Since the COVID 19 pandemic greater importance has been placed on Environmental, Social, and Governance (ESG) criteria, not only because of its ethical qualities, but also for investors to mitigate risk in the long term.

Research shows that the funds invested in companies with better ESG practices have, in the main, performed better and suffered less during the wild market swings of the past 18 months, which for investors, has meant less risk and more stable performance.

Before the pandemic interest in ESG investing was on the rise pulling in a record-breaking £15.5 billion of new money in 2019 – almost four times the 2018 figure of £4.1 billion, itself a record. But with the outbreak of the pandemic, inflows in 2020 were over 5 times greater than those of 2019.

In such a short period of time the growing demand for ESG investing has been significant. The interest has now intensified to such an extent that it will now likely have a significant role in the future investment strategies for both fund manager and investor.

As demand for ESG investing grows, there has been an influx of new ESG funds and portfolios to enter the marketplace. But for an industry that has been typically slow to react in the past now scrambling to get in the ESG market as fast as possible, it has raised concerns that this will come at the sacrifice of quality. For now, much of the newer funds have yet to be tested so their quality remains unclear.

For investors, identifying the most suitable and efficient all round ESG portfolio can be a challenge but there is a relatively small selection of proven ESG centric portfolios on the market. In this report, we have assessed 15 similar risk ESG portfolios for performance and identify which Ethical portfolios have performed the best.

Why Investing In An ESG Strategy Is Sensible Investing

An ethically centred approach to customers, employees and the world at large is increasingly seen as an indicator that a company is a good long-term investment.

ESG funds are tied to powerful trends such as sustainability, demographic development or technology – and may grow faster than the wider economy. In turn, investors will be more likely to stick with them through difficult markets, benefiting from the rebound and avoiding losses.

Indeed, sustainable funds outperformed traditional peer funds and reduced investment risk during coronavirus in 2020, according to the Morgan Stanley Institute for Sustainable Investing.

The comparative analysis bolsters favourable perceptions of sustainable investing, which are becoming more widely accepted among investors and asset managers, who see potential for sustainable portfolios to yield attractive financial returns, alongside positive environmental or social impact.

The reality is that Ethical and sustainable investing is no longer niche and should now be a consideration for growth focused investors.

As the world moves closer towards the end of the pandemic the outlook for funds with holdings in companies that have implemented ESG practices is brighter than those who have yet to make the move, which for investors provides some exciting opportunities for future growth.

In another sign that ESG investing is going to continue to grow exponentially, new plans by the Financial Conduct Authority (FCA) aimed at supporting the move to a low-carbon economy will require all UK listed companies to tell investors all the climate risks they face. Such a requirement will force companies to up their game and will not only benefit the environment but it will also benefit investors.

The Best Performing ESG Portfolios

As a relatively new concept, ESG investing has helped to facilitate the rise of new fund management brands who have proven to be more nimble than traditional models in creating their ESG investment products. Some of the most popular ESG portfolios on the market are those from online brands such as Nutmeg, Moneyfarm and Wealthify.

These brands initially launched as low cost providers of passively managed portfolios, which typically only appealed to smaller investors whose priority was to save on fees rather than focus on growth. But the huge rise in demand for ESG products particularly since the onset of the pandemic has redirected their focus towards ESG investing, and as quick adapters, they have positioned themselves at the forefront of ESG investing.

Although the primary function of an ESG investment strategy is to adhere to key environmental, social and governmental principles, the overall objective is the same as any other investment strategy, and that is to achieve capital growth within the desired time frame and risk parameters.

To provide an overview as to how some of the most popular ESG portfolios have performed, we analysed the past 1, 3 & 5 year performance of the ESG portfolios from Nutmeg, Moneyfarm, Wealthify, Tilney and Yodelar.

ESG Portfolio Performance Comparison

We analysed a total of 15 portfolios across 3 different risk profiles (Cautious, Balanced and Adventurous) listing the portfolios in order of the highest growth over the past 12 months to the lowest growth.

As identified in the below performance tables the Yodelar ESG portfolio has the highest returns across all 3 risk models over the past 12 months with the Wealthify portfolios returning the lowest.

