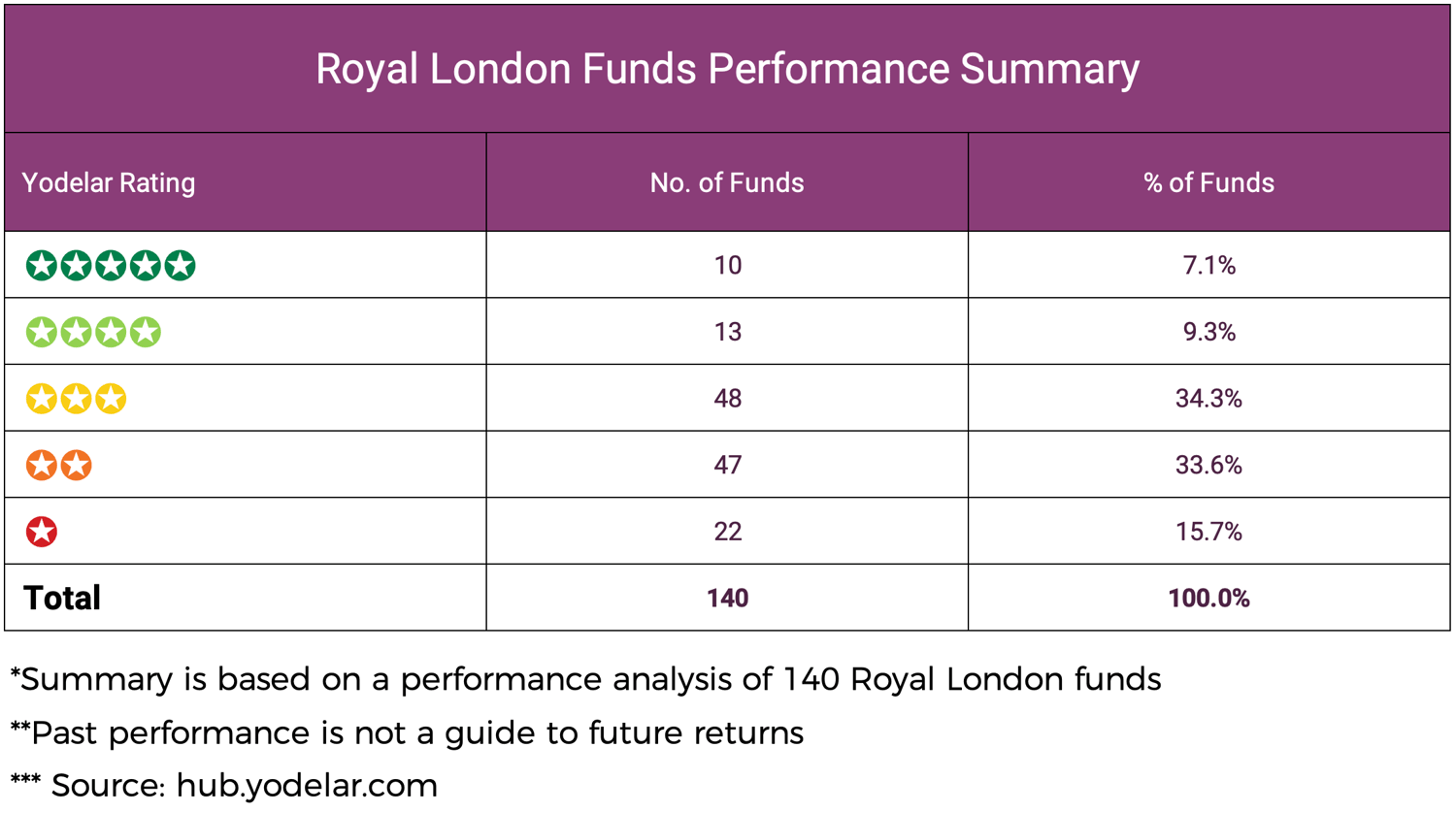

- From an analysis of 140 Royal London funds, only 7.1% achieved a top 5 Star Yodelar Rating, demonstrating consistent top-quartile performance across all measured periods.

- Across the full Royal London range, 81 funds (68%) delivered only average or below-average returns, emphasising the importance of selective fund choice within large fund groups.

