- Uncertain times ahead for the North American Sector.

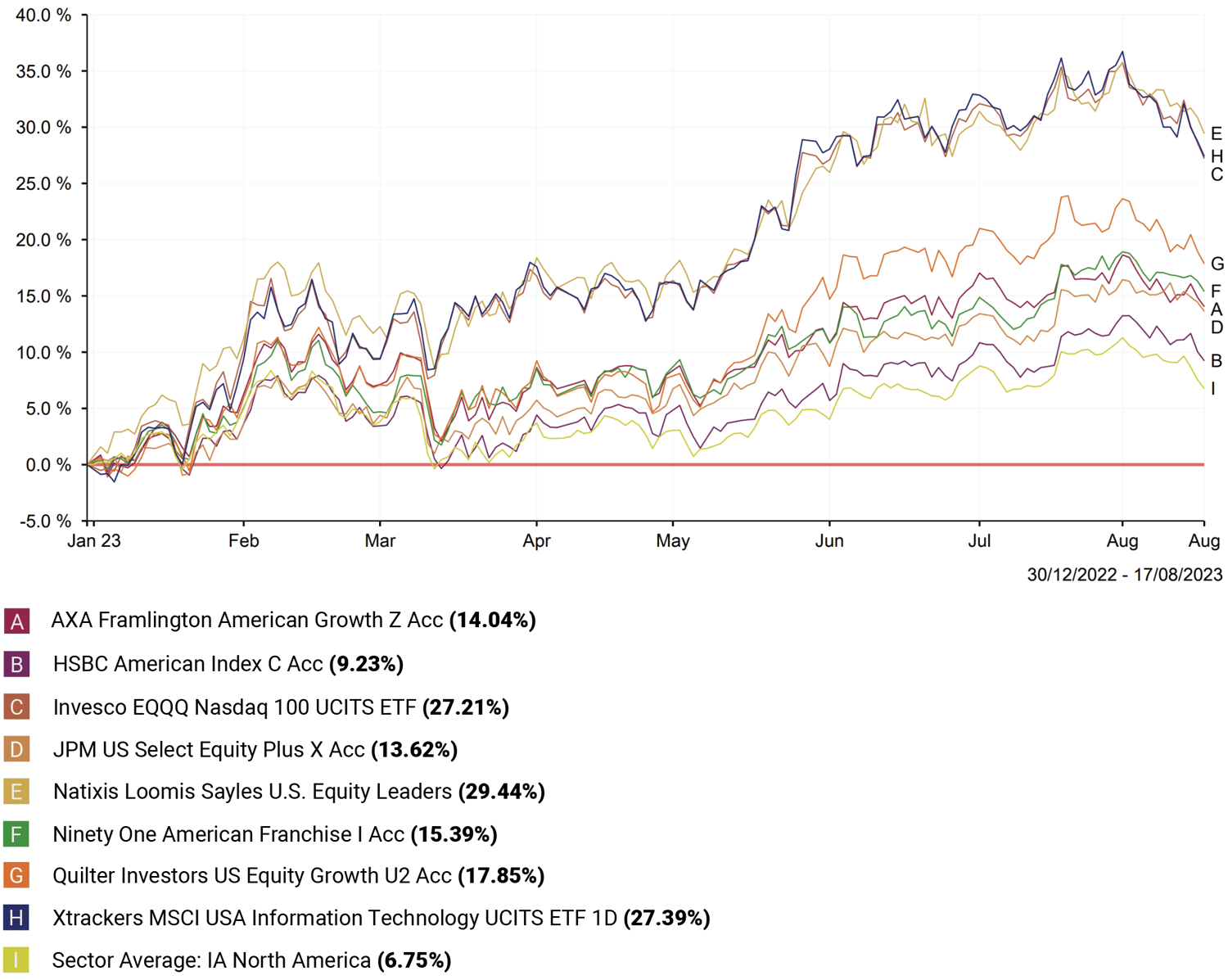

- Despite recent volatility the Natixis Loomis Sayles U.S Equity Leaders fund has returned 29.44% for the year to date. Over the past 12 months its performance has ranked 1st out of 227 funds in the IA North American sector.

