During periods of negative investment growth it is common for investors to question declining values. Is my investment strategy efficient? Am I the only investor experiencing downturns? Is poor performance is a consequence of wider global market conditions.

We cannot predict the future, but if our strategy is managed efficiently we can still meet our medium to long term goals.

Confidence in your strategy comes from understanding and knowledge. This understanding is central to discerning between quality related negative growth or market related negative growth. An efficient investment strategy will give you the confidence that your portfolio effectively follows the processes that mitigate against excess risk while enhancing the potential for future returns.

But what does an efficient investment strategy look like?

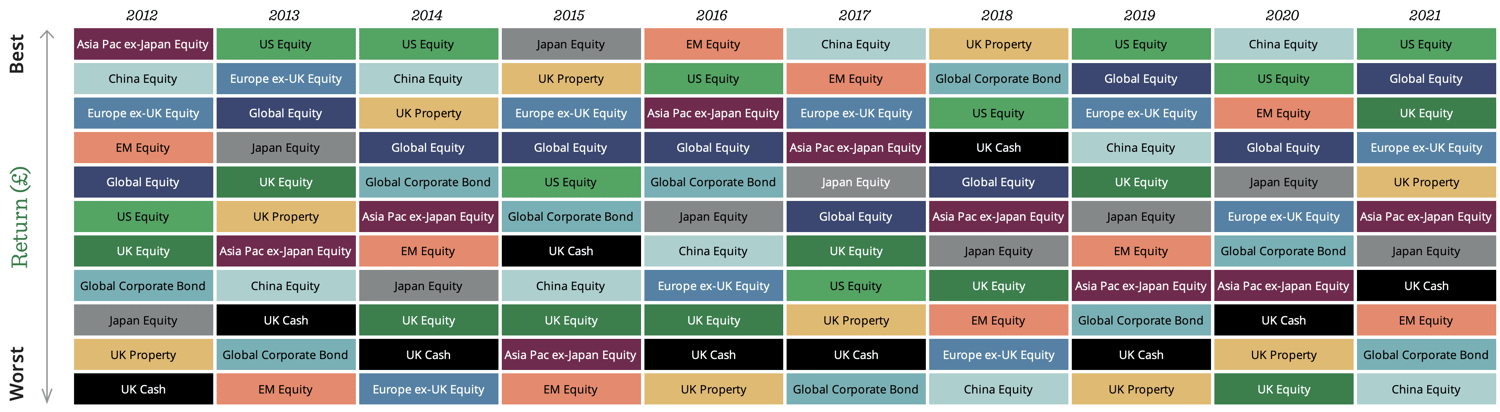

1. Asset Allocation & Diversification

The asset allocation model of any pension or investment portfolio is the single most important aspect of investing and is critical to ensuring your portfolio does not assume more or less risk than you are comfortable with.

Investing in funds across varying asset classes allows you to diversify across global regions and industry sectors, minimising the impact on your portfolio should one sector or market take a dip.

Your asset allocation should be chosen based on factors such as tolerance to risk, investment objectives and time horizon, as all of these can be impacted depending on the strategy chosen. However, we increasingly see portfolios where diversification is almost non-existent and it is clear that an investor is chasing performance, neglecting asset allocation and diversification, which can have terrible consequences.

If one region or industry sector is performing considerably better than others it can prompt poorly disciplined investors to move a sizeable proportion of their portfolio into funds within these markets. Yes, in the short term it may result in gains but it overexposes the portfolio, and the shock of that sector experiencing a drop - which all sectors and regions will inevitably experience at some stage - will potentially prove catastrophic for the investor.

The importance of adhering to a suitably defined asset allocation model cannot be overstated. It is critical to risk management and avoids the urge to invest chase returns and the inherent risk that entails.

The chart above - with each colour representing a different asset class - shows how varied the performance of different investment assets (such as equities, bonds, and property) has been over the last 10 years, highlighting the necessity for diversification and avoidance of any over reliance.

2. Fund Selection

Selecting funds/fund managers that consistently outperform their peers and fit within a suitable asset allocation model will help investors to maximise their portfolios growth potential.

