In this article, we highlight the serious risks for many investors who have an over reliance in the IA Global sector. We compare the performance, cost and holdings of 5 of the largest funds in this sector (Fundsmith, SJP, Vanguard & Lindsell Train) to 5 of the best performing funds in the sector.

- The IA Global sector has 500 core funds with £168.9 billion of funds under management yet the 5 largest funds in the sector account for 35% of the FUM.

- The Guinness Global Innovators fund was one of the top performing funds in the sector with returns of 272.67% over the last 10 years, which was more than double the sector average.

- The 5 biggest funds in the IA Global sector have a higher average ongoing annual charge of 0.99% compared to the sector average of 0.87%.

- The alternative 5 top performing funds in this sector have a lower average annual charge of 0.68%.

Over Reliance In The Global Sector

At Yodelar we observe on a daily basis the heavy concentration investors have in the IA Global Sector. The IA Global sector is only one of 55 sectors, yet self investors using the likes of the Hargreaves Lansdown platform, or investors getting regulated advice under 'restricted' propositions such as St James's Place, have a concerning over reliance on the Global sector.

This concerns us for a number of reasons (1) many investors are invested in funds that are marketed more aggressively, but are not the best performing in the Global sector. (2) more significant is the fact that many Global funds have a large proportion in North America, leaving many investors at risk of losing a large proportion of their wealth should a downturn in this one sector occur.

Global funds are marketed in a manner that lead investors to believe they are spread across the Globe over many sectors but in reality they are for the most part as detailed in the table below invested in North America. The obvious risk being that North America is hit by a market downturn or bear market and investors lose 30-40% of their wealth, as experienced in previous North American Bear markets.

US stocks lose an average of 30-40% during bear markets, which have struck around 20-25 times over the past century (1 in 4-5 years). However, it is notable that between 2002 and 2020, the US stock market had 5 bear markets.

Good risk management requires an asset allocation model that is diverse across multiple major markets. On that basis Global funds and North America do play a part - however to often we see clients who avail of our free portfolio analysis service find out they have a 100% weighting in the Global sector, which is not in the best interest of client investors.

Clients who have a 100% investment in the Global sector may feel they have done well, but without understanding the risk they are taking by ignoring diversification and best practice's, they could at some point lose a large proportion of their misguided gains. To quote Lenny Kravitz, "it ain't over til it's over".

The IA Global Sector

The Investment Association's Global sector has a total of 500 funds with £168.9 billion of client assets under management, making it the largest and most invested sector in the UK.

Yet despite an abundance of options to choose from, investor assets remain concentrated in a small number of funds. The 5 largest funds alone represent 35% of the sector's total assets, with £59.7 billion invested within these 5 funds alone. Or to put it another way, a third of all capital flowing into the IA Global sector sits concentrated within less than 1% of all Global funds.

Such a high concentration in a small range of funds suggests many investors are overlooking alternative options, and reacting to marketing rather than data.

Register for 7 days free access to Yodelar's Investor Hub fund performance platform, and analyse the ongoing performance of all 500 Global funds, and 88,000 other funds and variants - click here.

