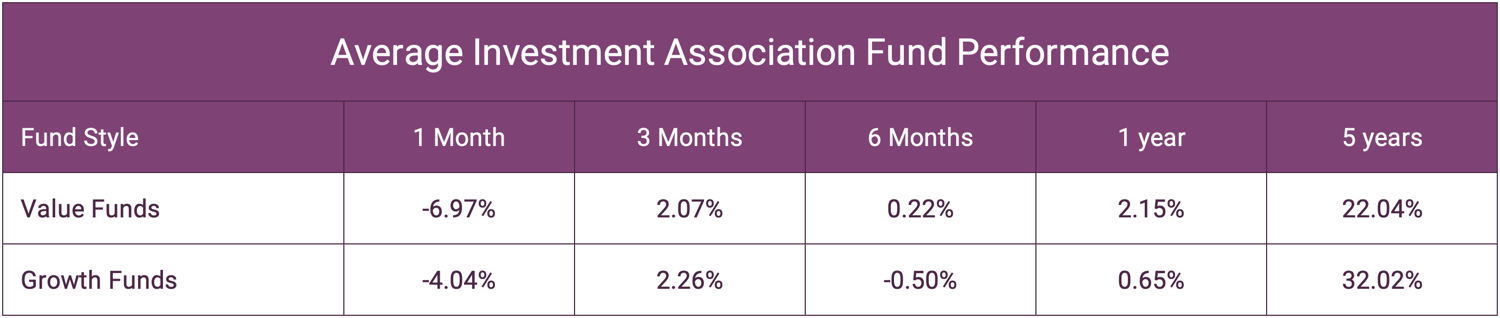

- Growth funds outperformed value funds in the 1st quarter of 2023 for the first time since 2021.

