- This report analyses the impact the coronavirus pandemic has had on the portfolios provided by True Potential, St. James’s Place, Hargreaves Lansdown, Yodelar Investments, as well as the popular Vanguard LifeStrategy fund range.

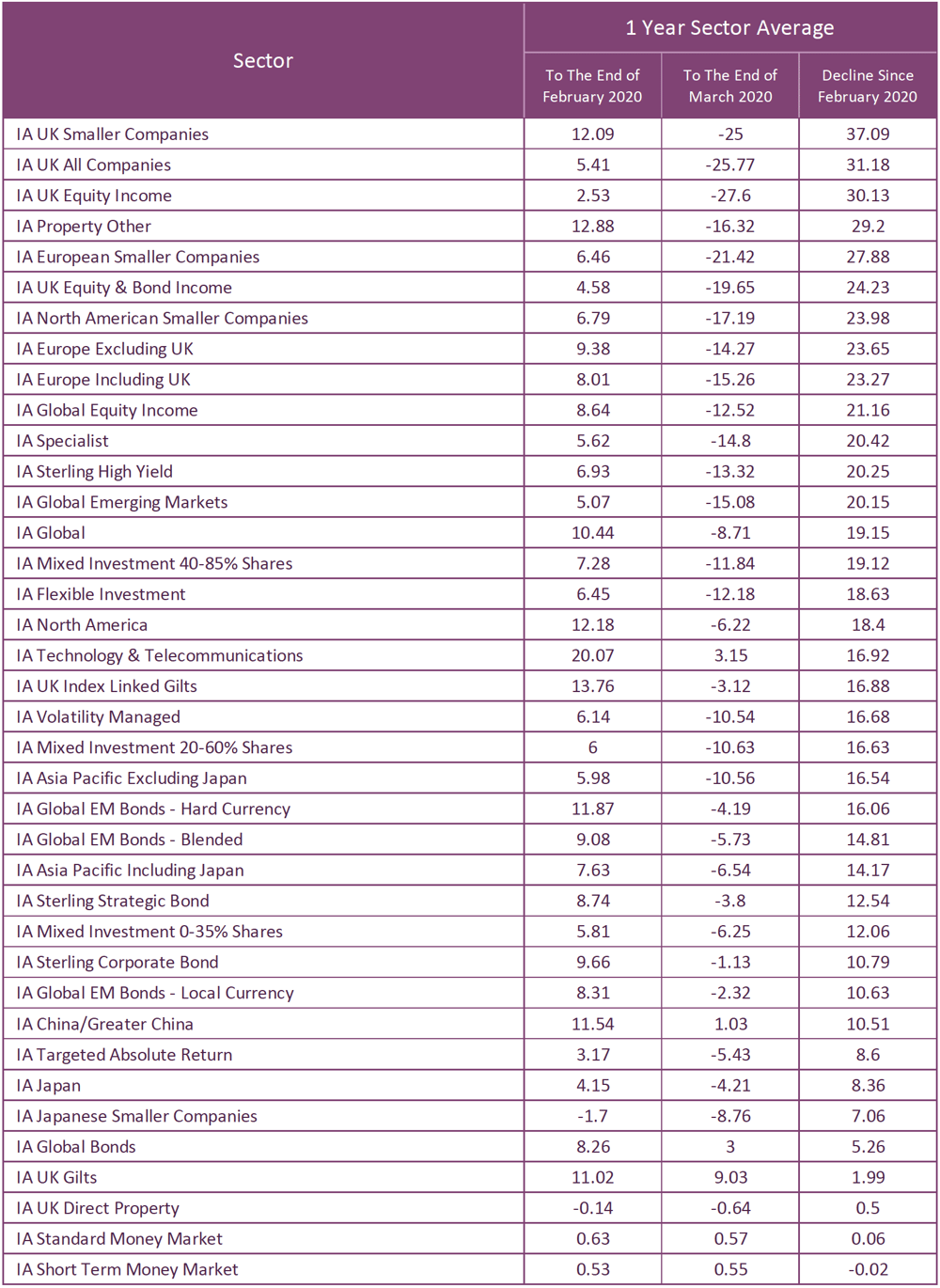

- Since the onset of the coronavirus pandemic 32 of the 38 Investment Association sectors experienced significant losses that wiped away any growth from the previous 12 months.

