- Liontrust Asset Management, managing £26 billion in assets, faced £6 billion in outflows and significant performance challenges over the past year.

- 66.1% of Liontrust’s funds have a history of underperformance, with 37 out of 56 funds receiving a low one or two-star rating.

- Out of the 56 funds analysed, 8 funds earned top 4 or 5-star ratings over the past 1, 3, and 5 years.

- One of their top performing funds was the Liontrust Global Dividend fund with growth returns of 29.80%, 28.29% & 78.88% over the past 1, 3 & 5 years.

- The Liontrust Russia fund has been one of their worst performing funds with negative returns of -22.17%, -71.71% and -59.45% over the past 1, 3 & 5 years.

Managing £26 billion in assets, Liontrust Asset Management is a prominent independent investment firm in the UK, renowned for its disciplined processes and a strong focus on ESG-driven funds. However, the company has recently encountered significant challenges.

Before stepping down in July 2024, former non-executive chair Alistair Barbour acknowledged these difficulties in the Liontrust Annual Report & Financial Statements 2024. He stated, "There is no doubt we have been confronted by one of the toughest periods for active asset managers. This is especially the case for those which offer investment styles that have been largely out of favour during this environment of interest rates remaining higher for longer than many expected. For Liontrust, this has impacted our quality growth, small and mid-caps, sustainable investing, as well as UK equity strategies; this is reflected in the net outflows of £6 billion over the financial year."

Barbour’s remarks highlight the specific headwinds that have affected Liontrust’s key strategies.

In this article, we analyse the recent 1, 3, and 5 year performance of 56 Liontrust funds, comparing their performance against peer funds within the same sectors. We identify Liontrust's top performing funds as well as those that have struggled, offering a comprehensive view of Liontrust's fund performance.

Liontrust Funds Performance

We conducted a detailed analysis of 56 Liontrust funds, evaluating their performance and sector rankings over 1, 3, and 5-year periods. Each fund was assigned an overall performance rating based on relative returns within its sector.

Our findings reveal that only 8 funds achieved a top-tier rating of 4 or 5 stars, indicating strong performance and competitive returns compared to their sector peers.

However, the majority of funds underperformed, with 37 receiving lower ratings. This includes 21 funds (37.5%) rated 2 stars and 16 funds (28.6%) earning the lowest 1-star rating. These results highlight that most Liontrust funds have struggled to outperform their sector peers across the periods analysed.

5 Best Performing Liontrust Funds

The table below highlights 5 best performing Liontrust funds based on their performance over the most recent 1, 3, and 5-year periods.

These funds have consistently ranked among the top performers in their respective sectors, delivering impressive results that earned each a top 4 or 5-star rating.

Liontrust Global Dividend Fund

Launched in December 2012, the Liontrust Global Dividend C Acc GBP fund has firmly established itself as one of Liontrust's top-performing offerings, managing £386.08 million in client assets. Its primary objective is to generate income while achieving long-term capital growth over five years or more, targeting a net yield that meets or exceeds the MSCI World Index annually by investing at least 80% of its assets in shares of companies worldwide.

The fund’s performance has been exceptional, consistently outperforming its peers in the IA Global Equity Income sector. Over the past 12 months, it delivered growth of 29.80%, well above the sector average of 19.04%, ranking 2nd out of 56 funds. Over three years, it achieved cumulative growth of 28.29%, compared to the sector average of 26.09%. Its five-year return of 78.88% also significantly outperformed the sector average of 53.16%.

This strong performance reflects the fund’s disciplined stock selection process, focusing on high-quality companies with sustainable competitive advantages, strong financial health, and compelling valuations. Notable holdings include Broadcom Inc., Constellation Energy Corporation, and Apple Inc., showcasing its emphasis on innovative businesses.

Liontrust Japan Equity Fund

The Liontrust Japan Equity Fund has established itself as a consistent top performer within the IA Japan sector. Over the past year, the fund achieved growth of 13.03%, comfortably outpacing the sector average of 9.98%. Its three-year cumulative growth of 15.75% was more than three times the sector average of 5.5%, while its five-year growth of 33.41% also significantly surpassed the sector average of 22.15%. These results underscore the fund's ability to deliver strong returns across multiple time frames.

