Since the Brexit vote investors have withdrew £12 Billion from UK equity funds. However, during this time UK funds have achieved average growth of 31.6%, better than half of all investment sectors. In this article we investigate why the sector has continued to prosper during such times of uncertainty.

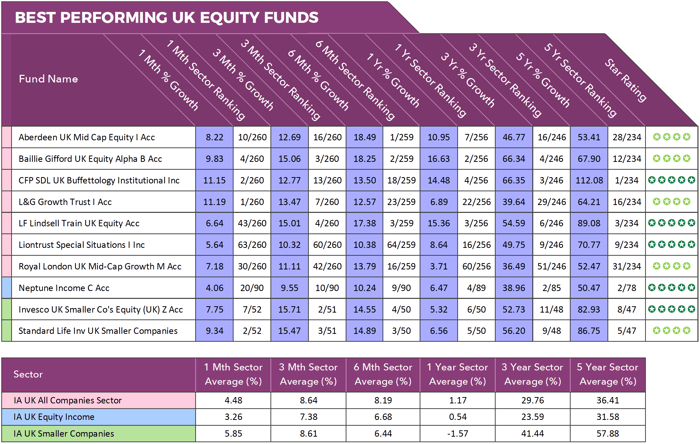

Our team reviewed 395 UK Equity funds, analysing their performance and sector ranking over the recent 1 month, 3 months, 6 months, 1 year, 3 years and 5 years. Also featured are 10 funds that have consistently outperformed at least 75% of their peers over each of these six periods.

- Almost £12 billion has been withdrawn from UK Equities since the Brexit vote.

- Despite a lack of investor confidence UK Equities have averaged returns of 31.60% in the 3 years since Brexit, which is higher than half of all other Investment Association sectors.

- A difficult 2018 saw UK Equities average losses for the year but the past 6 months they have averaged growth of 7.10%, higher than 70% of Investment Association sectors.

£11.9 billion has been withdrawn from UK Equity funds since the Brexit vote in June 2016, and this figure continues to rise with the investment association reporting withdrawals of £816 million in the first quarter of 2019. Despite the lack of investor confidence, UK Equities remain an integral part of a diversified portfolio. But how have UK Equity sectors performed compared to other markets, and which of their funds have performed the best?

The UK is home to some of the most successful companies in the world, and as many are globally diversified, they can absorb many of the UK’s political and economic changes. Many other UK companies with less global appeal have also been able to thrive despite the uncertainty of Brexit. As identified in this report, a proportion of the UK Equity funds available have continually delivered strong returns despite being faced with political and economic uncertainty.

The Best UK Equity Funds

3 of the 36 Investment Association sectors are UK Equity sectors. These sectors are the UK All Companies, UK Equity Income, and the UK Smaller Companies and combined they hold 395 funds. Our analysis of all 395 funds identified 253 have consistently underperformed by ranking in the bottom 50% of their sector.

Just 35 of the UK Equity funds analysed returned growth over the recent 1, 3 & 5 years that was greater than at least 75% of all other funds within the same sector and only 16 of these funds had maintained top quartile performance when also analysed over the recent 1, 3 & 6 months.

From these 16 funds, we compiled a table of the 10 best performers. Each of these 10 UK Equity funds has consistently outperformed at least ¾ of their peers over each of the 6 periods analysed.

7 of these funds are from the UK All Companies sector, 1 from the UK Equity Income sector and 2 from the UK Smaller Companies sector.

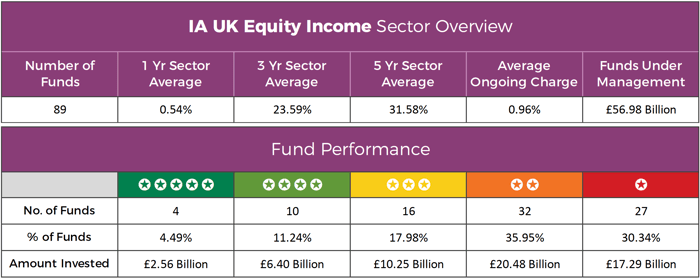

UK Equity Income Sector

The UK Equity Income sector contains funds that aim to offer the potential for a regular income, with a degree of capital growth, by investing mainly in UK companies that pay good dividends.

The Investment Association define the criteria for this sector as "Funds which invest at least 80% in UK equities and which intend to achieve a historic yield on the distributable income in excess of 100% of the FTSE All Share yield at the fund's year end on a 3 year rolling basis and 90% on an annual basis."

Funds that fail to meet this threshold are removed from the sector and failure to achieve 90% of the index yield in any one year will also result in a fund being removed from the sector.

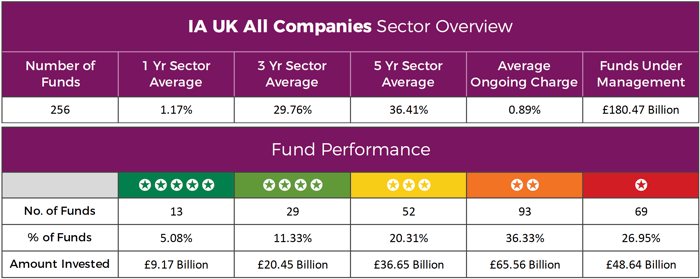

UK All Companies Sector

.Funds in this sector must invest at least 80% of their assets in UK equities and have a primary objective of achieving capital growth.

