In the first quarter of 2022, 93% of the 4,372 classified and unclassified funds available to UK investors have returned losses. All markets have been impacted with rising inflation, interest rate hikes and the fallout of the Russian invasion of Ukraine making for a difficult investment landscape.

It has been the worst start to a year for investment markets since the turn of the century with widespread negative returns. Markets have recovered from all previous financial crises and we can expect the same this time, but with so many Global issues impacting markets it remains unclear when this will happen.

However, a small number of sectors have returned growth, with current conditions favouring certain industries such as property or those in the energy sector and commodities like metals and gold.

While many portfolio strategies will have some weighting in property funds few will have any kind of weighting in commodity based funds. The reason for this is commodities are highly volatile and unpredictable and they carry a higher risk of their short term gains being trumped by losses in the long term. As such, it is a strategy that makes little sense to many investors. But within the Commodities & Natural Resource sector are funds whose primary holdings are in energy such as oil and natural gas, which has attracted significant interest in recent weeks particularly due to the huge rise in energy prices and the Global impact of sanctions placed upon Russia. So the question is, should investors consider altering their strategies and moving to these types of funds?

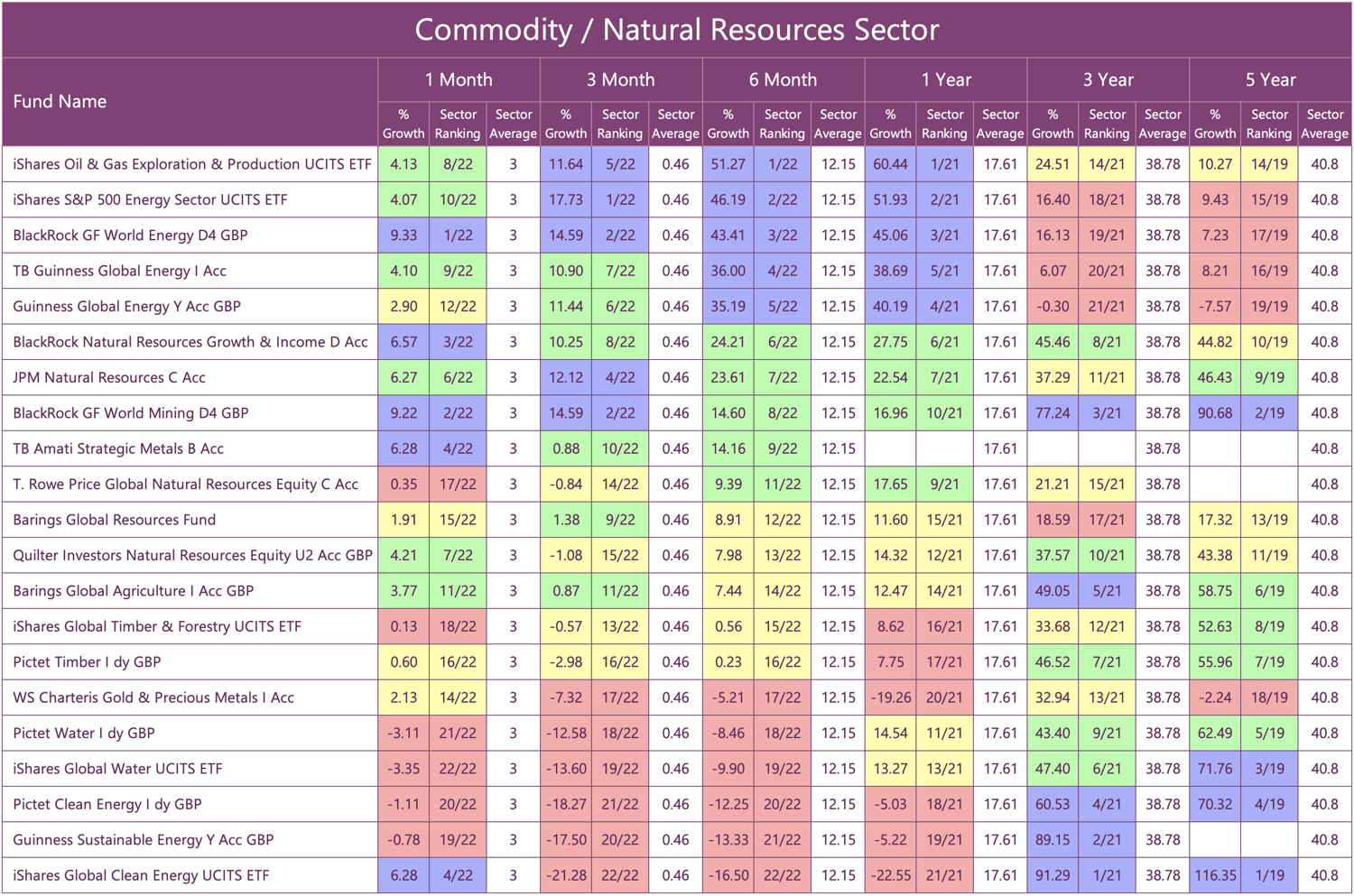

In this report, we feature the performance and sector ranking of all funds within the IA Commodity & Natural Resources sector over the past 1, 3 & 6 months as well as over the past 1, 3 & 5 years, identifying how they have each fared.

