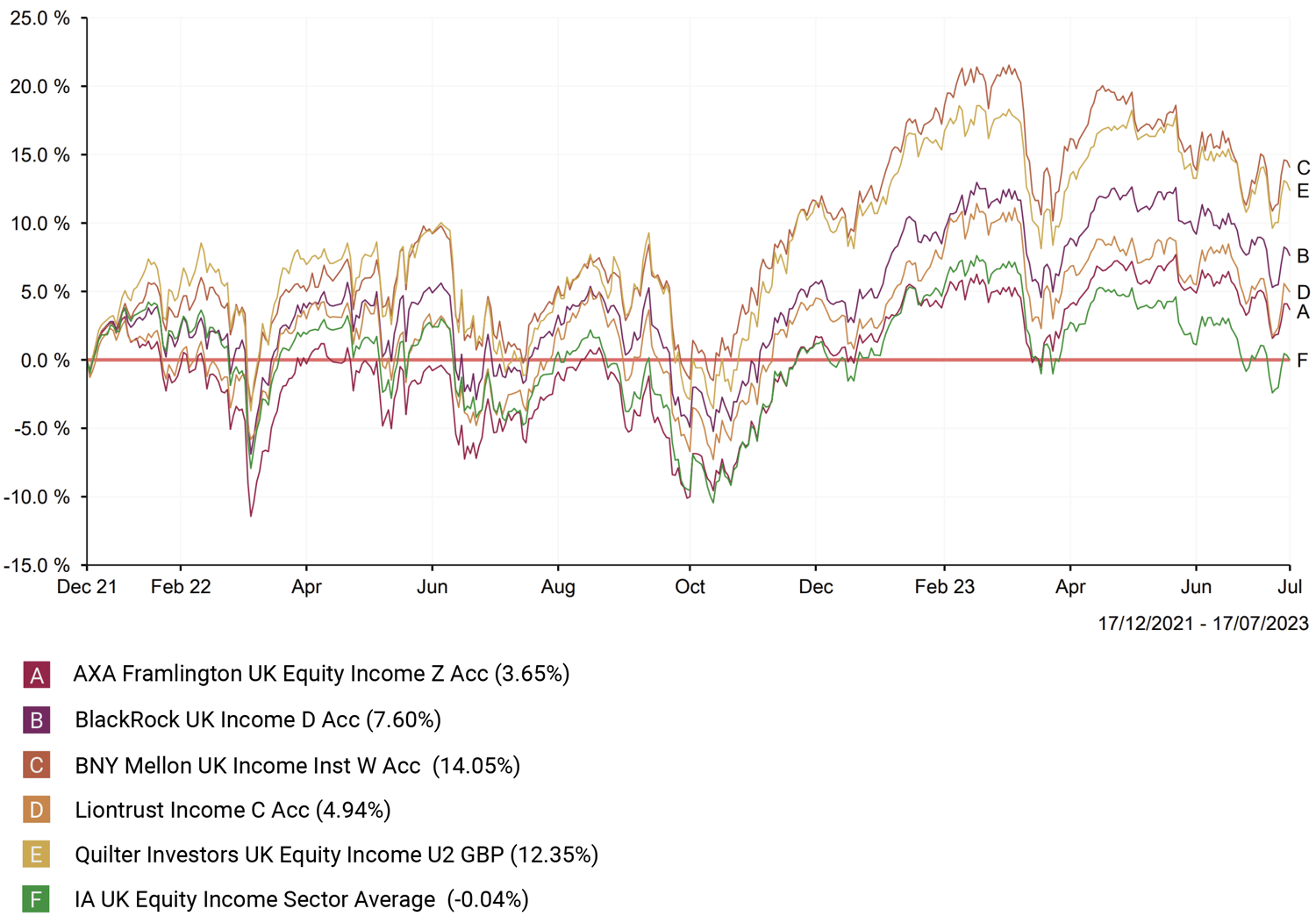

- The UK Equity Income sector averaged returns of -0.04% from 17th December 2021 when UK interest rates began to rise until 17th July 2023.

- The highest growth fund for the period was the BNY Mellon UK Income W Acc fund with returns of 14.05%.

