There are approximately 3,000 investment funds available to UK investors that have received a sector classification from industry trade body the Investment Association. From these 3,000 funds, 20% have managed to consistently outperform at least half of all competing funds within their sectors over the past 1, 3 & 5 years, and have thus received a high quality 4 or 5-star performance rating from Yodelar. There is no shortage of quality funds across all asset classes and having the freedom to make informed choices can help improve portfolio efficiency and overall performance.

A fund managers ability to maintain a consistent level of performance when compared to competing same sector funds is an important metric for many investors when making investment decisions. The ability of a fund manager to maintain a level of outperformance in comparison to funds within the same sector demonstrates a level of quality and expertise that stands them above their peers.

In this report, we feature 10 funds that represent some the most consistent and best-performing funds on the market and identify how a suitably balanced portfolio of such top-performing funds can help investors maximise the growth of their portfolio.

The Best Funds For Performance

The 10 funds featured in this report have proven their ability to excel but they represent a select few of the many consistently top-performing funds available to UK investors. Access the latest top funds report to see all 4 and 5 star rated funds.

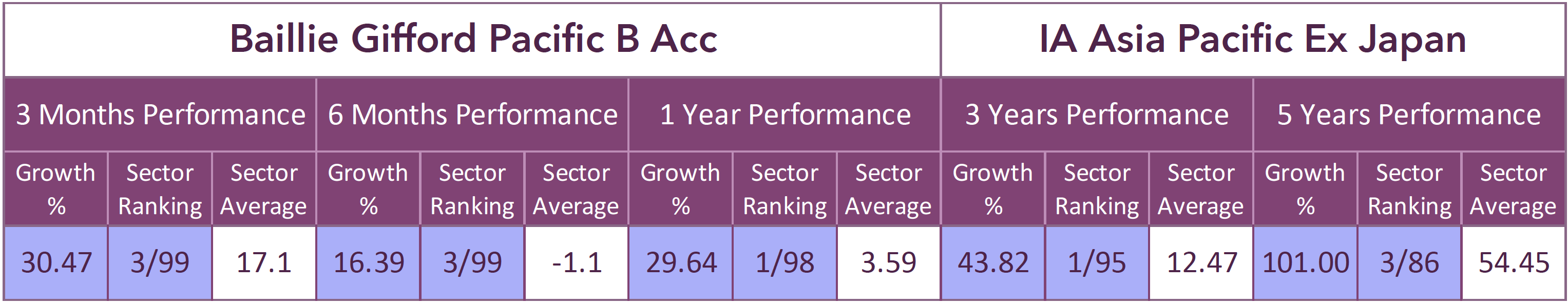

Baillie Gifford Pacific Fund

The Baillie Gifford Pacific fund has consistently been a top performing fund in the Asia Pacific excluding Japan sector. This funds manager Roderick Snell believes as the first major region to come out of the Covid19 crisis, Asia excluding Japan looks increasingly attractive with roughly 80% of the companies that make up this funds portfolio now getting back to work without having destroyed their balance sheets with stimulus like many western economies.

Mr Snell sees a huge opportunity for this fund as he believes Asian regions in which this fund invests have properly handled the Covid19 crisis better than those who have not, namely those in Europe and America. He feels that crucially, as Asian countries have not been forced to take on any drastic stimulus packages as seen in the west, they have been able to maintain reasonably sensible interest rates with no ballooning balance sheets which he believes leaves many Asian countries in a stronger position over the coming years.

Mr Snell believes Asia is coming out of this crisis first, in far better financial shape than other economies, with superior long-term growth prospects and cheaper valuations. The Baillie Gifford Pacific fund is unquestionably an exceptional fund, and one that has proven its quality over both the short and long-term navigating the Covid19 crisis and many other economic and political hurdles better than almost all competing funds in the same sector.

