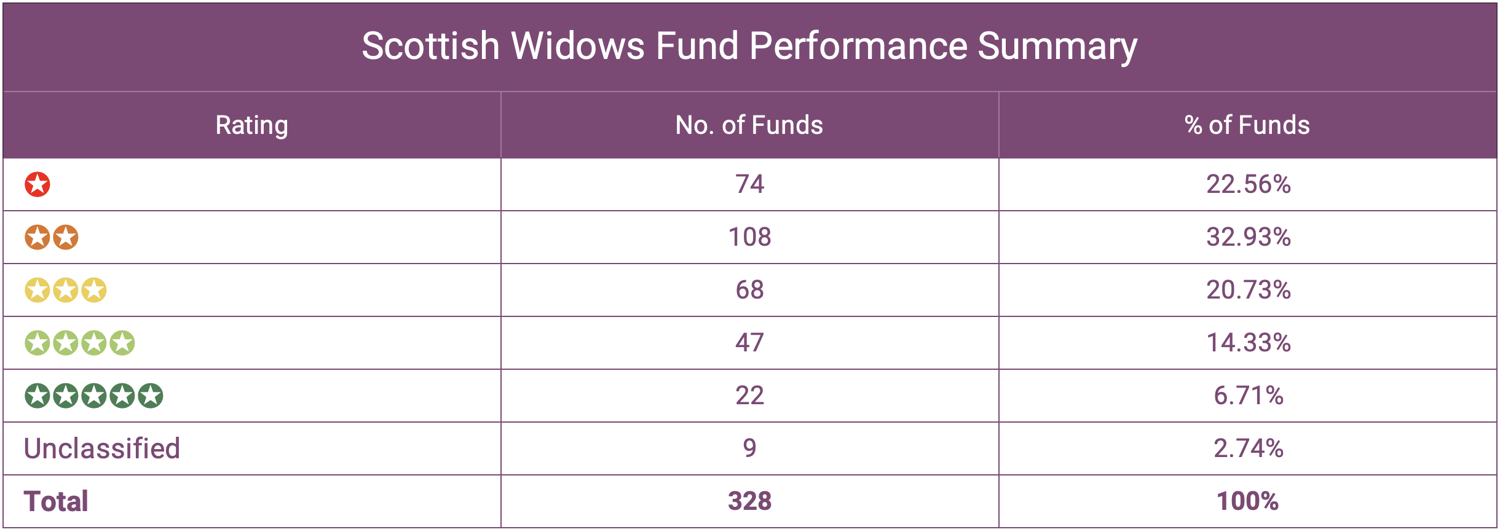

- From an analysis of 328 Scottish Widows funds we identified 69 top Scottish widows funds that consistently outperformed their peers within their respective sectors.

- Our analysis identified that 21% of Scottish Widows have consistently been among the top performing funds in their sector.

- 55% of Scottish Widows funds ranked as poor performing 1 and 2 star rated funds, ranking among the worst performing funds in their sectors over the past 1, 3 & 5 years.

- From the 9 Scottish Widows Socially Responsible and ESG funds with 5 year history, 4 have consistently ranked among the top performers in their sectors over the past 1, 3 & 5 years.

- The Scottish Widows default pension workplace pension fund has performed better than the popular NOW Pension and B&CE The People's Pension over the past 1 and 3 years. Over 5 years, it has outperformed the Legal & General and Standard Life default workplace pensions.

Scottish Widows Performance Summary

From our analysis of all 328 funds we identified that 55% received a poor performing 1 or 2 star rating, 21% receiving a modest 3 star rating, with the remaining 69 funds consistently outperforming the majority of their peers over the past 1, 3 & 5 year periods thus receiving an impressive 4 or 5 star rating. 9 Scottish Widows funds have no sector classification, and therefore could not be analysed.

Best Scottish Widows Funds

Future performance is never guaranteed nor can it be accurately predicted but research has shown that the fund managers with a history of strong performance are more likely to maintain this level of performance going forward, when compared to poor performing fund managers that are consistently in the worst 25% of their sector.

Scottish Widows North American Pension Fund

The Scottish Widows North American Pension fund is an equity fund which aims to outperform the S&P 500 Index. The fund invests in a range of American companies with technology and Industrial companies among the largest of their holdings. The fund currently manages in excess of £300 million on behalf of investors and it has consistently been one of the top funds in the sector over both volatile and calm market conditions.

