As the world's governments battle to dampen and contain the onslaught of the Covid19 virus, volatility and instability remain prevalent throughout world’s financial markets.

When will markets stabilise? No one knows with any degree of confidence but when it does, fund managers and investors will be vying to optimise growth when market correction comes into effect. When this happens, the fund managers with greater proficiency will offer the best opportunity for investors.

In this report, we feature 10 funds across different sectors and asset classes that are well positioned and among the most promising to maximise returns when markets correct. Each has a history of outperformance within their sectors and while no one knows what the future holds, we believe they represent excellent investment opportunities for growth and recovery when markets stabilise.

Why Many Investor Losses Have Been Compounded By Poor Fund Choices

Investors have watched the value of their portfolio plummet almost overnight as economies and industries have been left reeling in the wake of the destruction caused by the coronavirus pandemic. However, for many investors, the losses they have experienced have been compounded by the added underperformance of the funds they have invested in. As a consequence, many investors will remain in underperforming funds during periods of high volatility awaiting for markets to correct even though these funds struggled for performance when market conditions were stable.

Relying on poor performing fund managers now, or in the medium term is not an effective strategy. If investors wish to remain invested in a particular sector like North America or Japan, they must consider the more efficient fund managers in order to be best placed to maximise any growth potential when markets correct.

Less than 10% of funds maintain a top quartile sector ranking over a continuous 1, 3 & 5 year period, with a large proportion of funds consistently ranking in the bottom 25% & 50% of their sector. Investing in funds that continually underperform can have a sizable impact on an investor’s portfolio when markets are stable. But during a market downturn, it is more likely that consistently poor performing funds and fund managers will incur greater losses and they will also recover less efficiently when markets begin to correct.

The Risks of Investing For Growth In The Midst of A Global Lockdown

The funds featured in this report have a proven track record for outperformance comparative to their competitors and their defined strategies make them excellent investment opportunities that could yield strong growth for investors when market stability returns.

However, markets are currently far from stable with many global economies yet to experience the peak of the pandemic and therefore the full human and economic toll this could have remains unknown. Therefore, investing with growth in mind could result in further losses as experienced by investors in recent weeks. As such, a period where protection is the primary focus rather than growth has become the chosen strategy for many investors who wish to protect their investments for now by moving into low risk investment products temporarily then revert to the optimum growth strategy to capitalise on market corrections when the economic outlook stabilises.

The Best Funds For Growth & Recovery When The Coronavirus Pandemic Ends

Investing in efficient, high quality funds when markets stabilise will put investors on the best path to recovery and provide them with opportunities to maximise their growth potential. The 10 funds featured below have consistently been among the top performers in their sectors and are well placed to deliver on their growth objectives when balance returns to their markets.

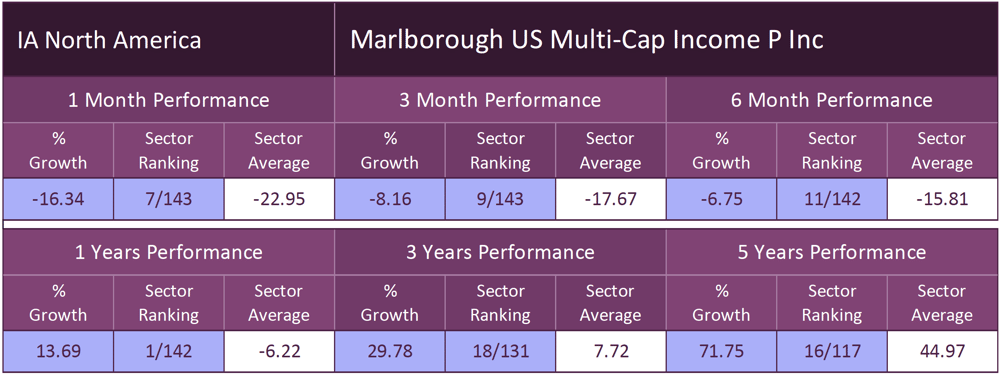

Top North American Fund – Marlborough US Multi Cap Income

The Marlborough US Multi Cap Income Fund invests in a concentrated portfolio of 30-40 US equities. Managers Brad Weafer and Brad Gardner, who are based in Boston, invest in high-quality companies that in their view have been mispriced by the market. The fund, although small in size, has consistently been among the most efficient and best performers in the North American sector.

