- 18% of Vanguard funds achieve 4/5 star rating and 49% are ranked as poor performing 1/2 star funds. Access full analysis in our latest Vanguard fund review.

- The LifeStrategy 80% Equity fund was the only fund in the LifeStrategy range to consistently maintain a top quartile sector ranking over the past 1, 3 & 5 years with returns of -1.65%, 16.27% and 36.44% respectively.

- One of the most disappointing Vanguard ETF’s was the Vanguard FTSE All World ex US Small Cap fund. This fund has consistently performed well below the sector average.

- Over the past 1, 3 & 5 years, the Vanguard Information Technology fund managed to return growth of 1.59%, 70.37% and 179.58% ranking among the top in the sector.

Vanguard founder and former chairman Jack Bogle, who died earlier this year aged 89, was credited with creating the world's first index fund – that is, an investment tied to a benchmark like the S&P 500 and not actively managed by human stock-pickers.

His idea was simply to "buy the market" as cheaply as possible, figuring that the gains from cutting out fees and expenses would pay off in the long run.

This philosophy has helped Vanguard build an investment juggernaut with almost £5 trillion in assets under management.

Vanguard offers investors access to a range of funds which include a mixture of multi asset, actively managed and passive funds. Although Vanguard have a reputation as a low cost fund manager, in this review of Vanguard we analyse the performance of all Vanguard funds identifying how competitive they have performed against all same sector branded funds.

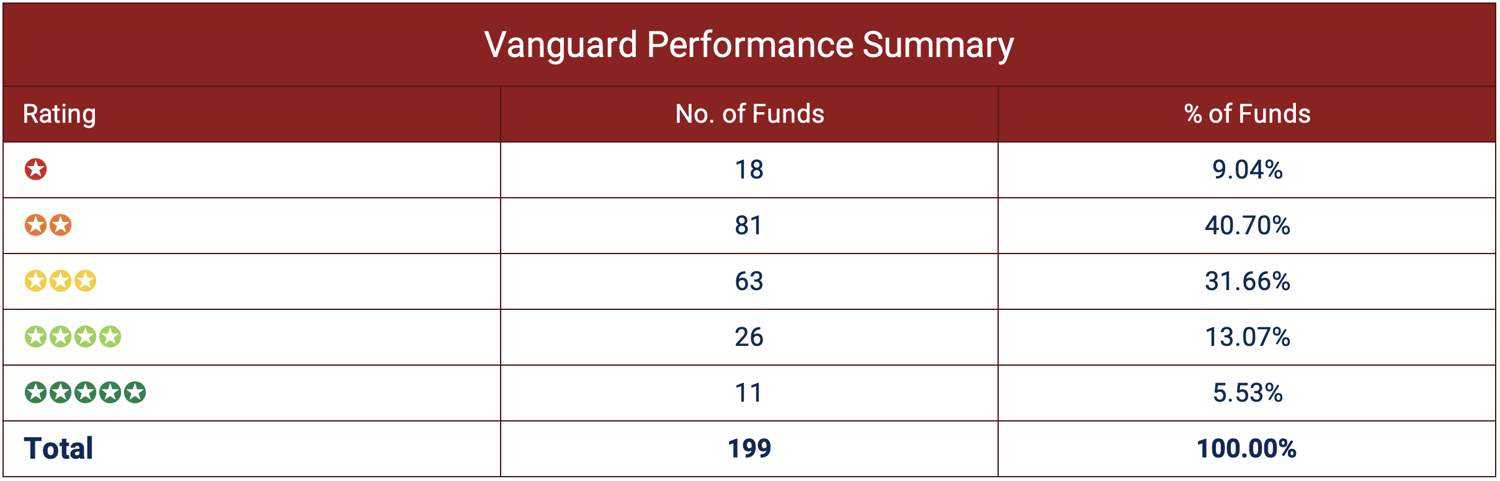

In this report, we analyse the performance of 199 Vanguard funds alongside all other funds within their respective sectors and provide them with an overall performance rating between 1 and 5 stars depending on how they rank within their relevant Investment Association sectors for.

18% of Vanguard funds achieve a 4/5 star rating. However 49% are ranked as poor performing 1/2 star funds.