If your portfolio is managed by a financial adviser you with a research driven knowledge in fund performance. There are financial advisers who demonstrate great expertise and knowledge when it comes to fund selection.

However, fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds. As a result, a large proportion demonstrate poor knowledge on the quality of funds they recommend.

Fund performance is a critical metric that efficient investors and high-quality advice firms analyse to help ensure their portfolios productively meet objectives while utilising the proven top-performing fund managers.

Top advisers want to ensure the portfolios they recommend use top fund managers, and for investors who make their own fund decisions, the same should apply.

Why Fund Performance Matters

Past performance is not an indicator of future returns, but when asked, investors would prefer to invest with fund managers that consistently perform, over varying time frames, in the top 25% of performers in their sectors versus fund managers that perform in the worst 25% of performers.

Comparative Performance

Each fund’s performance can be compared alongside all other competing funds that are classified within the same sectors. How each fund compares over the medium to long term can identify the quality of the fund and the competence of the fund manager.

Fund manager accountability

Past performance exposes the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors can reflect a level of expertise from the manager within that investment sector. Whereas, the fund managers whose funds continually rank low within their sector demonstrate a lack of quality and an inability to deliver competitive returns for investors. Past performance is not an indicator of future returns, but it is important information that holds fund managers accountable for their performance.

For those that have maintained a high level of comparative performance, it is reasonable to assume they can do so in the future.

3. Ongoing Portfolio Management

An efficient portfolio will only remain efficient if it remains suitably balanced. To maintain the right balance requires ongoing management as markets are in constant flux, and even a high quality mix of investments will need rebalancing.

It is important to regularly review your portfolio and rebalance if required. This is the process of realigning the weightings of assets in your portfolio when one sector grows more than another, shifting the percentage you have invested within particular sectors.

In our experience, the vast majority of self investors who manage their own portfolio do not manage the asset allocation and associated risk of their portfolio well. Some advice firms also neglect the time consuming process of rebalancing, leaving their clients paying management fees for a service that is not providing adequate protection or ensuring ongoing portfolio efficiency.

Quarterly performance and market updates that are relevant to your portfolio and investment strategy are also important in maintaining a clear overview of your portfolio. Yet many advice firms do not provide this information as it is not something they are required to do.

For self investors it can be a time consuming undertaking that is not always practical. But with clarity comes confidence and the understanding that your investments are being well tended, which reinforces the likelihood of meeting your long term investment objectives.

There are 3 different types of rebalancing.

Time-only: With this approach, the only consideration is time – not how much a portfolio has drifted from its strategic asset allocation. For instance, investors following this approach might rebalance, say, annually or at set times during a year.

Threshold only: Under this strategy, a portfolio is only rebalanced when a portfolio has drifted from its strategic asset allocation by more than a predetermined percentage, such as 5%. One of the drawbacks of the "threshold only" approach is that the portfolio would require consistent monitoring.

Time and threshold: With this approach, the portfolio is rebalanced at a scheduled time, such as annually or bi-annually.

4. Time Horizon

When investing, time is the most important of elements. It allows time to recover from negative market cycles and maximise growth during positive ones.

Having a long term investment outlook is the best way to meet your objectives. This should be at least seven years as the more time you invest the less impact market fluctuations have on your portfolio. If you want a quick win or are working towards a short-term goal, the risk of losses increases particularly during volatile periods. In contrast, having a longer term time horizon buffers against short term declines.

5. Patience

Warren Buffett said: “The stock market is a device which transfers money from the impatient to the patient.”

Patience will reward investors. In fact, it is viewed as the most important principle for successful investors.

Many people believe that knowing when to buy and when to sell is the secret of successful investing. The truth is that no one knows with certainty when markets will rise or fall. Trying to time the market is very seldom successful. It’s far better to use time to your advantage. The sooner you can start investing, and the longer you can invest for, the more likely it is for you to achieve your financial goals, regardless of any short-term blips. Of course, the strategy and quality of funds are crucial to maximising potential gains but even the best investments will have periods of underperformance that will test the patience of investors.