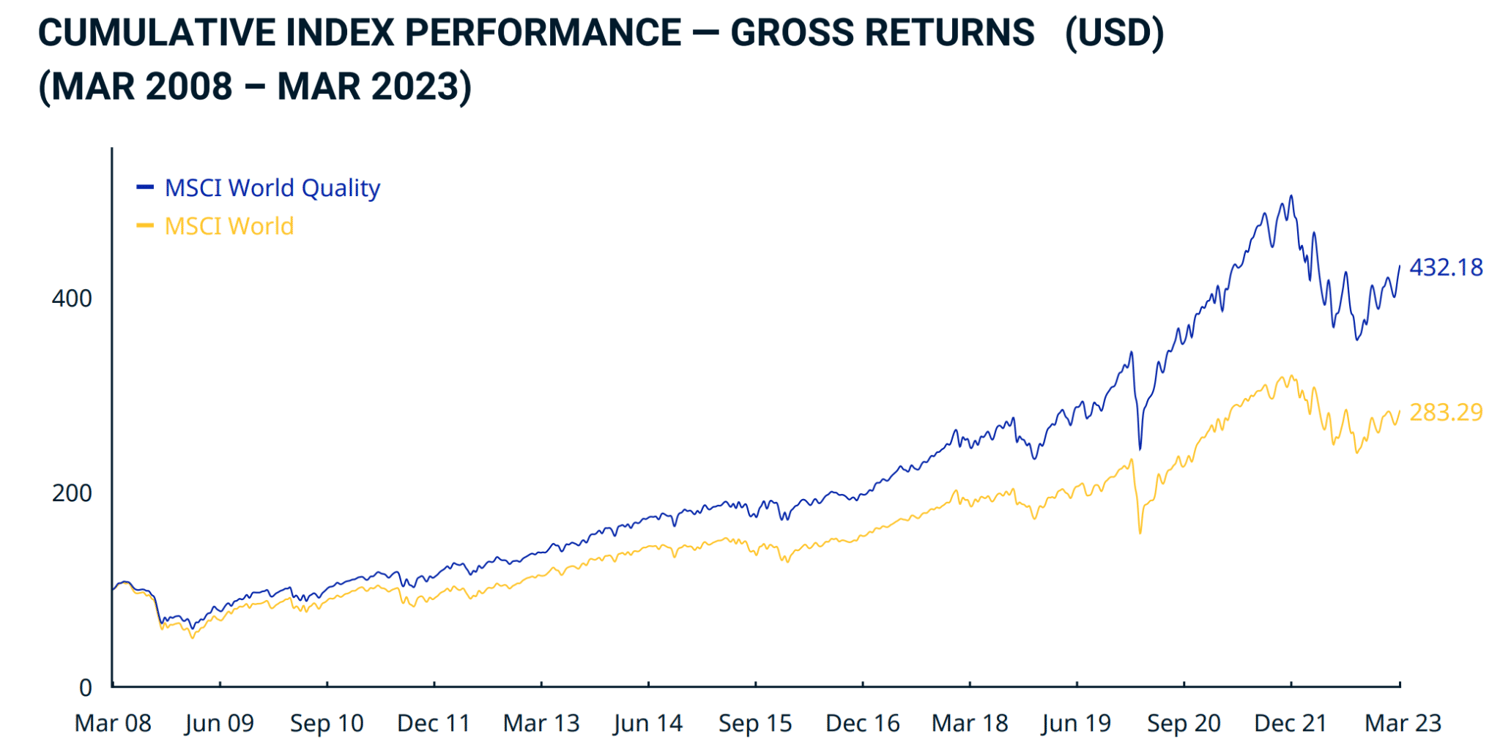

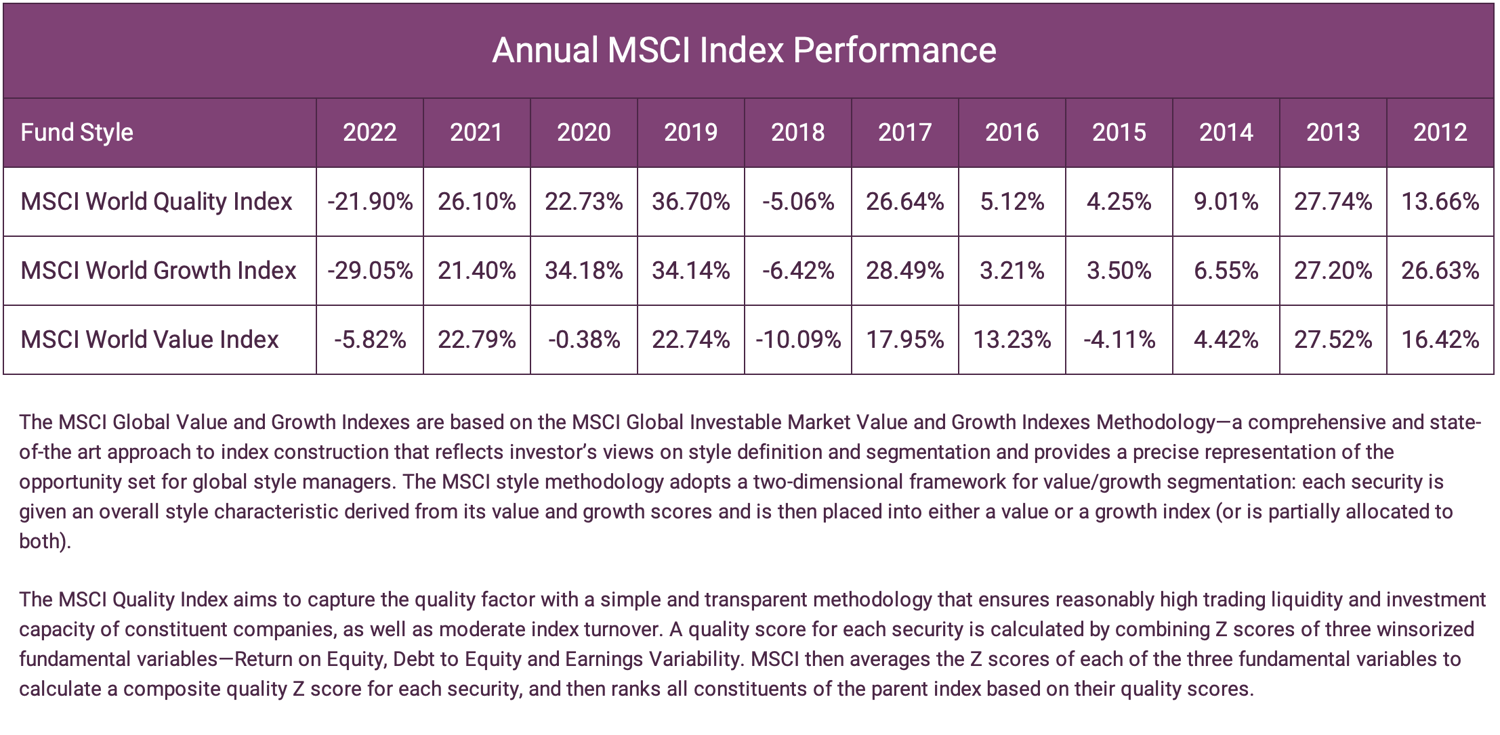

- Value funds have outperformed growth funds in only 4 of the past 11 years

Identifying quality funds is key to investment success. - Over the past 11 years growth funds averaged annual returns of 13.62% compared to 9.52% for value funds.

The past 18 months has been a difficult time for investors as markets spiralled into a negative cycle resulting in broad declines in portfolio valuations for almost all investors.

There are growing signs that markets are about to improve and in this article, we assess the differences between value and growth strategies and identify why now is a crucial time to ensure you are invested in the best strategy.

Growth & Value Funds What Is The Difference?

Growth and value funds represent two very distinct investment strategies.

Growth funds hold shares of companies that are expected to grow at a faster rate than the overall market. These companies typically reinvest their profits back into the business to fund expansion, research and development, or marketing, rather than paying dividends to shareholders. Growth companies often operate in industries that are rapidly expanding, such as technology or biotech, and may not be profitable yet, but they have a high potential for future growth. However, a negative of growth funds is that they tend to be more volatile during negative market cycles.