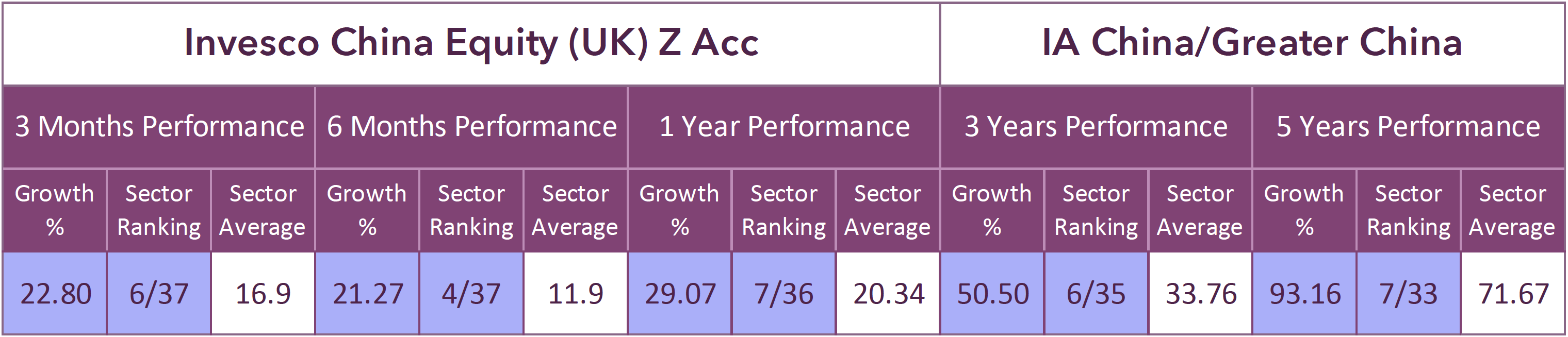

Invesco China Equity Fund

The managers (based in Hong Kong) are supported by a team of 20 analysts across the region who aim to identify companies that have a competitive advantage over their peers and have sustainable leadership in their industry. They specifically target companies they feel are undervalued by about 25-30% and hold them with the expectation they will reach a fair value over a three to five-year time horizon.

Invesco China Equity can invest in companies of any size, but because the managers are very selective about state-owned companies and generally dislike the banks, the fund tends to have a bias towards medium-sized companies. The managers also tend to avoid smaller companies and unquoted stocks.

The majority of their outperformance has come from stock-selection although there have been occasions when outperformance has been driven by their sector allocations. Over the short and longterm the fund’s manager has shown an excellent ability to outperform in all market conditions.

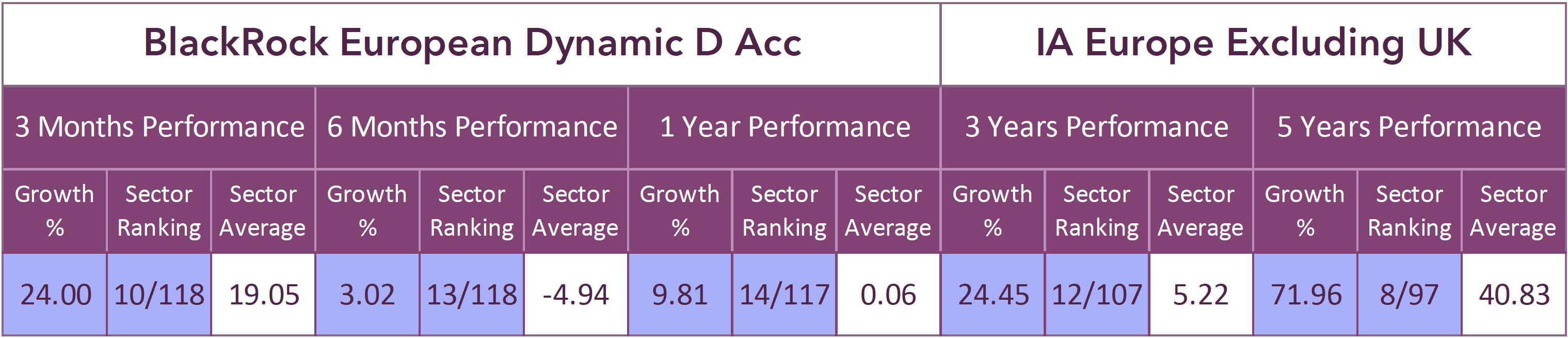

BlackRock European Dynamic Fund

The BlackRock European Dynamic fund invests in a relatively concentrated selection of 50 companies of all shapes and sizes across Europe. The fund has consistently ranked at the forefront of the Europe ex UK sector for performance across all market conditions over the past 10 years reinforcing its standing as a European fund with exceptional quality.

