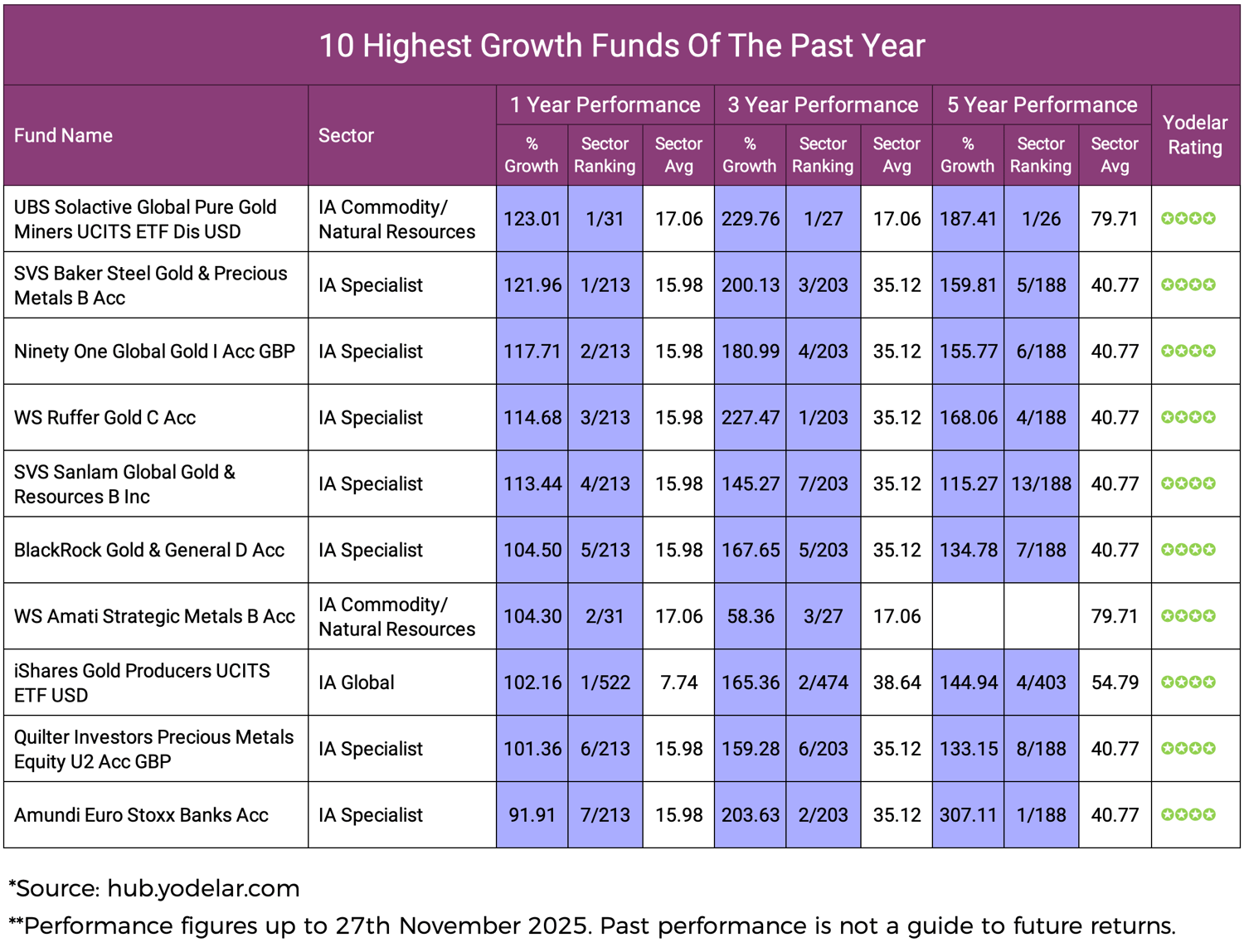

- The top ten performers showed a significant performance gap compared with the wider IA universe, with gold-focused funds returning between 101% and 123% over 12 months.

- Nine of the ten highest-returning funds of 2025 were gold-focused strategies based on analysis of 4,071 IA sector classified funds.

- The top performer delivered a 12-month return of 123.01%, the highest across all IA sectors.

