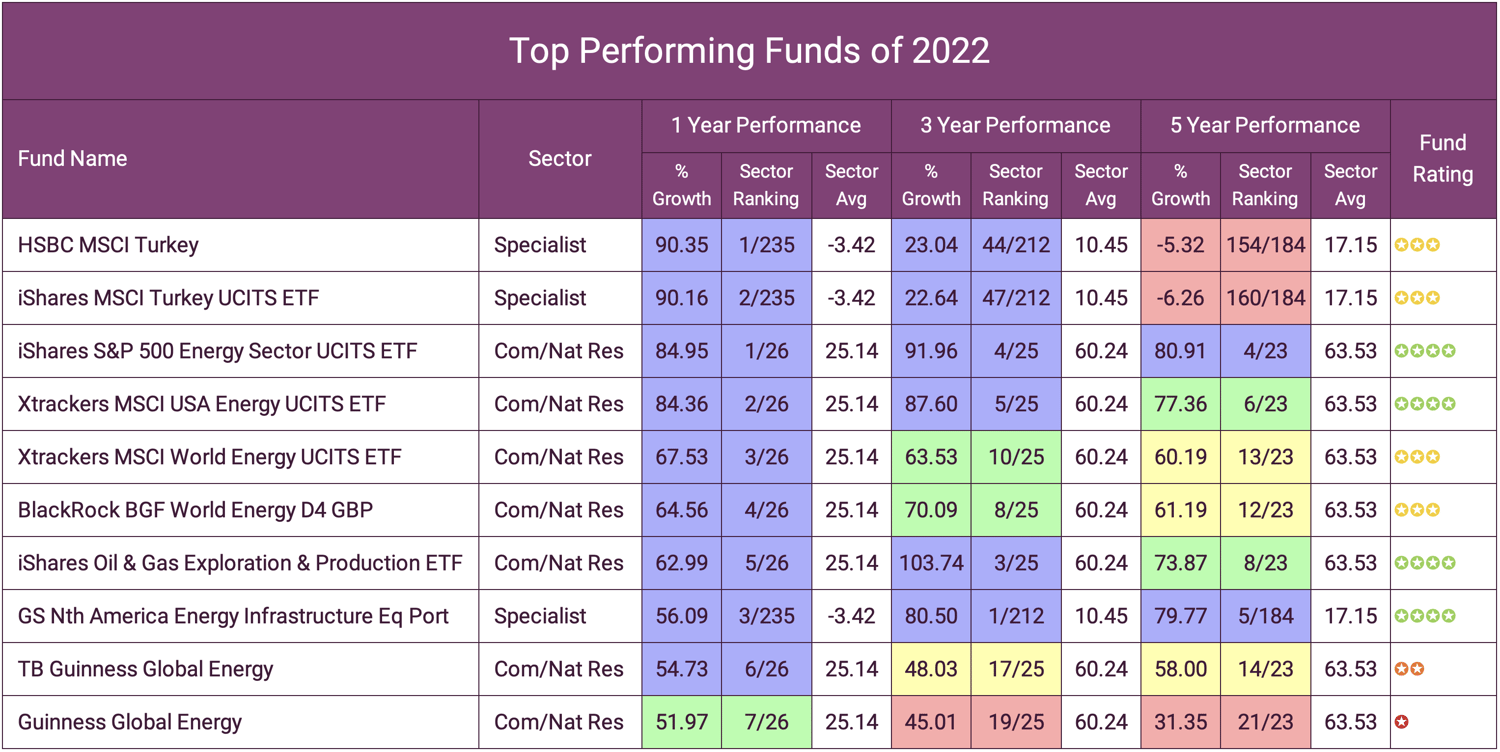

- From analysis of 3,883 funds and 56 investment sectors the highest growth fund of 2022 was the HSBC MSCI Turkey fund with returns of 90.35%.