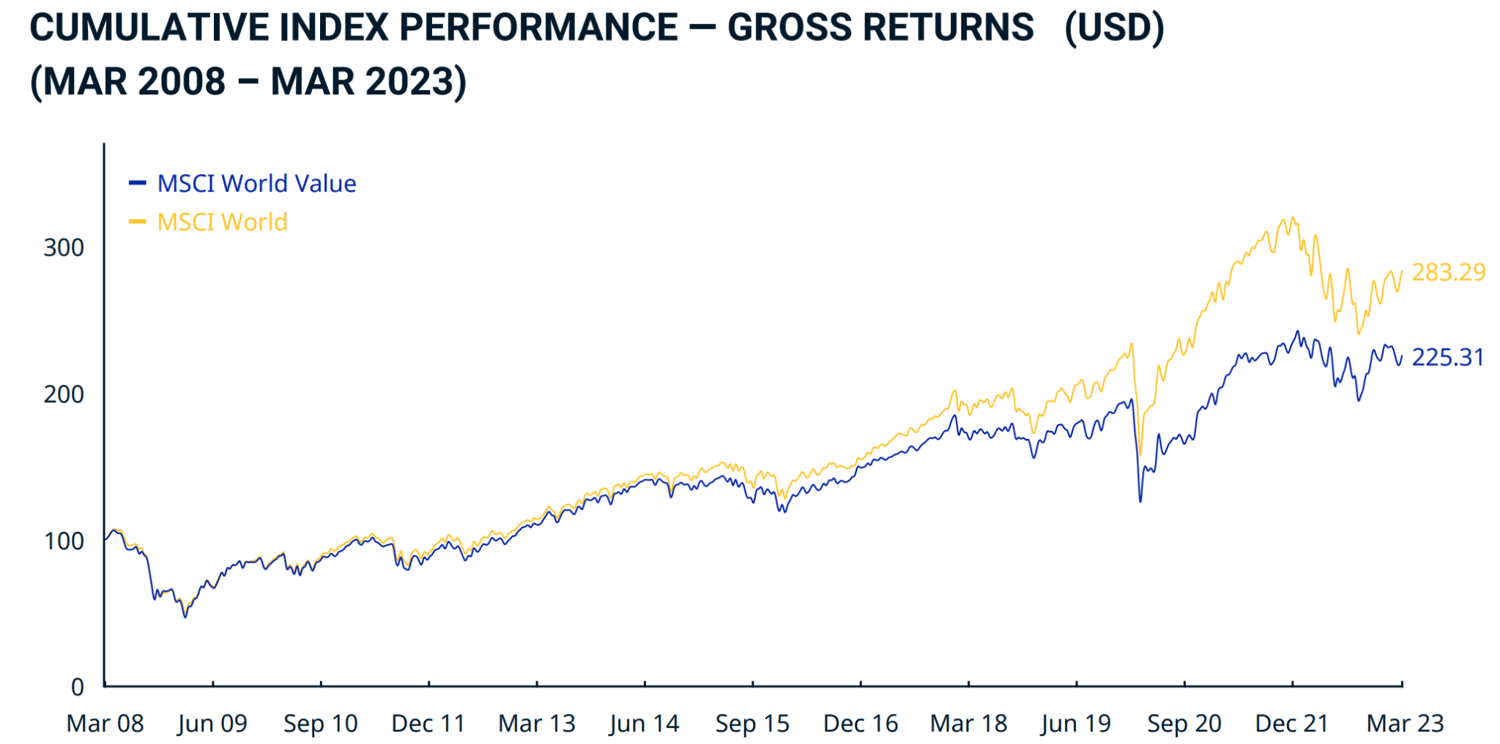

Value funds, on the other hand, hold shares of companies that are deemed undervalued by the market. Value investors look for companies that are trading at what they believe to be a discount to their intrinsic value and have a margin of safety. Although the valuation of the stocks value funds invest in can be low, this can be due to the quality of the business rather than the company being underpriced. As such, not all value funds offer real ‘value’. Also, value funds tend to underperform during periods of stability and market growth.

Value Funds Have Been Popular In 2022 But Should Growth Now Be The Focus?