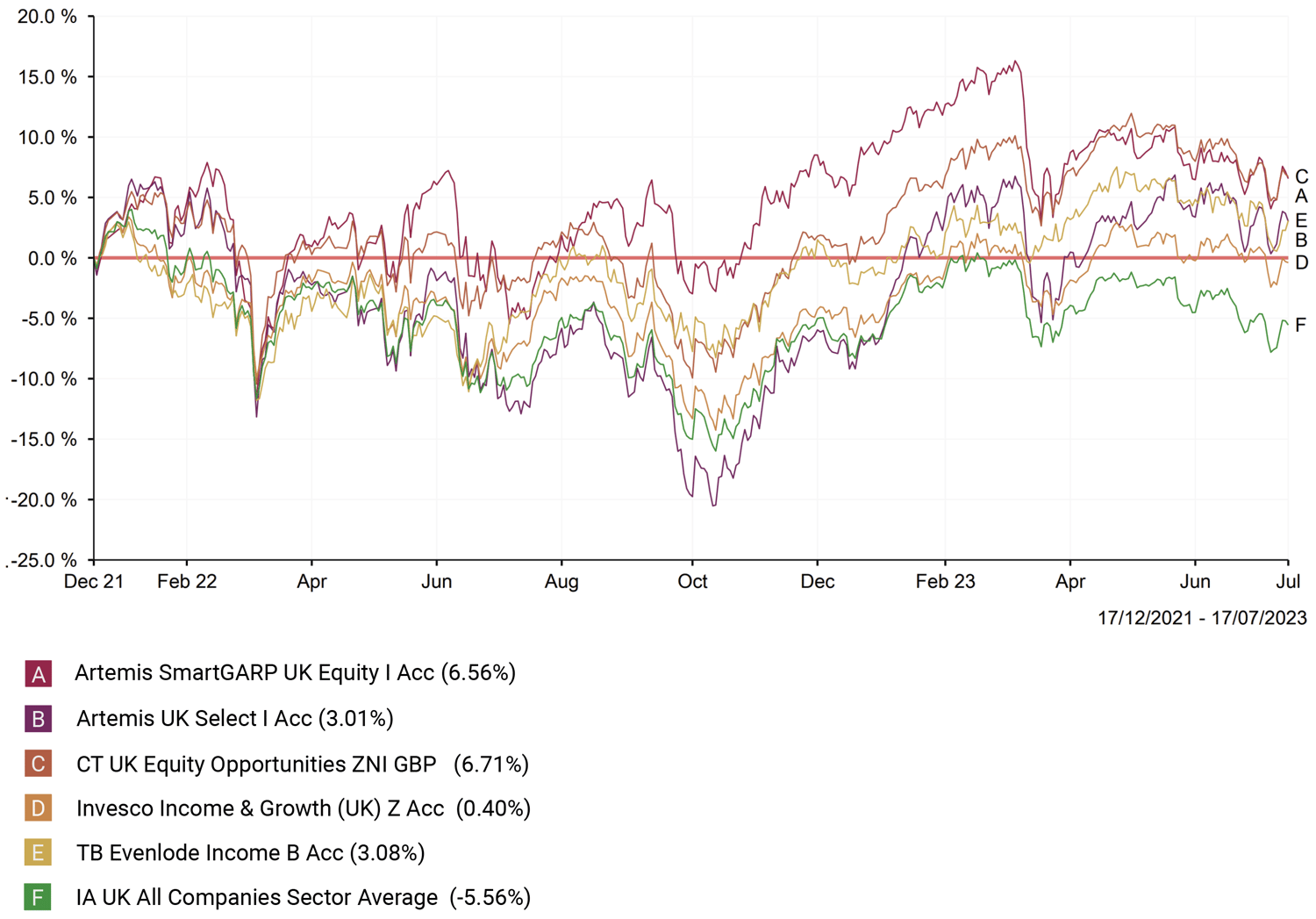

- The 5 UK Equity funds classified within the UK All Companies featured in this article have all delivered positive growth returns for the period, with the Artemis SmartGARP UK Equity fund with the highest at 7.30%

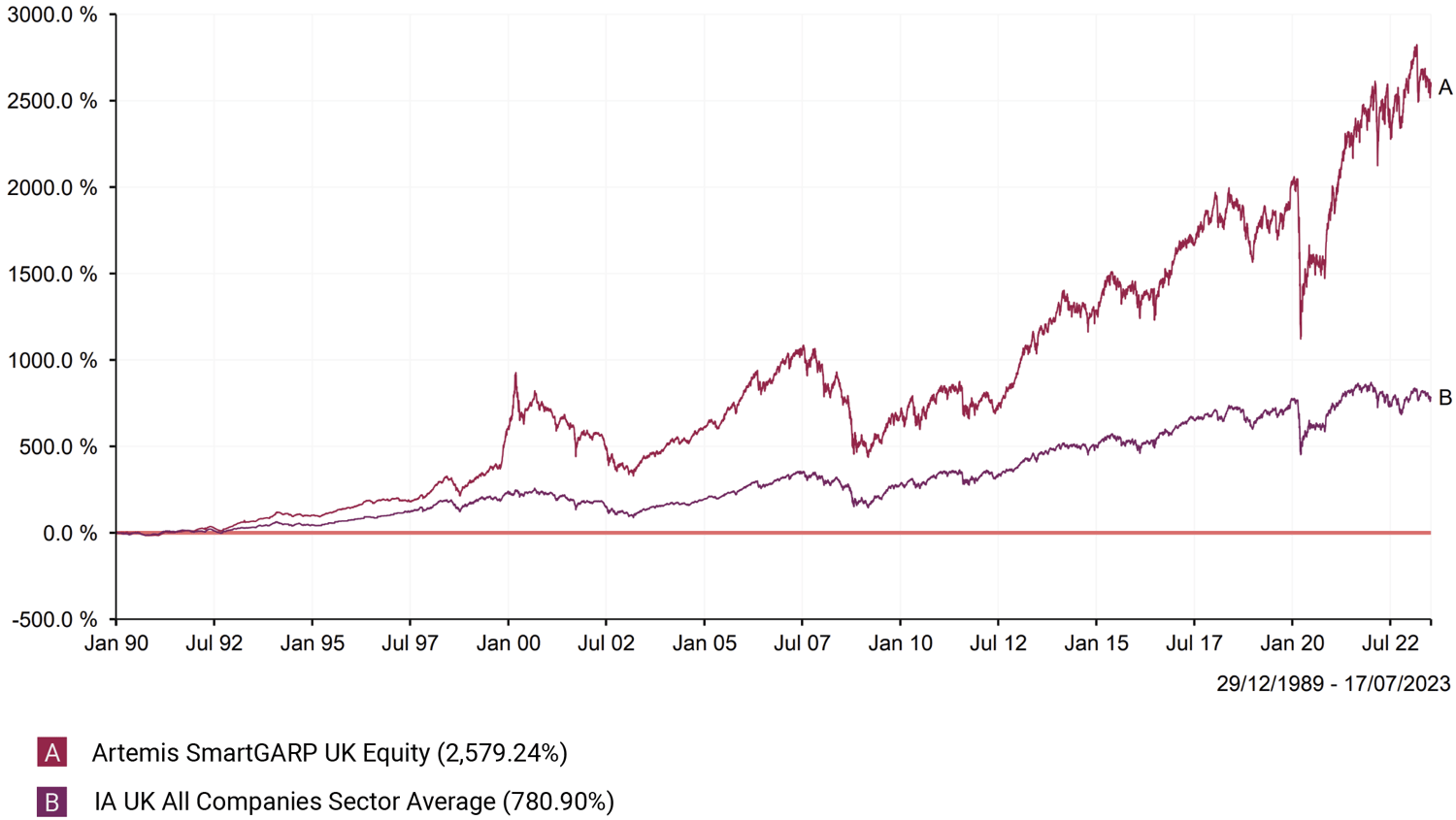

- The Artemis SmartGARP has returned exceptional growth of 2,579.24% since launch in 1989, which is 3.3 times the sector average.

Inflation has been a concern for investors worldwide with UK investors in particular experiencing large challenges with rising interest rates and inflation converging to push down fund valuations.

With rising inflation, it has become crucial for investors to identify opportunities that can potentially outpace inflation and provide attractive returns without increasing risk.

