- The IA China/Greater China sector led all IA categories with an average 1-year return of 40.89%, fuelled by technology, consumer growth, and policy support.

- Financials & Financial Innovation delivered strong gains as fintech, digital payments, and higher interest rates boosted global financial stocks.

- Technology & Technology Innovation continued its rebound, with themes such as AI and cloud computing driving sector-leading results over multiple periods.

- Asia Pacific ex-Japan funds benefited from rapid growth across emerging economies, supported by infrastructure spending and technology demand.

- European Smaller Companies funds capitalised on a rebound in valuations, with innovative SMEs providing investors with standout growth opportunities.

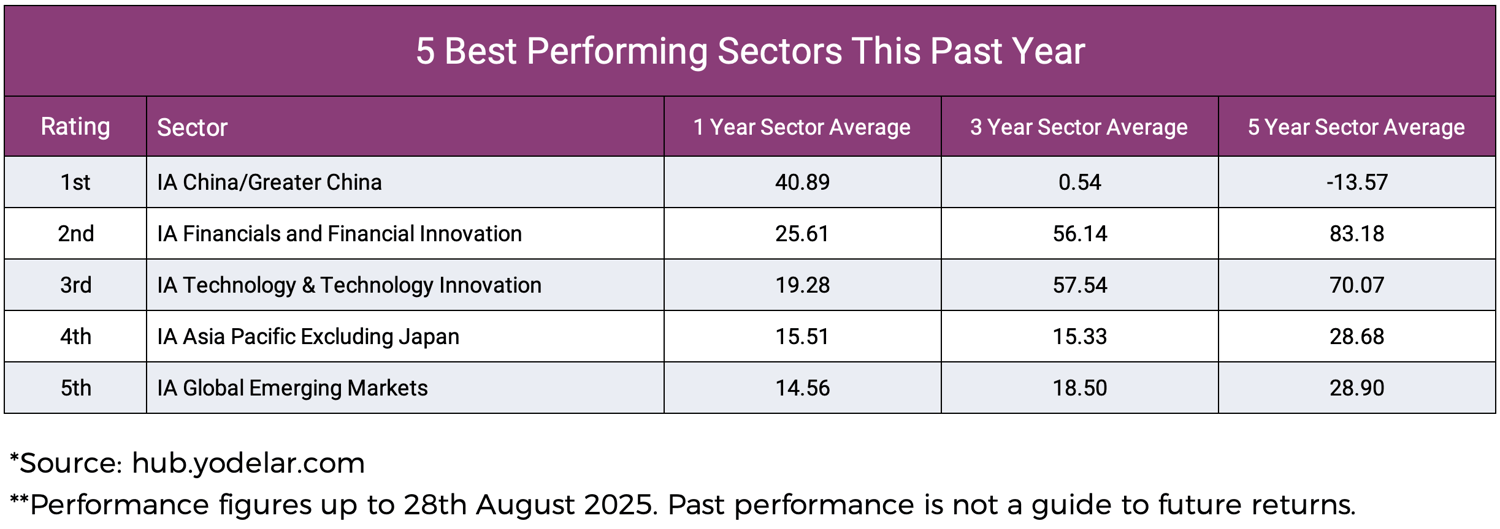

Despite ongoing uncertainty across global markets, including fluctuating interest rates, uneven economic growth and geopolitical tensions, several investment sectors have delivered exceptional results. Our review of all 55 Investment Association sectors highlights the five strongest performers over the past year: China/Greater China, Financials & Financial Innovation, Technology & Technology Innovation, Asia Pacific ex-Japan, and European Smaller Companies.

Each has been driven by distinct themes - from China’s rebound in technology and consumer markets, to the rapid expansion of fintech and artificial intelligence, and the growth of nimble European small caps. Alongside identifying these top-performing sectors, we also analyse 10 standout funds that have consistently outperformed peers across 1, 3, and 5 years.

This combined sector and fund analysis provides investors with a clear view of where the strongest opportunities have emerged and how they can be positioned to capture long-term growth.

5 Best Sectors for Growth

Here, we break down the five top sectors for growth over the past year, assessing where opportunities lie and what risks may come with them.

