- Individual stocks have a higher cost than most diversified funds

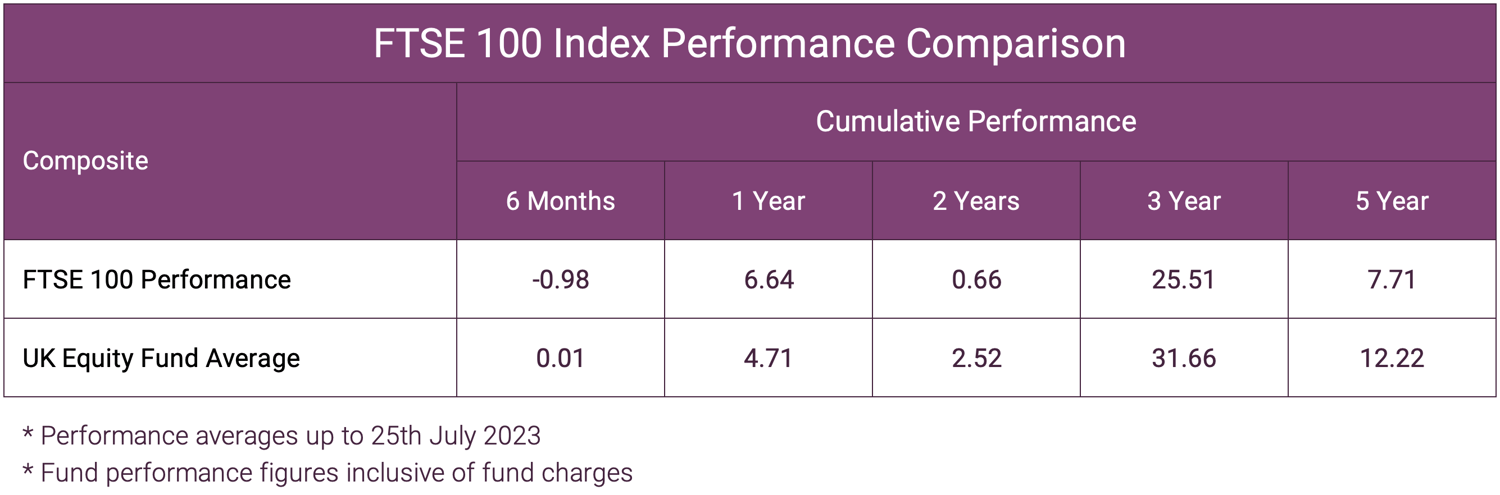

- Over 5 years, the average returns for 3 core indexes the FTSE 100, MSCI World and S&P 500 are below the average returns of funds within similar markets

- Picking winning stocks requires extensive research into factors like financial statements, management, competitors, markets, and industry trends. Whereas a quality investment fund will have a management team that will analyse all of this information

- Unlike funds, which can contain dozens of different stocks, buying shares of one company leaves you exposed. If that stock performs poorly, it can drastically drag down your overall returns, and in some cases result in catastrophic losses

Making sound investment decisions can be challenging as Investors seek opportunities that not only promise attractive returns but also minimise risks. While investing in individual stocks is enticing for many investors who are lured by the potential for huge gains, it can also be the most destructive form of investing with the potential to realise significant losses.

