- Poor Performance and high charges from St James's Place

- 8 out of 10 SJP funds have consistently underperformed.

- Over 50% of SJP funds rank in the worst 25% of their sector

- 72% of St James’s Place funds perform worse than the benchmark

- St James’s Place admits two thirds of funds failing consumers

- Restricted advice model, clients limited by fund choice

- SJP advisers are unable to advise investors on 99.3% of the investment market

- Exit penalties of up to 6% for the pension and bond products

- Limited protection under the Government FSCS Scheme

For the benefit of investors, we have independently assessed the performance of all St James’s Place investment funds and portfolios, comparing SJP fund performance to all other same sector funds available to consumer investors.

We have also compared St James's Place charges, including fund charges, advice charges and early exit penalties. This report evaluates the overall cost of investing with SJP and reviews St James Place unique and highly profitable business model.

DOWNLOAD THE FULL REPORT AS A PDF TO VIEW LATER

In this latest St James’s Place review, we analyse the factual performance of all 154 SJP investment and pension funds and identify that 84% of SJP funds have continued to perform worse than at least half their peers.

We would recommend that all existing St James Place investors upload their latest SJP statement and make use of our free portfolio analysis service . This is a free no obligation service which will identify the market ranking of your specific funds, and will demonstrate what proportion of your funds are invested in poor and top performing funds.

Quick & Useful Links

- 1. St James’s Place Performance

- 2. St James Place Charges

- 3. Download SJP Review (PDF Format)

- 4. The Risks of Investing with SJP

St James's Place Wealth Management

St James Place is currently the largest investment adviser firm in the UK. They currently manage between 12-15% of total UK investor assets, with an approximate value of £130 Billion. The company has over the last 20 years grown at an exceptional rate, recruited more advisers than any other firm, and converted many to their 'restrictive', but profitable practices. SJP now has the largest distribution of restricted advisers in the UK, restricted on the basis they can only sell/advise on SJP investment funds (which accounts for less than 1% of all funds and variants available to consumer investors).

As well as collectively being one of the worst performing fund managers available to UK investors (as detailed in this report) they are also one of the highest cost propositions available.

Despite repeated callouts from leading media outlets, industry watchdogs and independent analysts over their high and confusing charging model SJP have made it clear they have no intention of changing them.

Senior management have admitted their charging structure is confusing. Last year, in the wake of new legislation introduced by the industry regulator, the Financial Conduct Authority, St James’s Place were forced to admit that some two-thirds of their funds were failing to deliver value. This was reported extensively in the Times and the Telegraph.

A large proportion of SJP clients are unaware of the firm's structure and model. St James Place Wealth Management is the advice firm with self employed financial advisors, generally referred to as partners. However the investment funds are held with St James’s Place Unit Trust Managers. Both companies are the property of St James’s Place PLC. Under their proposition clients can opt to pay for advice or not pay for advice.

Yodelar has completed a number of reviews of St James’s Place and their investment funds over the last 5 years, and have continued to highlight to readers that a large proportion of their funds perform poorly when compared to all other same sector funds.

The restricted nature of their business model (only able to offer investors their own branded funds), hinders SJP from offering clients access to the top performing funds available from better fund managers listed in our Fund Manager League Table, such as Baillie Gifford, Schroders and Legg Mason.

Many St James’s Place clients have questioned SJP management in relation to the factual performance of their funds, SJP have replied saying they feel market assessments are unfair. However the reality is that the performance of their funds and their investment portfolios lag well behind the majority of their competitors.

Our overall opinion of St James’s Places is that they do not offer a competitive or value drive option for investors. Their pricey funds perform poorly and the organisation relies on the sales acumen of their partner distribution model to attract and convert clients.

The majority of SJP clients are unaware of their poor performance and high charges. Those that are aware are often tied in with hefty exit penalties or trust vehicles that make it impossible to leave. Now more than ever SJP clients are leaving when possible to invest in more efficient, and often lower cost funds under a ‘whole of market’, non restricted proposition.

St James’s Place Performance

In their recent ‘value assessment’ report St James’s Place admitted that less than 50% of their funds offer overall ‘good value’, yet in contrast to their own report, when questioned over the comparative performance of their funds they strongly believe their funds perform well.

The industry has a general acceptance that a fund that ranks in the top 25% when compared to all other same sector funds is a better performing fund. Contrary to this SJP says that a fund not in the worst 40% of same sector funds is a top performing fund. SJP have created an assessment line that is well below industry standards, aware that the majority of their clients will read SJP correspondence only and not independent research.

In effect St James’s Place in their performance assessment say that a fund below even the sector averages (i.e. bottom 50% of sector performers) can still be classed as a top performing fund.