IA China / Greater China

The IA China/Greater China sector offers investors exposure to one of the fastest-growing yet most volatile regions in the world. Funds in this sector must allocate at least 80% of assets to equities in mainland China, Hong Kong, and Taiwan. This provides access to opportunities in technology, manufacturing, financial services, and consumer markets.

With £2.1 billion in assets under management, the sector is relatively small compared with broader global equity categories. However, it remains a key choice for investors seeking concentrated exposure to the Chinese growth story.

The sector delivered the highest one-year return of all IA sectors, driven by urbanisation, a rising middle class, and advances in technology such as semiconductors and renewable energy. However, regulatory intervention, trade tensions, and slowing economic momentum continue to create volatility.

IA Financials & Financial Innovation

The IA Financials & Financial Innovation sector invests in equities across the global financial services industry. At least 80% of assets must be allocated to banking, insurance, capital markets, fintech, and consumer finance. It combines traditional financial models with disruptive technologies, providing exposure to both stability and innovation.

The sector has produced strong returns but remains relatively small, with £2.93 billion in assets under management. Its size suggests that many investors still prefer larger, more established sectors. For those willing to embrace change, however, it offers an attractive opportunity supported by the rapid growth of financial technology.

Risks remain significant. Returns are influenced by interest rate movements, regulatory changes, and the wider economic cycle. These factors create vulnerabilities that sit alongside the sector’s growth potential.

IA Technology & Technology Innovation

The IA Technology & Technology Innovation sector allocates at least 80% of assets to equities across technology and related industries, including telecommunications, robotics, software, and online retail.

The sector focuses on transformative themes such as artificial intelligence (AI), cloud computing, and e-commerce. As more industries adopt digital solutions, demand for technology continues to grow, driving sustained expansion.

The sector is highly rewarding but volatile. Technology stocks are sensitive to economic shifts, interest rates, and regulation. A sharp sell-off in 2022 highlighted these risks, but the sector rebounded to become the best-performing IA sector in 2023, with momentum carrying into 2024.

The sector currently manages £12.9 billion in assets. Despite its strong performance and appeal to growth-focused investors, it remains less popular than more diversified categories, reflecting its higher volatility.

IA Asia Pacific ex-Japan

The IA Asia Pacific ex-Japan sector requires at least 80% of assets to be invested in equities across the Asia Pacific region, excluding Japan. This includes developed and emerging markets such as Australia, Hong Kong, South Korea, Taiwan, and countries in Southeast Asia. The sector offers exposure to diverse economies with strong growth potential, supported by expanding middle classes, infrastructure investment, and technological development.

The sector is substantial in size, with £34.99 billion in assets under management as of July 2025. Its scale reflects the importance of the Asia Pacific to global growth and the broad opportunities available across the region.

Exposure to emerging markets brings vulnerability to currency swings, trade tensions, and political instability. The sector is also sensitive to global demand cycles, particularly in technology and commodities.

IA European Smaller Companies

The IA European Smaller Companies sector offers an investment opportunity in Europe’s small and medium-sized enterprises (SMEs), focusing on companies within the smallest 20% by market capitalisation. With greater growth potential than larger firms, the sector provides a distinctive entry point into developed European markets.

The sector currently manages £1.92 billion in assets as of July 2025, making it one of the smaller IA categories. Its lower popularity may reflect the higher risks of smaller firms, which are more exposed to economic cycles, funding pressures, and market volatility, factors that can magnify both gains and losses.

Nevertheless, underinvestment in the sector may represent an untapped opportunity for those seeking diversification in European equities and willing to accept greater risk in pursuit of long-term returns.

Average Performance of All Investment Association (IA) Sectors

The table below ranks all IA sectors from best to worst, based on the average returns of funds in each sector over the past 12 months.

10 Top Performing Funds This Past Year

The table below highlights the 10 best performing funds, providing a detailed overview of their returns over the most recent 1, 3, and 5 year periods.

Each of these funds has delivered consistently competitive results across changing market conditions and is recognised as a top performer within its sector. From each of the five leading sectors, two funds have been selected for their sustained outperformance and solid returns.

Each of these funds has also been awarded a star rating to reflect its performance relative to its sector peers.

