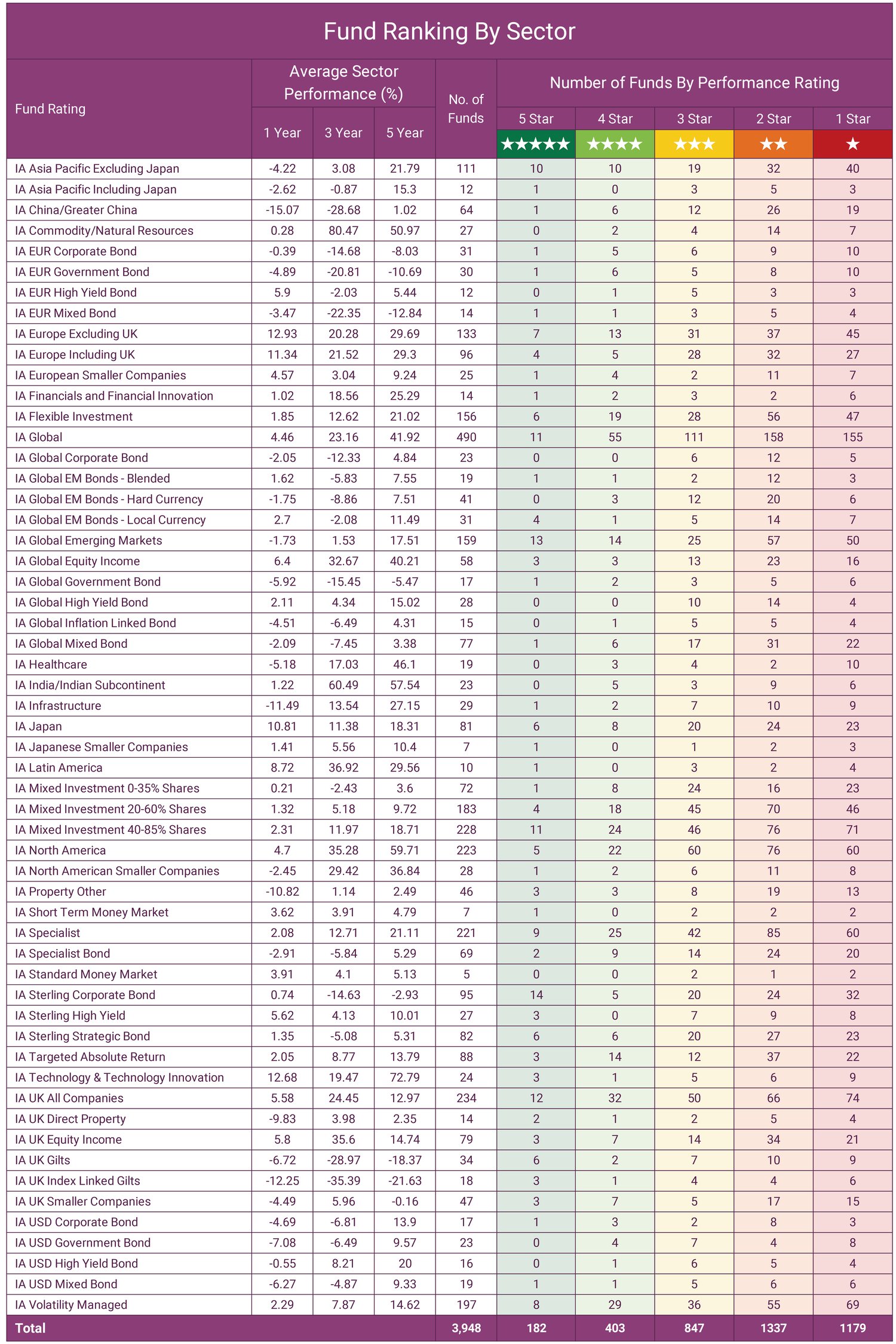

- The IA Technology & Technology Innovation sector has the highest average returns over the past 5 years (72.79%). However, only 4 of the 24 funds in this sector consistently outperformed.

- With 490 funds the IA Global sector is the largest available to UK investors. 66 of funds in this sector consistently outperformed over the past 1, 3 & 5 years

- We identify all 585 top performing funds in our latest best funds report

- From an analysis of 58 investment sectors and 3,849 funds we found that less than 15% of funds have a history of consistent top sector performance, highlighting the importance of fund selection.