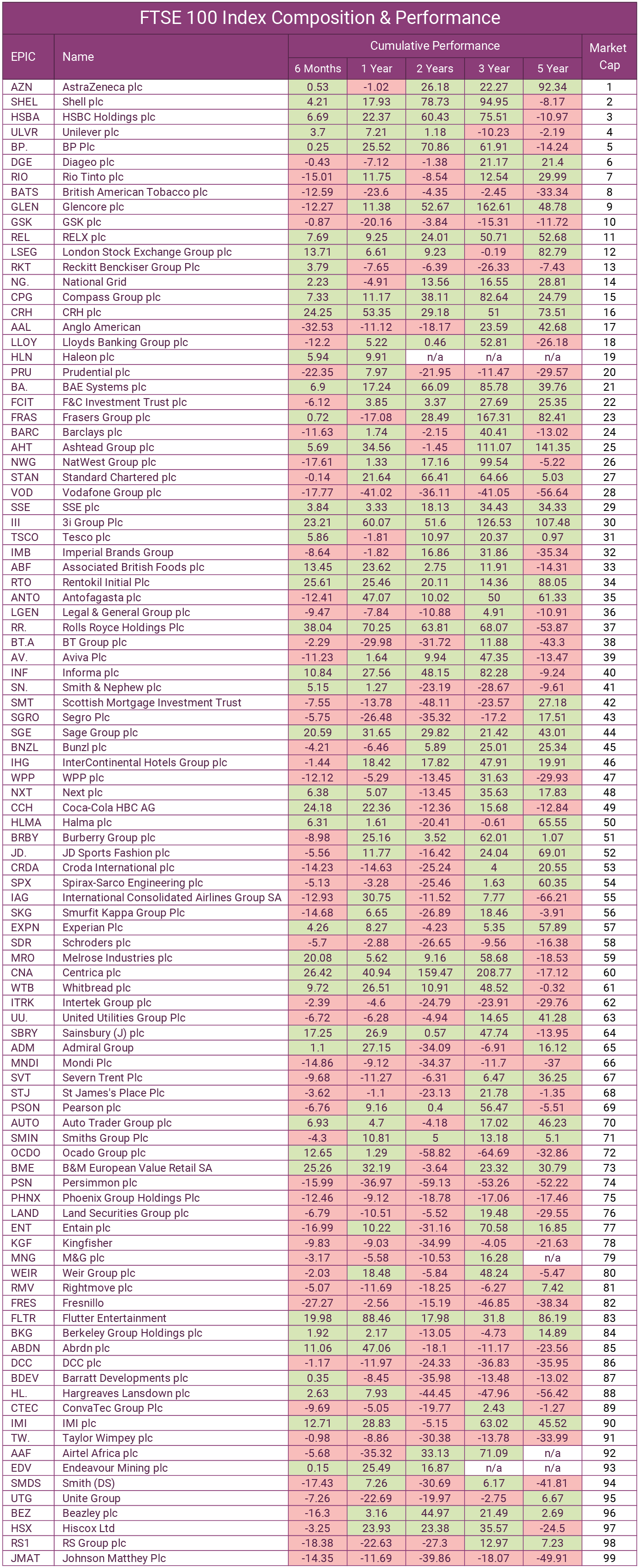

There is often a significant difference in the performance of the individual companies that make up the index, with huge returns from one mirrored by huge losses by another. It is such fluctuations in performance that makes investing in shares of individual companies a much more risky proposition for investors than simply investing in funds.

Research shows that by investing in a portfolio that is constructed of specialist, high quality performing funds within each core asset class, investors can achieve higher returns in the medium to long term, while also assuming a more modest level of investment risk.

Investment funds are managed by a fund manager or a team of managers and typically consist of shares in 30 or more companies thus spreading the risk whilst benefiting from the expertise of a team with substantial resources, company data and forecast models.

In this article, we will identify why investing in funds is a more rewarding long term strategy and how to identify investment opportunities that could help to improve portfolio performance.

The Huge Performance Fluctuations of Individual Shares

In the table below we list the companies that make up the FTSE 100, which is a stock market index that tracks the performance of the 100 largest UK companies listed on the London Stock Exchange. It includes major multinational corporations from a variety of industries like banking, oil & gas, pharmaceuticals, telecoms, and consumer goods. The index, which was launched in 1984, is managed by FTSE Russell and contains many of the largest multinational corporations that drive the British economy.

We provide the average returns for 3 core indexes the FTSE 100, MSCI World and S&P 500 and compare this average to the average returns of funds within similar markets.

We also feature each company's performance over the past 6 months, 1 year, 2 years, 3 years and 5 years. It is clear from the individual performance data that some shares have benefited from huge returns whereas others have suffered significant declines, further highlighting the risk involved of investing directly in shares. There is no doubt that the potential is there for investors to be rewarded with huge returns but due to the extremely volatile performance swings that are associated with investing in stocks they should only ever be considered by investors who fully understand the potential for sizeable losses and are accepting of the higher risk involved.

The Risks of Stock Picking for Individual Investors

The temptation of huge returns can result in stock investors to overlook the importance of diversification and make emotion based investment decisions that often overlook the expertise required to successfully invest in stocks.

There are 5 key challenges to investing in stocks that adventurous investors must take into account:

1. Diversification

Unlike funds, which can contain dozens of different stocks, buying shares of one company leaves you exposed. If that stock performs poorly, it can drastically drag down your overall returns, and in some cases result in catastrophic losses.

Investing in individual stocks can expose investors to considerable risk due to the concentrated nature of their holdings. Individual stocks provide almost no diversification across sectors and geographies as when you invest in individual stocks, you are investing in companies that are almost entirely reliant on a specific sector, region or industry. This lack of diversification can result in over exposure to the political and economic challenges of the region the company is based. It can also amplify the consequences of changes to regulation, seasonal performance and general market fluctuations.

