- The review assessed 4,185 IA sector classified funds, each with at least one year of performance history.

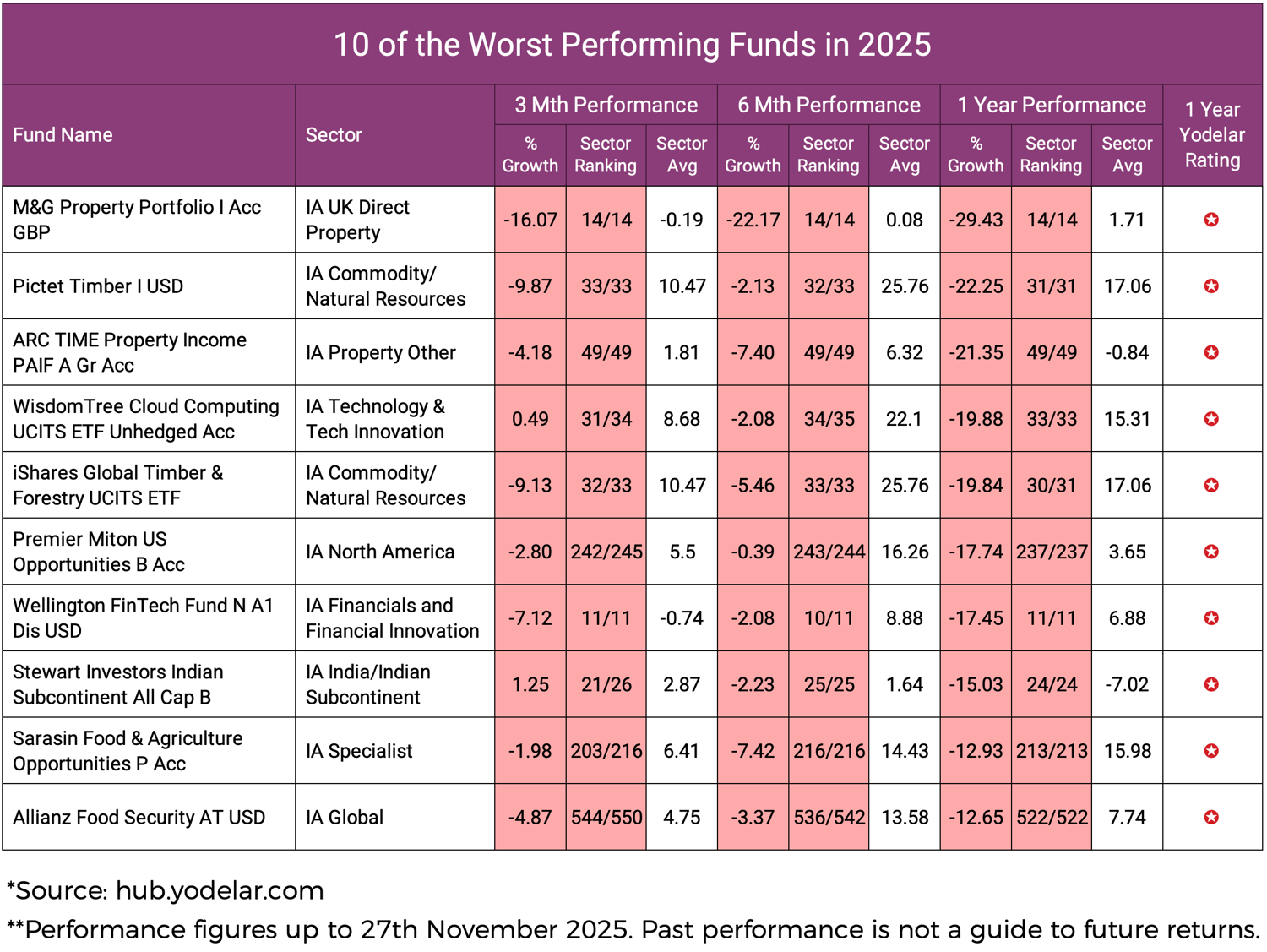

- The 10 funds featured in this report ranked among the worst performing funds over the past year

- The M&G Property Portfolio recorded the lowest 1 year return in the UK Direct Property sector at -29.43%, ranking last out of 14 funds.

- Across the 4,185 funds reviewed, 1,193 funds (28.5%) received a 1 star Yodelar Rating, indicating they lagged their sector averages.

- Premier Miton US Opportunities produced a 1 year return of -17.74%, the lowest result among all 237 IA North America funds.

Our latest analysis reviewed the short term performance of 4,185 IA classified funds with at least one year of performance history to identify the funds that struggled most in 2025. Using 3 month, 6 month and 1 year results, we isolated the ten funds that ranked at the bottom of their respective sectors across these key periods.