The investment fund universe presents a vast menu of over 4,000 strategies spanning regions, asset classes and management styles. With so much choice, it is remarkably easy for portfolios to end up over-allocated to underperforming funds that fail to meet investor objectives.

Our independent research indicates over 90% of investor portfolios contain underachieving funds, reflecting the prevalence of mediocre options and knowledge gaps in identifying excellence.

To help investors and advisors identify efficient strategies this article and attached best funds report download, analyses all 58 Investment Association investment sectors providing clear insights into the performance of each sector and the number of proven winners in each sector. Our best funds report will then identify each of the 585 funds that have consistently ranked in the top quartile relative to competitors over 1, 3 and 5 year periods.

Portfolio Analysis

For a complimentary portfolio analysis showcasing how your portfolio measures up, or to discuss implementing an elevated investment approach, contact our specialists. Our goal is to help investors assemble portfolios of exceptional funds to minimise risk and accomplish their financial growth objectives.

Top Performing Funds

With over 50 distinct investment sectors, the UK fund universe provides exposure to a vast range of geographies, asset classes and strategies. Sector classifications enable effective comparisons by grouping funds pursuing similar objectives and compositions.

For example, UK Equity funds primarily invest in British companies, while US Equity funds target American firms. Analysing performance requires matching funds to peer groups navigating the same market conditions. Comparing a UK and US fund would be an apples-to-oranges mismatch given diverging macroeconomic factors each navigates.

Having sector classifications, it enables funds with similar compositions and objectives to be categorised together making a like for like performance comparison possible.