Jupiter China Fund

The Jupiter China I Acc fund seeks to achieve long-term growth by outperforming the MSCI China Index over a period of at least five years. The fund invests a minimum of 70% of its assets in companies that are based or carry out most of their business in Greater China, which includes Hong Kong, Macau, and Taiwan. The balance, up to 30%, may be invested in other global assets such as cash or other investment funds.

Performance has been strong in recent years. Over the past 12 months the fund returned 62.65%, ranking 2nd out of 62 funds in its sector and ahead of the sector average of 40.89%. Over three years it gained 20.39%, ranking 3rd out of 60 funds, compared with a sector average of 0.54%. Over five years it delivered 5.74%, placing it in the top third of its peers, while the sector average fell by -13.57%.

The fund has assets of around £37 million. Recent performance has been supported by significant investments in technology and consumer companies such as Tencent, Alibaba, Xiaomi, and Pop Mart International, as well as exposure to large financial institutions including China Construction Bank. These positions have benefited from a recovery in Chinese equities, which has been helped by government policy measures and improving investor sentiment in Hong Kong.

The fund is actively managed and focused on growth opportunities in Greater China. It is considered higher risk due to the concentration in a single region and the volatility of emerging markets.

GAM Multistock – China Evolution Equity Fund

The GAM Multistock – China Evolution Equity R fund is designed to achieve long-term capital growth by investing primarily in Chinese companies. At least two-thirds of its assets are allocated to equities of firms with their registered office or main operations in China.

The fund has consistently ranked among the best in its sector. Over the past year, it returned 48.65%, ranking 8th of 63 funds and ahead of the 40.89% sector average. Over three years it gained 6.67%, ranking 15th of 60, compared with the sector average of 0.54%. Across five years it returned 0.97%, ranking 7th of 53, against the sector average of –13.57%.

Recent performance has been supported by effective stock selection in the consumer cyclical, financial, communication and technology sectors. Key holdings such as Tencent, Alibaba, Xiaomi, Trip.com and BYD account for nearly one-third of the portfolio and have made a notable contribution to returns.

Jupiter Global Financial Innovation Fund

The Jupiter Global Financial Innovation I Acc fund aims to grow over the long term, with a target of at least five years. It mainly invests in shares of companies around the world that are changing the way financial services work. At least 70% of the fund is in company shares, with the rest in assets such as other funds, cash, or financial instruments.

The managers focus on businesses driving change in areas like digital payments, fintech, blockchain, and new models of banking and insurance. They research individual companies in detail while also keeping an eye on wider industry and economic trends.

The fund has been the best performer within the IA Financials and Financial Innovation sector in the short to medium term. Over the past year it returned 47.37%, ranking 1st of 12 funds and well ahead of the sector’s 25.61% average. Over three years it gained 82.88%, again ranking 1st in the sector.

With around £32 million in assets, performance has been supported by a concentrated portfolio of global financial innovators. Key holdings include UniCredit, NatWest Group, Barclays and Swissquote, all of which have contributed significantly to returns. Regionally, assets are spread across the Eurozone, the UK and the US, giving broad exposure to developed financial markets.

The five-year record, however, is weaker than its shorter-term results. The fund returned 46.98%, below the sector average of 83.18%. This reflects volatility in global financial stocks and difficulties faced by some traditional banks and insurers during market downturns.

Janus Henderson Global Financials Fund

The Janus Henderson Global Financials I Acc fund aims to achieve long-term growth. It invests at least 80% of its assets in financial companies around the world. These include banks, insurers, asset managers, stock exchanges, and specialist finance businesses, covering both developed and emerging markets. The goal is to beat the FTSE World Financials Index by an average of 2% per year over a five-year period.

The fund has consistently outperformed its peers in the IA Financials and Financial Innovation sector. Over the past year, it achieved a return of 35.38%, ranking 3rd of 12 funds against a sector average of 25.61%. Across three years, it delivered 71.57%, again ranking 3rd of 10 and comfortably ahead of the 56.14% sector average. Over five years, growth reached 113.40%, placing it in the upper half of its peer group and outperforming the sector’s 83.18% average.

Performance has been driven by higher profitability in European and US banks, rising interest rates and corporate actions such as UniCredit’s share buy-backs. Insurers gained from higher yields and favourable pricing, while payment networks benefited from global transaction growth. Concentrated positions in JPMorgan, UniCredit, BNP Paribas and Mastercard enhanced results, with NatWest and Swissquote contributing through capital returns and digital innovation.