- The Royal London Global Equity Select Fund M Acc delivered the strongest long-term results, with 5-year growth of 131.18%, well ahead of the IA Global sector average.

- The Royal London Global Equity Income Fund M Inc achieved 5-year growth of 113.96%, ranking among the top performers in the IA Global Equity Income sector.

- The findings reinforce the value of a portfolio analysis, helping investors identify top-performing funds and avoid prolonged exposure to consistent underperformers.

Royal London is one of the UK’s most established investment groups, managing a broad range of equity, bond, and multi-asset funds for both retail and institutional investors. Its funds aim to deliver long-term growth and income across global markets, supported by a focus on sustainability and responsible investment principles that have become a core part of the group’s identity.

To evaluate how effectively Royal London’s funds have delivered for investors, we analysed 140 funds across 1, 3, and 5 year periods to 29 September 2025. Each fund was compared against its sector average to measure consistency, competitiveness, and the ability to add value over time.

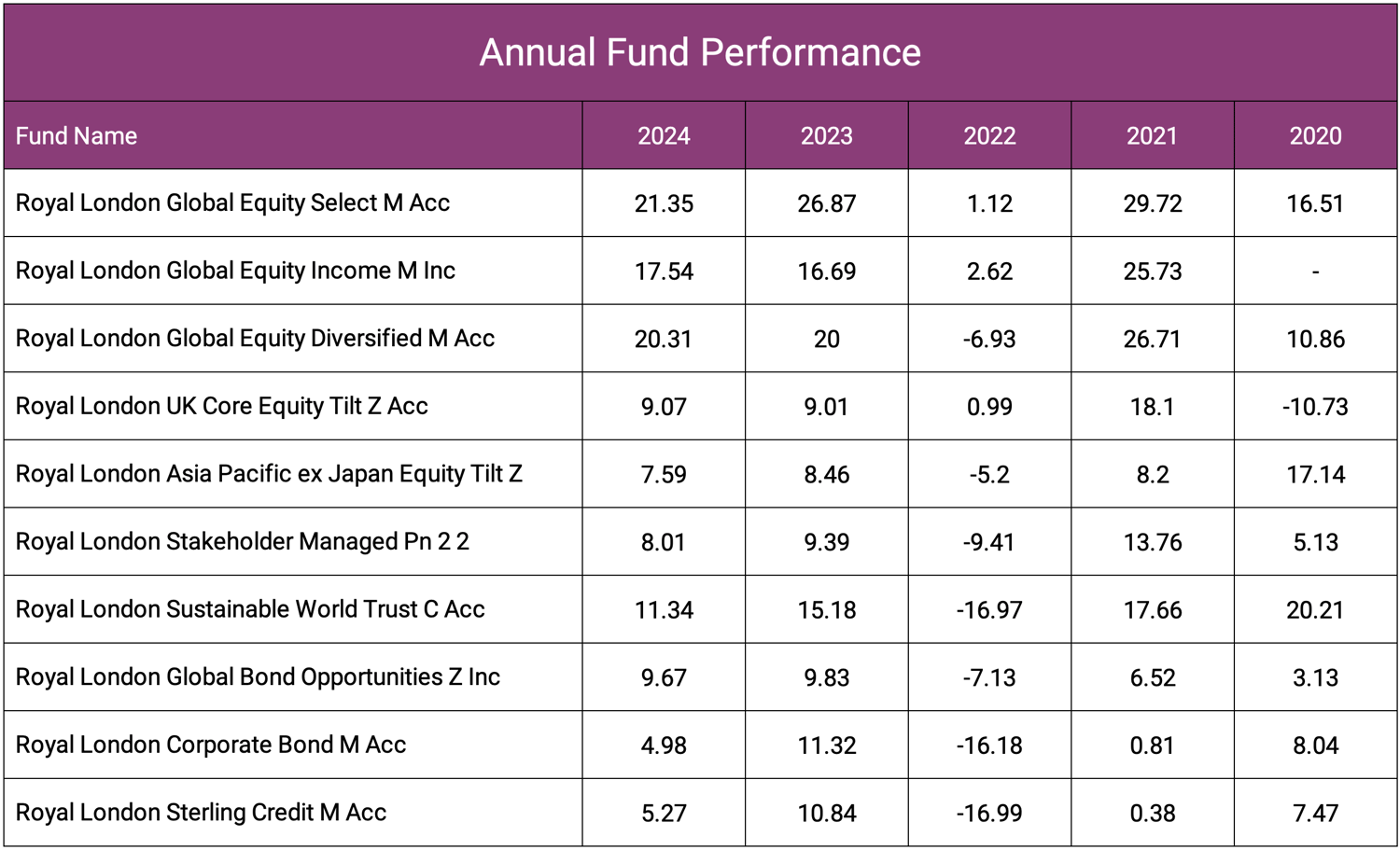

This review features 10 Royal London funds that have achieved the strongest overall performance, maintaining top-quartile sector rankings across multiple timeframes. The analysis also provides access to the full Royal London performance report, which includes detailed 1, 3, and 5 year results, sector rankings, and Yodelar Ratings for all 140 funds.

Royal London Fund Performance Summary

Of the 140 Royal London funds analysed, only 10 (7.1%) achieved a top 5 star Yodelar Rating, meaning they consistently ranked within the top quartile of their sectors over each of the three measured periods. A further 13 funds (9.3%) achieved 4 stars, reflecting above average performance. The largest proportion, 81 funds or almost 68%, received 1, 2, or 3 stars, signifying performance below or close to the sector average.

While the results show that Royal London has produced several standout performers, they also reveal significant variation across its range. The 10 funds that achieved 5 star ratings have distinguished themselves through consistent returns, experienced management, and robust investment strategies that have adapted well to changing market conditions.

Top Performing Royal London Funds

Among Royal London’s 140 funds, the following 10 have delivered the strongest and most consistent performance over 1, 3, and 5 years. Collectively, they represent a mix of equity, fixed income, and multi-asset strategies, reflecting the depth and diversity of Royal London’s investment capability.

Royal London Global Equity Select Fund