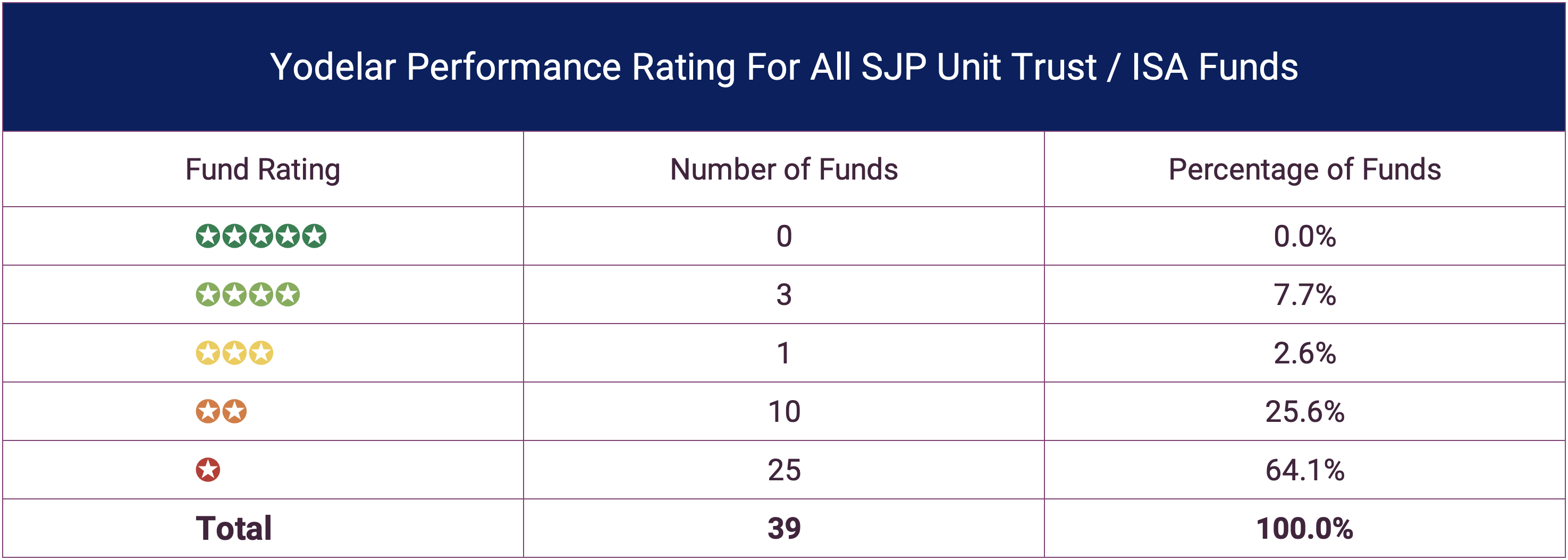

89.7% of St James’s Place funds rate as poor performing 1 or 2 star funds, making SJP one of the worst fund managers in the UK.

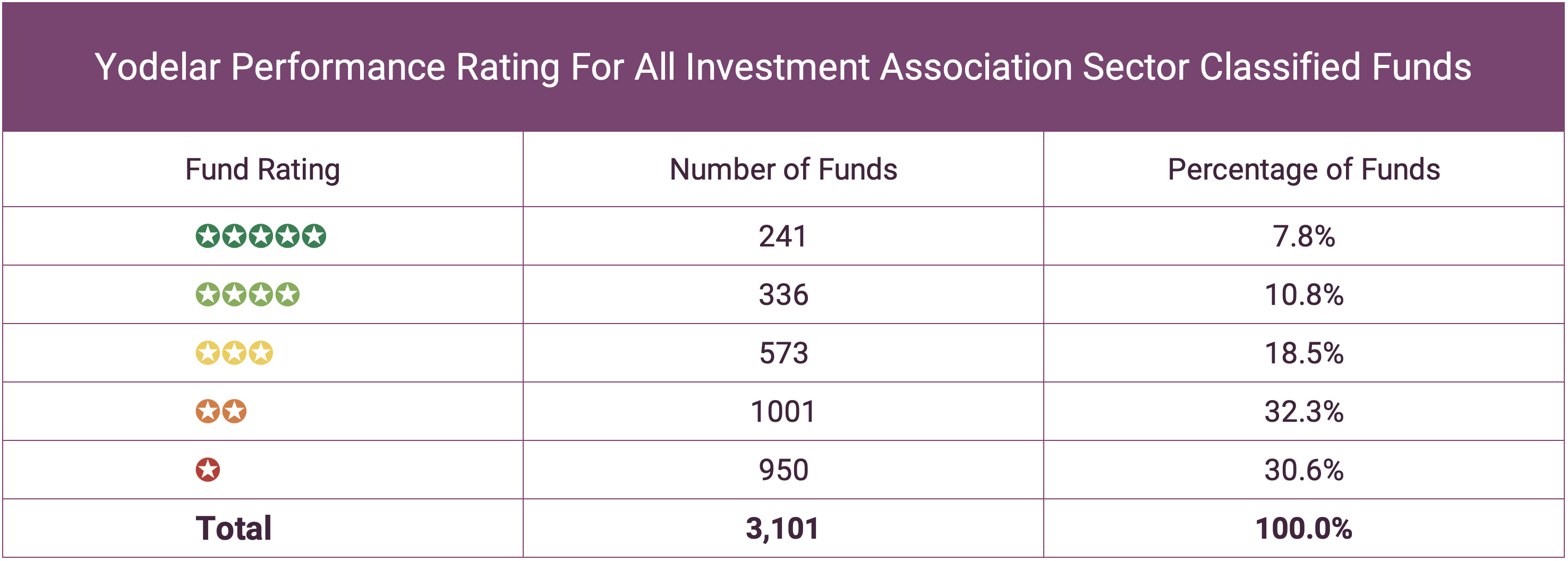

When we look at the entire unit trust market, and analyse the entire 3,101 funds classified by the investment association across all brand names, 62.9% rate as poor performing 1 or 2 star funds with 18.6% receiving a good 4 star or top performing 5 star rating.