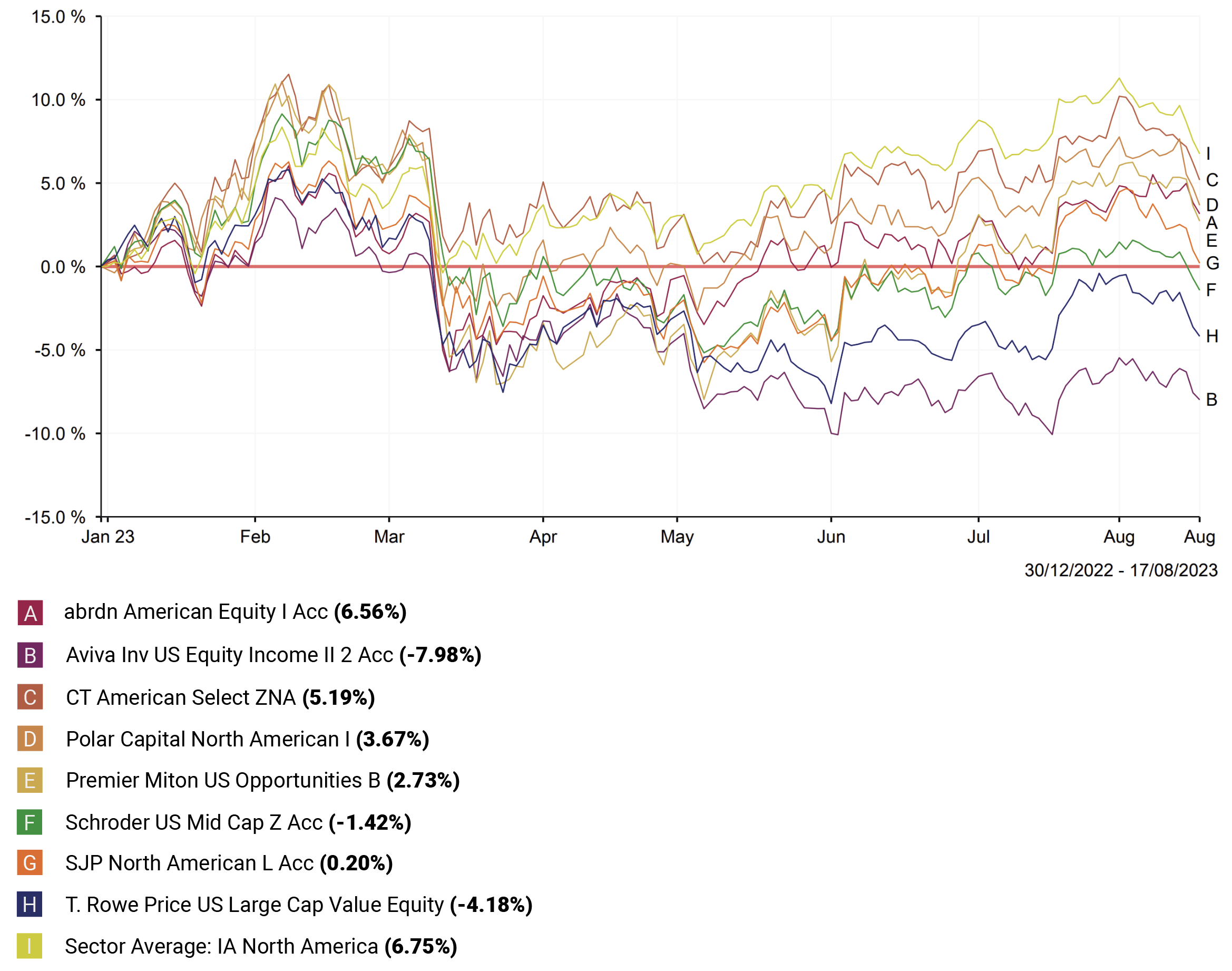

- The Schroder US Mid Cap fund has been one of the worst performing funds in the IA North American sector in 2023. For the year to 17th August 2023, this fund has returned growth of -1.42% compared to the sector average of 6.75%.

