- This report identifies 10 of the top performing IA Global funds of 2025, based on consistent sector rankings over the year rather than short periods of performance.

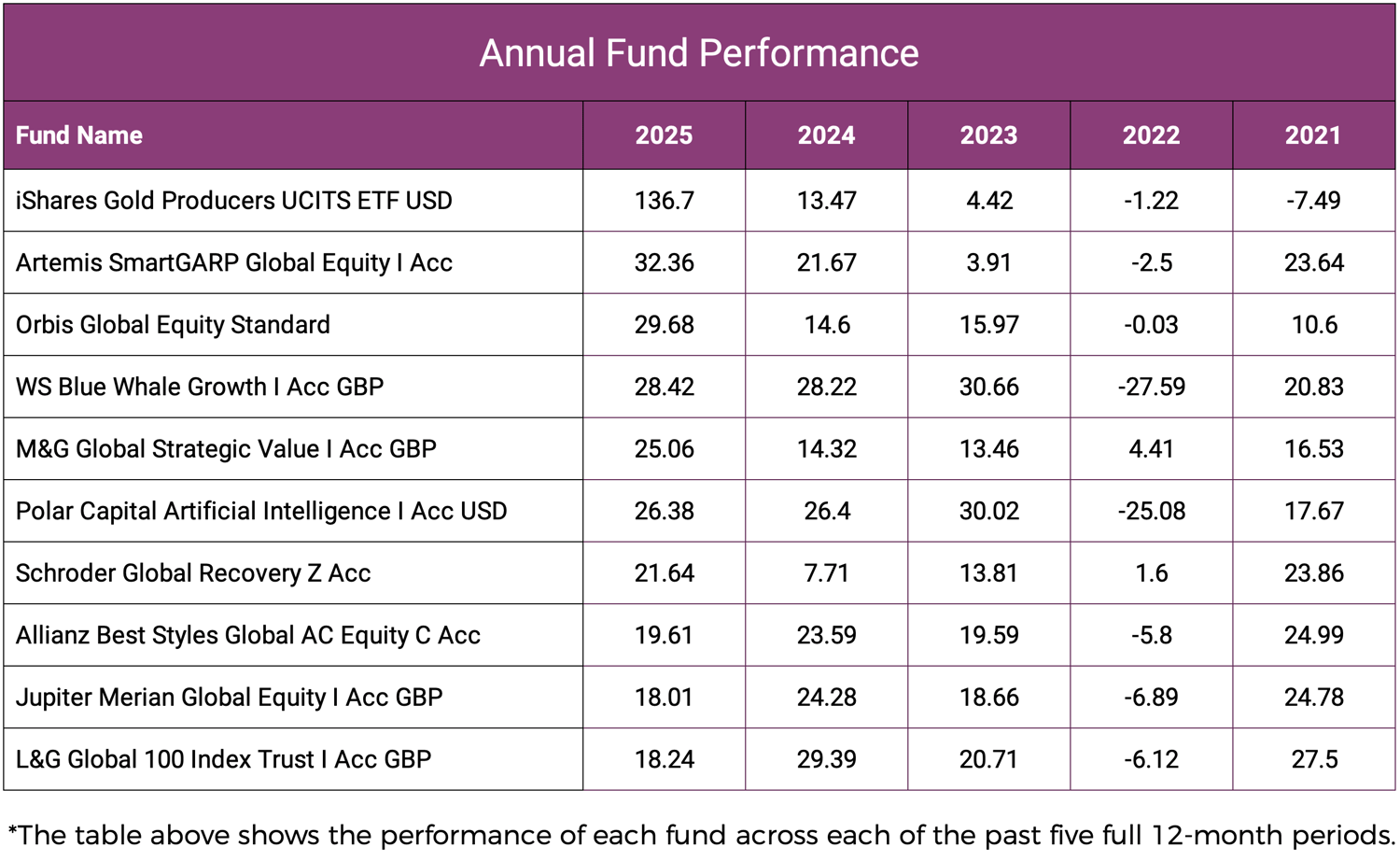

- iShares Gold Producers UCITS ETF ranked first in the IA Global sector over both the 6-month and 1-year periods, placing it at the top of the sector during 2025.

- Artemis SmartGARP Global Equity remained ahead of the IA Global sector average across all periods analysed, finishing the year among the highest-ranked global equity funds.

- Polar Capital Artificial Intelligence featured near the top of the sector over the 3-month, 6-month and 1-year periods, reflecting sustained strength in technology-focused strategies.

- WS Blue Whale Growth delivered strong results during 2025, ranking well within the upper range of the IA Global sector over shorter periods.