The fact that a significant proportion of SJP funds fall within the 1 or 2-star rating is simply down to their lack of quality and consistent poor performance. Click here for further information on how Yodelar rate investment funds.

Of 3,102 unit trust funds monitored by the fund industry trade body, the ‘Investment Association’, 62.9% were rated by Yodelar as poor performing 1 or 2-star funds (see table 1 below).

Out of the 3,102 main funds available to consumer investors, there are approximately 580 funds (18.7%) that have been able to maintain a top 25% performance ranking within their particular sector (4 & 5 star funds).

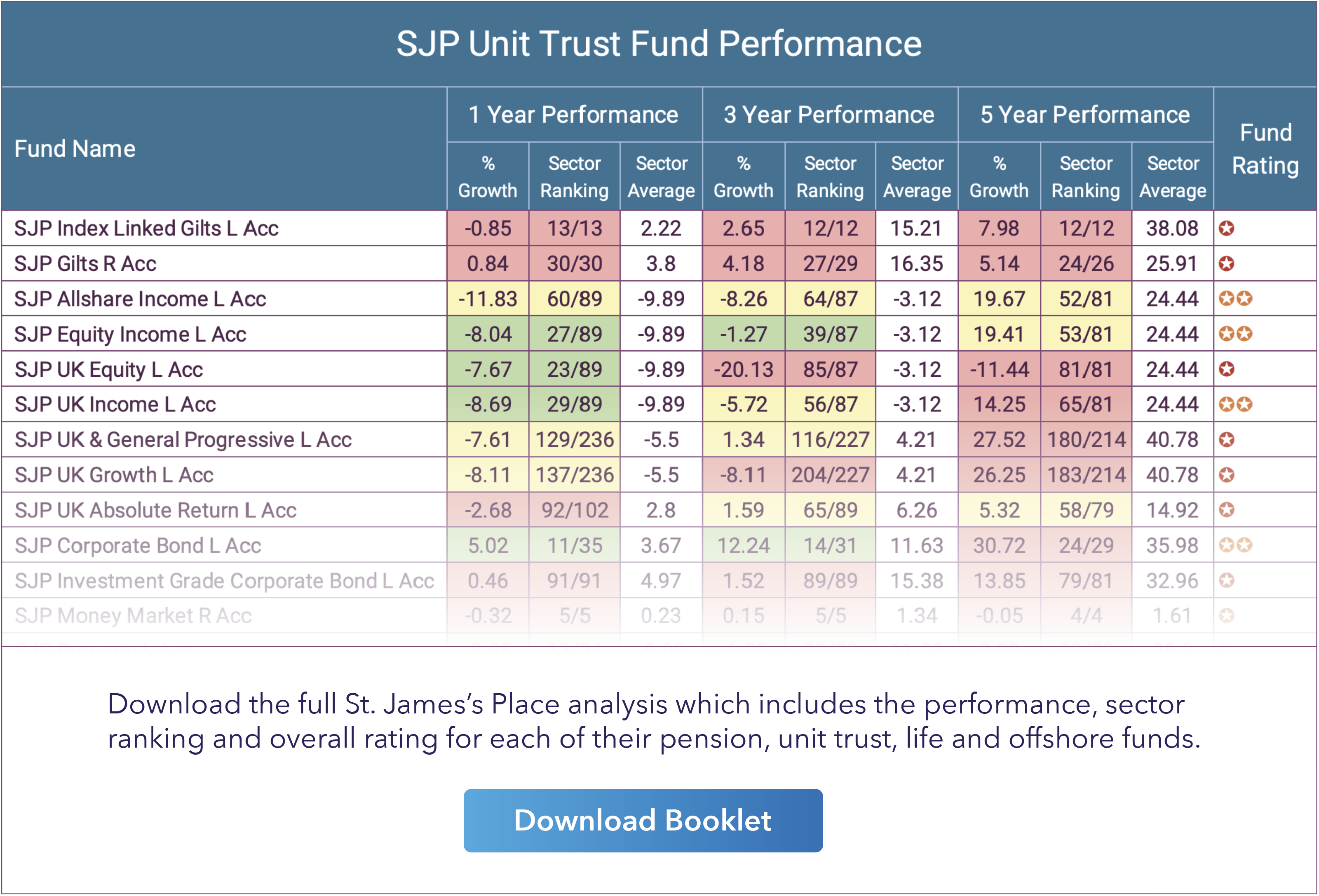

However, as identified in table 2 below, the average performance rating of SJP funds is significantly lower than the industry standard across all investment sectors.

Through our fund research service, we provide consumer investors with the ability to review all funds in all sectors and rank accordingly to identify the top performing funds. We annually analyse over 100 fund managers (of which St James’s Place are only 1) and independently highlight the best performing funds monthly via our online magazine and Top Performing Funds report.

