-

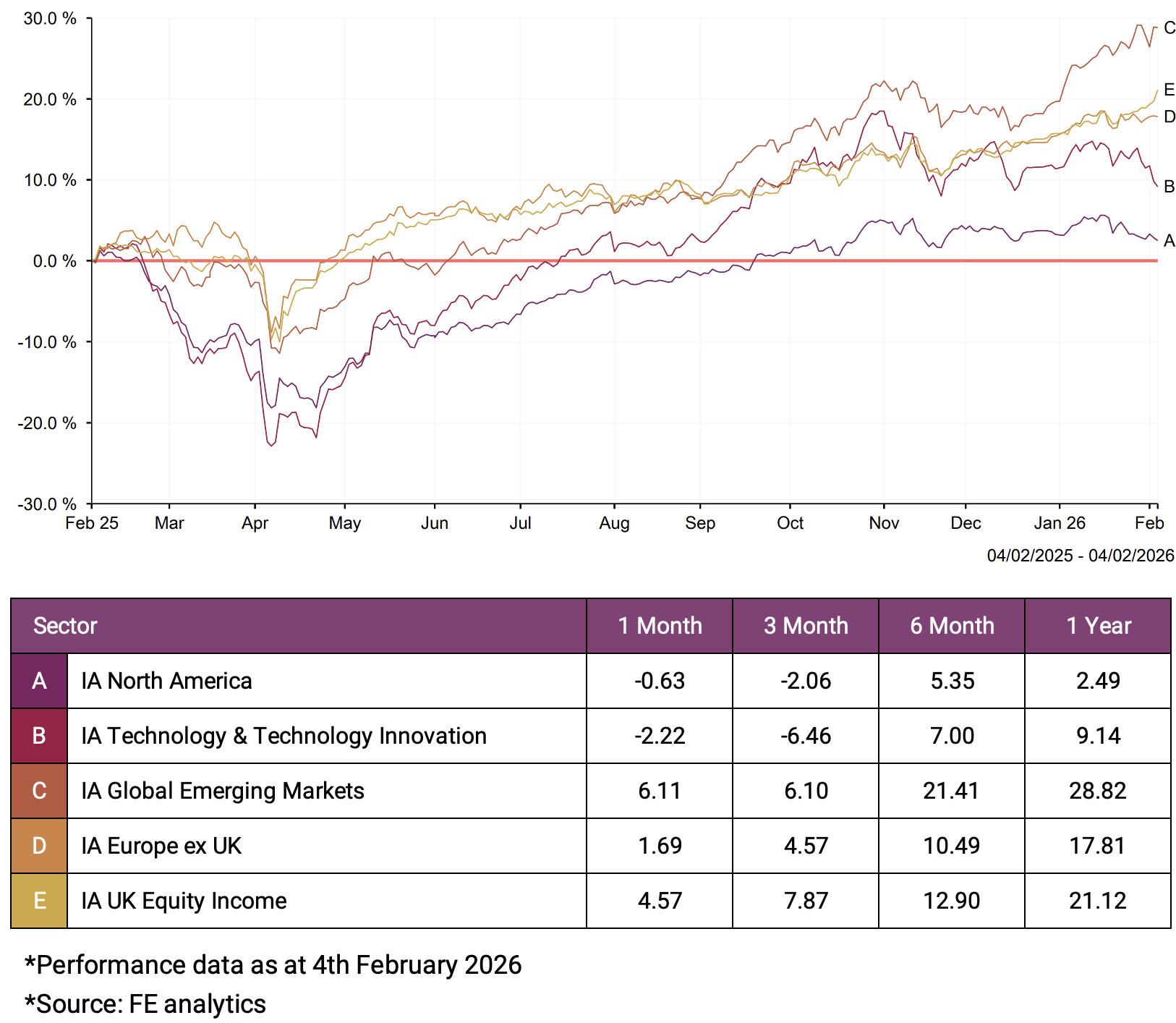

Over the three months to 31 January 2026, the IA North America sector returned -1.26%, while the IA Technology and Technology Innovations sector fell by -5.59%, highlighting increased volatility in these areas.

-

Over the same period, the IA Global Emerging Markets sector delivered growth of 4.46%, contrasting sharply with the negative returns seen in North America and technology-focused sectors.