Over 81% of the fund’s assets are held in large-cap companies which are mainly based in France, Germany and Holland. Since the fund launched in March 2002 it has accumulated growth of 648.97%. In contrast, the average returns in the Europe ex UK sector for the same period were 218.75%.

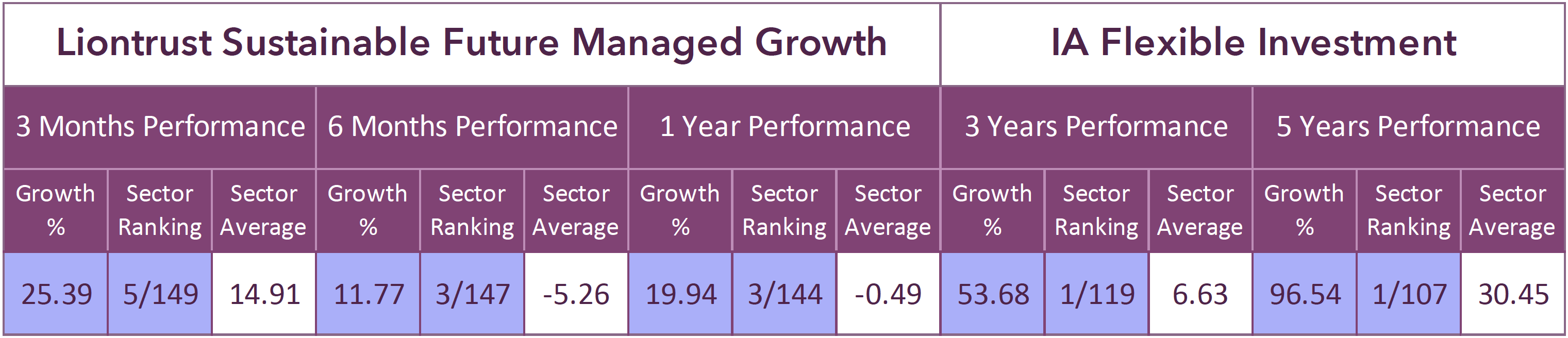

Liontrust Sustainable Future Managed Growth Fund

The core strategy of the Liontrust Sustainable Future Managed Growth fund is based on the belief that in a fast-changing world, the companies that will survive and thrive are those which improve people’s quality of life, be it through medical, technological or educational advances; drive improvements in the efficiency with which we use increasingly scarce resources; and help to build a more stable, resilient and prosperous economy.

There are three elements to investment selection for the Sustainable Future fund range: sustainability, strong business fundamentals and attractive valuation. Only stocks which meet all these criteria will be considered for selection in the portfolios. The Liontrust Sustainable Future Managed Growth fund has consistently been one of the best performing funds in the Flexible Investment sector and over the past 3 and 5 years, its cumulative returns of 53.68% and 96.54% were the highest in the entire sector.