St James’s Place Funds

SJP provides investors with an in-house range of products and portfolios that hold only SJP funds. The main limitation of the SJP model is that their advisers must only recommend SJP products and funds meaning their investors are only exposed to SJP funds irrespective of how good, bad or indifferent they are. As a restricted advice firm they have no onus to provide clients with comparative performance from all other fund managers, unlike 'whole of market' or Independent advice firms.

To provide a diverse range of funds and portfolios that cater to all risk categories St. James’s Place offers access to 154 funds that have at least 1 years performance history. These are made up of 39 unit trust funds, 39 pension funds, 39 life funds, and 37 offshore funds through SJP International (SJPI).

All of these funds are SJP owned and branded but none are actually managed by SJP themselves. Instead, SJP outsources the management of their funds to other fund management firms. These fund managers are selected by SJP’s investment committee and they are each mandated to build and run the fund in accordance with SJP’s objectives - such as the desired risk exposure and asset allocation. An important point to note is that all these funds/ fund managers are available to UK investors directly, and often at a lower cost than the SJP versions.

In recent years SJP has publicly withdrawn fund manager mandates from Neil Woodford, AXA Framlington, Janus Henderson, Schroders and BlackRock as concerns grew over their performance and direction.

SJP’s switching of fund managers is not unique and although they believe their exclusive relationships with these fund management brands increases the quality and level of expertise the end result has persistently underwhelmed, with some of their funds continually languishing at the bottom of their sectors.

As identified in our performance analysis of their funds, 8 out of 10 of their funds have consistently underperformed.

The below fund rating table identifies the number and percentage of SJP funds that were rated between 1 and 5-stars for their performance in comparison to all other competing funds within the same sectors over the past 1, 3 & 5 years.

Not ready to read the entire article now? Download the full St James's Place Review including performance tables in PDF format and review later - Click Here To Download

