Economic forces such as interest rates, inflation and exchange rates might seem complicated terms when you're a first-time investor, but how they work and relate to one another can have a huge impact on your portfolio.

In recent times, in particular, sharp fluctuations in exchange rates has been headline news, and it has had an impact on investment portfolios and the overall value of many investments.

But what causes fluctuating exchange rates and how can it affect your investments?

Why Exchange Rates Fluctuate

Exchange rates denote the value of one currency in comparison to another and are always expressed in pairs. The value of a currency comes from supply and demand – if a currency is in demand then its value will tend to rise, if not, it will tend to fall.

However, predicting currency movements is fraught with risk. The release of a budget or an unpredictable political event can cause a currency to slip or jump in the short-term. But in the medium or long term, there are several main drivers of currency trends.

Inflation Rates

Countries with lower inflation tend to have a rising currency as its purchasing power increases relative to other currencies.

Interest Rates

Higher Interest rates compared with other countries attract investors seeking a good return.

Trade Balance

Those who export more than they import will typically have strong currencies, boosted by the demand for their goods.

Public Debt

Countries with low levels of public debt often see their currency rise as the economy is more attractive to foreign investors.

The primary factor, however, is the strength of an economy, or the market’s perception of it. A stronger economy generally implies a stronger currency, as confidence in the country’s prospects rises among global investors, and they become more inclined to buy assets denominated in that currency.