Global equity funds produced very different outcomes during 2025. While some funds ranked near the top of the IA Global sector, many others ranked below their sector averages over the same periods.

The IA Global sector is the largest of the Investment Association’s 55 sectors, with £241.9 billion invested in funds classified within this group at the end of November 2025. This reflects the scale of capital allocated to global equities and underscores why understanding performance differences within this sector matters for investors and advisers alike.

Performance within the IA Global sector varied considerably through 2025, with clear gaps between funds that ranked towards the top of the sector and those that did not. This article highlights ten IA Global funds that ranked consistently towards the top of the sector during 2025. Selection is based on sector rankings over the past 3 months, 6 months and 1 year, focusing on funds that remained competitive within the sector across the year.

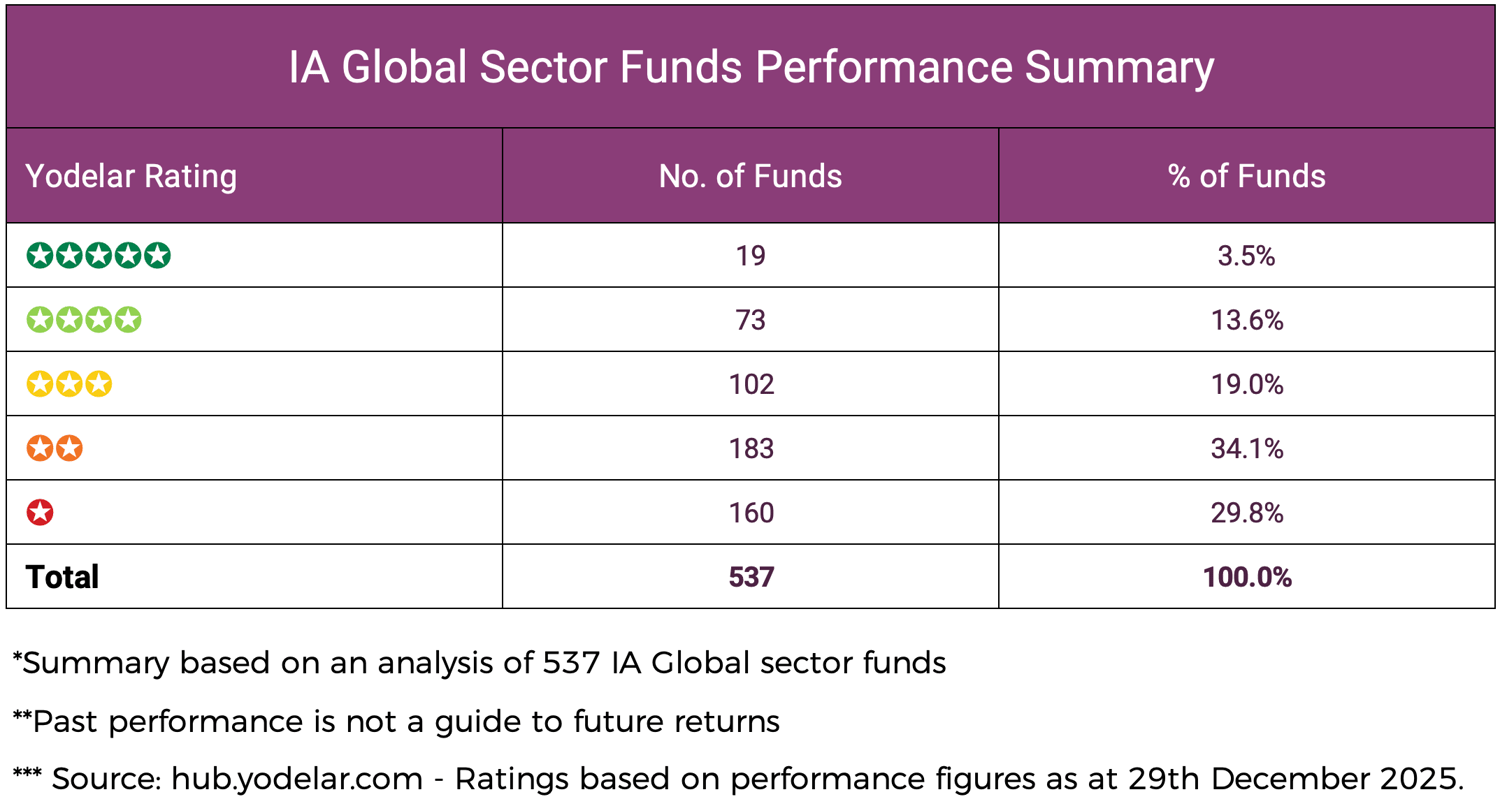

IA Global Sector Funds Performance Summary

The IA Global sector is one of the most widely used categories by advisers and investors seeking broad equity exposure. With over 500 funds in the sector, it encompasses a wide range of global equity strategies in different structures and currencies.

