2020 ended on a high, the final weeks of the year saw 3 viable Covid19 vaccinations pass their clinical trials prompting major governments to announce the rollout of ambitious vaccination plans. 2021 began with growing optimism that the end of the pandemic was finally in sight.

In anticipation that all sectors, particularly those hit hardest by the pandemic will be able to increase their operations the first quarter saw a large sell-off in tech companies and a sharp increase in the purchase of stocks in industries such as travel, cinema and car manufacturers.

This sell-off contributed to many of the UK’s most popular funds, many of whom had experienced a surge in growth since markets bottomed out at the start of the pandemic in March 2020, to drop in value. The Nasdaq 100, which is a stock market index made up primarily of the world’s largest technology companies, declined by 10.9% between 12th February and 8th March this year.

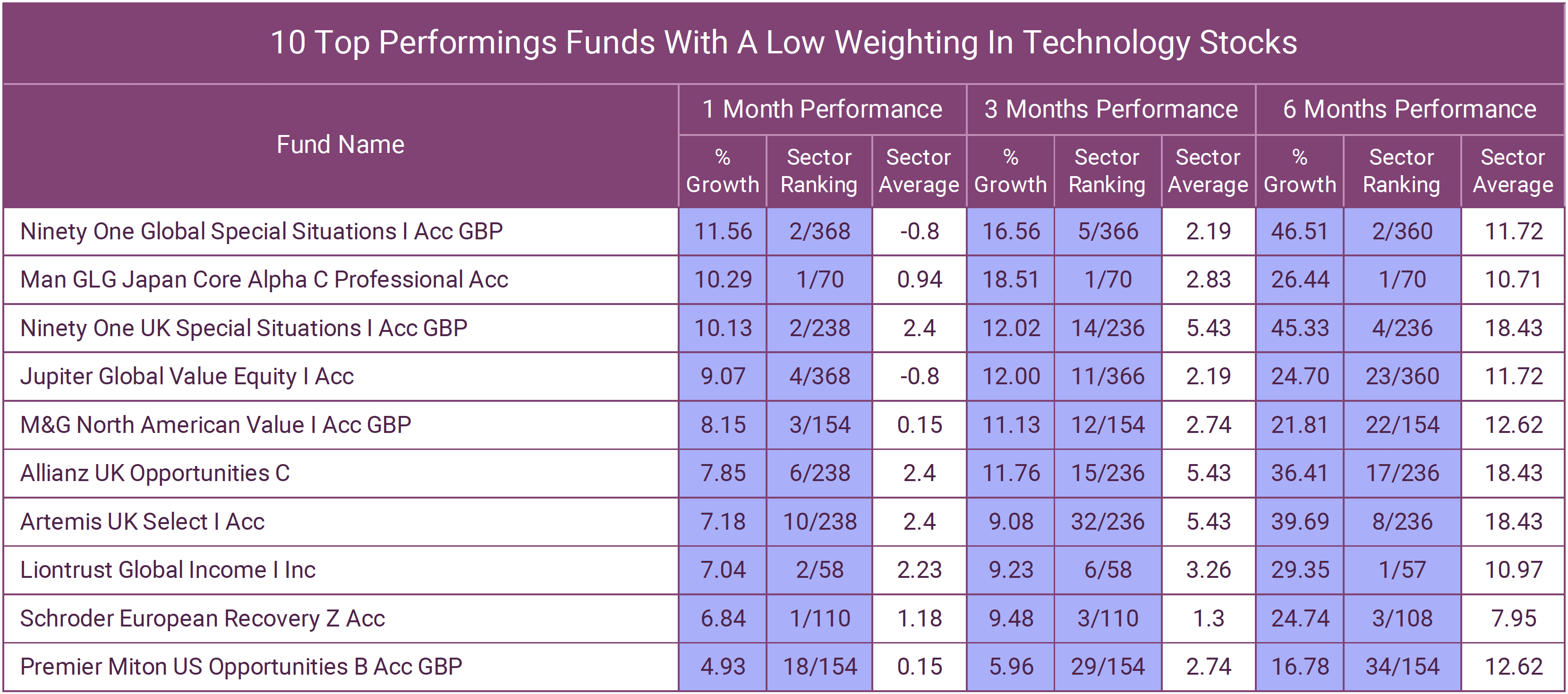

As a result, a growing portion of investors scrambled to move their investments into funds with a lower weighting in technology stocks but finding such funds can be difficult especially those that are well managed.

In this report, we feature 10 funds with a low weighting in technology stocks that have consistently performed well within their sectors and are well-positioned to benefit as markets hit hardest by the pandemic look towards recovery.

Ninety One Global Special Situations Fund

The Ninety One Global Special Situations Fund has a Global investment approach with 90% of the fund invested in companies in American, European and UK equities. The Fund focuses on investing in stocks believed to be undervalued by the market with the majority of its holdings in financial, industrial and consumer-based companies. Many of these sectors were the hardest hit when the pandemic first hit, indeed, when markets fell in March 2020, the Ninety One Global Special Situations fund dropped in value by a huge 49% compared to a 31% average for the IA Global sector.