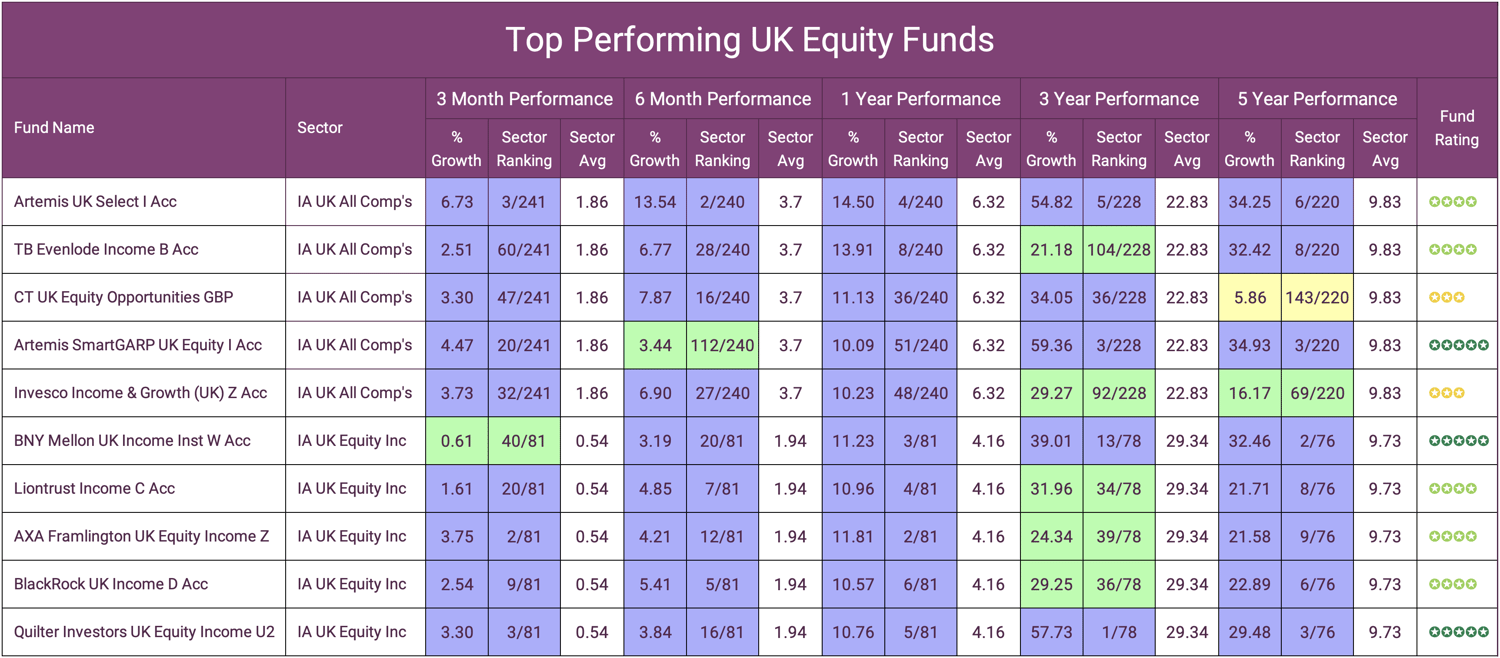

There is currently £188.4 billion invested in 370 UK equity funds. 240 of these funds are classified within the IA UK All Companies sector, 81 with the UK Equity Income sector and 49 from the UK Smaller Companies sector. For this article, we analysed each of these funds and identify 10 funds that have not only been successful in beating high inflation but also consistently delivered some of the best sector returns consistently since their launch.

Top Performing UK Equity Funds

The table below shows the 3 month, 6month, 1 year, 3 years & 5 years performance and sector ranking of 10 UK Equity funds that have been among the top performers in their sectors since the Bank of England began its raft of interest rate hikes in December 2021. Each of these funds comfortably outperformed the sector average since December 2021 navigating high volatility and rising inflation, but as identified in the table below, many of these funds have also consistently outperformed the sector average long before the current cycle of rising inflation and high volatility.

*Fund rating is based on 1, 3 & 5 year performance and sector ranking. How Yodelar rate fund performance

IA UK Equity Income Sector Performance

The graph below shows the performance of the 5 UK Equity Income sector classified funds from December 2021, when UK interest rates began to rise, up to 17th July 2023.

The IA UK Equity Income sector averaged returns of -0.04% from 17th December 2021 when UK interest rates began to rise until 17th July 2023.

The highest growth fund for the period was the BNY Mellon UK Income Inst W Acc fund with returns of 14.05%, which was comfortably above the sector average. This fund has also consistently maintained a high sector ranking with 5 year returns of 32.46% ranking 2nd out of 76 funds in the IA UK Equity Income sector.

IA UK All Companies Sector Performance

The graph below shows the performance of the 5 UK equity funds that are classified within the UK All Companies sector from December 2021 up to 17th July 2023.

For the period analysed, the Investment Association (IA) UK All Companies sector has averaged negative returns of -5.03% with the majority of funds in the sector struggling with falling valuations. The 5 UK Equity funds classified within the UK All Companies featured in this article have all delivered positive growth returns for the period, with the Artemis SmartGARP UK Equity fund with the highest at 7.30%, which was particularly impressive for such a highly volatile period.

The 10 Top Performing UK Equity Funds

Below we detail the management and strategy for each of the 10 featured funds identifying why they have performed well and why they have the potential to deliver competitive future returns for investors.

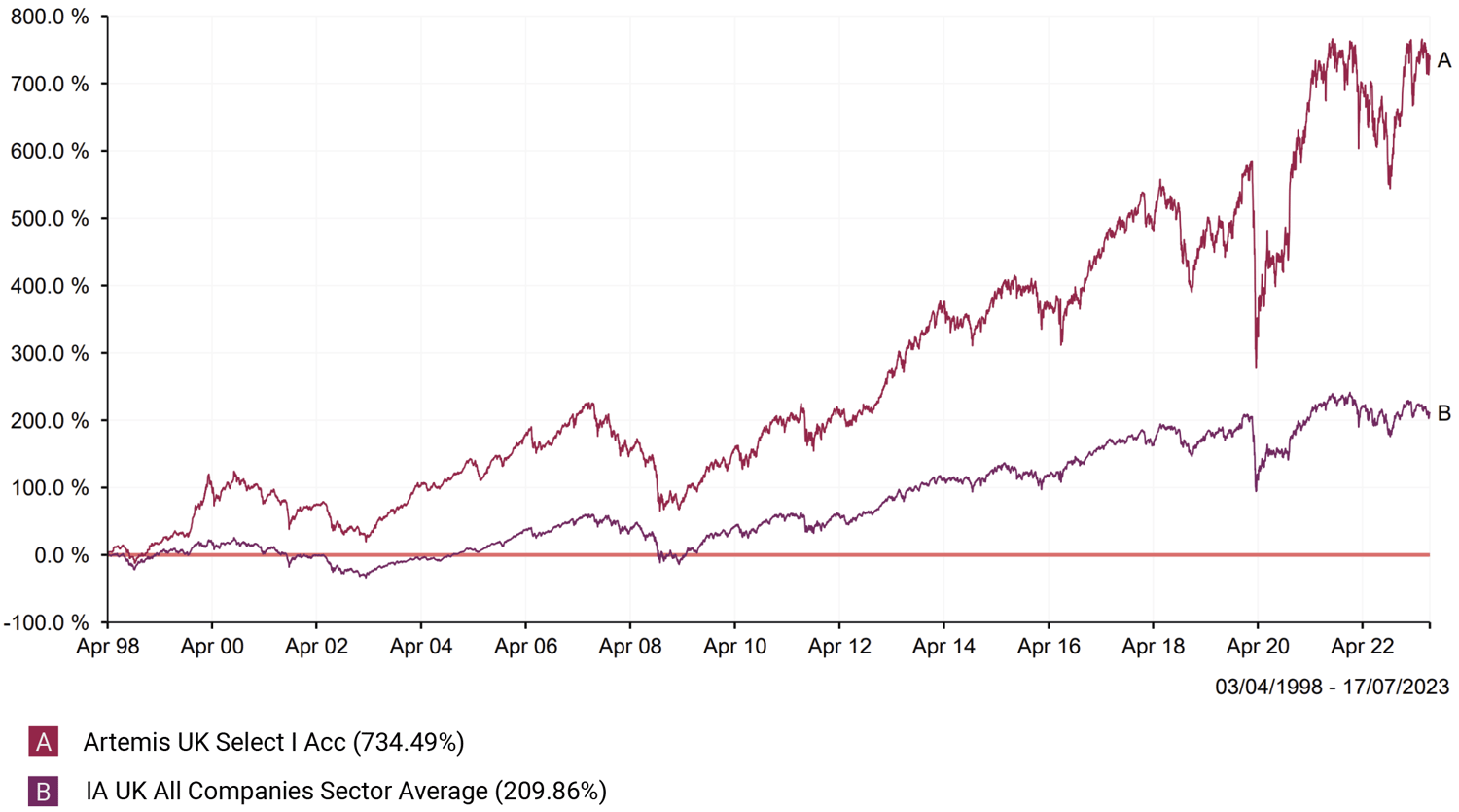

Artemis UK Select

The Artemis UK Select fund has proved resilient amidst the challenging economic conditions of high inflation and rising interest rates, significantly outperforming its IA UK All Companies peer group.