What Are Commodity Funds

Commodity funds invest in raw materials or primary agricultural products, known as commodities. These funds invest in precious metals, such as gold and silver, energy resources, such as oil and natural gas, and agricultural goods, such as wheat. Commodity funds may also invest in the companies that produce these commodities. Commodity funds are widely regarded as a higher risk investment but because of their unique makeup, they can have benefits for investors such as:

Protection against inflation

Commodity prices tend to rise with inflation, making commodities one of the few assets that benefits from inflation.

Potential financial growth

Commodity prices rise and fall in tandem with supply and demand. The more a commodity is in demand, the higher its price will rise, delivering higher profits to the investor.

What Classifies A Commodities & Natural Resource Fund?

The funds that are classified within the IA Commodities & Natural Resource sector must invest at least 80% of their assets in commodity or natural resources related equities. These funds may be diversified and offer broad exposure to commodities and natural resources, others may focus on specific industries/sectors. Their strategies can be quite diverse, which can make it difficult to compare their performance, but in the main the fund names provide an indication as to the specific commodities they invest in.

Why Commodity & Natural Resources Have Performed Well In 2022

With fuel prices jumping 38% in February from a year ago, food prices rising 8.6%, and the February consumer price index rising 7.9% (a 40 year high) it’s of little wonder that some investors have considered shifting focus to inflation-related products, such as the funds listed in the IA Commodities & Natural Resource sector. Many of the funds within this sector invest primarily in energy companies, many of whom have experienced a sharp rise in their valuations which typically goes hand in hand with rising costs for consumers.

Commodities and commodity companies are quite heavily exposed to political, economic, foreign currency and exploration risk. Since the Russian invasion of Ukraine and subsequent sanctions, markets have reflected the rising commodity supply risks.

Ukraine and Russia together are critical supply sources for several very important commodities. Europe has traditionally depended on Russia for the majority of its natural gas and crude oil imports, which flow by pipeline mostly through Ukraine. Together, Russia and Ukraine are the major suppliers of wheat, sunflower oil and fertilizers to Europe and the Middle East. Additionally the record prices in Europe for natural gas and electricity are shutting down fertilizer and aluminum production. Russia is also a very important producer of aluminum, nickel and palladium. All of these commodities were in short supply before the war, and in the near term, we believe there is no easy fix to the supply shortages.

Are Commodity & Natural Resource Funds Worth The Risk

As alternative options to Russian supplies become clearer such as increased supply from Saudi Arabia the price of oil and gas will inevitably fall back from recent highs to the detriment of many invested in funds reliant on these commodities.

Energy in general makes up the majority of the commodities & natural resource sector, but it's important to be clear that not all funds in the sector invest in energy. There are a small proportion of funds in the sector that focus on agriculture such as timber and grain, with others focusing on gold and other precious metals, but these are also notoriously volatile with wild fluctuations in values making them a high risk option, and one that only the most adventurous investor should consider.

Fluctuating Performance

The Commodity & Natural Resources Sector is one of only 2 investment association sectors to have averaged positive growth over the past 1, 3 & 6 months. The analysis below shows the performance, sector ranking and average returns for the sector over 6 time frames. It identifies wide fluctuations in performance as different funds focus on different commodities, with those focused on the energy market the strongest performers over the past 1 year.

However, many of the funds that have done the best in the past year are also the funds that have underperformed over the longer 3 & 5 year periods, which shows just how volatile the sector is.

Performance figures up to 1st March 2022

Be Prepared For Volatility

The energy sector is a challenging one for investors, especially oil and natural gas companies. Energy prices can change in a heartbeat. This volatility can have a massive impact on the sector, as well as on the global economy.

We’ve seen this firsthand in recent years. Oil and natural gas prices plunged during the early days of the pandemic as demand dried up. However, they rebounded sharply in 2021 as consumption recovered. They continued their ascent in 2022, hitting multi-decade highs after Russia invaded Ukraine.

Because of the impact commodity price volatility can have on the energy sector, investors need to be fully aware of the risks. That includes not allocating too much of a portfolio to one energy stock or the industry as a whole.

Commodities & Natural Resources Sector Funds Are All In

Energy has been the dominant commodity in the sector which will only increase further with the advancement of greener energy sources as governments put in place aggressive targets to reduce emissions and address the climate crisis. This will likely have a sizeable impact on the future values of energy based commodities. The shift towards more sustainable energy sources will ultimately impact on the values of oil and gas which as mentioned have seen their values soar in recent times - which is one of the reasons we believe investors should view the funds in this sector with caution.

The core issue with the funds in the commodities and natural resource sector is that they are all in. They invest almost entirely in energy, metals or agricultural commodities, making them high risk with large exposure to particularly sharp changes in valuations.

Balance Is Key

Commodities are essential to the Global economy, but the huge exposure from the funds within this sector poses a high risk for investors. But investors can still benefit from commodities and natural resources without the risk of extreme volatility. Across the Global, UK and other equity markets, many funds allocate a portion of their holdings to companies in energy and other commodity markets, whom they believe have the best growth opportunities without the need to assume excessive risk.