Over the recent 1, 3 & 5 years this fund returned growth of 12.62%, 55.52% and 95.52%, which were comfortably above the sector average for the periods.

Scottish Widows American Growth Fund

The Scottish Widows American Growth fund is a unit trust/ISA fund which currently manages almost £500 million of client money. The fund is also a North American equity fund and it aims to outperform the S&P 500 index by 1.25% on a rolling 3 year basis. It has managed to consistently outperform the sector average and over the past 1, 3 & 5 years the fund returned growth of 12.95% , 53.84% and 90.29%.

Scottish Widows Specialist Global Equity Pension Fund

The investment objective of the Scottish Widows Specialist Global Equity Pension fund is to provide investors with long-term capital growth primarily through direct and indirect investment in a portfolio of equity securities issued by companies from around the world.

Since its launch in 2010, the fund has only managed to attract investment of £22 million, making it one of the smaller funds in its sector. Despite its size, it has consistently been one of the top performers in its sector. Since its launch it has returned growth of 154% and over the past 1, 3 & 5 years this fund has returned growth of 2.85%, 45.77% and 58.86%.

Scottish Widows Adventurous Solution Pension Series 2 Fund

The aim of the Scottish Widows Adventurous Solution Pension fund is to provide growth through investment in other funds to provide exposure to a mix of asset classes. At least 65% of the Fund will provide exposure to shares. This may include UK, overseas and emerging markets shares. A maximum of 25% of the Fund may provide exposure to fixed interest securities. As it invests in other funds it is called a fund of funds but its asset mix and the quality of underlying funds has helped this fund deliver strong returns and rank among the top funds in its sector. This may include UK, overseas and emerging markets shares. A maximum of 25% of the Fund may provide exposure to fixed interest securities.

Over the recent 1, 3 & 5 year periods this fund has consistently outperformed the sector average with growth returns of 0.93%, 16.81% and 21.42% respectively.

Underperforming Scottish Widow Funds

182 of the 328 Scottish Widows funds analysed received a poor performing 1 or 2 star rating. Each of these funds have regularly ranked among the worst performers in their sectors with consistently better-performing alternatives available to investors.

Scottish Widows UK Select Growth Fund

The Scottish Widows UK Select Growth fund is a UK equity fund that aims to provide growth through investment in a select portfolio, typically 30 to 50 holdings, of UK shares. The fund is actively managed by the Investment Adviser who chooses investments with the aim of outperforming the FTSE All-Share Index by 3% per annum on a rolling 3 year basis, before deduction of fees.

The fund has consistently underperformed within the IA UK All Companies sector where it ranked 174th out of 228 funds over the past 5 years with returns of 8.27% compared to the sector average for the period of 14.95%.

Scottish Widows European Real Estate Pension Fund

The Scottish Widows European Real Estate Pension aims to achieve long-term growth by investing principally in a portfolio of companies whose activities include the ownership, management or development of real estate in Europe including the UK. Despite its objectives, the fund has consistently underdelivered with the majority of its holdings based both in the UK and Europe losing value on a consistent basis. This is particularly evident over the past 1 & 3 years with negative growth of -24.17% this past year and -5.04% over the past 3 years.

Scottish Widows Pension Portfolio Four Pension Fund

One of the largest funds under the management of Scottish Widows is the Scottish Widows Pension Portfolio Four Pension fund which currently manages in excess of £9.8 billion. The Fund aims to deliver long-term growth by investing in other funds. The Fund invests with an emphasis on fixed interest securities, with the remainder in equities including a small proportion in listed property securities, by investing predominantly in passive* index tracking funds. A small proportion may be actively managed. The fund has continuously been one of the most disappointing funds in their range with the fund struggling consistently with underperformance. Over the past 1, 3 & 5 years this fund returned -9.59%, 1.51% and 7.99%, each of which were among the worst returns of the entire sector.

