In the pursuit of investment returns we must find the right balance between risk and reward. A large factor in this is will primarily come down to the investment sectors we invest in and what proportion of our portfolios we allocate to each particular sector.

Some sectors carry more risk than others, but in doing so, they typically offer greater rewards. One such sector that continues to thrive is the North American sector, which is currently enjoying its longest bull run in post- World War 2 history.

In contrast, many markets have had a torrid year as the return of high volatility and challenging market conditions caused many funds to fall below growth levels enjoyed in previous years.

Why 2018 has seen many investors experience a decline in growth

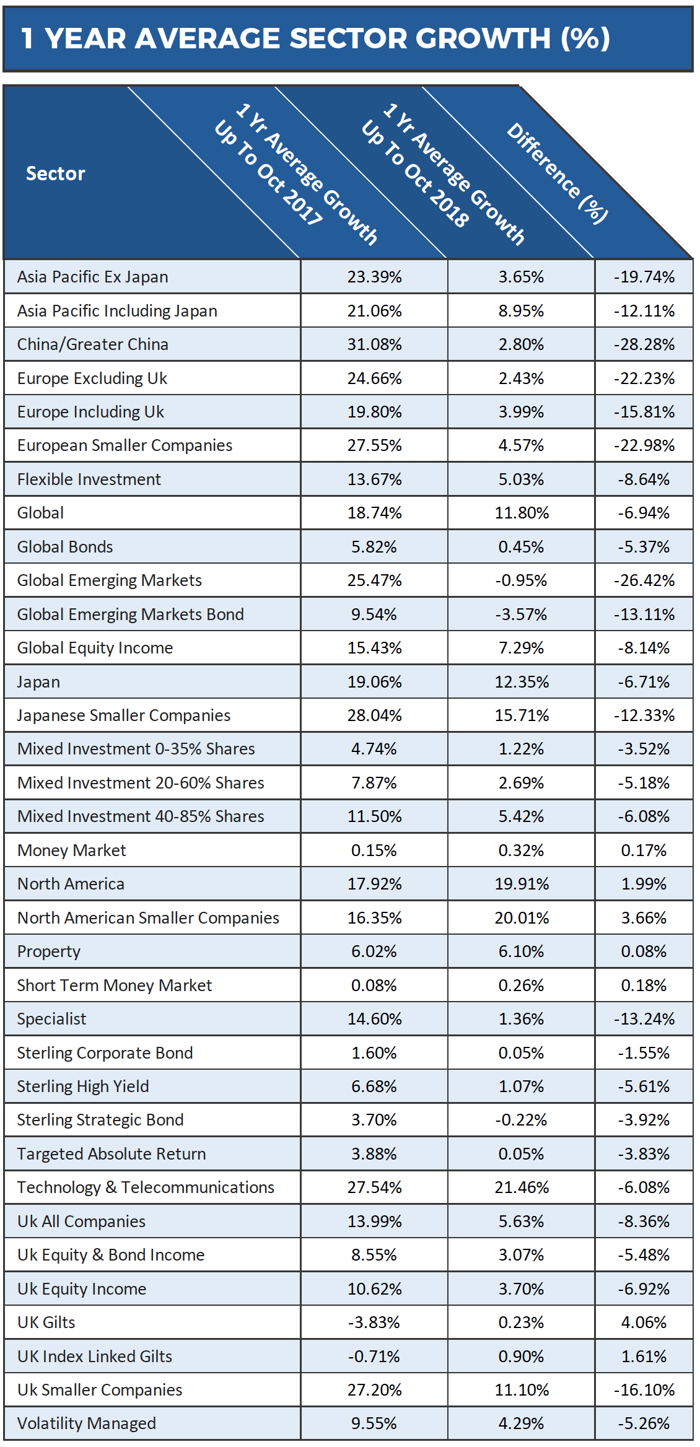

Emerging Markets, in particular, experienced a sharp decline in growth this year in comparison to recent years. In the 1-year period up to 1st October 2018, Emerging Market funds averaged negative growth of -0.95%, which was in stark contrast to the 25.47% average growth experienced the previous year. This decline is primarily a result of a strong U.S. dollar and rising interest rates which had a detrimental effect on both governments and private institutions in many Emerging Market countries that borrowed heavily in U.S Dollars when interest rates were rock bottom a few years ago.

The U.S has also heavily influenced Asian markets, as tensions from the recent and ongoing trade tariffs between America and China have caused many to fear a potential trade war. The China/Greater China investment sector returned average annual growth up to 1st October 2018 of just 2.8%, which is a significant drop from the 31.08% average retuned the previous year.

Figures are cumulative and represent the average growth within each Investment Association sector for the 1 year period up to 1st October 2017 and for the 1 year period up to 1st October 2018.

View all top fund reports and performance insights>>

How the Uncertainty of Brexit Has Impacted Investment Growth

The uncertainty caused by the drawn-out Brexit negotiations has contributed to a sizeable drop in growth in European and UK sectors. In the 1-year period up to 1st October 2017, the Europe excluding UK sector averaged growth of 24.66%. However, in the recent 1-year period up to 1st October 2018, the average growth of this sector was just 2.43%. In the UK, the UK Equity Income sector has also experienced a decline in growth figures over the past year with average growth of 3.7%, which was down from 10.62% in 2017.

The Highest & Lowest Growth Sectors In 2018

In 2018, the IA Technology & Telecommunications sector continued to deliver the highest average growth out of all the sectors in the (IA) Investment Association universe. The funds in this sector returned 1-year average growth of 21.46% to edge out the North American Smaller Companies and North America sectors which averaged growth of 20.01% and 19.91% respectively.

At the other end of the scale, the IA Emerging Markets Bond and IA Emerging Markets sectors have had the lowest sector average over the past 12 months.

However, despite the difficulties experienced by emerging market funds this past year there has still been continued inflows into the sector with £47 million placed into emerging markets funds in August alone.

Shifting the Balance of Your Portfolio In Pursuit of Greater Returns?

As investment markets fluctuate investors can panic and make mistakes. Investors who have a higher tolerance to risk are often more likely to deviate away from an existing strategy in the pursuit of high returns.

By reacting to the difficulties experienced by certain sectors, investors often increase their portfolio weighting in better performing sectors and reduce their exposure to sectors such as Emerging Markets. Such changes must be approached with extreme caution. While a portfolio heavily weighted in one sector can increase returns it can also increase risk and expose investors to higher losses should that particular market experience a sharp downturn.

Investment decisions should not be based on whether or not one sector is performing better or worse than another but rather on a strategic balance of assets that best fits your attitude to risk and overall investment goals.