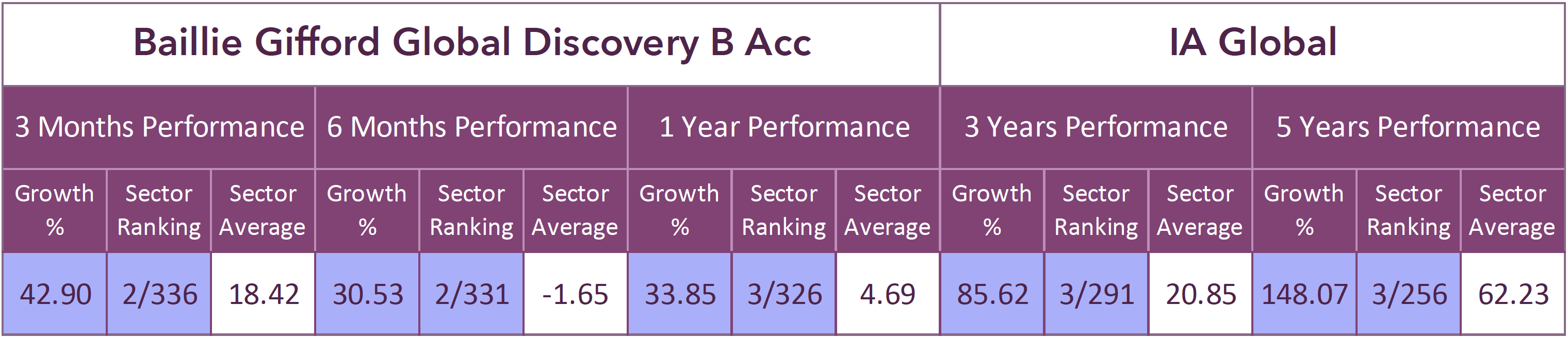

Baillie Gifford Global Discovery Fund

The Baillie Gifford Global Discovery fund is managed by Douglas Brodie who runs the fund in a way that Baillie Gifford has become well-known for – focusing on companies with big long-term growth potential. Brodie looks for small companies he thinks have the potential to solve global problems and grow into large companies. If they do he’s happy to ‘run his winners’ and stay invested if he thinks they’ll keep growing. He was the first Baillie Gifford manager to invest in electric car maker Tesla, and is still invested in the company as it’s gone from a relatively new business to a global manufacturer.

Since this fund launched in June 2001, it has returned cumulative growth of 1175%.

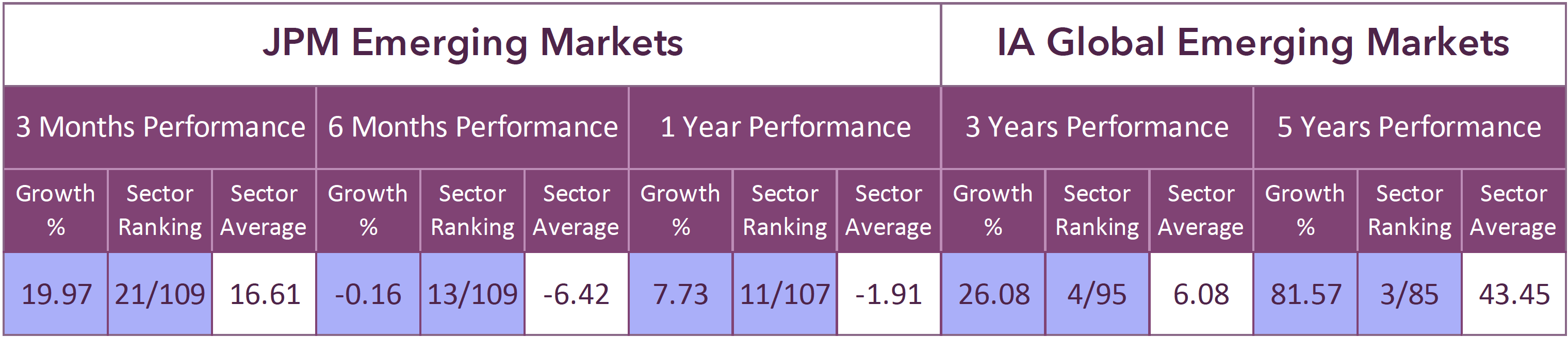

JPM Emerging Markets Fund

Austin Forey has managed JPMorgan Emerging Markets fund for 25 years through several crashes and rallies. Under his management, this fund has consistently excelled and consistently ranked among the best performers in the entire Global Emerging Markets sector. Over the past 3, 5 and 10 years, this fund has returned growth of 26.08%, 81.57% and 95%, each of which were better than at least 90% of competing funds within the same sector.