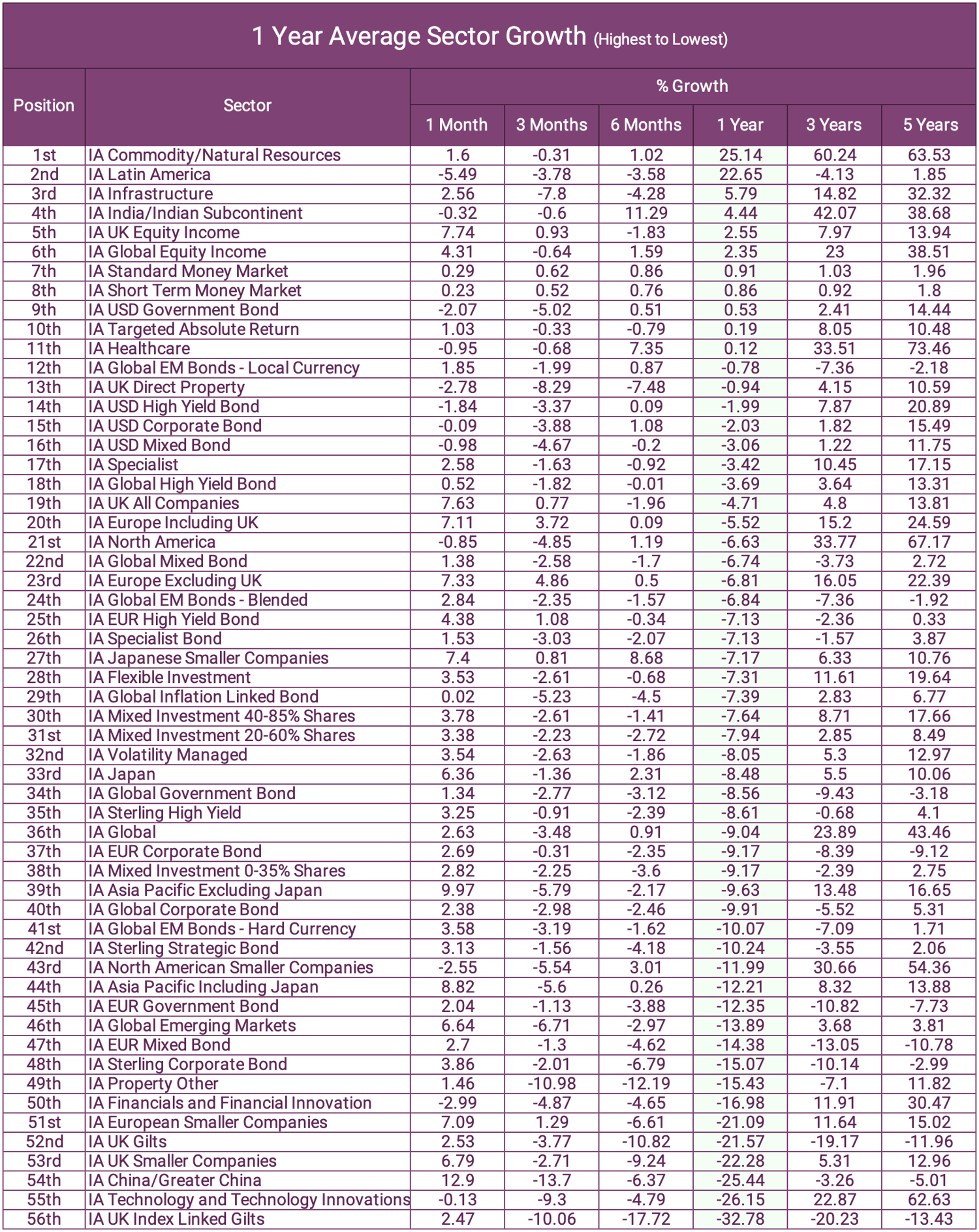

- Of the 56 sectors analysed, the IA Commodity and Natural Resources sector averaged the highest returns with growth of 25.14%.

- The UK Index Linked Gilts sector averaged the worst with negative growth of -32.78% for the year.