-

Looking over the past 12 months, IA Global Emerging Markets significantly outperformed both IA North America and IA Technology and Technology Innovations, returning 28.35% compared with 3.49% and 12.63% respectively.

This marked the first time since 2016 that the IA Global Emerging Markets sector has outperformed both North America and technology over a 12-month period, underlining how sector performance can rotate.

Markets move in cycles, and periods of strong performance often prompt questions about what comes next, including whether markets are in a bubble. In many cases, that question is too broad to provide genuinely useful insight.

A more practical question is this: how exposed is my portfolio if one region or theme starts to lag?

For much of the past decade, investors have been rewarded for staying heavily invested in US markets. North American equities, driven largely by a small group of dominant technology companies, have delivered strong and consistent growth. That experience has shaped expectations and behaviour. It has also quietly reshaped portfolios.

Through our portfolio analysis, we see that many UK investors now hold a higher level of exposure to US equities than they may expect. In most cases, this has not been the result of deliberate allocation decisions. Instead, it has developed gradually as funds with strong US exposure have delivered higher returns and grown to represent a larger share of portfolios over time.

As long as markets were rising, this concentration felt justified. Today, with political uncertainty increasing, concerns around the US dollar growing and early signs of slowing momentum appearing, that confidence is beginning to be questioned.

The concern is not simply whether markets fall. It is whether portfolios are built to cope if the conditions that supported the last decade of growth begin to change.

Why North America Features So Heavily In Many Portfolios

North American equities have earned their place in portfolios. The region is home to many of the world’s largest and most profitable companies, with strong balance sheets and global reach. Technology has been at the heart of that success, reshaping industries and driving growth at a pace few other sectors could match.

Over time, this dominance increased gradually. Global equity funds held higher allocations to US markets. Technology-focused funds attracted greater investor interest. Index-based strategies allocated more to the largest companies as their market values grew.

For investors, this often appeared to provide diversification, even though the underlying exposure was becoming more concentrated.

Holding a global fund, a North American fund and a technology fund can feel balanced. In reality, those holdings often rely on the same small group of companies to deliver returns. When those companies perform well, the overlap goes unnoticed. When performance slows, the concentration becomes harder to ignore.

The First Signs of a Shift

Over the past six months, cracks have started to appear. The Investment Association (IA) North America sector has fallen by -2.06%. The IA Technology and Technology Innovation sector has fallen further, returning -6.46% over the same period.

On their own, these figures do not signal a crisis. Short term pullbacks are a normal part of market behaviour. What makes them noteworthy is the timing and the context.

This slowdown follows a long period of sustained outperformance. Expectations were high. Valuations in parts of the market remain stretched. At the same time, political uncertainty in the US has increased, and questions around the future strength of the dollar have become more prominent.

For UK investors, these factors matter because they sit on top of already elevated exposure. When portfolios are heavily tilted towards one region and one style, even modest changes in performance can have an outsized impact on outcomes.

Technology’s Central Role and Its Risks

Technology is not a separate corner of the market. It sits at the centre of North American equity performance. Many of the largest companies in US equity indices are technology businesses or derive a significant proportion of their value from technology-driven models.

This matters because sector labels can be misleading. Funds classified in the IA North America sector are required to invest at least 80% of their assets in North American equities. Funds classified in the IA Technology and Technology Innovations sector must invest at least 80% of their assets in technology and related industries, including areas such as telecommunications and robotics.

In practice, this means the same large technology companies often appear. A portfolio holding a North America fund alongside a technology fund may therefore rely on many of the same underlying companies to drive returns, even though the fund labels suggest diversification.

This structure has worked well during periods of strong growth and stable conditions. It also means that when technology slows, the impact can ripple across a wide range of holdings, not just those explicitly labelled as technology focused.

The question many investors are now asking is whether this represents the early stages of a technology bubble deflating. That framing may be too simplistic. Markets rarely move in straight lines, and periods of consolidation often follow strong growth.

However, it is reasonable to question whether the conditions that supported the last decade of returns can continue unchanged. Rising costs, regulatory pressure, geopolitical tension and changing consumer behaviour all introduce uncertainty. When a single sector underpins such a large share of portfolio outcomes, that uncertainty becomes far more relevant.