Over the past several years as technology companies enjoyed record growth funds such as the Ninety One Global Special Situations Fund struggled to keep in touch. Indeed, in the 5 year period up until the covid19 induced market crash on 20th February 2020, the fund had returned cumulative growth of 62.10%, compared to the sector average of 67.98%.

Although the fund has a modest history it's weighting in stocks that are now viewed by some as having strong future growth opportunities has seen the fund thrive this past few months.

In the period between 31st October 2020 and 31st March 2021, the fund grew in value by 53% compared to the sector average of 15.83% and its heavy weighting in companies that are expected to strongly benefit from the end of lockdown and a return to normality make it an attractive investment opportunity for investors, particularly those who want to limit their exposure to technology stocks.

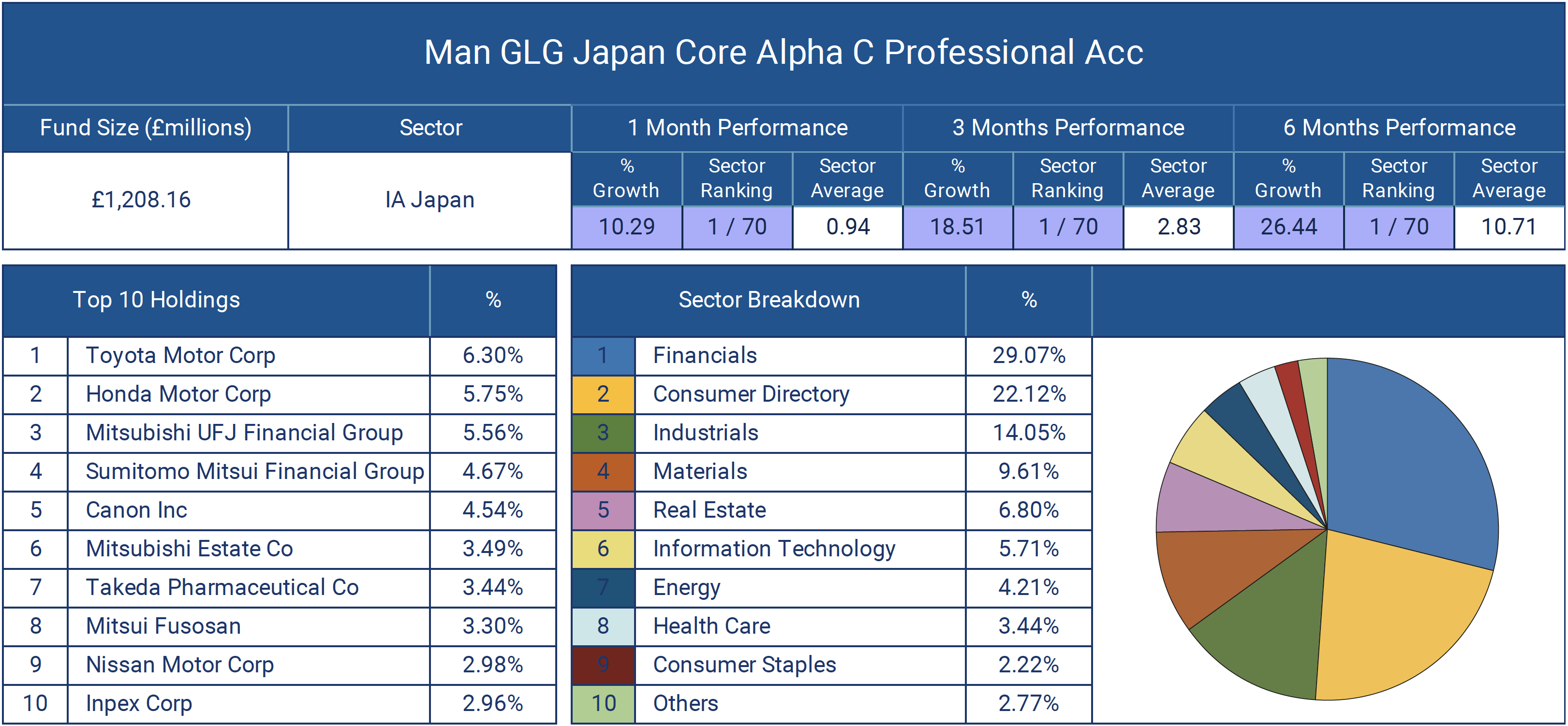

Man GLG Japan Core Alpha Professional Fund

The Man GLG Japan Core Alpha Professional fund is classified within the IA Japan sector and is primarily weighted in Japanese motor companies, which of course is a sector that was hit hard in the months after the onset of the pandemic. However, in the 1 month, 3 month and 6 month periods up to 31st March the fund has been the top growth fund in its sector even exceeding the returns of the Legg Mason IF Japan Equity fund, which has consistently been the highest growth fund in the sector over the past several years.