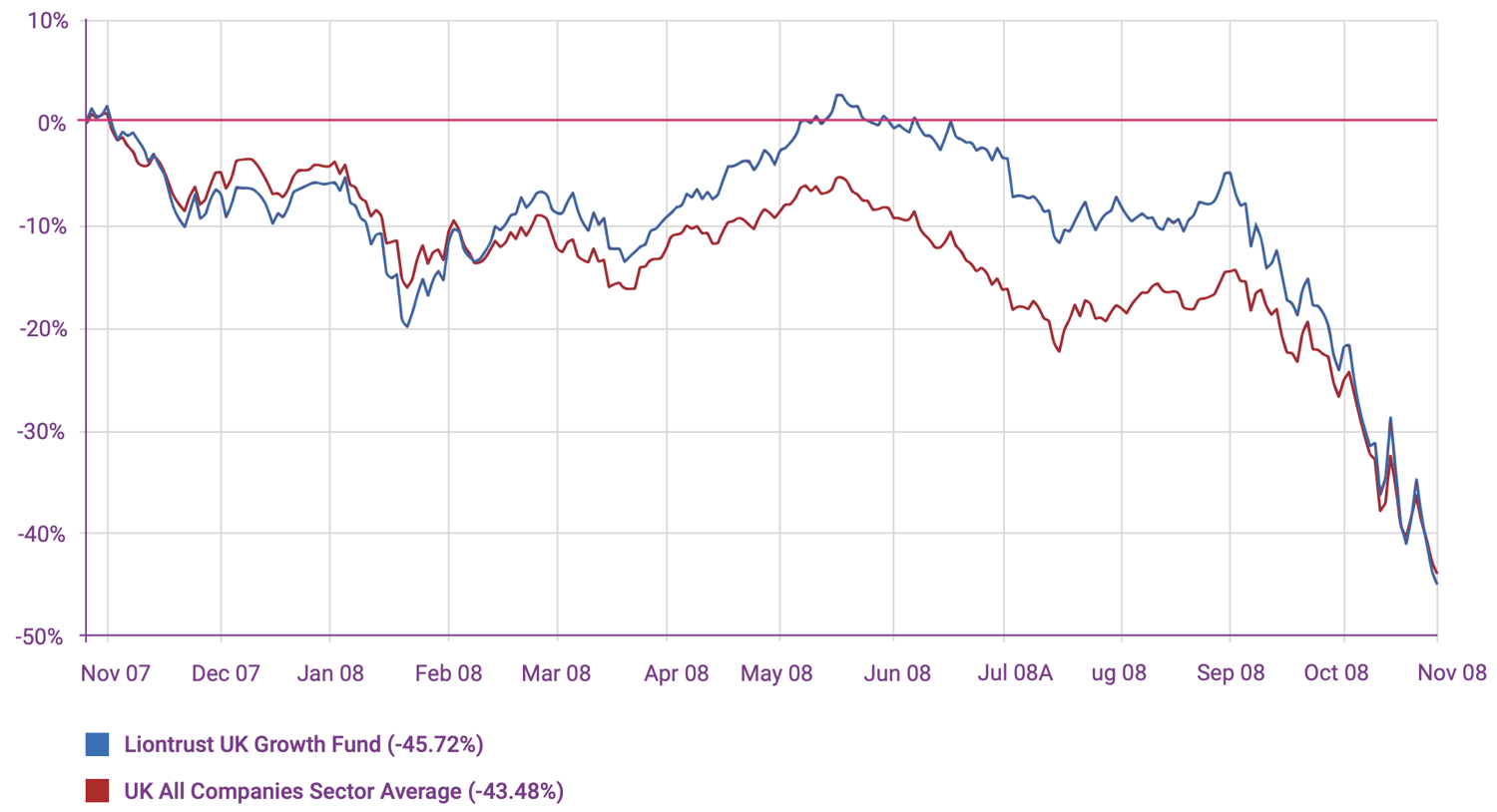

If we look at any quality fund with a long term history and break the funds performance into 6 months, 1 year or even 3 year segments, they will show periods of underperformance. Periods where they lost sizeable chucks of value and tested the resolve of their investors. But when looked at over a longer period almost all will have delivered net growth.

