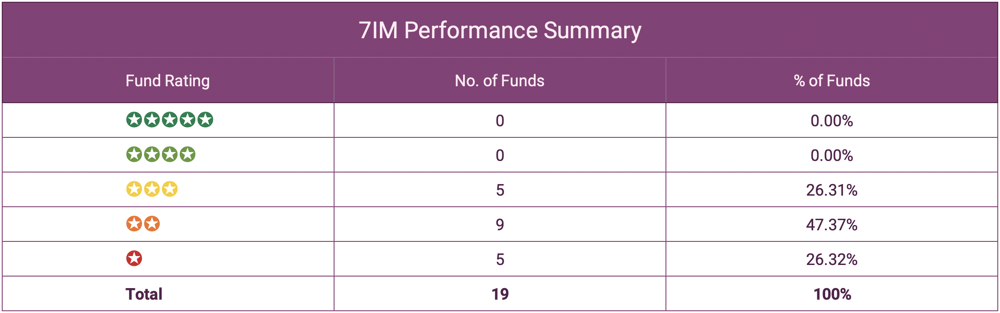

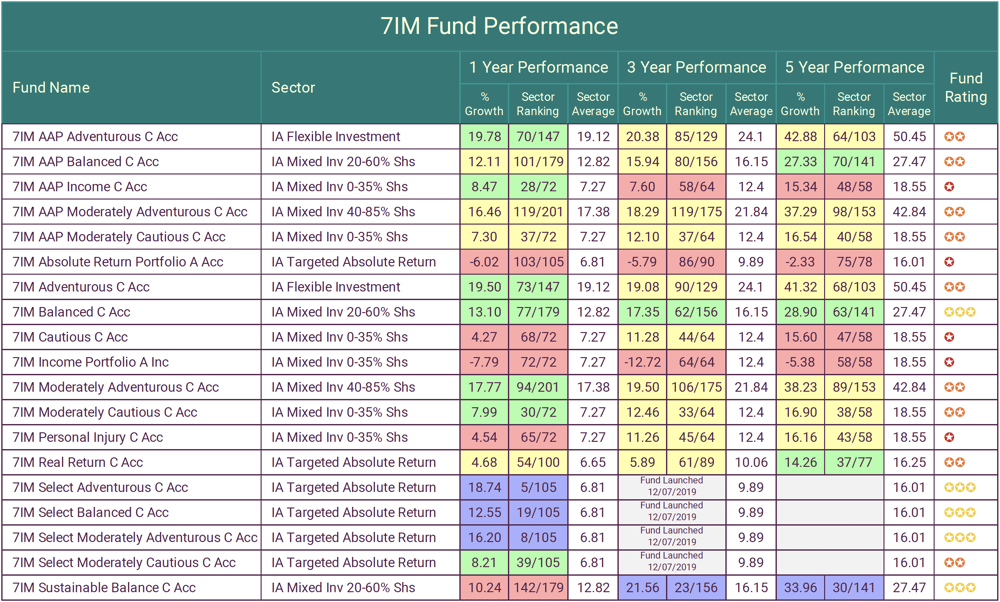

- 73.69% of the 19 7IM funds analysed received a poor performing 1 or 2-star rating.

- The recently launched 7IM Select fund range has ranked among the best in their sectors over the past year.

- The 7IM Income Portfolio has been the worst-performing fund in its sector over the past 1, 3 & 5 years

- Over the past 5 years, the 7IM Sustainable Balance fund returned growth of 33.96%, which was comfortably better than the 27.47% sector average.

7IM is an investment management company that was founded in 2002 and have grown to become a widely respected and trusted provider of quality funds and investment portfolios. They pride themselves on their dedication to managing wealth consistently with structure, rigour and discipline and through their range of funds they currently manage over £5.2 billion on behalf of their clients.

7IM are an ambitious firm who have actively tried to increase their funds under management through acquisitions, and just last year they agreed on a deal to purchase London-based advice firm Partners Wealth Management.

Despite their ambitions to grow the firm, 7IM has endured challenges in attracting new investors and keeping existing clients. In March last year, they were forced to make the difficult decision and close 2 of their funds as a result of sustained investor withdrawals, but in an attempt to curb outflows and boost their client bank, 7IM have recently launched a number of new funds and portfolios.

Many of these new funds have started positively with competitive performance in their short history. However, as identified in this analysis, the significant majority of their fund range has underperformed their sector average.

7IM Performance Summary

In this report, we provide a performance analysis of 19 Seven IM funds and identified that none consistently outperform at least half of the funds in their sectors. 5 rated as moderate 3 stars, with a total of 14 funds with a poor rating of 1 or 2 stars.

The above table and all performance related information in this report is based on performance figures up to October 2021.

7IM Closes Funds Due To Lack of Demand

At the start of the pandemic In March 2020, 7IM announced that they would be closing 2 of their funds following a prolonged period of significant withdrawals. They decided to close both the UK and European Equity Value funds at the end of April that year following a review of its fund range.