Scottish Widows UK Smaller Companies Fund

The Scottish Widows UK Smaller Companies fund is a relatively small fund despite being available to investors since 1993. The fund, as its name implies, invests in UK Smaller companies. It is an actively managed fund but its objective is to outperform the Numis Smaller Companies excluding Investment Trusts Index by 3% per annum on a rolling 3 year basis. But as identified in our analysis, this fund has failed to deliver competitive returns. Over the past 3 & 5 years the fund ranked among the bottom 25% of funds in its sector for performance with returns of 4.33% and 1.76% respectively. In contrast, the sector averaged growth of 16.77% and 29.94% for these periods, which emphasises the poor performance of this fund.

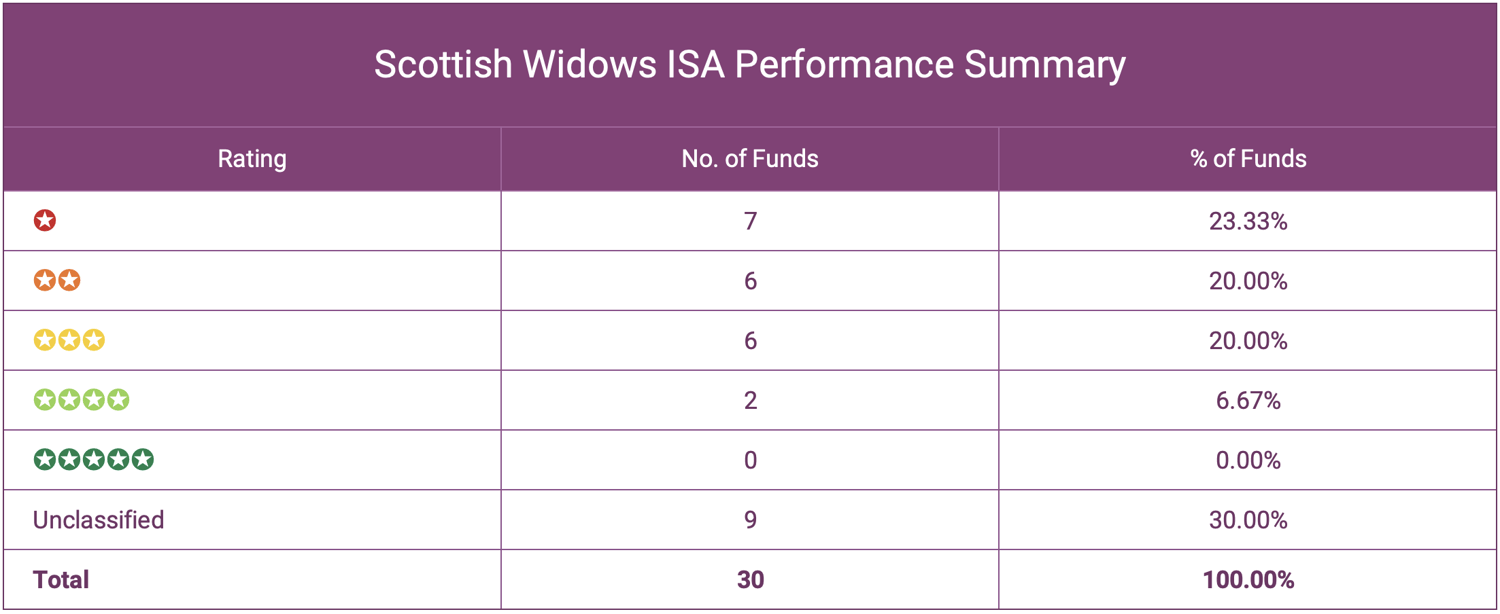

Scottish Widows ISA Funds

From the 328 Scottish Widow funds analysed, 30 were unit trust/ISA funds. 9 of these funds have no sector classification, which prevents their performance from being analysed alongside other funds. As such, these funds have not been provided with a performance rating. The remaining 21 Scottish Widows ISA funds have a sector classification and were provided with a performance rating.

From these 21 funds, 13 received a poor performing 1 or 2 star rating with 6 with a moderate 3 star rating and 2 with a 4 star performance rating.

Scottish Widows HIFML UK Property fund

The Scottish Widows HIFML UK Property fund was the only ISA fund from their range that managed to consistently rank in the top quartile of their sector over the 1, 3 & 5 year periods that were analysed. This fund actually ranked 1st in the IA UK Direct Property sector over the 3 periods with growth of 23.43%, 33.92% and 55.87% respectively.