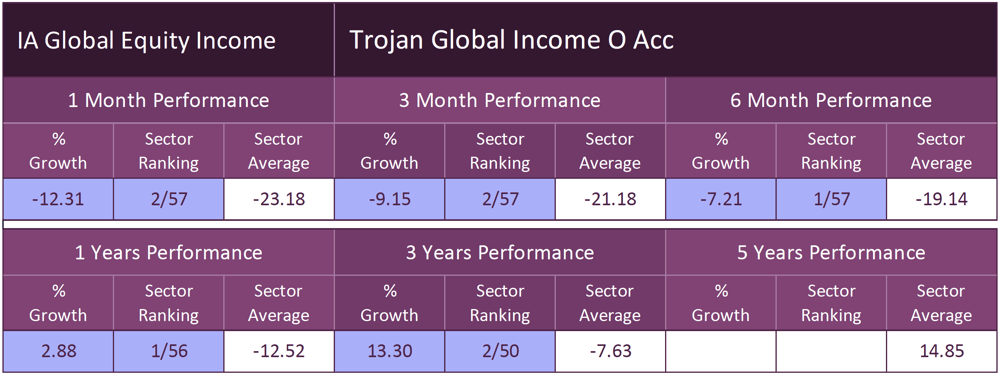

Top Global Equity Fund – Trojan Global Income

The fund’s managers have identified a select few long-term investments which are approaching favourable entry prices as they seek to allocate capital with patience and discipline. They believe this fund is well placed when markets recover given the robust free cash flow and income growth the companies they invest in should continue to deliver over the longer term despite current fears.

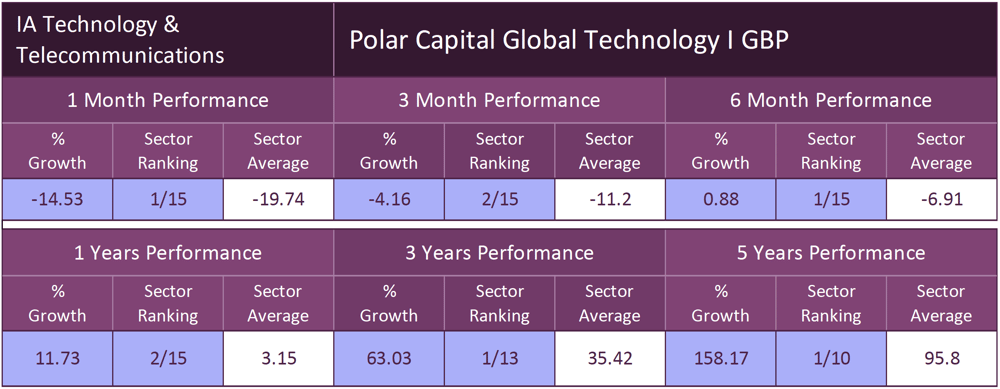

Top Technology & Telecommunications Fund – Polar Capital Global Technology

The Polar Capital Global Technology fund has consistently been one of the top growth funds in its sector. The fund has a global approach to technology investment across large, medium and smaller companies and holds between 70-90 stocks, approximately 35-75% are from America, 15-45% from Europe and 5-40% from Asia.

