- 12% of Legal & Generals funds received an impressive 4 or 5-star rating for their performance over the past 1, 3 & 5 years.

- The L&G UK Gilt fund has been the top fund in the sector with returns of 24.83% and 54.84%.

- From L&G’s range of 140 pension funds, 94 received a poor performing 1 or 2-star rating.

- as they each performed worse than at least 50% of their competitors during the periods analysed.

Legal & General are a FTSE 100 company and one of the oldest and largest insurance companies in the world, with a heritage dating back to 1836. They are the UK’s largest fund house and just last year the group's boss Nigel Wilson proclaimed to investors that their asset management arm was “built for the future” with “the best team we’ve ever had” with their total assets under management now reaching £1.2 trillion.

A dreadful 2020 has seen Legal and General lose almost a third of their value. This follows previous reports from the Financial Times that some of Legal & Generals employees had reported them to the FCA accusing the asset manager of compliance and risk failures that potentially cost its clients millions of pounds. They also alleged there is a culture of bullying at fund manager level, with one complainant describing the company’s culture as “toxic”.

Despite their problems, Legal & General believe their funds remain excellent options for investors. However, as identified in this report, many of their funds have in fact consistently failed to deliver competitive returns with their range of UK focused funds in particular ranking among the worst on the market for performance.

Performance Analysis of 297 Legal & General Funds

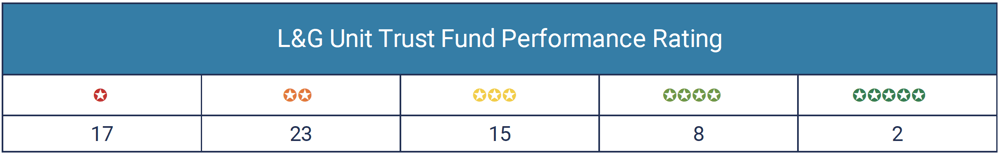

In this report, we analysed 297 funds managed by Legal & General across their range of unit trust, ETF, Life and Pension funds. Each fund was analysed for comparative performance over the recent 1,3 & 5 years alongside all other funds within their respective sectors. Based on their performance each fund was then provided with a rating between 1 and 5-stars.

Our analysis identified that from all 297 funds analysed 12% have received a 4 or 5-star rating by consistently ranking among the top performers in their sectors over the periods analysed. 23.9% rated as 3-star performing funds with the overwhelming majority, 63.3% have performed among the bottom half of their sectors consistently and therefore received a poor performing 1 or 2-star performance rating.

Top L&G Funds

From the 297 funds analysed, 65 are from their range of unit trust and OEIC funds. 10 of these funds are very competitive 4 & 5 star rated funds with 15 receiving a modest 3-star rating and the remaining 40 classifying as poor performing 1 or 2-star funds.

L&G European Trust Fund

One of Legal & Generals top-performing funds from their range of unit trust funds was the L&G European Trust fund. Europe has been blighted by political issues in recent years and some European economies are struggling with high levels of debt and unemployment. As a result, many European focused funds are struggling for consistency. But despite these obstacles, the L&G European Trust fund has consistently ranked among the top quartile of the IA Europe excluding UK sector over the past 1, 3 & 5 years with growth returns of 33.86%, 21.70% and 75.58% respectively.

L&G Global 100 Index Trust

The L&G Global 100 Index Trust has a Global investment mandate and is classified within the IA Global investment sector alongside 329 competing funds. This fund has also consistently excelled, with growth returns of 16.04%, 41.74% and 125.16% over the 1, 3 & 5 year periods analysed ranking among the top in the entire sector. In comparison, the average returns for this sector over the same period was 8.81%, 26.26% and 86.16%.

The L&G UK Alpha Trust Fund Was Outperformed By 99% of Funds In Its Sector

One of Legal and General’s most disappointing performing funds was their UK Alpha Trust fund. This fund has endured a torrid few years and has been plagued by heavy losses significantly worse than the sector average. Over the past 5-years, this fund has returned losses of -25.14% which was well below the 19.66% sector average and worse than 99% of all other funds in the IA UK All Companies sector.

L&G UK Equity Income Fund

Since its launch in 2011, the l&g UK Equity Income fund has continually performed below the sector average and in recent years it has been one of the worst in its sector for performance. The objective of this fund is to provide a combination of income in excess of the return represented by the performance of the FTSE All-Share Index, but it has only delivered losses to date for its investors.

L&G Asian Income Trust

The £300 million L&G Asian Income Trust fund is classified in the IA Asia Pacific excluding Japan sector alongside 98 competing funds. Over the past 12 months, this fund returned losses of -11%, which was the worst in the sector and well below the 11.28% average growth the sector returned for the period.

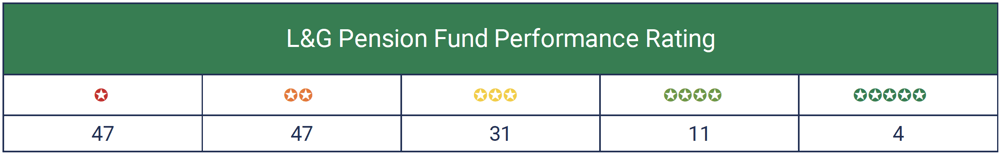

L&G Pension Funds

Legal & General manage 140 pension funds that have at least 1-year performance history and 94 have at least 5-years worth of performance history. Of the L&G pension funds with 5-years history, 4 (4.25%) of these funds have consistently returned a top quartile sector ranking over each of the 1, 3 & 5year periods analysed.

L&G High Income Pension Fund

A consistently top-performing pension fund is the L&G High Income pension fund. This is a relatively small fund with just £2.24 million of client assets under its management, yet it is a fund that has impressed with its performance. Over the past 1 and 5-years, it has been the highest growth fund in its sector.