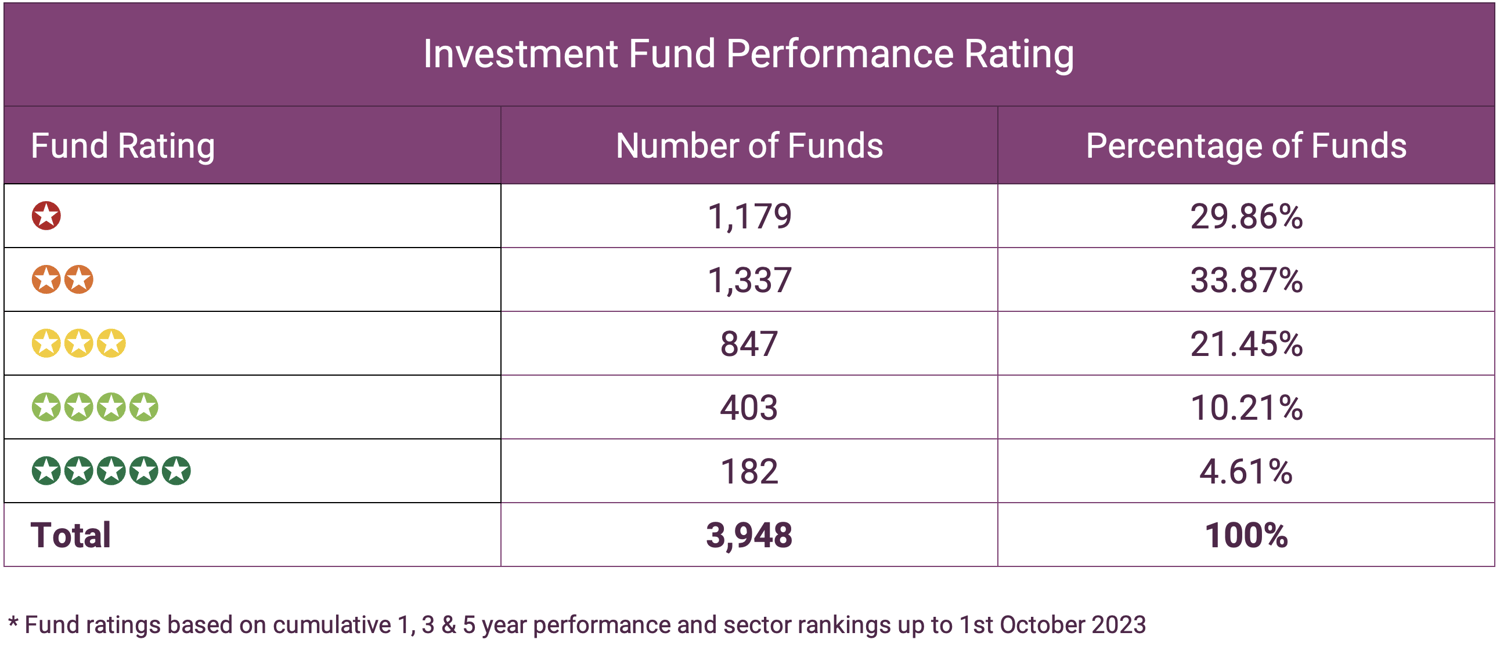

We analysed 3,948 funds across all 58 investment sectors and categorised each fund from 1 to 5 stars based on how the ranked within their sector over the past 1, 3 & 5 years.

Our analysis of these funds identified that 63.7% received a poor performing 1 or 2 star rating with less than 14.8% gaining a top 4 or 5 star performance rating.

This underscores the imperative of rigorous due diligence to identify the select group of elite funds able to consistently generate alpha and minimise downside.

By leveraging sector peer analysis, advisors and investors can effectively evaluate funds and construct portfolios concentrated in top-tier strategies with the greatest probability of success in accomplishing investor objectives. This informed fund selection is key to maximising returns and effectively managing risk.

How Yodelar Rate Fund Performance

A total of 585 funds received a top performing 4 or 5 star rating. Discover these funds by downloading your free copy of our best funds report.

Fund Performance By Sector

The chart below details the average 1, 3 & 5 year performance of all 58 sectors and the number of funds within each sector based on their performance rating.

Collectively, over 40.5% of investor money within the Investment Associations 3,948 sector classified funds, equating to £487.4 billion, are allocated across these core regional strategies.

Several geographic equity sectors standout for their popularity among UK investors seeking exposure to leading global economies. These include UK All Companies, North America, Europe ex-UK, Emerging Markets and Global Equities.