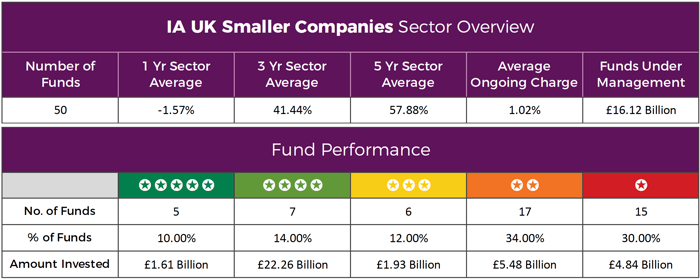

UK Smaller Companies Sector

Funds which invest at least 80% of their assets in UK equities of companies which form the bottom 10% by market capitalisation.

This sector contains funds that allow you to benefit from the growth potential of the UK’s smaller and medium-sized companies. But Smaller companies shares can be more volatile and less liquid than larger company shares, so smaller companies funds can carry more risk.

The Best UK Equity Funds

1. Aberdeen UK Mid Cap Equity

The Fund’s objective is to maximise total return from capital investment predominantly in the companies of the FTSE 250 Index (excluding investment trusts), though other UK listed equities may be held when the funds management deem appropriate.

Over the 6 periods analysed this Fund has consistently been one of the best performers within the UK All Companies sector and its 5-year growth of 53.41% was better than 88% of its rivals.

2. Baillie Gifford UK Equity Alpha

The Fund adopts a long-term, low turnover investment approach and aims to hold higher quality, growth companies which are principally listed in the UK and are capable of growing their profits and cash flows faster than the market average. This Fund holds shares in approximately 30 to 40 companies, but its top 10 holdings account for almost 50% of its assets. Over the 6 periods analysed this Fund has never performed outside the top 5% of funds in the UK All Companies sector.

3. CFP SDL UK Buffettology

This £675 million fund aims to achieve an annual compounding rate of return over the long term, defined as 5-10 years, which is superior to the performance of the UK stock market.

Over the recent 5 years, it has returned growth of 112.08%, which ranked 1st out of the 234 funds in the UK All Companies sector with at least 5 years performance history and it has remained one of the most consistent UK Equity funds.

4. L&G Growth Trust

The objective of this Fund is to provide growth. The Fund will typically invest between 80% and 100% in company shares from the UK. The Fund will invest in shares of companies which, in the manager's view, have strong growth prospects.

This Fund currently has funds under management of £221 million, and over the 6 periods analysed it was among the top performers in the UK All Companies sector.

5. LF Lindsell Train UK Equity

The LF Lindsell Train UK Equity fund is one of the most popular UK Equity funds with investors and the 4th largest with funds under management of £6.2 billion.

This Fund has consistently outperformed the FTSE All-Share index, and over the past 5 years, it returned growth of 89.08%, which was the 3rd highest in its sector and considerably better than the 36.41% sector average.

6. Liontrust Special Situations

The Fund’s managers Anthony Cross and Julian Fosh use the Economic Advantage process to identify companies, which they believe, have a durable competitive advantage that allows them to defy industry competition and sustain a higher than average level of profitability for longer than expected.

Their strategy has helped this Fund deliver consistently strong returns within a very competitive sector.

7. Royal London UK Mid Cap Growth

The investment objective and policy of the Fund is to maximise capital growth over the medium to long term, mainly through the investment in medium-sized UK companies.

Its top holding is the veterinary pharmaceutical company Dechra, who recently reported impressive interim results as it remained one of the largest positive contributors to this Fund.

8. Neptune Income

The Neptune Income Fund consists of a 33 equally-weighted stock portfolio with the aim of generating a yield in excess of the FTSE All-Share Index.

This Fund sits within the UK Equity Income sector, and over the recent 5 year period it returned growth of 50.47%, which ranked 2nd of all 78 funds in its sector. Although a consistently top performer within the UK Equity Income sector, this sector has averaged lower returns than the UK All Companies sector for each of the 6 periods analysed.

9. Invesco UK Smaller Companies Equity

The Fund aims to achieve capital growth by investing in smaller UK-listed companies. The fund manager focuses on identifying quality businesses with strong balance sheets, which he deems to be capable of self-help, rather than being overly reliant on the broader economy to stimulate growth. Over the recent 1, 3 & 5year periods this UK Smaller Companies fund has returned growth of 5.32%, 52.73%, and 82.93%, which were consistently among the best in its sector.

10. Standard Life Investments UK Smaller Companies

This UK Smaller Companies fund launched in 1997, and currently, it manages £1.57 billion of investor assets.

Similar to many of its peers, this Fund invests primarily in Industrial companies. However, it has continually managed to outperform the majority of its rivals with its returns ranking among the highest in its sector.

Why Investors Should Not Overlook The UK Equity Market

Many of the companies listed on the UK Stock Exchange will derive a large amount of their income from overseas, so although the sector dictates that at least 80% must be invested in UK companies, there is no easy way of telling where the listed companies activities are. Therefore, the fortunes of the holdings are often inextricably linked with global economic conditions. As such, many UK Equity funds are not as restrictive as some may believe.

The UK is home to some of the most successful companies in the world, and as many are globally diversified, they can absorb many of the UK’s political and economic changes. Many other UK companies with less global appeal have also been able to thrive despite the uncertainty of Brexit. As identified in this report, a proportion of the UK Equity funds available have continually delivered strong returns despite being faced with political and economic uncertainty.

Despite its unpopularity in recent years, the UK Equity market remains an important sector for investors and excluding them could increase your portfolio's level of risk and potentially result in missed growth opportunities.