L&G Growth Pension Fund

The L&G Growth Pension fund is a UK focused fund and it is classified within the Pn UK All Companies sector. The fund will typically invest between 80% and 100% in company shares from the UK, with Experian, 3i Group and Rentokil the funds’ 3 largest holdings.

This fund has consistently performed comparatively well in the sector and over the past 1 year, it was the number one ranked fund for growth out of all 824 funds in its sector with growth of 13.13%. In comparison, the sector averaged losses of -9.31% for the same period.

L&G World Ex UK Equity Index PMC Pn

The L&G World Ex UK Equity Index PMC pension fund is a tracker fund that aims to efficiently track the performance of the FTSE World (excluding UK) Index. The fund is classified within the highly competitive Global Equities sector where it has remained relatively competitive. Over the past 5-years the fund returned growth of 109.41%, which was better than 89% of all other funds in the sector and comfortably above the 74.53% sector average.

L&G Pension Funds That Have Consistently Underperformed

From L&G’s range of 140 pension funds, 94 received a poor performing 1 or 2-star rating as they each performed worse than at least 50% of their competitors during the periods analysed.

L&G UK Smaller Companies Pn

The L&G UK Smaller Companies Pension fund has been one of Legal & General’s most disappointing funds with its performance consistently among the bottom of its sector.

The fund currently invests in smaller UK companies that make up the lowest 10% by size of the main UK share markets. Over the past 5-years, this fund has returned growth of 10.98% which was lower than 95% of funds within the same sector and well below the sector's average growth of 40.84% for the period.

L&G UK Equity Income Pn

The L&G UK Equity Income Pension fund is another UK companies focused fund that has failed to impress. The fund has continually languished in the bottom quartile of its sector as it returned losses for each of the three periods analysed.

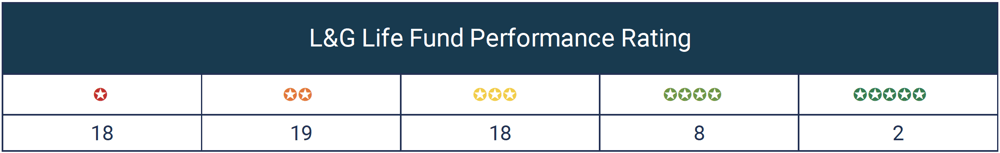

Legal & General Life Funds

Legal & General currently manage 65 Life Funds. Our analysis of these 65 funds identified that 5 have consistently maintained a top 25% sector ranking over each of the 1, 3 & 5 year periods analysed. In contrast, some 37 of the 65 L&G Life funds received a poor performing 1 or 2-star rating.

L&G Global 100 Equity Index Fund

Since its launch in 2009, this fund has consistently maintained competitive performance within the LF Global sector. The fund is an index tracker fund that tracks the performance of the S&P Global 100 Index, which is an index that consists of shares of the 100 largest multinational companies which of course includes Microsoft, Alphabet, Apple and Amazon. Over the past 1, 3 & 5 years this fund has returned growth of 12.01%, 30.45% and 88.88% respectively, each of which has been well above the sector average and better than at least 75% of all other funds within its sector.

L&G Gilt Fund

This fixed interest fund is classified within the LF UK Gilts sector where it has continually excelled for performance. Over the past 3 & 5 years, it has been the number 1 fund in the sector with returns of 24.83% and 54.84%. To provide a comparison, the sector average for the same periods was 8.86% and 17.36%.

L&G’s UK Funds Struggled

Similar to their other range of funds the UK has been the sector where their funds have struggled the most with some of their worst-performing funds in the UK sector.

L&G UK Alpha Life Fund

One of Legal & Generals worst-performing life funds has been their L&G UK Alpha fund. This fund is classified within the LF UK All Companies sector and over the past 5-years, this fund returned substantial losses of -31.38%, which ranked 529th out of 530 funds in the sector.

L&G UK Special Situations Fund

The funds objective is to invest in companies that they deem to be undervalued and thus offer potential growth from their recovery. However, the largest holding of this fund is with fund manager St. James’s Place, whom many believe is the opposite of undervalued, particularly in the current climate. The fund itself has persistently been among the worst in its sector for performance and over the past 12 months alone it has returned huge losses of -20.93%, which was worse than 94% of the funds in its sector.

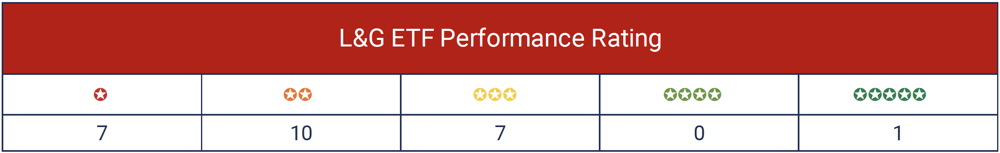

L&G ETFs

25 of the 297 funds analysed for this report are Exchange Traded Funds (ETFs). Our analysis of these ETFs classified 1 as a 5-star rated fund, 7 as 3-star rated funds and the remaining 17 as poor performing 1 or 2-star rated funds. Only the very volatile and high-risk L&G Gold Mining ETF managed to consistently maintain a top-quartile sector ranking over each of the periods analysed.

L&G Review Summary

The majority of Legal and Generals funds have underperformed with their UK range in particular struggling for competitive performance. However, our analysis also identifies the comparatively small range of funds that L&G manage that have been among the premier performers in their sectors.

Overall, the performance of L&G funds has been disappointing, but like most fund managers, a selection of their funds, albeit small, have shown their quality through their consistently competitive performance, and as a result, such funds could prove to be a worthy addition to a suitably diversified investment portfolio.