UK All Companies sector

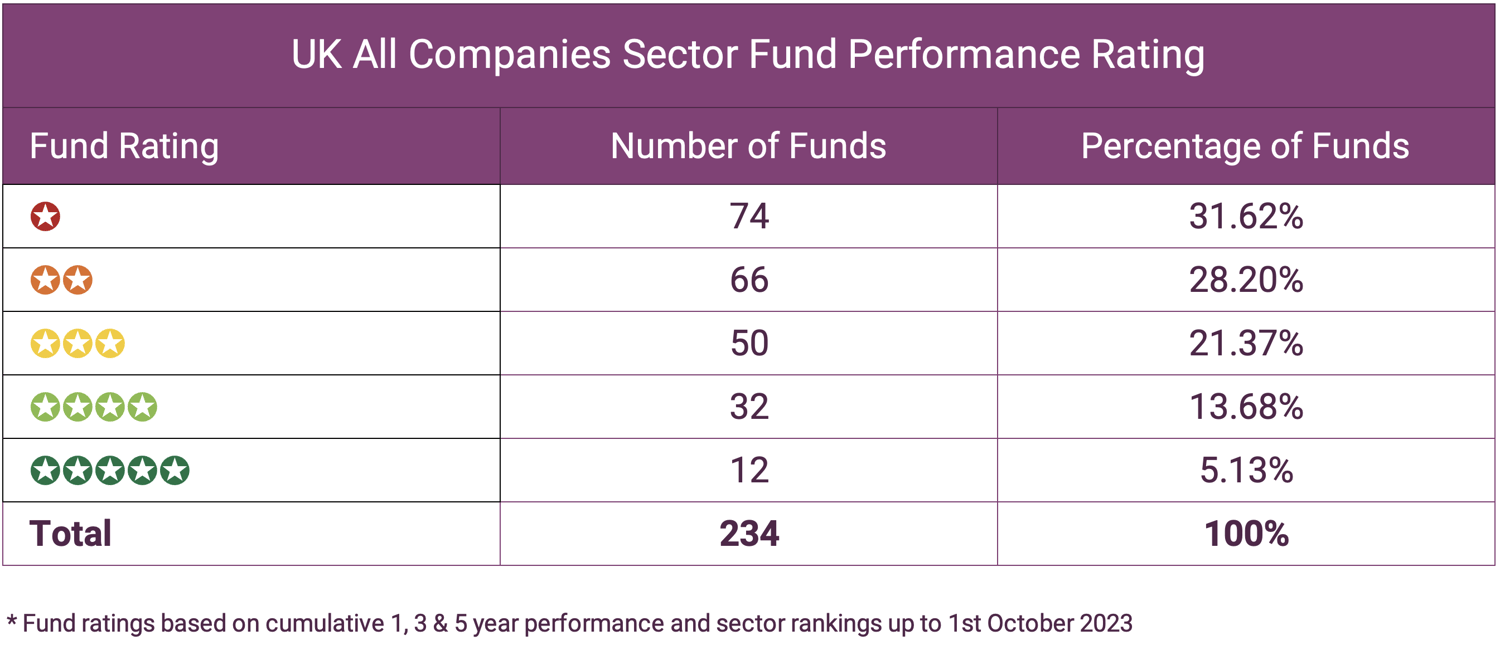

As home to globally diversified multinational corporations, the UK All Companies sector remains pivotal despite political uncertainty. Our analysis of the sector's 234 funds, representing £138.9 billion under management, identified that 18.8% have achieved top-quartile performance over trailing 1, 3 and 5 year periods.

Rigorous comparison of funds to regional peers reveals the minority able to consistently generate outperformance across market cycles. Blending these verified best-in-class strategies from key equity sectors provides reliable core portfolio growth. Monitoring ongoing results guides strategic adjustments to maintain allocations in leading managers as conditions evolve.

With over £1.2 trillion invested across all 3,958 funds, our independent research readily identifies the elite subset of strategies outperforming within core equity categories. Constructing portfolios around these consistent winners supports investors in effectively capturing regional growth opportunities.