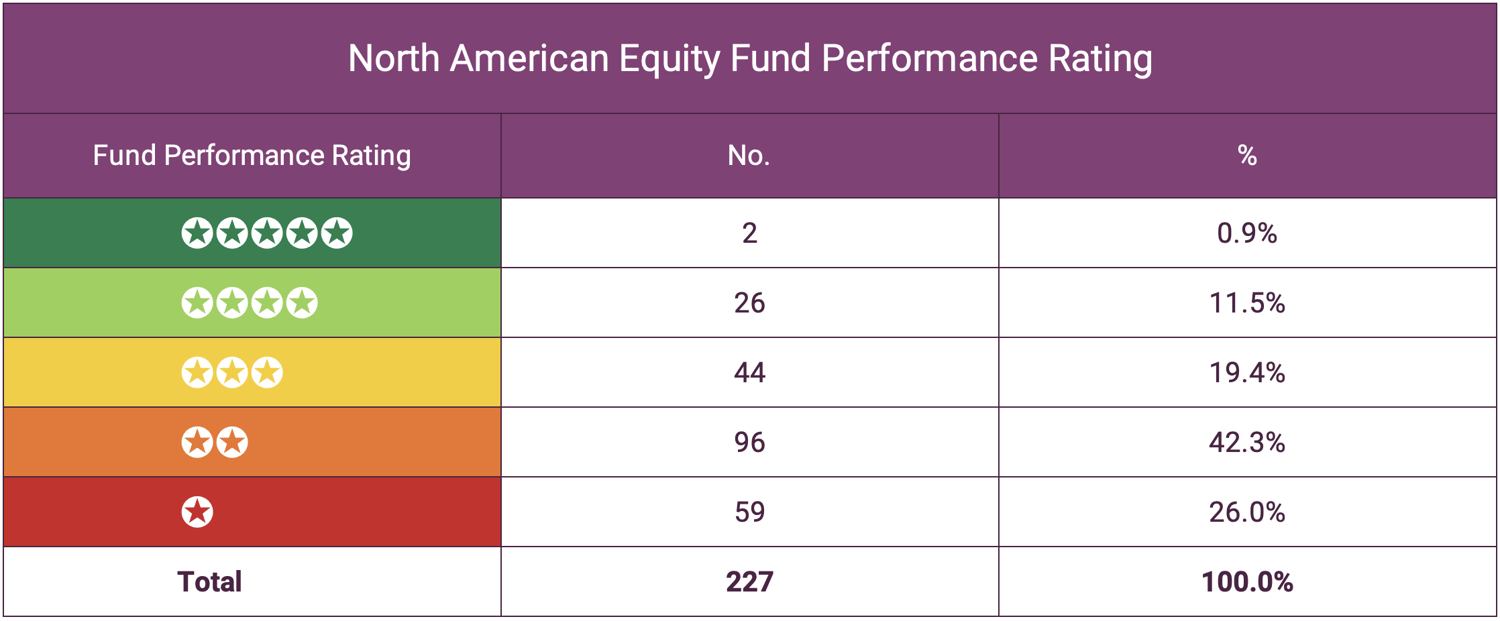

- Out of 227 funds in the IA North America sector 28 received a high 4 or 5 star performance rating. In contrast, 155 received a poor performing 1 or 2 star rating.

The North American equity sector has consistently been one of the top growth markets for investors. Since the start of the year the sector has averaged returns of 7.46%, recovering a large part of the losses from a highly volatile 2022 where the sector ended the year with negative returns of -9.70%.

Despite a difficult 2022, the sector has still managed to average returns of 33.39% over 3 years and 54.71% over 5 years.

There are currently 227 funds classified within the IA North American investment sector, some of which have a wide variation of performance. In this report we identify the top and worst performing North American funds so far this year.

Uncertainty Ahead For North American Equities?

In recent weeks, the downgrading of the U.S credit rating from AAA+ to AA+ by rating company Fitch, prompted yet another sell-off of technology stocks. As technology companies account for 28% of the S&P 500 Index (S&P 500 tracks the performance of the 500 largest U.S listed companies) it has prompted markets to experience a drop in values in recent weeks.

Large technology stocks like Amazon, Meta, Microsoft, Tesla, Nvidia and Apple have led the recent market declines. Because the tech sector is so forward-facing, it’s particularly sensitive to interest rate changes, which in America are at the highest levels for 22 years.