Scottish Widows UK Tracker Fund

The aim of the Scottish Widows UK Tracker fund is to invest in UK equities by tracking the performance of the FTSE 100 Custom Screened Index, with the largest holdings being from the financial and healthcare sectors. The fund has a modest size with current client funds under management totalling £373million and it is classified within the IA UK All Companies sector alongside 246 competing funds. Over the past year this fund ranked 16th in the sector with returns of 7.62%, which was well above the sector average of -7.99%. Over 3 & 5 years the fund has also outperformed the sector average with returns of 13.49% and 16.71%.

In contrast to the Scottish Widows UK Tracker fund, which is a passive fund, their actively managed UK equity funds all underperformed. As we have already noted, the Scottish Widows UK Smaller Companies fund and Scottish Widows UK Select Growth fund both ranked among the worst in their sectors for performance, which raises questions as to the quality of Scottish Widows fund management particularly in the UK equity market.

Scottish Widows Global Funds Perform Better

Although the performance of Scottish Widows UK equity funds has struggled their Global funds have fared much better. Unlike UK equity funds, which only invest in UK companies, Global funds have the freedom to invest in companies throughout the world. Their composition mainly includes U.S companies, as they represent the largest market but a good global fund will also incorporate strong companies from other markets such as Europe, Asia and the UK.

Scottish Widows have 2 funds within their ISA range that are classified within the IA Global sector and both of these funds have performed comparatively well.

Scottish Widows Global Growth Fund

The Scottish Widows Global Growth Fund currently holds £974million of investor assets. The majority of the fund's holdings are in companies within the information technology and Healthcare sectors, with 66% of the fund's assets in North American companies, 15% in European companies, 5% in UK and the rest spread across emerging markets and Japanese markets. Although this fund has a 3 star performance rating it has consistently outperformed the sector average over each of the 3 periods analysed. Over the past 12 months the fund has climbed up the sector rankings with returns of 7.2% better than 89% of its peers, with its performance during highly volatile markets being very impressive.

Scottish Widows Global Select Growth

The remaining Global fund from their ISA range is the Scottish Widows Global Select Growth fund. This fund is significantly smaller than the Global Growth fund with just £81million of client assets under management. However, the fund has also outperformed the sector average consistently with 1, 3 & 5 year returns of 2.33%, 44.69% and 58.35% respectively, each of which were considerably better than the sector average.