At the time a spokesperson for 7IM said: “At 7IM we regularly review our fund ranges as part of our commitment to offering investors the best range of investment opportunities.

“Following a recent review, we have decided to close the funds, primarily due to lack of demand.”

When the announcement was made the £13m UK Equity Value fund had seen outflows of £227m over the six months to February, with £182m redeemed in February alone, according to Morningstar estimates.

The £113m European Equity Value fund did not fare much better, losing 23% in the 12 month period up to the announcement of its closure.

7IM Ethical Portfolios

ESG investing has boomed in popularity in recent years as fears over climate change have led investors to consider the impact of their money and as a growing number of millennials have begun investing.

Recent data from Morningstar showed global assets in sustainable funds hit £1.21trn by the end of 2020, a record high, after investors pumped £111bn into such funds in the final quarter of the year alone.

7IM Pathbuilder Performance

In February 2021, 7IM launched ‘Pathbuilder’. Pathbuilder is a range of 3 Ethically themed funds that have a dynamic planner risk rating of 4,5,6 based on a range of 1 being the lowest risk rating and 10 the highest.

Since their launch, uptake in the portfolios has been slow with a lack of performance history likely to be a factor with the range currently managing a combined £86 million of client money.

As they are very young funds they have less than 1 years performance history, but based on their performance over the past 6 months they have impressed with the Pathbuilder 2 and Pathbuilder 3 funds both ranking among the top performers in their sector for that period.

The Best 7IM Funds

In July 2019, 7IM launched the Select fund's range. There are 4 funds in the range each with a different risk profile. The fund at the highest end of the risk spectrum is the 7IM Select Adventurous, preceded by the 7IM Select Moderately Adventurous Fund, the 7IM Select Balanced Fund and the 7IM Select Moderately Cautious Fund.

As they only launched in July 2019, these funds have a limited performance history but over the past 12 months, they have fared well with each ranking among the top performers in their sectors.

7IM Sustainable Balance Fund Performance

Over a longer 5-year time frame the 7IM Sustainable Balance fund has returned growth of 33.96%, which ranked 30th out of 141 funds in its sector and which was comfortably above the sector average of 27.47%. For the past 3 years, the fund has also outperformed with 3-year growth of 21.56% compared to the 16.15% average. However, over the past 12 months, this fund has struggled to match the performance of its peers. During this period the fund returned 10.24% growth which was below the sector average of 12.82% and worse than 79% of the funds in its sector.

7IM Asset Allocated Passive Funds (AAP) Performance

The 7IM AAP fund range offers a mixture of active management with passive funds, to offer a mixture of hands-on investment management with the low cost from passive investing. The AAP range has connected well with investors making it the most popular in their range with some 50% of investor money held in 7IM funds placed in their AAP fund range. But despite its popularity, all 5 AAP funds have struggled in their sectors with each fund performing below the sector average over the past 5 years.

The 7IM AAP Balanced fund, is the single largest 7IM fund with some £1.2 billion under its management. Although a favourite of investors the fund's performance has been underwhelming. Over the past 1, 3 & 5 years the fund has returned growth of 12.11%, 15.94% and 27.33%, each of which were below the sector average of 12.82%, 16.15% and 27.47%.

Both the 7IM AAP Moderately Adventurous and 7IM AAP Moderately Cautious funds have consistently ranked in the bottom 50% of their sectors for performance over the past 1, 3 and 5 years, with only the 7IM AAP Adventurous fund and 7IM AAP Income fund managing to outperform the sector average this past year.

7IM Multi Manager Fund Performance

There are 4 funds in 7IMs range of Multi-Manager funds. They are the 7IM Cautious, 7IM Moderately Cautious, 7IM Balanced and 7IM Adventurous funds.

These funds have experienced mixed performance, with only the 7IM Balanced fund managing to outperform the sector average over all 3 periods analysed, with returns of 13.10%, 17.35% and 28.90% respectively compared to the average of 12.82%, 16.15% and 27.47%.

In contrast, the 7IM Cautious fund has consistently underperformed the sector average, with its recent 12 months and 5 year performance particularly poor. Over the past 12 months, the fund ranked 68th out of 72 funds in its sector with returns of 4.27%, which was considerably lower than the 7.27% sector average. Over 5 years the fund was outperformed by 81% of the funds in its sector with its returns of 15.60% also falling well below the sector average for the period.

7IM Review Summary

7IM is a highly respected investment business that provides numerous services to investors, but our analysis of their funds identifies most of their funds to have a history of poor performance, with many of their peers providing consistently better-performing alternatives.

The turbulence and market swings of the past 18 months has caused many funds to struggle, and whilst this also may be the case for 7IM, over the longer term they also struggled which indicates a consistent lack of competitive performance from many of their funds across different market conditions.

Whilst no one can accurately predict how their funds will fare in the future, their struggles to attract new clients will not be helped by the performance history of their funds, with consistently better-performing alternatives readily available from other providers.