The U.S. economic outlook is uncertain amongst many economists, but recent events along with rising prices and lower consumer demand has increased concerns that the U.S is about to enter a recession. Different outlooks often means a rise in volatility, which depending on their strategies and composition, can have both a positive or negative impact on equity funds.

All markets go through positive and negative cycles - this will always be a part of investing. For investors, the best strategy is to invest for the longer term and have a portfolio that contains high quality funds, as over the longer term it is these funds that are more likely to outperform even if they struggle during the short term during negative cycles. Despite the prospect of a negative period for North America, the sector has no shortage of high quality funds the offer investors excellent long term growth prospects.

In this article we will identify the top performing North American funds this year and over the recent 1, 3 & 5 years as well as expose the funds that have been among the worst in the sector for performance.

Top Performing North American Funds

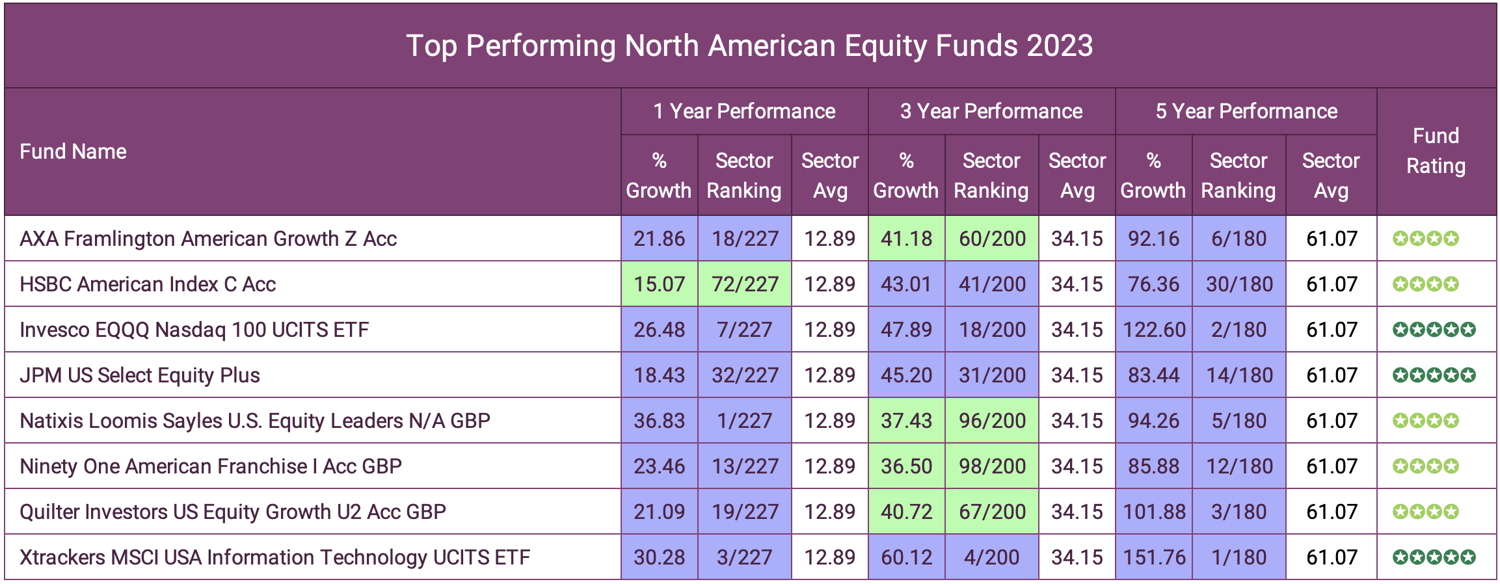

The table below shows the 1, 3 & 5 year performance, sector ranking and 5 year performance rating of 10 of the 227 North American sector funds that have not only been among the top performing U.S funds in 2023, but also over the past number of years.

* Performance figures are cumulative and inclusive of fund management charges

** The funds included in this analysis are for information purposes only and should not be viewed as a recommendation to invest.

Important Information - The value of investments can go down as well as up and you may lose some or all the capital you invest. Past performance is not a reliable indicator of future returns. The information on this website is for information purposes only and is not a personal recommendation for you to invest. If you are in doubt about any investment, consult a FCA-authorised investment firm such as Yodelar Investments.