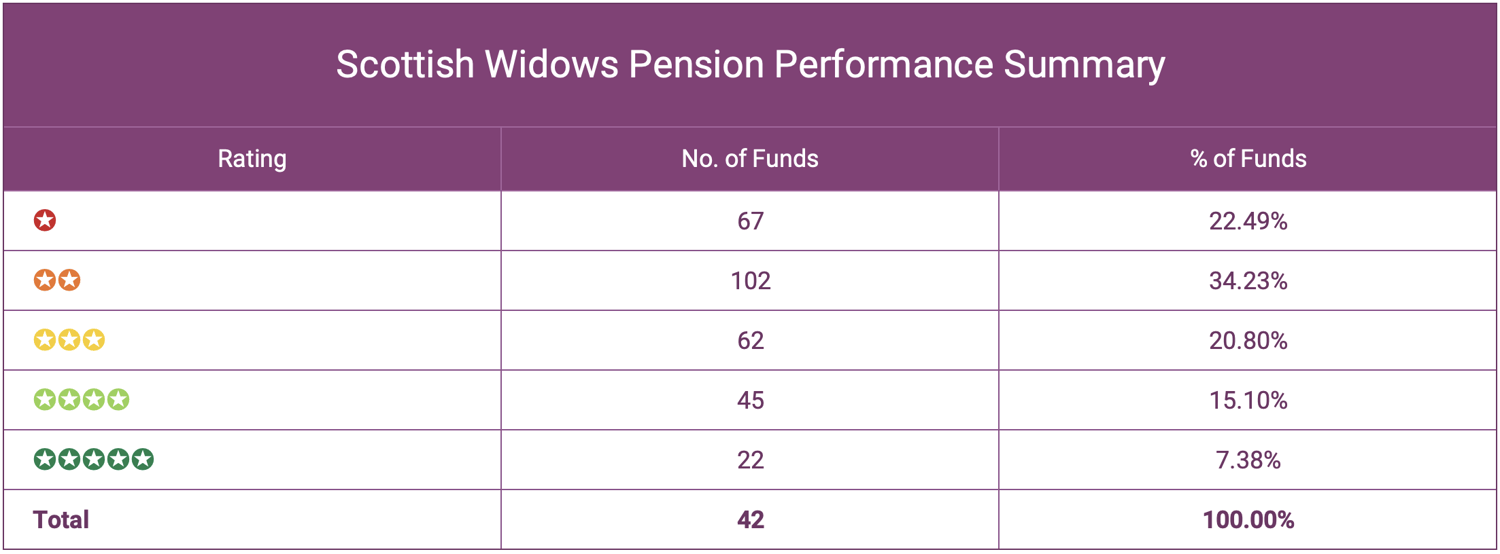

Scottish Widows Pension Funds

The significant majority of the funds under the management of Scottish Widows are pension funds. In total, we analysed 298 of their pension funds with 22.48% receiving a very good 4 or 5 star performance rating, which is comparatively high when compared to other pension providers. In contrast, 56.72% of Scottish Widow’s pension funds received a poor performing 1 or 2 star rating as they have each consistently ranked among the bottom half of their sector for performance over the past 1, 3 & 5 years.

Scottish Widows have an extensive range of pension funds on the market but the largest and most popular is their range of 5 pension portfolios, which combined hold almost £48 billion in client money.

Each of the Scottish Widows Pension Portfolios, with the exception of the lowest risk pension portfolio five, are classified in the Specialist pension sector but each act as a readymade portfolio as they invest in a range of funds from different providers. They each have a different risk rating with the lowest risk being the Scottish Widows Pension Portfolio Five and the highest risk rated being their Pension Portfolio One.

Scottish Widows Pension Portfolio Five

As the lowest risk model in the range, this fund invests in short- to medium term securities through other funds. These include fixed or floating rate debt instruments such as deposits, commercial paper, medium term notes, asset-backed securities and bonds. However, following the outbreak most of these products have experienced declining valuations, with the fund averaging negative returns of -0.53%, -0.95% and -0.95% over the past 1, 3 & 5 year periods.

Scottish Widows Pension Portfolio Four

The Fund invests with an emphasis on fixed interest securities, with the remainder in equities including a small proportion in listed property securities, by investing predominantly in passive index tracking funds. The fund has a risk rating of 4 out of 10, which is in line with a cautious investment approach. Over the past 1, 3 & 5 years the fund has returned -9.59%, 1.51% and 7.99% respectively.

Scottish Widows Pension Portfolio Three

The fund is similar to the pension portfolio four in that it primarily invests in passive funds. However, the fund has a greater weighting in equities with almost 70% of the fund invested in equities compared to 40% for the pension portfolio five. This fund has a risk rating of 6 out of 10, which is similar to that of a balanced investment approach. Over the past 1, 3 & 5 years this fund has returned -5.84%, 11% and 18.21%.

Scottish Widows Pension Portfolio Two

The equity investments of the Scottish Widows Pension Portfolio Two covers a mix of geographic regions. The fund is the largest in the range with assets under management totalling £24.6 billion. With a risk rating of 7 out of the 10 the fund is targeted towards moderately adventurous investors and over the past 3 & 5 years it has been one of the top performing funds classified within the IA Specialist sector. Over the past 1, 3 & 5 years the fund has returned -3.95%, 16.35% and 23.96%, each of which is comfortably better than the sector averages of -5.3%, 6.8% and 13.98%.

Scottish Widows Pension Portfolio One

The Scottish Widows Pension Portfolio One is the most adventurous in the pension portfolio range with a risk rating of 8 out 10. As such the fund should only be considered by investors with a high risk tolerance. Similar to the other pension portfolio funds, this fund invests mainly in passive funds but due to its higher risk approach a large proportion of the assets are in international and emerging market equities. The fund has the highest returns of the range, with 1 year growth of -3.95%, 3 year growth of 16.35% and 5 year growth of 23.96%.

Scottish Widows Ethical Investing Approach

Earlier this year, Scottish Widows announced that they would divest an additional £1.5 billion under an updated exclusion policy that adds tobacco firms and tightens the threshold for carbon-intensive companies, with greater focus on ethical investing.

