Investment trusts were relatively unheard of several years ago but as their reputation for delivering high returns grew, so too did their popularity. The upsurge in demand has reached record levels, and in 2020 the total assets under the management of Investment Trusts hit an all-time high of £178.58 billion.

Although still eclipsed by unit trusts in both size and popularity, the benefits of investment trusts are catching the attention of growth seeking investors. According to statistics from the Association of Investment Companies (AIC) who are the trade body that represents investment trusts, in most sectors Investment Trusts have beaten open-ended funds over the medium and long-term.

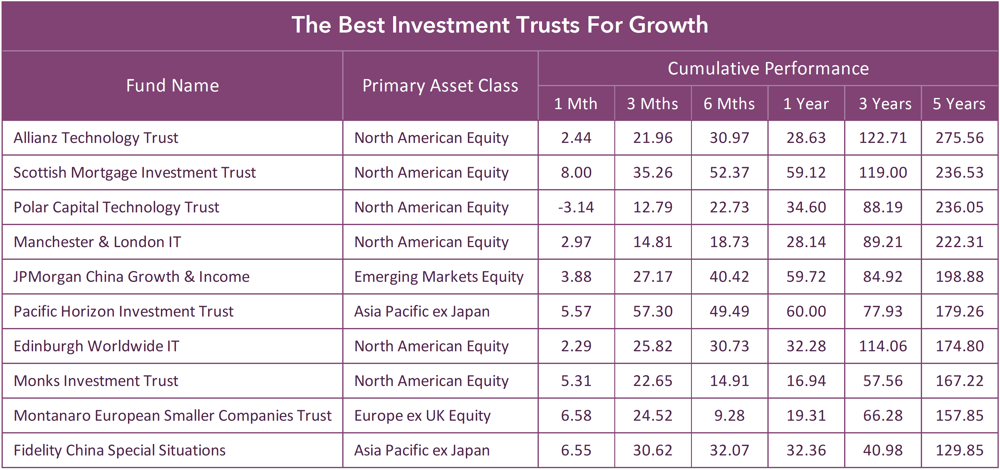

There are currently 470 Investment Trusts on the market to choose from and in this report we feature 10 Investment Trusts that have consistently delivered exceptional returns over the short term and long term.

What are Investment Trusts?

An investment trust is a public limited company (PLC) traded on the London Stock Exchange, so investors buy and sell from the market. It invests in other companies, seeking to generate profit for its shareholders.

The key difference between Investment trusts and unit trusts is that unit trusts are open-ended and investment trusts are closed ended.

When a fund is open-ended there is no limit to the number of units available – as more people invest, more units are created. By contrast, in a closed-ended investment trust there will only ever be a set number of shares available.

Like unit trusts, investment trusts are grouped by the geographical area and type of investment with which they are involved. The AIC lists more than 30 different sectors, ranging from UK Growth, Global Growth, Europe, Asia Pacific, Infrastructure, Property and Private Equity. However, Investment Trusts are typically more volatile than unit trusts, and their inclusion in a portfolio can influence a portfolios level of risk.

One thing to remember about investment trusts, and where they differ from other types of funds, is that the fund manager can borrow money to build a bigger portfolio. Many fund managers successfully use this gearing or leverage, as it is known, to manage their portfolios more efficiently. The danger with gearing is that if a fund manager does make a bad decision when investing this borrowed money, the investment trust’s returns will be even worse than they could have been without the borrowing.

Benefits of investment companies

- Closed-ended structure – this allows the manager to make longer-term decisions, without having to worry about needing to sell assets when investors sell their shares in the investment company.

- Listed on a stock exchange – this offers you the ability to buy and sell shares at any time in normal trading hours.

- Boards of directors – they are an additional layer of oversight, protecting your interests.

- Gearing – the ability of investment companies to borrow money to invest means that they may perform better over the long term.

- Ability to invest in hard-to-sell assets like private equity and infrastructure.

Risks of investment companies

- Gearing – this is likely to make your returns worse in periods when markets go down.

- Discounts – if an investment company discount widens when markets go down, you are likely to suffer a bigger loss than if you had invested in a similar open-ended fund.

The Best Performing Investment Trusts

Investment trusts are attractive to some investors, who believe they can outperform other fund types. The 10 Investment Trusts featured in this report have done just that. Each have consistently outperformed their rivals and represent some of the best performing Investment Trusts over the past decade.

The Investment Trusts below are not listed in any particular order.

Allianz Technology Trust

Allianz Technology Trust is managed by the highly experienced AllianzGI Global Technology team based in San Francisco. The team benefits from its close proximity to Silicon Valley where many of the world’s key technology companies are headquartered.

The Trust is a UK listed closed-ended fund and invests in mid to large technology companies. The companies they invest in are those which they expect to benefit from the continued growth in particular sub-sectors of technology, especially in companies that provide solutions to save money or enable companies to improve their relationships with customers and deliver revenue growth. The Trust also seeks to hold companies that will create shareholder value with the introduction of a new product or new technology.