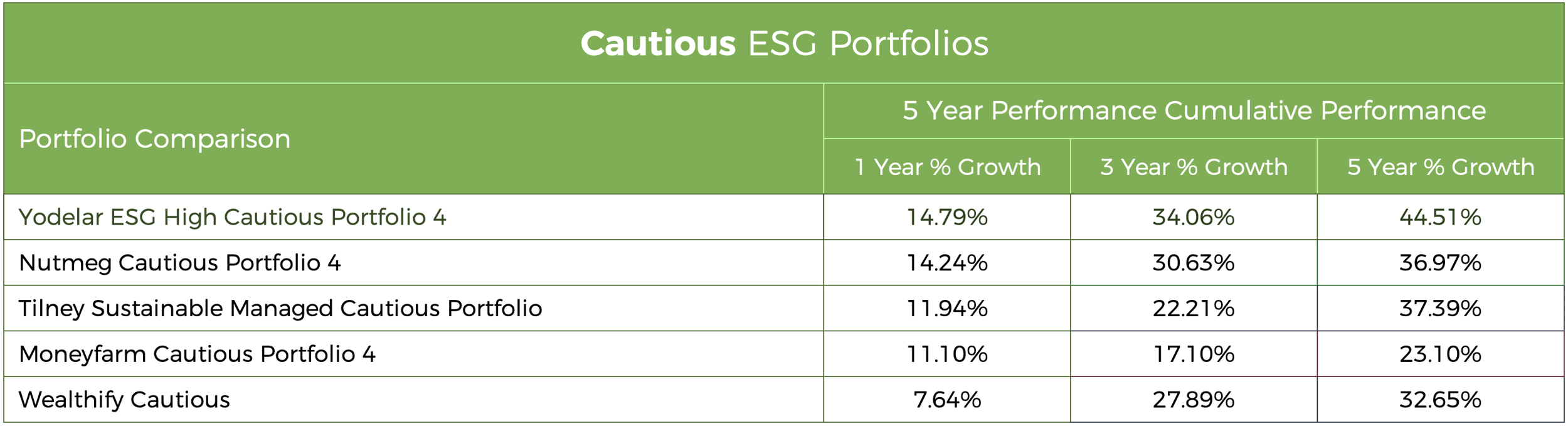

Cautious Portfolio Performance

From the 5 cautious risk ESG portfolios analysed for performance the Yodelar ESG High Cautious portfolio had the highest 1, 3 & 5 year cumulative returns. The Wealthify Cautious portfolio had the lowest growth returns over the past 12 months (7.64%) but over a longer 5 year period the Moneyfarm Cautious portfolio 4 had the lowest, with growth returns of 23.10%.

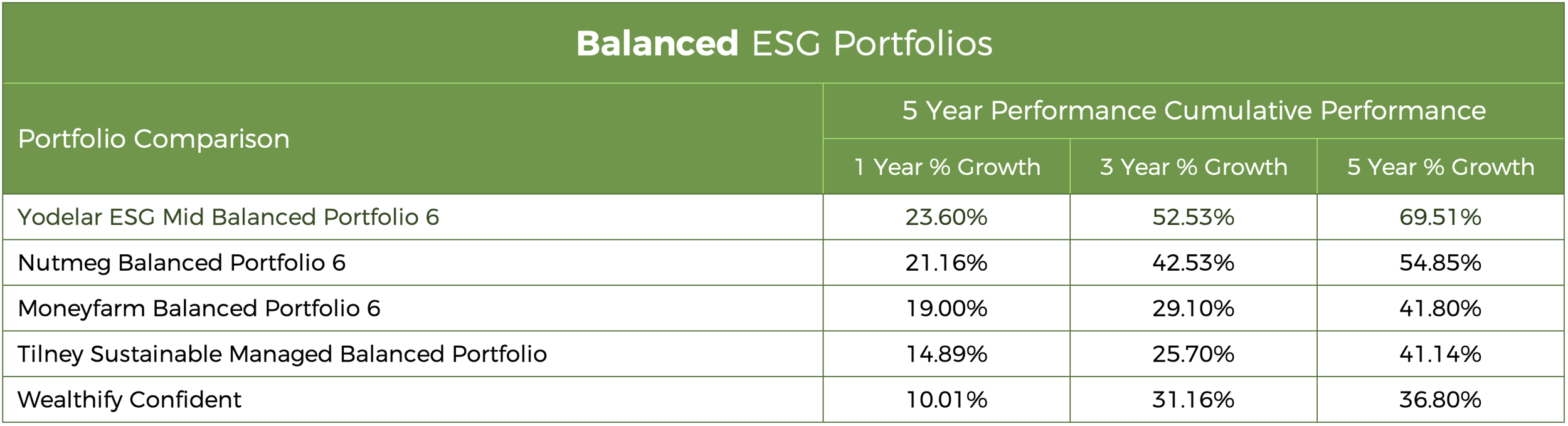

Balanced Portfolio Performance

Mid risk range portfolios typically deliver higher returns than lower risk portfolios but at the expense of assuming greater risk. A mid risk (Balanced) investment portfolio is the most popular among UK investors with approximately 47% of investors invested in mid risk range portfolios.