How Currency Movements Can Leave Investors Exposed

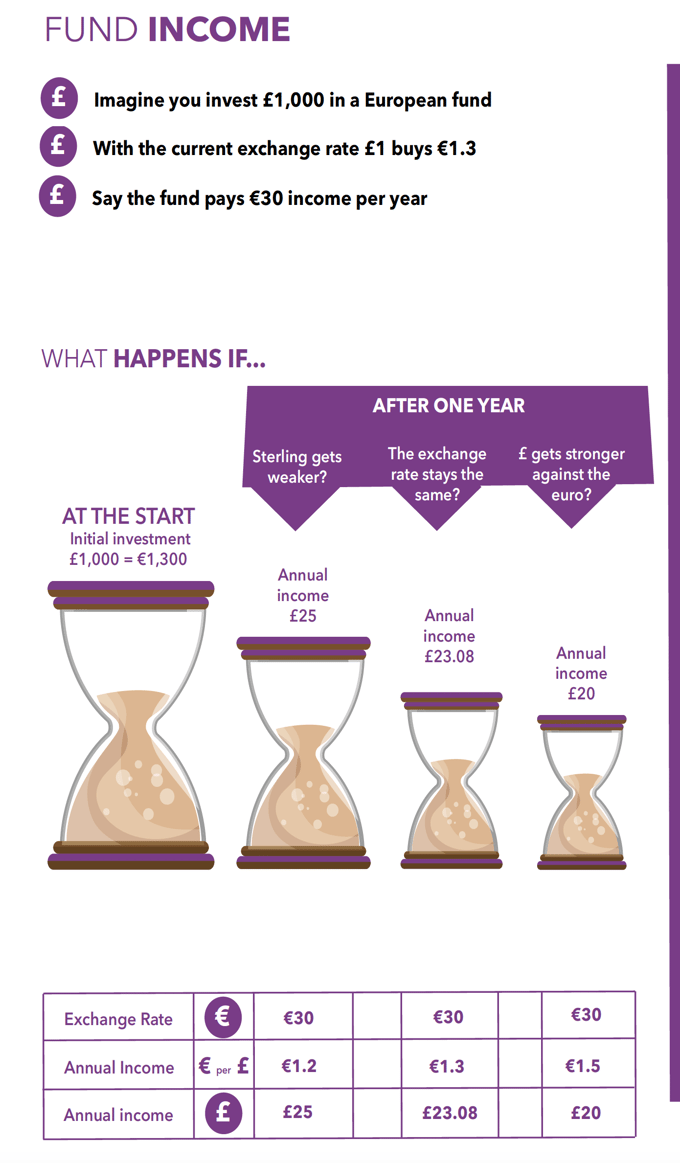

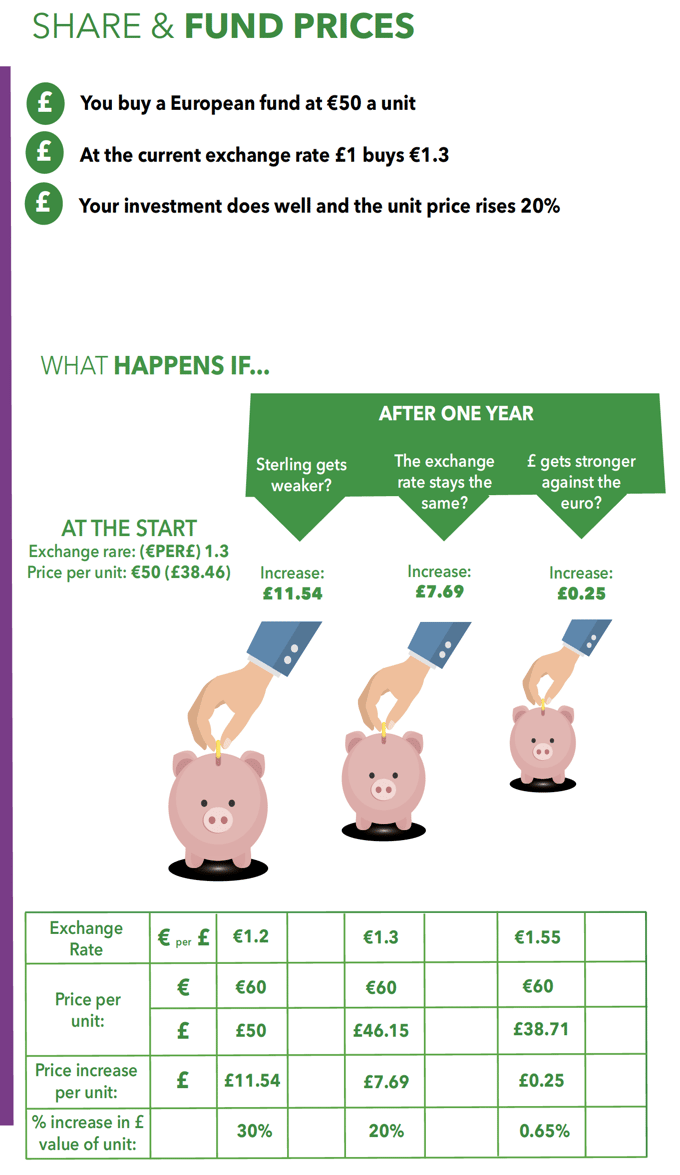

Even if you don’t invest in the FOREX market, its movements are likely to affect your portfolio. The main way this could happen is if you or your fund manager invest in funds that hold foreign stock or bond markets, such as North American, European or Asian funds. Then any gains or losses made will be offset or enlarged by the shift in currency values.

Assume you put £1,000 into a European fund at the beginning of a year, and during the 12 months the equity market doesn’t move – yet the euro climbs by 20% against the pound. When converted back into sterling at the end of the year, your investments would buy 20% more in sterling.

In this scenario, if you sell, you would crystallise a return of 20% on your European fund, even though they haven’t budged. Similarly, if the euro falls by 20% without the markets moving, you have lost 20% as the euro now buys a fifth less in pounds.

How UK Funds Can Be Affected By Currency Fluctuations

Even by investing in UK funds investors could still be indirectly exposed to currency risk. The reason for this is because nearly 70% of companies listed on the FTSE 100 derive their earnings from overseas given their global nature. As a result, these companies would benefit from weak sterling, as they did when the value of sterling tumbled after the Brexit decision was made. Conversely, the businesses which do little trading overseas and derive nearly all of their earnings from the UK shores, namely the small and mid-cap funds, would experience a fall in their value should the value of the pound fall.

Consider a simplified scenario of currency movement. If the exchange rate were $2 to the pound, then every $1,000 of revenue would be worth £500.

However, if sterling weakened and the exchange rate moved to $1.50 to the pound, then every $1,000 of revenue would be worth £667.

The strength of sterling against the euro is also important given the large chunks of revenue accounted for by France, Germany, Italy and other eurozone countries.

Is Global The Way To Go?

During strong markets investing in a top-quality fund that specialises in that market will likely deliver higher returns than a fund that is spread across several markets.

However, with political uncertainty, the potential impact of Brexit and other market forces contributing to an increasingly volatile landscape, many investors are taking a more Global outlook with their investments. By investing in funds that hold underlying funds in diverse markets and global companies, investors not only mitigate exposure to any one market but they can also lower the impact rising or falling currencies could have on their investments.

However, when it comes to making investment decisions, fluctuating currencies should always be secondary to investing in high-quality funds as ultimately the strength and benefits of high-quality investment funds will likely considerably out way any losses or gains from fluctuating currencies.