Two of the most important elements of investing are asset allocation and fund selection. Most investment portfolios have been built to a pre-set asset allocation model. This asset allocation model spreads risk by dictating what percentage of a portfolio is invested in which region or industry. It is essential to successful, long-term investing as it helps to ensure your portfolio is invested proportionately to fit your risk profile and investment objectives.

One of the key benefits of Asset allocation is that it naturally reduces the number of investment funds that are suitable for your portfolio.

However, with some 70,000 investment funds and share classes available, even with a defined asset allocation model, the enormous scale of choice makes it practically impossible for investors and professional investment advisers to efficiently analyse, rate, segment and select investment funds that deliver the best mix of balance and performance.

Highly Competitive And Overly Complex

The investment industry is a highly competitive market worth trillions of pounds and the funnel through which our money flows can be influenced by several factors that are not necessarily in our best interests. For example:

-

Many prominent media outlets receive sponsorship or advertising revenue from investment brands, and although speculative, it has been suggested that this could result in a monetary fuelled bias which could influence investment decisions.

-

Restricted financial advisers, can only offer their clients a limited number of investments, even if there are more suitable, better-performing alternatives available.

-

Recommended funds lists offered by major fund supermarkets, carry significant influence when it comes to fund choices. However, despite insisting that 'no one pays to get on the list' and that all funds are selected on merit, many have a history of poor performance, which has raised concerns as to the credibility of promoted funds lists.

As part of our continuous strive to champion investor needs, we remain entirely independent of fund manager brands ensuring we can deliver unbiased and factual performance information on fund managers and their funds, helping investors and advisers identify the best performing investments.

Identifying Top Performance

Although market movements dictate investment growth, not all funds can consistently maximise growth during fluctuating periods. Indeed, a large proportion of funds merely achieve growth through the performance of the market - when a market is thriving they benefit from easy gains, but when the market is struggling they are unable to maintain those gains.

In an industry that has often been criticised for its complexity and lack of transparency identifying top performance has never been straightforward.

However, like any industry, there are those who do a better job than others. When it comes to investing there is a proportion of funds or fund managers available that regularly demonstrate exceptional performance by following best practice processes.

These funds are typically comprised of strong underlying holdings, managed by quality fund managers who consistently deliver returns that outperform the market and their peers.

At Yodelar, our unique algorithm ranks funds and fund manager performance making it easy for investors and advisers to identify the best funds and top performing fund managers.

How Funds Are Ranked

Investment funds are comprised of shares in numerous companies within particular regions or industries. For example, the North American sector is a popular sector that most investment portfolios invest in. How much of our portfolio it holds is down to our risk profile and the asset allocation model we choose to follow.

However, there are hundreds of funds and share classes in this sector with similar objectives, yet their quality and performance can vary significantly. This is true for all other investment sectors.

Comparative Performance

To identify which funds have performed the best our algorithms filter each fund based on the sector they are classified in. We then measure each funds growth returns over the recent 1, 3 & 5-year periods alongside all other same sector funds. We then rank each fund from 1st to last based on the level of growth they returned during these periods.

Quartile Ranking

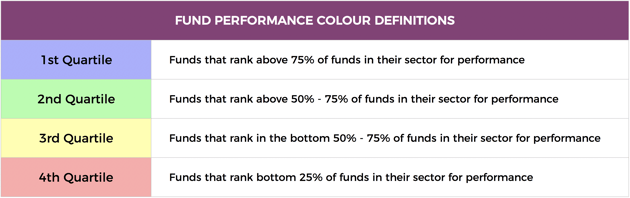

The 1, 3 & 5-year growth and sector ranking of each fund is also colour coded to identify their quartile performance within their sectors during each of the periods analysed.

Performance Rating

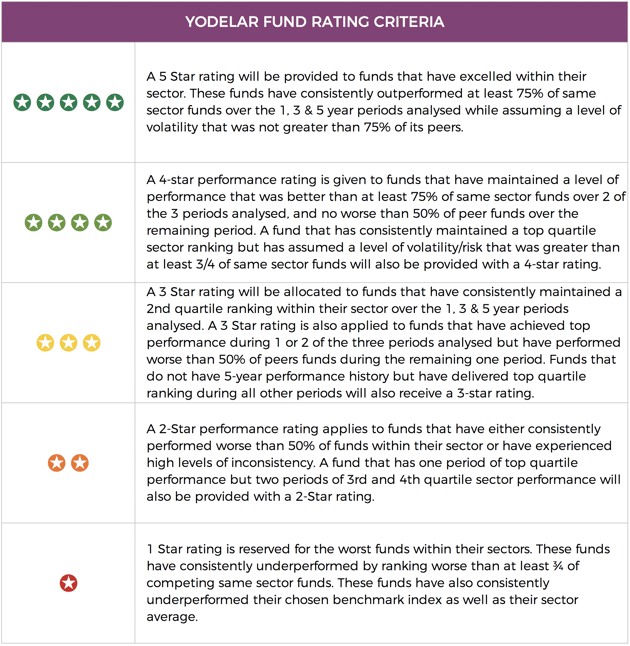

Each sector classified fund is then provided with an overall performance rating based on their comparative performance. Funds with a 1 or 2-star rating have a history of poor performance by consistently delivering returns that are below the sector average and worse than at least 50% of their peers. Whereas the funds with a 4/5-star rating have continually delivered returns that have outperformed the majority of their peers.

For example, ABC fund is classified in a sector with 99 other funds. To identify the quality of this fund we analyse its performance only against the performance of the 99 other funds with the same sector classification. Over the recent 1, 3 & 5-year periods this fund returned growth of 5.00%, 10.00%, & 15.00% which was consistently better than at least 75% of its peers. Therefore, because of its consistently top quartile sector ranking, it would receive a 5-star performance rating.

Volatility

However, the level of volatility assumed by some funds within the same sectors can vary. Essentially, volatility calculates the risk associated to the value of an asset; the higher the volatility, the more likely its value will fluctuate in either direction. Therefore, if a fund has consistently maintained top quartile performance within its sector - but in doing so assumed a level of volatility that was greater than 75% of its peers - it would receive an overall 4-star performance rating instead of 5.

By ensuring your portfolio contains only consistently top performing funds, within an asset allocation model suitable to your risk profile, you have added the 2 main ingredients to building a successful portfolio.

Investors are continually informed that past performance is not an indicator of future success, but we believe that past performance is a very important metric. Past performance can identify fund manager expertise, and an ability to do better than their peers. In every industry past performance is relevant - the investment sector is no different.

Of course, no one knows what the future holds, but by following an analytical, unbiased approach to fund selection and portfolio management, investors can consistently maximise their portfolio performance.

Empowering Investors To Maximise Their Portfolio Returns

Ultimately, as an investor, you have the choice to invest in funds that consistently deliver top performance OR funds that underperform within their given investment sector - and like any industry, there are those who simply do a better job than others.

Whether you prefer to manage your own portfolio or have someone do it for you, Yodelar is an essential knowledge base suitable for all investors. As a subscriber, investors have access to all factual fund performance, and ranking reports, including the top performing funds report, detailing all funds that have consistently maintained top quartile sector performance over the recent 1, 3 & 5 years. These factual and independent reports enable investors to clearly identify which funds are top or poor performing and help investors to make more informed investment decisions.