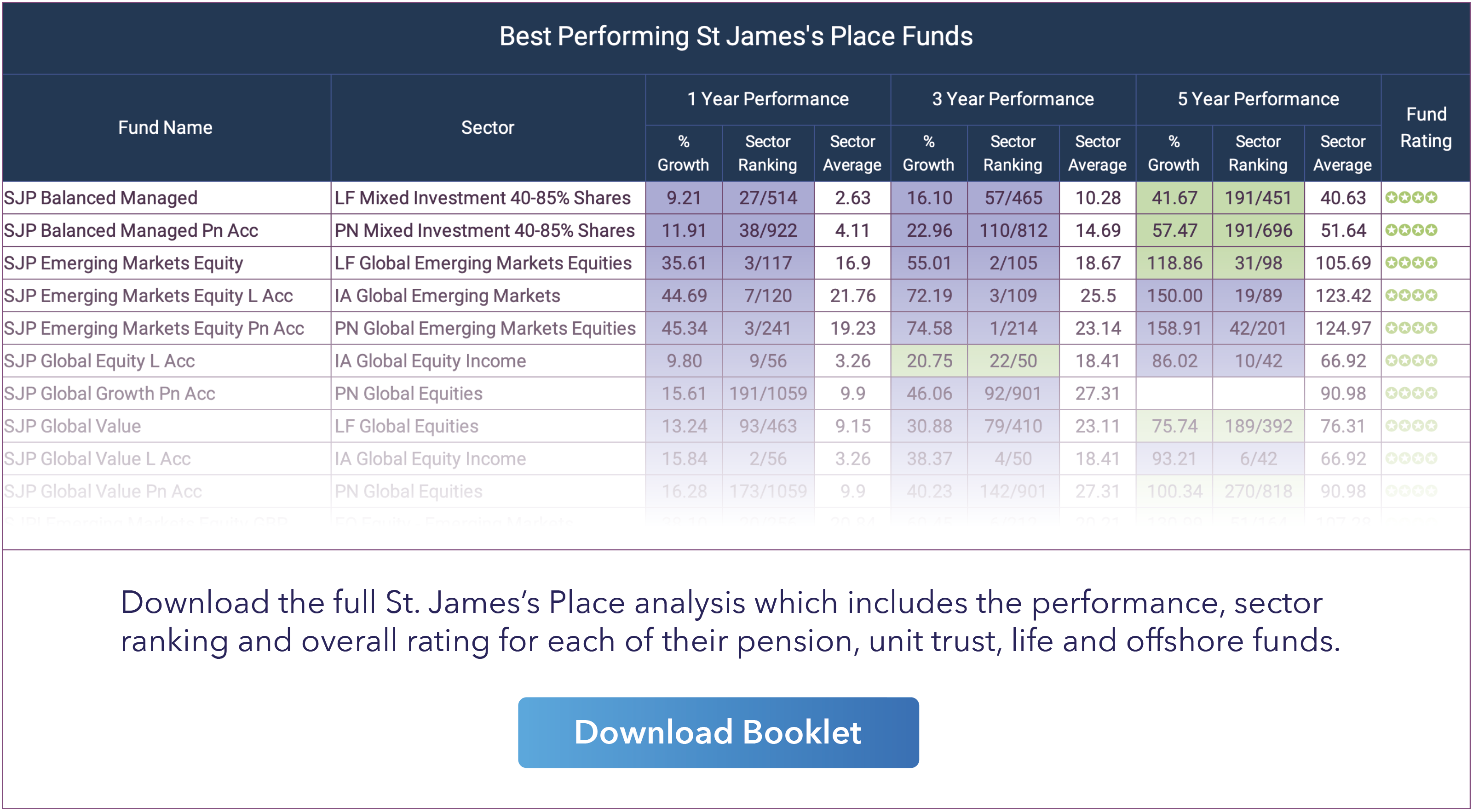

The Best St James’s Place Funds

Although their fund range is blighted by underperformance it is important to recognise the small proportion of their funds that have been competitive and consistently performed well. The table below shows the SJP funds that have performed the best within their respective sectors with the majority consistently outperforming two-thirds of their competitors over the periods analysed.

The SJP International Equity fund has been their strongest fund for comparative performance. This fund has a mid risk range and is managed by Hamish Douglass of Magellan. As identified in the table below it has consistently ranked among the elite performers in its sector over the 1, 3 & 5 year periods analysed.

St James's Place Portfolio Performance

St James’s Place claims that performance comparisons should not be made on their single funds but on their range of portfolios which their clients usually buy.

These portfolios are weighted based on their particular investment objectives and associated levels of risk.

As a restricted wealth management firm, St. James’s Place portfolios only consist of SJP funds, but as we identified in our fund performance analysis a large proportion of these funds have a history of poor performance, which reflects in their portfolios end performance as well..

The following tables demonstrate the recent 6 month, 1, 3 & 5-year returns of all nine SJP unit trust portfolios, pension portfolios and bond portfolios.

To provide a comparison, the table below features the returns of Yodelar Investment portfolios during the same periods as managed by our regulated advice team. Yodelar portfolios are composed of a mixture of active and passive funds that have been selected from an unbiased analysis of more than 70,000 funds and 100 different fund manager brands.

St James's Place Charges & Fees

St James's Place charging model is unique and often criticised for its complexity. Last year, their then recently appointed non-executive director, Helen Morrissey (since resigned) said "I would like to satisfy myself that fund charges are transparent and fair, but I do not believe they are because otherwise, I would be able to explain them to you very quickly."

Among the most contentious aspects of their fee model are the St James's Place exit penalties which they apply to their range of pension and bond products. Investors in these products who wish to exit and move their money to another provider are required to pay SJP up to 6% of their investment value to do so. SJP has been accused of using this penalty to secure control of clients' investments for several years as a means to increase their ongoing revenue.

This penalty reduces by 1% for each year the investor remains with SJP until after 6 years, at which point, exit penalties would no longer apply. However, there is a caveat, if you make changes to your SJP pension or bond portfolio by adding more funds for example, then this will automatically reset the exit penalty.

SJP's charges have been a regular source of contention and a report by The Sunday Times found their fees are even a concern to their advisers with a leaked call from St James’s Place managing director Ian Gascoigne identifying that some advisers want them to scrap their expensive fees, which have helped to pay for extravagant rewards from cufflinks to cruises which SJP had regularly awarded to their top selling advisers.

St. James’s Place Advice Fees

Similar to other advice networks SJP charges their clients an advice fee on top of fees associated with the funds and products they recommend.

However, the type of advice SJP provides and the type provided by an independent advisory firm is not the same. SJP is a restricted advice network and as such their advisers can only advise their clients on SJP branded products such as their own range of funds and investment portfolios. Therefore, SJP is unable to advise on 99.3% of the pension, life and unit trust market currently available to UK investors. This has led to concerns that SJP Partner Advisers are merely sales agents selling St. James’s Place funds and portfolios, with the majority of these demonstrating a poor performance history.

Some investors also believe that SJP’s restricted advice model means that their comparatively high advice fees are an unnecessary expense, and their relationship with SJP is transactional as opposed to an advisory one. Yet SJP’s 4.5% upfront advice charge remains one of the highest in the industry, and well above the 2.06% industry average that was established from a survey carried out by VouchedFor of 423 advisers from 263 firms.

For many investors, their model is overly expensive and according to Milena Mileva, a fund manager with Baillie Gifford, widely viewed as one of the best fund management firms in the UK, the fees charged by SJP were “very very high” across the entire chain, commenting that they “had to change”.