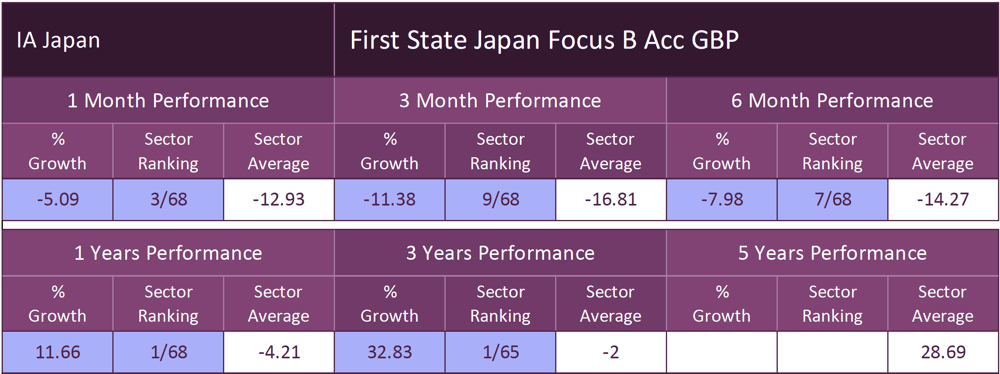

Top Japanese Fund – First State Japan Focus

The managers of the First State Japan Focus fund look for high-quality companies that can deliver sustainable growth at attractive valuations. They have a bias towards companies that generate their returns from domestic sales rather than export earnings. As a result, the fund managers spend a lot of time visiting the sites and meeting the management of targeted companies. This fund has continually displayed its quality by regularly outperforming its competitors within the Japanese sector.

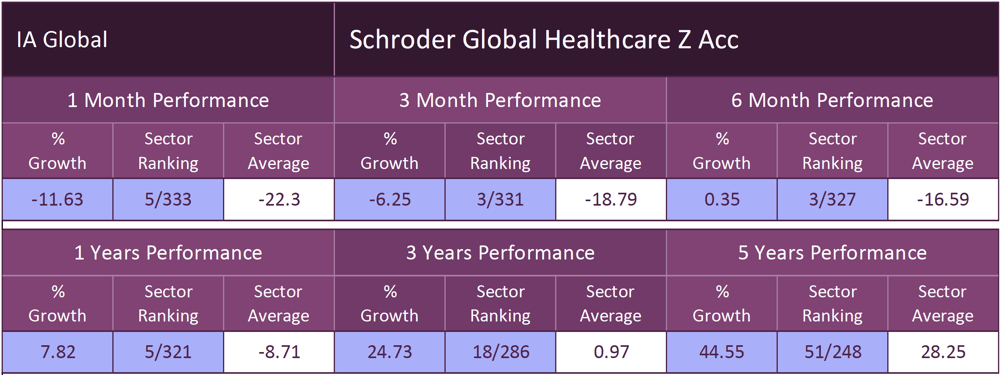

Top Global Fund – Schroder Global Healthcare

The Schroder Global Healthcare fund is actively managed and invests at least 80% of its assets in companies throughout the world which are engaged in healthcare provision, medical services and related products.

The fund is positioned to benefit from the structural growth in demand for healthcare provision and medical treatments, which will undoubtedly experience greater demand as a consequence of the coronavirus pandemic.

The investment manager has positioned the fund to benefit from the increased demand of areas such as biotechnology, generic drug manufacture and supply, pharmaceuticals, health insurance and hospital supplies.

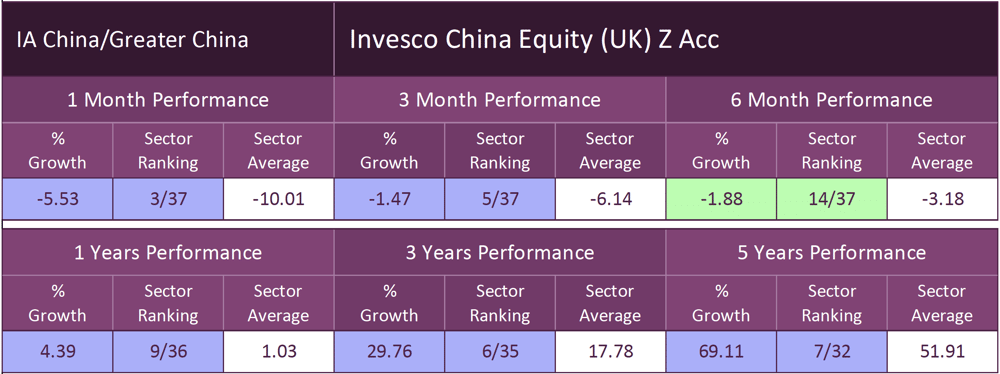

Top Chinese Equity Funds – Invesco China Equity

China’s unrivalled infrastructure and the Global reliance on this market will help this sector recover faster than most provided they experience no further setbacks in their battle with coronavirus.

