In this article we review the 10 most important aspects of investing. Our 10 point plan is something every investor should review to ensure they are investing efficiently in 2021.

How Yodelar Portfolios Outperform

The following 10 point plan contains core aspects regularly reviewed by our Investment Committee when building and maintaining efficient investment portfolios for our clients.

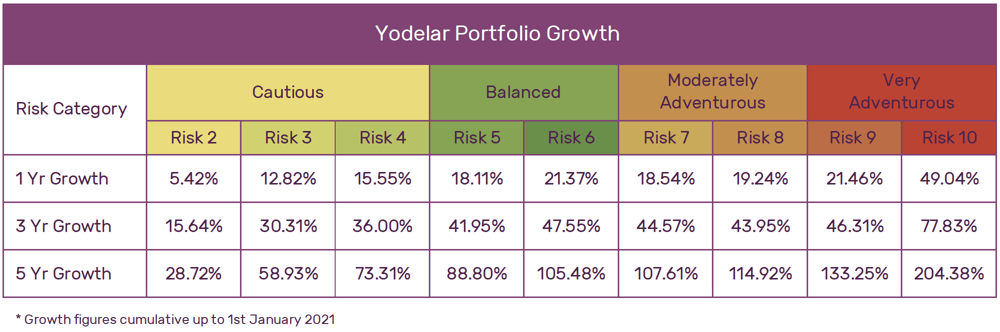

During the past year, 100% of the funds across all Yodelar portfolios ranked in the top half of their sectors On average the funds within our portfolios outperformed their sector median by 142%. This consistency combined with an efficient asset balance ensured comparatively strong performance for each of our growth-focused portfolios.

Our secret is ‘People’, we use the most experienced and productive fund managers in the various sectors suitable to our clients risk profile. Our role is to ensure our clients use the best people/fund managers who have a proven track record to produce better returns that the poorer performing fund managers so many investors invest in without knowing.

The 10 principles featured in this article, if managed well by you or your adviser will ensure you maintain a quality risk based portfolio for 2021.

-

1. Manage Your Risk

The asset allocation model of your portfolio is the single most important aspect of investing, and is critical to ensuring your portfolio does not assume more or less risk than you are comfortable with. Investing in funds across varying asset classes allows you to diversify, minimising the impact on your portfolio should one sector take a dip.

But for many the lure of performance can lead them to make investment decisions that can have huge implications on their portfolio. When a particular sector performs well, investors without a disciplined strategy may be tempted to abandon their asset allocation model to increase their exposure to such markets. But such an approach makes investors vulnerable to market corrections.

In our experience, the vast majority of self investors who manage their own portfolio do not manage the asset allocation and associated risk of their portfolio well. Many advice led clients are also not receiving regular risk assessments and rebalances of the asset classes within their portfolio.

For most, a broadly diversified portfolio of equities and fixed interest bonds, that is annually or semi-annually monitored and rebalanced will produce a reasonably structured portfolio that is both controlled and cost-effective.

Efficient investment advice firms can add value by helping investors to set an appropriate strategy for periodically rebalancing their portfolios in a non-emotional, cost-effective and impartial way.

-

2. Good Fund Selection

Fund performance is a critical metric that efficient investors and high-quality advice firms analyse to help ensure their portfolios productively meet objectives while utilising the proven top-performing fund managers. Top advisers want to ensure the portfolios they recommend use quality fund managers.

Past performance is not a guarantee of future returns, but when asked, investors would prefer to invest with fund managers that consistently perform over varying time frames in the top 25% of their sector versus fund managers that perform in the worst 25%.

Although future performance is never guaranteed it is reasonable to assume the funds which have proven their consistency over a 5-year period, will continue to outperform their peers in the future. These individual fund managers demonstrate a consistency in their ability to do their job well.

Selecting funds that consistently perform better than their peers and fit within a suitable asset allocation model will help investors to maximise their portfolio growth potential.

If using a financial adviser make sure you are partnered with someone that has performance knowledge and who can demonstrate that easily. As fund performance is not a regulated requirement of financial planning, financial advisers are not required to research the performance of funds. As a result, a large proportion of advisers have a poor level of knowledge in relation to fund performance. By ensuring your portfolio contains only consistently top-performing funds, within an asset allocation model suitable to your risk profile, you have covered the 2 main aspects of maintaining an efficient portfolio.