A new tobacco policy prevents it from investing in any company deriving more than 10% of revenue from tobacco. A paper explaining the rationale said tobacco holdings are irreconcilable with its socially responsible investment strategy and "pose an unrewarded investment risk," according to a news release.

Maria Nazarova-Doyle, head of pension investments and responsible investments at Scottish Widows said “they are taking the long view, with industries such as tobacco at severe risk of becoming stranded assets as they face intense pressure from investors, regulators and consumers, and consistently fail to properly address the social impacts of their products and within their supply chain."

Scottish Widows’ revised exclusionary policy for carbon-intensive industries also lowers the revenues allowed from thermal coal and tar to 5% from 10%. "We stand by our belief that carbon-intensive sources of energy such as thermal coal and tar sands will ultimately be replaced by greener renewable sources such as wind or solar," Ms. Nazarova-Doyle added. "As such, exiting these highly damaging areas and redirecting capital to more climate-aware investments makes perfect investment sense."

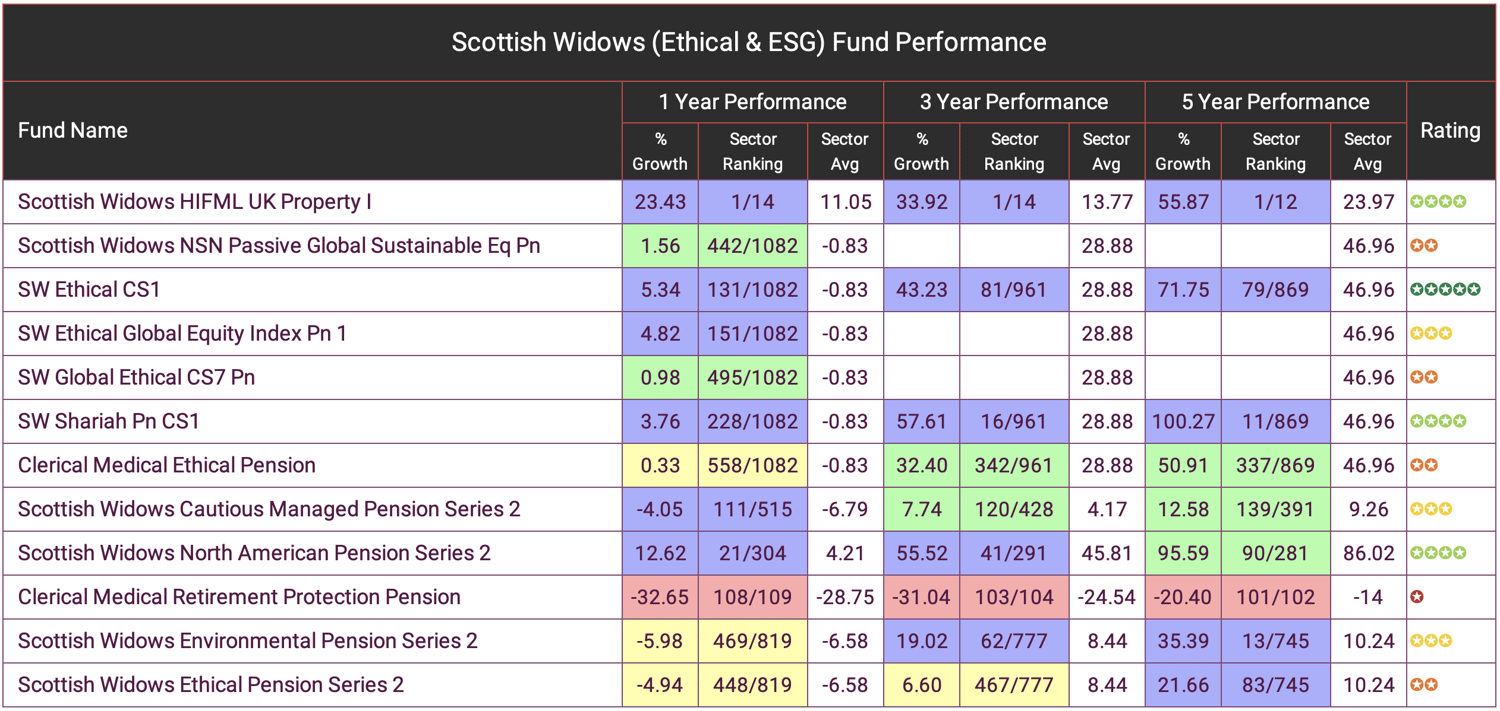

Scottish Widows Ethical Funds

In our analysis of the 328 Scottish Widow funds, we identified 12 funds across a range of sectors with an Ethical or ESG theme. Our analysis of these funds identified above average returns for 89% of these funds with 5 year history.

