- Our analysis of Liontrust funds identified that 47.42% have consistently outperformed at least half of their peers over the 1, 3 & 5 year periods analysed.

- Seven of the eight Sustainable Futures funds managed by Liontrust have maintained a 1st quartile sector ranking in their respective IA sectors over one, three and five years to 31st July 2020.

- Of the 14 Neptune funds that Liontrust acquired 9 have consistently underperformed.

Specialist fund management firm Liontrust is a progressive firm who differ from many of their peers as they have a philosophy of actively avoiding a restrictive corporate culture in order to encourage better performance from their fund managers.

They believe a fund managers performance and the funds they manage is not just down to the talent of the individual or team but also to the culture and environment in which they work and creating the right culture for fund managers to perform has been a central tenet of Liontrust since the company was launched in 1995.

The firm's investment philosophy is to focus on areas of investment where they feel they have a particular expertise, and one of these areas is sustainable and ethical investments, which Liontrust adopted relatively early compared to many of their peers.

Just last year Liontrust acquired struggling fund manager Neptune for £40million which increased their fund range to 42 and boosted their assets under management to £17billion.

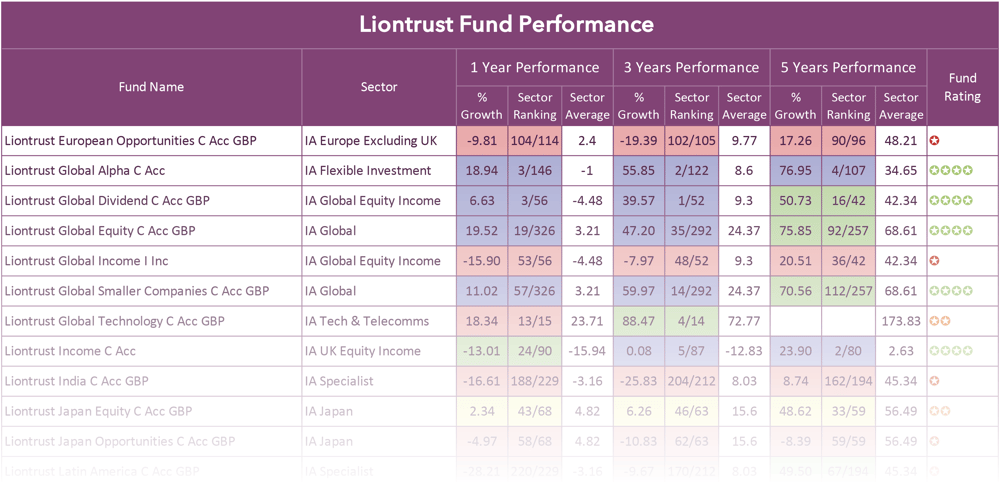

In this report, we analyse each of these 42 funds and identify how they each compare to their peers for performance and sector ranking. This analysis identifies impressive returns from a large proportion of their funds, with their sustainable investment funds in particular, consistently outperforming their competitors and ranking among the very best in their sectors.

The Pioneers of Sustainable Investments

Led by Peter Michaelis, the Liontrust Sustainable Investment team were among the pioneers of sustainable investing when they launched the Sustainable Future fund range in 2001. They have actively engaged on issues, often in the face of severe criticism, that are now central to mainstream investing.

These include raising concerns about the risks posed by oil sand investment and arctic drilling, poor health and safety in clothing supply chains, palm oil-driven deforestation and the mis-selling of financial products, and focusing on positive sectors such as healthcare, clean energy and technology.

The Liontrust Sustainable Investment team takes a proactive approach to ESG and ethical investing – and doesn't just avoid investing in stocks that don't meet its criteria. The managers believe a company's ESG strength is indicative of its corporate success, and pick stocks based on how well these are managed.

They only invest in companies with robust fundamentals, strong management and attractive valuations, and typically those improving people's quality of life, through medical, technological or educational advances and businesses that are improving efficiency in the use of scarce resources; or those helping to build a more stable, resilient economy.

The Rise of Sustainable Investing

Over the last decade, sustainability has become increasingly important in the investment world. More and more investors now want to know where their money is going and what it’s being used for.

In response, more and more governments, corporations and investors are adopting the principles of sustainable investing. In effect, increasing demand is driving the mass growth of these types of investments.

There is now more than $21.4 trillion invested sustainably in global assets, with $13 trillion of this in Europe alone. In the UK, more than half of investors have increased their sustainable investments over the past five years.

Liontrust has placed heavy emphasis on sustainable investing for several years in the belief that it will become more central to investment decisions. Indeed, since 1 April 2017, their Sustainable Investment team has grown its assets under management (AUM) to £6.5 billion as at 30 June 2020, which is just under a third of Liontrust’s total AUM.

In recent years, Liontrust has also proven its ability to deliver superior returns with their sustainable investment funds compared to conventional funds. Seven of the eight Sustainable Futures funds managed by Liontrust have maintained a 1st quartile sector ranking in their respective IA sectors over one, three and five years to 31st July 2020.