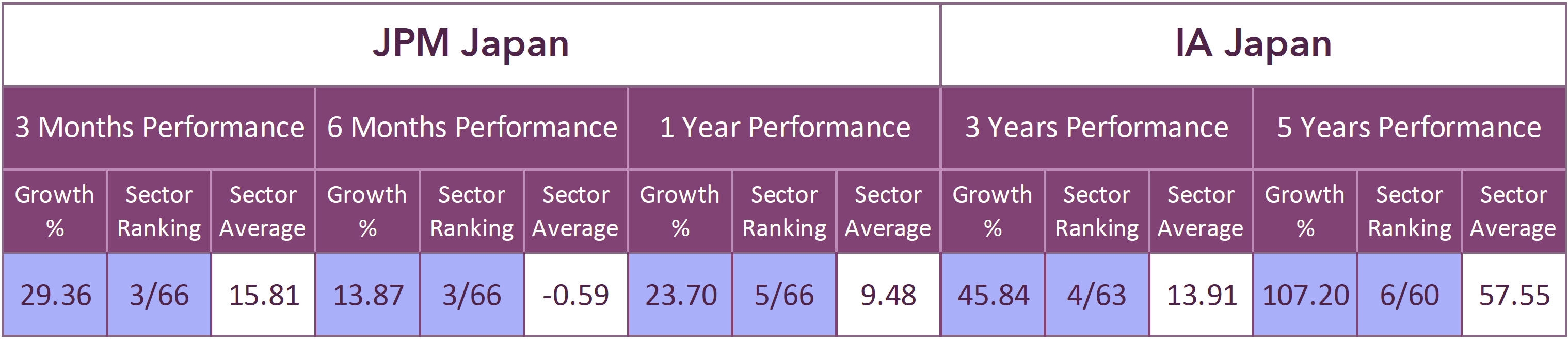

JPM Japan Fund

There are a handful of fund managers we think have the potential to outperform the broader Japanese market over the long term, each with different approaches, and the highly experienced managers of the JPM Japan fund are among the best in this market. Based in Tokyo and have exceptional access to local company management. Powered by their specialist knowledge of Japan companies, this aggressively-managed fund is designed to take full advantage of Japan’s long-term structural trends. The Fund will always have a stronger bias towards structural growth segments, like technology, which has been the most significant driver of returns since the Fund’s inception.

The fund may not have quite the same level of performance as the Legg Mason IF Japan Equity fund but it has been much less volatile while still consistently outperforming at least 90% of funds in the IA Japan sector.