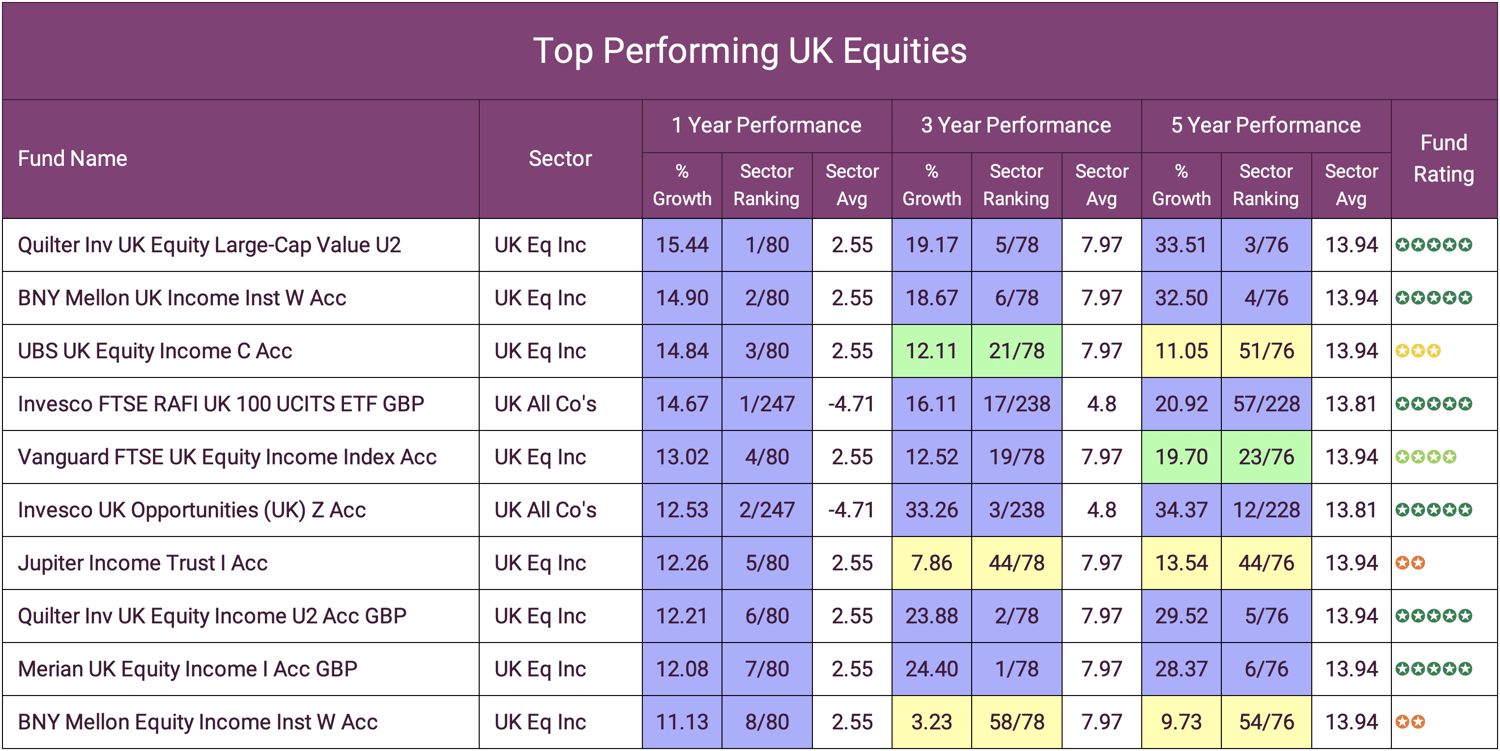

- The best UK Equity fund for performance was the Quilter UK Equity Large Cap Value fund which returned growth of 15.44%.

2022 was a year to forget for most investors with Global stocks tumbling by 20% for the year (FTSE All World Index). Everything from inflation to energy prices, rate hikes, the Ukraine war and global economic and political uncertainty all combined to drive global markets down beyond anything experienced this century.

But despite almost all major markets experiencing negative returns there are a few niche sectors and a proportion of funds within these sectors managed to thrive and end the year with strong growth returns.

In this report we analyse 3,883 funds and feature the 10 top performing funds of 2022. We also identify the 10 top performing funds in 6 core asset classes and list from 1st to last the performance of 56 investment sectors.

About This Analysis

For this analysis we review the performance of 3,883 sector classified funds across 56 investment sectors. We will identify the 10 top performing funds for the year and feature 10 funds across all core asset classes that have ranked top of their sector for performance in 2022.

We will also assess the overall performance averages of all 56 investment sectors and identify which sectors performed the best and worst over the past 1, 3 & 6 months and 1, 3 & 5 years.

The funds featured in the table above represent the 10 funds with the highest growth returns from an analysis of 3,883 funds over the past 12 months. As the table shows, 7 of the top 10 funds are classified within the Commodities & Natural Resources, which is unsurprising considering the huge hikes in energy prices since the outbreak of war in Ukraine. As the funds within this sector are heavily invested in energy companies they are among the few sectors to have average growth this year.

The 3 other funds within the table are all classified within the Specialist sector. One of which (Goldman Sachs North American Energy & Infrastructure Equity Portfolio) has also benefited from large holdings in infrastructure and energy companies.

The remaining 2 funds are both passive funds that track the MSCI Turkey Index, which is why their performance is very closely matched. This index is designed to measure the performance of the large and mid cap segments of the Turkish market. With 12 constituents, the index covers about 85% of the equity universe in Turkey.

As the above table shows, it has been a small range of markets and sectors that have yielded the best returns of the year. However, as we identify in our sector analysis later in this report, the huge gains from funds within the Commodities & Natural Resources sector seems to have peaked. Although the sector was comfortably the top growth sector for the year, over the past 3 months the sector ranked 11th out of 56 sectors with average performance for the period at negative -0.31% and over the past month it ranked 35th with average growth of 1.6% for the period. In contrast, the last quarter of the year saw UK and European Equities top the sector averages, as signs of market recoveries strengthen.

Best UK Equity Funds

The UK equities market had a particularly tough first half of the year with returns averaging at negative -10% for the period. However, despite high volatility and political uncertainties UK Equities have rallied with a more positive market outlook on the horizon. Over the course of the year a number of UK Equity funds have weathered the tough market conditions better than their peers with the 10 funds in the table below ranking as the top performing UK Equity funds of 2022.

The UK equity market is represented by 3 specific sectors - the UK Equity Income sector, UK All Companies sector and UK Smaller Companies sector. The 10 funds that make up the years top performing UK equity funds are from the UK Equity Income sector and UK All Companies sectors, which although similar in their core make-up they have subtle differences.

UK Equity Income Sector:

- have over 80% invested in quoted UK shares;

- an investment objective/policy to generate returns from both capital growth and income;

- a majority of investments in medium to giant cap companies;

- no more than 75% of expenses allocated to either capital or revenue account;

- a portfolio or dividend yield close to the average market yield;

- and a UK benchmark

UK All Companies Sector:

- have over 80% invested in quoted UK shares;

- an investment objective/policy to generate majority of returns from capital growth;

- a majority of investments in medium to giant cap companies;

- a majority of expenses allocated to capital; and

- a UK benchmark

The best UK Equity fund for performance was the Quilter UK Equity Large Cap Value fund which returned growth of 15.44% for the year to date, which was very impressive especially considering the sector averaged 2.55%. Unlike other funds featured in this report, this fund has consistently ranked highly in its sector. Despite the UK Equity market being serviced by over 100 fund management firms 6 of the 10 top performing UK equity funds are managed by just 3 fund managers with Quilter Investors, BNY Mellon and Invesco each having 2 funds in the top 10, which reflects a particular expertise in the UK equity market.

