- Unlike any other fund manager, who manage at least five funds, all of the funds managed by Lindsell Train have continually outperformed their peers over the recent 1, 3 & 5 year period.

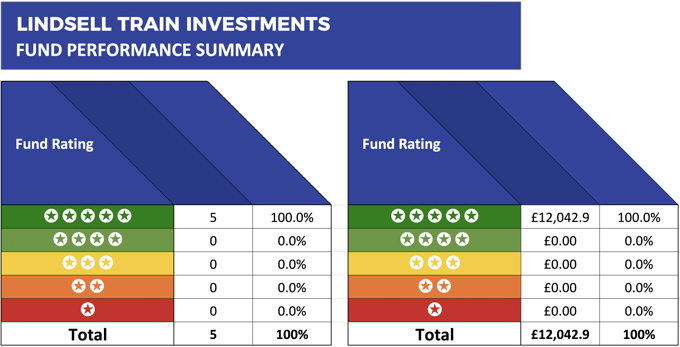

- All 5 Lindsell Train funds received an excellent 5-star performance rating

The Lindsell Train Investment Trust has a fantastic record of producing returns for investors, and it is by far the best performing trust in its sector and among the top performers of any investment trust in the UK.

The trust has returned growth of 246.22% over the recent five year period and a staggering 678% over the past ten years. For comparison, an investment in the FTSE 100 has produced a total return of only 80% over the last five years.

This strong performance is down to the investment skill of fund manager, Nick Train who’s astute bets on high-quality businesses has helped him achieve massive success with his funds.

Consistent and Quality Investments

Train’s best quality is his long-term focus. While other fund managers might chase results, Train is happy to invest in high-quality businesses that slowly grind out growth. He’s looking for companies with good cash flows that the managers believe will grow steadily. He also stays away from high-growth companies, including technology stocks, which can deliver outstanding returns but can also quickly fall from favour.

Register with Yodelar for just £1 and get full access to all fund manager reviews & much more >>

An Exceptional History of Top Performance

For this review, each of the five funds managed by Lindsell Train has been analysed for performance alongside every other competing fund within their respective sectors over the recent 1, 3 & 5 year period up to 1st June 2018.

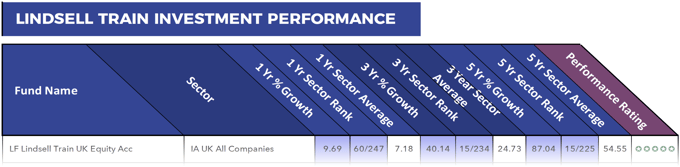

Unlike any other fund manager, who manage at least five funds, all of the funds managed by Lindsell Train have continually outperformed their peers over the recent 1, 3 & 5 year period. This exceptional record has helped Lindsell Train’s funds become among the most popular in the UK, with their UK Equity fund amassing some £5.3 billion of funds under management since its launch in July 2006.

This fund sits within the UK All Companies sector alongside 224 competing funds that have at least five years of history. This fund returned five-year growth of 87.04% which was higher than 94% of all other funds in its sector over the same period.

The Lindsell Global Equity Fund competes alongside 228 funds in the IA Global sector. Over the recent five year period this fund returned growth of 143.49%, which was the 2nd highest in its sector behind only the exceptional Baillie Gifford Global Discovery Fund.

The Lindsell Train Japanese Equity fund invests directly in the shares of Japanese companies primarily quoted on recognised exchanges in Japan. It has continually delivered strong performance returning growth of 24.25%, 102.34% and 150.48% over the recent 1, 3 & 5 year periods respectively.

Lindsell Train also manages the Lindsell Train Investment Trust and the Finsbury Growth & Income Trust. Both of these trusts have delivered high returns with the Finsbury Growth & Income Trust returning growth of 90.72% over the recent five year period.

Summary

One of the most impressive aspects of Lindsell Trains management style is the fact their funds cover many different markets, which require specialist knowledge and expertise to compete at a high level yet they all continually outperform their peers. Although a proportion of their holdings are in higher risk markets, Lindsell Train has been able to beat the market and their competitors consistently, making their funds a favourite with many investors.