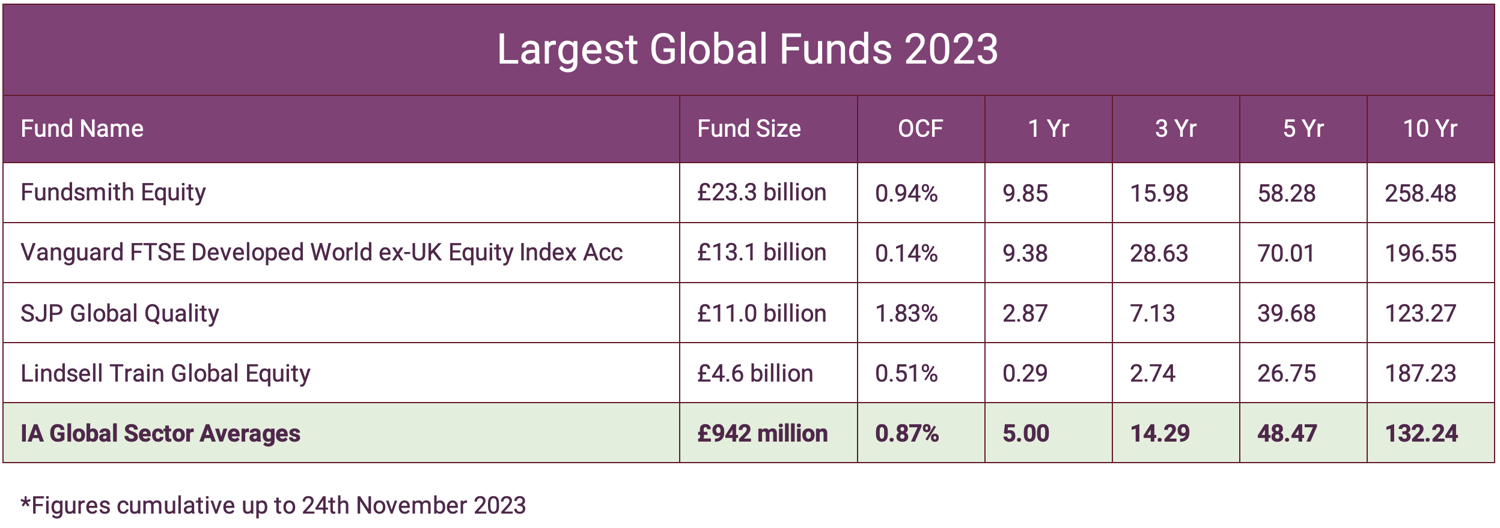

The Biggest Global Funds

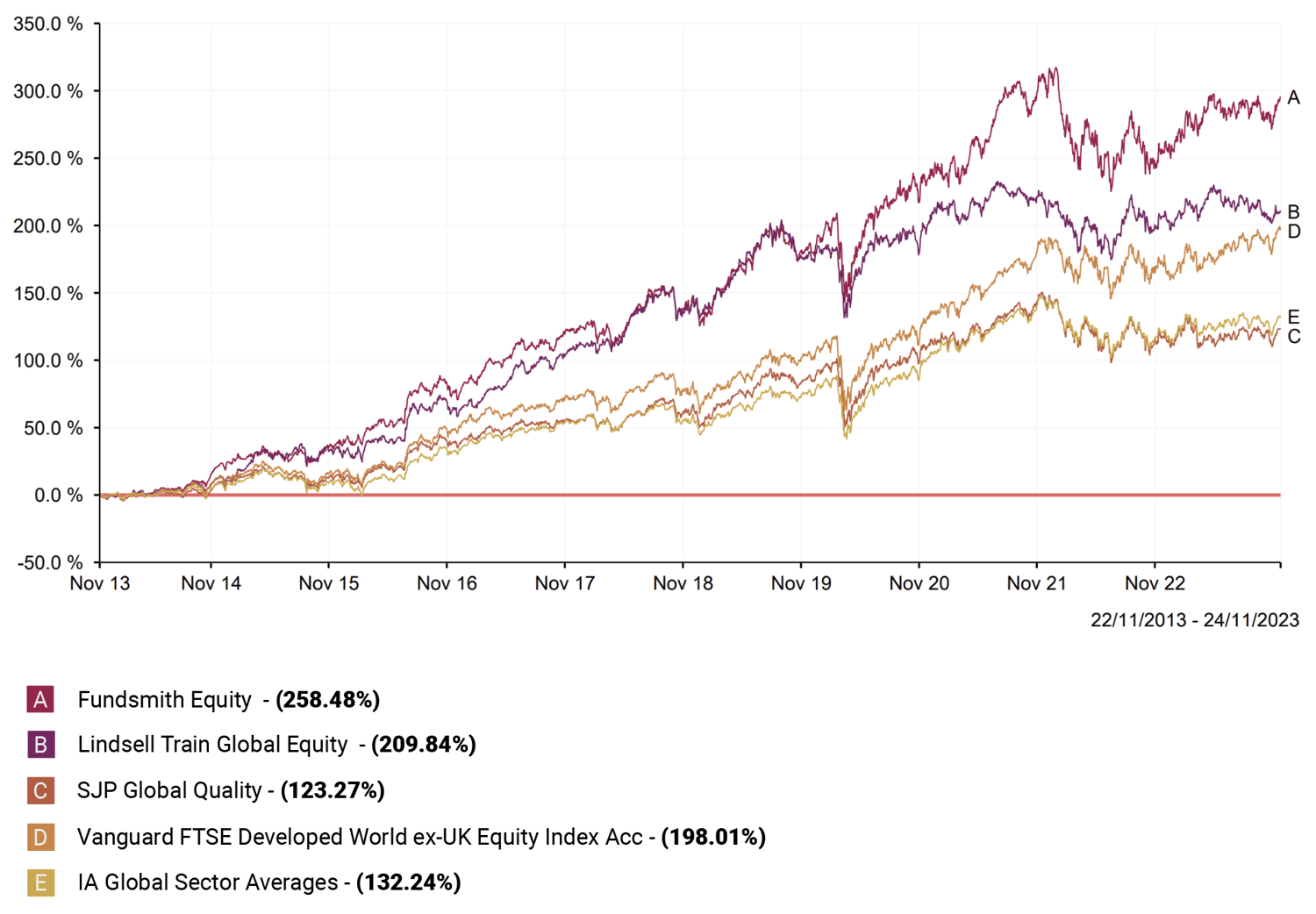

Before analysing the 5 top performing funds in this sector we will review the largest funds in the sector which include Fundsmith Equity, Vanguard, St James's Place and Lindsell Train's popular Global Equity fund.

In the table below we have also compared each fund to the sector average. Remember average is only 'Average", not something investors should aim to achieve.

St James's Place Global Quality fund stands out as the only fund that is consistently below the sector average, over all time periods analysed. It is also the fund with the highest annual cost to investors of 1.83%, over double the sector average of 0.83%.

Fundsmith Equity

The largest fund in the sector is the Fundsmith Equity fund which is managed by famed fund manager Terry Smith. The Fundsmith Equity fund, is Terry Smith's flagship fund which he launched in November 2010. The fund quickly became an investor favourite and now holds the spot as the largest fund in the UK with some £23.3 billion of client money currently entrusted to this fund. This one fund alone accounts for 13.7% of the entire £169.8 billion invested in the IA Global sector.

Lindsell Train Global Equity

When it launched in 2011 the Lindsell Train Global Equity fund emerged as a leading rival to the Fundsmith Equity fund. Although it never witnessed the same level of inflows, the fund closely matched Fundsmith for performance up until 2021 when high volatility and the sell off of technology stocks saw the funds value drop before many of its peers. Despite enduring a longer period of poor performance, the Lindsell Train Global Equity fund has still outperformed many competing funds. With assets under management in excess of £4.6 billion it continues to represent one of the largest funds in the sector.

Vanguard FTSE Developed World ex UK Equity Index Fund

The 2nd largest fund analysed for this report was the Vanguard FTSE Developed World ex UK Equity Index Fund which currently manages £13.1 billion of client money. The fund is the only index tracking fund of the 5 largest funds. Its objective is to track the performance of the FTSE AW Developed ex UK Index and it has an annual charge of just 0.14%, well below the sector average.

SJP Global Quality Fund

As a restricted wealth manager, St. James’s Place only invest their clients' money into their selection of own funds with the SJP Global Quality representing one of their largest funds holding £11 billion. The fund itself is typically recommended as part of a portfolio of funds and rarely offered as a stand alone investment but its size alone shows how much SJP utilises this fund. As our analysis shows, this fund was by far and away the worst performer over the past 10 years and the only fund analysed that delivered returns below the sector average. With fund charges of 1.83% it is also the most expensive option.

Despite being a consistent under-performer the SJP Global Quality fund is also one of the primary funds St. James's Place use within their new range of Polaris multi asset portfolios.

These 5 funds are among the biggest in the IA Global sector and combined they manage over 1/3rd of all assets in the sector.

