

Over 5 years, almost 75% of SJP funds yielded returns that were below the sector average.

The industry has a general acceptance that a fund that ranks in the top 25% when compared to all other same sector funds is a better performing fund.

Contrary to this SJP say that a fund not in the worst 50% of same sector funds is a top performing fund. SJP have created an assessment line that is well below industry standards, aware that the majority of their clients will read their correspondence only and not independent research.

Yodelar’s independent analysis of 142 SJP funds identified that three quarters have consistently ranked in the bottom 50-75% of their sectors over the past 1, 3 & 5 years and have received a poor 1 or 2 star performance rating.

Click here for further information on how Yodelar rate investment funds.

SJP Unit Trust / ISA Fund Performance

80% of St James’s Place unit trust funds rated as poor performing 1 or 2 star funds, which is one of the worst of the 100 plus fund management firms in the UK.

When we look at the entire unit trust market, and analyse the 3,951 funds classified by the investment association across all fund manager brand names, 56% rate as poor performing 1 or 2 star funds, with 17% receiving a good 4 star or top performing 5 star rating.

The fact that a significant proportion of SJP funds fall within the 1 or 2-star rating is simply down to their lack of quality, consistent poor performance, and possibly high internal costs/charges.

From the 3,951 main funds available to consumer investors, 18% have been able to consistently maintain a top 25% performance ranking within their particular sector (4 & 5 star funds) over a 1, 3 & 5 year period. These funds are available to all UK investors, but not via the SJP proposition.

As identified in table 2 below, the average performance rating of SJP unit trust funds is significantly lower than the industry standard across all investment sectors.

Through our fund research service, we provide consumer investors with the ability to review all funds and fund managers in all sectors and rank accordingly to identify the top performing funds. We annually analyse over 100 fund managers (including St James’s Place) and independently highlight the best performing funds monthly via our regular magazine and Top Performing Funds report.