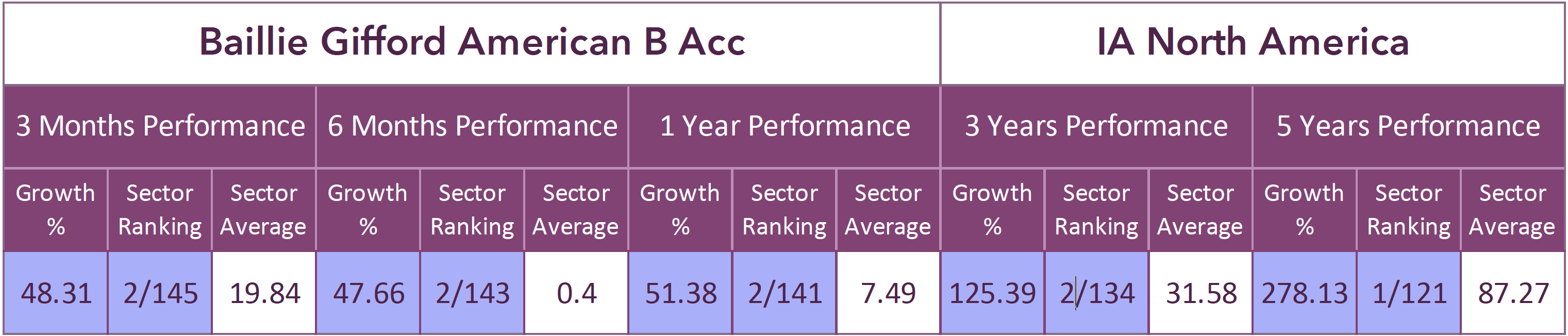

Baillie Gifford American Fund

Tom Slater, co-manager of this fund, explains: “The aim of the American fund is to generate long-term capital growth for investors by identifying some of the most attractive growth businesses in America and owning them for long periods of time, such that the advantages they have that stem from their culture and their competitive position translate into stock market returns.”

The Baillie Gifford American fund is an exceptional fund with a continuous history of outperformance. The fund typically holds between 30-50 stocks, with low turnover, and it aims to produce attractive returns over the long term.

Over the recent 5 years, the Baillie Gifford American fund has returned growth of 278.13%, which was not only the highest in the North American sector but it was also higher than all 2,821 funds in the Investment Association universe with 5-year performance history.

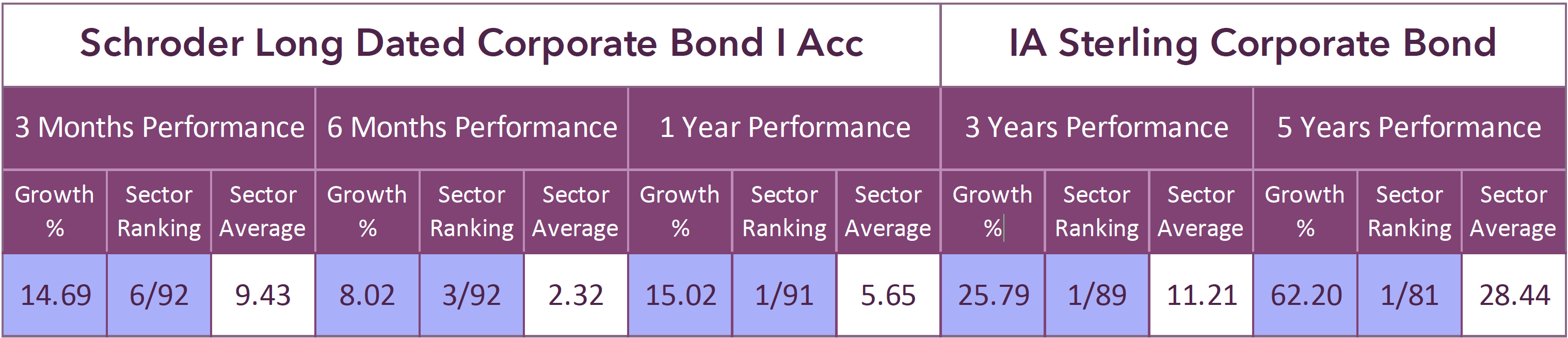

Schroder Long Dated Corporate Bond

This fund is managed by Alix Stewart who also manages the Schroder Sterling Corporate Bond which we also rate very highly. The fund aims to provide income and capital growth by investing in bonds issued by UK companies and companies worldwide. The fund invests at least 70% of its assets in bonds denominated in sterling (or in other currencies and hedged back into sterling) issued by companies worldwide.

Over the recent 1, 3 & 5 years the Schroder Long Dated Corporate Bond fund has been an exceptional fund, and one of Schroders strongest performers. During these periods the fund returned growth of 15.02%, 25.79% and 62.20%, which was higher than every other fund in the IA Sterling Corporate Bond sector. In contrast, the average returns within this sector over the same periods was 5.65%, 11.21% and 28.44% respectively.