Best European Equity Funds

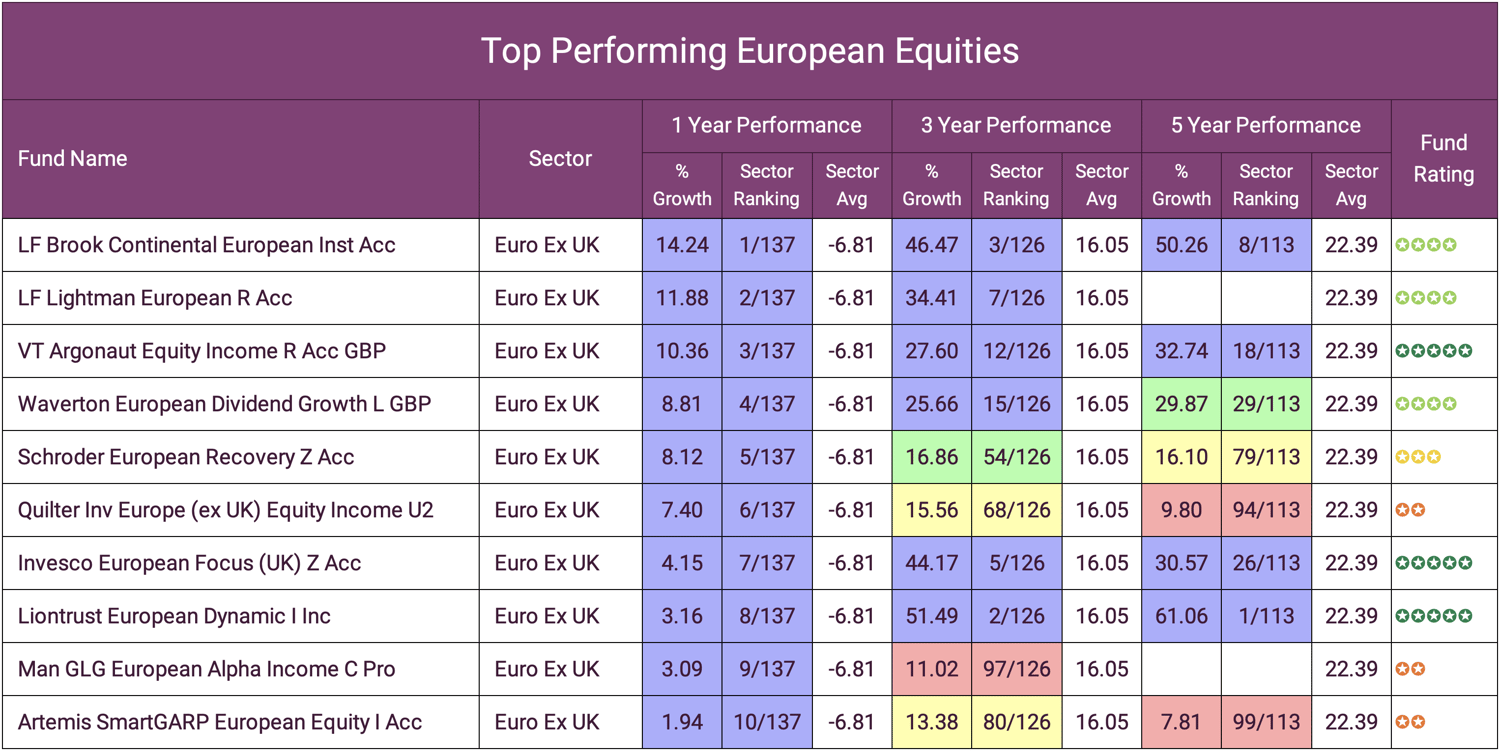

Over the past 12 months the Europe excluding UK investment sector ranked 23rd out of 56 sectors with average returns of negative -6.63%. Europe was hardest hit by the fallout of the Russian invasion of Ukraine but the region has quickly adapted to the the economic threats which is reflected in the performance of European equity markets in the last quarter of the year with the Europe excluding UK sector averaging the highest returns of all 56 sectors for the period with 4.86%.

However, despite the sector average negative returns for the year, a small proportion of European funds have returned growth. In the table below, we feature the 10 best European equity funds, each of which have delivered positive returns for the year with a proportion also managing to outperform the sector over 3 & 5 years.

The LF Brook Continental European fund returned the highest growth of any European equity fund in 2022. Despite its consistently strong performance the fund is not well represented in the portfolios of UK investors with the fund itself only holding £150 million of assets under its management.

The largest of the 10 funds is the LF Lightman European fund with £497 million of assets under management. This fund is also the lowest priced with annual charges of 0.80% with the overall annual charges for the 10 funds averaging 0.96%.

Also included in the top 10 is the Liontrust European Dynamic fund with 1 year returns of 3.16%. This fund has consistently ranked highly in the sector and over 5 years it has been the sectors highest growth fund with returns of 61.06%.