-

3. Use Quality Fund Managers

Each fund’s performance can be compared alongside all other competing funds that are classified within the same sector. How each fund compares can identify the quality of the fund and the competence of the fund manager.

For those that have maintained a high level of comparative performance, it is reasonable to assume they are more competent than those same sector managers that cannot

-

4. Balance Quality Funds & Asset Allocation

The balance of investments across different asset classes is the primary driver of portfolio returns, but the funds used to create the correct balance are essential to maximising portfolio growth and efficiency. This is core to the strategy of Yodelar Investment portfolios.

For example, a fund manager might take on a strategy favouring particular industry sectors over others when constructing their fund. Even though the fund might invest primarily in industries such as travel or tourism it can have the same sector classification as a competing fund which has a similar asset class but instead the fund manager might prefer to hold greater weighting in technology or healthcare companies.

The outcome can be significant and one that can see a fund rank highly within its sector or one that sees the fund languish among the worst performers.

Formulating the appropriate blend of investment funds to fit a portfolio’s specified asset allocation model and optimise growth potential is a complex process that requires thorough analysis. It is an important part of our investment committee’s strategy and one which we believe provides investors with optimal investment portfolios for all market conditions.

When building our portfolios we utilise funds that we believe represent the best choice to fit the assets for our asset allocation models. The funds we select are 4 and 5 star rated funds based on performance history. As we can never be sure how they will perform we monitor their performance monthly. From time to time a fund's performance may dip compared to their sector peers and result in a rating fall to 3 stars. For these funds, we monitor them using our traffic light system. This allows the funds time to recover should the dip be short term but it also avoids us replacing funds needlessly at the expense of the investor.

-

5. Invest For Growth

Investing by definition is about putting money to use by purchase or expenditure, in something offering potential profitable returns - Yet for some investors, growing their money is not the primary driver in their investment decisions.

In recent years, the cost of investing has become more influential, with some investors focusing more at how much they can save in fees compared to the quality of investment products that offer the best potential for returns.

Such an approach can prove to be costly resulting in investors missing out on returns that significantly outweigh the savings from investing in low-cost portfolios.

Each sector will have consistently top-performing funds when compared to all same sector funds. Those that prioritise experience and consistent performance first, and cost to invest second make use the better performing competitive funds, and generate better returns.

To achieve maximum efficiency from your portfolio it is important to distinguish the value between a high quality, possibly more expensive product, to that of a lower-priced poor-performing alternative. Cost and growth must be a balanced assessment based on factual information.

-

6. Don’t Sacrifice Balance For Growth

Many investors spend substantial time defining their investment goals and selecting an asset allocation to help them achieve those goals while also being mindful of their tolerance to risk. To meet their objectives they must be able to stick with an appropriate investment plan in all kinds of markets.

But for some, the lure of performance can lead them to make investment decisions that can have huge implications. For instance, when a particular sector such as the North American or the Technology sector performs strongly, investors without a disciplined strategy may be tempted to abandon their asset allocation model to increase their exposure to these markets. But such an approach makes investors vulnerable to a market correction, which could have a huge impact on their chances of meeting their financial goals.

-

7. Choose Quality Over Cost

The impact of fees is also less than many are led to believe. For example, an initial investment of £250,000 into an investment portfolio with an initial management fee of 2% and an ongoing portfolio and management fee of 1.49% (Yodelar High Cautious Portfolio) will have a higher value after 5 years than a portfolio where the initial and ongoing fees are just 0.3% simply by maintaining an annual level of growth that is on average 1.65% higher.

To put this into perspective, over the past 5 years the Yodelar Mid Balanced portfolio had an average annual growth of 21.10% compared to 11.25% for the similar risk-rated Vanguard LifeStrategy 60% Equity portfolio, which is a popular passive portfolio that is viewed as one of the best of its kind on the market.

It is also important to recognise that low-cost portfolio providers are forced to maintain their low fee structure in order to maintain the viability of their proposition. As a consequence, they are forced to overlook many high-quality funds that do not fit their cost structure in favour of lower-priced, and often lower growth alternatives.

When it comes to investing, cost will and should always be an important consideration, but it should never be the dominant factor. Investing is about growth and although many low-cost portfolios do just that, they have a deep-rooted flaw that will always limit their potential. As a consequence, the real value from investing is not in the short term gain from saving on fees but from the long-term value of investing in portfolios that focus on quality.