The funds featured in this report span a broad mix of Investment Association sectors, including property, commodities, technology, regional equities and global equities. Their performance illustrates the considerable dispersion that has emerged this year, with the weakest funds falling well behind their sector averages.

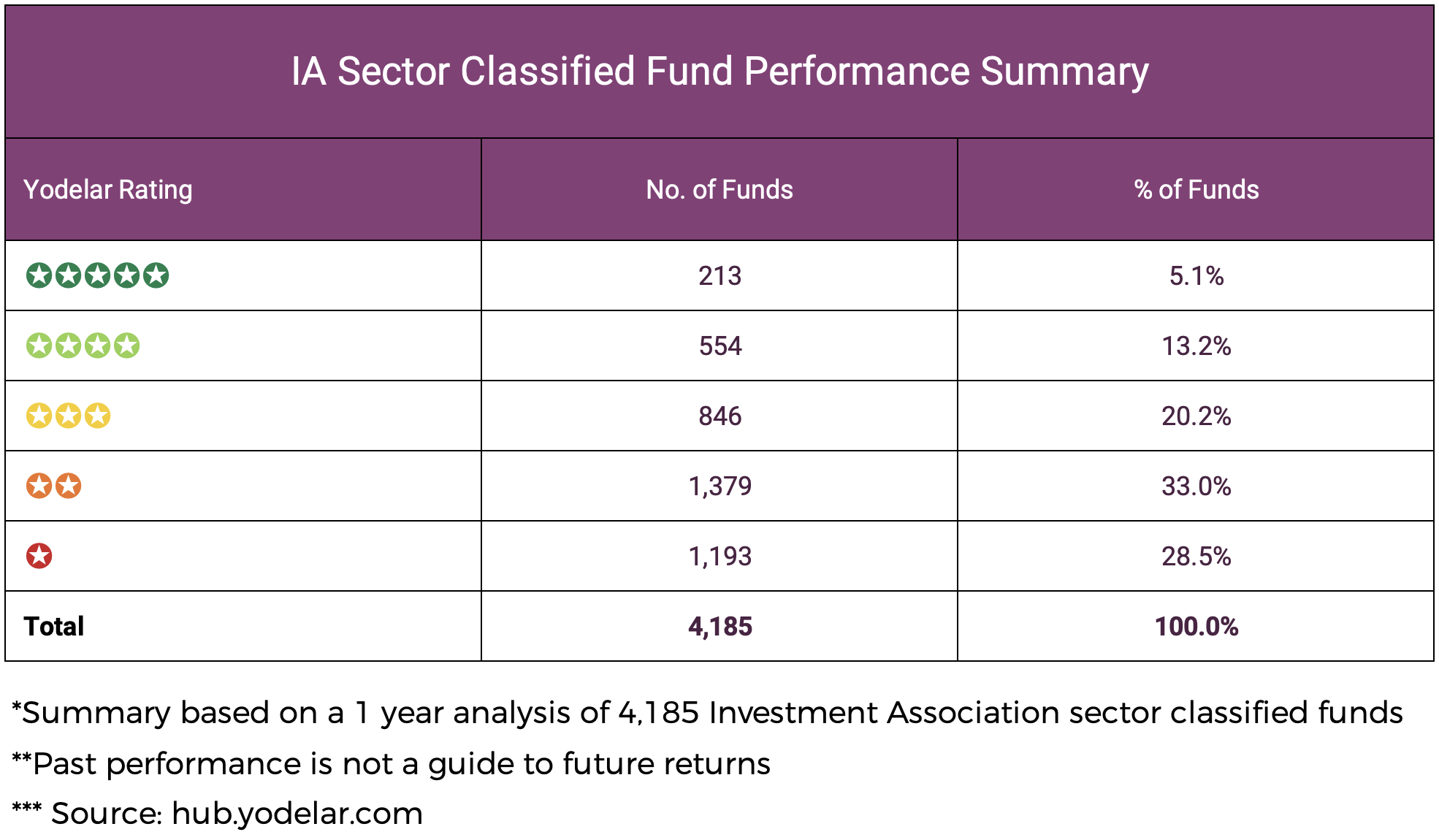

For broader context, we have included a summary of Yodelar fund ratings across all 4,185 funds assessed. Only 5.1% achieved a 5 star rating, while 28.5% received a 1 star rating. This distribution reinforces the value of structured fund comparison and the need for disciplined portfolio oversight to avoid persistent underperformance.

How the Worst Performing Funds Were Identified

All 4,185 IA classified funds with at least one year of performance data were assessed across 3 month, 6 month and 1 year periods. Funds ranking consistently in the bottom quartile of their sectors across these timeframes were shortlisted.