About Vanguard

Jack Bogle was the founder of Vanguard and the creator of the first tracker fund, who profoundly changed the fund industry and investing.

In 1976, Bogle and Vanguard launched the fund now known as the Vanguard 500 Index fund, which was borne out of the simple insight that by buying and holding the stock market at low cost, investors could do better than most active managers. A year later Vanguard started selling its funds directly to investors.

Despite, much derision at the time and several years of financial uncertainty, Bogles, passive investing strategy took hold and saw Vanguard grow to become 2nd biggest investment management firm in the world behind only BlackRock.

Bogle argued for an approach to investing defined by simplicity and common sense. He summed up his investing by following 8 basic rules.

- Select low-cost funds

- Consider carefully the added costs of advice

- Do not overrate past fund performance

- Use past performance to determine consistency and risk

- Beware of stars (as in, star mutual fund managers)

- Beware of asset size

- Don’t own too many funds

- Buy your fund portfolio – and hold it

Famed investor Warren Buffett remains one of his big admirers. As a mark of tribute, Buffett said: "Jack did more for American investors as a whole than any individual I've known."

Much has been made of the Passive v Active funds debate but as we identified previously there is a valid argument for both, with understanding of what to look for and where to look the key to finding the best funds to fit an efficient and top performing investment strategy.

No fund manager has a monopoly on good performance, and as we identify in this report, Vanguard has a range of top performing funds and poor performing funds.

Vanguard Performance Review

From the 199 Vanguard funds assessed in this report 5 were from the popular Vanguard LifeStrategy range of ready made portfolios, which combined manage more than £14 billion of client money, and a further 11 funds were from their target retirement range.

Our analysis of these 199 funds identified that 49% received a poor performing 1 or 2 star rating with the majority (31%) receiving a modest 3 star rating. The remaining 37 funds had consistently outperformed the majority of their peers over the 1, 3 & 5 year periods analysed and received a very impressive 4 or 5 star rating.

Vanguard - The Creator of Passive Investing

In 1976, Bogle and Vanguard launched the fund now known as the Vanguard 500 Index, which was borne out of the simple insight that by buying and holding the stock market at low cost, investors could do better than most active managers. A year later Vanguard started selling its funds directly to investors.

Ultimately Vanguard became one of the largest money managers in the world with about $5.3 trillion under management.

Vanguard Active Funds

Although Vanguard has a global reputation for creating and providing passive funds, the firm also manages over £334 billion in actively managed equity assets globally and has been offering actively managed funds, which unknown to many, makes them one of the world’s largest active managers.

Vanguard uses a range of external and internal fund managers to manage their active fund range with 3 core principles in mind.

Costs - An ongoing commitment to driving down costs

Talent - Have access to a vast talent pool of fund managers whether this means outsourcing or managing funds internally

Patience - Their active funds are designed for the long term investors.

Although Vanguard has been a vocal proponent of passive investing and the majority of their business is based on selling their passive products they have also admitted that the value of quality active funds is hard to ignore.

The typically lower cost of passive investing is one of the key benefits that Vanguard uses in promoting their passive funds but in promoting their active fund range they make it clear that quality managers, although typically more expensive, can make up more in added growth than any savings that can be made from lower cost, tracker funds.

They believe that successful active management is driven by the combination of cost, top talent, and patience. While lower fees should reduce the hurdles necessary to outperform a benchmark, low costs alone cannot guarantee success.

Although many active managers have underperformed their benchmarks there are a large range of high quality active funds on the market - with the top performing funds across all sectors coming from these active funds.

How Have Vanguards Active Funds Performed?

