-

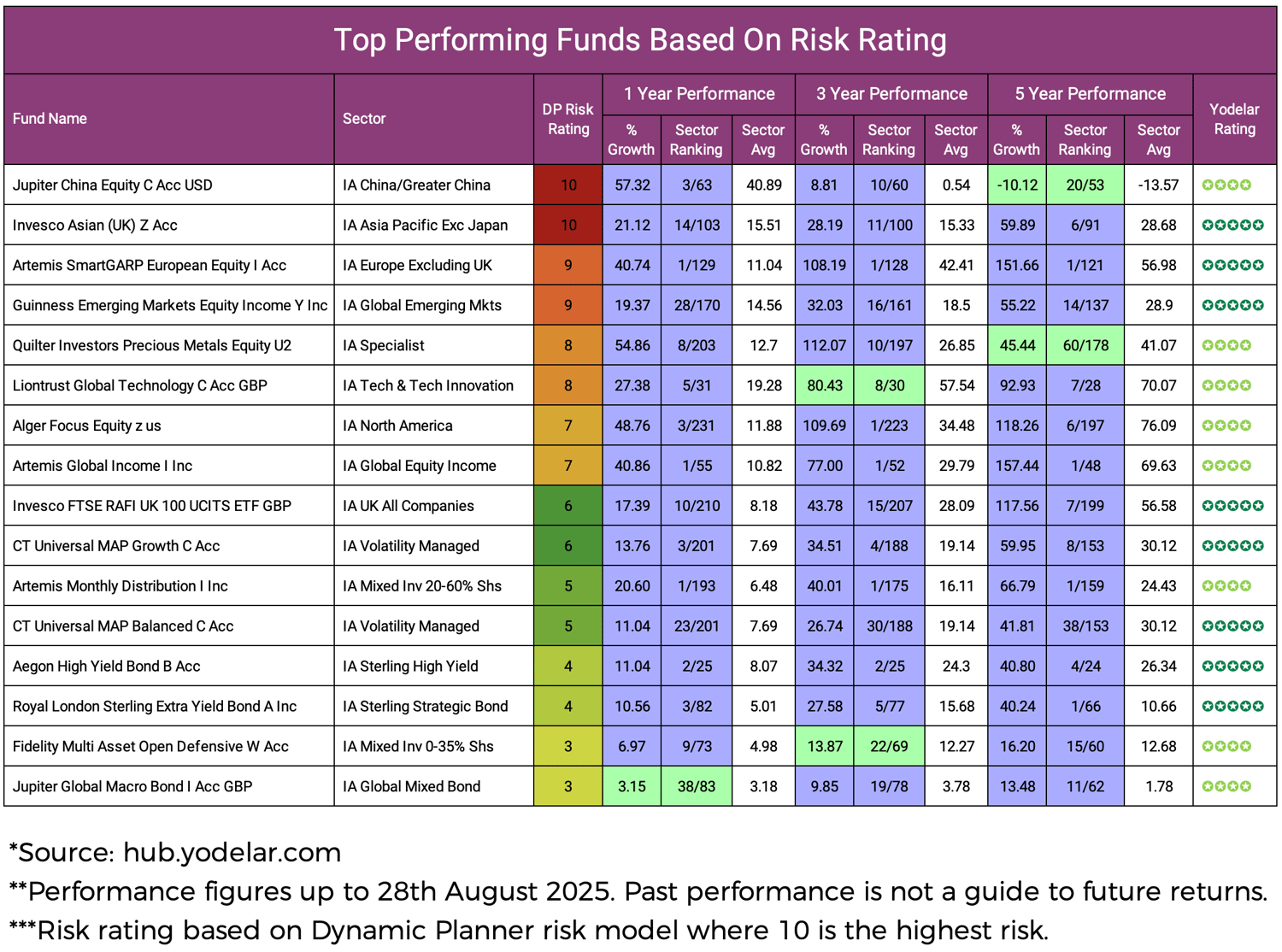

Our analysis highlights 16 funds across risk levels 3 to 10 that have consistently outperformed their sector averages over 1, 3 and 5 years.

-

Higher-risk funds, such as those in technology, emerging markets and specialist sectors, have produced some of the strongest gains but with greater volatility.

-

Lower-risk funds, including bond and cautious multi-asset strategies, have delivered steadier outcomes while still outperforming sector peers.