The chart above shows the performance of the 8 best North American equity funds since the start of the year up to 17th August 2023. During this period the performance of these funds varied between 29.44% for the Natixis Loomis Sayles U.S. Equity Leaders fund to 9.23% for the HSBC American Index fund. In comparison, the IA North American sector average for the period was 6.75%.

Download the latest Best Funds Report

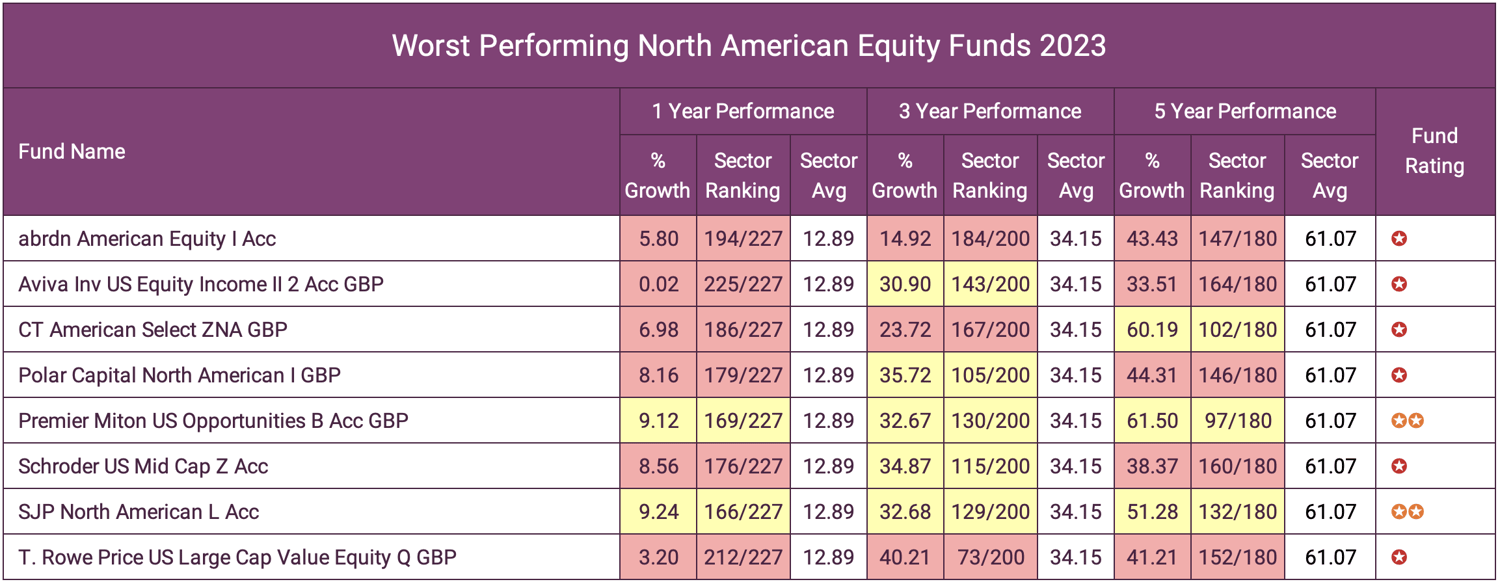

Worst North American Funds of 2023

The table below shows the 1, 3 & 5 year performance, sector ranking and 5 year performance rating of 10 of the 227 North American sector funds that have not only been among the top performing U.S funds in 2023, but also over the past number of years.

The funds that have performed among the worst in the sector this year also have a history of underperformance over the past 1, 3 & 5 years. As per the 5 year performance table above, the Aviva Investors US Equity Income fund had the lowest returns and in the chart below the fund has also delivered the lowest returns this year to date.