A key reason is the portfolio's emphasis on undervalued, high quality companies with durable competitive advantages. The funds managers focus intensely on cash flow returns on investment and balance sheet strength. This discipline provides inflation protection as companies with pricing power can pass on higher costs.

Additionally, the managers proactively positioned the fund towards sectors that tend to benefit from inflation. The fund's overweight allocations to the energy and materials sectors, including stocks like Shell and Rio Tinto, aided performance as commodity prices surged.

The managers also pivoted the fund away from sectors that are vulnerable to rising rates and valuations pressures. The underweight positions in consumer discretionary and technology provided resilience, while avoiding highly leveraged companies also minimised risks.

Since launch in April 1998 the Artemis UK Select fund has returned growth of 734.49%, which was 3.5 times greater than the sector average for the period.

TB Evenlode Income Fund

The TB Evenlode Income fund has performed well amid high inflation and rising rates by focusing on investing in high quality businesses with durable competitive advantages and predictable cash flows.

The fund also prioritises investing in firms with low financial leverage and high cash flow returns on investment. This balance sheet strength provides earnings stability during periods of economic uncertainty and rising input costs. Companies like Unilever and Relx, which make up a proportion of the TB Evenlode Income fund, saw continued dividend growth during the periods analysed.

The fund's managers invest with a long-term mindset and limit portfolio turnover. This patient approach and avoidance of overtrading has insulated the fund from spells of equity market volatility triggered by sharp rate rises.

The high weightings to the consumer staples, healthcare and technology sectors provided resilience as these defensives held up better amid equity market rotation from growth to value. The underweight positions in rate-sensitive sectors also added value.

Active management enabled the fund to pivot holdings to companies with greater pricing power as inflation accelerated. This adaptability and high conviction stock selection contributed to the fund's ability to outperform the sector average.

Since the TB Evenlode Income fund launched in October 2009 it has returned growth of 294.24% more than double the 142.45% sector average.

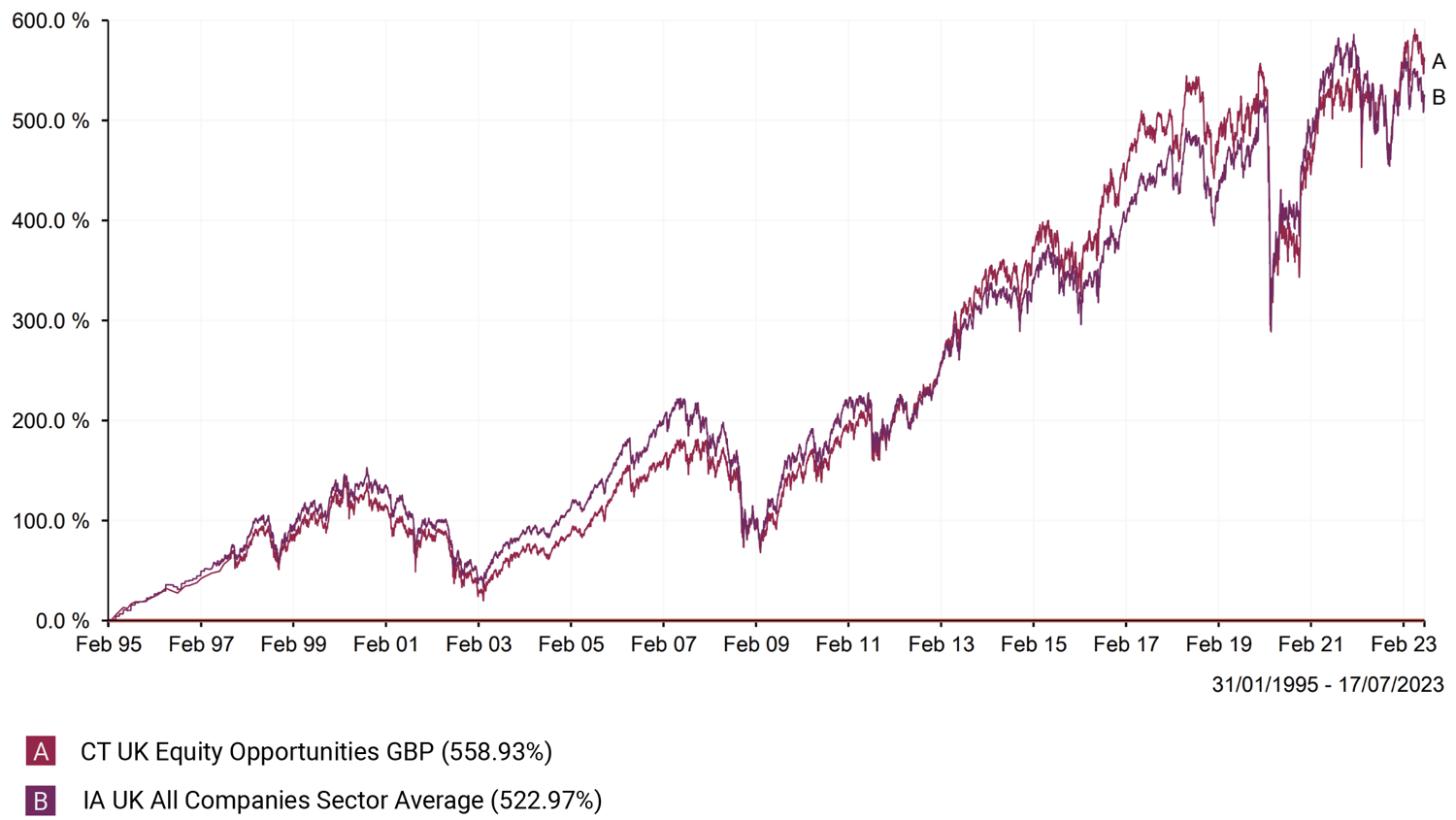

CT UK Equity Opportunities

The CT UK Equity Opportunities fund has significantly outperformed its IA UK All Companies peer group during the current cycle of high inflation and rising interest rates.

The management team made large active sector bets to pivot the portfolio into areas benefitting from the macroeconomic trends. Most notably, he went significantly overweight in financials, mining, energy and materials stocks. Banks, insurers, commodities producers rallied strongly amid rising rates and inflated commodity prices. Stocks like Lloyds, Barclays, Shell and Glencore were top contributors.

At the same time, the management team reduced exposure to high growth and rate-sensitive sectors vulnerable to lower valuations like technology and utilities. This rotation from overvalued to undervalued parts of the market boosted returns during the value resurgence.