-

A diversified and efficient portfolio should include a blend of funds across risk levels, with asset allocation and regular oversight more important than chasing short-term returns.

-

Many self-directed investors fall into pitfalls such as duplication, concentration in certain sectors, and unintended risk exposure – issues that only become clear during market downturns.

Investors are often drawn to headline performance, but the real test of a fund is whether those returns are appropriate for the level of risk taken. A high-risk fund may deliver strong gains in favourable conditions, but can equally expose investors to sharp losses. Lower-risk funds, on the other hand, typically deliver steadier outcomes, though with less potential for dramatic growth.

To compare funds on a fair and consistent basis, many of the UK’s largest fund groups use the Dynamic Planner risk model. This framework, widely adopted across the advice market, ranks funds on a scale of 1 (lowest risk) to 10 (highest risk). By aligning performance to risk, it allows investors and advisers to judge whether results have been delivered in line with expectations.

In this article, we analyse some of the top-performing funds across multiple Dynamic Planner risk levels. We identify the funds that have consistently delivered above-average results over 1, 3 and 5 years.

Understanding Risk Levels in Fund Analysis

For this report, fund risk ratings are based on the Dynamic Planner 1–10 scale. Dynamic Planner is a risk-profiling model used across the UK investment market, and it provides a structured way to compare performance in relation to risk. On this scale, 1 represents the lowest level of risk and 10 the highest.

-

Levels 1–3 (Low Risk): Funds in this range tend to prioritise stability, often holding larger allocations to cash or bonds.

-

Levels 4–7 (Medium Risk): These funds typically combine equities with bonds and other assets to balance growth with stability.

-

Levels 8–10 (High Risk): Funds at this level invest heavily in equities, smaller companies, or emerging markets, with potential for stronger returns but greater short-term volatility.

By applying this framework, performance can be reviewed on a like-for-like basis. This ensures that results are assessed in the context of the level of risk taken to achieve them.

Top Performing Funds by Risk Rating

The table below highlights 16 funds identified as among the stronger performers within their risk categories. To provide a balanced view, the selection includes two of the best-performing funds for each risk level between 3 and 10. Only a small number of funds are classified outside of this range, so these have been excluded from the analysis.

Each of the funds listed has delivered returns above their sector average over 1, 3 and 5 years and has received a Yodelar performance rating of 4 or 5 stars. This rating reflects how consistently a fund has ranked in the top half of its sector across multiple timeframes.

In the sections that follow, we review examples from both higher- and lower-risk categories, comparing how they have performed relative to peers and how outcomes have varied across different market conditions.

RISK 10 - Jupiter China Equity Fund

This fund carries the highest risk rating of 10 and sits within the IA China/Greater China sector. Over the past year it returned 57.32%, ranking 3rd out of 63 funds and well ahead of the sector average of 26.62%. Over three years it gained 8.81% compared with 0.54% for the sector, while over five years it fell –10.12%, though this was still ahead of the sector average of –13.57%.

Performance has been highly variable, reflecting the influence of regulatory policy, currency movements and broader emerging market volatility. The fund provides exposure to companies with significant links to China, Hong Kong and Taiwan, an area where returns can swing sharply depending on economic and political conditions.

RISK 10 - Invesco Asian (UK) Fund

The Invesco Asian (UK) fund has a risk rating of 10 and is classified in the IA Asia Pacific ex Japan sector. Over the past year it returned 21.12% against a sector average of 15.51%. Over three years, it delivered 28.19% compared with 15.33%, and over five years 59.89% versus 28.68%.

The portfolio is invested across Asia and Australasia, excluding Japan, with exposure to markets such as China, Taiwan, South Korea and Hong Kong. Returns have reflected the strength of these economies in recent years, though investors in the region remain exposed to higher levels of volatility compared with more developed markets.

RISK 9 - Artemis SmartGARP European Equity Fund

This fund has a risk rating of 9 and is part of the IA Europe ex UK sector. Over one year it returned 40.74% compared with a sector average of 11.04%. Across three years, it gained 108.19% versus 42.41%, and over five years it achieved 151.66% against 56.98%.

The strategy invests mainly in European equities, applying a screening tool to identify growth opportunities at attractive valuations. Returns have been particularly strong in recent years, although the fund remains exposed to shifts in European economic and political conditions, which can lead to periods of heightened volatility.