Average North American Sector Performance

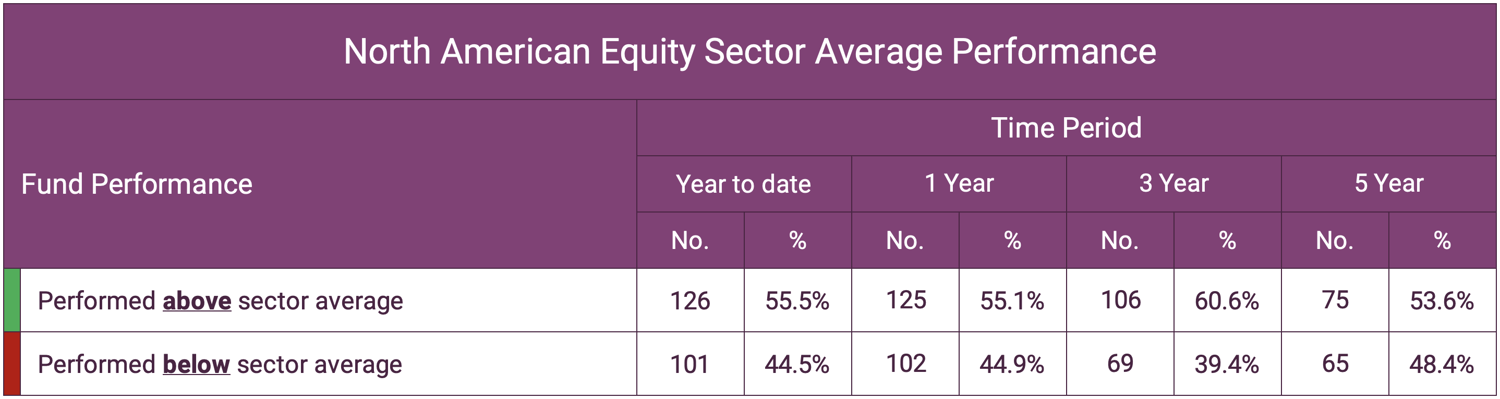

Over the 4 periods analysed, the number of funds that outperformed the sector average was higher than those that fell below the average.

When comparing all IA North American sector classified funds against the sector’s average returns more funds outperformed the sector average for each of the 4 periods analysed than underperformed. However, we believe investors should seek returns above the sector average as research shows approximately 15% of all available funds have a history of outperforming three quarters of competing funds within the same sector over 1, 3 & 5 years.

Although past performance is not an indicator of future returns it is reasonable to expect that a fund with a history of consistent outperformance across different market conditions can continue to outperform.

In the table below, we filter each of the 227 IA North American funds based on their 1, 3 & 5 year performance rating.

How Yodelar Rates Fund Performance

155 of the 227 funds received a poor performing 1 or 2 star rating with 12.4% or 28 funds maintaining a consistently high level of performance over the past 1, 3 & 5 years receiving a 4 or 5 star rating.

The North American equity sector is one of the most popular equity markets with investors, often holding a strong weighting within the portfolios of most UK investors.

The sector is not only home to some of the most globally recognised brands in the world, but it is also at the centre of technological innovation and at the forefront of industry development, it is easy to see why it represents such a strong investment market.

one of the most competitive on the market, with 227 funds currently classified within the IA North America sector.

Over the past 5 years, the IA North America sector has had the 2nd highest average growth returns of the 36 Investment Association sectors, behind only the IA Technology & Telecommunications sector, which reflects the sizeable influence the sector has on how well the portfolios of many UK investors perform. But like any sector, there are funds that perform poorly, those that perform moderately and those that excel.

Consistency is a crucial component that successful fund managers must achieve and the 5 funds featured in this report have been among the top performers in the sector since the start of the year but with extreme volatility this can quickly shift and it remains to be seen if they can maintain this performance going forward.

The Significance of Fund Performance

Evaluating fund performance is a pivotal metric for astute investors and quality advisory firms. Its analysis serves the purpose of ensuring that portfolios effectively align with objectives, all the while entrusting fund managers who have consistently showcased their ability to deliver above average returns.

While it's important to note that past performance does not guarantee future returns, investors often exhibit a preference for fund managers who exhibit consistent excellence across various time frames. This document spotlights a selection of fund managers who have consistently outperformed more than 75% of their counterparts within the same sector.

Comparative Performance Assessment

Each fund's performance can be assessed in relation to other competing funds classified under the same sector. This comparative analysis across multiple time frames can shed light on both the fund's overall quality and the competence of its manager.