The fund takes an actively managed, high-conviction, research-driven approach, focusing on industry-leading companies with robust growth potential. Central to its strategy is investing in multinational Japanese businesses with substantial exposure to faster-growing regions, such as emerging markets. This enables the fund to capture revenue growth opportunities beyond Japan’s domestic market.

With its emphasis on high-quality, globally connected Japanese companies, the Liontrust Japan Equity Fund is a compelling choice for investors seeking exposure to Japan’s economy while benefiting from international growth trends.

Liontrust MA Dynamic Passive Adventurous Fund

Launched on 7th March 2011, the Liontrust MA Dynamic Passive Adventurous S has emerged as the best-performing fund in the Liontrust range. Designed for capital growth and income, it aligns with a high-risk profile of 7 on a scale where 1 is the lowest and 7 the highest, appealing to investors with a higher risk tolerance.

This actively managed fund operates as a cost-efficient fund of funds, allocating at least 70% of its assets to other investment vehicles such as investment trusts and ETFs. By focusing on passive strategies, it ensures broad market exposure at a competitive cost. The portfolio primarily consists of equities from developed and emerging markets, complemented by smaller allocations to fixed income and property assets for diversification. Its adventurous profile reflects its significant equity weighting and potential for high returns.

Managing £64.98 million in assets, the fund has delivered exceptional performance over various time frames. Over the past year, it returned 22.31%, far surpassing the sector average of 15.83%. Its three-year cumulative growth of 20.84% nearly triples the sector average of 7.04%, while its five-year return of 50.51% is more than double the sector average of 23.76%. These results position it as one of the leading funds in the IA Volatility Managed sector.

.

Liontrust MA Dynamic Passive Growth Fund

The Liontrust MA Dynamic Passive Growth S Acc fund is structured to achieve capital growth and income with a moderately high level of volatility, rated as a 6 on a risk scale from 1 (lowest) to 7 (highest). It currently holds approximately £179.60 million and has greater exposure to higher-risk assets compared to other funds in the Liontrust MA Dynamic Passive range with lower risk profiles.

The fund allocates at least 70% of its assets to other funds, such as investment trusts and ETFs, targeting a diverse range of global asset classes, including equities and bonds. It balances its emphasis on emerging markets with diversification through fixed income and indirect property exposure via REITs. The fund’s asset mix can change in the short term, but its overall risk level stays the same. The underlying investments are largely passive, aiming to track market indices, but the fund is actively managed to allow for adjustments based on market conditions.

Over the past 1, 3, and 5 years, the fund has delivered impressive returns of 20.85%, 19.96%, and 43.24%, respectively. In comparison, the IA Volatility Managed sector averages for these periods were 15.83%, 7.04%, and 23.76%. These results highlight the fund's ability to outperform its peers and capitalise on market opportunities effectively.

In contrast to the Liontrust MA Dynamic Passive Adventurous fund, which is rated 7/7 on the risk scale and focuses almost exclusively on equities, the Passive Growth fund offers greater diversification and a more balanced risk approach. It is well-suited for moderately aggressive, long-term investors seeking a combination of growth, stability, and income. Additionally, the fund maintains a competitive ongoing charge of 0.40%, enhancing its cost efficiency for investors.

Liontrust MA Explorer 85 Fund

The Liontrust MA Explorer 85 Fund manages £88.96 million in assets, offering a well-diversified portfolio with broad exposure across asset classes and regions. This diversity has helped the fund navigate changing market conditions effectively and maintain a strong performance track record.

The fund has consistently outperformed its peers in the IA Mixed Investment 40-85% Shares sector. Over the past year, it delivered a return of 18.92%, ahead of the sector average of 17.21%. Its three-year growth of 12.11% significantly exceeded the sector average of 8.44%, while its five-year return of 38.02% was well above the sector average of 29.66%. These figures demonstrate the fund’s ability to generate competitive returns over varying time periods.

The fund’s success is driven by its strategic investment approach, combining long-term planning with short-term adaptability. By allocating assets dynamically to take advantage of market trends in sectors such as technology, financial services, and industrials, it balances growth opportunities with diversification.