Europe ex-UK equity sector

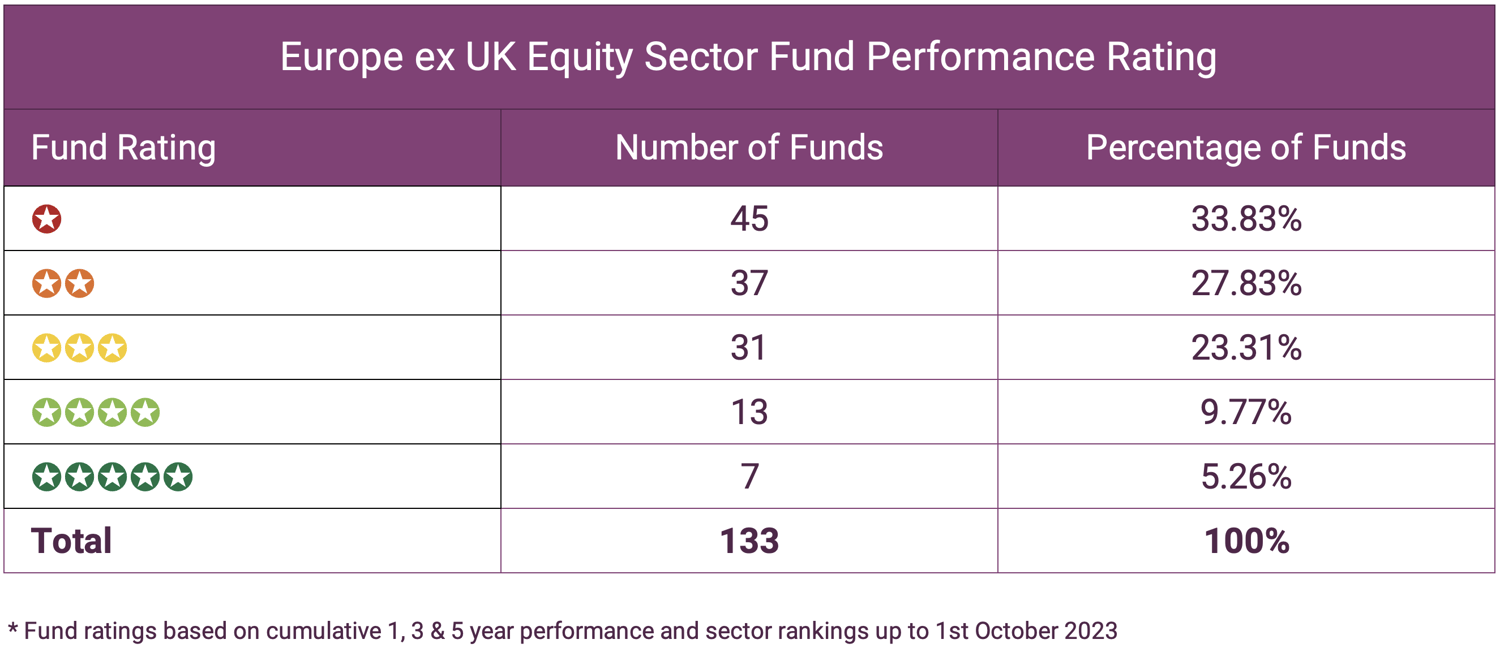

The Europe ex-UK equity sector provides exposure to the diverse economic makeup of the European continent, comprising approximately 50 countries and 28 EU member states. Funds within this broad sector invest predominantly in European equities while limiting UK exposure.

To qualify as Europe ex-UK, a minimum 80% of assets must be allocated to European stocks, excluding Britain. Up to 5% UK equity is permitted, allowing flexibility around corporate actions. The markets span mature developed economies as well as emerging opportunities.

This wide scope requires funds emphasise quality management and stock selection skill to navigate macroeconomic divergences and identify companies benefiting from regional trends. Our rigorous analysis identifies the select Europe ex-UK funds able to consistently deliver standout returns within the sector.

Our analysis of the 133 funds classified within the IA Europe ex UK sector identified that 20 funds (15%) have consistently ranked among the top quartile for performance over the past 1, 3 & 4 years.