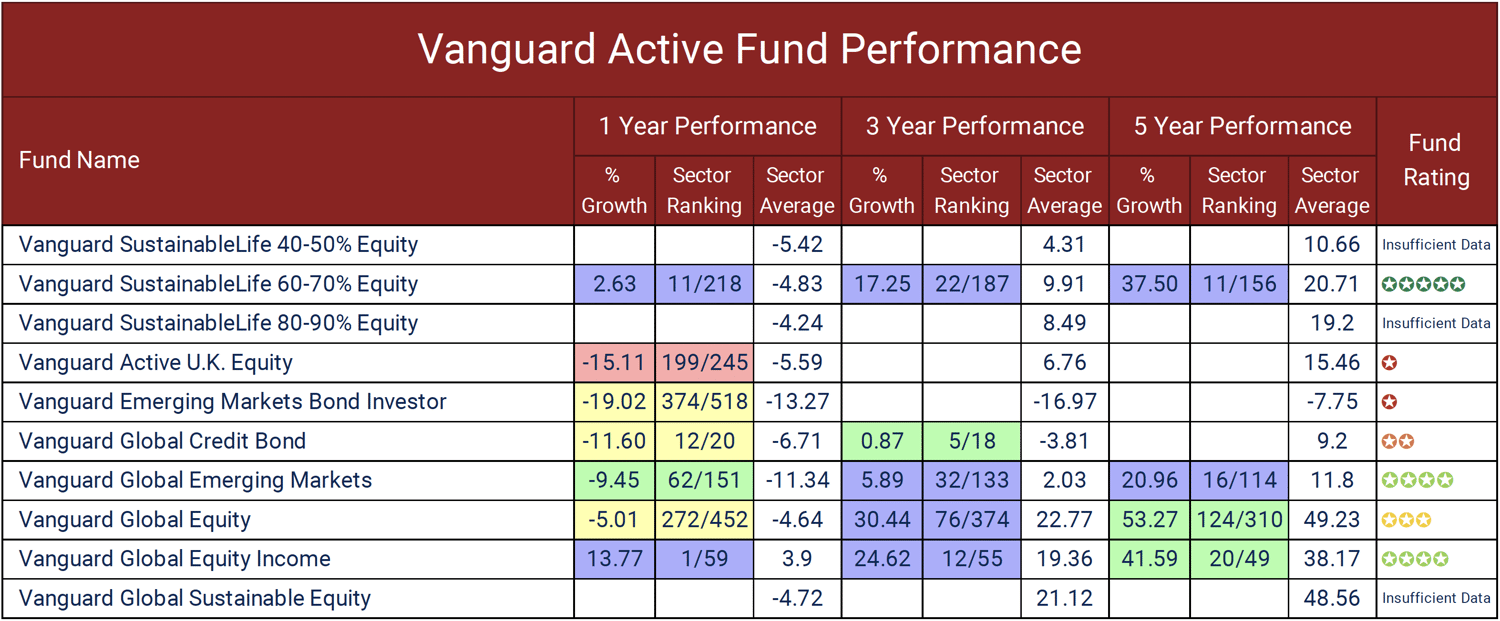

Vanguard currently has 11 actively managed funds available to UK investors. But only 4 of these funds have been around for over 5 years and3 have less than 1 years history.

From our analysis of these funds 4 have a history of top quartile sector performance over 3 years with all 4 of their funds with 5 year history outperforming the benchmark, ranking among the top performers in their sectors.

Vanguard SustainableLife 60-70% Equity Fund

The Vanguard SustainableLife 60-70% Equity fund seeks to achieve its investment objective by investing in a combination of shares of companies (between 60-70% of the portfolio, with an expected allocation of 65%) and bonds (between 30-40% of the portfolio, with an expected allocation of 35%) selected in accordance with Vanguards Sustainability Policy. This policy implores the funds manager to excludes investments that fall within an exclusions policy (which excludes companies involved in and/or deriving revenue (above certain thresholds) from tobacco, thermal coal, oil sands, nuclear / controversial weapons), and then considers each company’s alignment to the Fund’s net zero emissions targets and conducts an assessment of good governance standards.

This active fund sits within the same sector as the hugely popular Vanguard LifeStrategy 60% equity and 80% equity funds, and it has outperformed both over the past 1, 3 & 5 years.

Vanguard Global Emerging Markets Fund

The Vanguard Global Emerging Markets fund is an active fund investing primarily in shares of companies located in emerging market countries. Emerging markets are countries that are progressing toward becoming advanced, usually shown by some development in financial markets, the existence of some form of stock exchange and a regulatory body. At least 80% of the Fund’s assets will normally be invested in the shares of such companies.

The Fund typically invests in a diverse range of large, mid-size and small companies representing different economic sectors and industries, producing a mix of investments in companies whose earnings are expected to grow faster than their peers in the market and those that are considered to have been undervalued by the market.

