- Investment Trusts hold total assets of £200 billion, which represents a rise of £121 billion in just 10 years.

- Baillie Gifford manage 10 investment trusts with total assets exceeding £15 billion, which is the largest of any other fund manager and represents a 7.5% share of the market.

- 3i Group is the largest Investment Trust with total assets of £9 billion.

Investment trusts were relatively unheard of several years ago but as their reputation for delivering high returns grew, so too did their popularity. In just 10 years the total assets managed by Investment Trusts has more than doubled to £200 billion.

Although still eclipsed by unit trusts in both size and popularity, the benefits of investment trusts are catching the attention of growth seeking investors. According to statistics from the Association of Investment Companies (AIC) who are the trade body that represents investment trusts, in most sectors Investment Trusts have beaten open-ended funds over the medium and long-term.

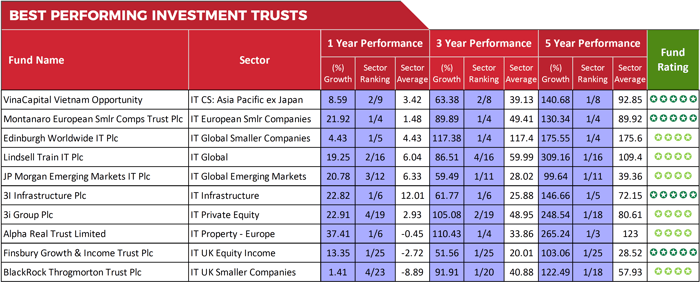

There are 399 Investment Trusts to choose from and to provide some clarity as to what investment trusts have performed the best, we have broken down a list of 10 that have returned exceptional growth over the past five years and have consistently been among the top performing trusts in their sectors.

VinaCapital Vietnam Opportunity

Launched in 2003, The VinaCapital Vietnam Opportunity IT (VOF) is one of the largest Vietnam funds with over $1 billion in assets. The trust provides investors with access to the Vietnamese market across a range of industry sectors and asset classes, including but not limited to listed and unlisted equity, private equity, operating assets and real estate projects.

The trusts objective is to achieve medium to long-term returns through investment in assets either in Vietnam or in companies with a substantial majority of their assets, operations, revenues or income in, or derived from, Vietnam.

Since its launch in September 2003, the VinaCapital Vietnam Opportunity IT has returned growth of 971.67%, and over the recent 1, 3 & 5 years it has returned growth of 8.59%, 63.38% and 140.68% respectively.

Edinburgh Worldwide

Edinburgh Worldwide aims for capital growth from a global portfolio of initially immature entrepreneurial companies, typically with a market capitalisation of less than $5bn at time of initial investment, which are believed to offer long-term growth potential. A spread of risk is achieved by having 75 – 125 holdings, with exposure to a minimum of 6 countries and 15 industries, with the trust currently investing primarily in Biotechnology and Software companies.

Over the past 10 years the Edinburgh Worldwide IT returned growth of 471.77% and during the recent 1, 3 & 5 years it has consistently been the top performer in the AIC Global Smaller Companies sector.

Lindsell Train IT

The trust's manager Nick Train favours consumer companies and particularly drinks firms. Indeed, the trust's biggest holding (apart from the 45% stake in Lindsell Train limited), is drinks maker Diageo, which represents more than 7% of the trust’s portfolio. Other top holdings include Heineken and Unilever.

The trust has consistently been the highest growth fund in the IT Global sector, which includes Baillie Gifford’s popular Scottish Mortgage Investment Trust and Monks Investment Trust. But it has experienced a sharp drop in performance in recent weeks upon the news Hargreaves Lansdown was to remove the trust, and Lindsell Trains UK Equity fund, from their influential Wealth 50 recommended funds list. Hargreaves Lansdown chief investment officer Lee Gardhouse said, “Both have performed very well, and we believe have the potential to do so in the future”. He explained they were being cut from the list due to the broker's policies and procedures for policing the Wealth 50.

Despite the recent plummet in performance the Lindsell Train IT has still managed to deliver cumulative growth of 19.25%, 86.51% and 309.16% over the recent 1, 3 & 5 years periods.

JP Morgan Emerging Markets IT Plc

JPMorgan Emerging Markets Investment Trust plc seeks to uncover quality stocks from across emerging markets that are also attractively valued. Over 50% of the trusts holdings are in Chinese and Indian companies with Housing Development Finance Corporation Limited, which is an Indian financial services company based in Mumbai, featuring prominently and Tencent Holdings, who specialise in various Internet-related services and products, entertainment, artificial intelligence and technology both in China and globally.

For the past 1, 3 & 5 years the JP Morgan Emerging Markets IT was the top performer in the AIC Global Emerging Markets sector with cumulative returns of 20.78%, 59.49% and 99.64%.

3i Infrastructure

The 3i Infrastructure investment company aims to build a diversified portfolio of equity investments in entities owning infrastructure businesses and assets. The company seeks investment opportunities globally, but with a focus on the UK and Europe. Its 2 largest holdings are in UK companies Infinis, who are a generator of electricity from landfill gas and coal mine methane, and (WIG) Wireless Infrastructure Group UK, who provide communication towers and equipment. The main objective of the company is to provide its shareholders with a targeted total return of 8% to 10% p.a. over the medium term.