We analysed 5 mid risk rated ESG portfolios from Yodelar, Nutmeg, Moneyfarm, Tilney and Wealthify over the past 1, 3 & 5 years.

The average growth of the 5 portfolios over the 1, 3 & 5 year periods analysed was 17.73%, 36.20% and 48.82%, with only the Yodelar ESG Mid Balanced portfolio 6 and Nutmeg Balanced Portfolio 6 outperforming the average over all 3 periods.

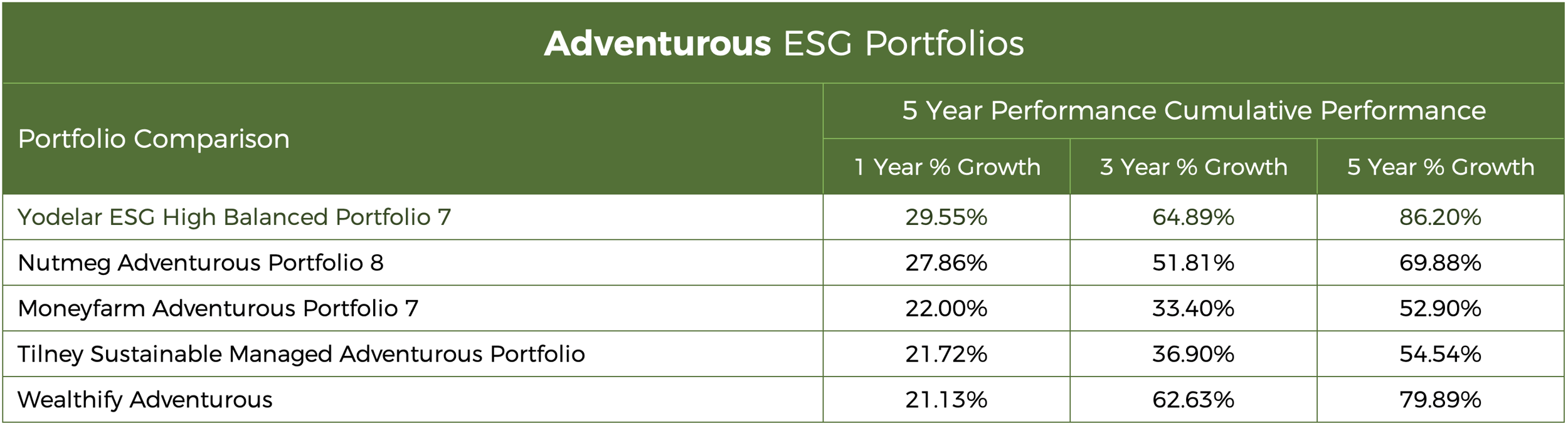

Adventurous Portfolio Performance

Adventurous portfolios are most suited to investors who seek greater returns from their investments, but who in turn are comfortable in accepting increased risk of greater losses should investment markets experience negative growth.

From the 5 adventurous ESG portfolios analysed, the average 1, 3 & 5 year returns were 24.45%, 49.93% and 68.68%. Only 2 portfolios managed to consistently deliver higher returns: the Yodelar ESG High Balanced portfolio and the Nutmeg Adventurous portfolio. Over the most one year it was again the Wealthify portfolio that had the lowest returns, but over 3 and 5 years their portfolio had higher growth than Tilney, Moneyfarm and Nutmeg’s adventurous portfolios.