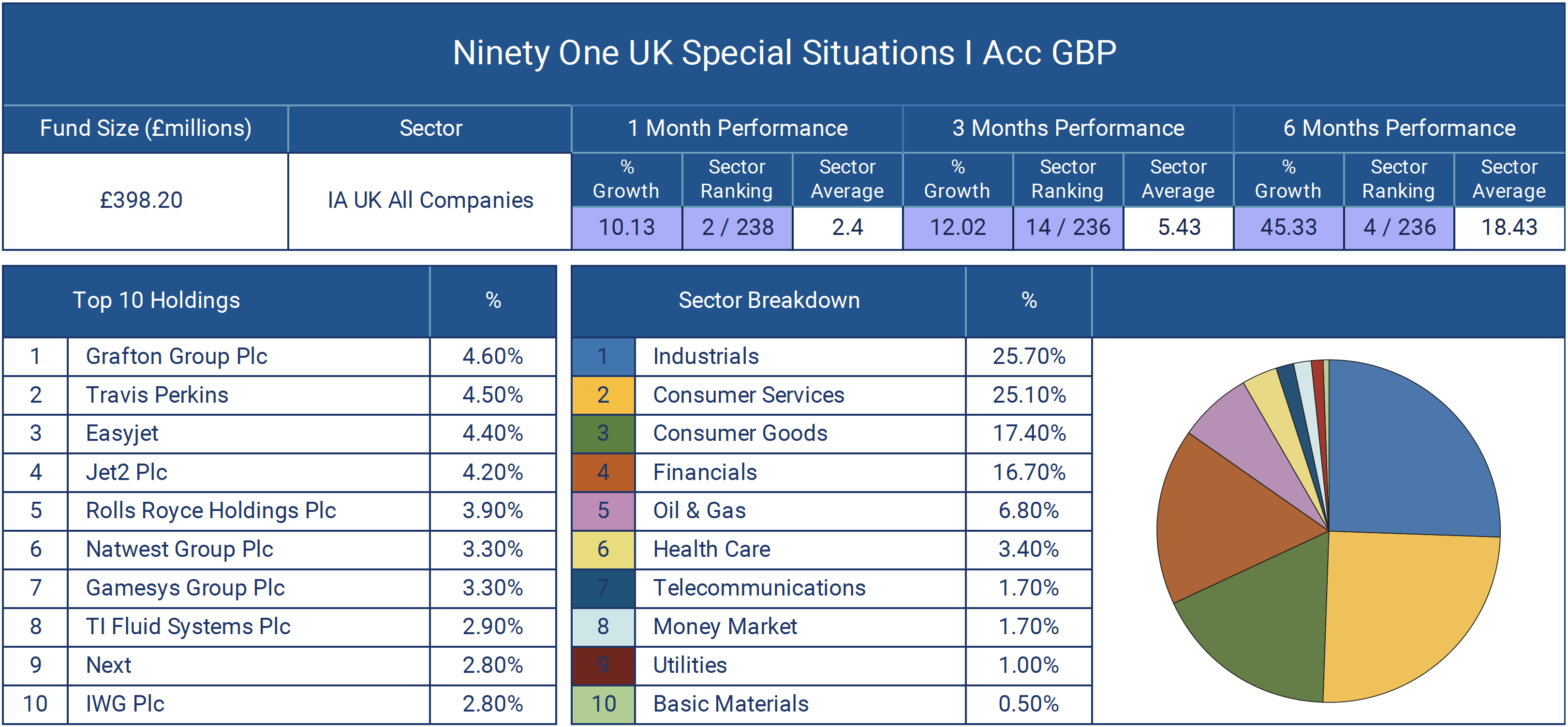

Ninety One UK Special Situations Fund

The Ninety One UK Special Situations Fund is another fund that has an underwhelming performance history often performing below the sector average. The strategy of the fund has been to invest in airlines, Financial Institutions and retail companies, which are sectors that have had modest growth over the past number of years but as it is primarily invested in sectors that are expected to benefit most from the lifting of restrictions the fund has seen a sharp improvement in performance over the past number of months.

In the 6 month period up to 31st March 2021, the fund returned growth of 45.33%, which was almost 2.5 times more than the sector average for the period.