The sector performance summary shows a broad range of outcomes during 2025. Only a relatively small number of funds ranked consistently ahead of the sector average across the main reporting periods, while a large number of funds remained below sector averages.

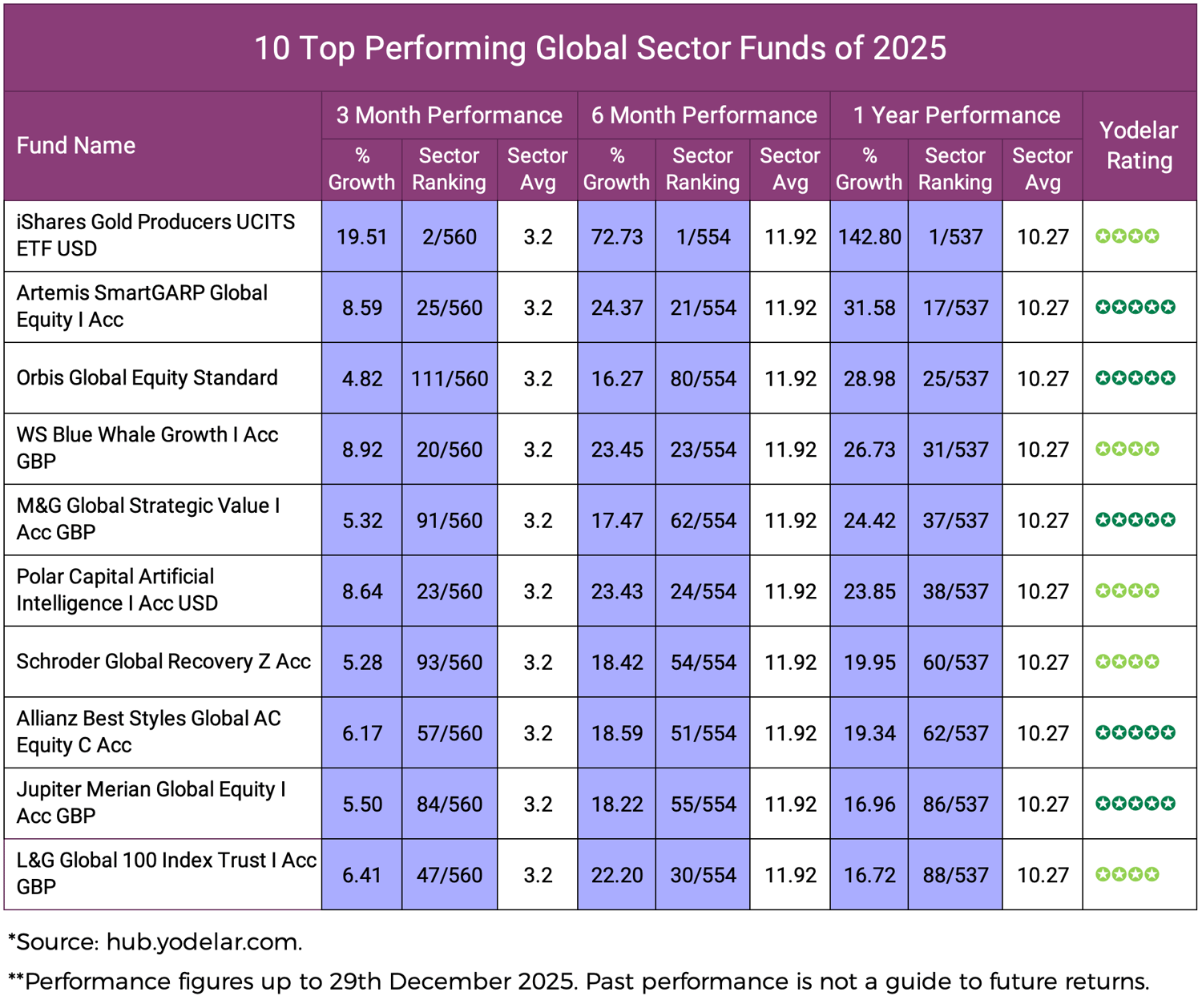

10 Top Performing Global Sector Funds of 2025

The table below highlights ten IA Global funds that ranked within the top quartile of the sector over the past 3 months, 6 months and 1 year. Funds are included based on their sector rankings, reflecting how each compared with other IA Global funds across the periods reviewed.

iShares Gold Producers UCITS ETF USD

This fund ranked at the top of the IA Global sector over both the 6-month and 1-year periods. Performance was driven by strength in gold mining equities, supported by higher gold prices and improved operating conditions for producers. Returns have been closely linked to movements in commodity prices and investor sentiment towards resource stocks. As a result, performance has been more variable than that of broader global equity funds.