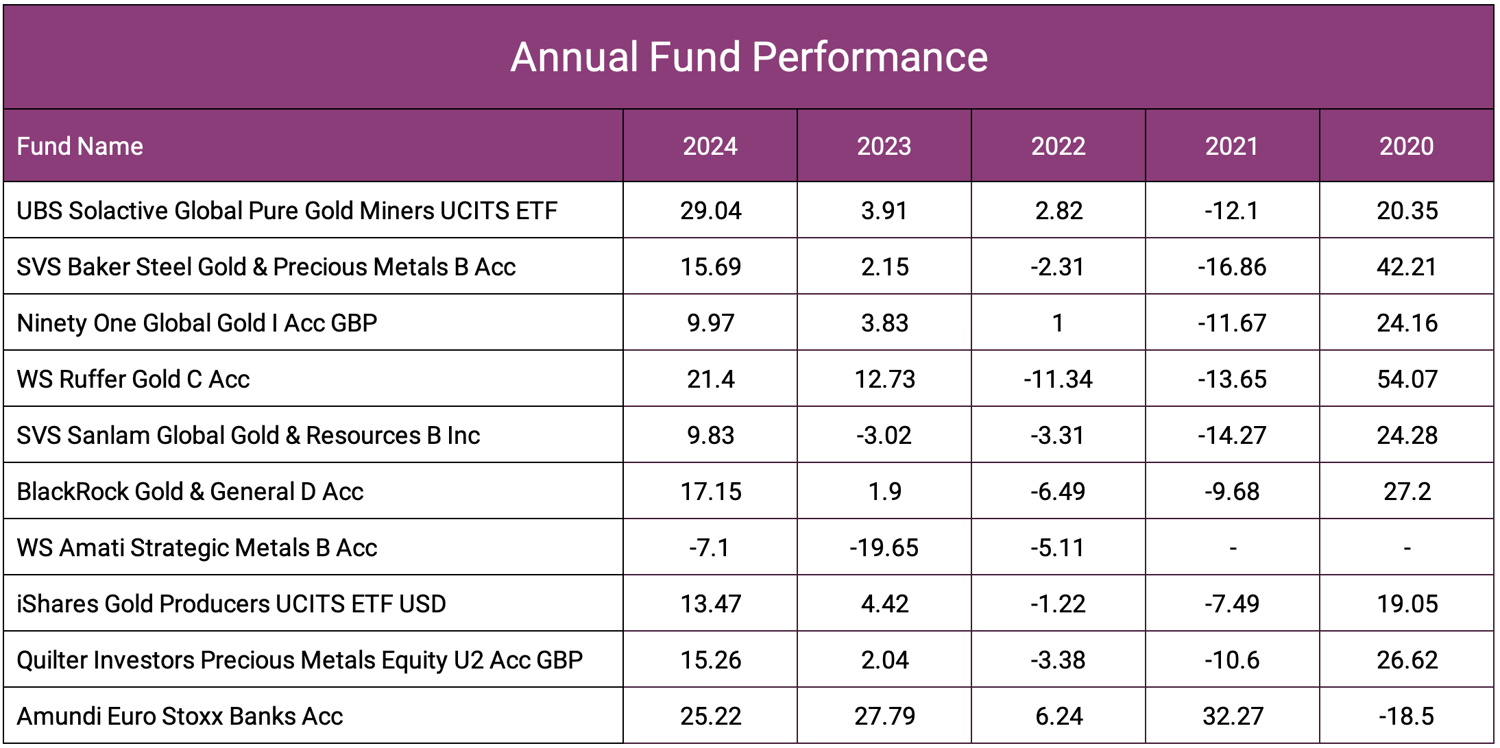

- Several gold-focused funds that ranked highly over 1 year also ranked strongly over 3 and 5 year periods relative to their sector averages.

Analysis of the Investment Association fund universe in 2025 has revealed a clear pattern in the top end of the performance tables. Of the 4,071 funds assessed across all IA sectors, the strongest returns over the past 12 months have come from funds with a focused exposure to gold mining companies. Nine of the ten highest-growth funds this year have been gold oriented strategies, marking one of the most concentrated outcomes seen in recent annual performance rankings.

This article examines the data behind that trend. By comparing these funds with their sector averages over multiple timeframes, we highlight where performance has been strongest, how rankings have shifted, and what characteristics these gold focused strategies share. The aim is to provide a clear, evidence-based overview of why these funds sit at the top of the IA performance tables in 2025.