Allianz believes that the present events around the COVID-19 crisis will spur the use of technology and change how we live and work in the future, which will help this trust thrive. As companies adjust budgets due to supply and demand disruptions, Allianz feels the need for companies to reduce costs should accelerate the move to cheaper and more productive solutions such as cloud, software-as-a-service, artificial intelligence, cybersecurity, etc.

The manager of this trust believes that we are in a period of rapid change, where the importance of technology is key to the prosperity of most industries. This environment is likely to provide attractive growth opportunities in many technology stocks over the next several years.

One of the ways Allianz Technology Trust stands apart from other tech funds is that it has scope to drift further beyond its benchmark index than most. This means it can combine larger or smaller positions in some of the world’s largest technology companies with outsized stakes in faster-growing names, although it could also make the share price more volatile.

This trust has consistently excelled for performance in the 10 year period up to 31st July 2020, it returned cumulative growth of 717.34%. Over the past 5-years the trust managed to return growth of 275.56%, which was the 3rd highest of the 384 available investment trusts that have at least 5-years performance history.

Scottish Mortgage Investment Trust

Launched in 1909, Scottish Mortgage is considered to be Baillie Gifford's flagship investment trust. These days the trust is Global rather than Scottish and has nothing whatsoever to do with mortgages.

The managers of the trust believe that the main driver of returns for the longterm investors is the impact of a very small exceptional group of companies, and they describe this trust as a portfolio of some of the greatest growth companies in the world.

The trust is made up of holdings in approximately 30 to 50 companies with just 3 companies Tesla, Amazon and life science technology firm Illumina accounting for more than 20% of the total assets.

This trust has consistently maintained competitive performance and over the recent 1, 3 & 5years, it was the top growth fund in its sector with returns of 59.12%, 119% and 236.53%. Over the longer term, it has also excelled with 10-year returns of 727.09%.

Polar Capital Technology Trust

Launched in 1996, Polar Capital Technology Trust plc aims to maximise long-term capital growth by investing in a diversified portfolio of technology companies from around the world.

This Trust provides investors with access to the potential of companies in the global technology sector.

The technology sector is an ever-changing investment universe and the managers believe the Trust is taking advantage of a key theme they are seeing right now – disruption.

Disruption is fuelling digital transformation, where existing companies having to change their business model, even their entire DNA, to reinvent themselves as organisations like Amazon, Uber and Netflix disrupt their businesses. This has created a number of opportunities for technology investors.

Managed by a team of dedicated technology specialists, the Company has grown to become a leading European investor with a multi-cycle track record. Over the past 10-years, the Polar Capital Technology Trust has returned cumulative growth of 566.67% and over the past 1, 3 & 5 years it has returned growth of 34.60%, 88.19% and 236.05% respectively.

Manchester & London IT

The trust keeps a relatively focused portfolio and will not invest more than 15% of their gross assets in any one company.

The trust invests heavily in large, intellectual property-rich in developed markets with the big 5 of Amazon, Alibaba, Alphabet, Microsoft and Facebook accounting for 63% of the trust’s overall asset exposure.

Although July was a poor month for the trust as it returned losses of -5.2%, over the longer term it has consistently ranked among the top performers in the IT Global sector. Over the past 1, 3 & 5 years this Trust has returned growth of 28.14%, 89.21% and 222.31% respectively.

JP Morgan China Growth & Income

The JP Morgan China Growth & Income fund is the first investment trust to focus purely on the greater China region, which is a region where JP Morgan has extensive local knowledge and experience in identifying investment opportunities in China, Taiwan and Hong Kong.

It is heavily focused on technology stocks, which make up a third of the total portfolio. It also has 30% in consumer stocks and 14% in healthcare companies. The biggest individual holdings are Alibaba, the Chinese online retail giant, Tencent Holdings, the world’s largest video game company, and Ping An Insurance.

The trust has had a very strong last 6 months since the Covid19 induced Market crash earlier this year as it returned growth of 40.42% for the period, which was the highest in its sector.

Over the longer-term, this Trust has been consistent in its strong performance with returns of 198.88% over the past 5 years, which again was the highest in its sector.

Pacific Horizon Investment Trust

Pacific Horizon aims to achieve capital growth through investment in the Asia-Pacific region (excluding Japan) and the Indian Subcontinent.

Investment managers Roderick Snell and Ewan Markson-Brown believe that Asia is going to be one of the fastest-growing regions over the coming decades. And they argue that the best way to unleash this potential in your portfolio is by buying growth companies in that growth region.

They believe that Asia is going through a period of unparalleled economic and political change driven by a rise in the middle class, urbanisation and rapid technological improvement. Their philosophy is to find the best growth companies within this growth region and it is their belief that returns in Asia are concentrated in a handful of winning growth companies. It is these companies that they believe will at a minimum double their returns over a 5 year period.

The managers hold a portfolio of 60 - 80 stocks where they believe growth is underappreciated by the market. They find these companies by investing in a diverse number of countries and sectors; such as strong technology companies in South Korea, China, Taiwan or consumer stocks in India and real estate in Vietnam.

