-

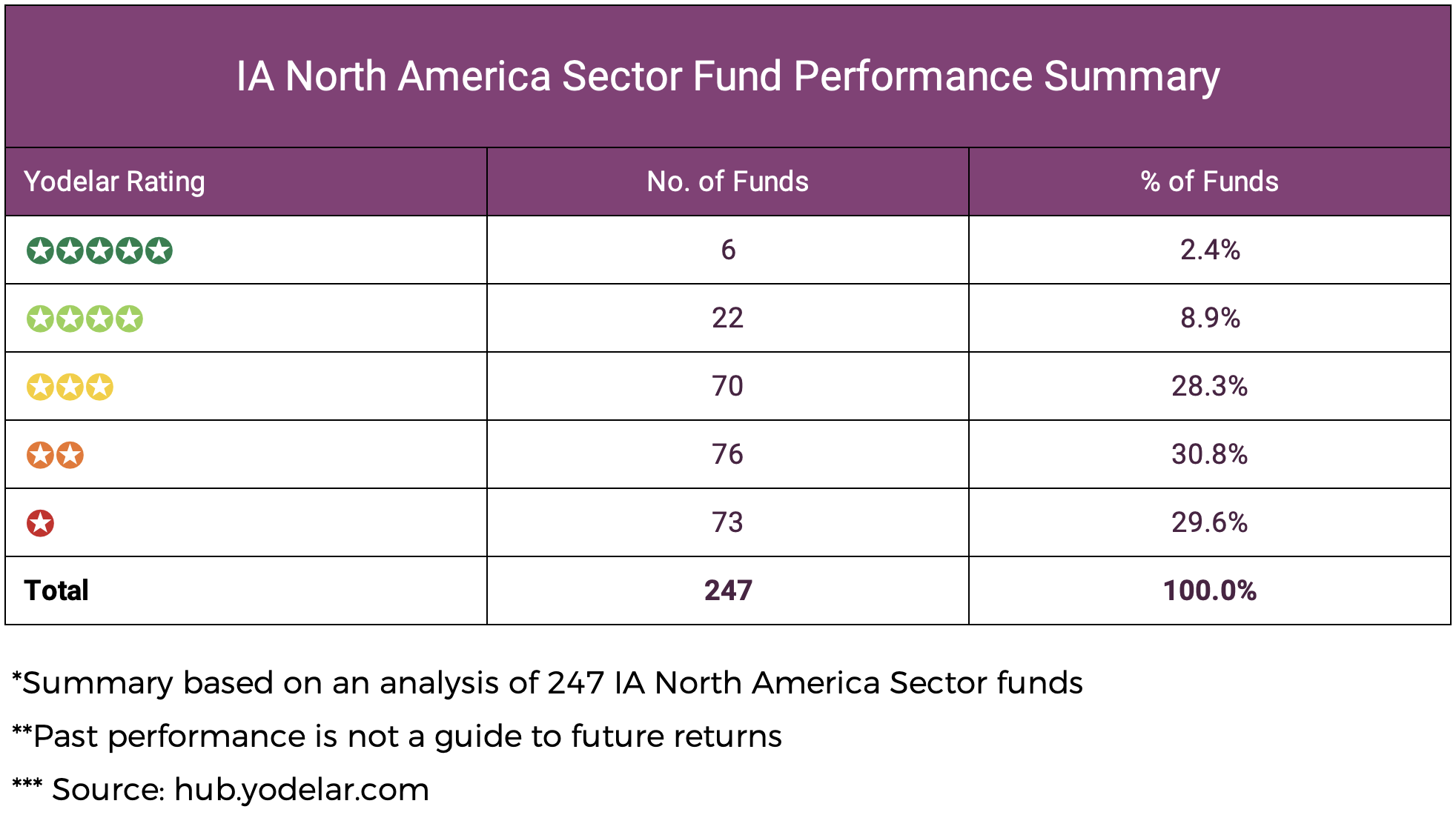

Analysis of 247 IA North America funds shows that fewer than 12% delivered consistently strong results relative to the sector average across 1, 3 and 5 years.

