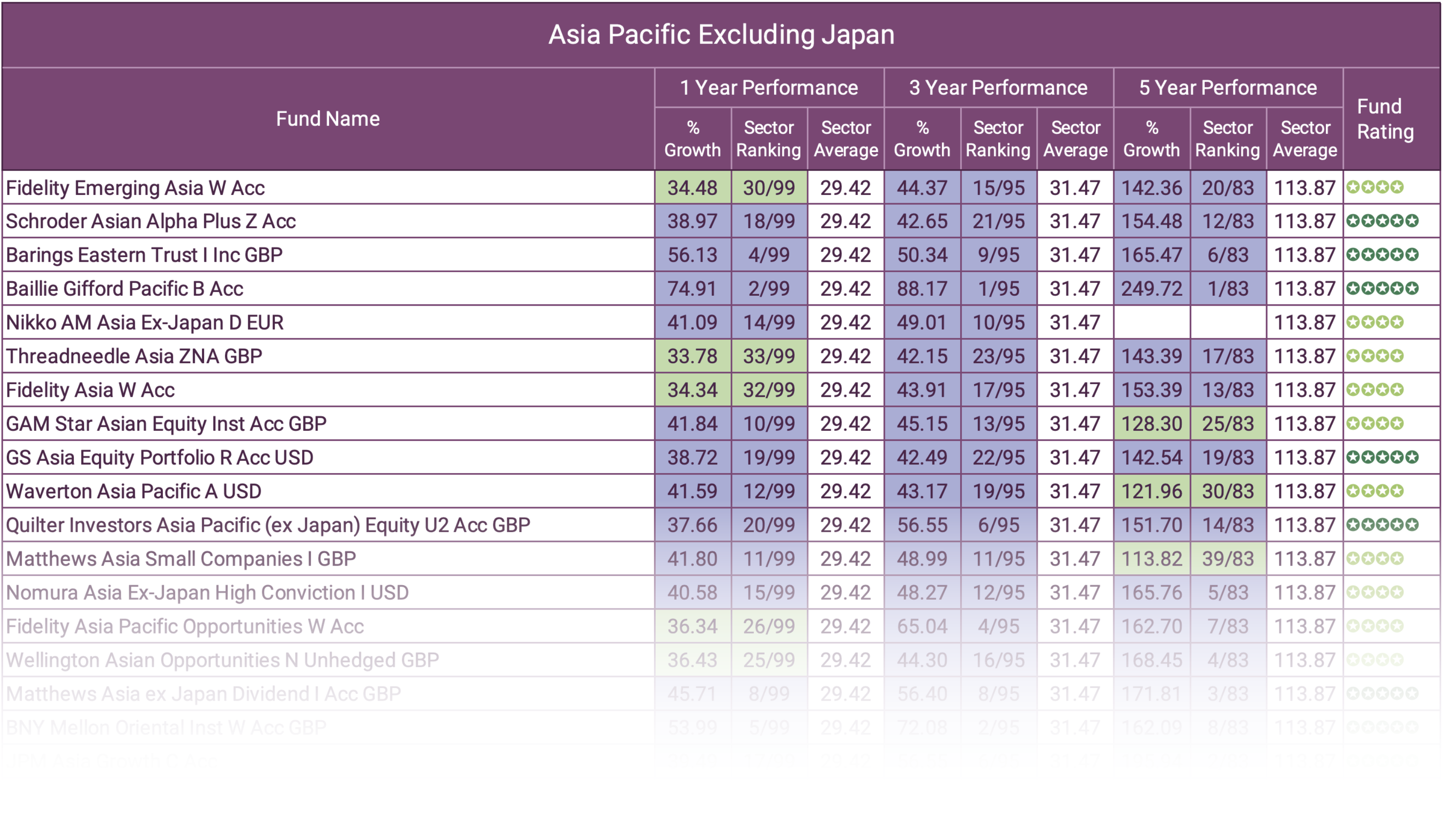

There are 3,139 investment funds available to UK investors that have at least one years performance history and received a sector classification from industry trade body the Investment Association.