Best Global Equity Funds

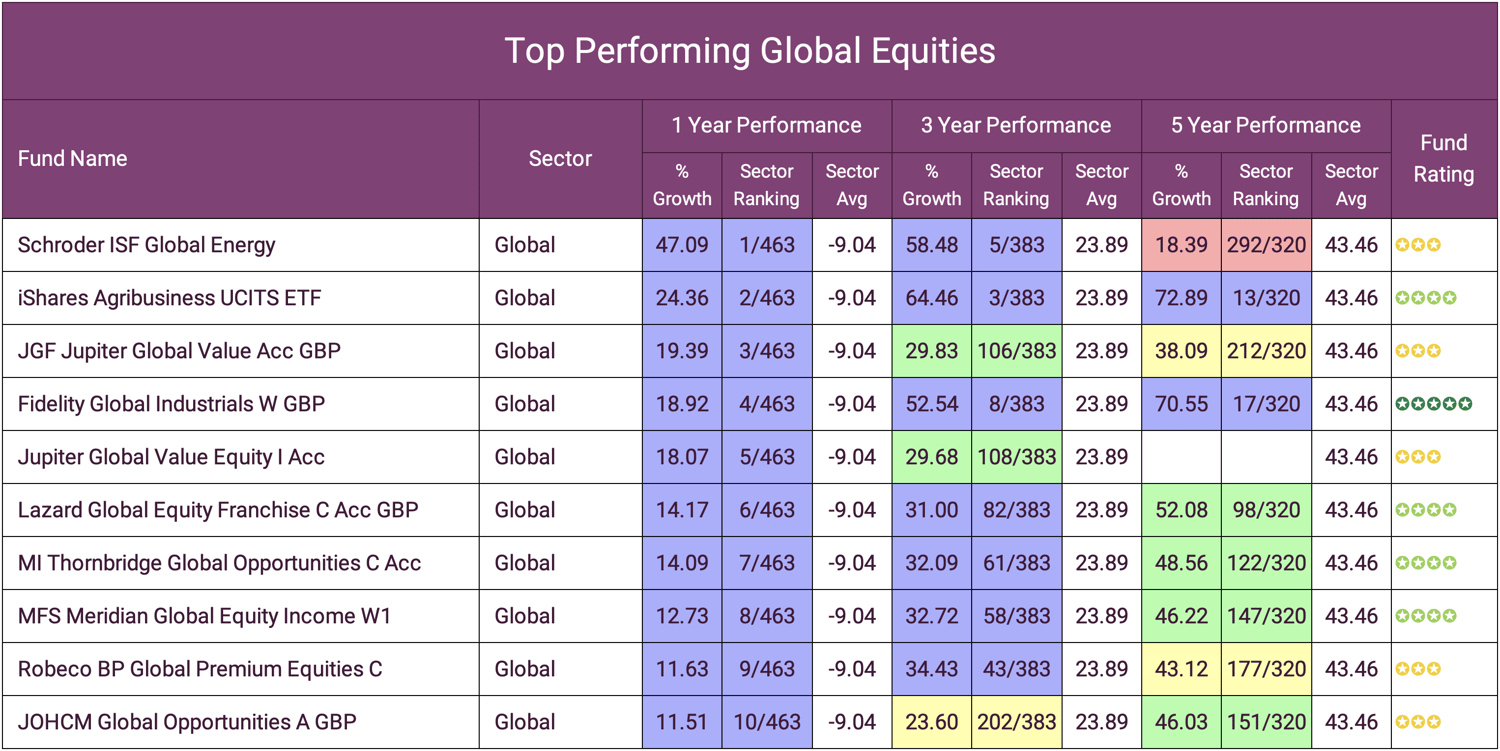

Global equity funds invest in a wide range of stocks across world markets, with this broad focus potentially helping to minimise the impact of stock market shocks on a portfolio.

Attracted by its regional diversity, the Global sector has become the most heavily invested sector on the market with over £155 billion of investor money currently under the management of the 463 funds within the sector.

Due to the sectors wide ranging criteria, the funds within this sector are eligible to hold shares in companies across a range of industries, with the top performing funds in the sector are unsurprisingly those with a higher proportion of assets held in energy and global infrastructure companies.

The top performing fund within the Global sector this year was the Schroder ISF Global Energy Fund. Although the fund is classified within the Global sector it is primarily composed of holdings in commodity and energy companies, which are the markets that have benefited most from the years high volatility and general economic uncertainty.

The Fidelity Global Industrials was the highest rated fund in the top 10 with a 5 star rating. The fund has consistently ranked among the best performers in the entire Global sector and managed to do so by assuming a moderate level of risk compared to may of its peers.