In addition to making timely asset allocation shifts, the fund has focused on fundamental stock picking to identify opportunities benefiting from economic recovery and higher prices. His willingness to blend growth, value and quality styles saw the fund rank among the top performers in the sector.

Although the CT UK Equity Opportunities fund has been among the better performing UK Equity funds in recent times, over the long term it hasn't been as impressive. Since its launch in January 1995 the funds performance has been similar to that of the sector average.

Artemis SmartGARP UK Equity

The Artemis SmartGARP UK Equity fund has delivered resilient returns relative to its IA UK All Companies peer group amidst the challenging investment backdrop. The manager of the fund has a flexible approach combining growth and value is a key driver of outperformance.

The fund’s focus on quality companies with durable competitive advantages enabled it to tap into growth opportunities without overpaying. Seeking sustainable earnings growth at reasonable valuations provided downside protection as the market rotated from growth into value.

Importantly, the management team adjusted growth expectations to account for inflationary and rising rate impacts. This reduced his exposure to expensive growth names with unrealistic projections vulnerable to multiple compression. He instead they placed emphasis on firms with pricing power and an inflation hedge.

The manager actively identified value opportunities in areas benefitting from macro trends like energy, mining and financials. The overweight positions in economically sensitive stocks provided much needed cyclical exposure during the recovery.

The Artemis SmartGARP UK Equity’s flexible investment approach, high quality bias, active sector positioning, earnings stability focus and pragmatic growth-value blend is has enabled it to navigate inflation and outperform its sector peers.

The Artemis SmartGARP has returned exceptional growth of 2,579.24% since launch in 1989, which is 3.3 times the sector average.

Invesco Income & Growth (UK) Z Acc

The Invesco Income & Growth fund has performed well in recent months primarily as the manager opted to hold a significant overweight position in financials and energy sectors, boosting returns. Banks and oil companies benefitted from rising interest rates and surging energy prices amid supply constraints. Stocks like BP and Lloyds were top contributors.

The Invesco Income & Growth’s high yield, stock selection and active management helped drive outperformance versus UK equity income peers during inflationary headwinds.

%20Z%20Acc.png?width=1500&height=842&name=Invesco%20Income%20%26%20Growth%20(UK)%20Z%20Acc.png)

The fund launched in January 1995, the same time as the CT UK Opportunities fund, but its growth returns of 737.10% was considerably higher.

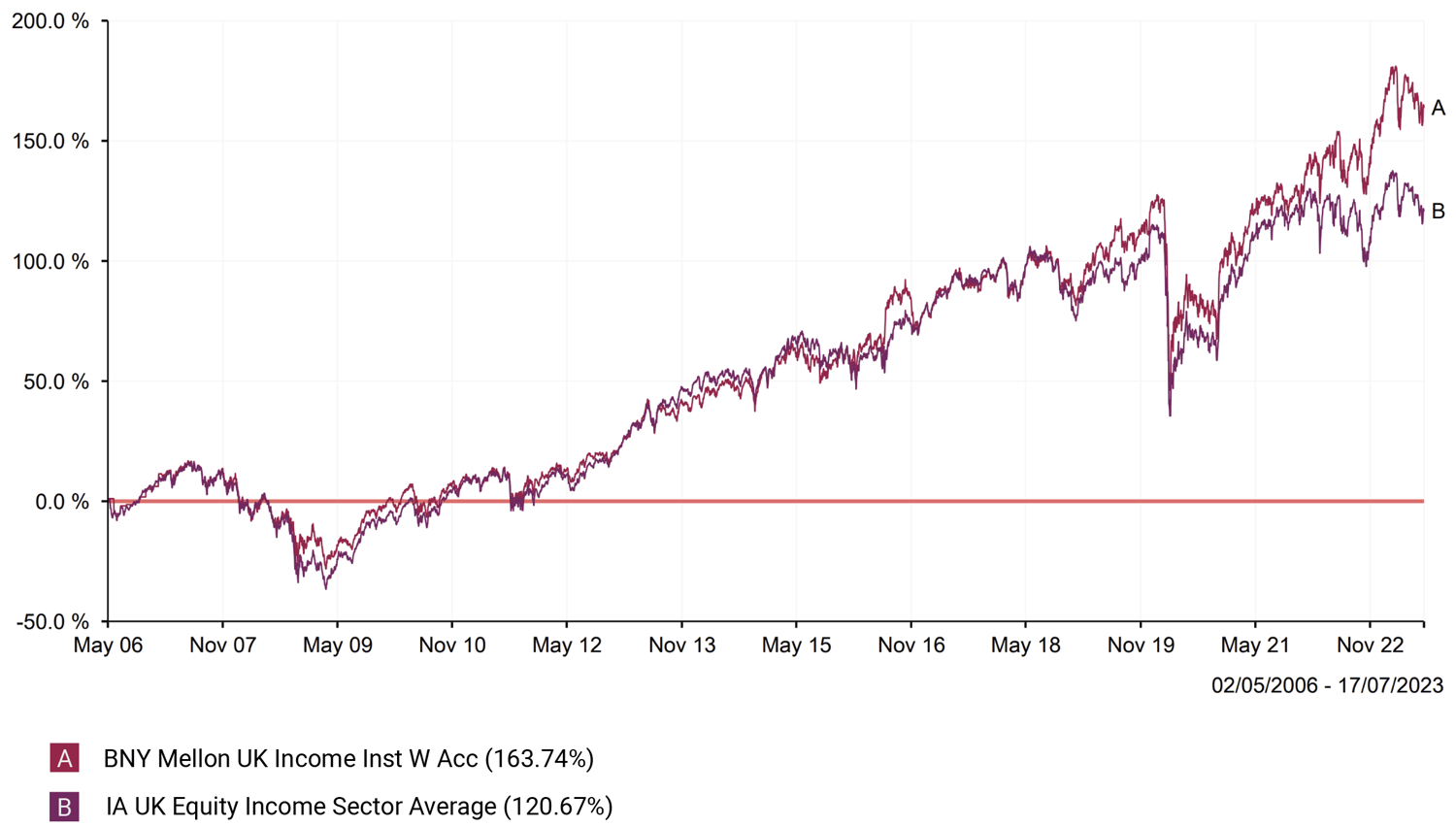

BNY Mellon UK Income Fund

The BNY Mellon UK Income fund focuses on undervalued, cash generative companies which provided a margin of safety during the recent negative market cycle. The fund's manager has a value-oriented approach and positioning is a key reason behind this strong performance.

The manager moved towards defensive sectors like consumer staples and healthcare which are less sensitive to interest rate movements. This provided resilience as rates rose.

The fund has a high conviction active management and concentrated portfolio which has allowed the fund to proactively take advantage of growth opportunities while managing risks. This flexibility to adapt to the changing macro environment was valuable.

The BNY Mellon UK Income fund launched in May 2006 and since then it has returned growth of 163.74%. In contrast the IA UK Equity Income sector average for the period was 120.67%.