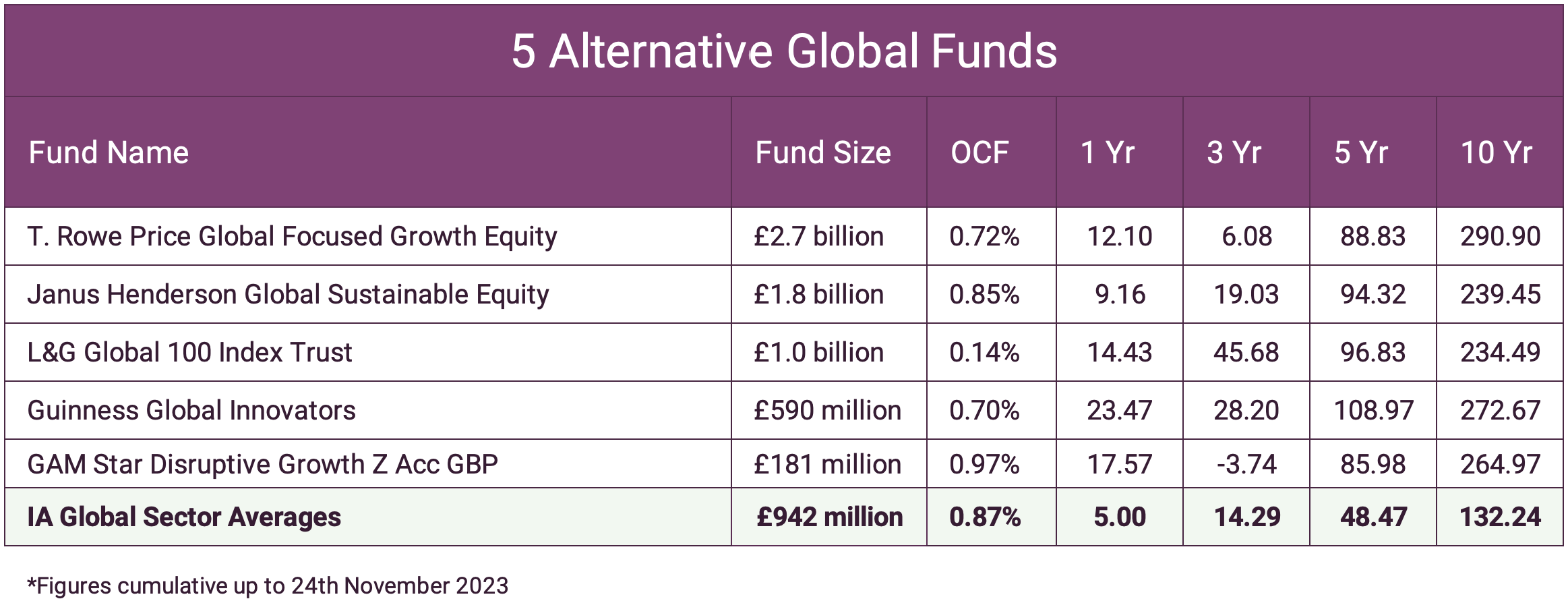

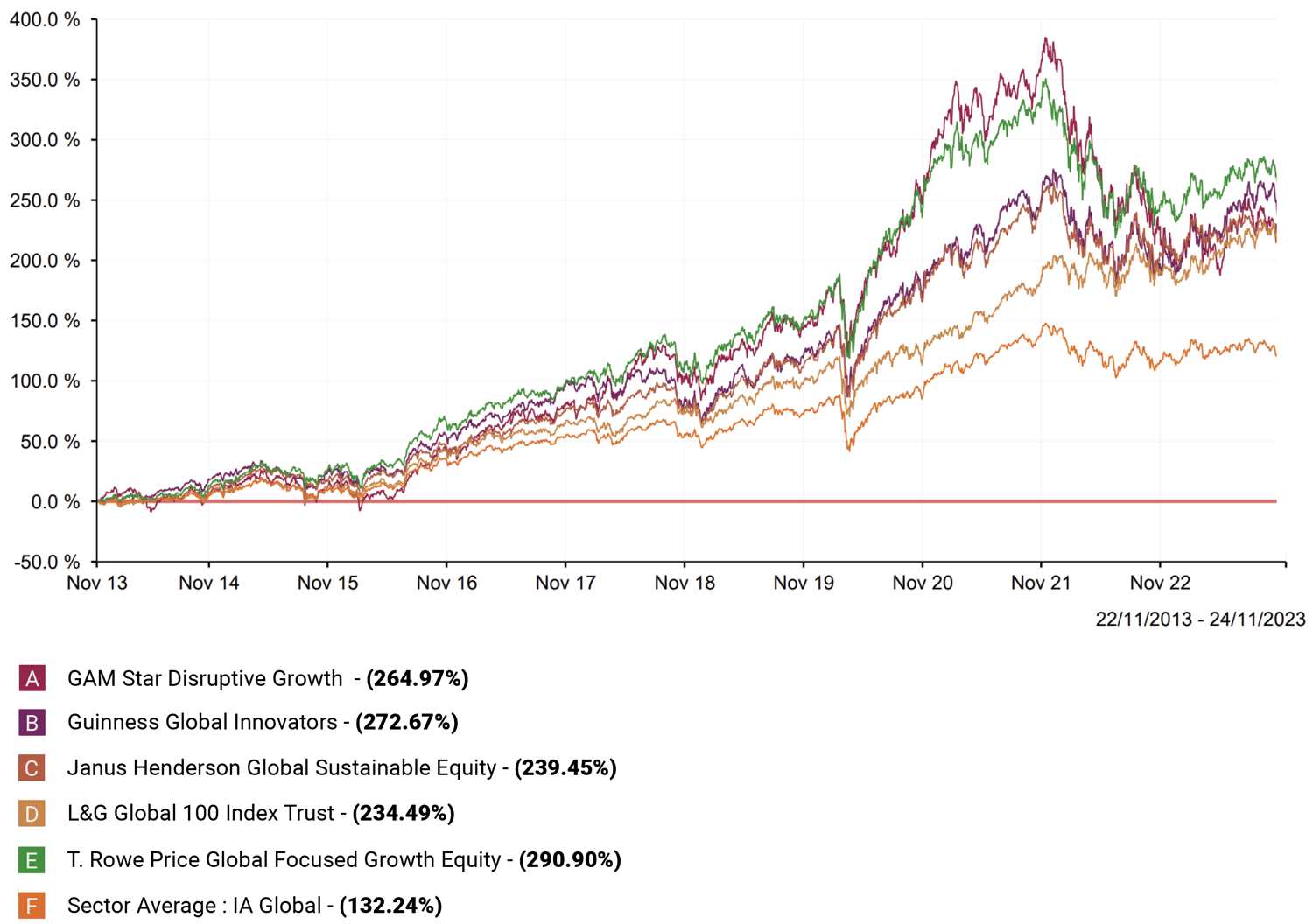

The Top 5 Performing Global Funds

In a sector containing 500 core funds options are not in short supply.

In the table below we have listed the top 5 performing global funds over multiple time frames. These funds have delivered the strongest performance returns in the entire sector with the average ongoing charges much lower than their larger counterparts.

These 5 alternative Global funds have combined total funds under management of £6.3 billion and represent some of the top performing funds in the sector over the past 10 years.

These funds are more likely to be seen in a portfolio of funds where an investor has an understanding of performance, cost and market alternatives, and with some such as L&G and Guinness having a large proportion in North America should be built into a diverse asset allocation model portfolio, not to over expose an investor to market volatility and bear market drops.

T. Rowe Price Global Focused Growth Equity fund

T. Rowe Price Global Focused Growth Equity fund invests in a diversified selection of global companies. The funds management philosophy is based on implementing their best ideas based on key themes to create a global equity fund with considerable potential for delivering long term returns across all market conditions. By maintaining a focused portfolio of just 60-80 quality growth names, the fund exploits the management team's experience and analytical resources to identify firms trading at reasonable valuations.

The fund currently has assets under management of £2.7 billion, which although above the sector average is someway below the 5 biggest funds in the sector. Performance wise, the fund’s strategy has consistently yielded competitive medium to long term growth with most recent 5 & 10 year returns of 88.33% and 290.90%. In comparison, the sector average for these periods were 48.47% and 132.24%.

