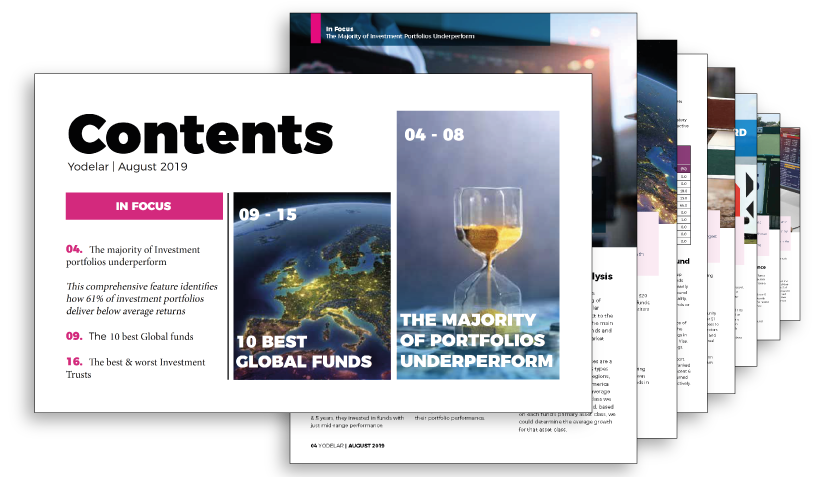

IN FOCUS

THE MAJORITY OF PORTFOLIOS UNDERPERFORM

61% of investment portfolios deliver below average returns, with portfolios from the most popular risk category averaging 5-year growth that was almost 25% lower than the industry average.

These startling figures were obtained from an extensive performance analysis of more than 3,000 funds, their sectors, asset classes and 5 industry recognised asset allocation models.

In this report, we feature the average performance of portfolios within each risk category, the estimated returns investors should have averaged and how much growth they could have achieved from a top-performing portfolio.

We also look at why most investment portfolios are underperforming, and how investors or their advisers can identify deficiencies and maximise their portfolio performance.

Access this edition plus all premium features. Subscribe today for £1*.

IN FOCUS INCLUDES

- The 1, 3 & 5-year growth investor should have averaged with their portfolios

- The 1, 3 & 5-year growth UK Investors actually averaged.

- The growth investors could have achieved by investing in top performing funds.

.png)