Why Gold-Focused Funds Have Led This Year’s Rankings

This year’s performance data shows that funds investing in gold mining companies have delivered some of the highest returns across the entire Investment Association universe. Independent industry reports, including findings from the World Gold Council, show that central banks have continued to purchase gold at elevated levels. At the same time, global gold mine supply has remained broadly steady, with only limited year-to-year changes. These factors have coincided with a firm pricing environment for gold over the past year.

As gold focused funds invest in mining companies rather than the metal itself, their performance has moved in line with the share prices of those companies. Many gold miners have seen stronger share prices during this period, and this has been reflected in the results of the funds that hold them. The data clearly shows that this alignment has placed gold focused strategies at the top of the 2025 performance tables, with nine of the ten strongest 1-year performers coming from this area of the market.

10 Top Performing Funds of 2025

The table below highlights the ten highest-returning funds from our analysis of 4,071 Investment Association classified funds. These results show a clear pattern in this year’s performance rankings, with gold-focused strategies occupying nine of the top ten positions. Each of the funds listed has delivered exceptional 1-year growth and has outpaced the average return of its respective sector by a wide margin. This section provides a straightforward view of where the strongest performance has been achieved in 2025.

UBS Solactive Global Pure Gold Miners UCITS ETF

The UBS Solactive Global Pure Gold Miners UCITS ETF has delivered 123.01% over the past 12 months, the highest return of all 4,071 Investment Association classified funds. It sits within the IA Commodity Natural Resources sector, where it performed far ahead of the 17.06% sector average. Its 3 year and 5 year returns of 229.76% and 187.41% also place it at the top of its sector and among the strongest performers across all sectors.

The fund’s structure means it moves in line with the companies included in its index. When gold mining companies deliver higher share prices, the fund follows this movement without any discretionary selection. Its long term results show that it has captured a large share of the growth produced by the gold mining sector whenever that part of the market has delivered stronger returns.

SVS Baker Steel Gold & Precious Metals B Acc

This fund has been one of the strongest performers across the past 1, 3 and 5 year periods, supported by its concentrated exposure to gold and precious metals companies. Its 1 year return of 121.96% places it second out of all 4,071 funds analysed and first within the IA Specialist sector. Its longer term returns of 200.13% over 3 years and 159.81% over 5 years also remain ahead of the sector average, reflecting a consistently competitive profile across multiple timeframes.

The fund invests in companies whose share prices tend to move in line with changes in the gold market, and this has been a key factor in its strong results. When gold related companies have delivered higher share prices, the fund has reflected this movement. Its multi year rankings show that it has remained closely aligned with the stronger end of the sector whenever gold focused strategies have produced higher returns.

Ninety One Global Gold I Acc GBP

Ninety One Global Gold has delivered 117.71% over the past 12 months, ranking 2 out of 213 funds in its sector. Its longer term results also remain competitive, with returns of 180.99% over 3 years and 155.77% over 5 years. These figures place it well ahead of the sector average of 40.77% and show a pattern of consistently strong performance across multiple periods.

The fund invests in a broad range of international gold mining companies, and its results reflect how these firms have performed over time. When gold related companies have delivered higher share prices, the fund has tended to follow that movement. Its multi year profile shows that it has regularly remained within the stronger end of the sector whenever gold focused strategies have produced higher returns.

WS Ruffer Gold C Acc

WS Ruffer Gold has delivered 114.68% over the past 12 months, placing it third out of 213 funds in the IA Specialist sector. Its longer term results also remain competitive, with a 5 year return of 168.06% that ranks fourth out of 188 funds. These results show a pattern of strong performance across multiple timeframes and position the fund among the sector’s higher ranked options.

The fund invests in a range of gold producers and companies linked to the gold mining industry. Its performance has reflected movements in the share prices of these firms, and the data shows that it has tended to maintain a strong position whenever gold focused companies have delivered higher returns.

SVS Sanlam Global Gold & Resources B Inc

This fund has delivered 113.44% over the past 12 months, ranking fourth out of 213 funds in the IA Specialist sector and achieving the fifth highest return of all 4,071 funds analysed. Its 3 year return of 145.27% and 5 year return of 115.27% also exceed the sector average, placing it among the more competitive performers across both shorter and longer timeframes.

The strategy invests across companies involved in gold exploration, development and production, giving it exposure to different stages of the gold mining process. This includes established producers as well as firms developing new projects, creating a blend of operational and early stage holdings. The fund’s performance has reflected movements in the share prices of companies within this group, and its multi year data shows that it has captured a substantial share of the growth delivered by gold related companies during periods of stronger sector performance.