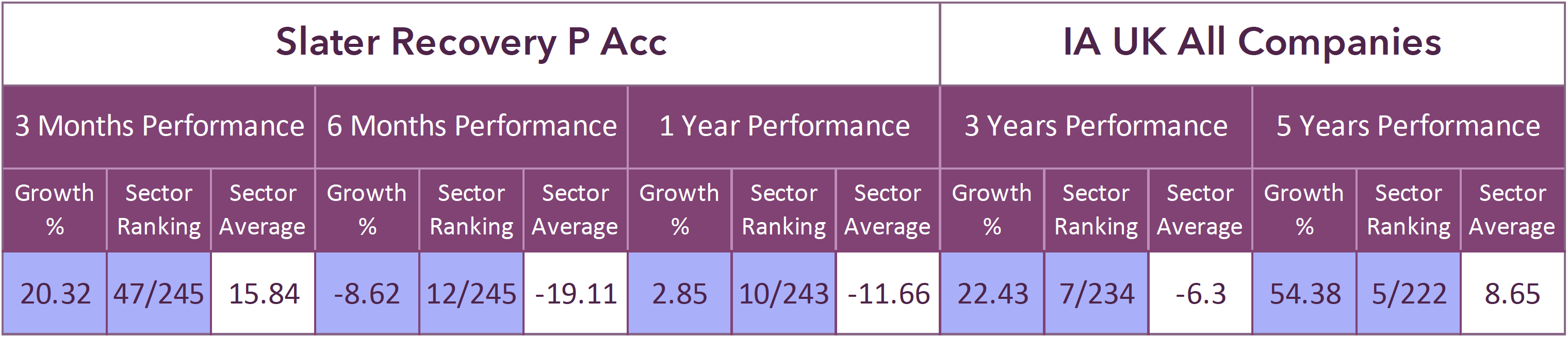

Slater Recovery Fund

Mark Slater has been building an enviable reputation as a consistently outperforming stock picker and his Slater Recovery Fund shows why.

This fund has consistently been one of the best performing funds in the UK All Companies sector which it has achieved by investing in companies that have a low price-to-earnings ratio (PE) in relation to their earnings growth, strong cash flow and a strong financial position.

The fund has a focus on companies with strong balance sheets, powerful competitive, high returns on capital and rising margins and sales per share. Mark carries out thorough reviews of company accounts and analysts’ forecasts vigorously before selecting the companies to make up his fund and he places a great deal of emphasis on positive recent trading statements and directors’ share dealings. If he is still interested in a company at this stage, he will meet with senior company management to get an understanding of both the opportunities and risks facing the business in the future. If, and only if, he thinks all boxes have been ticked will he invest in a company. It is this extensive management style and consistently competitive performance that has undoubtedly contributed to this fund’s exceptional performance history.

The Importance of Consistency

The 10 funds featured in this report have all displayed a high level of consistency which is an important indicator of quality and success. Investment funds that maintain a high sector ranking over continuous periods display the type of consistency that reflects efficiency and expertise from the fund manager, and as such, they have proven their ability to deliver competitive returns for their clients over both the short and long term.

Selecting funds that consistently outperform their peers and fit within a suitable asset allocation model can help investors maximise their portfolios growth potential.

If your portfolio is managed by a financial adviser you want to make sure you are partnered with someone with a knowledge of fund performance. There are financial advisers who demonstrate great expertise and knowledge when it comes to fund selection. However, fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds. As a result, a large proportion demonstrates a poor level of knowledge on the quality of funds they recommend.

By ensuring your portfolio contains only consistently top performing funds, within an asset allocation model suitable to your risk profile, you have added the 2 main ingredients to building a successful portfolio.

Making Fund Choices Based On Facts

By ensuring your portfolio is composed of funds and fund managers that have proven their quality by consistently outperforming their peers can improve the quality of your portfolio and potentially result in better long-term returns. The 3 key metrics to consider when making fund choices are:

-

Comparative Performance.

Each fund’s performance can be compared alongside all other competing funds that are classified within the same sectors. How each fund compares can identify the quality of the fund and the competence of the fund manager.

Fund manager accountability.

Past performance does not guarantee future returns but what it does is expose the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors can reflect a level of expertise from the manager within that investment sector. Whereas, the fund managers whose funds continually rank lowly within their sector have demonstrated a lack of quality and an inability to deliver competitive returns for investors. Past performance is not an indicator of future returns, but it is important information that holds fund managers accountable for their performance.