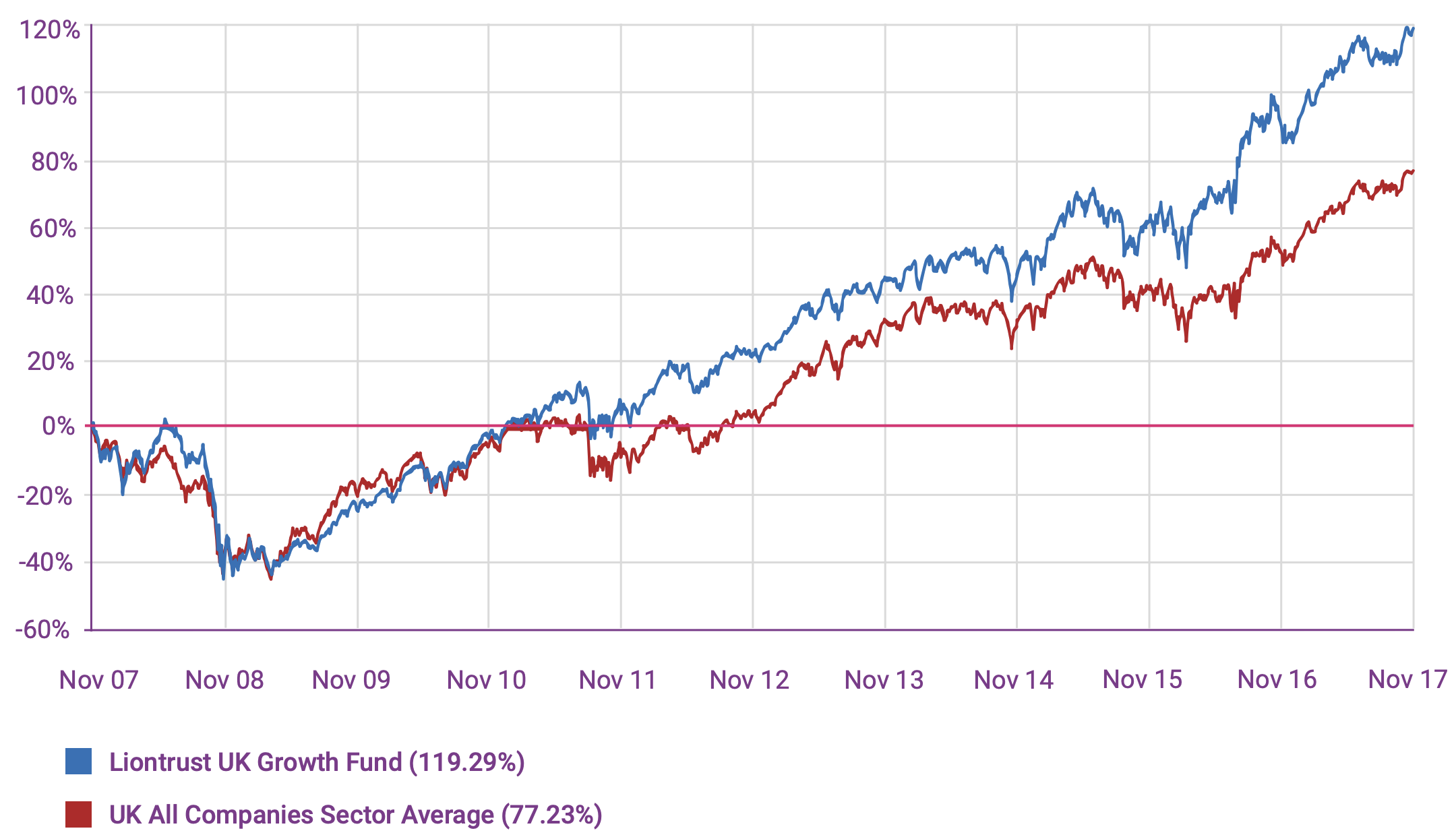

An example of this can be seen with the Liontrust UK Growth fund, which is a popular UK equity fund with a history of strong performance in its sector. But as the table below shows this isn’t always visible.