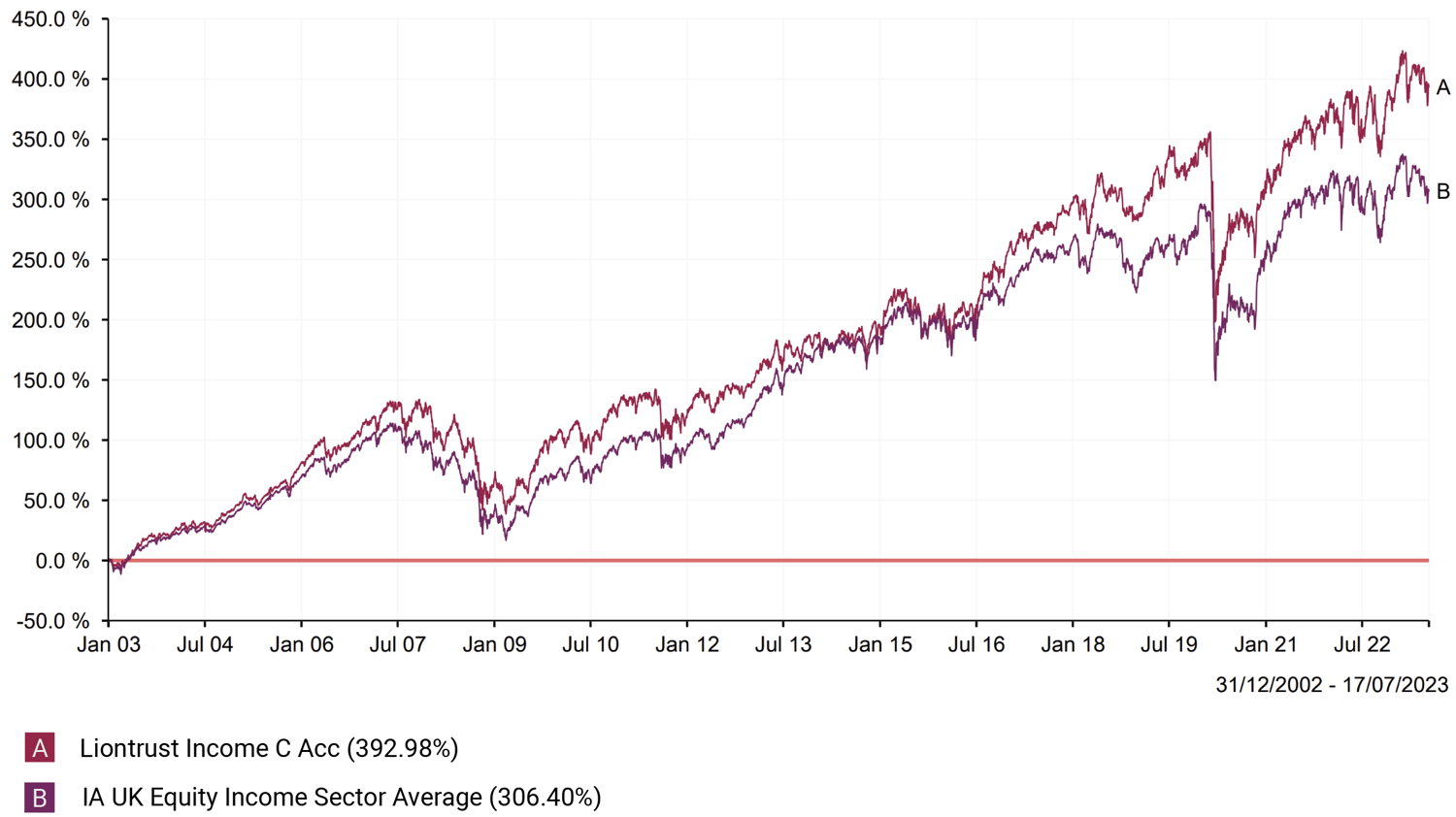

Liontrust Income Fund

The Liontrust Income fund has outperformed the IA UK Equity Income sector average in recent times primarily as it has been significantly overweight oil & gas stocks, which benefitted from surging energy prices triggered by the war in Ukraine and supply constraints.

The fund also moved towards defensive sectors including healthcare, consumer staples and utilities. These sectors held up better during the market volatility and growth to value rotation induced by rising rates and inflation.

The Liontrust Income fund has been active for almost 21 years and in the period it has returned cumulative growth of 392.98%. Although this was above the sector average it was below that of many other peer funds for the period.