However, when investing in funds you entrust your investments to fund managers, they carefully spread the risk across a wide array of stocks, industries, and sectors. This diversification technique aims to reduce the impact of adverse events affecting a single company, industry, or region, significantly mitigating risks. Consequently, even if a particular stock underperforms, it is offset by other well-performing stocks in the fund's portfolio, ultimately creating a more stable and resilient investment strategy.

Download our latest Fund Manager League Table

2. Research Commitments

Picking winning stocks requires extensive research into factors like financial statements, management, competitors, markets, and industry trends. Whereas a quality investment fund will have a management team that will analyse all of this information. For an individual investor, finding the time to do thorough research on multiple stocks can be very difficult. Lack of comprehensive research increases the likelihood of investing in underperforming or overvalued stocks.

3. Emotional Biases

Individual investors are more prone to emotional biases like loss aversion and overconfidence. A fund manager is more likely to follow a disciplined, unemotional approach to selecting investments and rebalancing a portfolio. Whereas individual investors are more likely to panic and sell stocks when markets decline or become irrationally exuberant when stocks are rising. This can lead to buying high and selling low.

4. Expertise

Professional fund managers devote their careers to researching companies and industries and understanding macroeconomic environments, market psychology and stock valuation techniques. An individual investor is unlikely to have the training or experience to pick stocks as effectively. Fund managers make investing decisions on behalf of many clients, while individuals are managing money primarily for themselves.

There are more than 3,000 sector classified funds available to UK investors. These funds are

managed by over 100 fund management brands with combined assets under management of £1,382 billion.

5. Increased Costs

Individual stocks have a higher cost than most diversified funds. Even if an investor is building a portfolio of individual stocks that rivals the diversification of a fund this will often involve higher trading commissions and end up being more expensive net of all fees. Fund charges are inclusive of all trading costs as well as all management fees and as they are diversified across multiple companies their combined total charges are often much lower than that of a portfolio composed of individual stocks.

Why Investing In Funds Make More Sense

There are 4 key reasons why having a portfolio of funds which are each managed by quality fund managers is more beneficial than investing in individual stocks.

-

1. Harnessing Experience and Expertise:

Quality fund managers bring with them a wealth of experience and expertise, acquired over years spent analysing the markets. Through countless market cycles, they have honed their ability to identify and capitalise on profitable investment opportunities. Unlike individual stock investors, who are often subject to the unpredictability of market fluctuations, fund managers rely on in-depth research and due diligence to select a diverse range of stocks that can weather market storms, offering investors a safeguard against the volatility of individual stocks.

-

2. Risk Mitigation through Diversification:

Investing in individual stocks can expose investors to considerable risk due to the concentrated nature of their holdings. However, when you entrust your investments to fund managers, they carefully spread the risk across a wide array of stocks, industries, and sectors. This diversification strategy aims to reduce the impact of adverse events affecting a single company, industry, or region, significantly mitigating risks. Consequently, even if a particular stock underperforms, it is offset by other well-performing stocks in the fund's portfolio, ultimately creating a more stable and resilient investment strategy.

-

3. Exclusive Insights and Networks:

Fund managers are often privy to exclusive research, data, and market insights that individual investors may not have access to. This valuable information allows them to stay ahead of the curve and identify emerging trends or industries poised for growth. Furthermore, fund managers have extensive networks of industry professionals, executives, and analysts. This network provides them with firsthand knowledge and unique opportunities that individual investors may find hard to come by. By tapping into these resources, fund managers can position their portfolios advantageously and increase the potential for superior returns.

-

4. Time-Intensive Portfolio Management:

Successfully investing in individual stocks requires constant monitoring, extensive research, and analysis. It demands a considerable investment of time and effort to keep abreast of market conditions, financial news, and company updates. In contrast, fund managers shoulder the responsibility of managing these portfolios on behalf of their investors, allowing them to focus exclusively on studying the market, spotting potential risks, and identifying profitable investment opportunities. This active management significantly reduces the burden on individual investors while benefiting from the comprehensive and timely decisions made by skilled professionals.

Average Stock Returns Are Below Average Fund Returns

The performance table of the composite companies that make up the FTSE 100 show a wide divergence in performance. If you don’t pick a stock that delivers high growth, the greater the likelihood any stock you pick will result in losses. When analysing the returns of all the companies that make up the FTSE 100 their combined average returns over a 5 year period are lower than that of the average UK Equity fund, which also carries much less risk.