Discover All Top Performing European Equity Funds

North American equity sector

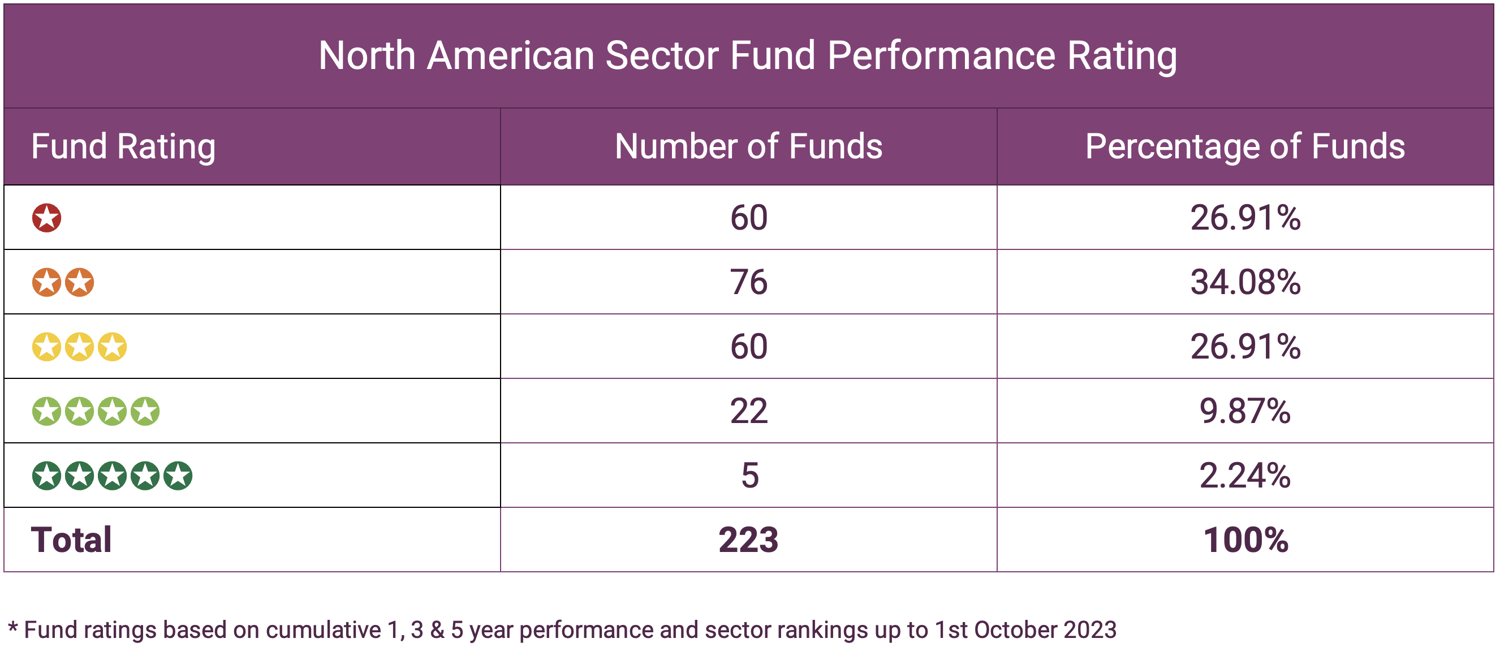

The North American equity sector represents an integral allocation for most growth-oriented portfolios. Companies listed across the US and Canadian markets account for a meaningful share of global market capitalisation.

Over the past 5 years, the sector has delivered an average return over 59.71% - the 2nd highest of all 58 IA sectors. However, North American equities are also among the most volatile. Additionally, significant dispersion exists between the top and bottom performing funds.

Our analysis shows only 12% of funds gain top quartile rankings over the past 1, 3 & 5 years, while 61% consistently underperform the category benchmark and peers. This gap underscores the importance of rigorous selection to identify consistent winners adept at navigating the sector's risks and rewards.

Blending top-tier North American equity funds can provide impactful exposure to the region's innovation and economic dynamism.

From our analysis of all 223 main unit North American sector funds we identified 27 to have consistently maintained a top quartile sector ranking over the past 1, 3 & 5 years, with some 61% of funds underperforming.

Navigating North American equities successfully demands identifying best-in-class funds with the potential for sustainable alpha generation. Our independent oversight provides the insights and scoring to pinpoint consistent out-performers across market cycles.