Since its launch in March 2007, the 3i Infrastructure IT returned growth of 381.08%, in contrast, the AIC Infrastructure sector, which it is classified within, returned 107.06% for the same period.

3I Group Plc

The popular 3i Group Investment Trust aims to achieve long-term capital and dividend growth, by focusing on buyouts, growth capital, venture capital, infrastructure and quoted private equity investments across Europe, Asia and the US. Not only is this Investment Trust the World’s largest, with total assets of £9 billion, but it is also one of the best performing Investment Trusts available.

Over the recent 5-year period the trust returned growth of 248.54%, which was also the highest in the AIC Private Equity sector.

Alpha Real Trust Limited

Alpha Real Trust Limited (“the Company” or “ART” or “Trust”) targets investment, development, financing and other opportunities in real estate, real estate operating companies and securities, real estate services, infrastructure, infrastructure services, other asset-backed businesses and related operations and services businesses that offer attractive risk-adjusted total returns.

ART currently focusses on asset-backed lending, debt investments and high return property investments in Western Europe that are capable of delivering strong risk adjusted cash flows.

The Company currently plans to invest the majority of its cash into secured senior or mezzanine debt.

This past 1, 3 & 5 years the Alpha Real Trust has delivered exceptional growth of 37.41%, 110.43% and 265.24%.

Finsbury Growth & Income Trust

The company was founded in 1926 and Nick Train has managed the portfolio since his firm, Lindsell Train, was appointed as portfolio manager in 2000.

Nick’s approach is based on that of Warren Buffett’s and involves building a concentrated portfolio of “quality” companies that have strong brands and/or powerful market franchises. The bulk of these are UK companies. This leads to a very different portfolio when compared to the benchmark FTSE All-Share Index.

The portfolio has a heavy emphasis on branded consumer goods and services (Diageo, Unilever, AG Barr), media (Pearson, Sage) and financial services (Schroders, Rathbones, Hargreaves Lansdown).

Performance wise, the Finsbury Growth & Income Trust has consistently delivered the highest returns in its sector. Over the recent 1, 3 & 5 years it has returned growth of 13.35%, 51.56% and 103.06% - and over 10 years, it has achieved cumulative growth of 498.67%.

The Worst Investment Trusts

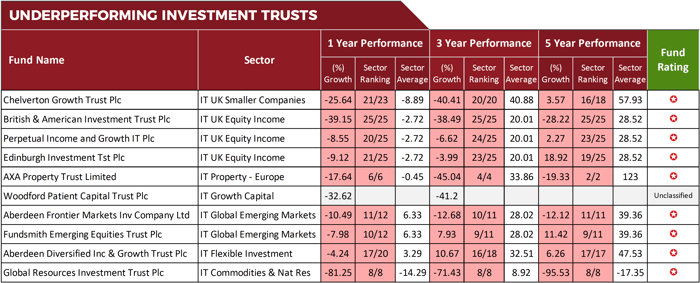

From the 399 Investment Trusts on the market, 239 performed within the bottom 50% of their sector during at least 1 of the 3 periods analysed, with some of the most popular trusts among the worst performers.

Above we feature 10 Investment trusts that combined have total assets in excess of £4 billion but have consistently been among the worst performers in their sectors.

Chelverton Growth Trust Plc

Chelverton Growth Trust seeks out growth opportunities from the very smallest companies in the market, with a capitalisation of less than £50m, so called “micro caps”. Not surprisingly, given the inherent risks, very few other fund managers operate in this area, which provides ample opportunity the Chelverton aim to exploit. The portfolio is very concentrated with the top six holdings representing 60% of the total, and more than half of the fund is held in unquoted stocks.

Despite Chelverton's believe that this strategy provides significant opportunities the Chelverton Growth Trust has persistently struggled. The trust is classified within the AIC UK Smaller Companies sector, which has had a difficult 12 months with the sector averaging losses of -8.89%.

However, the Chelverton Growth Trust returned losses for the period of -25.64%. This past 3 years the sector averaged growth of 40.88% but the Chelverton Growth Trust returned losses of -40.41%.

British & American Investment Trust Plc

The British & American Investment Trust invests predominantly in investment trusts and other leading UK and US-quoted companies with the aim of achieving a balance of income and growth. The trust is classified within the AIC UK Equity Income sector where it has consistently ranked at the bottom of the sector for performance. Over the past 5 year period the British & American Investment Trust has returned losses of -28.22%.

Perpetual Income and Growth IT Plc

The Company’s investment objective is to provide shareholders with capital growth and real growth in dividends over the medium to long term from a portfolio of securities listed mainly in the UK equity market. Similar to the British & American IT, the Perpetual Income and Growth IT is classified within the AIC UK Equity Income sector where it has also struggled for competitive performance. Over the past 12 months this trust returned losses of -8.55% and over 5 years it has only managed to return growth of 2.27%, which was well below the 28.52% sector average for the period.