From this group, one fund per sector was chosen to provide a broad view of where the weakest performance occurred in 2025. All figures are sector-relative, ensuring results are assessed fairly against funds with similar mandates and risk profiles.

This approach provides a clear, independent view of the funds that have lagged their sector averages and peers over multiple short term periods.

2025 Fund Performance Summary

Our assessment of 4,185 IA sector classified funds highlights a clear dispersion in performance over the past year. Only 213 funds, equal to 5.1% of the universe, achieved a 5 star Yodelar Rating. A further 554 funds, representing 13.2%, were rated 4 stars, which also signals strong performance within their respective sectors.

The largest group was the 3 star category, with 846 funds accounting for 20.2% of all funds analysed. Meanwhile, 1,379 funds (33.0%) received a 2 star rating, reflecting performance below their sector averages.

Notably, 1,193 funds, equal to 28.5% of the total universe, received a poor 1 star Yodelar Rating. Across the combined 3 month, 6 month and 1 year assessment periods, 51.1% of all funds were rated 1 or 2 stars, indicating that more than half of the market delivered weaker results than their sector averages over each timeframe.

10 of the Worst Performing Funds of 2025

The table below highlights 10 funds that recorded some of the weakest short term results in their respective IA sectors. Each fund ranked near the bottom of its category across the 3 month, 6 month and 1 year periods.

M&G Property Portfolio Fund

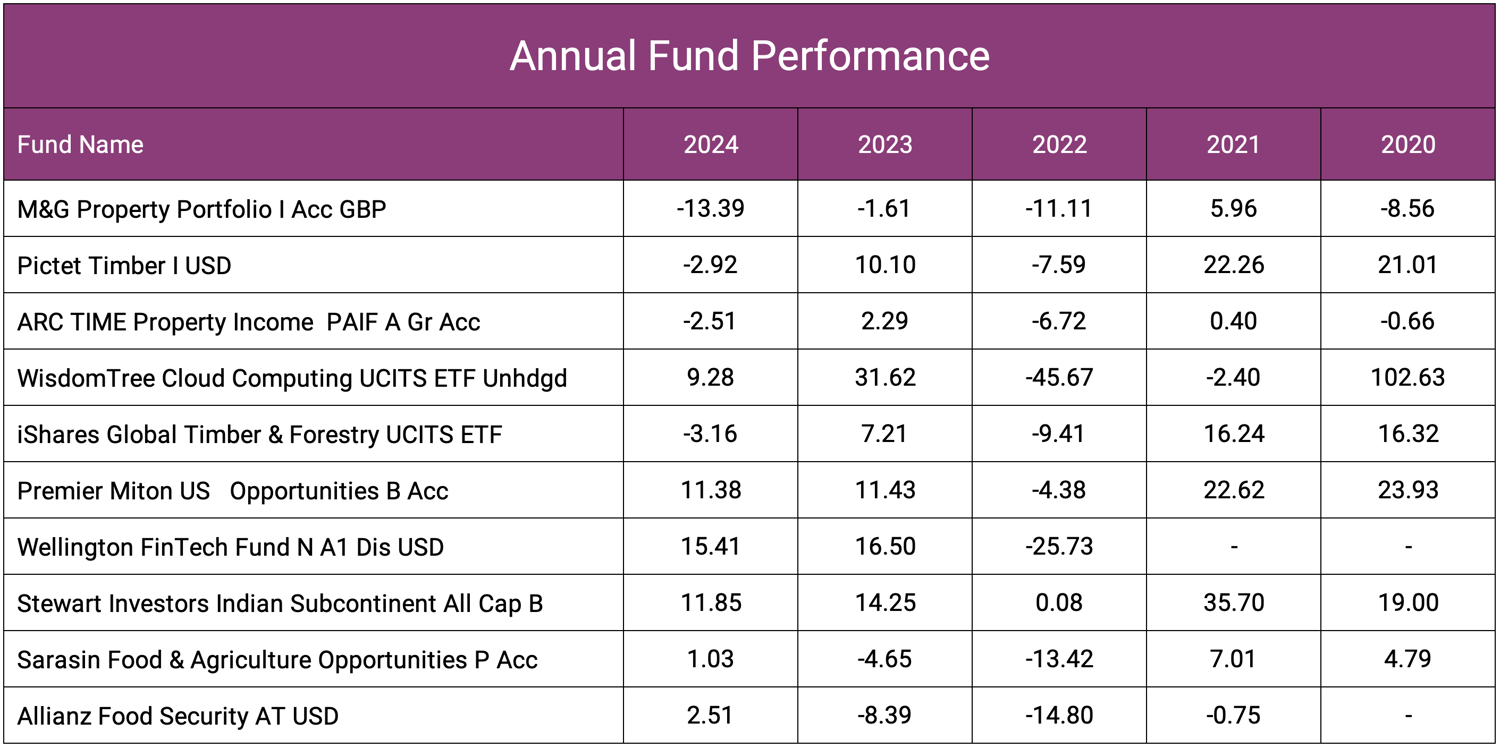

This fund recorded a 1 year loss of -29.43%, ranking 14th out of 14 funds in the IA UK Direct Property sector and falling well below the sector average of 1.71%. Its 6 month return of -22.17% also ranked 14th, and its 3 month return of -16.07% ranked 14th. Across all short term periods, the fund remained at the bottom of its sector.