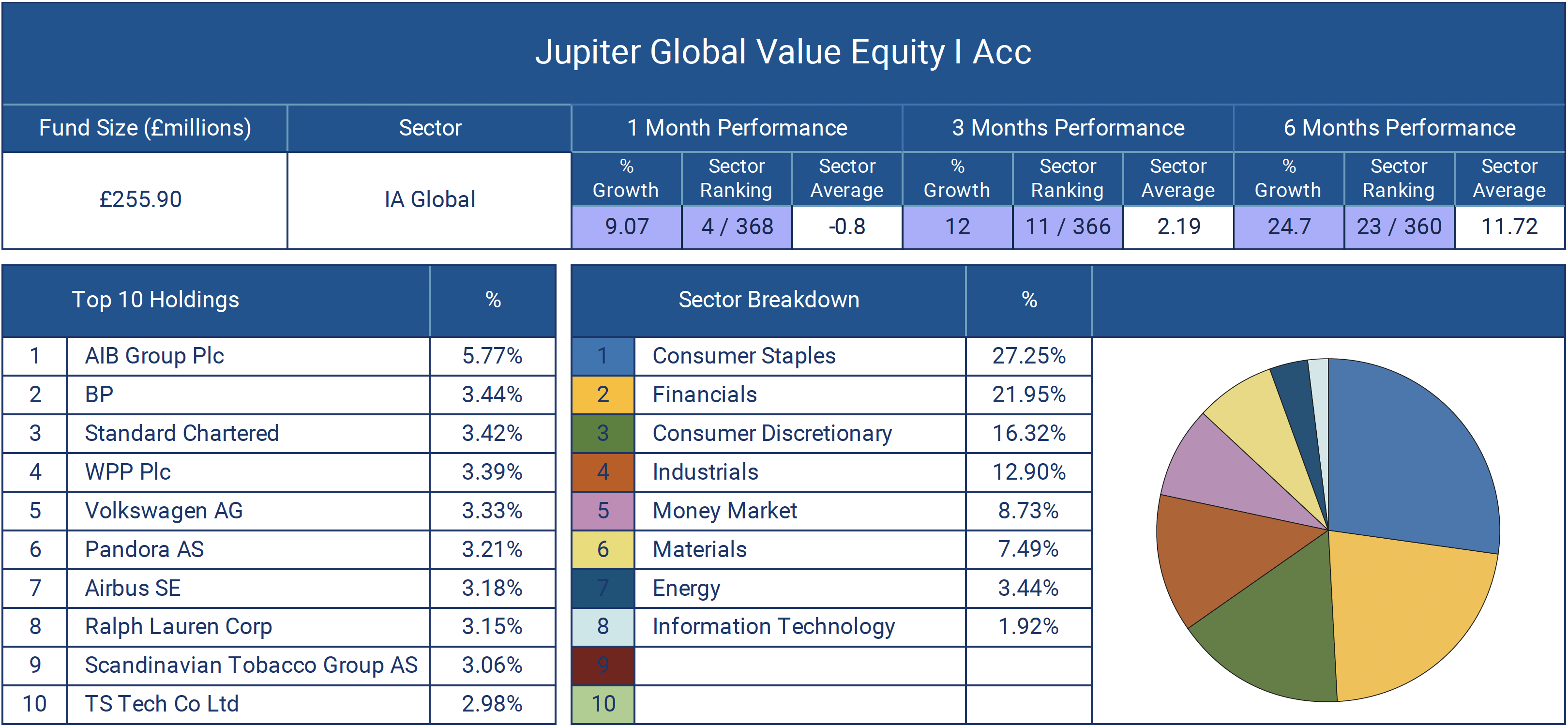

Jupiter Global Value Equity Fund

Similar to the Ninety One Global Special Situations fund, the Jupiter Global Value Equity has a Global investment mandate and is classified within the highly competitive IA Global sector. Again, this fund has struggled to deliver competitive returns in recent years with its low exposure to technology companies limiting its performance.

Jupiter Global Value Equity’s 10 largest holdings include companies in sectors that have been negatively affected by lockdowns but could do better as lockdowns are eased. These include oil company BP and aircraft manufacturer Airbus, which could benefit when travel resumes. The fund also holds luxury goods and clothing retailer Ralph Lauren, which could see an increase in sales when people go out more.

But if the pandemic can be brought under control as vaccines are deployed, sectors that have done badly could start to recover with the Jupiter Global Value Equity fund well-positioned to capitalise on these sectors recovering.