RISK 9 - Guinness Emerging Markets Equity Income Fund

With a risk rating of 9, this fund sits in the IA Global Emerging Markets sector. Over one year it returned 19.37%, above the sector average of 14.56%. Over three years, it gained 32.03% versus 18.50%, and over five years 55.20% compared with 28.90%.

The portfolio is deliberately concentrated, typically holding 35–40 dividend-paying companies across Asia, Latin America, Eastern Europe, Africa and the Middle East. While emerging market exposure brings political, regulatory and currency risks, the focus on quality income-producing businesses has supported resilient results.

RISK 8 - Quilter Investors Precious Metals Equity U2 Fund

This fund is classified within the IA Specialist sector and has a risk rating of 8. Over the past year it returned 54.86% compared with a sector average of 12.70%. Over three years it gained 112.07% versus 26.85%, and over five years it delivered 45.44% against 41.07%.

The fund invests primarily in companies linked to gold and other precious metals. Returns have benefitted during periods of market stress when demand for safe-haven assets tends to rise, although exposure to commodity prices and geopolitical developments can also contribute to sharp swings in performance.

RISK 8 - Liontrust Global Technology Fund

Carrying a risk rating of 8, this fund sits in the IA Technology & Technology Innovation sector. Over one year it returned 27.38% compared with a sector average of 19.28%. Over three years, it gained 80.43% against 57.54%, and over five years it delivered 92.93% versus 70.07%.

The portfolio is focused on leading technology and telecommunications companies worldwide, with holdings that include Nvidia, Taiwan Semiconductor and Oracle. Returns have been supported by growth in areas such as artificial intelligence and cloud computing. At the same time, the fund remains sensitive to regulatory pressures and the cyclical nature of the technology sector.

RISK 7 - Alger Focus Equity Fund

This fund carries a risk rating of 7 and is part of the IA North America sector. Over the past year it returned 48.76% versus a sector average of 11.88%. Over three years it delivered 109.69%, and over five years 118.26% compared with 76.09% for the sector.

The portfolio is concentrated in around 40–50 US growth companies, often sector leaders with strong earnings potential. While this approach has generated significant gains, the fund’s narrow focus makes it more sensitive to economic cycles, interest rates and investor sentiment than more diversified strategies.

RISK 7 - Artemis Global Income Fund

With a risk rating of 7, this fund sits within the IA Global Equity Income sector. Over the past year it returned 40.86% compared with a sector average of 10.82%. Over three years it gained 77.00% versus 29.79%, and over five years it achieved 157.44% against 69.63%.

The strategy invests in a diversified portfolio of dividend-paying companies worldwide, typically holding 60–80 stocks. Its global remit helps reduce reliance on any single region. However, as with all equity-focused funds, performance remains influenced by wider market movements and investor demand for income-producing shares.

RISK 6 -Invesco FTSE RAFI UK 100 UCITS ETF GBP

This fund has a risk rating of 6 and sits in the IA UK All Companies sector. Over one year it returned 17.39% compared with a sector average of 8.18%. Over three years, it gained 43.78% versus 28.09%, and over five years it achieved 117.56% compared with 56.58%.

Rather than tracking the market by size, the index it follows weights the UK’s 100 largest companies by factors such as cash flow, dividends, sales and book value. This fundamental approach has delivered above-average returns in recent years, although results remain tied to the performance of the UK economy and its largest listed companies.

RISK 6 - CT Universal MAP Growth Fund

With a risk rating of 6, this fund is part of the IA Volatility Managed sector. Over one year it returned 13.76% compared with a sector average of 7.69%. Across three years, it gained 34.51% against 19.14%, and over five years it achieved 59.95% versus 30.12%.

The fund invests globally across equities, bonds, cash and other assets, with equity exposure usually between 60% and 80%. This structure provides diversification across regions and asset classes, although performance remains influenced by movements in global stock and bond markets.

RISK 5 - Artemis Monthly Distribution Fund

This mixed investment fund is mapped to a risk rating of 5 and classified in the IA Mixed Investment 20–60% Shares sector. Over one year it returned 20.60% versus a sector average of 6.48%. Over three years it gained 40.01% compared with 16.11%, and over five years it achieved 66.79% against 24.43%.