FTSE 100 Index

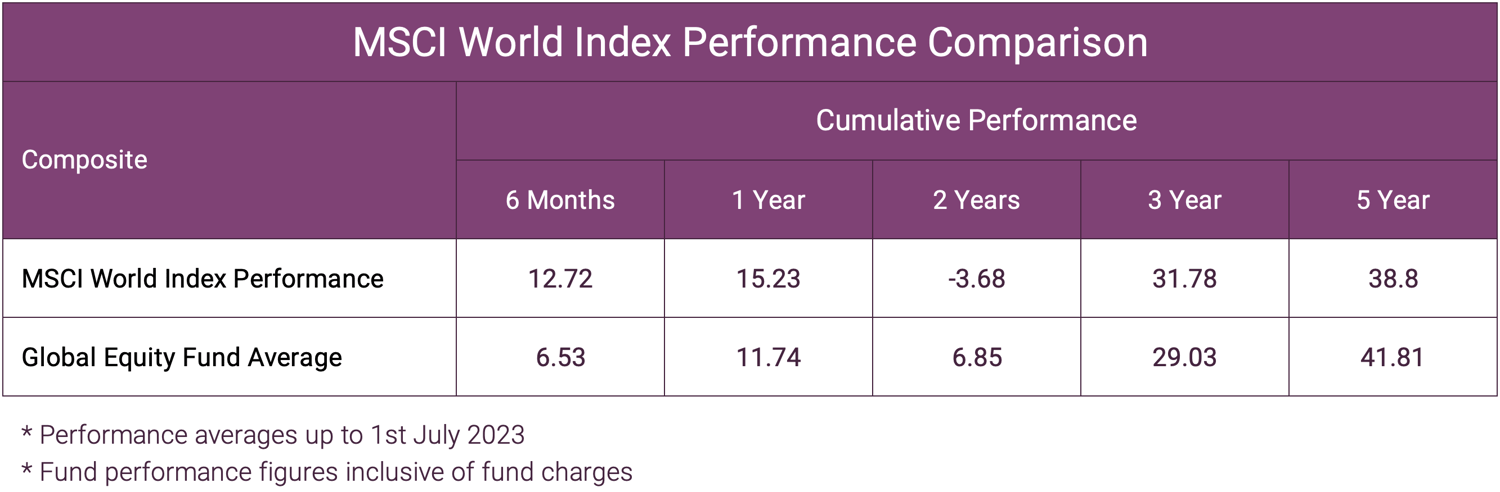

We also analysed the average returns of 2 other core indexes MSCI World and S&P 500, and compared these averages to those of funds that represent the same markets.

MSCI World Index

The MSCI World Index tracks over 1,600 stocks from 23 developed countries around the world. The index includes stocks from countries such as the United States, United Kingdom, Canada, France, Germany, Japan, and Australia. It is rebalanced quarterly by MSCI to ensure new market developments are incorporated. It covers companies across many different industries and sectors like technology, healthcare, financial services, and consumer products.

The index functions as a benchmark that investment managers aim to beat with their funds. As it is a Global Index the companies included in the Index are Global brands that are not primarily reliant on any specific region such as the UK for companies within the FTSE 100.

The above table also shows that over a longer 5 year period the average performance of Global funds outperforms the average performance of the 1600 global companies within the MSCI World Index.