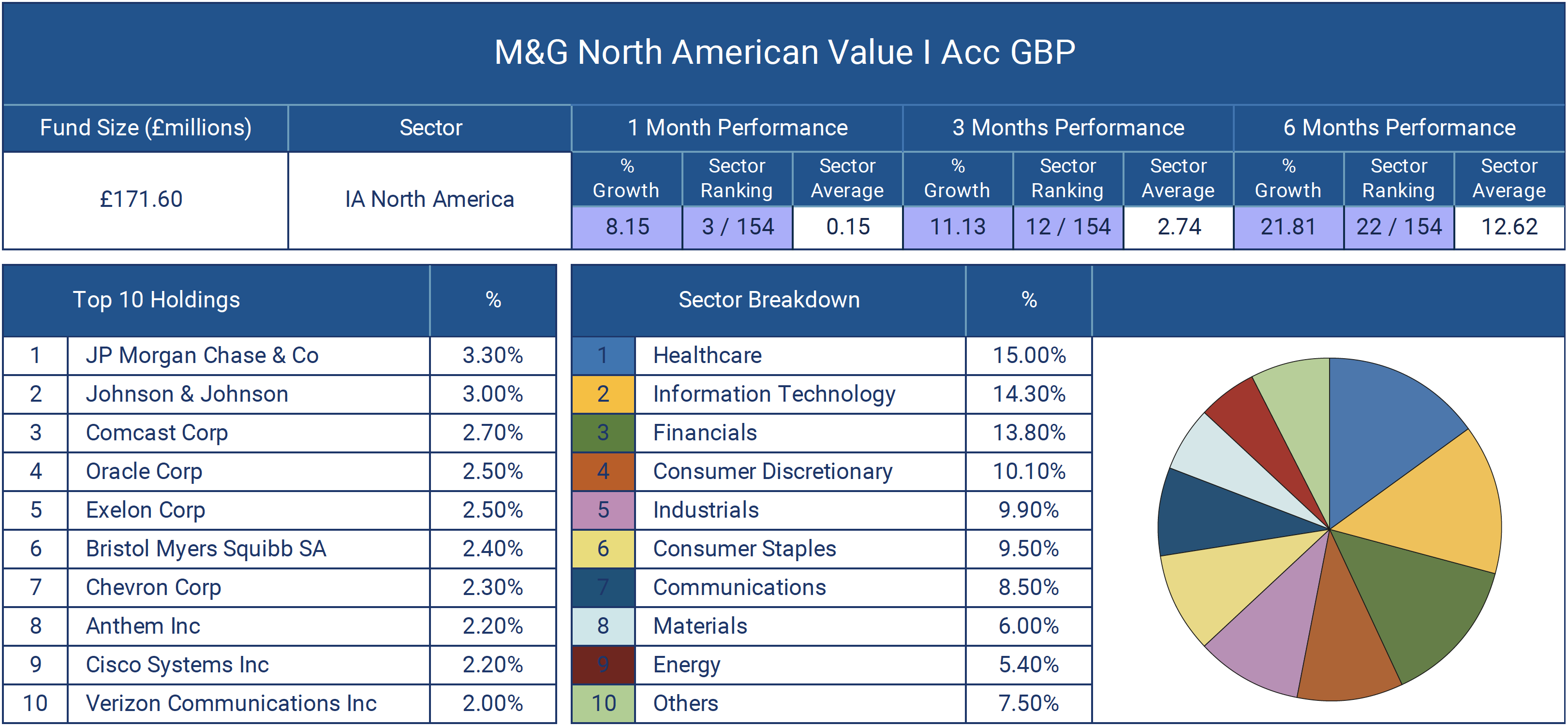

M&G North American Value

At least 80% of the fund is invested directly in companies across a wide range of sectors doing most of their business activity in the United States of America and Canada.

The past several years has been a challenging period for value investing, but the managers of the M&G North American fund have consistently focused on buying cheap stocks that they consider mispriced and they believe the fund is well placed to take advantage of any value recovery. When the pandemic hit, they took advantage of turbulent market conditions to invest in a number of new holdings, primarily in technology, that they believed would weather the extreme challenges from the pandemic and maintain their weighting in stocks that they believed would potentially thrive in the recovery.

Approximately 15% of the fund's assets are held in technology stocks but the fund is also heavily weighted in Healthcare and Financial companies. In the 6 months up to 31st March 2021, the fund has returned growth of 21.81%, which was well above the IA North American sector average of 12.62%.