Pictet Timber Fund

Pictet Timber recorded a 1 year return of -22.25%, placing it last out of 31 funds in the IA Commodity and Natural Resources sector. This compares with a sector average gain of 17.06% over the same period. Over 6 months it returned -2.13%, placing 33rd, while its 3 month return of -9.87% also ranked 33rd. Results across all timeframes show the fund consistently lagged behind the rest of the sector.

ARC TIME Property Income Fund

This fund returned -21.35% over one year, ranking 49th out of 49 funds in its sector and below the sector average of -0.84%. Over 6 months it declined -7.40%, ranking 49th, and over 3 months it fell -4.18%, ranking 49th. It positioned last in the sector across all short term periods.

WisdomTree Cloud Computing UCITS ETF

The ETF delivered a 1 year return of -19.88%, ranking 33rd out of 33 funds and behind the sector average of 15.31%. Its 6 month return of -2.08% ranked 34th, while its 3 month return of 0.49% ranked 31st. The ETF consistently remained at the tail end of the sector rankings.

iShares Global Timber & Forestry UCITS ETF

This fund returned -19.84% over 1 year, ranking 30th out of 31 and behind the sector average of 17.06%. Its 6 month return of -5.46% ranked 33rd, while its 3 month return of -9.13% ranked 32nd. The fund has remained significantly below sector averages across all 3 time periods analysed.

Premier Miton US Opportunities Fund

The fund delivered a 1 year return of -17.74%, ranking 237th out of 237 IA North America funds. Over 6 months it returned -0.39%, ranking 243rd, while its 3 month return of -2.80% ranked 242nd. It remained the lowest-ranking fund in the sector over 1 year.

Wellington FinTech Fund

This fund returned -17.45% over 1 year, ranking 11th out of 11 funds and below the sector average of 6.88%. Over 6 months it declined -2.08%, ranking 10th, and over 3 months it fell -7.12%, ranking 11th. It has consistently placed last or near last within its sector.

Stewart Investors Indian Subcontinent Fund

The fund delivered a 1 year return of -15.03%, ranking 24th out of 24 funds and behind the sector average of -7.02%. Its 6 month return of -2.23% ranked 25th, while the 3 month return of 1.25% ranked 21st. Across all periods, results remained below sector averages.

Sarasin Food & Agriculture Opportunities Fund

This fund returned -12.93% over one year, ranking 213th out of 213 funds in the IA Specialist sector. Over six months it returned -7.42%, ranking 216th, while its three month return of -1.98% ranked 203rd. The fund remained at the tail end of its broad peer group.

Allianz Food Security Fund

This fund recorded a 1 year return of -12.65%, ranking 522nd out of 522 IA Global funds and below the sector average of 7.74%. Its 6 month return of -3.37% ranked 536th, and its 3 month return of -4.87% ranked 544th. The fund placed last across all measured periods within one of the largest IA sectors.

Maintaining Perspective When Assessing Underperformance

Short term underperformance does not automatically indicate long term weakness, but persistently lagging results can signal areas of a portfolio requiring review. Funds that fall well behind their sector averages over multiple periods may contribute little to overall returns or distort the intended balance of a portfolio.

A structured portfolio analysis can help identify whether weaker funds are isolated occurrences or part of a broader pattern. It highlights how each fund compares with its sector, whether allocations remain suitable and where diversification has weakened over time.

For investors wishing to understand the underlying drivers of their portfolio’s results, our analysis service provides a clear comparison of performance, risk exposure and cost across all holdings.

Conclusion

The funds featured in this review represent some of the weakest performers across the IA universe in 2025. Their results show how wide the gap can be between the strongest and weakest funds within each sector and underline the importance of regular portfolio monitoring.

Understanding which funds have lagged their peers is a key part of maintaining an efficient and well-diversified portfolio. A structured review helps investors assess whether underperformance is affecting long term objectives and whether adjustments may be required.

In changing market conditions, ongoing oversight remains essential. Investors who routinely assess fund performance, diversification and cost are better positioned to maintain a resilient, objective-led investment strategy.