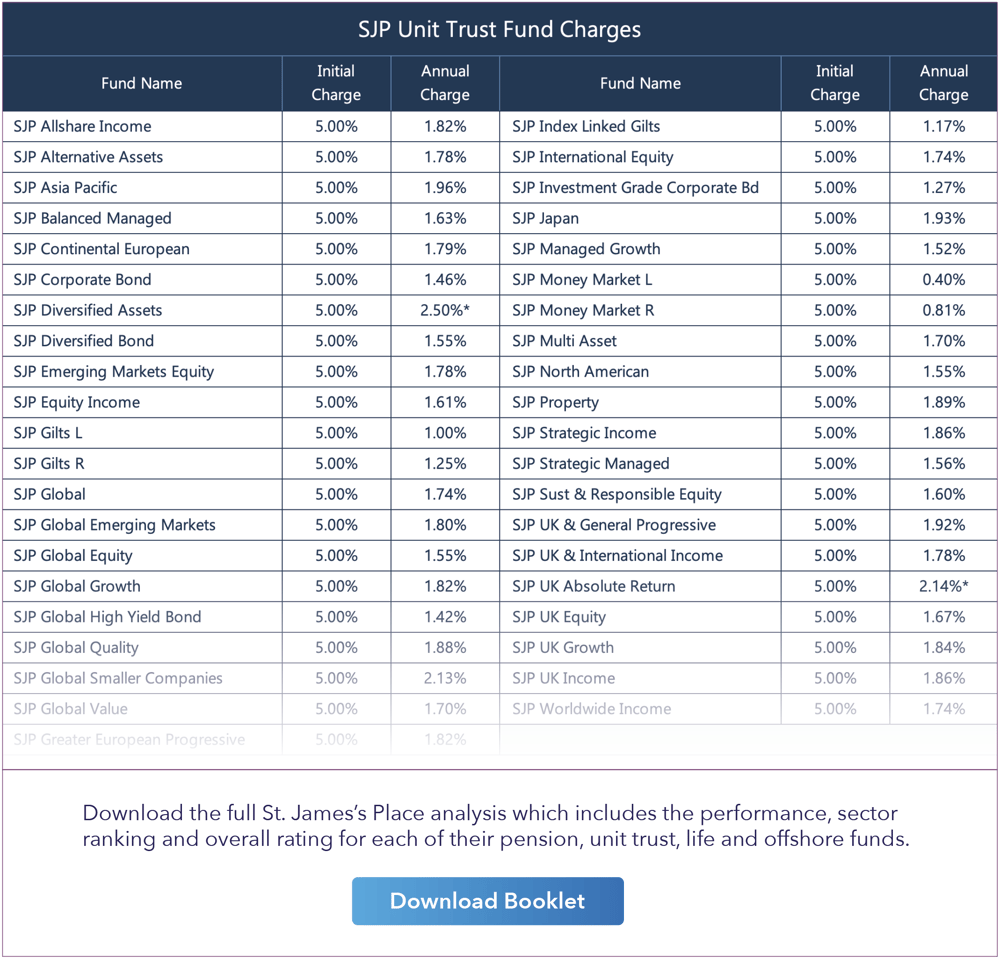

St. James's Place Fund Charges

As well as high advice charges, SJP have also been criticised for the charges associated with their funds.

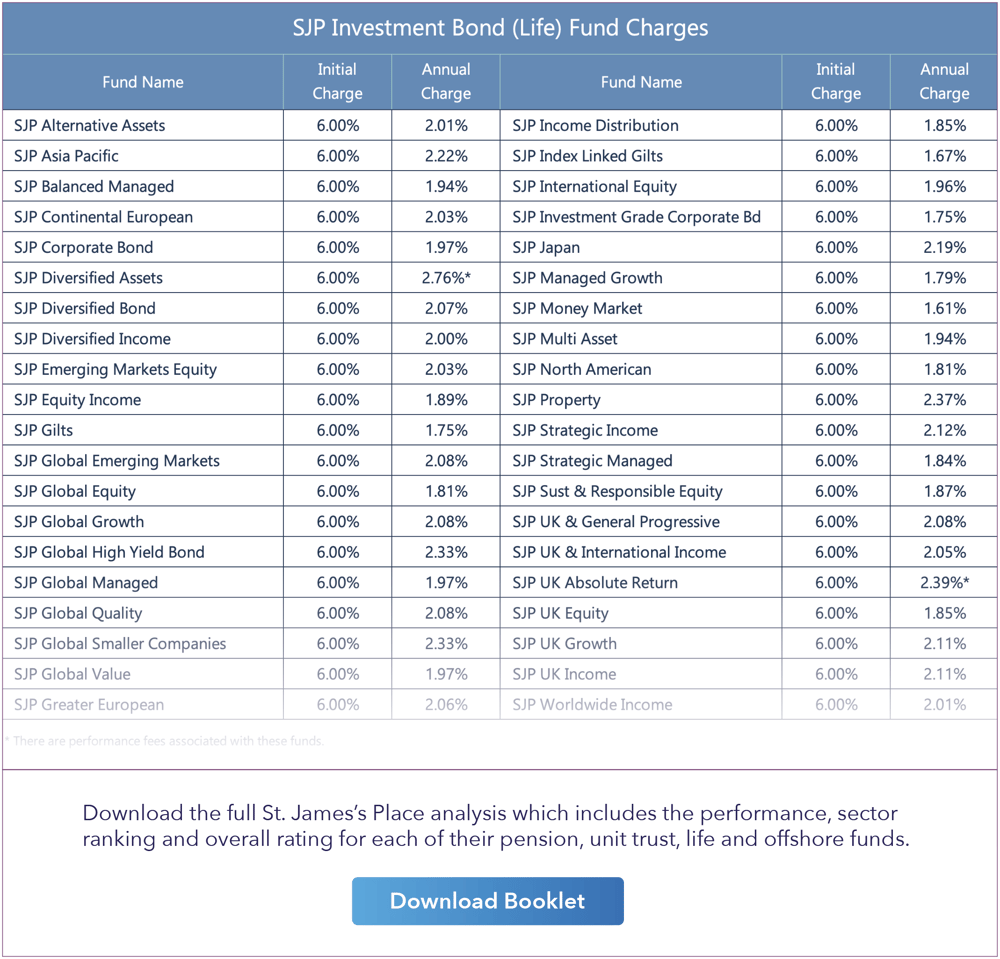

There are over 3,400 unit trust funds available to UK investors and on average the average fund charge is 0.94%. For SJP’s unit trust range of funds their annual charge (excluding their cash fund) is between 1.00% and 2.50%.