This fund has ranked among the top performing emerging market funds for performance over the past 3 & 5 years, with returns of 5.89% and 20.96%, both of which were well above the sector average.

Vanguard Active U.K. Equity Fund

In contrast to the top performing Vanguard SustainableLife 60-70% Equity fund and Vanguard Global Emerging Markets fund, the Vanguard Active U.K. Equity Fund has underperformed since it launched in October 2019.

The fund is classified within the highly competitive UK All Companies sector and since its launch this fund has returned growth of 2.48%, which is significantly down on the 12.07% average for its sector.

The performance of the fund has been so concerning to Vanguard that in August this year they decided to abandon their long term strategy by removing control of the fund from Marathon Asset Management and replacing them with Schroders from September. The change in fund manager will inevitably bring a change in strategy, which may take some time for the effects to be seen.

Vanguard LifeStrategy Funds

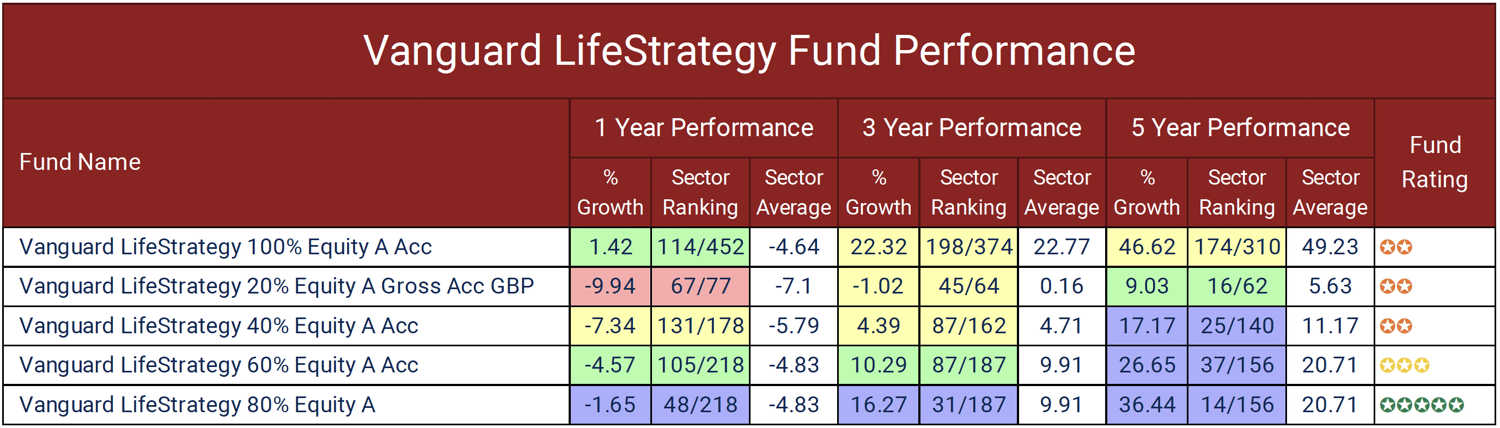

Vanguard launched their popular range of 5 LifeStrategy funds with the aim of making investing simple. These five funds act as ready-made portfolios, and each has different levels of potential risk and return.

LifeStrategy range: a snapshot

- Each fund created with 6,000 to around 20,000 underlying holdings

- Globally diversified in equities and bonds – helping to reduce risk

- Invested in the full range of sectors including technology, media and energy

Each of the five LifeStrategy funds offers a different blend of shares and bonds – made up of Vanguard index funds and ETFs. Each LifeStrategy fund will have between 6,000 and 20,000 underlying holdings across a full range of sectors and industries, and their low-cost structure means investors only pay 0.22% in ongoing charges (OCF) each year, with no entry or exit fees.

Similar to BlackRock Consensus funds, the risk profile of each LifeStrategy fund ranges from 3 to 7, with the lowest risk being the LifeStrategy 20% equity, which has a risk profile of 3 and is made up of 80% equities and 20% bonds. The highest risk being the LifeStrategy 100% equity, which unsurprisingly holds up to 100% in equities.

Combined the 5 LifeStrategy funds hold almost £14 billion of client funds, with the mid-range Vanguard LifeStrategy 60% Equity fund proving to be the most popular among investors.