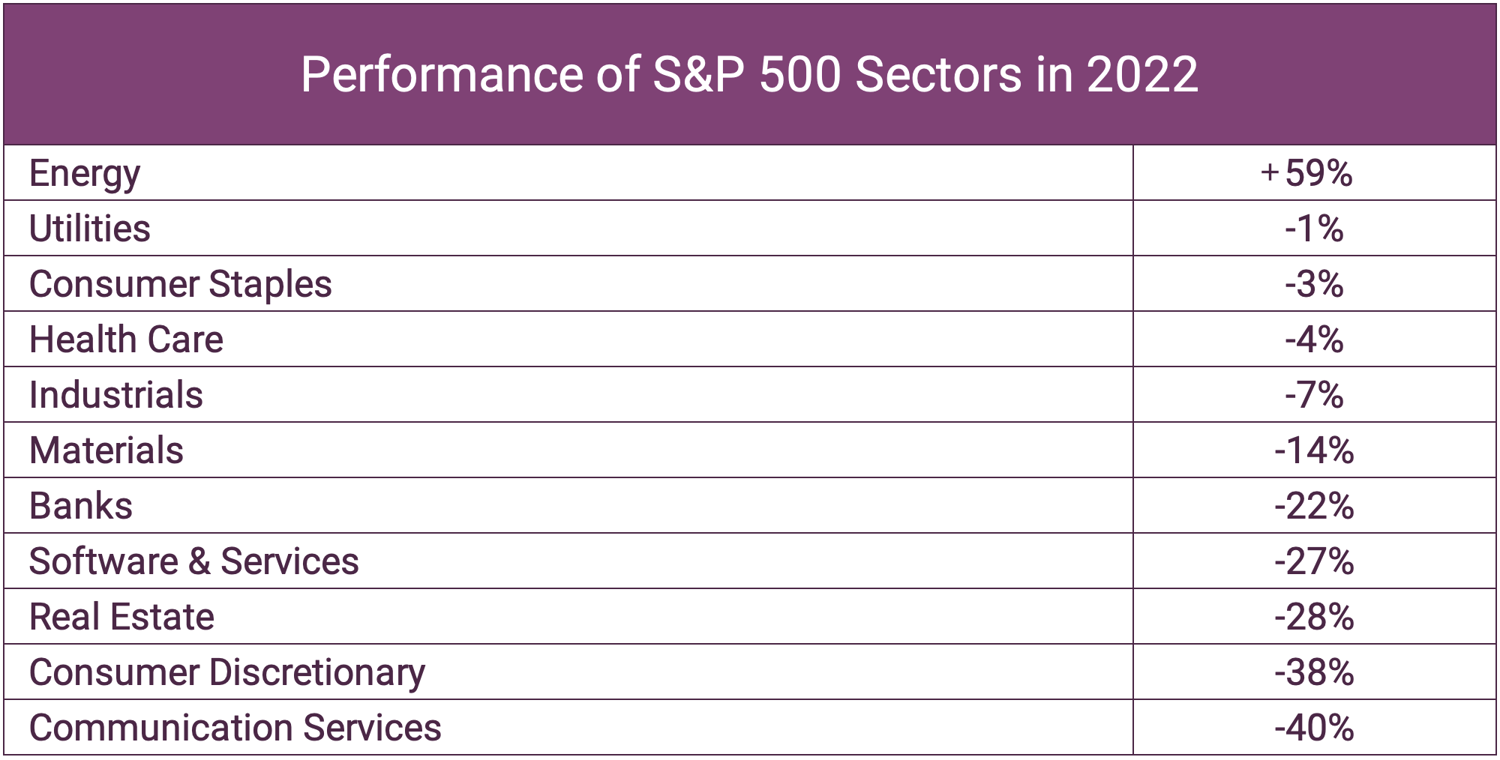

The turbulence of investment markets over the past 18 months has caused a significant swing in portfolio values, with almost all sectors negatively impacted during this highly volatile period. The period resulted in a strategy shift for many investors as protection and mitigating against excess losses drove investment decisions as panic resulted in the abandonment of many medium to long term growth strategies.

Value funds have performed better than growth and quality funds in 2022, but unless you are planning on encashing your investments in the very near future, this doesn’t mean much.

As the table above shows, the first quarter of 2023 has shown a performance shift between value and growth funds for the first time since the bear market took effect at the end of 2021. Although markets are by no means in a growth phase, those who moved into value funds must now reevaluate their strategy or risk missing out on the rebound when markets recover.

What Factors Will Decide If 2023 Will Be A Year For Growth or Value Funds

The UK economy escaped a recession and interest rates here are forecast to come down in the near future. While this is a huge positive for the economy and UK markets, globally it will have limited weighting. Much of how global markets perform will be dictated by the American economy.

There are 3 scenarios that will likely decide how 2023 will perform for investors.

1. If inflation has peaked, and the U.S economy escapes a recession. If so, all equities will likely rally, but growth stocks will perform best, retracing much of their lost ground as the Federal Reserve gradually lowers interest rates. Goldman Sachs forecasts that there is approximately a 35% chance that the U.S will dip into a recession in 2023, which lends itself to favour a year that is much better than 2022 and most likely one that favours growth over value.

2. If inflation has peaked, but the U.S economy goes into recession this will be less pleasant but still relatively strong for growth stocks as they would benefit both from declining interest rates and from the strength of their business operations. This would also favour growth over value.

3. The scenario that would favour a value strategy would be if inflation was yet to peak and further interest rate rises were on the horizon.

Of course, these are only three scenarios. As we have seen with the pandemic and more recently the war in Ukraine and subsequent energy crisis, a lot can happen that can have a significant impact on investment markets. Nevertheless, the economic outlook and the recent market performance does offer some clues about what the rest of the year might bring.

Are You Focused On Growth or Looking For Value?

As shown in the tables below, the performance of Value funds unsurprisingly performed better in 2022 than funds with a growth strategy but it also highlights how Value funds over a longer period do not perform as well.

Although funds with a growth focused strategy mainly average better returns only a small percentage of both growth and value funds are actually high quality funds.

There are almost 4,000 sector classified funds within the Investment Association universe with less than 15% that manage to consistently rank highly within their sectors over a 1, 3 & 5 year period. It is these high quality funds, within a suitably diversified portfolio that provide investors with the best opportunities for long term growth.

The table below, identifies that with the exception of 2022 which was comparatively the best year for value funds in recent history, quality funds significantly outperformed the average value fund in 9 of the past 11 years and outperformed the average growth fund in 8 of the past 11 years.