What a Strong Market Can Hide

Strong markets are forgiving. They allow portfolios to drift without obvious consequences. Concentration builds quietly. Duplication increases. Risk becomes harder to see because returns remain positive.

This is one of the most common challenges we see when reviewing portfolios. Investors often believe they are well diversified because they hold a number of different funds. When we look beneath the surface, the reality is often very different.

Multiple funds may hold the same companies. Regional exposure may be heavily skewed. Risk may be coming from a much narrower set of drivers than expected. During periods of broad market growth, these issues remain hidden. When growth becomes uneven, they are exposed.

Related Article: Are You Paying Twice? The Cost of Asset Duplication in Portfolios

Should Investors Look Toward Emerging Markets?

One of the most striking developments in 2025 was the performance of the IA Global Emerging Markets sector. For the first time since 2016, it delivered higher average returns than both the IA North America and IA Technology and Technology Innovation sectors.

This does not mean emerging markets are suddenly the new leaders, nor does it suggest investors should make wholesale changes. What it does highlight is how leadership can rotate after long periods of dominance.

Emerging markets had spent years lagging behind, often overlooked due to concerns around volatility, governance and geopolitical risk. Lower valuations and improving fundamentals in parts of the region created a different starting point compared to highly priced US equities.

The lesson here is not about chasing performance. It is about recognising that markets move in cycles. Periods of underperformance often precede recovery. Periods of sustained outperformance can create vulnerability when expectations are stretched.

Is This the Start of a Market Bubble Bursting?

The idea of a bubble bursting is emotionally powerful, but often unhelpful. Markets rarely move from confidence to collapse overnight. More often, they transition through phases of uncertainty, uneven returns and changing leadership.

What we are seeing now does not confirm the end of US or technology led growth. It does suggest that the easy gains of the past may be harder to repeat. In that environment, concentration becomes more costly.

The real question for investors is not whether a bubble exists, but whether their portfolios are resilient enough if conditions remain uncertain for longer than expected.

Why Portfolio Awareness Matters More Than Predictions

Predicting market turning points is notoriously difficult. What investors can control is how their portfolios are structured.

Understanding true exposure. Identifying where returns are coming from. Recognising duplication and unintended concentration. These factors have a far greater influence on long term outcomes than trying to time short term market moves.

As Warren Buffett was famously noted as saying, “Risk comes from not knowing what you’re doing.” In today’s market, that risk often stems from not knowing how exposed portfolios have become to a single region, sector or currency.

A Moment to Take Stock, Not Panic

Periods like this are uncomfortable because they challenge long held assumptions. They force investors to confront the possibility that the next decade may not look like the last.

That does not mean abandoning North American equities or technology. It does mean reassessing balance. Ensuring diversification is genuine rather than assumed. Making sure portfolios are aligned with risk tolerance today, not with market conditions from several years ago.

The recent slowdown in US and technology focused sectors, combined with the relative strength seen elsewhere, is not a verdict. It is a reminder.

Markets change. Portfolios drift. Awareness is what separates measured decision making from reactive behaviour. For investors willing to look beneath the surface, this period of uncertainty may prove more useful than any period of uninterrupted growth.

Understanding What Your Portfolio Is Really Exposed To

This article has focused on a simple but often overlooked issue: many portfolios have become increasingly dependent on the same region, the same companies and, in many cases, the same currency.

While individual fund performance can look reasonable in isolation, it does not show how those funds combine within a wider portfolio. Across many of the portfolios we review, holdings that appear diversified on the surface share a heavy reliance on North American equities and technology-led business models. When those areas slow, the impact can be felt across multiple holdings at the same time.

This is how portfolios become more exposed than investors realise. Funds added at different times, for sensible reasons, can end up relying on the same drivers of return. Over long periods of strong US-led growth, that concentration can go unnoticed. When conditions change, it becomes far more visible.

A portfolio analysis helps bring this clarity. Rather than focusing on individual funds, Yodelar’s portfolio analysis looks at how holdings work together, identifying where exposure overlaps, where performance has fallen behind sector averages, and how much of the portfolio outcome is linked to specific regions or currencies.