Classified within the IA Global sector, this fund has achieved exceptional long-term results, delivering 9.12% over 1 year, 60% over 3 years, and 131.18% over 5 years. It is an actively managed, high-conviction portfolio of around 40 global equities, focused on quality companies with strong growth characteristics. The fund holds major global names such as Microsoft, Nvidia, and Alphabet. With an OCF of 0.71%, it has provided strong value through consistent benchmark outperformance and disciplined portfolio construction.

Royal London Global Equity Income Fund

Within the IA Global Equity Income sector, this fund has produced sustained income and capital growth, returning 13.49% over 1 year, 54% over 3 years, and 113.96% over 5 years. It targets dividend-paying global equities while maintaining a focus on quality and value. With holdings including Microsoft, Alphabet, and Broadcom, the strategy has balanced steady income delivery with participation in long-term global growth trends. Its OCF of 0.72% remains competitive for an active global income strategy that has consistently ranked in the top quartile of its sector.

Royal London Global Equity Diversified Fund

Part of the IA Global sector, this fund has achieved growth of 52.86% over 3 years and 98.73% over 5 years, outperforming the majority of peers. It combines quantitative screening with active stock selection to balance risk and opportunity, and maintains a diversified portfolio across global markets. Large-cap technology holdings such as Nvidia, Apple, and Microsoft have supported strong returns. With an OCF of 0.41%, it delivers cost-efficient access to an actively managed, globally diversified equity strategy.

Royal London UK Core Equity Tilt Fund

This fund is classified within the IA UK All Companies sector and aims to replicate the performance of the FTSE 350 Total Return Index while applying a sustainability tilt that reduces carbon intensity. Over 5 years it has achieved growth of 85.49%, outperforming both its benchmark and the sector average of 57.39%. With an OCF of only 0.10%, it represents one of the lowest-cost active UK equity options in the market, delivering strong, index-beating results with a lower environmental footprint.

Royal London Asia Pacific ex Japan Equity Tilt Fund

Classified in the IA Asia Pacific Excluding Japan sector, this fund has been a consistent top-quartile performer, returning 16.46% over 1 year and 63.92% over 5 years. It invests across developed and emerging markets in Asia Pacific, maintaining a carbon intensity at least 30% below its benchmark. The fund has benefited from its allocation to leading Asian technology and financial companies, helping it deliver strong growth with an OCF of 0.19% that makes it one of the most efficient funds in its category.