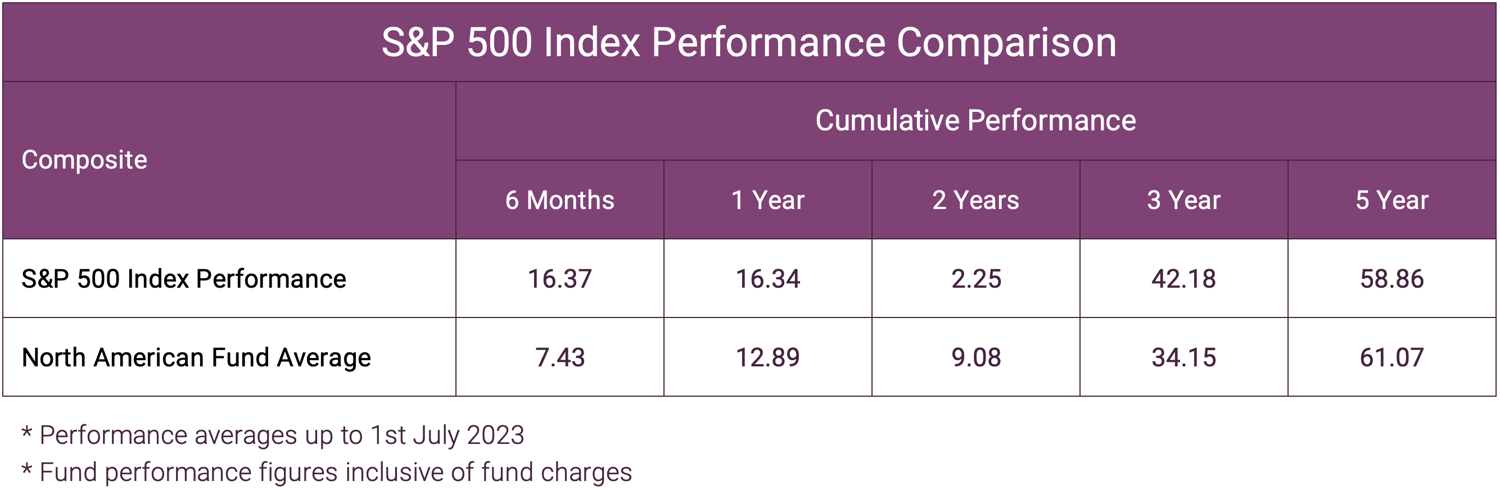

S&P 500

The S&P 500 is a stock market index that tracks the stocks of 500 large-cap U.S. companies. It is one of the most commonly followed equity indices and is widely regarded as the best gauge of the overall U.S. stock market. The largest components of the S&P 500 are some of the largest and most influential companies in the world with Apple, Microsoft, Amazon, Tesla and Nvidia among the largest constituents.

When analysing the average performance of the companies within the S&P 500 it once again shows that over a 5 year cycle North American equity funds have on average delivered higher returns.

While investing in individual stocks may sometimes outperform funds during certain periods, the added risks mean stocks are generally better suited for speculation than for core long-term portfolio holdings.

Investing In Top Performing Funds

Fund managers who specialise in a sector like technology, a region like emerging markets, or an asset class like high-yield bonds have several advantages over generalist fund managers. Their deeper knowledge and experience in their area of focus allows them to more effectively evaluate risks and identify opportunities.

For example, a manager who has analysed Asian markets for over a decade will have better insights into the nuances of companies, currencies, and political developments across the region. This experiential knowledge is very difficult to replicate and gives them an edge in picking the best stocks or bonds to generate long-term returns.

By combining actively managed funds in your key areas of interest with low-cost index funds for broader market exposure, you can build a balanced portfolio that effectively leverages expertise within sectors while maintaining prudent diversity. Just be sure to evaluate each fund manager’s experience, track record, and costs before investing.

Quality Is King When Investing In Funds

There are more than 3,000 sector classified funds available to UK investors. Identifying which are the best funds that offer the most value is an important aspect of successful investing as in the fund management industry, like any industry, there are those who do a better job than others. The fact is, only 15% of available funds have a history of consistent outperformance.

Investing in quality may sound obvious, but the reality is many investors either don’t do this or do not have a good definition of a high quality fund.

There is no shortage of underperforming funds. As an investor, it is up to you or your adviser to seek out the quality investment opportunities.

What Makes A Quality Fund

Quality funds are managed by fund managers who are specialists in their sectors. They have a deep understanding of each company, industry and region in which they invest and only provide exposure to high-quality, market leading companies that have the potential to generate significant long term growth. These funds are much more likely to outperform in relatively stable as well as positive market conditions, but they can experience periods of underperformance when markets are in a negative cycle. As investment markets experience significantly more periods of up’s than down’s, investing in quality is much more likely to provide the best outcomes.

Efficient Investing

At Yodelar Investments our portfolios are constructed using a mix of actively managed and tracker funds, weighted to different risk strategies that are designed to provide investors with exceptional growth opportunities. Rather than simply tracking a benchmark our portfolios contain funds that are managed by experts who specialise within their target sector and asset class. As such, these fund managers have the ability to actively analyse market trends, identify investment opportunities, and make more dynamic investment decisions.

While past performance is not a guarantee of future returns, funds with a proven track record of generating above sector average returns indicate the presence of skilled fund managers, effective investment strategies, and robust research capabilities, which can continue to drive outperformance in the future. We do not feel it is a lot to ask that a fund manager achieve the top 25% in their sector, or above the sector average.

Summary

Top performance and quality portfolio management are both key to truly successful investing. Investing is about maximising returns within an acceptable level of risk, and a portfolio that has been built based on investing in individual stocks is not the most efficient strategy in the vast majority of instances.

At Yodelar, we understand that the real value from investing is not in the short term gain from saving on fees but from the long term value of investing in portfolios that focus on quality.

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research identified that only a small proportion of funds and fund managers have consistently delivered top performance, with more than 90% of the portfolios we reviewed containing funds that continually underdeliver. This research has enabled us to identify efficient processes and top-quality investments which we have utilised to ensure our portfolios are built using only the top quality funds within each asset class with excellent potential for growth.