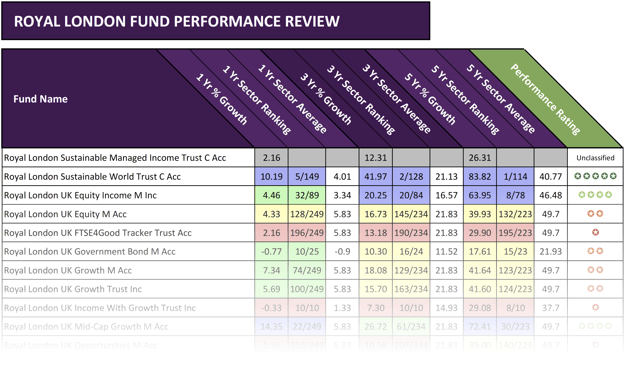

In this report we have analysed the performance and sector ranking of 56 Royal London funds:

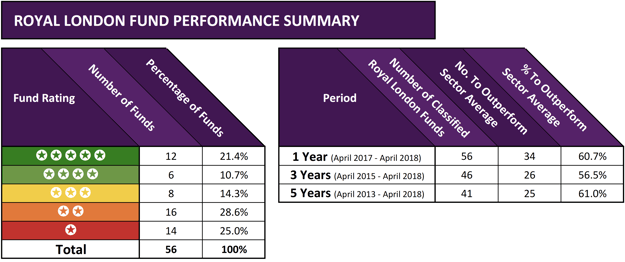

- 12 of the 56 Royal London funds analysed consistently outperformed at least 75% of competing funds in 1, 3 & 5 year period up to April 2018.

- However, over the same 5-year period 49% of their funds returned growth that was below the sector average.

- 53.6% of Royal London funds received a poor 1 or 2 star performance rating.

Royal London Asset Management (RLAM) is one of the UK’s largest fund management companies with around £113.6 billion of assets under their management. Established in 1988, they have built a reputation as an innovative, high performing fund manager who takes pride in the performance they have delivered for their clients.

With some 56 pension and unit trust funds under their management, we analysed the performance of each and identified precisely how well they performed in comparison to all other competing same sector funds.

As detailed in our analysis, some 50.6% of RLAM funds rated a weak 1 or 2-star Yodelar performance rating. However, some 21.4% of their funds have consistently been among the very best in their sectors.

The Best Royal London Funds

From the 56 funds analysed 12 (21.4%) received a 5-star Yodelar rating as each has continually outperformed at least 75% of competing funds within the same sector over the recent 1, 3 & 5-year period up to April 2018.

One of their most impressive funds was the Royal London Sterling Extra Yield Bond. Launched in 2003 this low volatility fixed interest fund holds around £1.6 billion of assets under management, and it has consistently performed well. Over the recent 12 months this fund enjoyed growth of 8.83%, which ranked 4th out of 79 funds in its sector, and over 5 years it returned cumulative growth of 49.06%, which was significantly higher than the sector average of 22.37%, and better than 97% of same sector funds.

Another 5-star rated Royal London fund was their Corporate Bond fund. This fund invests in a broad range of sterling fixed interest assets, and since its launch in 1999, it has amassed some £1.1 billion of client funds under management. Over the recent 1, 3 & 5 year period this fund returned cumulative growth of 3.46%, 14.48% and 32.41%, which was consistently better than the sector average of 2.04%, 11.78%, and 26.08%.

From their range of 10 pooled pension funds, a very impressive 7 received a 5-star Yodelar performance rating as they consistently outperformed at least 75% of competing same sector funds over the 1, 3 & 5 year periods analysed. One of these ‘top performing funds’ was RLPPC Long Aggregate Bond Pension fund. Launched in 2006 and managed by Richard Nelson, this fund holds a modest £95.95 million of client funds under management, but it has continually outperformed its peers. Over the recent 5-year period this fund returned growth of 52.46%, which was the highest of all 120 funds in its sector and considerably higher than the sector average for this period of 23.05%.

The RLPPC UK Corporate Bond was another Royal London pension fund to excel within its sector. Over the recent 5-year period this fund managed to return cumulative growth 37.10%, which was the 3rd highest in a sector with 203 funds.

Sign in to view the complete Royal London review in the April edition of the Yodelar magazine. Not a member? Register now for just £1 and get instant access to all premium reports.

Royal London Funds That Have Underperformed

As identified in our analysis, Royal London has a robust selection of quality, 5-star rated funds but 50.6% of the 56 funds they manage have received a poor 1 or 2-star Yodelar performance rating.

One of the most disappointing Royal London funds was their European Opportunities fund. Over the recent 5-year period this fund returned cumulative growth of 52.38%, which ranked 72nd out of 85 funds in its sector. Another of Royal London’s funds to struggle was their UK Opportunities fund, which launched in 2010 and currently has funds under management over £700 million. This fund has continually struggled for performance in comparison to its peers, and over the recent 1-year period it returned growth of 1.35%, which was lower than 84% of same sector funds.

The best fund managers: Download our most recent fund manager league table ⇒

A Slow Start For Royal London’s Global Multi-Asset Portfolios

In response to the growing investor demand for ready-made portfolios, Royal London launched a range of Global Multi-Asset Portfolios (GMAP) in March 2016. These 6 risk-rated portfolios range from the lower risk conservative and defensive portfolios to the mid-range balanced and growth portfolios up to the higher risk adventurous and dynamic portfolios. All 6 of these portfolios are primarily managed by Trevor Greetham, who joined Royal London in 2015 from his previous role as asset allocation manager with Fidelity. Since their launch, these 6 funds combined have amassed some £331 million of client funds under management.

These 6 risk-rated portfolios range from the lower risk conservative and defensive portfolios to the mid-range balanced and growth portfolios up to the higher risk adventurous and dynamic portfolios. All 6 of these portfolios are primarily managed by Trevor Greetham, who joined Royal London in 2015 from his previous role as asset allocation manager with Fidelity. Since their launch, these 6 funds combined have amassed some £331 million of client funds under management. However, they have struggled for performance in comparison to their peers, with only their Adventurous fund managing to return growth that was above the sector average.

As demonstrated in our analysis, Royal London and their funds have experienced mixed performance over the recent 5 years. With strong performance, in particular from their pension fund range and uninspiring performance from a proportion of their new and established unit trust funds.

Although some of their funds have struggled, Royal London has been able to deliver excellent returns from a comparatively large selection of their funds. Indeed, with 32.1% of their funds receiving a robust 4-5 star Yodelar performance rating, they ranked a very respectable 13th out of 78 fund managers in our most recent fund manager league table, which was distinctly better than many of their competitors.