Janus Henderson Global Sustainable Equity

The Janus Henderson Global Sustainable Equity fund has been one of the consistently top performing ethical themed funds in the global sector. The funds management team believe there is a strong link between sustainable development, innovation and long term compounding growth, which is the basis of their long term strategy for this quality fund.

Their investment framework seeks to invest in companies that have a positive impact on the environment and society, which they have managed to deliver whilst maintaining highly competitive performance. Over the past 5 & 10 years the fund has returned growth of 94.32% and 239.45% respectively.

GAM Star Disruptive Growth

The GAM Star Disruptive Growth fund seeks to generate long-term capital growth by investing in companies advancing disruptive innovations with potential to profoundly transform industries. Managed by a seasoned investment team with deep expertise identifying emerging technology paradigm shifts early, the actively managed global fund takes high conviction positions in small and mid-cap companies driving disruption.

The fund holds approximately 25-45 stocks which are clustered around transformational themes including electric vehicles, artificial intelligence, gene sequencing, cloud computing and cybersecurity. The fund embraces elevated short-term volatility associated with disruptive growth which can be uncomfortable for some investors during challenging market conditions. The fund did endure a difficult 2022 with a sharp fall in performance but it has had a very strong 2023 with 1 year returns of 17.57%. Over 5 & 10 years the fund has outperformed many of its peers with growth of 85.98% and 264.97%.

Guinness Global Innovators

With just £590 million of funds under management the Guinness Global Innovators fund is one of the smaller sized funds in the sector. Although the fund is unknown to many investors and advisers it has consistently been one of the best performing and lowest priced actively managed global equity funds on the market.

This is a high quality fund whose managers have identified nine core innovation themes through research. These themes are: advanced healthcare; artificial intelligence and big data; clean energy and sustainability; cloud computing; internet, media and entertainment; mobile technology and the internet of things; next generation consumer; payments and FinTech; robotics and automation.

Only companies with a market capitalisation of over $1billion and with exposure to these themes are considered by the fund's managers. These companies are then screened for quality, which includes: return on capital should be more than the cost of capital last year, debt to equity should be less than 150% and positive earnings growth should be expected in the coming year.

Companies which look interesting on these metrics will be researched in much more detail. The managers will seek to understand the company’s business model and potential risks faced. Only the best companies will make it into the final concentrated portfolio. Guinness Global Innovators fund is generally long term, with a low turnover and an average holding period of three to five years.

Like all Guinness funds, the portfolio is made up of 30 equally-weighted stocks. The managers trim winners and top up under-performers. There is a strict one in one out policy.

L&G Global 100 Index Trust

As its name suggests, the L&G Global 100 Index Trust is an index fund. The funds aims to track the performance of the S&P Global 100 Index by investing almost entirely in shares of the index's 100 companies. As an index fund, it is one of the lowest priced in the sector at just 0.14% - over 6 times lower than the sector average of 0.87%. The fund has grown in popularity over recent years due to its continuous strong performance during challenging market conditions and now holds some £1 billion of client assets under management. The fund rebalances quarterly to maintain proportional index exposures and minimise tracking error and it has consistently outperformed the sector, including each of the 5 biggest funds over the past 3, 5 & 10 years.

With the exception of the Fundsmith Equity fund, each of these 5 smaller funds have outperformed the largest funds in the IA Global sector over the past 5 & 10 years.