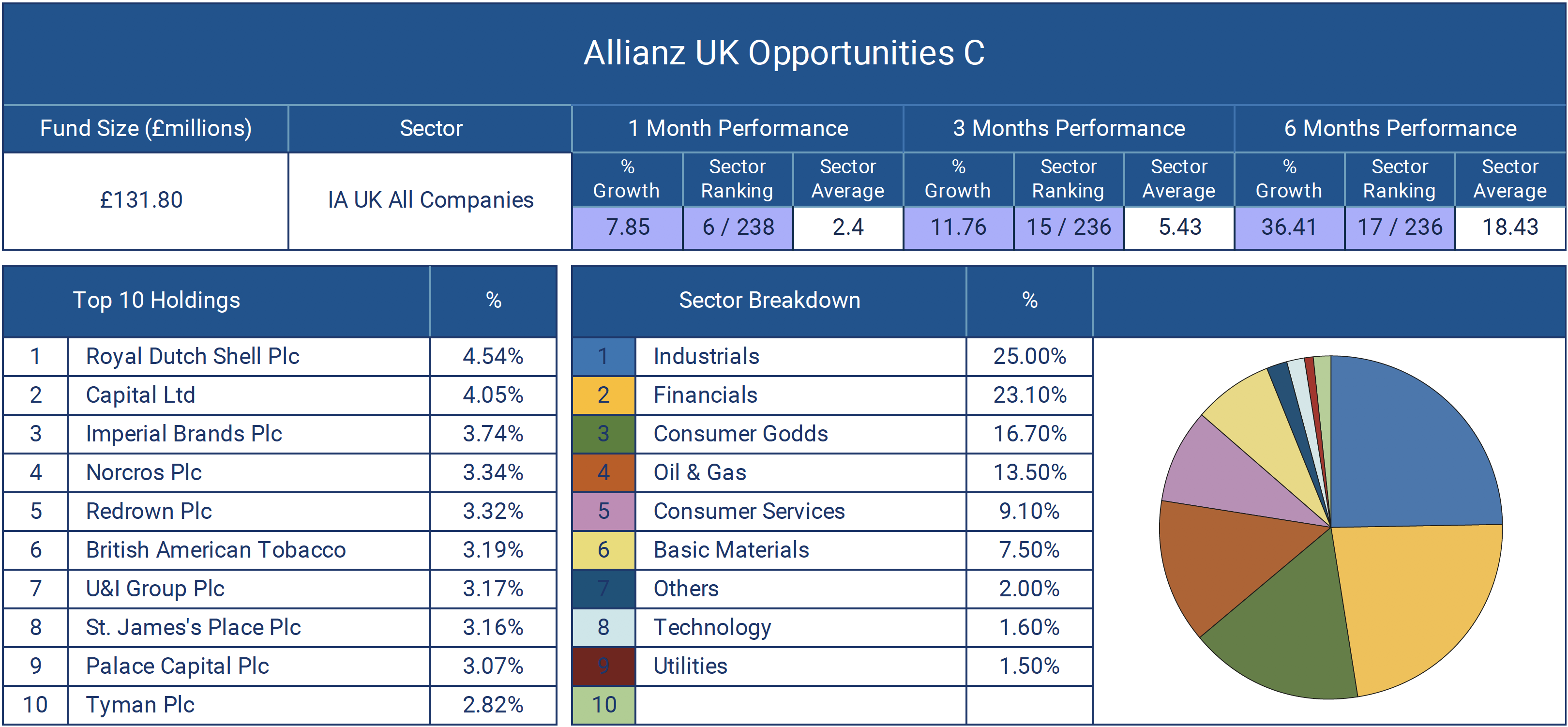

Allianz UK Opportunities Fund

Unlike many of the value funds available to investors, the Allianz UK Opportunities fund has maintained a competitive performance history over the past several years and has consistently outperformed the sector average. The fund is certainly not one for investors who wish to invest in sustainable investment funds as a significant proportion of this fund's assets are in tobacco companies along with oil and gas companies.

Over the past year, the fund has outperformed the IA UK All Companies sector but it is over the past 6 months that it has particularly excelled. In the period between 31st October 2020 up to 31st March 2021, the fund has returned growth of 40.56% compared to the sector average of 26.13%.

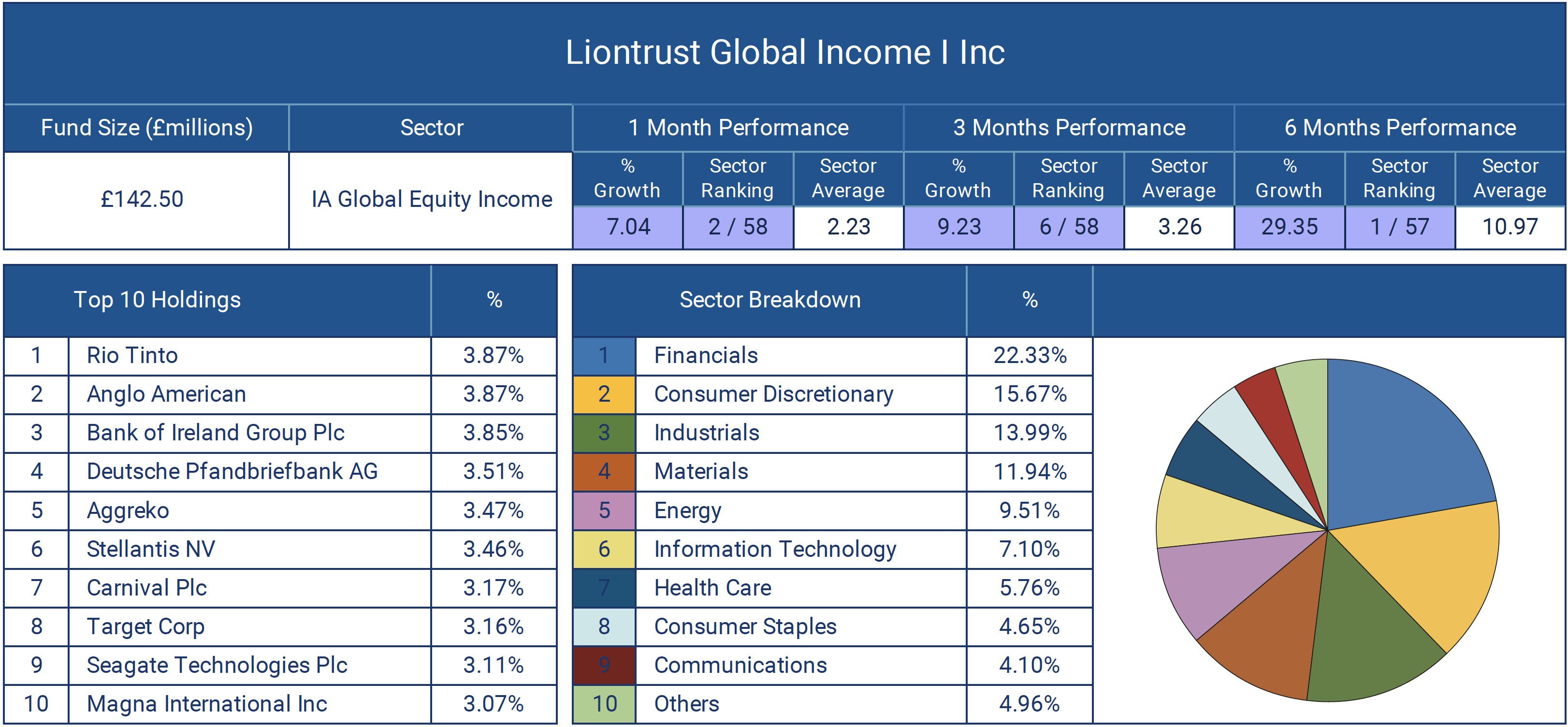

Liontrust Global Income Fund

The Liontrust Global Income Fund is another value fund that has struggled for competitive performance. The Fund seeks to deliver a high level of income with the potential for capital growth over 5 years or more by using the Cashflow Solution process to identify and invest in companies globally. Since its launch in July 1990, the fund has amassed modest funds under management of £143.67 million with its strategy of investing in Financial companies consistently returning below-average returns.