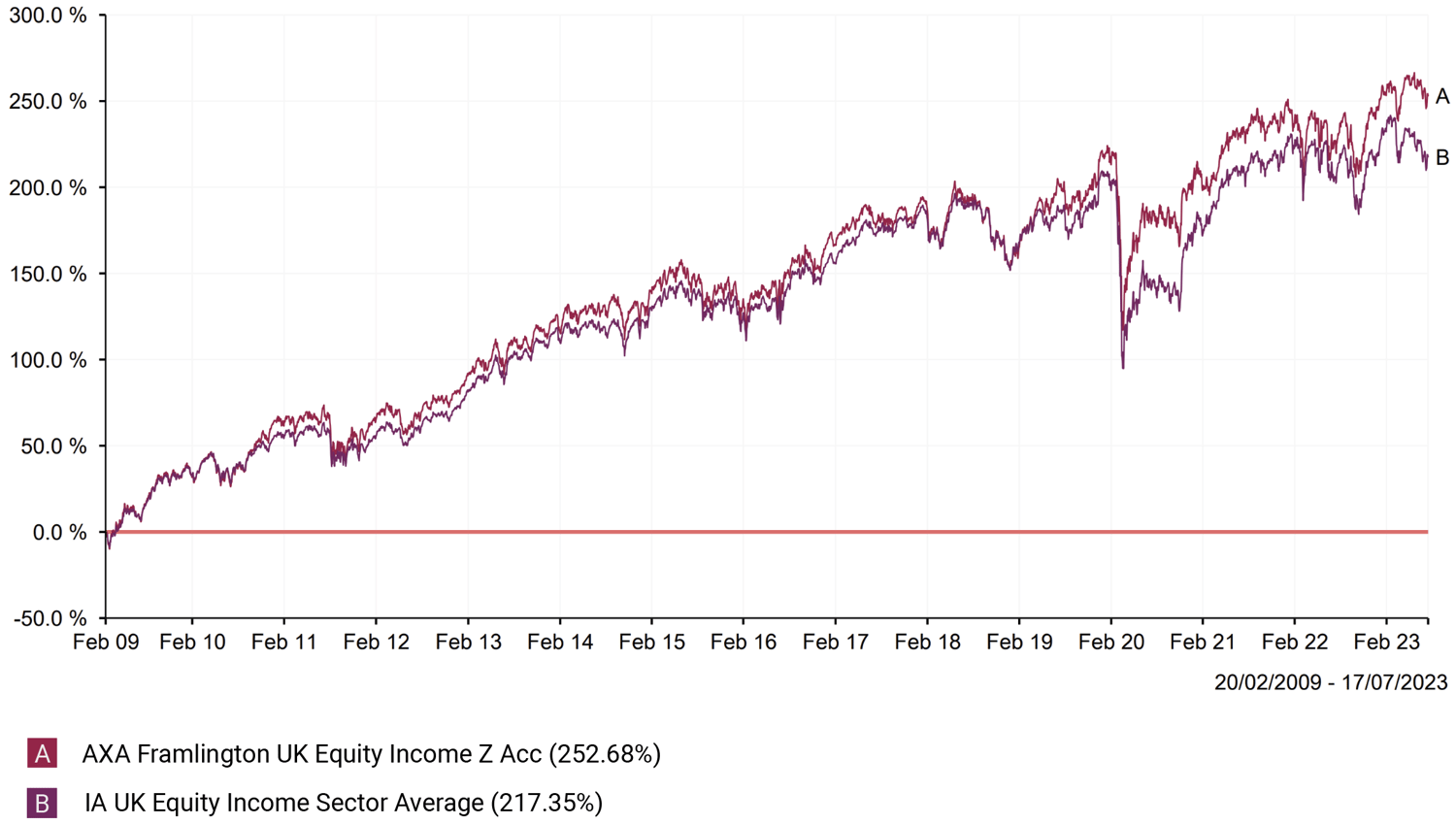

AXA Framlington UK Equity Income Fund

The AXA Framlington UK Equity Income fund is an actively managed UK equity income strategy with the aim of providing income and long-term capital growth. Launched in February 2009 and has £1.1 billion in assets under management.

The fund's manager invests in a diversified portfolio of around 50-70 stocks. The focus is on identifying quality companies with sustainable dividend growth potential trading at attractive valuations. Rigorous fundamental analysis informs the bottom-up stock selection process.

The fund has demonstrated competitive returns, outperforming its benchmark FTSE All-Share index and IA UK Equity Income sector over the 1, 3 and 5 year periods. The flexible approach and active stock picking capabilities have added value, especially during volatile macroeconomic conditions.

Since its launch in 2009, the fund has returned growth of 252.68%. As the above chart shows the fund closely matched the sector average up until the market crash in 2020 since then it has consistently delivered higher returns than the sector average.

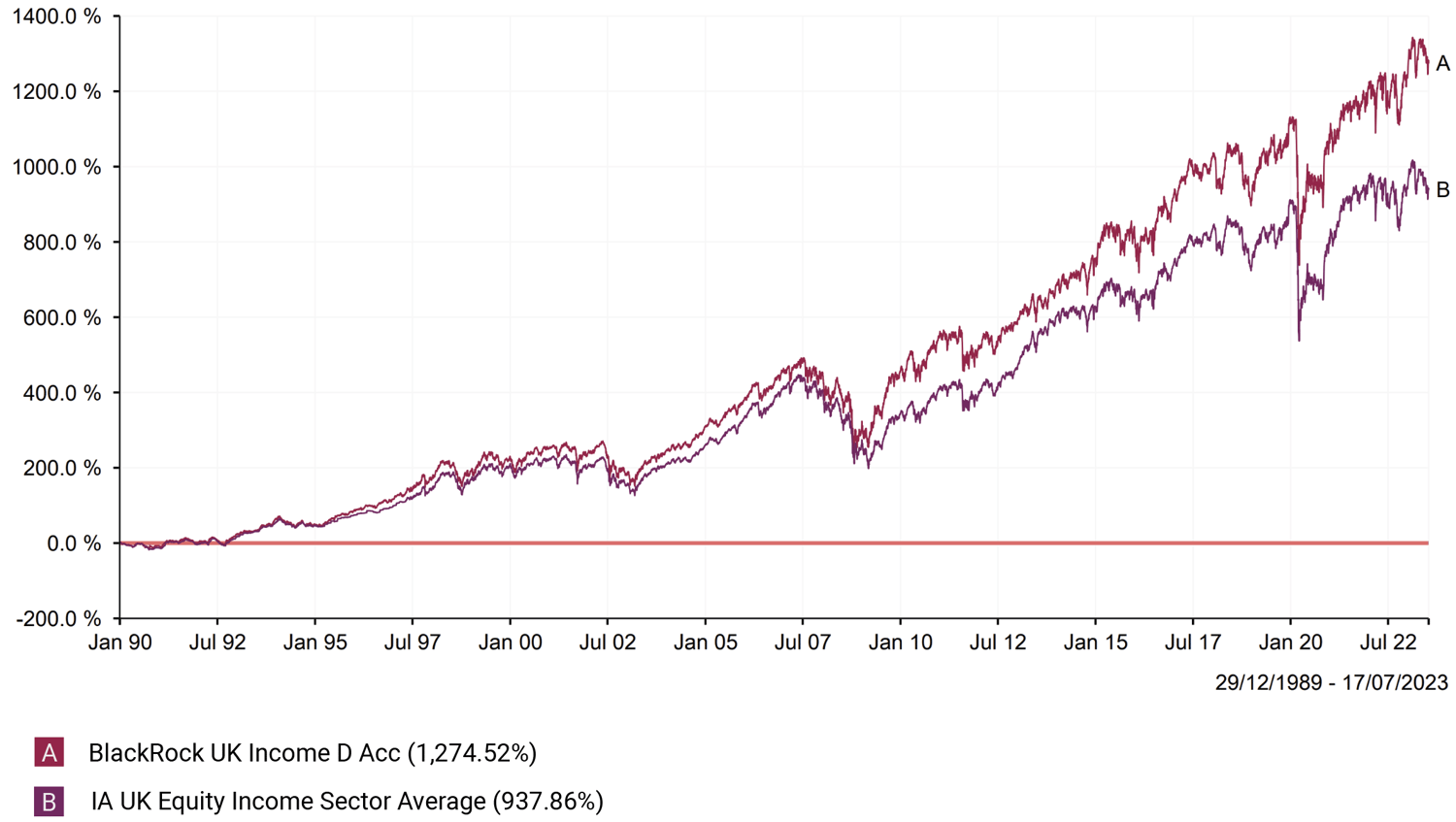

BlackRock UK Income Fund

The BlackRock UK Income fund is an actively managed UK equity income strategy that aims to deliver above average income and long-term capital growth. Launched in March 2012, the fund is managed by Adam Avigdori and David Goldman and has £507 million in assets under management.

The portfolio is currently overweight industrials, consumer staples and financials, which provide income stability. Underweight positions in consumer discretionary and utilities help manage volatility. As the fund is heavily weighted towards industrials, consumer staples and financial companies - which are defensive stocks, this insulated the fund as interest rates rose. The fund also has significant exposure to strong global brands with reach beyond the UK sector like Diageo, GSK, Unilever and AstraZeneca.

The BlackRock UK Income fund launched at the end of 1989 and in the 33 plus years since it has returned growth of 1,274.52%. In contrast, the IA UK Equity Income sector averaged 937.86% for the period.

Quilter Investors UK Equity Income Fund

The Quilter Investors UK Equity Income fund is an actively managed UK equity income strategy that aims to provide above-market income along with long-term capital growth.