Edinburgh Investment Trust Plc

The Edinburgh Investment Trust Plc is managed by Invesco Perpetual and its aim is to invest primarily in UK securities with the long term objective of achieving: 1) an increase of the Net Asset Value per share in excess of the growth in the FTSE All Share Index; and 2) growth in dividends per share in excess of the rate of UK inflation.

Over the past 5 years this trust has returned growth of 18.92%, which was well below the sector average and significantly lower than the 103.06% returned by the Finsbury Growth & Income Trust, which is classified within the same sector.

AXA Property Trust Limited

The Company is a limited liability, closed-ended, self-managed, Guernsey registered investment company advised by Worsley Associates LLP.

At the EGM held on 28 June 2019 Shareholders approved the recommendation for the Company to revert to a continuing operation in replacement for the previous investment policy of managed wind-down.

In conjunction with the implementation of the new strategy of investment in undervalued British quoted securities of smaller companies, the existing real estate asset will be realised in an orderly manner, that is with a view to optimising its disposal value.

This trust has been in difficulty for some time and has consistently lost money for investors. Over the past 1, 3 & 5 years this trust returned losses of -17.64%, -45.04% and -19.33% respectively.

Woodford Patient Capital Trust

The Woodford Patient Capital Trust is Woodford's 2nd largest fund – an investment trust, offering exposure to a mix of disruptive early-stage tech and biotech companies with the objective of delivering returns in excess of 10% per year over the longer term. When it launched, Neil Woodford explained the long-term nature of the company and that performance should be judged over a three-to-five-year period.

However, since its launch, the trust has struggled. Over the recent three years, the Woodford Patient Capital Trust returned substantial losses of -41.2%.

Aberdeen Frontier Markets Investment Company Ltd

The Aberdeen Frontier Markets IT aims to generate long-term capital growth primarily from investment in equity and equity related securities of companies listed in, or operating in, Frontier Markets. Frontier Market countries may include constituents of the MSCI Frontier Markets Index or additional countries that the Investment Manager deems to be, or displays similar characteristics to, Frontier Market countries. The trust is primarily exposed to Vietnamese companies with holdings in Mobile World Investment Corporation, which is a mobile retailer in Vietnam, and technology firm FPT.

Over the past 5 years consistent poor performance from the Aberdeen Frontier Markets IT culminated in losses of -12.12%. In contrast, the sector averaged growth of 39.36% for the period.

Fundsmith Emerging Equities Trust Plc

Launched in June 2014, Terry Smith said their purpose for starting the Fundsmith Emerging Equities Trust (FEET) was to offer investors a method of investing in Emerging Markets which is different to most approaches, and one he feels “produces better results.”

The Fundsmith Emerging Equities Trust invests in companies which have the same characteristics as the Fundsmith Equity Fund but instead have the majority of their operations in, or revenue derived from, Developing Economies, which are typically much more unpredictable than established equity markets but have the potential for significant growth.

Fundsmith says this trust offers defensive and disciplined exposure to the globe’s fastest growing markets. But emerging and developing markets have done poorly in recent times and the Fundsmith Emerging Equities Trust has had disappointing returns since its launch.

The strategy of the Fundsmith Emerging Equities Trust is to invest in good companies which make their money by a large number of everyday repeat, relatively predictable transactions; trying not to overpay when buying the shares; and then doing as little dealing as possible in order to minimise the expenses of the fund and allow the companies’ returns to compound for investors with the minimum of interference. However, this trust has consistently struggled since its launch and in May 2019 Terry Smith stepped down from managing the trust which returned comparatively low growth of 11.42% for this past 5 years.

Aberdeen Diversified Income & Growth Trust Plc

Aberdeen Diversified Income and Growth Trust (ADIG) follows a diversified multi-asset approach, aiming to generate attractive long-term income and capital returns. The managers aim to hold a genuinely diversified, global, multi-asset portfolio of investments with differing return drivers and risk characteristics, that should produce uncorrelated returns.

Performance has been mixed since the appointment of Aberdeen Standard Investments (ASI) as manager in February 2017, and over the past 12 months it has returned losses of -4.24%, with 5 years growth of just 6.26% falling well below the 47.53% sector average.

Global Resources Investment Trust Plc

Global Resources Investment Trust (GRIT) is an investment fund specialising in the natural resources industry. The fund primarily invests in small and medium sized listed stocks that have been identified by our investment team as being undervalued.

The principals behind GRIT believe that there is a huge opportunity to profit in the junior miner industry, which has been devastated in the last few years primarily due to heavy risk aversion by investors. Juniors are sitting on minerals resources that could be extremely profitable, but lack either the cash, management or scale to exploit this resource. GRIT intends to find in the best and most undervalued of these prospects and aid the company in maximising shareholder value in the medium to long term.

Despite the company’s objectives the trusts performance has been exceptionally poor. Over the past 5 years this trust has returned huge losses of -95.53%.

The Investment Trusts featured in this report represent some of the best and worst performers in their sectors. Their inclusion is entirely a result of their performance history and is intended for information purposes only.

How these Investment Trusts perform in the future is not guaranteed and remains to be seen, therefore, before making investment decisions investors should consider all the available options in order to make the most suitable choice for their investment needs.