Among the funds with a strong track record in the region is the Invesco China Equity fund who have utilised an ‘on the ground’ management team based in Hong Kong to establish a portfolio of companies that have helped this fund consistently rank among the best in its sector for performance.

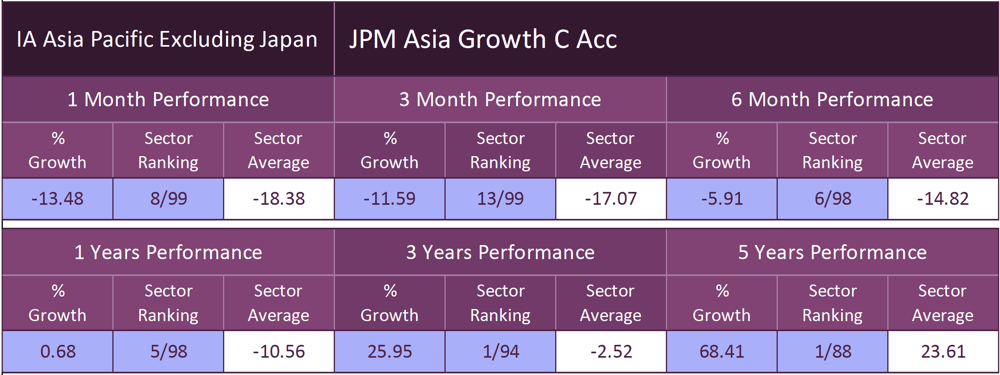

Top Asia Pacific Equity Fund – JPM Asia Growth

Countries within the Asia Pacific region are generally considered emerging markets and are of interest to investors looking for high-growth investment opportunities. Among the funds to have consistently performed well in this region is the JPM Asia Growth fund. JP Morgan has a strong reputation for the quality of their strategies in Asian markets with this fund among their most consistent and one which is well placed to see growth and recovery when markets begin to stabilise.

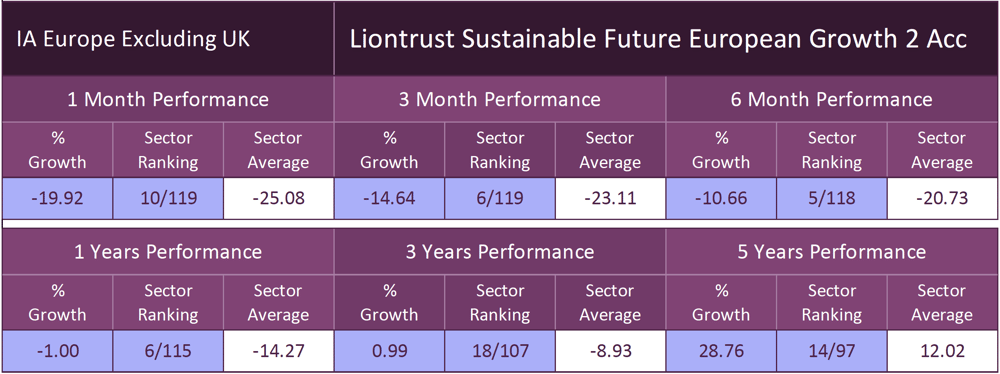

Top European Equity Fund – Liontrust Sustainable Future European Growth

The funds core strategy is based on the belief that in a fast-changing world, the companies that will survive and thrive are those which improve people’s quality of life, be it through medical, technological or educational advances; drive improvements in the efficiency with which we use increasingly scarce resources; and help to build a more stable, resilient and prosperous economy. This fund has maintained a high sector ranking and over the 6 periods analysed as it consistently ranked above 86% of competing funds in the European sector.