Vanguard LifeStrategy 20% Equity fund

The Vanguard LifeStrategy 20% Equity fund has the lowest potential for risk and currently it has a risk category of 3 out of 10. As the name suggests, this fund is made up of 20% equities with the remaining 80% held in lower risk bonds.

Over the recent 1-year period this fund underperformed the sector average and ranked 67th out of 77 funds in its sector with negative growth of -9.94%. However, over 5-years it managed to return 9.03%, which was well above the 5.63% sector average for the period.

Vanguard LifeStrategy 40% Equity fund

With a risk rating of 4 out of 10, the Vanguard LifeStrategy 40% Equity fund assumes a higher weighting in equities and thus is considered to have a slightly higher risk rating.

This fund is weighted to contain 40% equities (mainly US and UK equities) and 60% bonds and it sits within the IA Mixed Investment 20-60% Shares sector. Over the recent 12 months this fund ranked a poor 131st out of 178 funds with negative growth of -7.34%. But over 5 years it returned 17.17%, which was better than over 75% of the funds in the sector.

Vanguard LifeStrategy 60% Equity fund

The largest and most popular in the LifeStrategy range is the 60% Equity fund. With a risk rating of 5, this mid-range fund appeals to many balanced investors who are willing to assume marginally higher risk for the potential of greater returns. Similar to the 20% and 40% Equity variants, the 60% Equity fund maintained a top quartile sector ranking over the past 5 years as it returned growth of 26.65%.

Vanguard LifeStrategy 80% Equity fund

The Vanguard LifeStrategy 80% Equity fund is composed of approximately 80% by value of equity securities and 20% by value of fixed income securities as it aims to achieve its investment objective predominantly through investment in passive, index-tracking collective investment schemes.

The LifeStrategy 80% Equity fund was the only fund in the LifeStrategy range to consistently maintain a top quartile sector ranking over the past 1, 3 & 5 years with returns of -1.65%, 16.27% and 36.44% respectively.

Vanguard LifeStrategy 100% Equity fund

The most adventurous in the Vanguard LifeStrategy Fund range is the 100% equity fund. This fund has a risk rating of 7 out of 10. and it sits within the highly competitive IA Global sector.

Over the 3 & 5 year periods analysed it managed to returned 22.32%, and 46.62%. which fell below the sector average.

Target Retirement Funds

Vanguard’s Target Retirement Funds were introduced to service what they felt was an unmet need from investors for a simple, balanced investment to reach their retirement goals.

What Is A Target Retirement Fund?

A Target Retirement Fund, also known as a TargetDate fund, acts as a ready-made diversified portfolio that will automatically adjust asset allocation over time as investors move closer to retirement.

They are a popular choice, in particular with advisers, as their structure takes away a lot of the complexities that come with retirement planning. There are currently 11 Target Retirement Funds available and they range from a target retirement date of 2015 to the furthest of 2065.