SJP advises that these ongoing charges cover all aspects of operating each individual fund during the year, including fees paid for investment management, administration and ongoing advice.

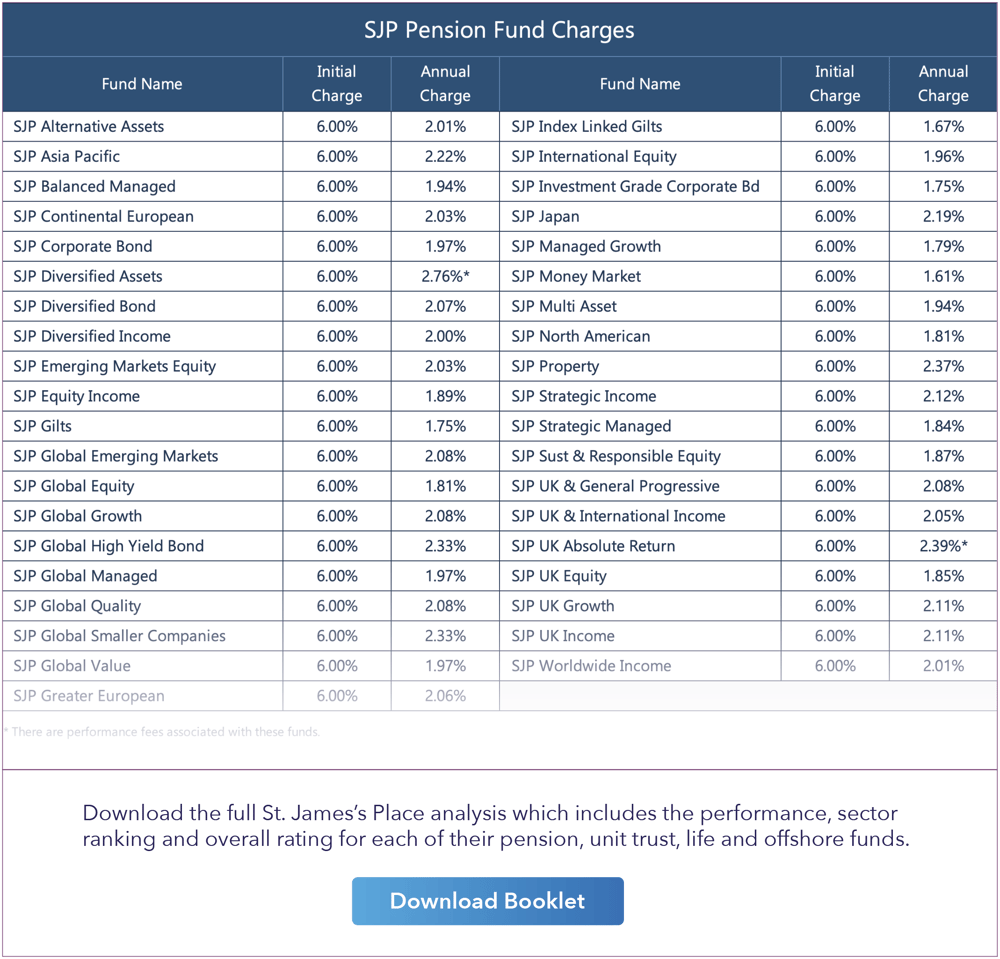

There are currently over 8,600 pension classified funds in the UK and on average these funds have an ongoing annual charge of 0.98%.

In contrast, the annual charge of SJP pension funds range between 1.67% (excluding their cash fund) to 2.76% for their Diversified Assets fund, which also comes with additional performance related fees.

SJP’s range of Investment Bond (Life) funds have a similar annual charge to their pension funds. They are also well above the average for similarly classified Life funds which on average have an annual charge of 0.84%.

SJP Performance Fees

SJP have added a performance fee to their UK Absolute Return Unit Trust fund. On this fund, a performance fee of 20% of any outperformance becomes payable if the fund outperforms the 3 month Sterling LIBOR benchmark, even though the annual fund charge is 1.86%.

SJP Maintenance Charges

Included in St. James's Place pension and bond products there is an ongoing charge of 0.5% which is to fund the ongoing advice and relationship with their partner advisers.

In addition to this, they also apply an annual maintenance charge, which they say is to fund the management and maintenance of your underlying investments.

The Risk Of Investing With SJP

One of the main risks of investing with SJP is the fact you have all your eggs in one basket. St James's Place is one provider. The Government's Financial Services Compensation Scheme protects investors up to the value of £85,000 per provider.

Many investors are unaware that they are only protected up to £85,000 as an SJP client, whereas a ‘whole of market’ advice firm will ensure you diversify across multiple providers to maximise your government protection. £850k invested across 10 fund manager brands allows an investor to have maximum protection under the FSCS.