Polar Capital Global Technology Fund

The Polar Capital Global Technology Fund was launched in October 2001 and aims to deliver long-term growth by investing in technology companies worldwide. The fund manages around £6.3 billion and is run by Polar Capital’s dedicated technology team. It usually invests in 60 to 85 companies.

The managers research individual businesses and focus on those with strong earnings and cash flow. While they have a preference for smaller and medium-sized companies with higher growth potential, they also invest in larger, more established firms when it makes sense in the market. This gives the fund flexibility to adapt as conditions change.

Over the past year, the fund returned 33.67%, ranking 1st of 31 funds against a sector average of 19.28%. Over three years, it gained 84.84%, ranking 3rd of 30 compared with 57.54% for the sector. Over five years, its cumulative return reached 81.80%, ahead of the sector’s 70.07% average. This record places it among the best performers in the IA Tech & Tech Innovation sector.

The fund has capitalised on the surge in artificial intelligence, boosting demand for semiconductors and related infrastructure. Key positions in NVIDIA, Alphabet, Meta Platforms, Broadcom, TSMC and AMD strengthened recent returns. The portfolio is largely concentrated in US companies, with additional exposure in Asia and Canada, which provides access to broader global technology growth.

Liontrust Global Technology Fund

The Liontrust Global Technology Fund aims to deliver long-term growth over five years or more. It invests at least 80% of its assets in technology and telecommunications companies around the world. These are businesses classified within the global information technology and communication services sectors.

Managing around £225 million in assets, the fund has consistently outperformed the IA Tech & Tech Innovation sector. Over the past year, it returned 27.38% compared with the sector average of 19.28%. Over three years, it gained 80.43% versus 57.54%, and over five years, it delivered 92.93%, well ahead of the sector’s 70.07%. Its longer-term record highlights the effectiveness of this approach.

Recent outperformance reflects effective stock selection across the technology sector. Expanding use of artificial intelligence has created greater demand for semiconductors, cloud capacity, and data-centre infrastructure. Holdings such as Broadcom, CrowdStrike, Palantir, NVIDIA, TSMC and Meta Platforms contributed through earnings growth and pricing power.

Federated Hermes Asia ex-Japan Equity Fund

The Federated Hermes Asia ex-Japan Equity Fund is designed to deliver long-term capital growth over rolling five-year periods. The fund commits at least 80% of its capital to equities and equity-related securities of companies based in, or generating significant revenues from, Asia excluding Japan. These holdings are listed or traded on regulated markets worldwide.

With around £3.4 billion in client assets under management, the fund has consistently ranked among the top performers in its sector. Over the past year, it returned 26.01%, placing 3rd of 103 peers against a sector average of 15.51%. Across three years, it delivered 30.92%, nearly double the sector’s 15.33%, ranking 5th of 100. Over five years, the fund generated 64.88%, more than twice the sector average of 28.68%, securing 4th place out of 91 funds.

Recent performance has been driven by selective investments in Asian financials, technology and communication sectors. The fund’s valuation-led, contrarian style—focusing on quality companies trading below fair value—has been instrumental in generating returns. The experienced management team fully integrates environmental, social and governance (ESG) factors into the investment process, underpinning sustained success.

Jupiter Merian Asia Pacific Fund

The Jupiter Merian Asia Pacific I Acc fund invests predominantly in companies across Asia and Australasia, excluding Japan. Its objective is capital growth through outperforming the MSCI AC Asia Pacific ex-Japan Index net of fees, with dividends reinvested over rolling three-year periods. The fund allocates at least 70% of assets in this region, including selective emerging markets.

The fund is actively managed, with decisions guided by company fundamentals such as valuation, balance sheet strength, growth potential, and market conditions. Derivatives may be used in limited cases to manage risk or reduce costs.

The fund oversees around £368.77 million and has delivered impressive results relative to its peer group. Over one year, it returned 20.34%, comfortably ahead of the sector’s 15.51%. Over three years, it achieved 35.42%, securing 2nd place among 100 funds, while over five years it posted 54.02%, well above the 28.68% sector average.