Discover All Top Performing North American Equity Funds

Emerging Market Equity Sector

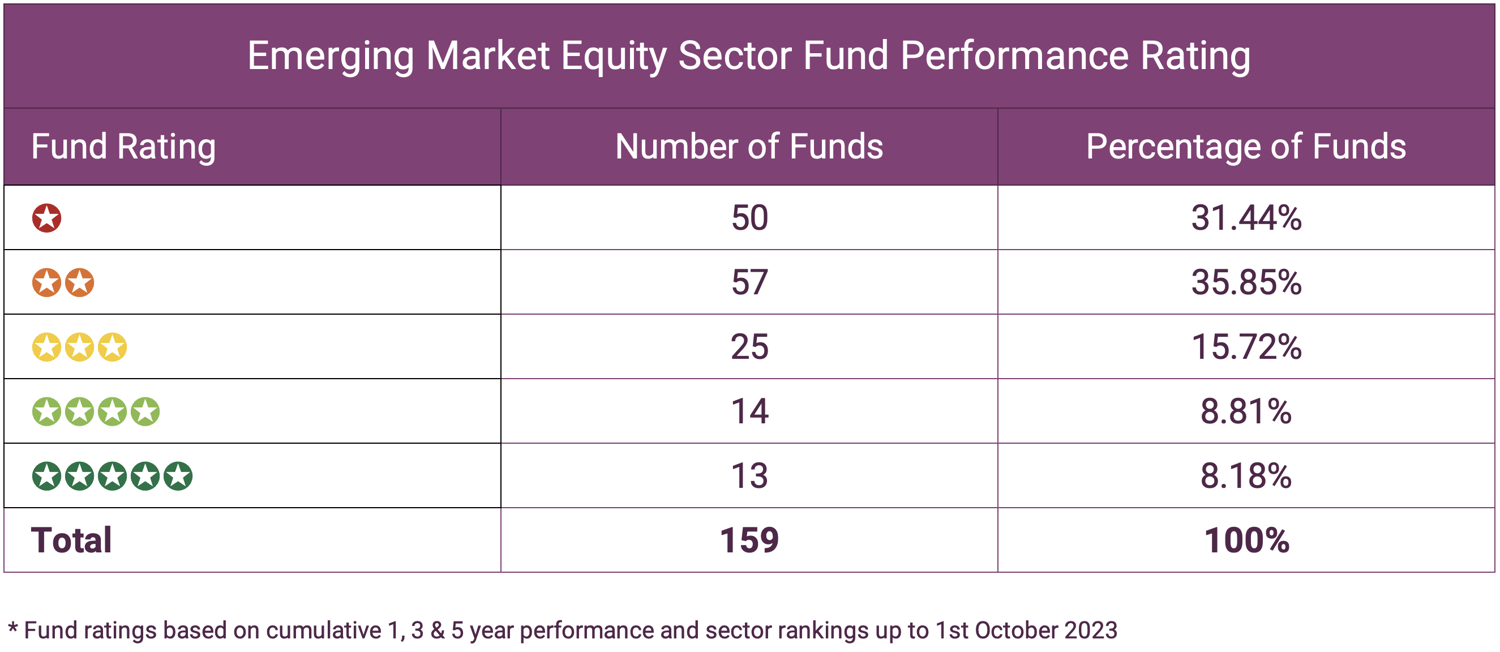

Emerging market equities provide access to rapidly growing economies but carry higher volatility versus developed markets. As such, exposure warrants prudent diversification. However, recent years have seen lower macroeconomic risk and rising contribution to global GDP growth from leading emerging market economies.

The top-tier emerging market funds have shown resilience amid recent choppy conditions, which emphasies the importance of quality active fund management skills. Through astute country and stock selection, these standout performers have consistently generated alpha to reward investors focused on long-term growth compounding.

Although unpredictable, emerging markets offer compelling structural opportunities. Blending a select group of top performing emerging market equity funds allows balanced portfolios to tap into this growth engine. Regular peer analysis ensures allocations stay concentrated in verified outperforming managers as markets evolve.

While maintaining a long-term view, careful diversification, and risk management focus, emerging markets present a potentially rewarding avenue for growth investors.

There are currently 159 funds classified within the IA Emerging Markets Sector. Our analysis identifies 17% to have outperformed consistently over the past 1, 3 & 5 years with the majority (67%) consistently underperforming.