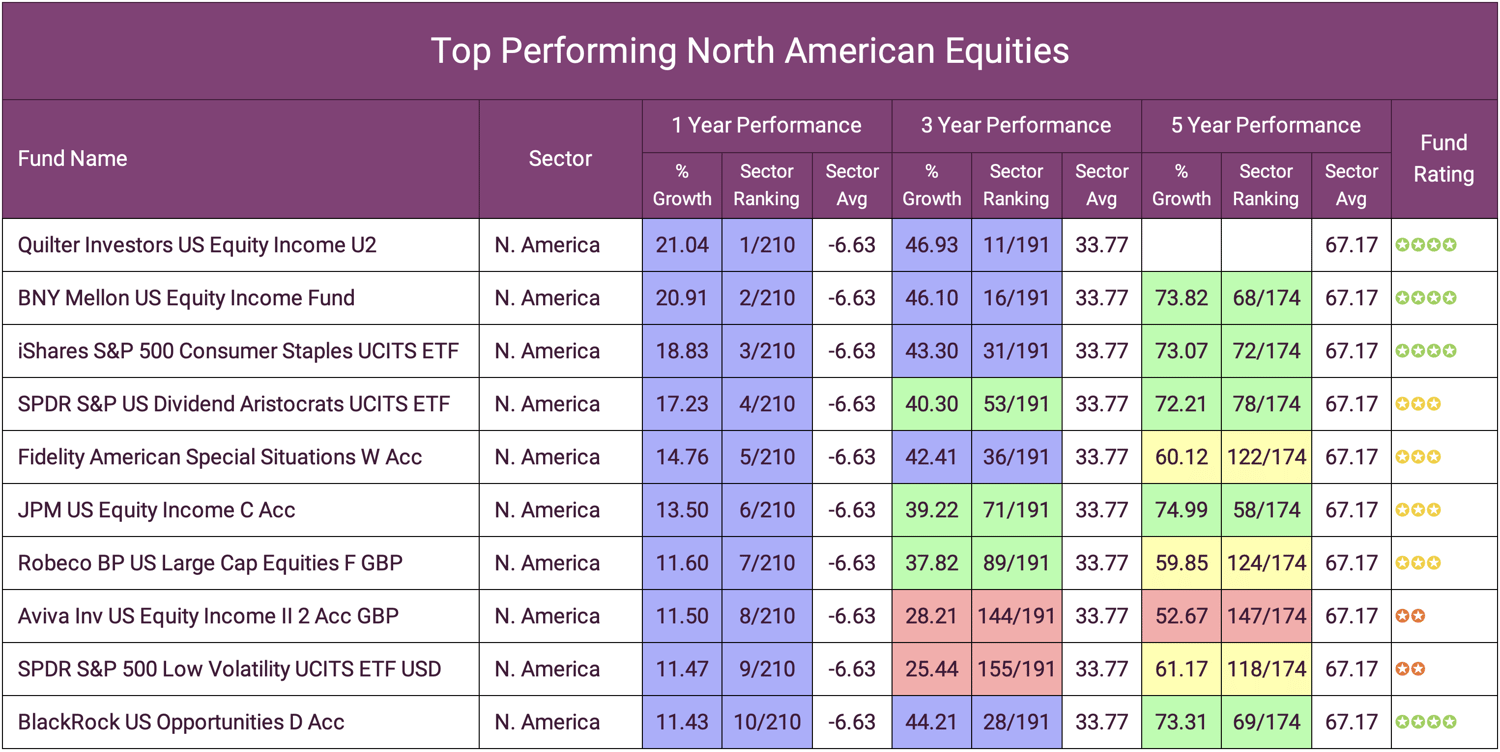

Best North American Equity Funds

The North American sector is an important asset class that is likely to form an integral part of many mid to higher risk investment portfolios.

Over the past 5 years, the North American equity sector has averaged returns of 67.17%, which was the 2nd highest of all 56 sectors - and over 10 years it has averaged the highest returns with an average of 259%.

The North America sector is one of the most competitive on the market, with 210 main unit funds classified within the sector. Like many other sectors, the North America sector has averaged losses for the year but as identified in the table below a number of funds have still managed to deliver high levels of growth.

The top performing US Equity fund of 2022 was the Quilter Investors US Equity Income fund with impressive returns of 21.04% well above the sector average of -6.63%. The fund is primarily invested in technology and industrial companies but is also diversified across healthcare, energy and financial services which has helped it weather the years challenges better than most.

Another fund to have ranked among the best US funds was the BNY Mellon US Equity Income fund. The fund has similar performance to the Quilter US Equity Income fund over the past 1 & 3 years but it is a more established fund with over 5 years history. However, the fund as a higher than average annual charge for the sector of 0.89% (sector average annual charge is 0.69%).