From these 3,139 funds, 554 (17.6%) have managed to consistently outperform at least half of all competing funds within their sectors over the past 1, 3 & 5 years, and have thus received a high quality 4 or 5-star performance rating from Yodelar. Although this highlights the large proportion of funds on the market to be underperforming, there is still no shortage of quality funds across all asset classes. By being able to identify the good performers from the bad, investors have the freedom to make informed choices that can help to improve portfolio efficiency and overall performance.

Our best performing funds report features all 554 funds that have received a 4 or 5 star Yodelar performance rating. Each of these funds have ranked among the best performers in their sectors over the past 1, 3 & 5 years up to March 2021.

How Yodelar Rate Fund Performance

5 Star Rating - Funds that have excelled within their sector. These funds have consistently outperformed at least 75% of same sector funds over the 1, 3 & 5 year periods analysed while also assuming volatility that was not greater than 75% of peers.

4 Star Rating - Funds that have maintained a level of performance that was better than at least 75% of same sector funds over 2 of the 3 periods analysed, and no worse than 50% of peer funds over the remaining period. Funds that have consistently maintained top quartile sector ranking but in doing so assumed a level of volatility/risk that was greater than at least 3/4 of same sector funds also receive a 4 Star rating.

3 Star Rating - Allocated to funds that have consistently maintained a 2nd quartile ranking within their sector over the 1, 3 & 5 years analysed. A 3 Star rating is also applied to funds that achieve top performance during 1 or 2 of the three periods analysed but have performed worse than 50% of peer funds during the remaining one period. Funds that do not have 5 year performance history but have delivered top quartile ranking during the 1 & 3 year periods will also receive a 3 Star rating.

2 Star Rating - Funds that have consistently performed worse than 50% of funds within their sector or have experienced high levels of inconsistency. A fund that has one period of top quartile performance but two periods of 3rd and 4th quartile sector performance will also receive a 2 Star rating.

1 Star Rating - Reserved for the worst funds within their sectors. These funds have consistently ranked worse than at least 50% of competing same sector funds with their performance typically ranking worse than 3/4 of their peers.

Download The Best Funds Report

The Importance of Consistency

A fund managers ability to maintain a consistent level of performance when compared to competing same sector funds is an important metric for many investors when making investment decisions. The ability of a fund manager to maintain a level of outperformance in comparison to funds within the same sector demonstrates a level of quality and expertise that stands them above their peers.

The funds featured in our best funds report have each displayed a high level of consistency which is an important indicator of quality and success. Investment funds that maintain a high sector ranking over continuous periods display the type of consistency that reflects efficiency and expertise from the fund manager, and as such, they have proven their ability to deliver competitive returns for their clients over both the short and long term.

Selecting funds that consistently outperform their peers and fit within a suitable asset allocation model can help investors maximise their portfolios growth potential.

If your portfolio is managed by a financial adviser you want to make sure you are partnered with someone with a knowledge of fund performance. There are financial advisers who demonstrate great expertise and knowledge when it comes to fund selection. However, fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds. As a result, a large proportion demonstrates a poor level of knowledge on the quality of funds they recommend.

By ensuring your portfolio contains only consistently top performing funds, within an asset allocation model suitable to your risk profile, you have added the 2 main ingredients to building a successful portfolio.

Making Fund Choices Based On Facts

By ensuring your portfolio is composed of funds and fund managers that have proven their quality by consistently outperforming their peers can improve the quality of your portfolio and potentially result in better long-term returns. The 3 key metrics to consider when making fund choices are:

-

Comparative Performance

Each fund’s performance can be compared alongside all other competing funds that are classified within the same sectors. How each fund compares can identify the quality of the fund and the competence of the fund manager.

Fund manager accountability

Past performance does not guarantee future returns but what it does is expose the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors can reflect a level of expertise from the manager within that investment sector. Whereas, the fund managers whose funds continually rank lowly within their sector have demonstrated a lack of quality and an inability to deliver competitive returns for investors. Past performance is not an indicator of future returns, but it is important information that holds fund managers accountable for their performance.

For those that have maintained a high level of comparative performance, it is reasonable to assume they can do so in the future.