If we focus on the 1 year period between October 2007 and October 2008, which was the period of the ‘subprime mortgage crisis’, the fund returned negative growth of -45.72%, which was below the average for the period and resulted in a large number of worried and impatient investors to cut their losses and abandon the fund.

But when looking at the funds performance over a longer period, as per the above table, the picture changes considerably. In the 10 years period from October 2007 to October 2017 the fund returned growth of 119.29%, which was 64% higher than the sector average.

Although 1 year may seem a long time to some investors, particularly during a volatile period, it really isn’t. As mentioned earlier, confidence comes from understanding that your investments are being managed efficiently and following best practice processes. For such investors, periods of underperformance are easier to accept as they have confidence that in the longer term the quality of their investments will deliver. A lack of understanding and confidence can result in investors selling off funds that have experienced a period of under performance, which is often much more costly in the longer term.

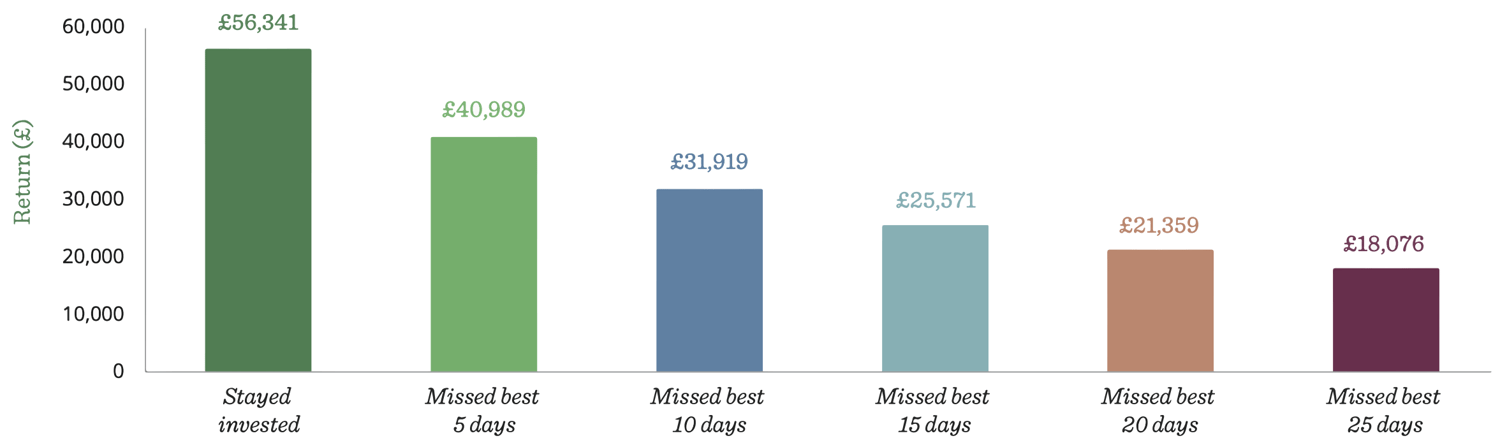

The table below shows just how costly it can be to miss out on the best days in the 20 year period between 31st December 2001 and 31st December 2021. It shows that if you had stayed invested in global equities over the entire period, you could have had a potential return that was three times greater than that of an investor who missed the best 25 days during the same period, based on both of you investing £10,000.

A Balanced Approach To Investing

Investing, like many aspects of life, isn't always straightforward and for some it can be more uncomfortable and stressful than others. As an investor, you will always be exposed to factors that can cause values to rise and fall.

Investing can result in emotional decision making, but the investors who reach their objectives efficiently are typically those who have a disciplined and pragmatic approach to investing, and follow a structured, long term strategy. When this is followed better outcomes can be achieved.

Leading The Way For Investors

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios.

Our research continues to identify that a small proportion of funds and fund managers consistently delivered top performance, with more than 90% of the portfolios we review containing funds that continually underdeliver.

This research has enabled us to identify efficient processes and top-quality investments which we have utilised to create 10 strategically balanced, risk-rated portfolios that are built using only the top funds within each asset class and offer investors phenomenal potential for growth.

Yodelar provides an advice and information service that is changing the way investors think.

Book a no obligation call with our team today and find out how we can help you growth your wealth efficiently.