8. Protection

As an investor, your investments are protected by the Financial Services Compensation Scheme (FSCS). The FSCS is the UK’s statutory compensation scheme for customers of financial products that have failed. For investors, this means it can pay compensation if a firm who is responsible for a fund you are invested in is unable, or likely to be unable, to pay claims against it.

FSCS is free to consumers and, since 2001, has helped more than 4.5 million people and paid out more than £26 billion.

The risk for investors is ‘should a fund management brand who owns/manages the funds you are invested in fail to cover their commitments then your money could be at risk’.

Restricted firms that only sell their own funds, as well as multi-asset funds and ready made portfolios, provide products that are owned and operated by one fund management brand. This means that any investment in such products above £85,000 will not be protected by the FSCS.

The chances of a fund management firm failing are small but as highlighted by the fall of the UK’s most recognisable fund manager Neil Woodford, protecting against such scenarios should not be overlooked.

To maximise protection under the FSCS and mitigate the risk of a fund provider failing investors must spread their portfolio of funds across several different providers. Yodelar Investments employs a comprehensive process for building and maintaining efficient portfolios for performance and security.

The selection process for the funds and fund managers we use within our investment portfolios require them to meet key performance metrics, but their inclusion is also based on other criteria such as how well-established the management firm is, the field of expertise of the fund manager, the consistency of their funds and their fund charges.

We use such information to help ensure the funds that we invest our client’s money in are highly efficient and consistently good performing. For enhanced security, through the FSCS we also ensure that our portfolios are balanced across several different fund management brands.

9. Maintain A Suitable Balance

Against a constantly changing world, the most efficient investment outcome is often achieved using a blend of investments across several asset classes. A portfolio of diversified assets can shield a portfolio from the effects of market volatility, beat inflation, and provide long term capital growth as well as a regular income if required.

Rebalancing is a critical component of investment management and without it the level of risk you assume with your investments can change significantly. It might seem surprising that your portfolio's risk level could change even if you didn't change any of your investments. But when one asset class is doing better than the others, your portfolio could become "overweight" in that asset class.

For example, imagine you selected an asset allocation of 50% equities and 50% bonds. If 4 years go by during which stocks return an average of 8% a year and bonds 2%, you'll find that your new asset mix is more like 56% stocks and 44% bonds.

In a nutshell, the purpose of rebalancing is to maintain a desired risk-reward ratio in an investment strategy. Rebalancing can consist of strategically selling investments and buying others in order to maintain an appropriate asset allocation, or it can consist of adding new funds and investing them in a strategic manner.

All Yodelar portfolios are continually monitored and rebalanced every quarter to mitigate such risk, correct portfolio drift and to ensure the asset allocation of each portfolio maintains maximum efficiency.

-

10. Review Your Portfolio Performance

As an investor, a large portion of your assets are locked away for long periods of time, it is a significant financial commitment and one which success is primarily based on the quality of the fund and fund managers selected. Despite the importance of investment decisions, many investors are unaware that the funds in which they entrust their money are often of low-quality, and as a consequence, their portfolios lack efficiency and deliver diluted returns.

For many investors, the reality is they could achieve substantially greater portfolio growth by placing their money within proven, high-quality funds that have consistently outperformed their peers. But the only way to determine how efficient a portfolio is performing is by comparing the performance and ranking of each fund within a portfolio to all other funds within their specified sector. It is a service that all investors should utilise to gain a factual understanding as to how each of their individual funds has performed and how their portfolio as a whole compares to similar risk-rated portfolios.

Optimal Investing

Our research has identified that the majority of investors are missing out on extra portfolio growth due to subpar fund choices and general inefficiencies in their portfolio. Inefficient investing will undoubtedly have adverse long-term consequences, which is why it is so important to be able to identify and correct any portfolio deficiencies.

Investing is about maximising returns within an acceptable level of risk and Yodelar portfolios are designed to deliver just that. They have been built to follow the asset allocation model as defined by the UK's leading asset allocation and risk profiler and contain a blend of consistently top-performing funds whose weighting has been balanced to make efficient use of their underlying assets.

Get in touch today if you would like to discuss your 2021 investment strategy. Click Here to book a call with a member of our team, or visit our homepage to chat online.