- UK equities fared the worst sector, with the IA UK Equity income sector dropping by 30.13% over the past month.

- Of the 35 portfolios analysed the SJP Deferred Income portfolio was hit the hardest. This portfolio returned losses of -21.30% for the past 12 months primarily as UK Equities accounted for 41.67% of its total holdings.

In just a short period of time the coronavirus pandemic has wiped away year’s worth of gains for many investors as investment markets plummeted to their lowest levels since the 2008 financial crisis.

Up until the end of February this year, investors had enjoyed years of consistent gains across all asset classes with US equities in particular averaging strong returns as it rode the longest bull run in its history.

As such an attractive market for so long many investment portfolios were heavily weighted in the North American sector, and it continually delivered. In the 12 months up to the end of February this year it had averaged growth of 12.18%. Fast forward to the end of March and this sector's average for the year had tumbled to -6.22%, a drop of 18.4% in just 1 month. This was just one of many sectors hit hard as markets went into freefall.

The coronavirus pandemic has had a huge impact on investment portfolios and in this report, we analyse some of the most popular portfolios with UK investors and identify how it has impacted their performance. We also provide a detailed breakdown of each portfolio's asset allocation and assess the bearing this had on each portfolio.

This report highlights the severity of the impact the events of recent weeks has had on investment portfolios - which reaffirms the risks of investing. But with markets unlikely to stabilise in the near future, it also makes it clear that investors have an urgent decision to make, and one that must be made with relative haste.

Sectors Hit Hard As Average Growth Figures Plummet

Since the onset of the coronavirus pandemic 32 of the 38 Investment Association sectors experienced significant losses that wiped away any growth from the previous 12 months. UK equities fared worse, with the IA UK Equity income sector dropping by 30.13% over the past month.

Almost all sectors experienced a decline during this period but among the sectors to come out comparatively well was the IA Technology & Telecommunications sector. In recent years, this sector has continually averaged the highest growth out of all other sectors and despite its average returns for the year falling from 20.07% at the end of February, to 3.15% at the end of March, it was one of only 6 Investment Association sectors that averaged growth over the recent 12 months.

In the 12 month period up to the end of February this year the 38 Investment Association sectors had a combined average growth of 7.4%, but just a few weeks later, for the year up to the end of March 2020, these 38 sectors averaged losses of -9.04%. This significant downturn is a result of the unprecedented coronavirus pandemic that has brought such a heavy human and financial toll across much of the world.

How The Coronavirus Pandemic Has Impacted Investment Sectors

Portfolios with greater exposure to UK equities will have been impacted the most from the recent market crash with the IA UK Smaller Companies sector tumbling by 37.09% in just one month and the IA UK All Companies sector falling by 31.18% over the same period.

The equity markets that were least affected were Japan and China with the IA Japan sector falling by 8.36% and the IA China/Greater China sector falling by 10.51% over a similar period.

Unsurprisingly, the lower risk asset classes such as Money Market instruments had the least impact with both the IA Standard Money Market and IA Short Term Money Market sectors remaining relatively unchanged.