Discover All Top Performing Emerging Market Equity Funds

Global Sector Funds

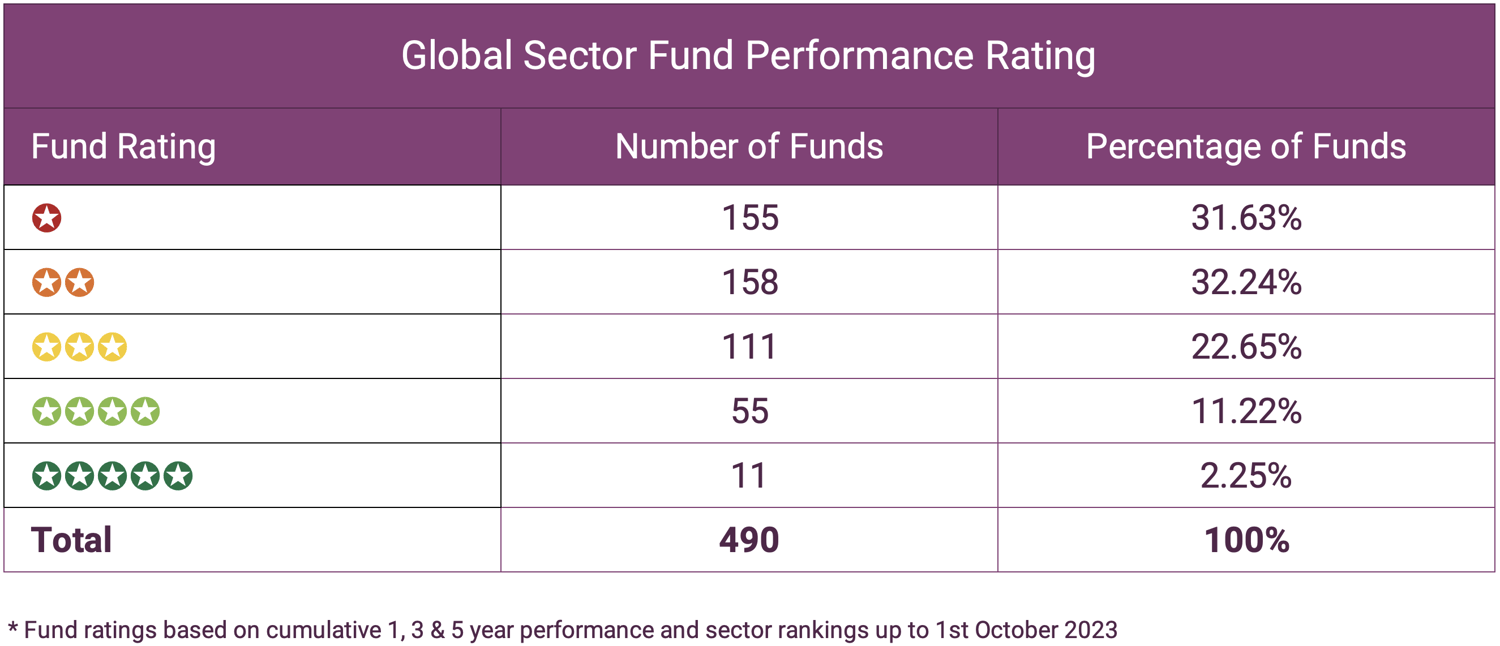

As the largest equity sector with some 490 funds managing £171 billion in assets, Global Equities provides broad diversification across geographies and sectors. Exposure helps mitigate regional risks, as underperformance in one market can be offset by gains elsewhere.

To qualify for the Global sector, funds must invest a minimum 80% in equities globally while maintaining diversification across regions. Popular picks like Fundsmith Equity and Lindsell Train Global Equity reside here rather than in North America, despite large US tilts.

Inclusion requires expanded opportunity sets beyond single country mandates. Top Global funds capitalise through flexible allocations to the most attractive stocks worldwide. However, with almost 500 competing strategies, identifying consistent outperformance is imperative.

Our analysis identifies 66 Global equity funds able to consistently deliver standout peer-relative returns over the past 1, 3 and 5 year periods. Blending these top-ranked strategies can help investors to best utilise the benefits from Global diversification.

Discover All Top Performing Global Equity Funds

What Makes A Quality Fund

High-quality investment funds are managed by specialists with deep expertise in their respective sectors. These experienced managers thoroughly research the companies, industries, and regions represented in their portfolios. Their rigorous analysis focuses on identifying market-leading firms with strong fundamentals, competitive advantages, sound finances, and the potential for sustainable long-term growth.

By concentrating their holdings in premium businesses, top-tier funds are well-positioned to outperform broad benchmarks during periods of relative economic stability and rising markets. However, they may lag during pronounced downturns or crises when lower-quality names briefly rally. While temporary underperformance is possible, quality-focused funds can provide attractive risk-adjusted returns for patient investors over full market cycles.

Historically, equities have experienced more positive years than negative ones. Due to their emphasis on durable, world-class businesses, high-quality funds are strongly positioned to capture more of the market's upside while limiting downside risk. For long-term investors, dedicating a portion of their equity allocation to these types of actively managed funds can potentially improve overall portfolio outcomes.

Analysis Summary

Our analysis of all 3,948 sector classified unit trust funds revealed that only 14.8% have consistently outperformed their benchmarks over multiple time horizons.

While past performance does not guarantee future results, funds with a demonstrated track record of exceeding benchmarks may merit special consideration by investors seeking superior risk-adjusted returns. However, building a prudently diversified portfolio involves much more than chasing last year's winners.

Factors like total costs, portfolio concentration, manager tenure, and investment strategy should also be evaluated. Working with a qualified financial advisor can help investors select funds aligned with their unique goals, time horizon, and risk tolerance. Though the number of top-tier funds remains limited, ample opportunities exist for those willing to do their homework.

Portfolios Built To Excel

At Yodelar, our investment portfolios are grounded in rigorous due diligence. Over many years, our research team has conducted an extensive evaluation of the investment universe, assessing more than 100 fund managers, tens of thousands of funds across vehicles like mutual funds, ETFs, and investment trusts, and analysing over 40,000 model portfolios.

This careful scrutiny consistently reveals that only a small fraction of available funds and fund managers are able to consistently outperform their benchmarks across market cycles. In fact, our analysis shows that over 90% of model portfolios contain underlying funds that chronically underdeliver.

By identifying the attributes of top-tier funds and managers, we've developed portfolio construction methods aimed at maximising risk-adjusted returns. This research-driven process underpins our suite of strategically allocated, risk-rated model portfolios, which exclusively utilise best-in-class investment vehicles tailored to each asset class.

At Yodelar, we believe advanced analytics and active due diligence can give investors an advantage. To learn more about our disciplined approach and explore how we can help grow your wealth, schedule a no-obligation consultation with one of our advisors today.