For those that have maintained a high level of comparative performance, it is reasonable to assume they can do so in the future.

-

Consistency

A cycle of 1, 3 & 5-years exposes investments to different economic and political challenges.

How a fund and fund manager perform during such cycles reflects on their capabilities and overall quality.

One of the main distinguishing elements of our portfolios is that they are each composed of funds that have proven their quality and their ability to deliver top-ranking sector performance on a consistent basis.

Top Quality Funds Balanced For Improved Efficiency

The balance of investments across different asset classes is the primary driver of portfolio returns, but the funds used to create the correct balance are essential to maximising portfolio growth and efficiency.

For most, a broadly diversified portfolio of equities and bonds, that is annually or semi-annually monitored and rebalanced will produce a reasonably structured portfolio that is both controlled and cost-effective. Cost efficiency is also important to consider as rebalancing often involves transaction and tax costs, which is why an annual or semi-annual rebalancing is the most common. However, much depends on the circumstances of each investor and the rebalancing strategies they adopt.

Efficient investment advice firms can add value by helping an investor set an appropriate strategy for periodically rebalancing their portfolios in a non-emotional, cost-effective and impartial way.

Maintaining A Portfolio of Top Performing Funds

It is not always realistic for even the best fund managers to continuously maintain a level of performance from their funds that exceeds that of many of their peers. But there are certain processes that can help investors to identify when a fund is experiencing a dip in fortune, and if so, whether or not they should stick with the fund or consider moving to an alternative.

One system applied by some quality firms to track and manage fund performance is referred to as the traffic light system. This system uses a 3-tiered fund grading model that promotes a pragmatic investment approach and helps to avoid poor investment decisions.

Green – Funds that have primarily maintained a level of performance that exceeds 75% of same sector funds over the recent 1, 3- & 5-year periods. Such funds are viewed as top performers and represent excellent investment opportunities. When constructing a portfolio, it is predominantly the funds with a green rating that are considered.

Amber – Funds that have previously rated as green but recently experienced a decline in performance compared to other funds within the same sector. Amber funds remain within the portfolio but are carefully monitored, typically over a 3-6-month period, to identify whether their performance has improved, remained stagnant or declined. If the fund’s performance has improved to a level that is better than 75% of competing same sector funds, it returns to be a green-rated fund. If it remains stagnant, it will continue to receive an Amber classification for a period of up to 6 months. If no improvement is seen during this period, it will receive a red rating.

Red - The red traffic light signifies that some action is due. It may be that the fund is removed from the portfolio and replaced with a suitable green-rated fund. Funds will be moved to a red rating if they continue to drop down the sector ranking over a 3-6 month period, or if they fail to improve six months after receiving an amber rating.

Many top investment firms use the above strategy to help ensure the portfolios they recommend perform efficiently for their clients.

Does Your Portfolio Contain Top Performing Funds?

Inefficient investing will undoubtedly have adverse long-term consequences, which is why it is so important to be able to distinguish the funds and fund managers who outperform their peers in order to ensure your portfolio is made up of high-quality funds.

Our free portfolio analysis service has helped thousands of investors to identify areas for improvement and provides complete clarity as to the quality of advice they have received, or the fund choices they have made.

Our portfolio analysis service will provide an independent analysis of your portfolio and identify:

- If your portfolio contains top, mediocre or poor performing funds

- How your portfolio growth compares to a similar risk portfolio of top-performing funds

- How efficient your fund choices you have been, or whether the recommendations you have received from your adviser has been up to par.

- Potential areas for improvement

- The overall quality rating of your portfolio

Our portfolio analysis feature provides a clear insight into how each of your individual funds is performing while grading your portfolio based on its overall performance - making it easy to identify weak points or areas for potential improvement.

Upload your portfolio for a comprehensive portfolio review and find out how competitive the performance of your portfolio has been and if the advice you have received to date has been up to par.