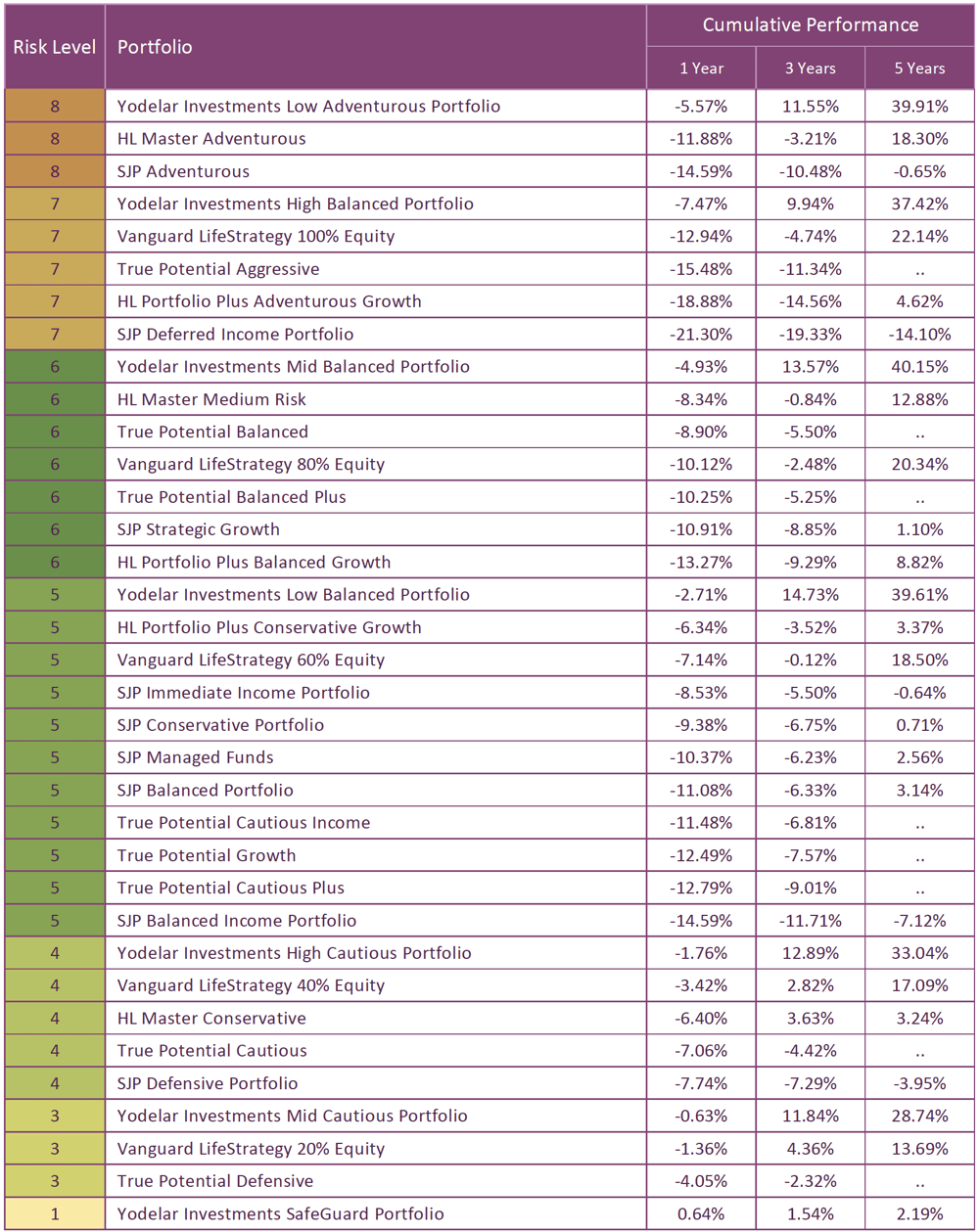

The Impact Coronavirus Has Had On Some of The UK’s Most Popular Investment Portfolios