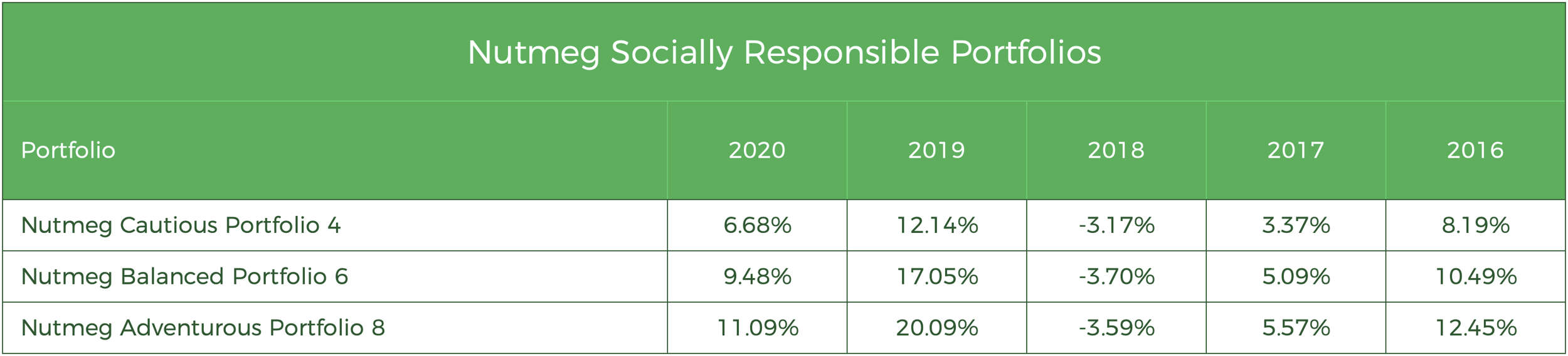

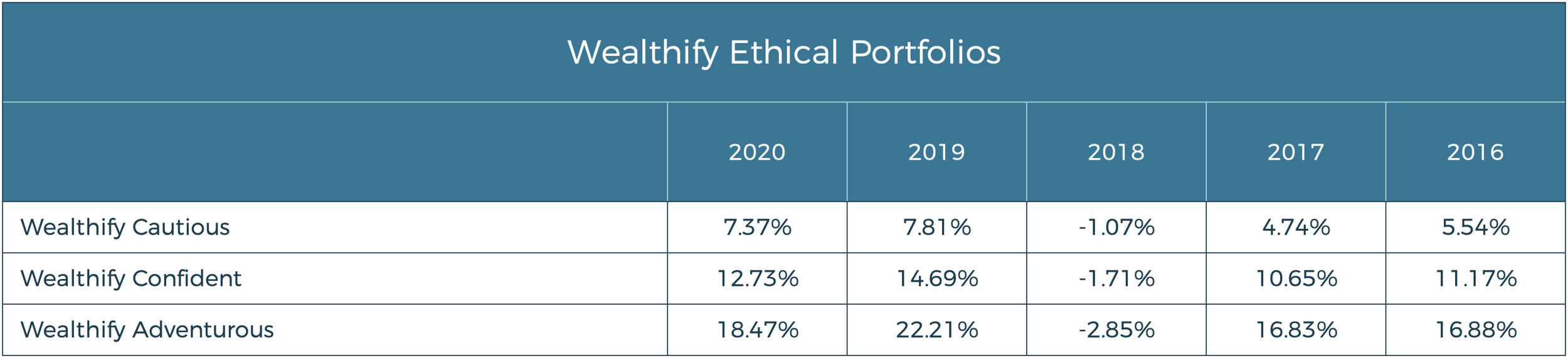

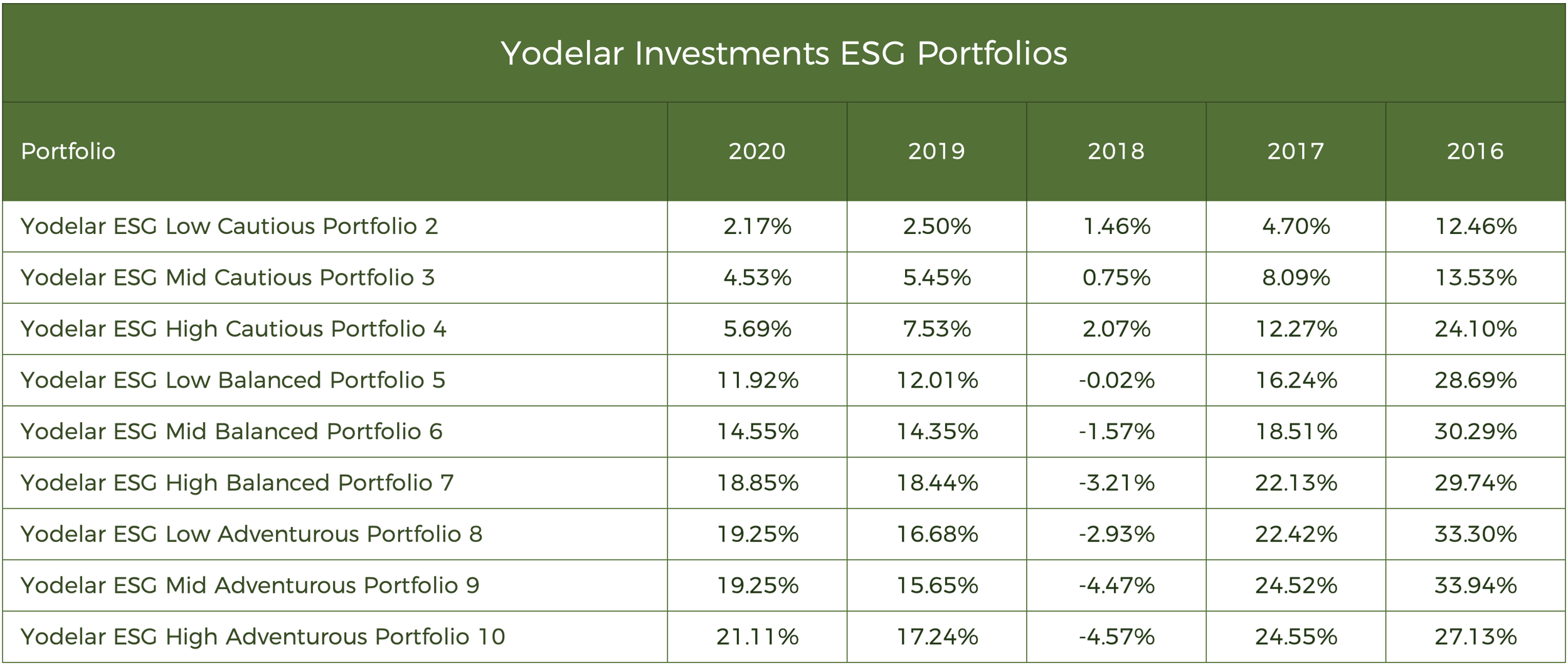

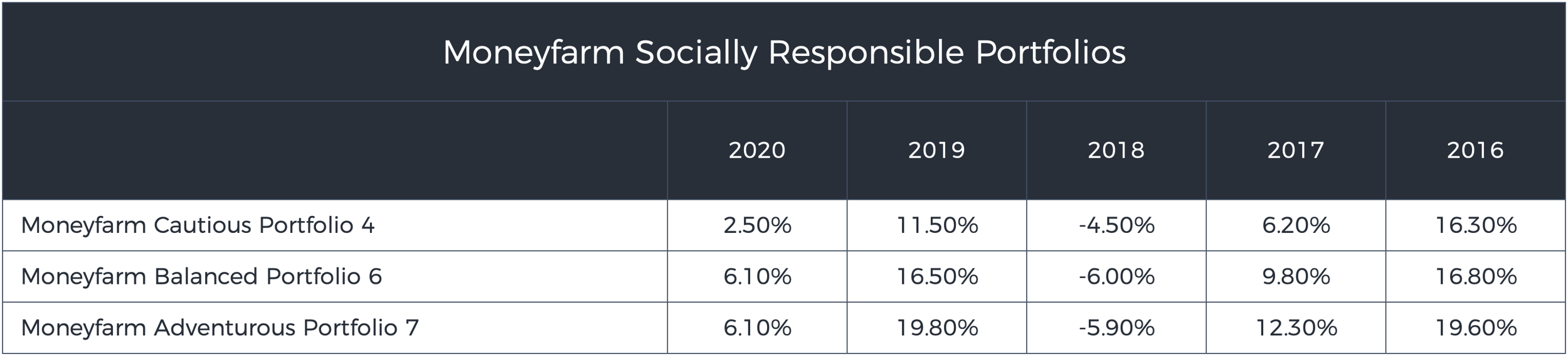

Annual Portfolio Performance

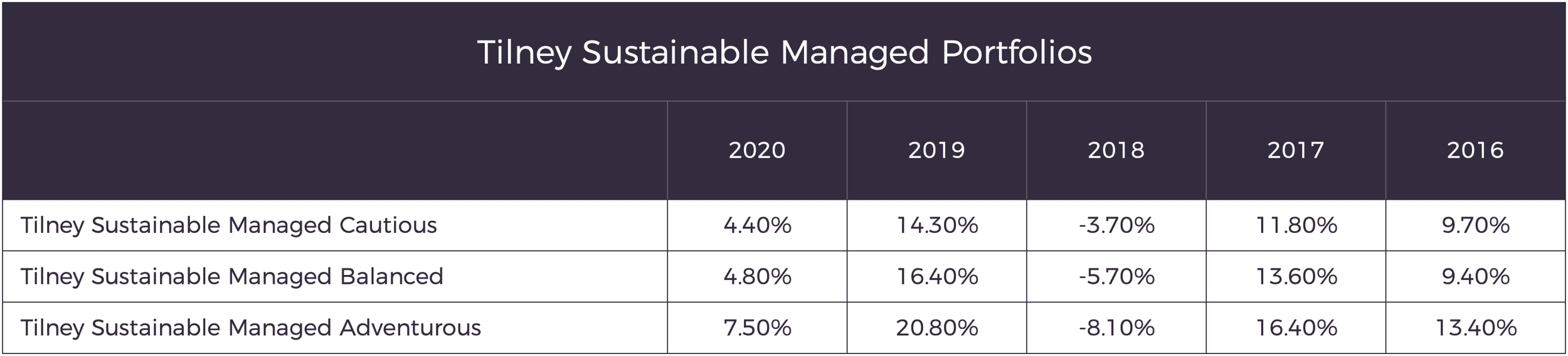

The tables below feature the performance of each providers portfolios over each of the past 5 full calendar years.

Finding The Best ESG Portfolios

Many investors who invest in ESG governed funds do so as they want their investments to have a positive impact on society and the environment. ESG investing is more than a way to do good by society; it is now a way to mitigate investment risk without necessarily sacrificing growth.

Solving Key ESG Challenges For Investors

There are complexities with sustainable investing and we identified 5 challenges and investor needs:

- Portfolio Construction: Building a sustainable portfolio tailored to specific requirements can be time-consuming and the impact on investment returns is unclear. Investors need a partner to aid in this transition.

- ESG Data: Sustainable data, metrics and calculations have been inconsistent and particularly difficult to dissect. Investors need confidence that important ESG criteria are considered and managed with clarity.

- Product Selection: There has been a myriad of new ESG fund entries into the market, many of which lack quality. Investors want an easier way of navigating sustainable product ranges. They want confidence that their ESG values are met without sacrificing quality.