The portfolio invests across bonds and equities, with the aim of producing monthly income alongside steady capital growth. While exposure to both credit markets and equities introduces some sensitivity to interest rate and market shifts, results have consistently compared favourably against sector peers.

RISK 5 - CT Universal MAP Balanced Fund

This fund carries a risk rating of 5 and sits within the IA Volatility Managed sector. Over one year it returned 11.04% against a sector average of 7.69%. Over three years it delivered 26.74% versus 19.14%, and over five years 41.81% compared with 30.12%.

The fund invests across global equities, bonds and cash, with allocations adjusted actively by the manager. Its positioning in the middle of the risk scale aims to balance long-term growth with some protection against market swings, although outcomes remain tied to global economic conditions.

RISK 4 - Aegon High Yield Bond Fund

This fund has a risk rating of 4 and is classified within the IA Sterling High Yield sector. Over the past year it returned 11.04% compared with a sector average of 8.07%. Over three years it gained 34.32% versus 24.30%, and over five years it achieved 40.80% compared with 26.34%.

The portfolio invests mainly in sub-investment-grade corporate bonds issued across global markets. While this approach carries greater credit risk than investment-grade bonds, it has supported higher income potential and stronger relative performance over the medium term.

RISK 4 - Royal London Sterling Extra Yield Bond

With a risk rating of 4, this fund sits in the IA Sterling Strategic Bond sector. Over one year it returned 10.56% against a sector average of 5.77%. Over three years it gained 27.58% compared with 15.68%, and over five years it returned 40.24% versus 10.66%.

The strategy invests predominantly in sterling-denominated bonds, with flexibility to include a limited allocation to non-sterling issues. Its objective is to deliver a yield above long-dated UK government bonds. While returns remain exposed to credit and interest-rate movements, the fund has consistently delivered above the sector average.

RISK 3 - Fidelity Multi Asset Open Defensive Fund

This fund carries a low risk rating of 3 and is part of the IA Mixed Investment 0–35% Shares sector. Over the past year it returned 6.97% versus a sector average of 4.98%. Over three years it gained 13.87% compared with 12.27%, and over five years 16.20% against 12.68%.

The portfolio invests mainly in bonds, cash and a diversified mix of assets, with only limited equity exposure. This cautious approach has led to steadier performance, with smaller fluctuations than higher-risk strategies, though at the cost of lower long-term growth potential.

RISK 3 - Jupiter Global Macro Bond Fund

With a risk rating of 3, this fund sits within the IA Global Bonds sector. Over one year it returned 3.15%, broadly in line with the sector average of 3.18%. Over three years it delivered 9.85% versus 3.78%, and over five years 13.48% compared with 1.78%.

The fund invests in a diversified range of government and corporate bonds globally, with active management of interest-rate and currency exposure. Its defensive profile is intended to provide stability and low volatility, though returns remain influenced by global bond yields and monetary policy trends.

Conclusion

This analysis shows that strong results can be achieved across different levels of risk, but the path to those results varies significantly. Higher-risk funds, such as those focused on emerging markets, technology or specialist sectors, have delivered some of the strongest returns in recent years, though with greater short-term swings. In contrast, lower-risk bond and defensive multi-asset funds have offered steadier outcomes, often outperforming their peers while keeping volatility more controlled.

The findings underline that performance should not be assessed by returns alone. The key question is whether results are consistent with the level of risk taken. The 1–10 risk framework applied in this report provides a structured way to make these comparisons, giving a clearer picture of how funds have delivered relative to expectations.

Building an Efficient Portfolio

There is no single fund that can meet every need. A truly diversified portfolio may include funds across a range of risk levels, but it is diversification and asset allocation that ultimately determine whether a portfolio is efficient and suitable. Our analysis of thousands of self-directed portfolios has highlighted recurring issues: overweight positions in certain regions or strategies, duplication of funds with similar holdings, and portfolios carrying more risk than investors intended. These weaknesses often only become apparent when markets move against them.

Building and maintaining an efficient portfolio requires more than selecting strong-performing funds. It demands structured diversification, disciplined allocation, and regular oversight to prevent drift away from the intended risk profile.

If you are unsure whether your portfolio is aligned with your objectives, you can book a free, no-obligation call with one of our advisers. We will identify any areas of inefficiency or risk concentration, and provide clarity on how effectively your portfolio is structured to meet your goals.