The Best Scottish Widows Ethical Funds

From the 9 Scottish Widows Socially Responsible and ESG funds with 5 year history, 4 have consistently ranked among the top performers in their sectors over the past 1, 3 & 5 years.

Scottish Widows HIFML Property

The Scottish Widows HIFML Property fund has consistently been the top performing fund in the UK Direct Property sector. Over the past 1, 3 & 5 years this property focused fund has returned growth of 22.43%, 33.92% and 55.87% respectively, which were more than double the sector average.

Scottish Widows Ethical

The Scottish Widows Ethical CS1 pension fund has a global investment strategy. The fund aims to track the total return of the FTSE4Good Global Equity Index which contains companies across a wide spectrum of sectors such as technology, healthcare and financial services. The fund is classified within the highly competitive Global Equities sector alongside 1081 competing funds. Over the past 1, 3 & 5 years this fund has managed to consistently outperform 88% of the funds within the sector with returns of 5.34%, 43.23% and 71.75% considerably better than the sector average.

Scottish Widows Shariah

The Scottish Widows Sharia CS1 pension fund aims to offer investors the opportunity to grow their money in line with the performance of the Dow Jones Islamic Titans 100 Index. The fund invests in company shares from around the world and is compliant with Islamic Shariah principles. The fund invests in the HSBC Life Islamic Global Equity Index fund, and is also classified within the Global Equities sector where it has been one of the stand out funds. Over the past 1, 3 & 5 years the fund has returned growth of 3.76%, 57.61% and 100.27%.

Scottish Widows Push For The Removal of Performance Fees

Scottish Widows are one of the UK’s largest pension providers to call for performance fees to be banned from pension products. The performance fee model means managers are paid a bonus, in addition to a fixed annual management fee, for outperforming a benchmark or “hurdle rate”.

“Scottish Widows sees no evidence to suggest that performance fees improve customer outcomes,” said the provider, in a submission to the government. “We do not see a need for performance fees to be permitted in default (pension) funds.”

Pressure has been building on the asset management sector to ditch the performance fee model. In an analysis published last year at Oxford university it was estimated that investors paid £200 billion in performance fees over a 10-year period for returns that could have been matched by an inexpensive tracker fund.

Scottish Widows largest rival in the workplace pension sector Nest also called for the scrapping of performance fees with Mark Fawcett, chief investment officer of Nest, saying performance fees were not justified and managers “should just be incentivised by doing a good job”.