5 Worst Performing Liontrust Funds

As highlighted in our performance analysis, 37 of the 56 Liontrust funds analysed have underperformed relative to their sector peers and received a poor performing 1 or 2 star rating.

From these 37 funds, we feature 5 of the worst performing funds over the recent 1, 3 & 5 years, all of which received a 1-star rating.

Liontrust Global Smaller Companies Fund

The Liontrust Global Smaller Companies Fund, within the IA Global sector, has faced challenges in delivering competitive performance across various time periods. Focusing primarily on smaller companies with market capitalisations under £10 billion, the fund aims to capitalise on growth opportunities in this segment but has struggled to keep pace with its sector peers.

Over the past year, the fund returned 20.45%, slightly below the sector average of 21.65%. Its three-year performance highlights deeper challenges, with a decline of -10.67%, significantly underperforming the sector average of 14.21% and ranking it near the bottom of its peer group at 422 out of 462 funds. Over five years, the fund delivered a cumulative return of 54.61%, falling short of the sector average of 58.5%.

Several factors have contributed to this underperformance. Currency fluctuations, particularly the appreciation of sterling against the dollar in late 2022, diminished the value of its overseas holdings. The fund’s reliance on smaller companies, which are more sensitive to economic downturns and market volatility, further impacted results. Additionally, its avoidance of capital-intensive sectors such as real estate and energy limited its ability to benefit during periods of strong performance in these areas. A significant allocation to high-growth sectors also increased volatility, exacerbating losses during market downturns.

While its focus on smaller companies with growth potential aligns with a long-term investment philosophy, the fund’s recent performance highlights the challenges of navigating economic and market fluctuations effectively.

Liontrust Russia Fund

The Liontrust Russia C Acc GBP Fund, managing £51.54 million in assets, has struggled significantly, consistently ranking as one of the poorest performers within the Liontrust range. Its concentrated focus on Russian equities, primarily in energy, materials, and financials, reflects the dominance of these sectors in the Russian economy but has exposed the fund to severe challenges.

Over the past year, the fund declined sharply by -22.17%, vastly underperforming the sector average of 13.77% and ranking last out of 210 funds. Its three-year performance was even more concerning, with a staggering loss of -71.71% compared to the sector average of 8.82%, placing it 205th out of 206 funds. Over five years, the fund recorded a cumulative loss of -59.45%, far below the sector average of 26.52%, and ranked 183rd out of 184 funds in the IA Specialist sector.

The fund’s poor performance stems from several interconnected factors. Geopolitical tensions, particularly the conflict in Ukraine, have led to severe international sanctions on Russia, crippling the economy and many of the companies in the fund’s portfolio. Sanctions have restricted access to global markets, weakened the Russian rouble, and led to economic isolation, all of which have heavily impacted the fund’s underlying assets. The portfolio’s lack of diversification and its heavy exposure to a single region exacerbated losses, leaving it highly vulnerable to these risks.

While the fund’s concentrated strategy is designed to take advantage of growth opportunities in a single market, its exposure to significant geopolitical and economic uncertainties has led to sustained underperformance.

Liontrust Special Situations Fund

The Liontrust Special Situations fund is designed to deliver long term capital growth over 5 years or more. At least 90% of the fund’s assets are invested in companies that are incorporated, domiciled, or conduct business within the United Kingdom. Its investment strategy employs the Economic Advantage process, focusing on companies with unique intangible assets that provide a sustainable competitive edge.

This £3 billion fund delivered 12 month returns of 15.37%, falling notably short of the sector average of 19.50%. The fund returned negative growth of -0.66% over the past 3 years, which was some ways below the sector average of 8.89%. Over five years, it achieved cumulative returns of 25.31%, which fell narrowly below the sector average of 25.75%. This consistent underperformance has resulted in the fund to rank among the worst performers in the IA UK All Companies sector.

The fund’s underperformance is linked to ongoing economic challenges in the UK. Inflationary pressures, weak consumer confidence, and Brexit-related uncertainties have negatively impacted the domestic companies dominating its portfolio. Rising inflation and interest rates have further affected its focus on quality-growth businesses. Additionally, significant exposure to UK mid and small-cap stocks has heightened vulnerability to market volatility. The fund’s concentrated portfolio has limited its flexibility to adapt to rapidly changing conditions, further weighing on its overall performance.