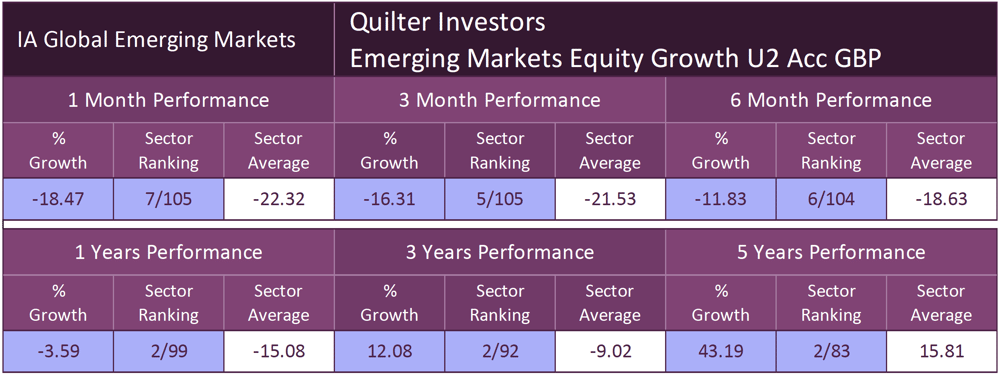

Top Emerging Markets Equity Fund – Quilter Investors Emerging Markets Equity Growth

Emerging markets have been a favoured asset class for many risk averse, growth seeking investors as its developing regions and economies often offer opportunities for considerable growth.

However, many of these developing markets have been hit hard by the coronavirus pandemic and their lack of infrastructure may see these markets experience a slower recovery.

But as the Quilter Investors Emerging Markets Equity Growth fund has maintained a top 7% performance rating in this sector we believe it is well placed to deliver for investors when growth returns to emerging markets.

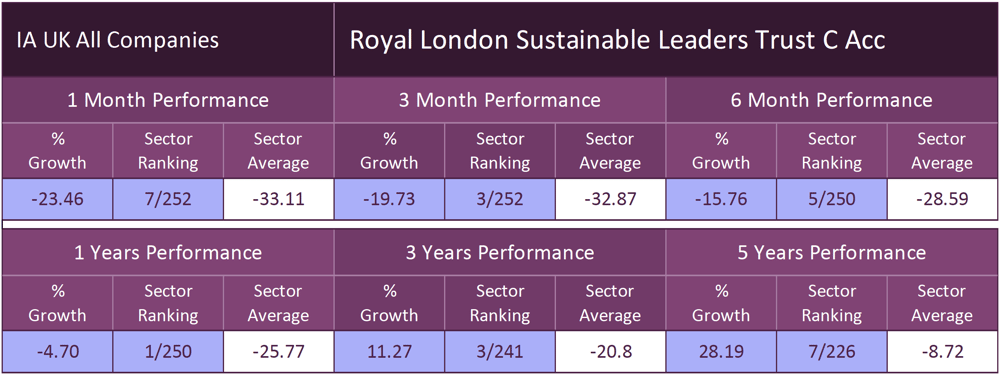

Top UK Equity Fund – Royal London Sustainable Leaders Trust

UK Equities have been the hardest hit from the coronavirus pandemic with the IA UK All Companies sector averaging losses of -33.11 for the month up to the end of March. Investors will be cautious in committing to the UK Equity market but when markets stabilise and growth returns this fund is well placed to benefit. The fund is well positioned relative to powerful trends in the areas of healthcare, technology, infrastructure, corporate governance and the growing requirement to invest sustainably.

Maximising Growth & Recovery By Investing In Proven Quality

Each of the 10 funds featured have consistently been among the top performers in their sectors and in recent weeks as markets tumbled, they withstood the fall much better than the majority of their peers with losses well below their sector average.

Their strong performance when markets have been both stable and highly volatile reaffirms the view that they are well placed to maximise growth and recovery when markets stability returns in the aftermath of the coronavirus pandemic.