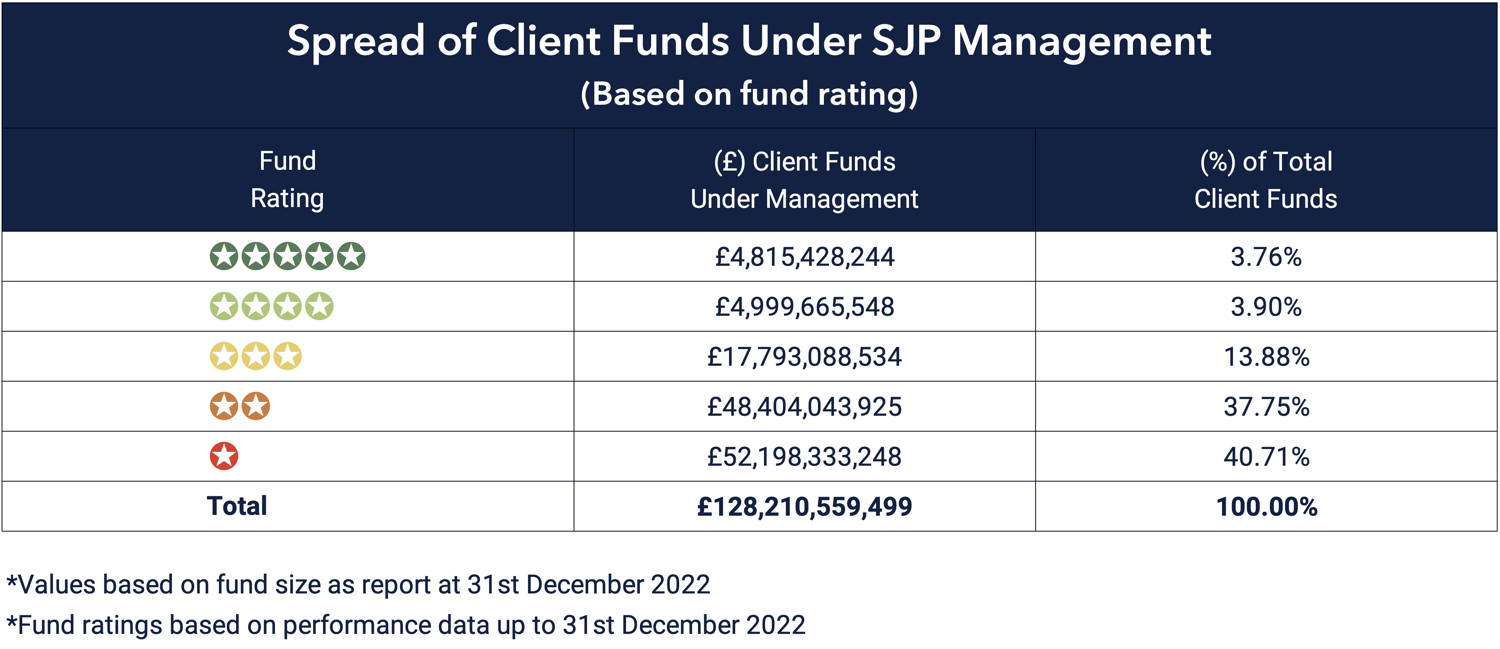

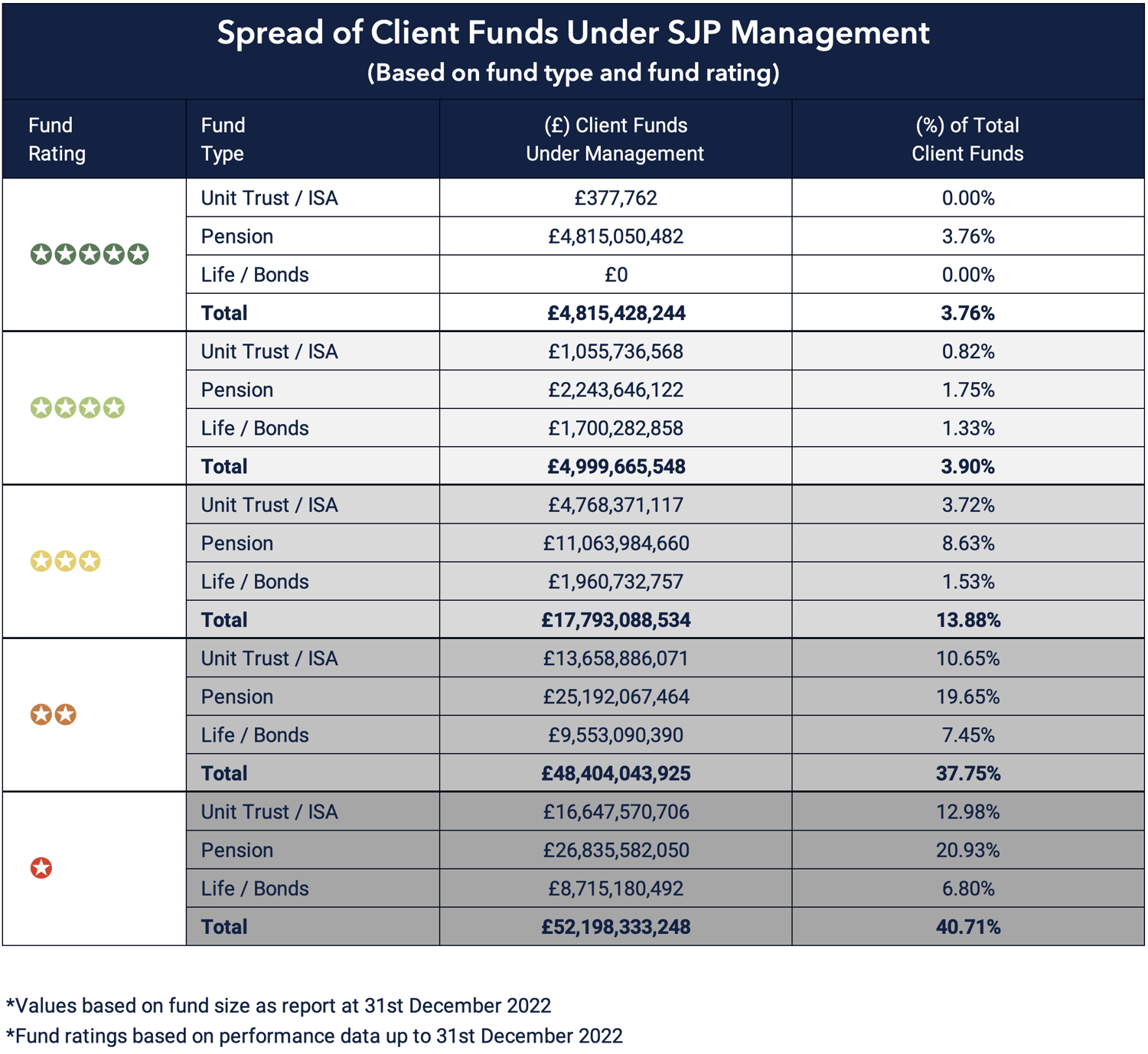

SJP Client Money Invested in Poor Performing Funds

84.5% of Client Funds Are In Poor Performing SJP Funds

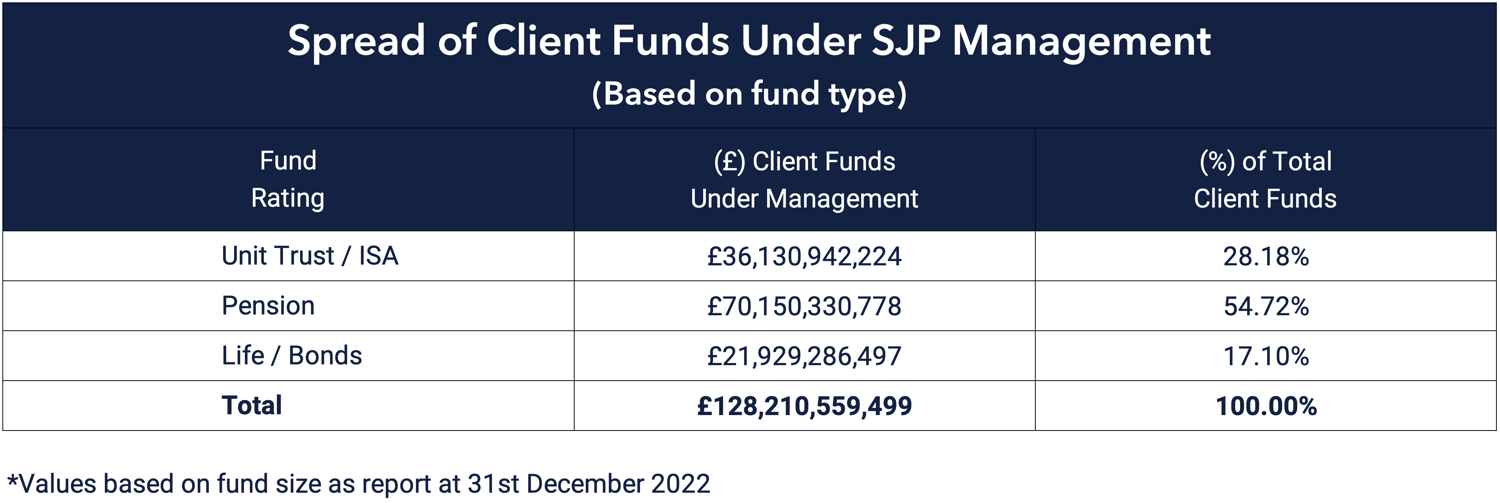

There is currently £128 billion of client money under the management of St. James’s Place in their 105 unit trust, Life and Pension funds. Our analysis of these 105 funds identifies that £100 billion (78%) is held in funds that received a poor performing 1 or 2 star rating.

In contrast, £9.8 billion or 7.66% of client money invested with SJP is under the management of their range of top performing 4 and 5 star funds.

St James’s Place Fund Management

SJP provides investors with an in-house range of products and portfolios that hold only SJP funds. The main limitation of the SJP model is that their advisers must only recommend SJP products and funds meaning their investors are only exposed to SJP funds irrespective of how good, bad or indifferent they are. As a restricted advice firm they have no onus to provide clients with comparative performance from all other fund managers, unlike 'whole of market' or Independent advice firms.

To provide a diverse range of funds and portfolios that cater to all risk categories St. James’s Place offer access to 142 funds that have at least 1 years performance history. These are made up of 36 unit trust funds, 35 pension funds, 34 life funds, and 37 offshore funds through SJP International (SJPI).

All of these funds are SJP owned and branded but none are actually managed by SJP themselves. Instead, SJP outsources the management of their funds to other fund management firms. These fund managers are selected by SJP’s investment committee and they are each mandated to build and run the fund in accordance with SJP’s objectives - such as the desired risk exposure and asset allocation. An important point to note is that all these funds/ fund managers are available to UK investors directly, and often at a lower cost with better performance history than those offered by St. James Place.