Liontrust Sustainable Future Global Growth 2 Fund

The Liontrust Sustainable Future Global Growth 2 Fund, part of the IA Global sector, manages £1.437 billion in assets and invests primarily in companies producing sustainable products and services or adhering to progressive ESG practices. Despite its alignment with the rising demand for sustainability-focused investments, the fund has underperformed its sector peers in recent years.

Over the past year, the fund delivered a return of 21.18%, slightly trailing the sector average of 21.65%. Its three-year return of -4.28% was significantly below the sector average of 14.21%, reflecting challenges in navigating a volatile economic environment. Over five years, the fund returned 56.76%, narrowly underperforming the sector average of 58.5%.

The fund’s struggles stem from its heavy allocation to growth-oriented sectors such as technology and healthcare, which have been adversely impacted by rising interest rates and broader economic pressures. Additionally, its strict ESG mandate has excluded high-performing sectors like energy and industrials, which have benefitted from recent market conditions. Inflationary pressures and market volatility have further weighed on its growth-focused portfolio, constraining returns.

While the fund’s commitment to sustainability remains attractive to ESG-conscious investors, its performance highlights the challenges of maintaining a strict ESG approach in fluctuating market conditions.

Liontrust US Opportunities Fund

The Liontrust US Opportunities Fund focuses on North American equities, with at least 80% of its holdings in US-based companies. Its strategy centres on selecting businesses with strong competitive advantages, robust financials, and significant growth potential, aiming to capitalise on opportunities within the world’s largest economy. Employing a bottom-up stock selection approach, the fund identifies companies with clear catalysts for positive returns. Its concentrated, high-conviction portfolio spans various market capitalisations and investment styles.

Despite its focused strategy, the fund has struggled to deliver competitive performance in recent years, ranking among the weaker performers in the IA North America sector. The £238.82 million fund posted returns of 22.45%, 13.17%, and 75.24% over the past 1, 3, and 5 years, respectively. While these figures might appear strong, they fall notably short of the sector averages of 27.69%, 28.36%, and 84.05% over the same periods.

The fund’s significant exposure to growth sectors such as technology has been a key factor in its underperformance. These sectors have been particularly volatile in an environment of rising interest rates and broader economic uncertainty. Furthermore, the concentrated nature of the portfolio has magnified the impact of underperforming stocks, limiting its ability to offset losses. Broader economic pressures, including inflation and geopolitical instability, have also weighed heavily on US equities, especially in growth-oriented sectors, further hindering the fund’s performance relative to its peers.

Summary

Liontrust Asset Management has encountered challenges in recent years, including underperforming funds and market-driven outflows. As identified in this analysis and attached Liontrust fund review download, our evaluation of 56 Liontrust funds revealed mixed results, with 37 funds underperforming and receiving a one or two-star rating.

This analysis highlights that no fund manager consistently excels across all areas of performance. While Liontrust offers a diverse range of funds, including some standout performers, it is clear that success varies across their portfolio. To maximise portfolio returns, it is crucial for investors to carefully distinguish between top-performing funds and underperformers, regardless of the provider.

Having a strategic investment approach and maintaining a diversified portfolio are key aspects of managing risk and achieving success, in long-term investments.

Remember, no single sector consistently leads in performance, so diversifying across various asset classes and regions can help stabilise and grow your investments over time.

Identifying the best performing funds within each asset class will also contribute to achieving optimal returns and safeguarding your financial future.

