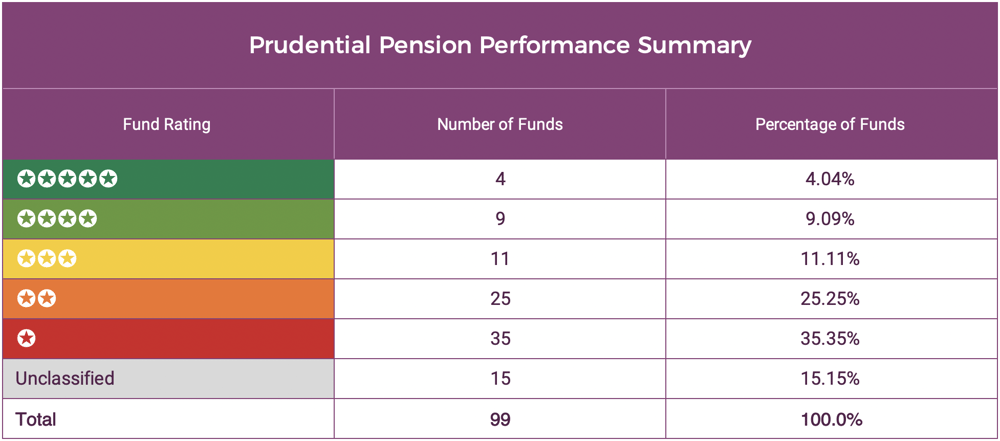

- 14% of Prudential pension funds have consistently maintained a top-quartile sector ranking over the past 1, 3 & 5 years.

- Of the 99 Prudential pension funds analysed over 60% received a poor performance rating of 1 or 2 stars.

- 9% of funds received an impressive 4-star performance rating and 4% of their funds consistently outperformed their competitors and received a high-quality 5-star rating.

Just last year the Prudential admitted it had provided poor service on its retirement accounts after accusations they had failed to release the pension funds of their clients when requested forcing many to wait months for their money. This comes a year after they were fined £24 million for mis-selling annuities to clients who would have qualified for better deals elsewhere; and on top of this concern has been raised regarding the performance of their funds and whether their investors would be better off investing elsewhere.

In this report, we analysed the performance of 99 Prudential pension funds over the last 1, 3 & 5 years, comparing their performance alongside all other same sector competing funds.