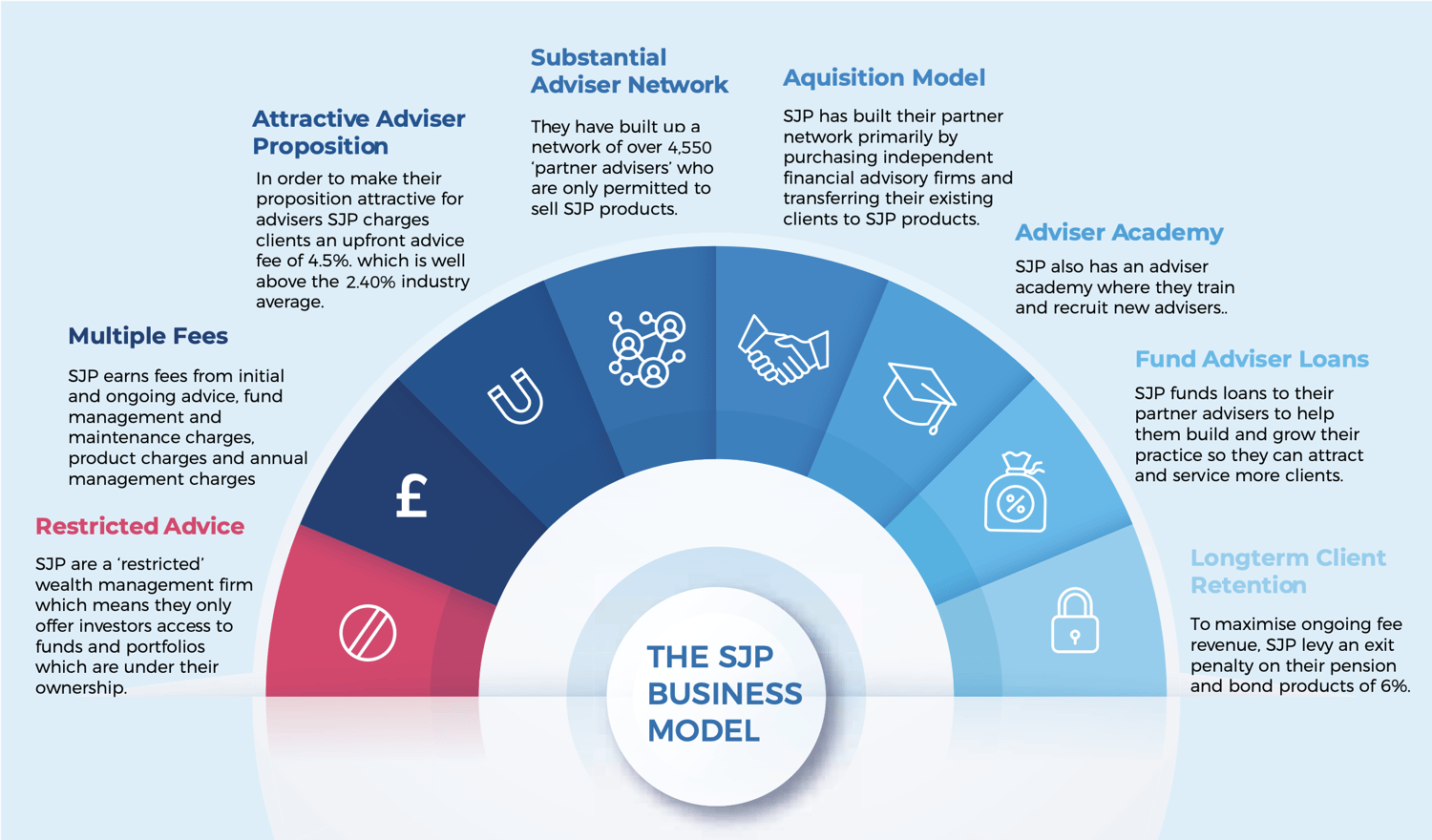

St James’s Place Business Model

Like all wealth management firms, SJP aims to generate fees by managing the money of investment clients. Most inward fees come from initial and ongoing advice fees. But what makes SJP’s proposition different is that their business model creates several revenue streams as detailed below.

SJP’s model is unique, and one that has helped them become the largest wealth management firm in the UK with some £128 billion of client assets under their management. But this growth has come at a cost, a cost that has been handed down to their clients.

For their model to work it requires them to charge their clients high fees in order to help fund the entire process. But in recent years in particular, greater access to performance information and lower cost products have made the SJP proposition significantly less appealing than it once was. Many firms have adapted and altered their proposition either by lowering costs or by taking steps to improve the quality of funds within their investment portfolios.

In an attempt to adapt, SJP has announced plans to increase its range of tracker funds, which do not have a manager and use computers to follow a market index.

However, due to SJP’s model, their tracker funds will continue to have very high costs compared to other tracker funds on the market, which makes it difficult to see how this approach can work for SJP clients. The company has one tracker at the moment, the Index Linked Gilts fund, which charges 1.11% a year, this is significantly more than the 0.20% average charge for similar tracker funds from other providers.

Many investors have stated that they wish they had invested in St James’s Place Shares instead of their funds. Their high charges, cash flow and high profitability have allowed SJP to acquire more financial advice firms than any other firm in the UK, with SJP clients indirectly footing the bill.

As a distribution model, SJP has been able to acquire IFA practices faster and more aggressively than any other firm in the UK. Their ability to extract large chunks of cash from client investments as initial fees and ongoing charges has allowed them to acquire a large number of advisory firms and associated client banks.

SJP offer large upfront payments to advisory firms as an incentive to join and become a St James's Place partner, a popular option for advisers aiming to retire in the short to medium term. Once onboard newly recruited advisers will transfer their client's investments across to SJP portfolios and funds. The associated upfront fees are again generated, creating more SJP sales revenue to acquire more firms. This strategy has been extremely effective for SJP Wealth Management, but questionable for the client, who is indirectly funding further SJP acquisitions and growth.

Above Average Fees, Below Average Returns

SJP said its customers benefit from its advice, embedded into its fund costs. But as a restricted advice network these costs are seen by many as unjustifiably high.

For example, the UK Equity market is among the most important for investors with the asset class representing a sizeable weighting in many UK portfolios. There are currently a total of 301 funds with a 10 year performance history that service this asset class across 3 sectors - UK All Companies sector, UK Equity Income sector and the UK Smaller Companies sector. The average growth across these sectors over the past 10 years was 96.02%.

Like all asset classes there are good and bad performing funds to choose from and within these sectors there are approximately 50 funds that have consistently performed well receiving a 4 or 5 star performance rating.

There are only 2 UK Equity focused fund options available to St. James’s Place clients - the SJP UK fund and the SJP UK Equity Income fund. Both of which have underperformed.

The SJP UK fund has an annual charge of 1.16%, excluding ongoing advice charges, which is well above the average fund charge of 0.83% across the 3 UK equity sectors analysed. This fund has also consistently performed below the sector average, with returns over the past 10 years of 59.98% ranking 266th out of the 301 funds across all 3 UK Equity sectors.

The SJP UK Equity Income fund also has an above average fund charge (excluding advice fees) of 1.12% and it has also struggled to consistently deliver competitive long term returns. Although the fund fared better than the UK fund it still delivered 10 year returns that were below average.

The above examples highlight the importance of having options when it comes to maximising your portfolio's potential for better returns and the negative limitations restricted investment providers such as SJP can have.