Book A No Obligation Call With A Yodelar Adviser

Evaluate Your Portfolio's Performance with a Free Portfolio Analysis

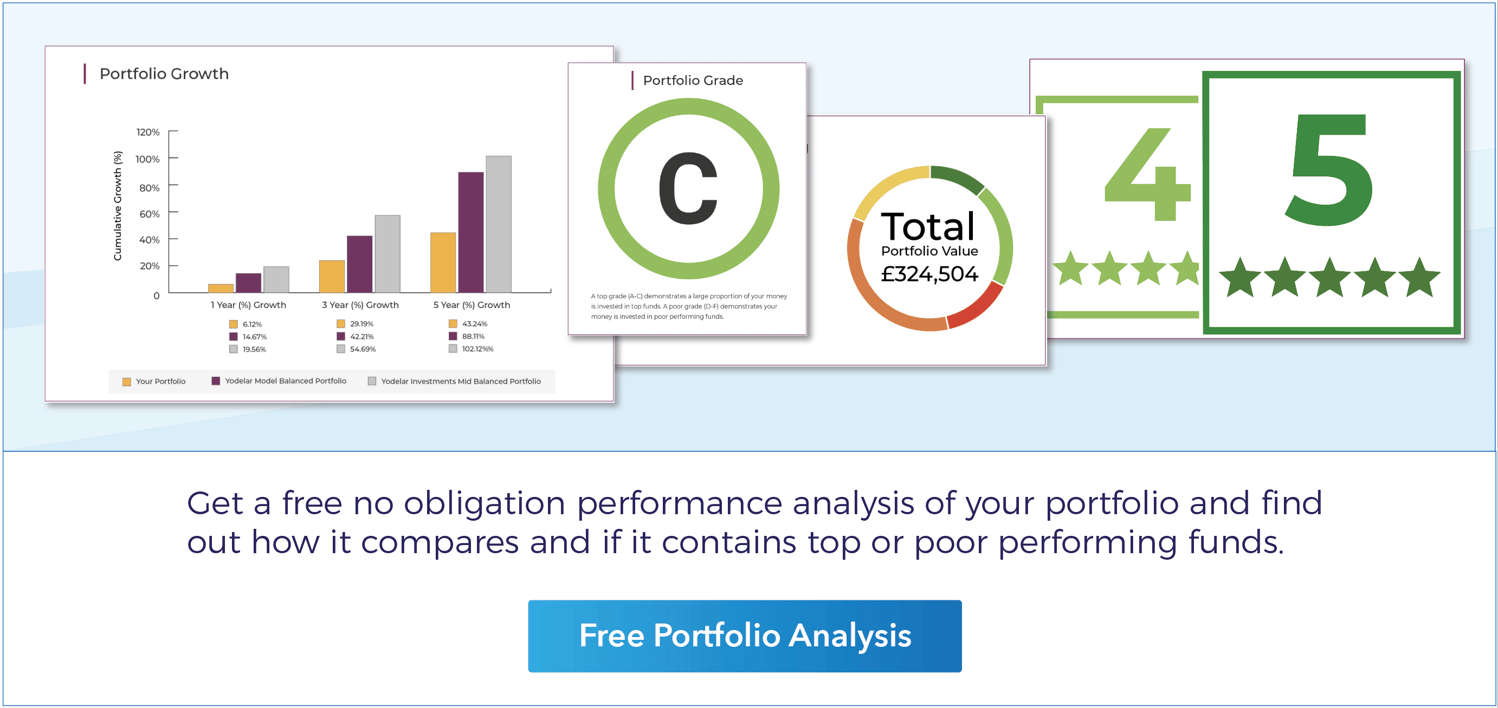

For years, Yodelar has analysed the performance and quality rating of portfolios for thousands of UK investors. Our extensive analysis has uncovered that over 90% of investors hold portfolios containing inefficiencies that stunt growth potential, resulting in many UK investors to miss out on enhanced portfolio growth.

Inefficient investing can have adverse long-term consequences, making it crucial to identify and correct any portfolio deficiencies.

Our industry leading portfolio analysis service enables investors to find out how their portfolio compares to a similar risk-profile portfolio constructed with top-performing funds. This unique tool provides measurable ratings that offer complete transparency into the quality of individual fund choices and the overall portfolio's competitiveness.

By utilising our free portfolio review feature, investors gain detailed insights into the performance of their investments and can determine whether their current approach is optimally positioned for growth.

Key Benefits Include:

- Assess the performance of each fund

- See where each fund ranks within its sector over 1, 3, and 5 years

- Find out each fund's performance rating between 1 to 5 stars

- Identify the proportion allocated to top, mediocre, or underperforming funds

- Compare portfolio growth against model portfolios built with consistently top-performing funds

- Receive an overall portfolio performance grade from A to F