Artemis SmartGARP Global Equity I Acc

The Artemis SmartGARP delivered 8.59% growth over 3 months, ranking 25 out of 560 funds, well ahead of the sector average of 3.2%. Over 6 months, growth of 24.37% ranked 21 out of 554, again comfortably ahead of the sector average of 11.92%. Over 1 year, the fund returned 31.58%, ranking 17 out of 537, supporting its 5 star Yodelar Rating and indicating consistently strong sector-relative growth across all periods analysed.

Orbis Global Equity Standard

Orbis Global Equity Standard produced 4.82% growth over 3 months, ranking 111 out of 560, modestly ahead of the sector average. Over 6 months, growth of 16.27% ranked 80 out of 554, still above the sector average of 11.92%. Over 1 year, the fund returned 28.98%, ranking 25 out of 537, placing it firmly towards the upper end of the sector and supporting its 5 star Yodelar Rating.

WS Blue Whale Growth I Acc GBP

Over 6 months, the fund delivered 23.45% growth, ranking 23 out of 554, materially ahead of the sector average. One-year growth of 26.73% ranked 31 out of 537, keeping the fund consistently within the upper tier of the IA Global sector.

M&G Global Strategic Value I Acc GBP

The fund produced 17.47% growth over 6 months, ranking 62 out of 554, above the sector average. Over 1 year, growth of 24.42% ranked 37 out of 537, reflecting solid and consistent sector-relative growth across both periods analysed.

Polar Capital Artificial Intelligence I Acc USD

Polar Capital’s specialist focus on artificial intelligence and related technologies supported strong performance during the year. The fund ranked highly across the periods analysed, returning 1 year growth of 23.85%, which ranked 38 out of 537 IA Global sector classified funds.

Schroder Global Recovery Z Acc

The Schroder Global Recovery fund returned growth of 5.28% over 3 months, which comfortably ahead of the sector average. Over 6 months, the fund returned growth of 18.42% as it ranked 54th out of 554 funds for the period. Over 1 year, the funds returns of 19.95%, which ranked 60th in the sector.

Allianz Best Styles Global AC Equity C Acc

The fund delivered 6.17% growth over 3 months, ranking 57 out of 560, ahead of the sector average. Over 6 months, growth of 18.59% ranked 51 out of 554, comfortably outperforming the sector average of 11.92%. Over 1 year, returns of 19.34% ranked 62 out of 537, supporting its 5-star Yodelar Rating and indicating consistent sector-relative growth.

Jupiter Merian Global Equity I Acc GBP

The Jupiter Merian Global Equity fund returned 16.96% growth over 1 year, placing it modestly above the sector average. Returns of 18.22% over 6 months supported a competitive but less differentiated sector position.

L&G Global 100 Index Trust I Acc GBP

The L&G Global 100 Index Trust fund delivered 16.72% growth over 1 year, consistent with broader market performance within the sector. Stronger 6-month growth of 22.20% reflected market momentum, with rankings aligning closely with index-driven returns.

The Importance of Diversification and Risk Management

Reviewing sector performance provides useful insight, but concentrating disproportionately in funds with high rankings can lead to unintended concentration risk. Holding a narrow selection of funds without reviewing how they interact within a portfolio may increase sensitivity to specific market movements.

A structured asset allocation framework helps maintain balance and keeps portfolios aligned with an investor’s agreed risk level. Including a range of exposures across markets and asset types can help manage volatility and reduce reliance on any single area of the market.

Maintaining diversification based on long-term objectives, rather than reacting to recent results alone, remains an integral part of portfolio construction.

Bringing Fund Performance Into Context

The IA Global sector data for 2025 highlights clear differences between funds that consistently ranked towards the upper end of the sector and those that did not. While a small number of funds achieved stronger sector rankings, a much larger proportion sat below the sector average over the same periods.

Assessing fund performance in isolation can therefore be misleading. A fund may deliver positive growth yet still lag its sector average, a pattern that can persist over time and influence overall portfolio outcomes without being immediately apparent.

A portfolio analysis helps bring this into focus by comparing each holding against its sector average across multiple periods. This approach highlights funds that have underperformed relative to peers, identifies potential duplication, and flags where portfolio structure may no longer align with the intended level of risk.

For investors seeking greater clarity, a Yodelar Portfolio Analysis provides an independent review of fund performance and charges, alongside comparisons against similar risk profiles. This broader perspective supports more informed portfolio decisions.