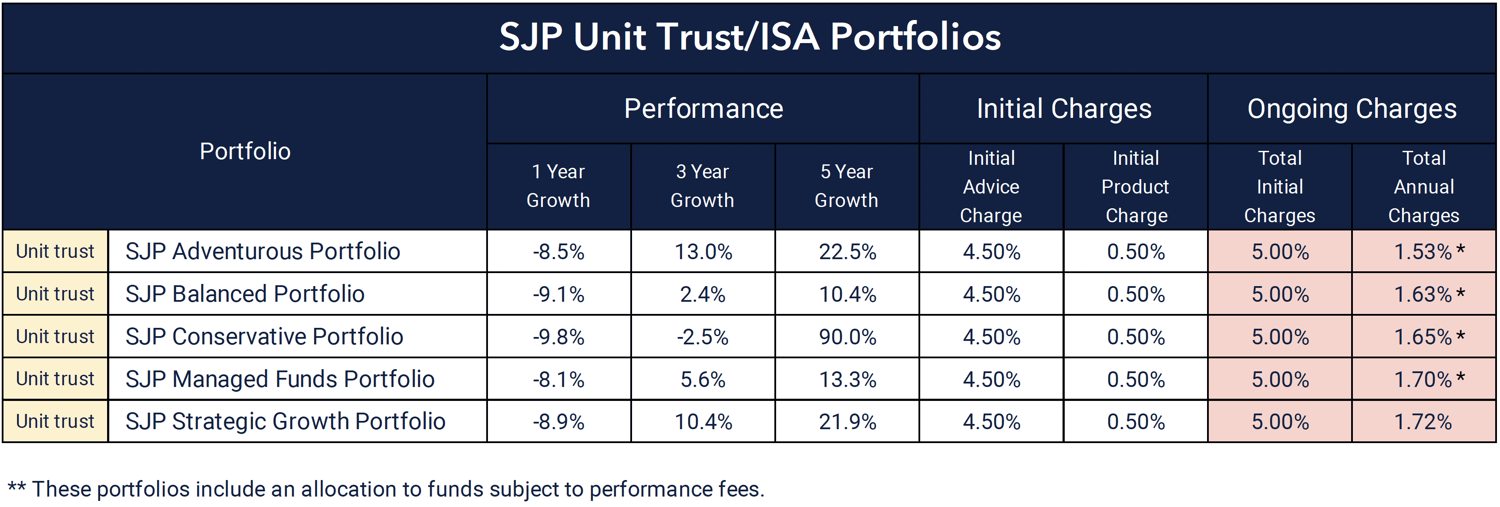

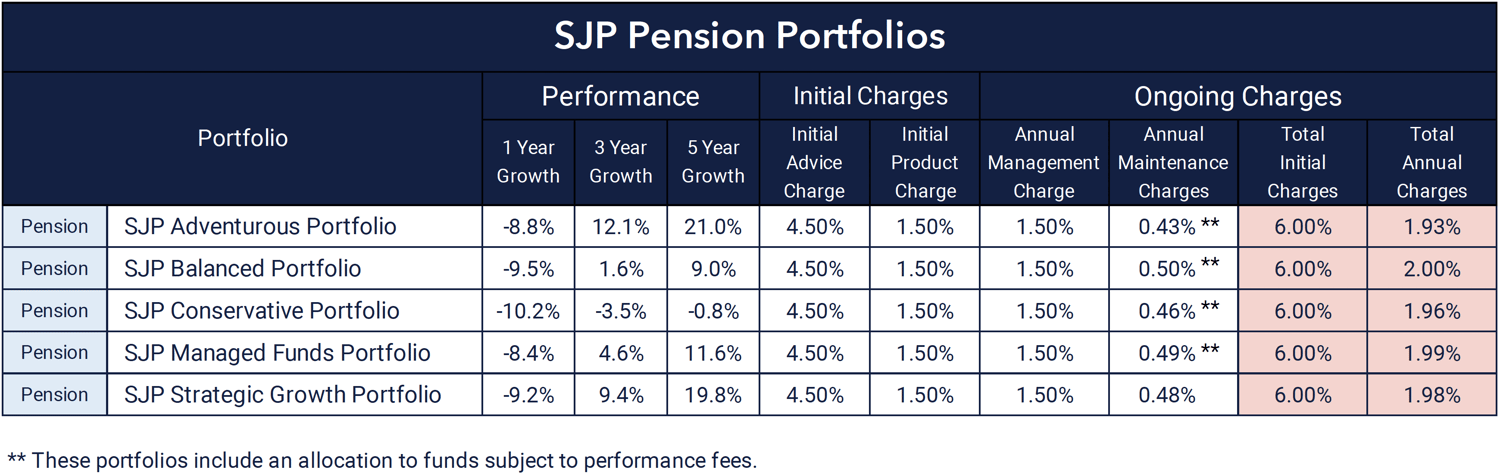

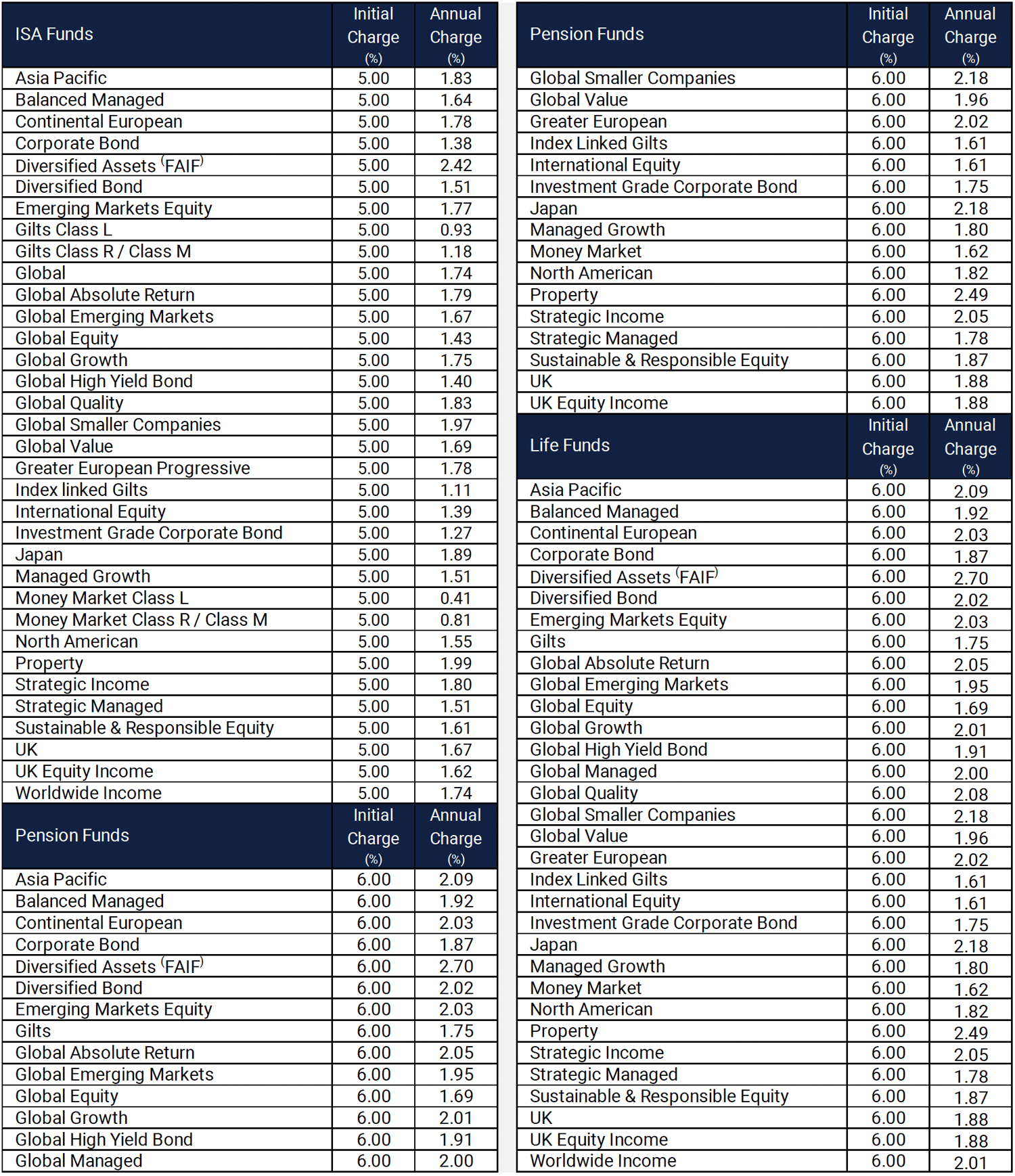

SJP Fund Charges

SJP Charges Erode Portfolio Returns

The charges St James Place levy on their clients has regularly been a source of contention. Their unique and antiquated business model requires a high fee structure to attract and hold on to partner advisers whom SJP are reliant upon to sell their funds and portfolios. As a restricted wealth manager, SJP’s partner advisers are only permitted to invest client money in funds and portfolios owned by St. James’s Place, which ensures they hold all of the money invested. Unlike other providers who invest their clients money in a range of funds across multiple providers and suitable platforms.

The Financial Conduct Authority (FCA) says advisers charge an average of 2.4% of the amount invested for initial advice and 0.8% a year for ongoing advice (1.9% p.a with underlying product and portfolio charges factored in).