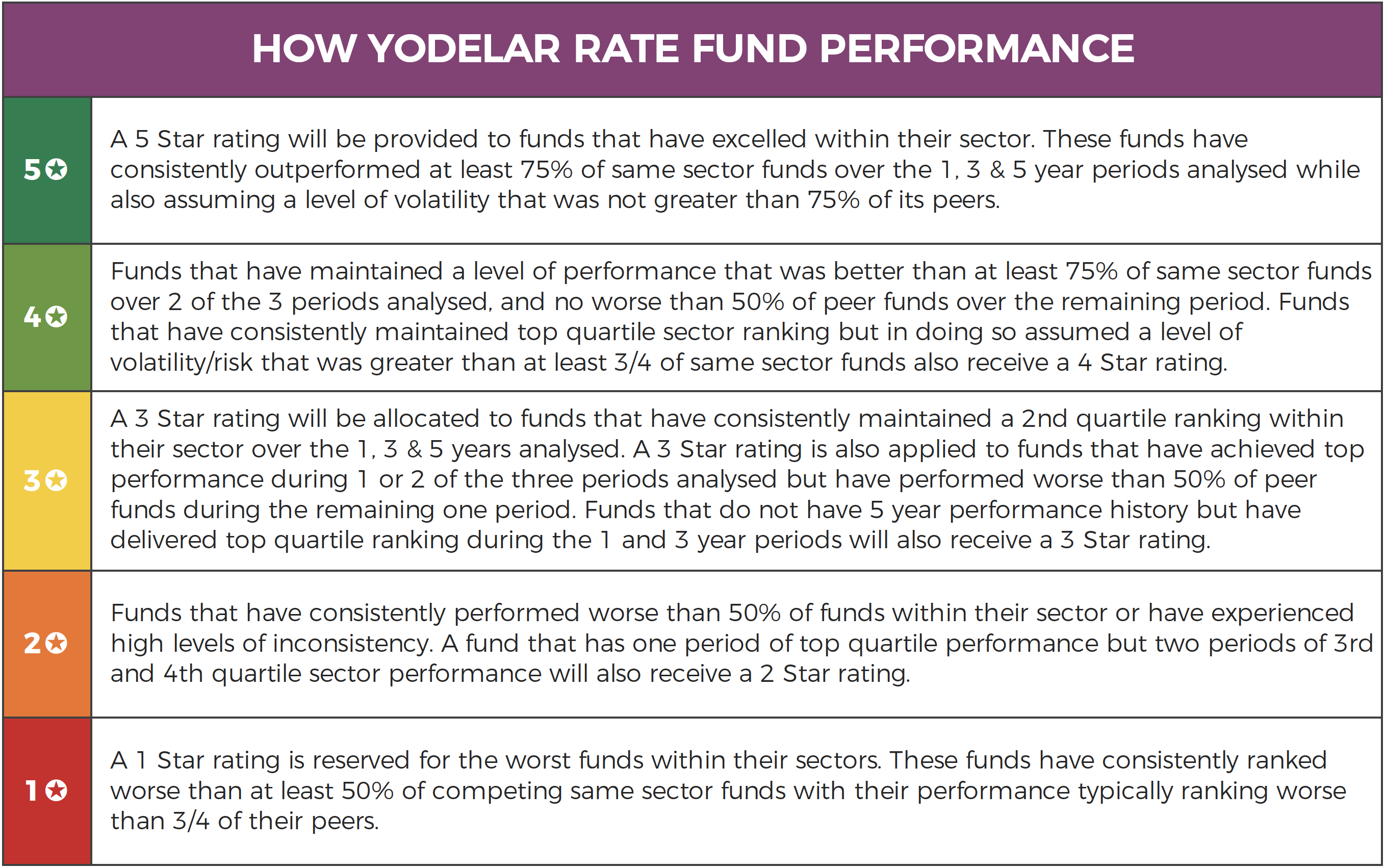

Based on their comparative performance we provided a performance rating for each fund between 1 and 5-stars.

As identified in this review, 14% of Prudential pension funds have consistently performed well within their sectors and received an impressive 4 or 5-star performance rating. In contrast, 60% rated as poor performing 1 or 2-star funds because they consistently performed worse than at least half of their peers within the same sectors.

About This Analysis

This analysis provides an insight into the performance of 99 pension funds that are managed by Prudential. The following tables detail the last 1, 3 & 5-year cumulative growth figures for each fund up to 1st November 2020. Each fund has been provided with a performance ranking between 1 and 5-stars based on how well their growth figures compared alongside all other competing same sector funds over the periods analysed.

Prudential Pension Fund Performance

From our analysis of 99 Prudential Pension funds, 35 (35%) received a very poor 1-star performance rating. Each of these 35 funds have consistently ranked among the bottom quartile in their respective sectors for performance and delivered returns that were well below the sector average. 25 Prudential Pension funds (25%) received a poor 2-star rating. Each of these funds consistently performed worse than at least half of all other funds in their sectors. 11 funds (11%) had a mediocre 3-star rating with 9 funds (9%) receiving an impressive 4-star performance rating and 4 (4%) of their funds consistently outperforming their rivals and rating as high-quality 5-star funds.

The remaining 15 funds are not classified within any investment sector and their performance cannot, therefore, be compared to other funds.

The Top Performing Pru Funds

As identified in the performance summary table there were 13 Prudential funds that managed to outperform their competitors consistently over the 1, 3 & 5 year periods analysed with the Pru Long Dated Corporate Bond among the most impressive.

Pru Long Dated Corporate Bond Pn S3

The Pru Long Dated Corporate Bond Pn S3 fund invests mainly in high-quality sterling corporate bonds with over 15 years to maturity.

The fund is actively managed and the managers have done an impressive job to date with the fund ranking 1st in its sector for performance over each of the 1, 3 & 5 year periods analysed.

Pru Dynamic Growth IV

The Pru Dynamic Growth IV fund is the largest of the 99 funds analysed for this report with £2.3 billion under the fund’s management.

As well as being their most popular fund it is also one of their best performers; over the past 5 years, the fund has managed to return growth of 50.95% which was better than 87% of the funds in its sector and comfortably above the 38.12% sector average.

Pru All Stocks Corporate Bond Pn S3

The Pru All Stocks Corporate Bond fund is a relatively small fund with just over £42 million of client money under its management but it is a fund that has impressed by consistently outperforming more competing funds within the same sector many of which have been more popular with investors.

The manager of the funds has placed the majority of the fund’s holdings in UK Corporate fixed interest bonds that have helped this fund excel in its sector.

Over the past 1 year, the fund ranked 2nd out of 271 funds in the PN Sterling Fixed Interest sector with growth of 7.24% and over 5 years it outperformed 95% of its sectors with returns of 40.06%.

60% of Pru Pension Funds Rated As Poor Performing

Despite a proportion of Prudential pension funds consistently maintaining top quartile sector performance, the significant majority have struggled in comparison to other funds in the same sector.

Pru Personal Pension Fund

Among their most uncompetitive was the Pru Personal Pension fund. The objective of this fund is to achieve long-term capital growth by investing mainly in UK and International companies,, but it has consistently struggled for performance. Over the recent 5-year period this fund returned growth of 34.01%, which was worse than 96% of the funds within the same sector and well below the 74.53% sector average.

Pru Managed Pension Fund

The investment strategy of the Pru Managed fund is to provide growth by investing mainly in a broad spread of Prudential's investment-linked funds and collective investment schemes. The fund will typically have exposure to a range of asset types, including UK and overseas equities, fixed interest and commercial property. It is a popular fund with assets under management in excess of £1.5 billion but it has had a troubled performance history. This fund has consistently ranked among the worst in its sector for performance and over the past 1, 3 & 5 years it returned -2.57%, 1.37% and 34.03%, each of which were well below the sector average.

Summary

Investing is about balancing the risk you’re comfortable with alongside the potential rewards that you want to achieve. To improve efficiency the funds that you choose to build your portfolio and meet your risk requirements should be high-quality funds which can improve your investment outcome. As identified in this report, Prudential have a selection of pension funds on offer that have consistently delivered competitive returns for their clients but a sizeable portion of their funds have also under-delivered and the fact is, there are many competing fund options that have delivered better returns for investors.