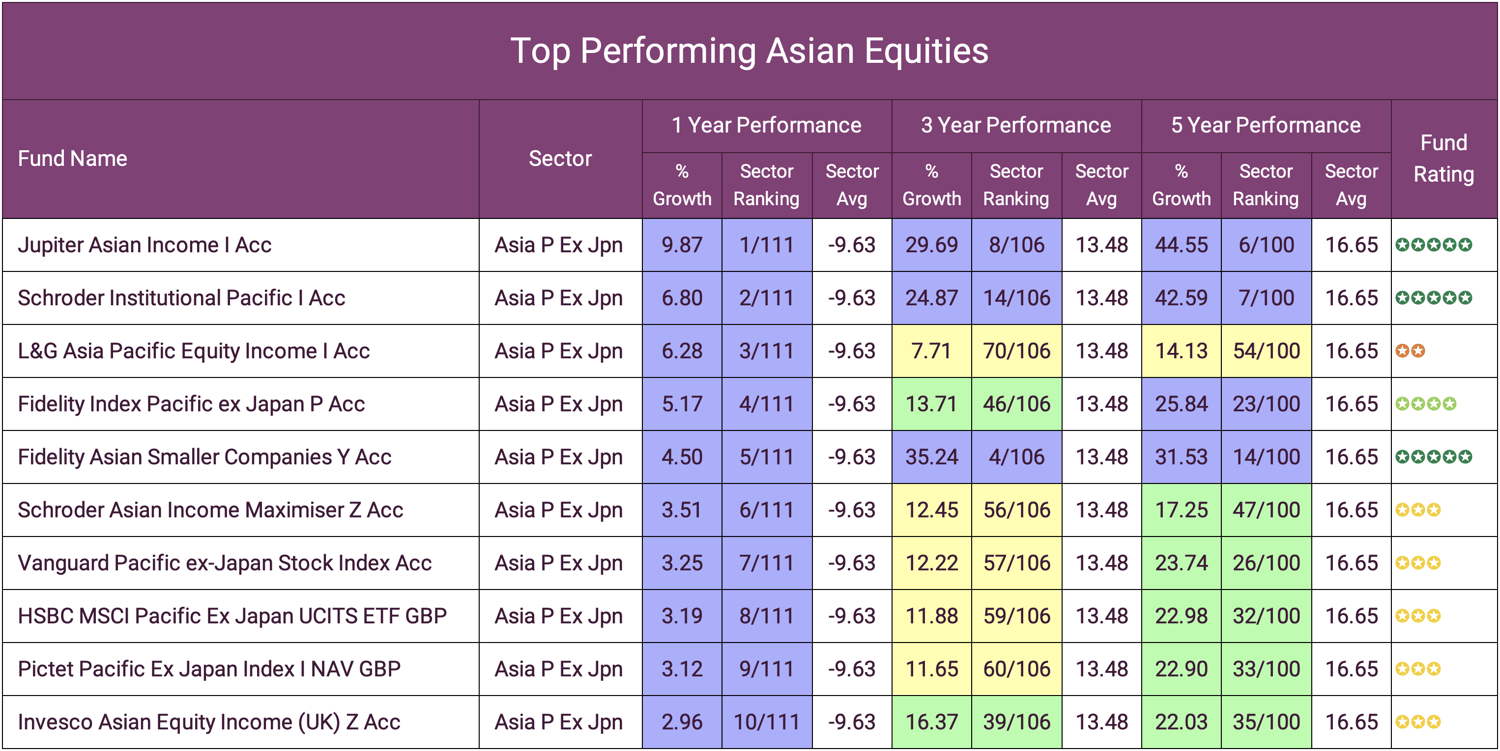

Best Asian Equity Funds

The Asia ex-Japan sector covers the economic region of countries located in Asia, but not including Japan. These countries are generally considered emerging markets and are typically only suited to investors looking for high-growth investment opportunities who have a higher risk tolerance.

The sector itself has been one of the hardest hit in 2022 with average returns for the year at negative -9.63%. Out of the 111 funds classified within this sector only 18 managed to deliver positive returns for the year with the 10 top performers listed below.

The 5 star rated Jupiter Asian Income fund was not only the top performing Asian equity fund of 2022, but it has also consistently been one of the best funds in the sector over 3 and 5 years. The majority of the companies held in this fund are based in Australia, with technology and financial companies the primary industries it owns holdings in. The fund manages just over £1.1 billion of investor money and with an annual charge of 0.98% it is also priced at just below the sector average of 0.99%.

Closely matching this fund for performance was the Schroder Institutional Pacific fund which returned 1, 3 & 5 year growth of 6.80%, 24.87% and 42.59% respectively. This fund also boasts a top performing 5 star rating and similar to the Jupiter Asian Income fund, it is primarily invested in Australian companies. But for investors, the main differentiator between this fund and the Jupiter fund is its low annual charge of just 0.55%.