It is a diverse fund that has consistently delivered for its investors. Over the past 10 years the trust has returned growth of 262.89% and for the past 1, 3 & 5 years it ranked 1st in its sector with returns of 60%, 77.93% and 179.26%.

Edinburgh Worldwide IT

The philosophy of the Edinburgh Worldwide Investment Trust is to find and invest in the most interesting, innovative, entrepreneurial companies that are problem solving in nature. They seek to find these companies that are small and immature with the intent of owning these companies as they mature and grow and potentially become dominant businesses of the future.

Edinburgh Worldwide invests typically in companies with a market capitalisation of less than $5bn at time of initial investment. A spread of risk is achieved by having 75 – 125 holdings, with exposure to a minimum of 6 countries and 15 industries, with the trust currently investing primarily in Biotechnology and Software companies.

Over the past 10 years the Edinburgh Worldwide IT returned growth of 439.52% and during the recent 1, 3 & 5 years it has consistently been the top performer in the AIC Global Smaller Companies sector.

Monks Investment Trust

The Monks Investment Trust is also managed by Edinburgh based fund manager Baillie Gifford. This popular Trust holds assets under management totalling £1.7 billion and similar to the Edinburgh Worldwide Investment Trust it competes within the Global sector. However, the investment focus of this company is considerably different as it aims to achieve capital growth by investing principally in a portfolio of global quoted equities.

The Monks Investment Trust has an unrestricted Global approach when it comes to looking for ,and investing in, companies with exceptional growth opportunities. The managers deliberately maintain a diversified portfolio in order to smooth out the inevitable booms and busts. They pay particular attention to classic businesses that compound over time and therefore have built a strong, long standing brand. They see such companies as not particularly glamorous but as steady growers that are reliable and deliver perhaps not over the shorter term but certainly over the long term.

However, the strategy of the Monk Investment Trust is not to simply invest in established brands with steady growth but to also invest in what the managers term as ‘rapid growth stocks’. They quantify such companies as those that are typically immature, early stage companies that are developing their own market or aggressively entering an existing one.

Its portfolio of investments include various sectors, such as telecommunications, technology, financials, industrials, consumer goods, healthcare, consumer services, basic materials, oil and gas, and others. The Company's investments in the equities include various businesses, such as media and e-commerce, international financial services, online brokerage, building materials distributor, insurance, retail bank, social networking, enterprise software and agricultural biotechnology, among others.

The Monks Investment Trust has been a consistent top performer and its strategy has seen it deliver in both the short-term and long-term.

Montanaro European Smaller Companies Trust

Launched in 2006, the Montanaro European Smaller Companies Trust aims to achieve growth by principally investing in small European companies. The Trust currently manages assets of £231 million, which is comparatively small compared to some of the other Trusts featured in this report.

Despite its size, the Trust has become a favourite of many investors impressed by the funds performance compared to its benchmark. However, the manager of the Trust has recently voiced concerns over financial market uncertainty but has said the fund will continue to only invest in companies that meet their strict “Quality” criteria that includes: strong balance sheets; good cash flow; and run by competent management teams.

They have a selective and conservative approach which they believe is the best way of ensuring attractive returns over the long-term particularly at a time when short term uncertainties have seldom been greater.

Indeed, the trust was hit particularly hard by the market fall in March this year returning losses of 40% in the period between 24th February and 18th March. Since then it has steadily recovered and cumulatively over the past 12 months it has still managed to return growth of 19.31%.

In recent years this fund has maintained a high level of consistency and proven its quality by returning growth of 66.28% and 157.85% over the past 3 & 5 years.

Fidelity China Special Situations

The trust provides broad, diversified exposure to Chinese equities, including 'H' shares listed in Hong Kong and mainland-listed 'A' shares. It has been managed by Dale Nicholls since April 2014. He focuses on faster growing, consumer-orientated companies with robust cash flows and capable management teams.

The trust features a diversified portfolio of 130-140 high quality stocks and is likely to have a bias to the under researched, small and mid-cap space.

The portfolio is relatively concentrated, with the top 10 holdings making up almost half of the trust. The largest sector exposures are IT and consumer discretionary with no holdings in banks or property, which are considered higher-risk sectors.

The trust was an early investor in Alibaba and Tencent, both of which have grown to become some of the largest ecommerce, social media and gaming companies in the world.

Since its launch in April 2010 the trust has considerably outperformed both the MSCI China index and its peers and returned cumulative growth of 236.81% up to 31st July 2020.

Investing In Quality

Whether or not Investment Trusts are the right option for your portfolio they are undoubtedly becoming an increasingly popular choice with investors. Like any type of investment product they have their risks and rewards and there can be a wide variation in the performance and quality of the Investment Trusts that are currently available to UK investors.

When research is applied investors are able to identify the Investment Trusts that have proven their long-term quality by outperforming their peers.

The 10 Investment Trusts featured in this report have all displayed a high level of consistency which is an important indicator of quality, which also reflects efficiency and expertise from the fund manager. Each have proven their ability to deliver competitive returns for their clients over both the short and long term, and as part of a balanced strategy they may provide investors with an excellent opportunity to maximise future returns.