The fund was hit harder than most within its sector when markets crashed in February 2020, and up until the end of October 2020, it was one the worst performers in its sector as some of its stocks notably cruise ship company carnival taking a huge hit during the period. However, over the past 6 months, the fund has been the top performer in its sector with returns of 29.35% almost 3 times that of the sector average and it remains well-positioned to benefit from the recovery.

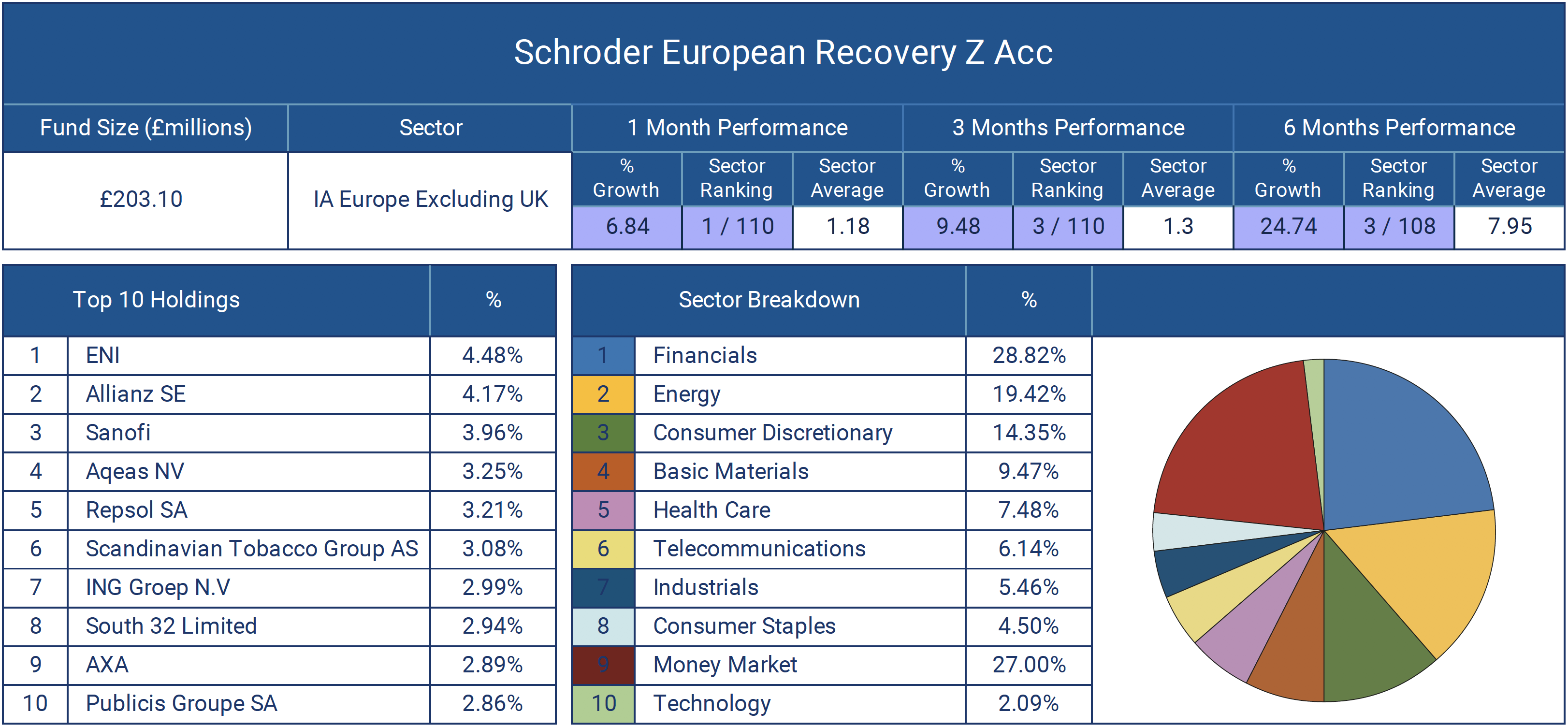

Schroder European Recovery Fund

In the month between February and March last year, the Schroder European Recovery fund fell in value by over 38%, which was one of the steepest declines in the value of any fund within the IA Europe ex UK sector. Before the outbreak of the pandemic, the fund had been poor with its performance regularly among the bottom of its sector but as it is composed of value stocks that are perceived to offer greater opportunity for growth as the world recovers from the pandemic it is seen by some as an attractive investment.