The fund’s success is largely attributed to its exposure to technology and financials, sectors supported by rising demand and favourable regional policies. Its portfolio has been tilted towards markets such as Taiwan, China, India, Korea and Australia, with holdings including Taiwan Semiconductor, Tencent, Alibaba, AIA Group and Infosys. These companies have contributed to returns through stable earnings and dividend payments. The fund’s concentrated strategy has amplified results but also increases sensitivity to sector-specific risks and market volatility.

Mirabaud Discovery Europe ex-UK Fund

The Mirabaud Discovery Europe ex-UK D Cap fund targets capital growth through European small and mid-cap equities, excluding the UK. It invests in companies with niche market leadership, innovative business models, and the ability to benefit from structural change.

The strategy is aligned with three sustainability themes: SAFER (safety and compliance), SMARTER (using technology to improve lives), and CIRCULAR (reducing waste).

Classified within the IA European Smaller Companies sector, the fund has been a consistent top performer. Over one year, it returned 28.55%, more than double the sector average of 13.33% and ranked 1st of 25 peers. Over three years it gained 50.42% against 31.65%, while over five years, it achieved 84.91%, compared with 40.07% for the sector. Assets under management currently stand at £293.67 million.

The fund’s success is driven by investments in companies with high growth potential and innovative business models, while avoiding controversial sectors. Sectors such as engineering, banking, real estate, and technology have given it a big boost. The managers also pick firms with high ESG ratings to lower risks and work with them to improve standards.

BNY Mellon Small Cap Euroland Fund

The BNY Mellon Small Cap Euroland W Acc fund targets long-term capital growth by investing 90% of its assets in small-cap companies based in countries that use the euro (“Euroland countries”). The fund excludes sectors such as tobacco and follows rigorous ESG criteria to ensure responsible investing.

The fund has delivered steady returns across various market environments. It posted a 21.22% gain over one year, beating the sector average of 13.33%. Over three years, it returned 44.51%, and over five years, 61.78%, ranking fifth in a group of 25 funds, well above the sector average of 40.07%.

Its outperformance stems from a well-balanced portfolio invested across industrials, financials, healthcare, and technology sectors. Key holdings such as Italgas SpA and DWS Group have played a vital role in driving returns. The combination of diversified sector exposure, disciplined management, and favourable macroeconomic conditions has strengthened the fund’s reputation for delivering sustained growth.

Conclusion

Over the past 12 months, the China/Greater China sector has led performance, recording the strongest growth of all IA sectors. Financials & Financial Innovation, Technology & Tech Innovation, Asia Pacific excluding Japan, and European Smaller Companies also ranked highly, reflecting strength across fast-growing regions, emerging industries and smaller businesses. These results highlight the extent to which sector trends can shape investment outcomes.

Within these sectors, a number of funds outperformed their peers over multiple timeframes. While this underlines the potential benefits of active management, it also shows the wide variation in results between funds within the same sector.

Overall, the analysis illustrates how different parts of the market can deliver contrasting outcomes over time, emphasising the importance of understanding sector dynamics and monitoring fund performance relative to peers.

Smart Investing for Long-Term Portfolio Success

Inefficient investing can damage long-term returns and put future financial goals at risk. Identifying weaknesses in a portfolio early makes it more resilient. Success is not about short-term gains but about how well a portfolio is built to perform over the years ahead. Spreading investments across regions, sectors, and asset classes, with a clear long-term plan, provides the foundation for stability. No single fund or provider will lead in every market cycle, which makes diversification essential.

Following the merger of Yodelar with MKC Wealth, investors now have access to portfolios managed on a discretionary basis by MKC Invest, part of the MKC group. Where suitable, advisers may recommend these portfolios as part of a client’s overall strategy. This approach allows timely adjustments, helping portfolios remain aligned as markets change.

Problems often arise when portfolios are neglected, reviewed too infrequently, or heavily weighted towards funds and sectors that have recently performed well. The MKC process seeks to prevent this through ongoing analysis and active management, helping portfolios stay efficient and appropriate for investor objectives.

Regular reviews are important to check whether a portfolio remains suitable for an investor’s goals and risk profile, giving a clearer view of its long-term fit.