-

Consistency

A cycle of 1, 3 & 5-years exposes investments to different economic and political challenges.

How a fund and fund manager perform during such cycles reflects on their capabilities and overall quality.

One of the main distinguishing elements of our portfolios is that they are each composed of funds that have proven their quality and their ability to deliver top-ranking sector performance on a consistent basis.

Maintaining A Portfolio of Top Performing Funds

It is not always realistic for even the best fund managers to continuously maintain a level of performance from their funds that exceeds that of many of their peers. But there are certain processes that can help investors to identify when a fund is experiencing a dip in fortune, and if so, whether or not they should stick with the fund or consider moving to an alternative.

One system applied by some quality firms to track and manage fund performance is referred to as the traffic light system. This system uses a 3-tiered fund grading model that promotes a pragmatic investment approach and helps to avoid poor investment decisions.

Green – Funds that have primarily maintained a level of performance that exceeds 75% of same sector funds over the recent 1, 3- & 5-year periods. Such funds are viewed as top performers and represent excellent investment opportunities. When constructing a portfolio, it is predominantly the funds with a green rating that are considered.

Amber – Funds that have previously rated as green but recently experienced a decline in performance compared to other funds within the same sector. Amber funds remain within the portfolio but are carefully monitored, typically over a 3-6-month period, to identify whether their performance has improved, remained stagnant or declined. If the fund’s performance has improved to a level that is better than 75% of competing same sector funds, it returns to be a green-rated fund. If it remains stagnant, it will continue to receive an Amber classification for a period of up to 6 months. If no improvement is seen during this period, it will receive a red rating.

Red - The red traffic light signifies that some action is due. It may be that the fund is removed from the portfolio and replaced with a suitable green-rated fund. Funds will be moved to a red rating if they continue to drop down the sector ranking over a 3-6 month period, or if they fail to improve six months after receiving an amber rating.

Many top investment firms use the above strategy to help ensure the portfolios they recommend perform efficiently for their clients.

How Yodelar Investments Use The Spread Of Assets To Improve Portfolio Efficiency

The balance of investments across different asset classes is the primary driver of portfolio returns, but the funds used to create the correct balance are essential to maximising portfolio growth and efficiency. Yodelar Investments ensure that each of the funds they use to achieve this balance are consistently among the very best performers within their set asset class. Each fund selected is thoroughly evaluated by the investment committee and only the most suitable options are selected to be included in our portfolios.

All sector classified investment funds are made up of a selection of holdings in companies that fit within the funds sector classification. For example, funds classified within the UK All Companies sector are required to invest at least 80% of their assets in UK equities that have a primary objective of achieving capital growth. The remaining 20% can be spread across other asset classes that the fund manager deems appropriate to the fund’s overall objectives. The spread of this remaining amount can have numerous implications which we carefully analyse when composing our portfolios.

Formulating the appropriate blend of investment funds to fit a portfolio’s specified asset allocation model and optimise growth potential is a complex process that requires thorough analysis. It is an important part of how Yodelar portfolios are built and it reveals an attention to detail that helps to improve portfolio efficiency.

Does Your Portfolio Contain Top Performing Funds?

Inefficient investing will undoubtedly have adverse long-term consequences, which is why it is so important to be able to distinguish the funds and fund managers who outperform their peers in order to ensure your portfolio is made up of high-quality funds.

Our free portfolio analysis service has helped thousands of investors to identify areas for improvement and provides complete clarity as to the quality of advice they have received, or the fund choices they have made.

Our portfolio analysis service will provide an independent analysis of your portfolio and identify:

- If your portfolio contains top, mediocre or poor performing funds

- How your portfolio growth compares to a similar risk portfolio of top-performing funds

- How efficient your fund choices you have been, or whether the recommendations you have received from your adviser has been up to par.

- Potential areas for improvement

- The overall quality rating of your portfolio

Our portfolio analysis feature provides a clear insight into how each of your individual funds is performing while grading your portfolio based on its overall performance - making it easy to identify weak points or areas for potential improvement.

Upload your portfolio for a comprehensive portfolio review and find out how competitive the performance of your portfolio has been and if the advice you have received to date has been up to par.