Fund Manager Quality

Past performance serves as a revealing gauge of fund efficacy and the capabilities of its managers. Funds that maintain a consistent high rank within their sectors can indicate a notable level of expertise. Conversely, fund managers overseeing consistently underperforming funds within their sector showcase a deficiency in quality and an inability to deliver competitive returns to investors. While past performance isn't a crystal ball for future returns, it's a crucial tool that holds fund managers accountable for their achievements.

Strong Performance History

Over a span of five years, investments encounter a variety of economic and political challenges. How a fund and its manager navigate these cycles reflects their capabilities and overall competence.

Investing In Proven Quality

Despite the recent economic troubles and downgrading of the U.S. credit rating, there are still opportunities in the North American equity fund market for savvy investors. A number of high quality, well-managed funds in the investment association sector have consistently offered above average returns, even in the face of market volatility and the threat of recession. By carefully selecting funds with experienced managers, diversified portfolios, and solid long-term performance histories, investors can position themselves to benefit as the North American economies eventually recover. While the current environment presents challenges, the outlook is not uniformly bleak for those willing to be prudent and patient in finding the standout funds that are navigating the turbulence and generating positive gains.

Balance Is Key

In the pursuit of growth, it can be easy for investors to become over-reliant on the success of one asset class and thus load the weighting of their portfolio in funds in sectors that have performed well. But the risk of doing so can be painfully evident should that sector take a slump.

As the North American sector has traditionally been one of the top sectors for growth it often entices investors to neglect their portfolio diversification and allocate more than they should to sectors with a history of higher returns. But no single equity style, sector, country or region will outperform all of the time, which is why diversification remains the single most important aspect of investing. Global diversification spreads a portfolio's weighting across different countries and currencies to offset the risk of investing in just one region or country. As such, globally-diversified portfolios are vital to long-term investment success, and mitigate the impact should one region experience a downturn. With forecasts predicting a recessionary period in North America the risks of a downturn for the region are rising, with those overexposed more likely to have their portfolio values negatively impacted, irrespective of the quality of the funds their portfolios hold.

Get Quality Investment Advice

While the key factors for good investment advice can add value to any investment portfolio there are a number of additional factors that most advisers don't utilise, factors that can add even more value to investors.

Although financial advisers can add sizeable value to investors over the course of their investment horizon, only a relatively small proportion have a high level knowledge of fund and fund manager performance. 2 areas that if measured and used effectively to implement and maintain a top performing portfolio of funds, can add significant additional value.

Such advisers are able to build and manage efficient portfolios suitable to their clients’ risk profile and overall objectives. But like any industry, there are those who are good at what they do, and there are those who are not. The main difference in the financial sector is that it is very difficult for a client to know whether their adviser has the expertise until they take the chance and invest with them.

If your portfolio is managed by a financial adviser you want to make sure you are partnered with someone with a research driven knowledge in fund performance. There are financial advisers who demonstrate great expertise and knowledge when it comes to fund selection. However, fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds. As a result, a large proportion demonstrate poor knowledge on the quality of funds they recommend.

Quality advice and portfolio management firms understand fund and fund manager performance and are able to use this knowledge to identify the best options and build efficient, top performing portfolios. It is this process that distinguishes the top advice firms from the rest.

Efficiently Managing Your Investments

We believe as investors, growth should be the primary aim and as such our strategies are built upon using quality funds and fund managers who have a proven history of outperforming the markets. This unbiased approach allows us to focus only on what really matters, to think independently and to maintain a long-term perspective.

It is this quality driven approach that we believe will yield the best investor outcomes in the medium to long term. There are many pitfalls to investing but this article details the core topics that if effectively managed will add value to any portfolio.

At Yodelar Investments we implement efficient processes to ensure all of our portfolios follow best practices for all topics featured in this article.

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research identified that only a small proportion of funds and fund managers have consistently delivered top performance, with more than 90% of the portfolios we reviewed containing funds that continually underdeliver. This research has enabled us to identify efficient processes and top-quality investments which we have utilised to create strategically balanced, risk-rated portfolios that are built using only top quality funds within each asset class and offer investors excellent potential for growth.

Yodelar provides an advice and information service that is changing the way investors think. Book a no obligation call with our team today and find out how we can help you grow your wealth efficiently.