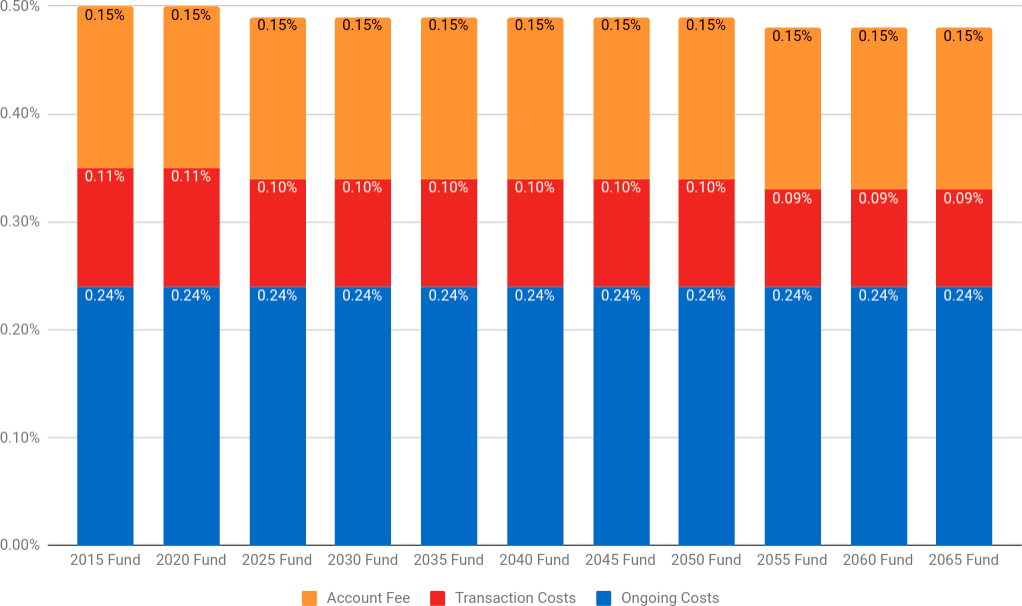

Each fund in the target-date series has similar underlying holdings that are essentially a mix of Vanguard index funds, however the asset allocation for each varies to reflect their different retirement dates. Due to the composition of index mutual funds and the Vanguard management style, the Vanguard Target Retirement series of funds has a low expense ratio ranging from 0.16% to 0.18%.

The Target Retirement funds have 3 key features that Vanguard believe offer investors with specific retirement dates in mind high quality investment options.

- 1. Diversification

-

Each of the Target Retirement Funds invests in Vanguard's broadest index funds, giving you access to thousands of U.S. and international stocks and bonds.

- 2. Managed Asset Allocation

The funds' managers gradually shift each fund's asset allocation to fewer stocks and more bonds so the fund becomes more conservative as you get closer to retirement.

- 3. Low Cost

-

The average Vanguard Target Retirement Fund expense ratio is 78% less than the industry average.

As they are a passive investment, the fees for Target Retirement funds are very competitive. The below table shows the ongoing charges, accounts fees and transaction costs for owning Vanguard Target Retirement Funds.