- Climate Considerations: Climate has become an emerging focus. Investors want help integrating climate considerations into their sustainable portfolios.

- Ongoing Suitability: When investing sustainably investors want to know that their portfolios contain funds that maintain long-term ESG values and that they are managed efficiently to maximise growth potential to keep their long-term investment objectives on track.

Straight Forward ESG Investing

Many ESG products on the market struggle to incorporate all of the above, with currently only limited high quality options available. However, Yodelar’s diverse range of ESG portfolios aims to provide ethically minded investors with both value and quality. They have been developed to give a structured but uncompromising performance driven solution to ESG investors.

Each of the funds within the Yodelar ESG portfolios have consistently ranked highly within their sectors for performance with our investment committee confident that the fund managers and their strategies will continue to provide exciting growth opportunities for investors, whether or not they are interested in investing in sustainable funds. Across the range of 9 risk adjusted ESG portfolios there is a combined total of 25 funds, each of which has been selected based on their composition of underlying holdings, asset allocation, performance and MSCI ESG rating.

To help ensure the fund's ESG portfolios meet consistent ESG metrics Yodelar follows the MSCI ESG rating criteria. The MSCI is a Global leader in providing expert research, data and technology that helps to add transparency and drive more informed investment decisions. Their ESG measurement criteria is extensive and their unbiased, straight forward, clear rating formula fits perfectly with our whole of market outlook on investing, which we believe is the most beneficial to investors.

The MSCI ESG Rating is designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks. They use a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers.

ESG Portfolios With A Strong Focus On Growth

The development of Yodelar portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research identified that only a small proportion of funds and fund managers have consistently delivered top performance, with more than 90% of the portfolios we reviewed containing funds that continually underdeliver. Our investment approach ensures that the funds used to achieve the correct balance for each of our portfolios are consistently among the best performers in their sectors. We believe this efficient and quality-based investment philosophy will help our ESG portfolios to excel and securely maximise the growth for our investors within a controlled ESG framework.

Learn more about the Yodelar ESG portfolios