-

Just 6 funds achieved a 5-star Yodelar Rating, highlighting how rare sustained high sector rankings have been within the sector.

-

The article identifies 10 funds that ranked consistently among the strongest performers, examining their growth, sector rankings and portfolio structure in detail.

-

Results varied widely between funds classified within the same sector, with portfolio structure and exposure playing a key role in performance differences.

-

The findings highlight why fund selection and portfolio context matter, particularly where multiple North America funds hold similar exposures and increase duplication risk.

The Investment Association North America sector remains one of the most widely used equity sectors in UK investor portfolios. Funds in this sector provide exposure primarily to US equities, with returns often influenced by the performance of a relatively small number of large companies. As a result, performance across the sector can vary significantly between funds, depending on fund construction, stock selection and risk exposure.

In this review, we analyse the performance, sector ranking and rating of each fund classified within the IA North America sector over the past 1, 3 and 5 years. From this analysis, we feature 10 funds that have consistently achieved high sector rankings over the periods analysed.

North America Sector Performance Summary

This analysis covered 247 funds classified within the IA North America sector. The distribution of Yodelar Ratings shows that only a small proportion of funds delivered consistently strong results relative to the sector average across the periods analysed.

Just 6 funds (2.4%) achieved a 5-star Yodelar Rating, while a further 22 funds (8.9%) received a 4-star rating. Combined, fewer than 12% of funds ranked consistently towards the upper end of the sector.

The largest share of funds sat in the middle of the rating range. 70 funds (28.3%) received a 3-star rating, indicating mixed results when compared with the sector average across 1, 3 and 5 years.

149 funds (60.4%) received a poor performing 1 or 2-star rating, reflecting consistent underperformance in comparison to the sector average.

Overall, the analysis shows that consistent outperformance within the IA North America sector has been relatively rare, reinforcing the importance of fund selection rather than relying on sector exposure alone.