Royal London Stakeholder Managed Pension Fund 2

Sitting in the ABI Mixed Investment 40–85% Shares sector, this multi-asset fund invests across Royal London’s internal range, including UK and global equity funds as well as fixed income holdings. Over 5 years it has achieved growth of 47.08%, outperforming its sector median. With a balanced allocation between equities and bonds, the fund has navigated varying market conditions effectively. Its OCF of 1.49% reflects the additional pension structure costs, but its consistent performance shows effective asset diversification.

Royal London Sustainable World Trust

Positioned within the IA Mixed Investment 40–85% Shares sector, this fund combines competitive long-term performance with a clear sustainability mandate. It has grown 46.40% over 3 years and 40.76% over 5 years, both ahead of the sector average. The fund invests in companies aligned to themes such as clean energy, healthcare, and financial inclusion, and has delivered consistently strong performance with an OCF of 0.77%, reinforcing Royal London’s leadership in responsible investing.

Royal London Global Bond Opportunities Fund

Within the IA Global Mixed Bond sector, this flexible fixed income strategy has delivered strong total returns of 8.30% over 1 year, 32.99% over 3 years, and 32.63% over 5 years. It invests across investment grade, high yield, and non-sterling debt markets to generate a balance of income and capital growth. The fund’s broad scope and proactive positioning have contributed to steady top-quartile results. Its OCF of 0.40% offers efficient access to diversified global bond exposure.

Royal London Corporate Bond Fund

Part of the IA Sterling Corporate Bond sector, this fund has achieved 5-year growth of 8.69%, outperforming both its benchmark and sector averages. It invests primarily in high-quality sterling-denominated corporate bonds, including exposure to structured credit and financial institutions. The fund has performed consistently across all timeframes, supported by its disciplined credit selection and focus on higher-yielding issues. Its OCF of 0.56% remains competitive within the corporate bond category.

Royal London Sterling Credit Fund

Also classified in the IA Sterling Corporate Bond sector, this fund has achieved 6.38% over 1 year, 31.77% over 3 years, and 7.57% over 5 years. It maintains a higher exposure to BBB and sub-investment-grade credit, enhancing returns without excessive risk. Its focus on structured and financial sectors has supported performance through varying rate cycles. With an OCF of 0.53%, it remains one of the more efficient active credit funds in its sector.

Analysing Performance Across the Full Royal London Range

While these funds represent the strongest examples of Royal London’s success, performance across its wider range has been more variable. Over half of its funds have delivered only average or below-average returns relative to peers, highlighting the importance of careful selection within such a large suite.

Royal London’s strengths are most evident in global equities, sustainable strategies, and active bond management, where the firm’s depth of expertise and scale have produced competitive results. Performance within UK and multi-asset funds has been more uneven, with many struggling to deliver consistent outperformance over time.

Key Takeaways for Investors

Royal London remains one of the UK’s most respected investment managers, combining scale with a strong reputation for responsible investing. Its top-performing funds demonstrate clear capability in global equity and credit markets, supported by experienced management and disciplined processes.

However, with only a small proportion of its funds achieving top-tier performance, investors should not assume that brand recognition guarantees results. As with any large investment group, quality varies between strategies, and selecting the right funds is essential to achieve long-term efficiency and growth.

Ensure Your Portfolio is Performing Efficiently

Even among major fund providers such as Royal London, the difference between average and top-quartile funds can have a substantial impact on long-term outcomes. Many investors continue to hold underperforming funds without realising the effect this has on their portfolio’s growth potential.

A Yodelar Portfolio Analysis provides a clear, independent assessment of how efficiently your portfolio is performing. Each fund is compared against its sector average, highlighting areas of underperformance, duplication, or imbalance. Your portfolio is then benchmarked against optimised alternatives that align with your preferred risk level.

This process helps investors identify practical ways to enhance performance through improved diversification, better fund selection, and reduced costs. It is a simple but highly effective step towards ensuring your investments are positioned for long-term success.

To find out how your portfolio compares, you can request a free analysis at www.yodelar.com/portfolio-analysis.

Source: hub.yodelar.com. Data to 29 September 2025. Past performance is not a guide to future returns.