BlackRock Gold & General D Acc

BlackRock Gold & General has returned 104.50% over the past 12 months, ranking fifth out of 213 funds in its sector and sixth out of all 4,071 funds analysed. Its 3 year return of 167.65% and 5 year return of 134.78% remain well above the sector average, giving it a strong multi year profile.

The fund focuses on established global gold mining companies and selected exploration firms, giving it a broad spread across the industry. Its performance has moved in line with share price changes across this group, and the longer term data shows that it has regularly occupied a competitive position within the precious metals sector.

WS Amati Strategic Metals B Acc

Although not exclusively focused on gold, this fund has gained from the strong rise in metal prices more broadly. It has returned 104.30% over the past year, ranking 7th from all 4,071 funds analysed for growth over the past year. Its performance is more mixed over longer periods, with a 3 year return of 58.36%, which is still ahead of its sector average.

The fund invests across a range of metal producers, with gold companies forming an important part of its holdings. This diversification can reduce extreme swings in performance, though it also means the fund does not move as sharply as pure gold funds during strong gold market periods. This year’s results reflect the benefit of having meaningful exposure to gold producers at a time when the metal has strengthened significantly.

iShares Gold Producers UCITS ETF USD

The iShares Gold Producers ETF returned 102.16% over the past 12 months, ranking first out of 522 funds in the IA Global sector for 1 year growth. Its 3 year return of 165.36% places it second out of 474 funds, and its 5 year return of 144.94% is also ahead of its sector average. This makes it one of the strongest long term performers among global ETFs with a commodity focus.

The ETF tracks a large group of gold mining companies and has benefited from this year’s broad rise across the industry. Its low ongoing charge has also helped support long term results. Because it does not select or avoid specific companies, it closely reflects the performance of the overall gold mining market, which has been particularly strong during the current upswing.

Quilter Investors Precious Metals Equity U2 Acc GBP

This fund has achieved a 1 year return of 101.36%, ranking sixth out of 213 funds in its sector. It has continued to deliver competitive multi year performance, including a 5 year return of 133.15%, which is well ahead of the sector average. These results demonstrate the fund’s close link to the fortunes of the gold mining industry.

The fund invests in a mix of global precious metals companies, with gold producers forming the core of the portfolio. As gold prices have risen, these companies have typically seen improving financial results, which has flowed through into stronger share prices. The fund tends to move in line with the overall sector, and this year that alignment has led to significant growth.

Amundi Euro Stoxx Banks Acc

This fund is the only non gold strategy to appear in the top 10 this year, with a 1 year return of 91.91% and a ranking of seventh out of 213 funds. Unlike the other top performers, it focuses on European banks rather than commodities. Its 5 year return of 307.11% is notably high, reflecting the strong recovery in European financial stocks over the period.

The fund tracks a concentrated index of major European banks, which have benefited from improving profitability and stronger balance sheets. While its inclusion in this list stands out, its performance has been driven by different forces from the nine gold funds. It highlights that although gold has dominated this year’s top performers, individual equity sectors can still produce strong results when market conditions favour them.

Portfolio Analysis Considerations

The strong performance of gold focused funds this year highlights the wide dispersion that can appear between sectors. While these funds have led the 2025 rankings, the results also show how concentrated performance can become in certain periods. For investors, this underscores the importance of reviewing whether a portfolio remains suitably diversified and whether current holdings continue to perform competitively relative to their IA sector peers.

A portfolio analysis can help identify whether exposure to specific sectors, such as gold oriented funds, is proportionate to an investor’s objectives and risk level. It can also highlight underperforming funds, duplicated strategies and allocation imbalances that may have developed over time. The purpose is not to chase strong past performance, but to ensure each holding continues to contribute effectively within a diversified strategy.

Conclusion

Gold focused funds have delivered the strongest results in the IA universe this year, with nine of the top ten performers coming from this specialist area. Their returns reflect well-documented trends in the gold market and the strong share price movements seen across many mining companies during the past 12 months. While this has shaped the 2025 performance tables, it is important to view these outcomes as part of a broader assessment of how a portfolio is built and how each fund compares with its sector over time.

A balanced approach remains essential. Reviewing a portfolio regularly helps ensure that holdings continue to perform competitively, remain aligned with an investor’s goals, and avoid becoming overly concentrated in any one area. The strong results of gold focused funds this year highlight how different sectors can perform very differently, reinforcing the value of ongoing, evidence-based assessment.