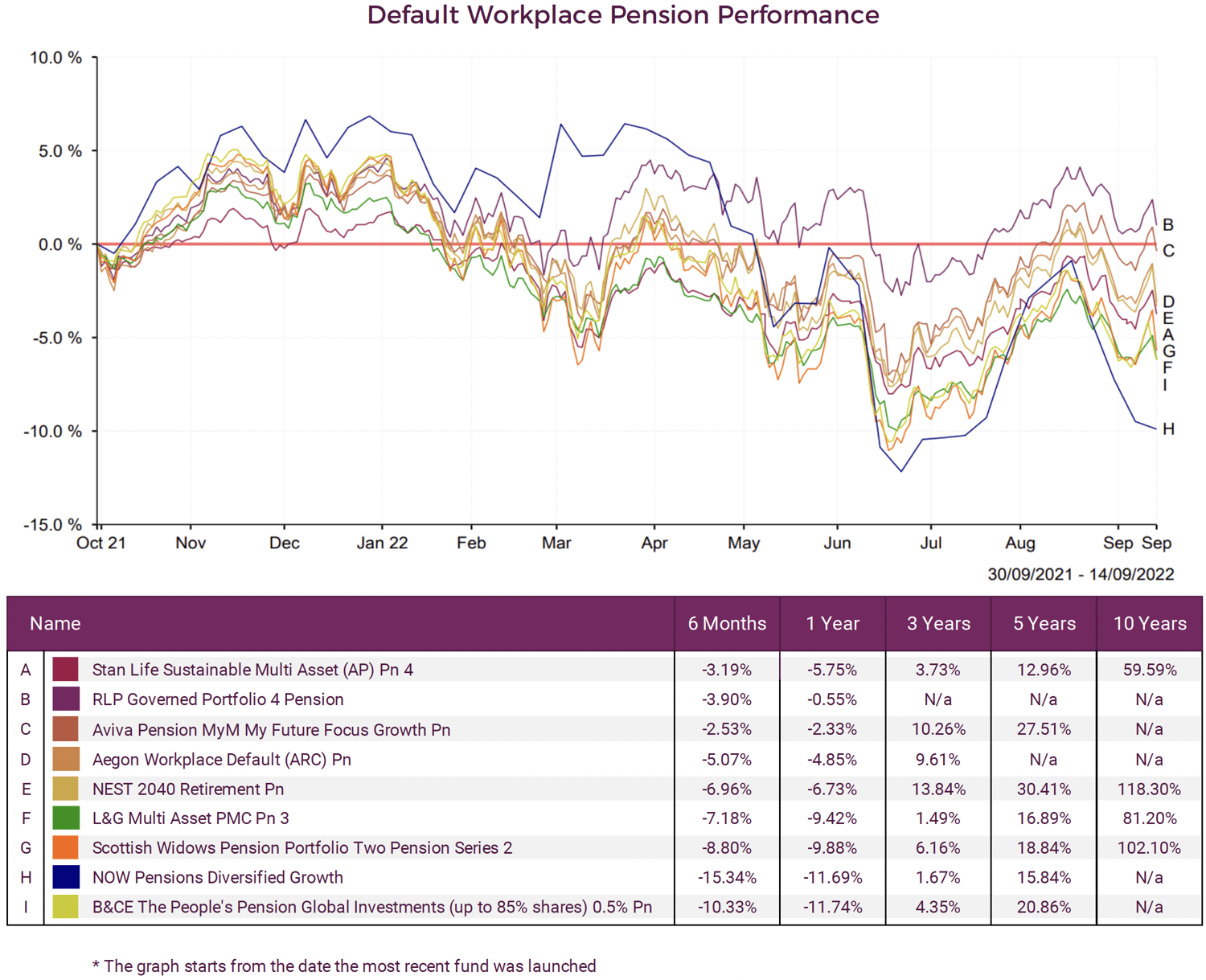

Scottish Widows Workplace Pension Funds

Default workplace pensions are the funds in which contributions to workplace pensions will automatically be invested in. Unless employees are given and exercise their own investment choices then they will be invested automatically in these funds, in which case there will be a range of funds from which they may choose.

Research from The Pensions Regulator shows that more than 95% of workers stay in their pension scheme’s default fund. So it makes sense for investors to understand what that default fund is and how well it compares.

The following graph and table shows how the default investment funds for some of the most common pension providers have fared over the past 10 years or since their inception.

It identifies that the Scottish Widows default pension has performed better than the popular NOW Pension and B&CE The People's Pension over the past 1 and 3 years. Over 5 years, it has outperformed the Legal & General and Standard Life default pensions.

Scottish Widows Review

Scottish Widows is one of the largest providers of pension and investment funds in the UK, with their range of products a popular choice with advisers and investors alike.Their workplace pension funds are among the top selected options for small, medium and large companies.

Despite their scale and popularity, our analysis shows that a large proportion of their funds have consistently underperformed. But on the flip side, from their large range of funds they also have some excellent and highly competitive investment options. These top performing funds are identified in our full report which features the performance and ranking of all 328 funds.

In conclusion, Scottish Widows, like most large scale pension and investment providers with a huge selection of funds, will always have a sizeable portion of their funds that rank as poor performing. But there is also a good proportion of top quality performing funds if investors know where to look. Access our Investor Hub fund research portal today for a free trial or discuss your needs with our advice team.

With so much choice available identifying and investing in the funds that have consistently outperformed could help investors meet their pension objectives more efficiently.