The fund has a concentrated portfolio of 30-50 UK companies with attractive dividend yields and the potential for dividend growth. Emphasis is on undervalued, cash generative businesses with strong fundamentals trading at discounts to intrinsic value.

The Quilter Investors UK Equity Income provides a compelling option for income-focused investors through a disciplined and valuation-aware approach. The experienced management team and concentration on fundamentals make it well-positioned looking ahead.

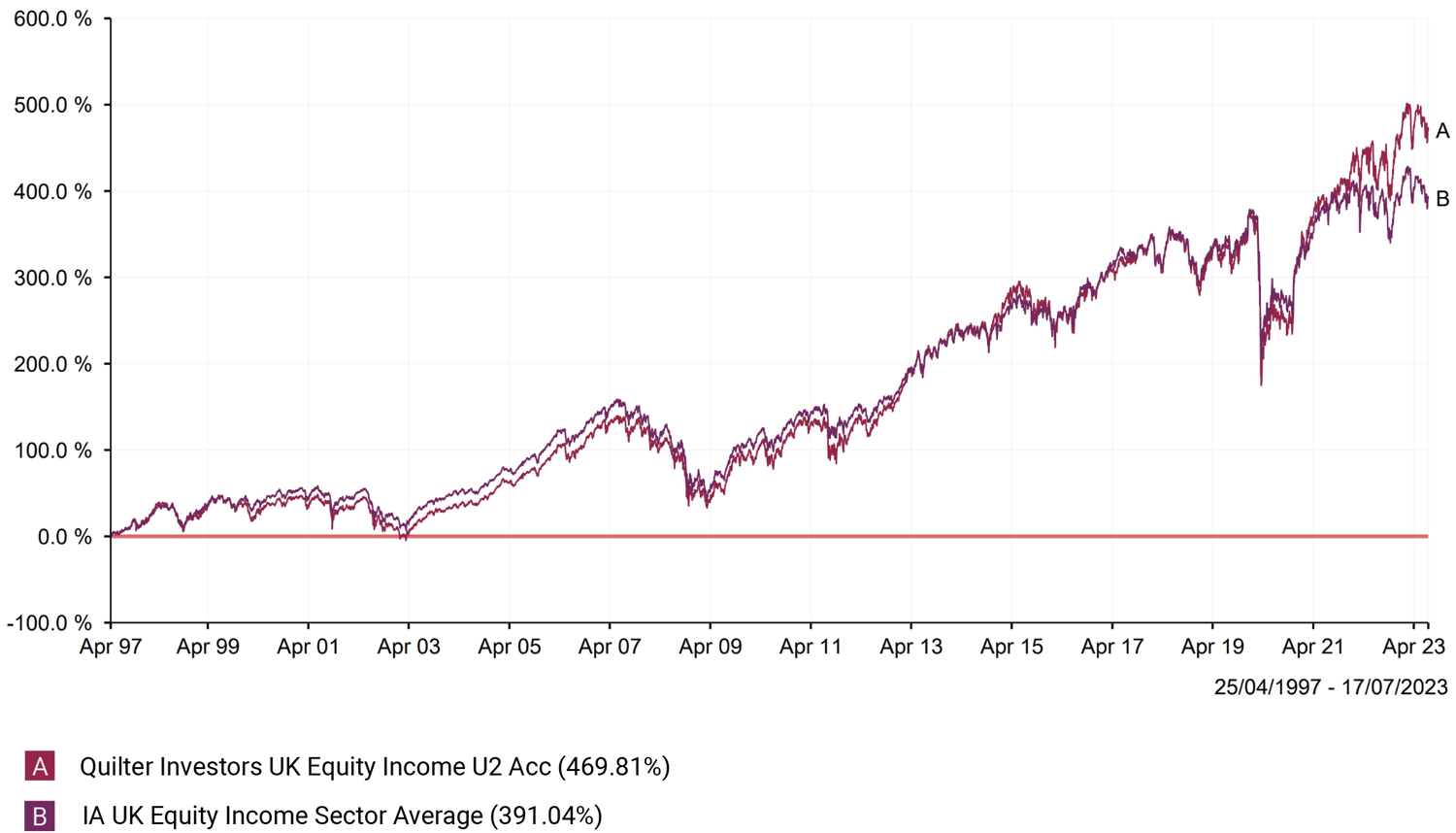

The Quilter Investors UK Equity Income fund has delivered the 2nd highest growth returns since the Bank of England began increasing interest rates in December 2021. However, as the above chart shows the fund has closely matched the sector average for performance up until this point. Since launch it has returned growth of 469.81% compared to the sector average of 391.04%.

The Impact of Inflation and Rising Rates on UK Equity Funds

The UK economy has been battling runaway inflation and aggressive monetary policy tightening since the end of 2021, which has significantly affected UK equity funds.

Consumer prices in the UK hit a 41-year high of 11.1% in October 2022, driven by surging food and energy costs. To curb inflation, the Bank of England has undertaken a forceful rate hiking cycle, with the policy rate currently at 3.5%, up sharply from just 0.1% in December 2021.

These dynamics have weighed on UK stock market performance and impacted equity funds in different ways:

Earnings Headwinds

As input costs rise rapidly, companies have struggled to fully pass on higher prices to consumers facing a cost-of-living crisis. This is compressing profit margins and creating earnings headwinds for UK Inc.

Valuation Pressures

Higher interest rates decrease the present value of future corporate earnings. This has led to contraction in price-to-earnings ratios and other valuation metrics, negatively impacting equity funds, especially growth-oriented strategies.

Small-Cap Underperformance

Smaller UK firms with domestic exposure have significantly underperformed the larger multinationals. Limited pricing power and high operating leverage have made small caps vulnerable to margin pressures.

Quality Rewarded

Funds focused on high-quality companies with strong balance sheets, competitive advantages and pricing power have demonstrated resilience amidst the volatility.

Growth Opportunities Ahead

Last year, UK investors exhibited caution by shifting away from growth focused stocks in favour of less volatile value-oriented funds which helped mitigate losses and improved performance during the period. These changes were driven by concerns surrounding overvaluation and a perceived downward trajectory of funds with a technology focus. However, as detailed in our recent article - Bull Market Incoming: Why Now Is The Time To Invest In Technology the time for such investors to reassess this decision is now. Therefore, many funds that have underperformed in recent times could experience a strong recovery when conditions allow.

As identified in this article, UK equities have faced challenging conditions but there are a range of funds that have weathered the conditions better than others and their active management style has allowed them to adjust proactively to the difficult conditions. With inflation having peaked, analysts and economists alike now see a period of positive returns on the horizon for many core equity markets including the UK. Although this may require a further change in strategy for UK equity funds, the skill and foresight shown by the management team of the funds featured in this article will add confidence to their investors.

Getting The Most From Your Portfolio

Diversification is essential to maximising opportunities and maintaining efficiency. Research has shown that having a diverse portfolio of high quality funds across different markets and asset classes improves long term portfolio returns. Through continuous research and data analysis Yodelar provides investors with the opportunity to invest in suitably risk rated portfolios created to maximise opportunities efficiently.

Book a no obligation call with one of our advisers to find out more about our portfolios.