Premier Miton US Opportunities Fund

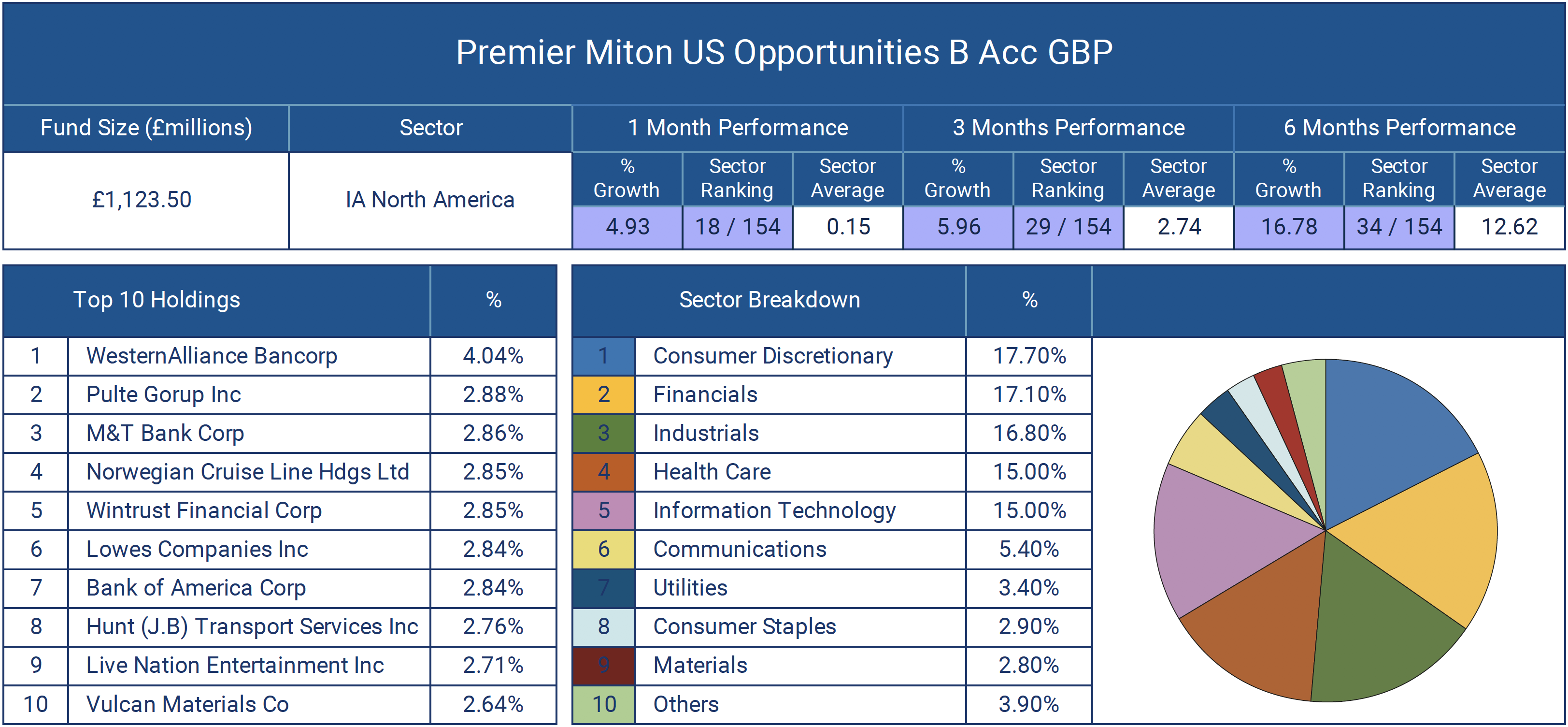

The Premier Miton US Opportunities is a value fund that has consistently performed well across different market conditions. The fund manages more than £1.1 billion of client money and it is classified within the competitive and traditionally high growth, technology-driven IA North American sector, which is a sector that saw the sharpest rise in growth since markets bottomed out amid the onset of the pandemic. The most popular North American equity fund is the Baillie Gifford American fund which currently holds just over £6.8 billion of investor money. This fund was also the highest growth of all 3,000 plus unit trust funds on the market last year but its heavy weighting in Technology stocks meant it was impacted more than most when many investors sold off technology stocks in February this year. As the Premier Miton US Opportunities fund is primarily invested in financial and consumer discretionary companies it has significantly outperformed the Baillie Gifford American fund in recent months. In the period between 31st October 2020 and 31st March 2021, the Premier Miton US Opportunities fund returned growth of 20.72% compared to 9.63% from the Baillie Gifford American fund.

The fund is held in high regard by many investors who believe its asset model leaves it well-positioned to outperform in the coming months and beyond.

Summary

Many of the funds featured in this report have had a sub-par performance history but as a proportion of investors see future gains driven primarily by value stocks these funds may offer attractive investment opportunities for the recovery.

But, what about beyond? Will these funds continue to outperform competing funds with a heavier weighting in technology stocks? It is worth remembering that the majority of funds with a heavy weighting in value stocks have struggled to keep up with the sector average over the past several years and to expect a long term reversal of this trend is unlikely.

Excited by the prospect of an end to lockdown and an expected swift return to previously popular consumer spending habits, sectors such as retail, hospitality, travel and transportation the funds invested in these sectors are now a popular choice for many who see them as offering strong investment opportunities.

But, what about beyond? Will these funds continue to outperform competing funds with a heavier weighting in technology stocks? It is worth remembering that the majority of funds with a heavy weighting in value stocks have struggled to keep up with the sector average over the past several years and to expect a long term reversal of this trend is unlikely.