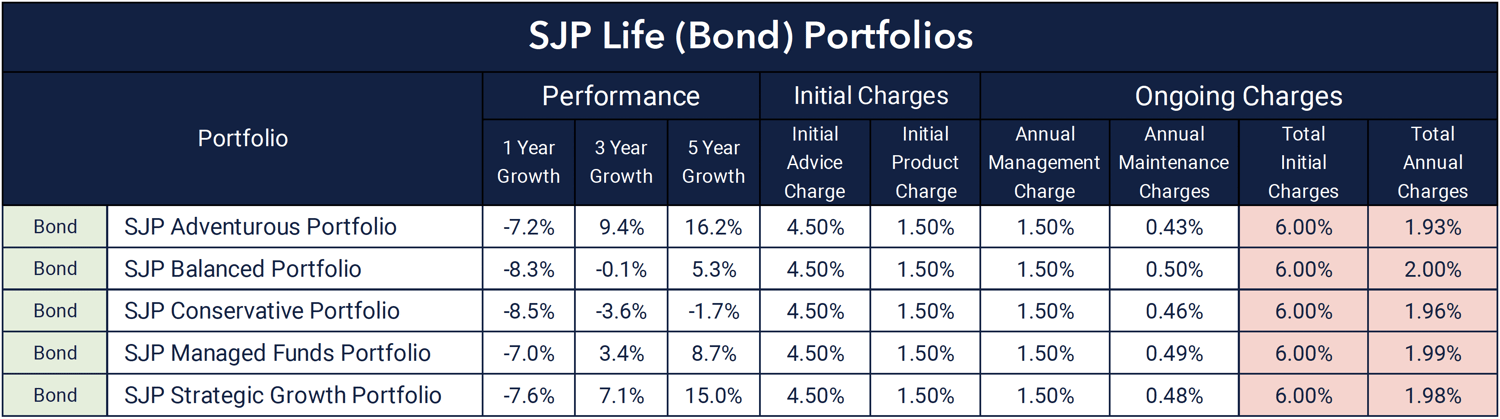

In contrast, SJP charges an initial fee of 6% for the pension and bond products and 5% for their Unit trust and ISA products, more than twice the industry average. Their ongoing fees average 1.97% with further performance fees applicable to some of their portfolios.

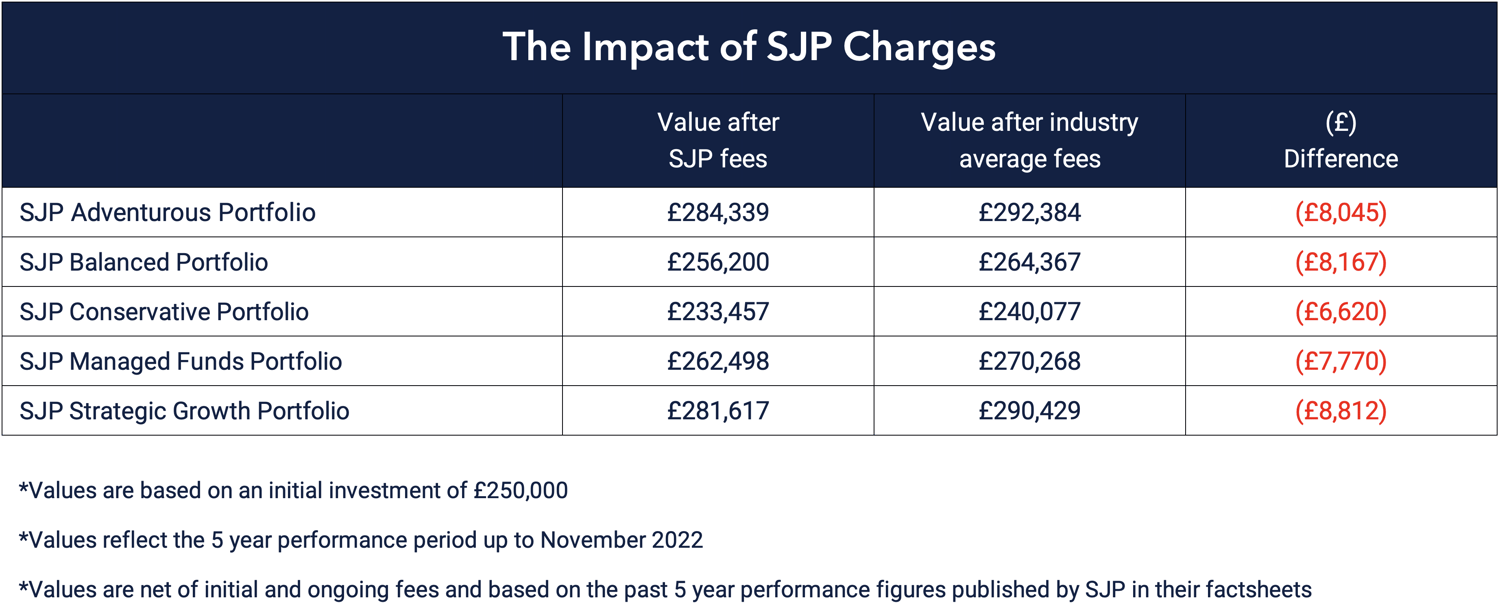

To provide an example of how SJP fees cost more and further erode investment returns, we analysed the performance of each SJP pension portfolio over the past 5 years using an initial investment value of £250,000 and using the performance figures provided by SJP in their most recently published portfolio factsheets. We then compared their performance to that of the same portfolios but applying industry standard fees instead.

The above table shows the real money additional impact SJP’s high fee structure has on a portfolio.

SJP are an expensive proposition and their charges are not reflective of the industry average. In an ever more competitive market, the gap between their pricing model and those of their competitors will likely only widen. This is significant, and something that should not be overlooked.

By applying the average charges instead of SJP’s charges to the exact same portfolio the difference is significant.

