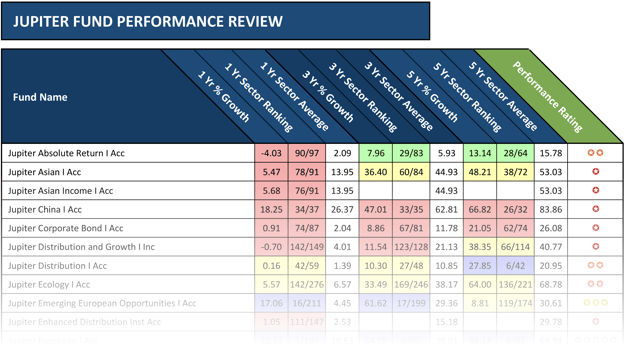

For this report we analysed the performance and sector ranking for all funds managed by Jupiter Asset Management.

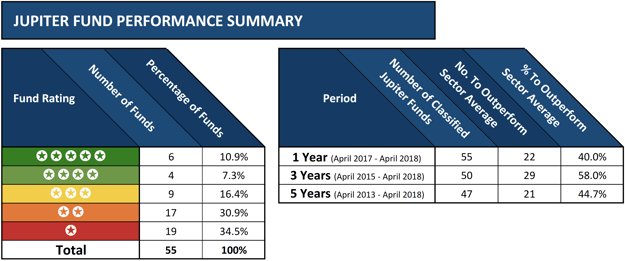

- 65.4% of the Jupiter funds analysed received a poor performing 1 or 2 star Yodelar performance rating.

- 6 of their 55 funds were rated as excellent 5 star funds as they have continually outperformed competing same sector funds in the 5 year period up to April 2018.

- The £5 billion Jupiter European fund returned 5 year growth of 88.14%, which was higher than 93% of all other competing funds within the same sector.

Founded in 1985, Jupiter is a London based active fund manager whose funds have consistently been a popular choice for UK investors. In recent years Jupiter has actively sought to grow their presence throughout Europe and Asia as they try to increase their client numbers and funds under management. However, reported net outflows of £1.3bn in Q1 of 2018, while assets under management declined 6.6% over the quarter. This sharp decline has caused concern among industry analysts. David McCann of Numis Securities said, “If they continue to lose money at this rate throughout the year then clearly they have a problem.”

But is underperformance the reason investors have moved out of Jupiter in their droves?

In our Jupiter fund review, we detail the performance and sector ranking for 55 Jupiter funds that currently hold more than £39 billion and identify that the significant majority funds have underperformed in comparison to their peers.

Underperformance sparks huge outflows

From the 55 Jupiter funds analysed 47 have over 5-years history. 65.3% of these funds have returned recent 5-year growth that fell below the sector average.

Jupiter’s largest fund, Dynamic Bond, is one of Europe’s largest fixed-income vehicles and grew more than 3,000 percent between 2012 and 2017, peaking at £9.7bn in October 2017. However, investors have since pulled hundreds of millions of pounds from the strategy with the fund shrinking to £7.9 billion in April this year.

The company’s third-biggest fund, Strategic Bond, follows the same approach as Dynamic Bond but is structured as a unit trust. The two funds, both managed by Ariel Bezalel, have recently suffered from underperformance which has seen them fall from £13.6bn assets under management in November to £10.3bn this month.

In the one year period up to April 2018, the Dynamic Bond fund experienced a dip in performance as it returned growth of 1.39%, which ranked 62nd out of 236 funds in its sector. However, it is worth noting that over the recent 5-year period this fund has returned growth of 21.4%, which was well above the sector average and better than 76% of its peers.

The Strategic Bond fund ranked 56th out of 79 funds in its sector over the recent 12-months as it returned growth of 2.02% - well below the sector average of 3.13%.

Mr. Bezalel said recent underperformance of these funds was due to his team being more cautious. “We have lagged peers who have been more gung-ho in chasing credit risk,” he said.

The best fund managers: Download our most recent fund manager league table ⇒

The Jupiter Funds That Have Struggled The Most

Our analysis of 55 Jupiter managed funds identified underperformance from a significant proportion. In fact, 65.4% of their funds received a 1 or 2-star Yodelar rating as during the periods analysed they have performed worse than at least 50% of competing same sector funds.

One of their most substantial funds to struggle was their Merlin Income Portfolio, which currently holds some £2.66 billion of funds under management, and has experienced long periods of underperformance. Over the recent 5-year period this fund returned growth of 22.63%, which was worse than 80% of same sector funds and well below the sector average of 29.78%.

The Jupiter UK Growth fund, which holds some £1.2 billion of client funds under management, has been very disappointing as it has consistently underperformed. Over the recent one year period it returned negative growth of -0.16% and was outperformed by 92% of all other funds in the same sector. Over 5-years it hasn’t fared much better as its cumulative growth of 38.95% was considerably lower than the sector average of 49.7%.

From their range of offshore funds, it has been their Asian focused fund range that has struggled the most. The Jupiter Asia Pacific Income fund has consistently been among the worst performing funds in its sector, and over the recent 5-year period it ranked 91st out of 121 funds in its sector with growth of 32.72%. The Jupiter China fund has also struggled. This fund returned recent 5-year growth of 70.01%, which was well below the sector average of 79.54% and worse than 78% of same sector funds.

View the complete Jupiter review 2018 in the April edition of the Yodelar magazine. Sign in to view. Not a member? Register now for just £1 and get instant access to all premium reports.

Jupiter Funds That Have Excelled

Although our analysis identifies that quite a large proportion of Jupiter managed funds have struggled for performance in comparison to their peers they also have a select number of funds that have continually excelled. In contrast to their Asian focused funds, which have struggled, their range of European funds has been their strongest performers.

Among the best Jupiter funds was their hugely popular European fund which holds almost £5 billion of investor assets. The fund is managed by Alexander Darwall who is Jupiter’s Head of Strategy, European Growth and the objective of the Fund is to achieve long-term capital growth by investing in companies quoted on a European stock exchange.

Over the recent 12-month period this fund has been the best performer in its entire sector as it returned growth of 22.52%, which was more than double that of the sector average (10.63%). Over 5-years, this fund has returned growth of 88.14%, which was higher than 93% of all other competing funds within the same sector.

From their Offshore fund range, the Jupiter European Growth fund has been a stellar performer. This fund is also managed by Alexander Darwall, whose European strategies have proven to be very strong, and currently holds some £1.7 billion of investor assets under management.

In the 5-year period up to April this year, this fund has returned growth of 79.63%, which was significantly greater than the sector average of 49.69%, and better than 95% of competing funds. Over the recent 12-months, it has been even more impressive as its growth of 18.14% eclipsed the sector average of 7.54%, and outperformed 96% of its peers.

View the complete Jupiter review 2018 in the April edition of the Yodelar magazine. Sign in to view. Not a member? Register now for just £1 and get instant access to all premium reports.

A Mixed Bag From Jupiter

With some 65.4% of the funds analysed in this report receiving a poor 1 or 2-star performance rating, it is apparent that the majority of Jupiter’s funds have lagged behind their peers. Their Asian focused funds, in particular, have failed to prove competitive, with their UK funds also struggling.

However, buoyed by the exceptional performance from some of their European funds, our analysis highlights that a total of 6 Jupiter funds have continually outperformed their competition and were rated as 5-star performing funds.

Therefore, despite apparent underperformance from some of their funds, Jupiter has a selection of funds that have been stellar for their investors and their consistently strong performance compared to their peers supports the fact that they still offer investors high-quality investment options.