Download the full Liontrust Review >>

Liontrust Sustainable Futures Funds

In 2001, Liontrust launched their Sustainable Futures range of funds in the belief that the companies that will survive and thrive are those that help to build a more stable, resilient and prosperous economy by improving people’s quality of life through ethical and sustainable means.

The investment process for their Sustainable Future funds is to invest in companies positively exposed to long-term transformative themes and to limit or completely avoid investment in companies exposed to activities that cause damage to society and the environment.

Investing in ethical and sustainable funds is becoming increasingly important to investors and with greater commitment globally in adopting sustainable practices, investing in ethical and sustainable funds no longer means investors have to sacrifice growth for a clear conscience, and as identified in our analysis most of the Liontrust Sustainable Futures range has consistently ranked among the top-performing funds in their respective sectors, with growing opportunity for these funds to excel in the future.

From the 9 Sustainable Futures funds analysed, 7 have consistently performed better than 75% of all other funds in their sectors over the past 1, 3 & 5 years. One of their funds, the Liontrust Sustainable Futures Managed Growth 2 fund returned the highest growth of all other funds in its sector over the past 3 & 5 years.

The Liontrust Sustainable Investment team believe that this performance will only get better as they believe there is a clear opportunity for growth in the companies helping with the transition to a more sustainable, zero-carbon world in the coming years, with massive change required from many of these sectors as they work to overcome the hurdles from the fossil fuel industry.

Underperforming Liontrust Funds

2 of the worst-performers in their fund range is the Liontrust UK Mid Cap fund and the Liontrust UK Opportunities fund. Both of these funds have been among the very worst in their sectors for performance over each of the 1, 3 & 5 year periods analysed with both consistently outperformed by at least 79% of all other funds in the IA UK All Companies sector.

However, it is important to note that both of these funds were inherited from Neptune when Liontrust acquired Neptune asset management in October 2019. Liontrust has also recently announced their intention of merging these two underperformers into one.

In fact, of the 14 Neptune funds that Liontrust acquired 9 have consistently underperformed. These include the now renamed Liontrust Japan Opportunities fund which was the worst-performing fund in the entire IA Japan sector over the past 5 years as it returned negative growth of -8.39% compared to the sector average of 56.49%.

Another inherited fund that has been a serial underperformer is the Liontrust European Opportunities funds (formerly Neptune European Opportunities Fund). This fund has consistently ranked among the bottom of the competitive IA Europe ex UK sector for performance. Over the past 3 years, this fund returned cumulative losses of -19.39% which was worse than 97% of all other funds in its sector.

Of their own range of funds, the Liontrust Macro UK Growth has consistently been one of the worst performers. This fund is 1 of 220 funds that sit within the IA UK All Companies sector where over the past 5 years it ranked 206th as it returned losses of -9.30%. In comparison, the average returns within the sector over the same period was 12.21%.

Liontrust Fund Performance Summary

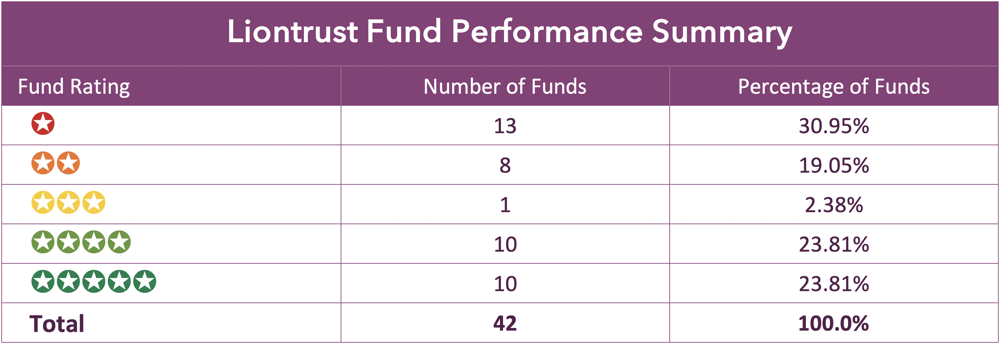

Our analysis of Liontrust funds identified that 47.42% have consistently outperformed at least half of their peers over the 1, 3 & 5 year periods analysed. 2.38% received a moderate 3-star performance rating with 50% receiving a poor 1 or 2-star performance rating. However, it is important to acknowledge that 43% Liontrust funds that received a poor 1 or 2-star performance rating are funds they inherited from their acquisition of Neptune in the summer of 2019.

How yodelar rate fund performance

Liontrust Have Proven Their Funds Can Deliver Top Performance

Despite inheriting Neptunes underperforming funds our recent fund manager league table highlights Liontrust as one of the top-performing fund managers in the UK.

In comparison to some of the larger more recognisable fund management brands Liontrust

A significant proportion of their best performing funds come from their range of sustainable funds, which have shown Liontrust's ability to deliver superior returns with their sustainable investment funds compared to conventional funds.