St. James’s Place Advice Fees

Similar to other advice networks SJP charges their clients an advice fee on top of fees associated with the funds and products they recommend.

However, the type of advice SJP provides and the type provided by an independent advisory firm is not the same. SJP is a restricted advice network and as such their advisers can only advise their clients on SJP branded products such as their own range of funds and investment portfolios. Therefore, SJP is unable to advise on 99.3% of the pension, life and unit trust market currently available to UK investors. This has led to concerns that SJP Partner Advisers are merely sales agents selling St. James’s Place funds and portfolios, with the majority of these demonstrating a poor performance history.

Some investors also believe that SJP’s restricted advice model means that their comparatively high advice fees are an unnecessary expense, and their relationship with SJP is transactional as opposed to an advisory one. Yet SJP’s 4.5% upfront advice charge remains one of the highest in the industry.

St James's Place Penalty Fees

St James's Place charging model is unique and often criticised for its complexity. Among the most contentious aspects of their fee model are the St James's Place exit penalties which they apply to their range of pension and bond products. Investors in these products who wish to exit and move their money to another provider are required to pay SJP up to 6% of their investment value to do so. SJP has been accused of using this penalty to secure control of clients' investments for several years as a means to increase their ongoing revenue.

This penalty reduces by 1% for each year the investor remains with SJP until after 6 years, at which point, exit penalties would no longer apply. However, there is a caveat, if you make changes to your SJP pension or bond portfolio by adding more funds for example, then the exit penalty would once again apply.

SJP Performance Fees

SJP have added a performance fee to their UK Absolute Return Unit Trust fund. On this fund, a performance fee of 20% of any outperformance becomes payable if the fund outperforms the 3 month Sterling LIBOR benchmark, even though the annual fund charge is 1.86%.

SJP Maintenance Charges

Included in St. James's Place pension and bond products there is an ongoing charge of 0.5% which is to fund the ongoing advice and relationship with their partner advisers.

In addition to this, they also apply an annual maintenance charge, which they say is to fund the management and maintenance of your underlying investments.

The Risk Of Investing With SJP

One of the main risks of investing with SJP is the fact you have all your eggs in one basket. St James's Place is one provider. The Government's Financial Services Compensation Scheme protects investors up to the value of £85,000 per provider.

Many investors are unaware that they are only protected up to £85,000 as an SJP client, whereas a ‘whole of market’ advice firm will ensure you diversify across multiple providers to maximise your government protection. £850k invested across 10 fund manager brands allows an investor to have maximum protection under the FSCS.

Suggested Article - Why Your Investments May Not be Protected

Conclusion

In an age where investment information is more accessible, investors are beginning to look beyond the perceived security from investing with large corporations such as St James's Place. They are more focused on performance, quality and value when making investments decisions, or assessing quality advice. They are also more savvy in regards to risk and the issues around relying on one provider only.

Among the factors to drive investment decisions is protection, which is even more prevalent on the back of the high profile collapse of Neil Woodford in 2019.

As a result, the government's Financial Services Compensation Scheme (FSCS) and the protection it provides to investors has become a more important factor in the decision-making process of investors. As mentioned, this scheme protects investors up to a maximum of £85k per provider, which makes it riskier for investors who rely on one provider such as St James’s Place.

A diverse portfolio using the best brands in the various sectors allows investors to have a diverse portfolio with more protection from the Government's Financial Services Compensation scheme.

Today, it is much easier to access real information such as performance and ranking data which in the past was the biggest challenge to the traditional decision-making process of investors. This is diluting the authority of referrals, recommendations and advice relationships, and it poses one of the biggest threats to wealth management firms such as St James's Place, whose restrictive model is becoming increasingly less appealing.

With relevant information available Investors are now better equipped to make informed decisions that are driven by a desire to invest efficiently using the better performing fund managers for improved outcomes. We welcome the fact that investors are spending more time assessing the performance and quality of funds & investment products.

SJP’s business model is focused on complete ownership of their client journey and generating multiple revenue streams from each client.

Although highly profitable, SJP’s business model has been accused of being outdated in the new information age. The performance of their funds has consistently been poor and this coupled with high charges and restrictive practices has been a principal reason why a growing number of informed investors are moving away.

An increase in investor knowledge has encouraged many investors to move away from SJP, towards lower cost, better performing alternatives, who place clients at the centre of their value proposition.

The very model that has helped SJP become a fund management giant is the model that is restricting them from adapting to the modern investing environment, and the one that makes them unattractive to informed investors.

Despite accusations of being out of touch with investors SJP have recently said they have no plans to review their charging structure, nor do they believe that their fund performance is cause for any concern. But the fact is investor decisions are now being driven by these very factors, and as identified in this report, all but a select few of SJP funds have consistently underdelivered, which makes their long term investment proposition one that is distinctly less appealing.

About the Author: This article was researched and constructed by the Yodelar.com Research team. Every year we complete performance reviews on 100+ fund managers assessing their funds and comparing their results to the performance of all other same sector funds. Our Independent research team have given St James’s Place a ‘Poor’ ranking as a fund manager, and investment option for consumer investors.