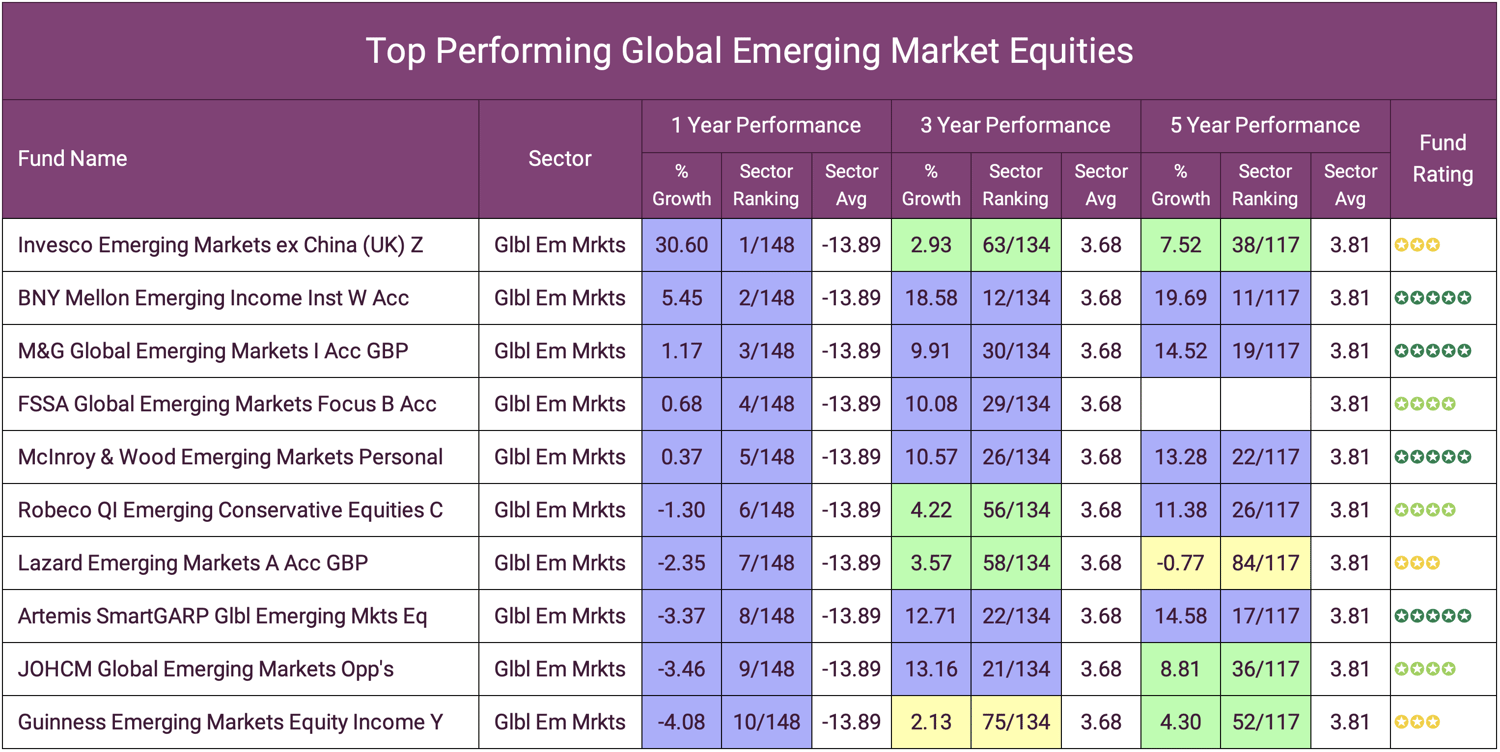

Best Emerging Market Funds

The term “emerging equities” refers to the listed shares of companies based in emerging-market countries. In general, emerging-market countries are regarded as having rapidly growing economies that show greater potential returns but higher risk than developed markets.

Investing in emerging markets is typically reserved for higher risk investment portfolios but it is not uncommon for mid-range portfolio's to include a small proportion of holdings in emerging market funds due to the growth potential they provide.

The higher risk nature of the sector was exposed this past year as it averaged losses of -13.89%, which ranked 46th out of 56 sectors. As a consequence of the high volatility the sector has endured this past year only 3 of the sectors 148 funds returned growth of 1% of more for the period.

The Invesco Emerging Markets ex China fund was comfortably the best performer of the year with returns of 30.60%. 2nd on the list was the BNY Mellon Emerging Income fund which although its 1 year growth of 5.45% was well below the Invesco fund it has a much better performance record over 3 & 5 years, which highlights a particular level of emerging market expertise from the funds manager.

The Best Performing Investment Sector

Our analysis of 3,883 funds and the 56 sectors in which they are classified within identified that on average, there has been losses of -7.18% for the year. A small selection of sectors such as Commodity and Natural Resources sector and Latin America sectors averaged strong growth but some sectors such as UK Index Linked Gilts and the Technology sector had a torrid year with average returns of negative -32.78% and -26.15% respectively.

Although in this report we feature the best performing funds for the year within the core equity sectors, the year has been blighted by widespread underperformance. But the positive take from this is that many funds are now undervalued and when market stability returns they have significant growth potential. 2022 is a year to forget for investors and despite ongoing political and economic troubles many analysts and economists foresee 2023 as a year were growth returns.

A Balanced Approach To Investing

Investing, like many aspects of life, isn't always straightforward and for some it can be more uncomfortable and stressful than others. As an investor, you will always be exposed to factors that can cause values to rise and fall.

Investing can result in emotional decision making, but the investors who reach their objectives efficiently are typically those who have a disciplined and pragmatic approach to investing, and follow a structured, long term strategy. When this is followed better outcomes can be achieved.

Leading The Way For Investors

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios.

Our research continues to identify that a small proportion of funds and fund managers consistently delivered top performance, with more than 90% of the portfolios we review containing funds that continually underdeliver.

This research has enabled us to identify efficient processes and top-quality investments which we have utilised to create 10 strategically balanced, risk-rated portfolios that are built using only the top funds within each asset class and offer investors phenomenal potential for growth.

Yodelar provides an advice and information service that is changing the way investors think.

Book a no obligation call with our team today and find out how we can help you growth your wealth efficiently.