Quality Is King

Most fund managers own too many stocks. Apart from making their performance track the indices, which you can achieve much more cheaply with an index fund, this also makes it difficult for them to invest in the companies they own with conviction. How much can a fund manager know about the 80th company in their funds portfolio?

The reality is, there is no shortage of underperforming funds whether or not markets favour value or growth strategies. Above all else, it is seeking out the quality investment opportunities that should drive investment decisions.

Investing in quality may sound obvious, but the reality is many investors either don’t do this or do not have a good definition of a high quality fund.

What Makes A Quality Fund

Quality funds are managed by fund managers who are specialists in their sectors. They have a deep understanding of each company, industry and region in which they invest and only provide exposure to high-quality, market leading companies that have the potential to generate significant long term growth. These funds are much more likely to outperform in relatively stable as well as positive market conditions, but they can experience periods of underperformance when markets are in a negative cycle. But as investment markets experience significantly more periods of up’s than down’s, investing in quality is much more likely to provide the best outcomes.

Quality Investing Avoids Short Term Performance

Whilst a period of underperformance against the index is never welcome it is nonetheless inevitable. No investment strategy will outperform in every reporting period and every type of market condition. So, as much as we may not like it, investors must expect some periods of underperformance. Underperforming the MSCI World Index is one issue, registering a fall in value is another. In 2022 unless you restricted your equity investments to the energy sector you were almost certain to have experienced a drop in value:

Trying to navigate the peaks and valleys of market returns, investors naturally want to jump in at the lows and cash out at the highs. But no one can predict when these will occur. Of course we’d all like to avoid declines. The anxiety that keeps investors on the sidelines may save them some pain, but it will also ensure they miss out on market gains. Historically, each downturn has been followed by an eventual upswing.

Time, not timing, is what matters

Timing The Markets Is Never A Good Strategy

Looking back over a market cycle it is easy to see which funds and markets would have been good to invest in and which would have been good to avoid. But the issue here is the funds that would have been better to invest in during negative market cycles are very often not the funds you want to be invested in when markets recover - which they inevitably will do.

Trying to transition from a positive growth cycle into a negative cycle and then out of a negative market cycle into a growth cycle - which is typically over a relatively short time frame, is just simply a bad idea.

For an investor to time a market cycle correctly they would need to do it twice, once at the beginning of the cycle and again at the end of the cycle. This is almost impossible. Luck is not a strategy, and should therefore never be relied upon. The only reasonable fund strategy that an investor should follow is one that involves investing in quality funds for a period of at least 5 years, ignoring short term market turbulence and focusing on medium to long term outcomes.

What many investors often forget, is that they will only realise growth or loss from their investments when they sell them. The period in between simply represents the values at that time. Therefore, as an investor, unless you need access to your investment money in the near future, it is best to focus on the quality of the funds you are invested in and not their current values.

The Pitfalls of Switching Between A Value & Growth Focus

The reality is that many of the investors who sold off and replaced their funds during the negative cycle of the past 18 months would have done so after their values had already declined, locking in those losses. Although any changes they made may have mitigated against further losses, they will likely miss out on the best part of any market recovery because as mentioned previously, the types of funds that do better during negative cycles are unlikely to be the ones that benefit most when markets recover. Therefore, unless they sell off their current batch of funds and buy back into better quality growth focused funds at the right time they could miss out on significantly more growth than from any savings they may have made.

Summary

The outcome from this analysis is that on average growth funds do better than value funds but as an investor it is quality that is important and if your portfolio is made up of high quality funds, irrespective of short term cycles it is significantly more likely to outperform in the medium to long term.

Top performance and quality portfolio management are both key to truly successful investing. Investing is about maximising returns within an acceptable level of risk but for most investors, their current investment portfolios do not achieve this.

At Yodelar, we understand that the real value from investing is not in the short term gain from saving on fees but from the long term value of investing in portfolios that focus on quality.

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research identified that only a small proportion of funds and fund managers have consistently delivered top performance, with more than 90% of the portfolios we reviewed containing funds that continually underdeliver. This research has enabled us to identify efficient processes and top-quality investments which we have utilised to ensure our portfolios are built using only the top quality funds within each asset class with excellent potential for growth.