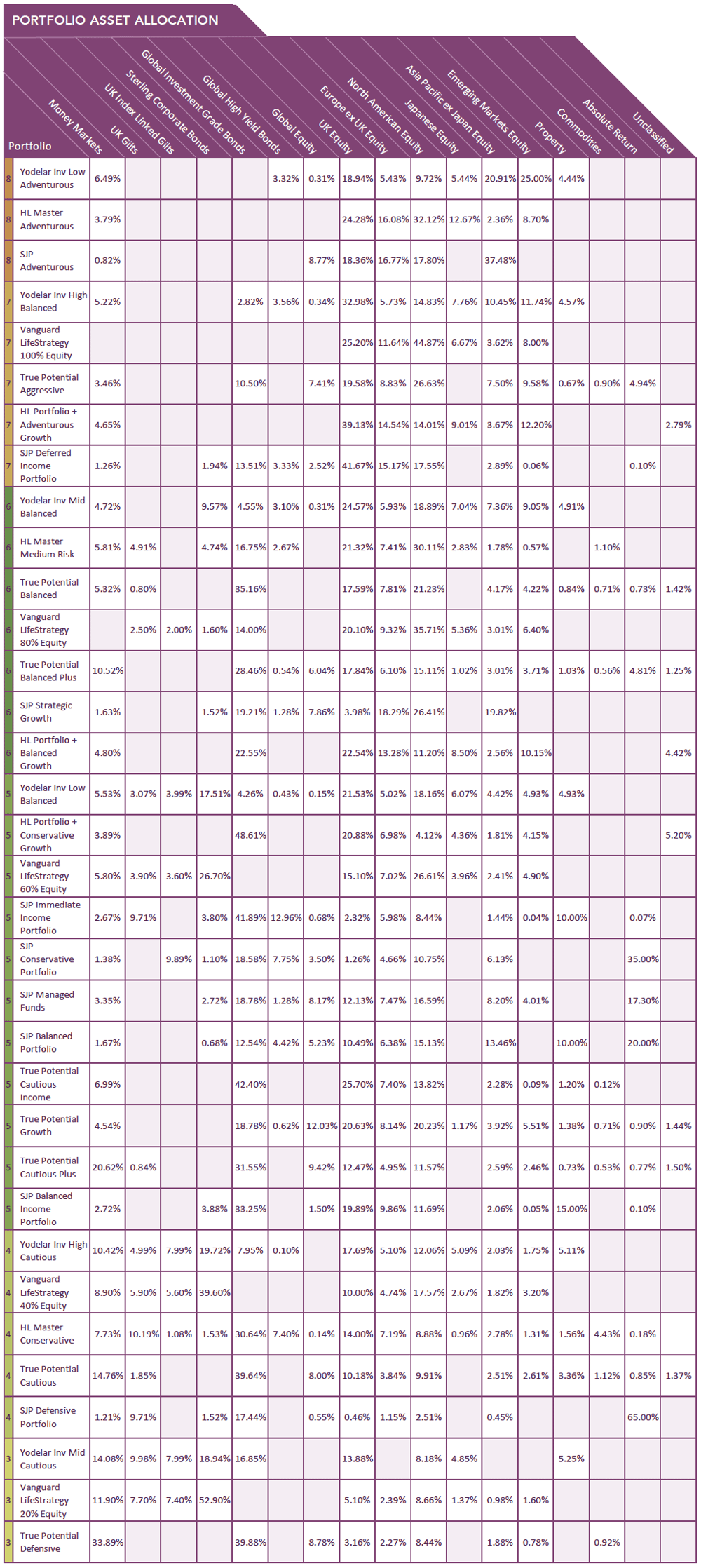

There are many different asset allocation models used by UK investors, each of which will have different levels of exposure to particular markets which will influence how their portfolios perform.

To gauge the immediate impact the market slump caused by the coronavirus pandemic has had on investment portfolios we analysed the performance of some of the most popular portfolios in the UK. These portfolios share similar risk ratings but they each have differing underlying holdings and follow separate asset allocation models.

We analysed the portfolios provided by True Potential, Yodelar Investments, St. James’s Place, Hargreaves Lansdown as well as the popular Vanguard LifeStrategy fund range - which act as ready-made portfolios.

Portfolios With A Heavy Weighting In UK Equities Performed The Worst

The portfolios with an asset allocation model primarily weighted in UK, European and North American equities fared the worst, with the portfolios with a heavier weighting in lower risk asset classes such as Gilts and Money Market instruments impacted the least.

Of the 35 portfolios analysed the SJP Deferred Income portfolio was hit the hardest. This portfolio returned losses of -21.30% for the past 12 months primarily as UK Equities accounted for 41.67% of its total holdings. It has a 7 out of 10 risk grade with the similarly rated Hargreaves Lansdown Adventurous Growth and True Potential Aggressive portfolios collecting the 2nd and 3rd largest losses from all 35 portfolios that we analysed over the past 12 months.

Compared to competing portfolios within a similar risk category, the Yodelar Investment range of portfolios had the highest performance figures for the periods, with St. James’s Place portfolios experiencing the largest losses.

With Portfolio Performance Continuing To Fall Investors Have Decisions To Make

Our analysis highlights the value of investing in an efficient spread of assets that are appropriately balanced to react to both periods of growth and decline. However, the devastating events of recent weeks have triggered a period of extreme uncertainty and imbalance throughout the investment industry which investors must not ignore.

Investors are seeing first-hand the accelerated decline in portfolio performance when markets fall. As even relatively low risk portfolios suffer hefty losses it has reinforced the inherent risks of investing and is forcing many investors to reconsider their appetite to risk.

Therefore, during periods of such high levels of uncertainty, investors need to ask themselves if they believe markets will continue to fall and if a strategy for growth is the most efficient right now or if a protection focus could be the best option until markets return to some form of normality.