Top Performing IA North America Funds

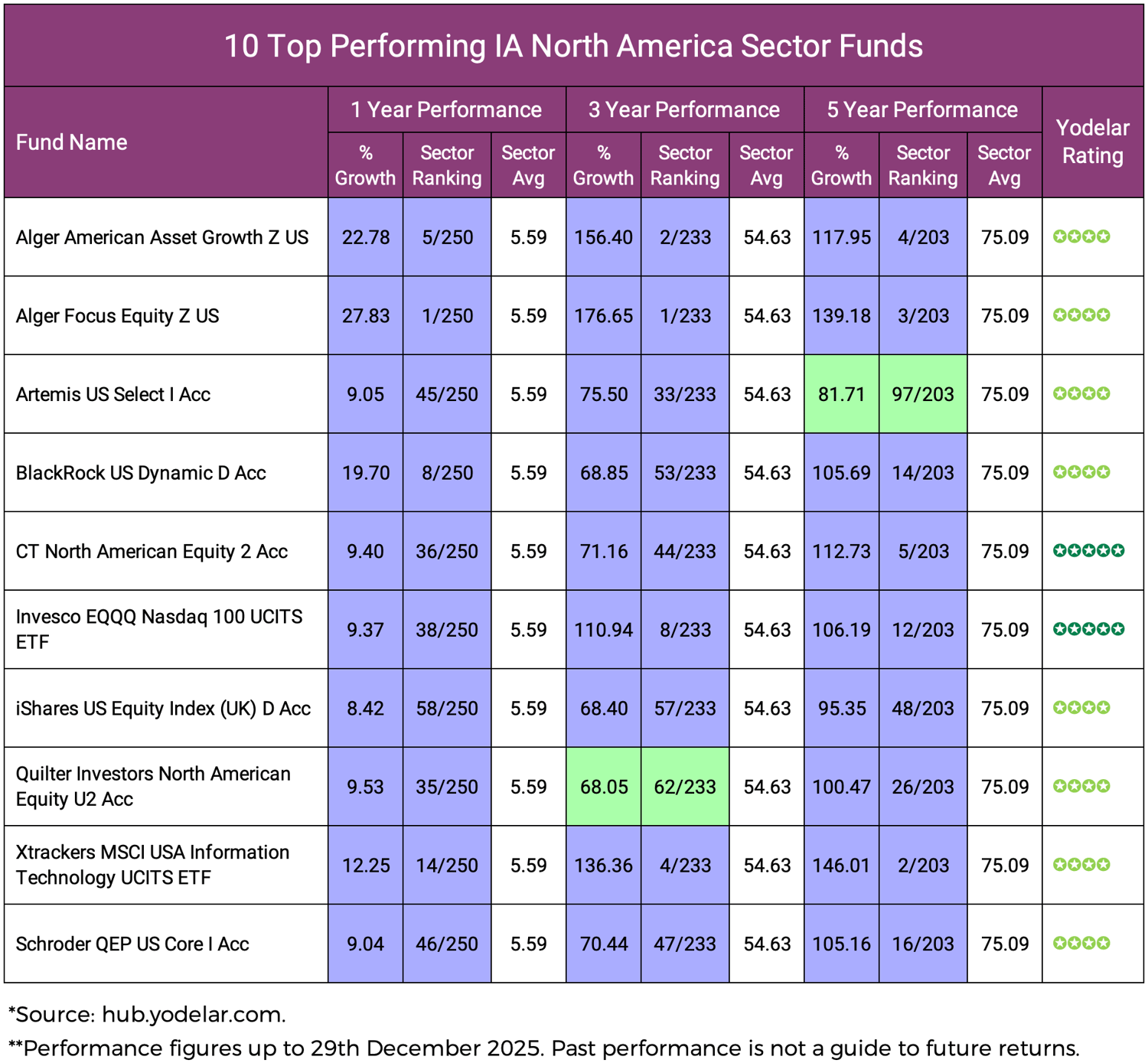

The table below highlights 10 IA North America funds that have demonstrated more consistent historic performance relative to their sector peers. Inclusion is based on a combination of sector rankings across 1, 3 and 5 years and higher Yodelar Ratings.

Selection is not based on short-term performance alone. Instead, the focus is on funds that have ranked consistently among the top performers over the three periods analysed.

Alger American Asset Growth Z US

The Alger American Asset Growth fund delivered 22.78% growth over 1 year, ranking 5th in the sector, well ahead of the sector average. Over 3 years, returns of 156.40% ranked 2nd, and over 5 years growth of 117.95% ranked 4th, placing the fund consistently among the higher-ranking options across all periods analysed. The portfolio is growth-focused and relatively concentrated, with a high weighting to large US technology companies and a limited number of holdings.

Alger Focus Equity Z US

The Alger Focus Equity fund returned 27.83% over 1 year, ranking 1st in the sector, making it the highest-ranking fund in the table over that period. Over 3 years, returns of 176.65% also ranked 1st, while 139.18% growth over 5 years ranked 3rd, showing sustained high sector rankings across all periods analysed. The portfolio typically holds around 50 stocks and has a strong allocation to technology and communication services.

Artemis US Select I Acc

The Artemis US Select fund delivered 9.05% growth over 1 year, ranking 45th, above the sector average. Over 3 years, returns of 75.50% ranked 33rd, while 81.71% growth over 5 years ranked 97th, reflecting more variation in sector rankings over longer periods. The fund holds between 40 and 60 stocks and is diversified across technology, healthcare, industrials and consumer sectors.

BlackRock US Dynamic D Acc

The BlackRock US Dynamic fund returned 19.70% over 1 year, ranking 8th in the sector. Over 3 years, returns of 68.85% ranked 53rd, while 105.69% growth over 5 years ranked 14th, placing the fund towards the upper end of the sector over the longer period. The portfolio holds fewer than 40 stocks and focuses on larger US listed companies, rather than smaller or early stage businesses.