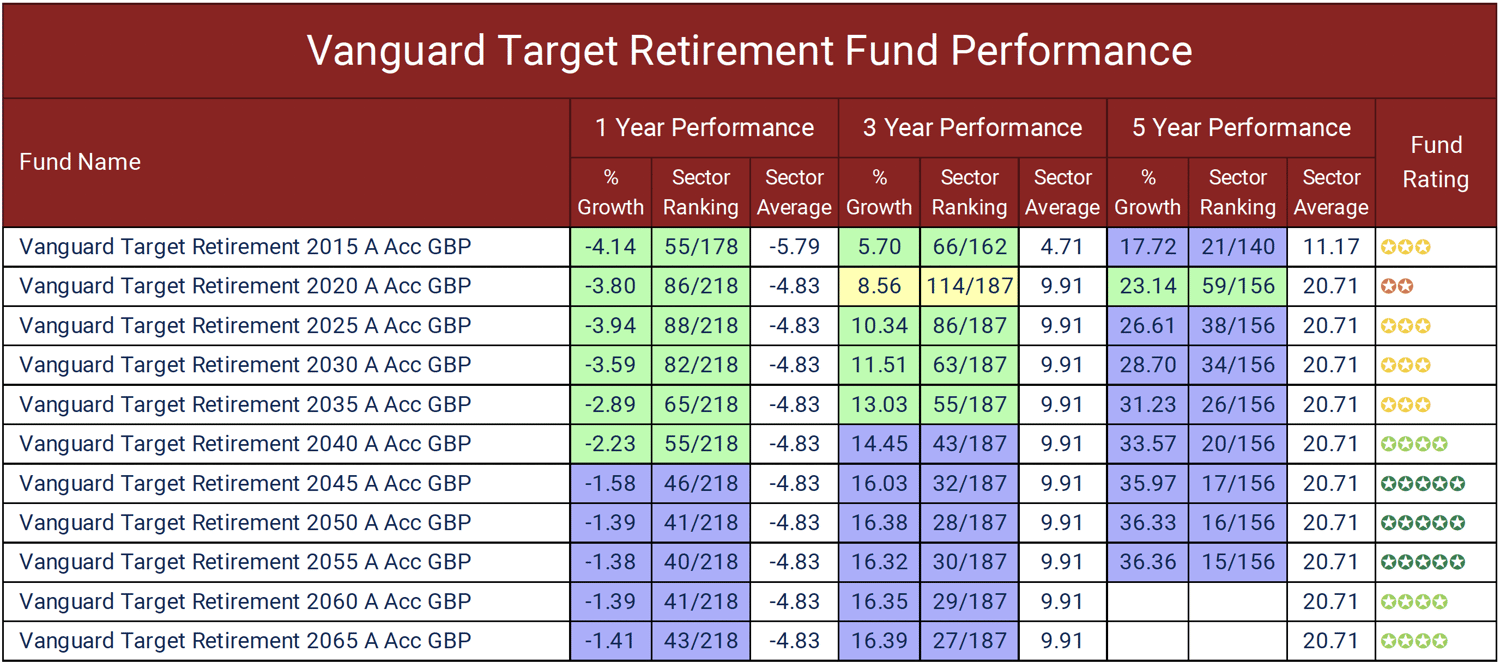

Vanguard Target Retirement Performance

The performance of the Vanguard Target Retirement funds has been very impressive. All of these funds, with the exception of the Target Retirement 2015 fund, sit within the IA Mixed Investment 40-85%.

As identified in our analysis, every Target Retirement fund with a date beyond 2045, has ranked among the top 75% of funds in their sector for performance. Only the 2020 fund has 1 period of underperformance, with the remaining funds all outperforming the sector average consistently.

Vanguard ETFs

84 of the 199 Vanguard funds analysed were from their range of ETFs. Our analysis of these ETFs identified 45 as having a history of poor performance and therefore rating as poor performing 1 or 2 star funds.

One of the most disappointing Vanguard ETF’s was the Vanguard FTSE All World ex US Small Cap fund. This fund has consistently performed well below the sector average with 1, 3 & 5 year returns of -7.69%, 12.55% and 18.81% respectively.

Among the top performing ETFs managed by Vanguard is their Information Technology fund which is a huge ETF that is responsible for almost £41 billion of client assets. This fund is classified within the Global ETF Equity - Tech Media & Telecom sector, which averaged losses of -17.45% this past year. However, the Vanguard Information Technology fund managed to return growth of 1.59% for the period.

Over 3 & 5 years its performance has been equally strong with returns of 70.37% and 179.58% ranking among the top in the sector.

Vanguard Unit Trust Funds

Our analysis found that of the 99 unit trust funds that we reviewed for this report, 18 managed to consistently rank among the top performers in their sectors with a 4 or 5 star performance rating.

The Vanguard FTSE U.K. All Share Index Unit Trust fund was one of their most popular top performers. The Fund seeks to track the performance of the FTSE All-Share Index and currently it manages over £12.4 billion of investor assets. Over the past 5 years this fund ranked 16th out of 114 funds in its sector with growth of 20.96% substantially outperforming the sector average of 11.8%.

Another fund that performed well was the Vanguard FTSE Developed World ex-UK Equity Index fund. This fund is also a tracker fund that holds more than £12 billion of client assets. The Fund seeks to track the performance of the FTSE AW Developed ex UK Index, which is an index that has Apple, Miscrosoft, Alphabet, Amazon and Tesla as its largest holdings.

Over the past 1, 3 & 5 years this fund has managed to return growth of 1.22%, 31.31% and 63.70%, each of which were better than the sector average of -4.64%, 22.77% and 49.23%.

Low Cost & Competitive Performance

Vanguard has been one of the biggest beneficiaries from the rise of low cost, passive investment products which has helped them grow from £575 billion of client funds under management in 2005 to £5 trillion today.

Their founder Jack Bogle was credited with creating the first index fund and his famous saying "Don't look for the needle in the haystack. Just buy the haystack!" fits Vanguard's mainly passive approach to fund management.

Their relatively recent addition of convenient, ready-made investments has proven popular with UK advisers and their investors, who have entrusted tens of billions to these low-cost products, which have largely performed well compared to their peers. This mixture of convenience, low cost and competitive returns certainly makes Vanguard and their products an attractive option for many, but for those who wish to maximise their portfolios returns the passive structure of Vanguards funds is not always the best option As demonstrated in our top fund reports, the best performing active fund managers often deliver considerably higher returns than their passive counterparts, which for growth seeking investors, can be significantly more rewarding.

However, despite a large proportion of their funds consistently underperforming, they still hold a range of highly competitive funds that also benefit from comparatively being lower-priced that their peers.