Suggested Article - Why Your Investments May Not be Protected

St James’s Place Business Model

Like all wealth management firms, SJP aims to generate fees by managing the money of investment clients. Most inward fees come from initial and ongoing advice fees. But what makes SJP’s proposition different is that their business model creates several revenue streams as detailed below.

SJP’s model is unique, and one that has helped them become the largest wealth management firm in the UK with some £129 billion of client assets under their management. But this growth has come at a cost, a cost that has been handed over to their clients.

For their model to work it requires them to charge their clients high fees in order to help fund the entire process. But in recent years in particular, greater access to performance information and lower cost products have made the SJP proposition significantly less appealing than it once was. Many firms have adapted and altered their proposition either by lowering costs or by taking steps to improve the quality of funds within their investment portfolios.

In an attempt to adapt, SJP has announced plans to increase its range of tracker funds, which do not have a manager and use computers to follow a market index.

However, due to SJP’s model, their tracker funds would have very high costs compared to other tracker funds on the market, which makes it difficult to see how this approach can work for SJP. The company has one tracker at the moment, the Index Linked Gilts fund, which charges 1.17% a year, this is significantly more than the 0.20% average charge for similar tracker funds from other providers.

The St James’s Place entire business model would need to change if they are going to pass on lower fees to their clients. As a restricted firm they are always going to be limited to selling their own selection of funds even though there are numerous better performing options elsewhere.

Many investors have stated that they wish they had invested in St James’s Place Shares instead of their funds. Their high charges, cash flow and high profitability have allowed SJP to acquire more financial advice firms than any other firm in the UK, with SJP clients indirectly footing the bill.

As a distribution model, SJP has been able to acquire IFA practices faster and more aggressively than any other firm in the UK. Their ability to extract large chunks of cash from client investments as initial fees and ongoing charges has allowed them to acquire a large number of advisory firms and associated client banks.

SJP offers large upfront payments to advisory firms as an incentive to join and become a St James's Place partner. Once onboard newly recruited advisers will transfer their client's investments across to SJP portfolios and funds. The associated upfront fees are again generated, creating more SJP sales revenue to acquire more firms. This strategy has been extremely effective for SJP Wealth Management, but questionable for the client, who is indirectly funding further SJP acquisitions and growth.

Their model has been shunned by other IFA's as the "Road to Nowhere".

Conclusion

In an age where investment information is more accessible, investors are beginning to look beyond the perceived security from investing with large corporations such as St James's Place. They are more focused on performance, quality and value when making investments decisions, or assessing quality advice. They are also more savvy in regards to risk and the issues around relying on one provider only.

Among the factors to drive investment decisions is protection, which is even more prevalent on the back of the high profile collapse of Neil Woodford. As a result, the government's Financial Services Compensation Scheme (FSCS) and the protection it provides to investors has become a more important factor in the decision-making process of investors. As mentioned, this scheme protects investors up to a maximum of £85k per provider, which makes it riskier for investors who rely on one provider such as St James’s Place.

A diverse portfolio using the best brands in the various sectors allows investors to have a diverse portfolio with more protection from the Government's Financial Services Compensation scheme.

Today, it is much easier to access real information such as performance and ranking data which in the past was the biggest challenge to the traditional decision-making process of investors. This is diluting the authority of referrals, recommendations and adviser relationships, and it poses one of the biggest threats to wealth management firms such as St James's Place, whose restrictive model is becoming increasingly less appealing.

With relevant information available Investors are now better equipped to make informed decisions that are driven by a desire to invest efficiently using the better performing fund managers for improved outcomes. We welcome the fact that investors are spending more time assessing the performance and quality of funds & investment products.

SJP’s business model is focused on complete ownership of their client journey and generating multiple revenue streams from each client.

Although highly profitable, SJP’s business model has been accused of being outdated in the new information age. The performance of their funds has consistently been poor and this coupled with high charges and restrictive practices has been a principal reason why a growing number of informed investors are moving away.

An increase in investor knowledge has encouraged many investors to move away from SJP, towards lower cost, better performing alternatives, who place clients at the centre of their value proposition.

For many investors, their model is overly expensive and according to Milena Mileva, a fund manager with Baillie Gifford (widely viewed as one of the best fund management firms in the UK), the fees charged by SJP are “very very high” across the entire chain, adding they “had to change”.

The very model that has helped SJP become a fund management giant is the model that is restricting them from adapting to the modern investing environment, and the one that makes them unattractive to informed investors.

Despite accusations of being out of touch with investors SJP have recently said they have no plans to review their charging structure, nor do they believe that their fund performance is cause for any concern. But the fact is investor decisions are now being driven by these very factors, and as identified in this report, all but a select few of SJP funds have consistently underdelivered, which makes their long term investment proposition one that is distinctly less appealing.

About the Author: This article was researched and constructed by the Yodelar.com Research team. Every year we complete performance reviews on 100+ fund managers assessing their funds and comparing their results to the performance of all other same sector funds. Our Independent research team have given St James’s Place a ‘Poor’ ranking as a fund manager, and investment option for consumer investors.