CT North American Equity 2 Acc

The CT North American Equity fund delivered 9.40% growth over 1 year, ranking 36th. Over 3 years, returns of 71.16% ranked 44th, while 112.73% growth over 5 years ranked 5th, highlighting stronger relative performance when viewed over the longer period. The portfolio holds over 100 stocks and has a broad sector spread, with technology and consumer discretionary as the largest allocations.

Invesco EQQQ Nasdaq 100 UCITS ETF

The Invesco EQQQ ETF returned 9.37% over 1 year, ranking 38th in the sector. Over 3 years, returns of 110.94% ranked 8th, while 106.19% growth over 5 years ranked 12th, placing the fund among the higher-ranking options over longer periods. The fund tracks the Nasdaq 100 Index and is weighted towards large US technology and growth companies.

iShares US Equity Index (UK) D Acc

The iShares US Equity Index fund delivered 8.42% growth over 1 year, ranking 58th. Over 3 years, returns of 68.40% ranked 57th, while 95.35% growth over 5 years ranked 48th, broadly tracking the sector average across all periods analysed. The portfolio holds over 500 stocks and provides broad exposure to the US equity market.

Quilter Investors North American Equity U2 Acc

The Quilter Investors North American Equity fund returned 9.53% over 1 year, ranking 35th. Over 3 years, returns of 68.05% ranked 62nd, while 100.47% growth over 5 years ranked 26th, showing more competitive sector rankings over the longer period. The portfolio is diversified across sectors, with technology and financials as the largest weights.

Xtrackers MSCI USA Information Technology UCITS ETF

The Xtrackers MSCI USA Information Technology ETF delivered 12.25% growth over 1 year, ranking 14th in the sector. Over 3 years, returns of 136.36% ranked 4th, while 146.01% growth over 5 years ranked 2nd, placing it consistently among the highest-ranking funds over longer periods. More than half of the portfolio is invested in US information technology companies.

Schroder QEP US Core I Acc

The Schroder QEP US Core fund returned 9.04% over 1 year, ranking 46th. Over 3 years, returns of 70.44% ranked 47th, while 105.16% growth over 5 years ranked 16th, showing improved relative positioning over the longer period. The portfolio holds several hundred stocks and has sector exposure broadly aligned with the wider US equity market.

Wider Observations Across the IA North America Sector

The analysis of the IA North America sector shows a wide spread of performance between funds classified within the same sector. While a small number of funds achieved high sector rankings across the periods analysed, a much larger proportion delivered returns close to, or below, the sector average.

Performance was not consistent across periods. Funds that ranked highly over one period did not always maintain those positions over 3 and 5 years, with rankings shifting frequently as market conditions changed.

The data also shows that strong sector averages can hide large differences between individual funds. Funds classified within the same sector delivered very different results, often due to differences in portfolio structure, such as exposure to different industries.

Bringing Sector Performance Into Portfolio Context

While this analysis of the IA North America sector identifies funds that have performed consistently well and those that have underperformed, it does not show how funds interact within a portfolio. Many of the funds that ranked highly in the sector hold significant exposure to the same group of large US technology companies. As a result, performance at fund level can be closely linked across multiple holdings.

Where portfolios contain several North America funds with similar exposures, this can lead to duplication rather than diversification. In these cases, a downturn affecting a small number of heavily represented companies would have a broad impact across multiple funds, increasing overall portfolio sensitivity to the same risks.

This highlights the importance of diversification even within a single sector. Holding more than one fund in the IA North America sector does not automatically reduce risk if those funds share similar holdings or strategies.

While past performance can help identify funds that have delivered strong results, fund selection is more effective when considered in a wider portfolio context. Understanding how each fund fits within an overall portfolio strategy is just as important as reviewing historic returns, particularly where portfolios have been built around a small number of dominant themes or market leaders.