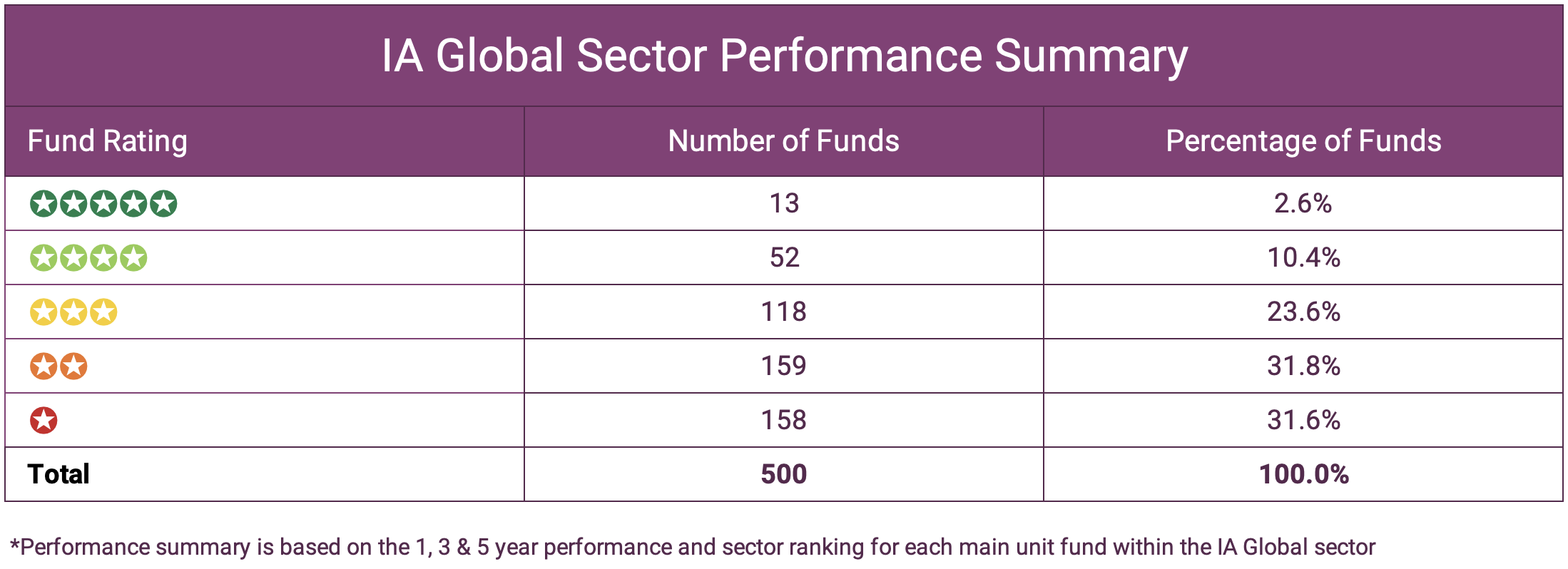

63.4% of All Global Funds Underperform

Over the past 1, 3 & 5 years 317 of the 500 funds available in the IA Global sector have underperformed and received a poor performing 1 or 2 star Yodelar fund rating. The large portion of underperforming funds in the sector shows the importance of fund selection and that only a comparatively small range of funds consistently perform well. For some investors, fund selection is based upon fund recognition or fund size but as identified in our analysis this does not necessarily equate to above average returns.

How Yodelar Rate Fund Performance

Despite 317 of the 500 funds within the IA Global sector rating poorly, there are still some exceptional funds available. Funds with strong performance history and excellent management that offer very strong ongoing growth opportunities for UK investors.

Pursuing Returns Through Rigorous Portfolio Construction

At Yodelar Investments, our philosophy emphasises quality across all elements of portfolio management to ensure clients are invested efficiently to manage risk and performance. We take an unbiased, research-driven approach to identify superior asset managers with proven histories of benchmark-beating returns.

Extensive analysis of funds and underlying manager skill underpins our process. By studying tens of thousands of strategies across multiple sectors, our team works to identify consistent performance and quality. Just a tiny fraction of funds demonstrate the consistency to justify inclusion in our portfolios.

Our due diligence informs construction of our risk-optimised model portfolios to align with specific investor objectives. Diversification through selective and transparent exposure (rather than dilution) best enables compounding growth. Our holdings are concentrated around high-conviction opportunities yet balanced across assets to allow sustainable wealth accrual without taking unnecessary risks.

Ultimately, we aim to serve as responsible stewards of capital, not salespeople. Our incentive is deepening understanding of market complexities so clients grasp how quality managers thrive across cycles.

Yodelar provides an advice and information service that is changing the way investors think. Book a no obligation call with our team today and find out how we can help you grow your wealth efficiently.