- Top performing active funds across 21 sectors average 75.74% versus average of 22.80% for passive and tracker funds

- Over last 3 years passive funds performed better than active average in 11 sectors

- Passive funds only available in 21 of 40 sectors

Active or Passive investing has traditionally been a pick a side debate with arguments for and against each, but as we identify in this report, there is much more to consider.

The key questions at the heart of it is on the ability (or not) of active managers to beat their underlying benchmarks and whether investors should simply abandon active strategies for passive investments.

For an active manager, the critical measure is to compare long-term investment performance, net-of all-costs, against relevant passive funds and an active peer group. Put simply, is the investor better off than if they had invested in a passive equivalent? And is that investor better off than if they had invested in an active fund?

For this report, we analysed the performance of 2,247 active funds and 564 passive funds across 21 different investment sectors. We identify which on average performs the best and how investors can look beyond these averages to find the best active and passive funds to invest in.

The Origin of Passive Investing

Passive investing was made available for retail investors in 1976 when Jack Bogle, founder of Vanguard, created the world’s first retail index fund. Appropriately named the “First Index Investment Trust”, it tracked the S&P 500 – an index of the 500 largest companies in the US.

Bogle’s motto, “Don't look for the needle in the haystack. Just buy the haystack”, neatly sums up passive investments. It suggests that simply tracking an index, rather than attempting to beat it, protects investors from active managers’ human error.

As with all new ideas, it was met with challenge at first. The investment space was ruled by active managers and, unsurprisingly, they weren’t keen on an approach that was cheaper (and in some cases better) than their stock picking.

What Is Passive Investing?

Passive funds, also known as tracker funds, aim to track the performance of a particular index, or stock market. For example the FTSE 100, which is made up of the UK’s largest 100 companies. This approach is different from actively-managed funds where professional fund managers invest into a select number of companies, with the aim to beat the performance of an index.

Most tracker funds typically invest in every stock that makes up the index it’s trying to replicate – known as full replication. Some funds won’t invest in every stock, but they’ll hold a sample of shares which represent the wider index. This is known as partial replication.

Either way, buying and selling companies involves costs which can eat away at performance. To keep the fund’s performance as close to the index as possible, tracker funds use techniques like reinvesting dividends at an appropriate time to keep costs to a minimum.

According to the promoters of passive investing, tracking the performance of a chosen market is cheaper, delivers better performance, and is more reliable than active funds, which rely on a fund manager to pick the stocks and manage the fund.

What Is Active Investing?

Active investing means investing in funds whose portfolio managers select investments based on an independent assessment of their worth—essentially, trying to choose the most attractive investments. Generally speaking, the goal of active managers is to “beat the market,” or outperform certain standard benchmarks.

Is Active Investing, Actual Investing?

One of the top performing fund management firms in the UK has coined the phrase, active investing is actual investing. Edinburgh based fund manager Baillie Gifford, stresses that ‘actual’ investment requires a willingness to be different, to accept uncertainty and the possibility of being wrong.

Ultimately the firm feels investment management should not be all about processing power, trading and speed. Instead it should be about imagination, creativity and working constructively on behalf of clients with entrepreneurs and companies who have greater ideas than our own.

Baillie Gifford accepts that ‘passive’ index-tracking funds have their place for offering cheap stock market access and on average better results than active managers after fees. However, it does not believe investment decisions can be made on numbers alone using supercomputers and complex algorithms. They point out that this approach has little to do with the process of targeting and subsequently allocating capital to the innovative companies changing the world.

‘Passive investing has its benefits. Allocating capital with no reference to the underlying uses of that capital is certainly a low-cost way to gain market exposure, but it is not investing, in the purest sense,’ Dunbar said.

Do Passive Funds Perform Better Than Active Funds?

Do passive funds perform better? The answer is yes if we look at the average growth figures but no if we compare passive funds to quality active funds.

The fact is, the investment fund market is littered with poor quality funds, funds that pull the average growth of active funds down considerably. As identified in our recent fund manager league table, over 57% of funds consistently underperform when compared alongside their sector peers over 1, 3 & 5 years, with a further 26% of funds averaging moderate levels of performance.

Therefore, the combined average returns of actively managed funds is often below the average returns of passive funds, which leads some to conclude that passive funds are a better option for investors than active funds. But to come to this conclusion would be premature and ignore the fact that the level of expertise between active fund managers can vary greatly, with some continually excelling and achieving returns from their funds that passive funds are unable to replicate.

Active Versus Passive - A Detailed Comparison

To provide a transparent comparison, we analysed the performance of 2,247 sector classified active funds and 564 passive funds across 21 sectors over the past 1, 3 & 5 years. We established the average growth for these periods for both passive and active funds and identified the number of quality active funds within each sector that outperformed their passively managed alternatives.

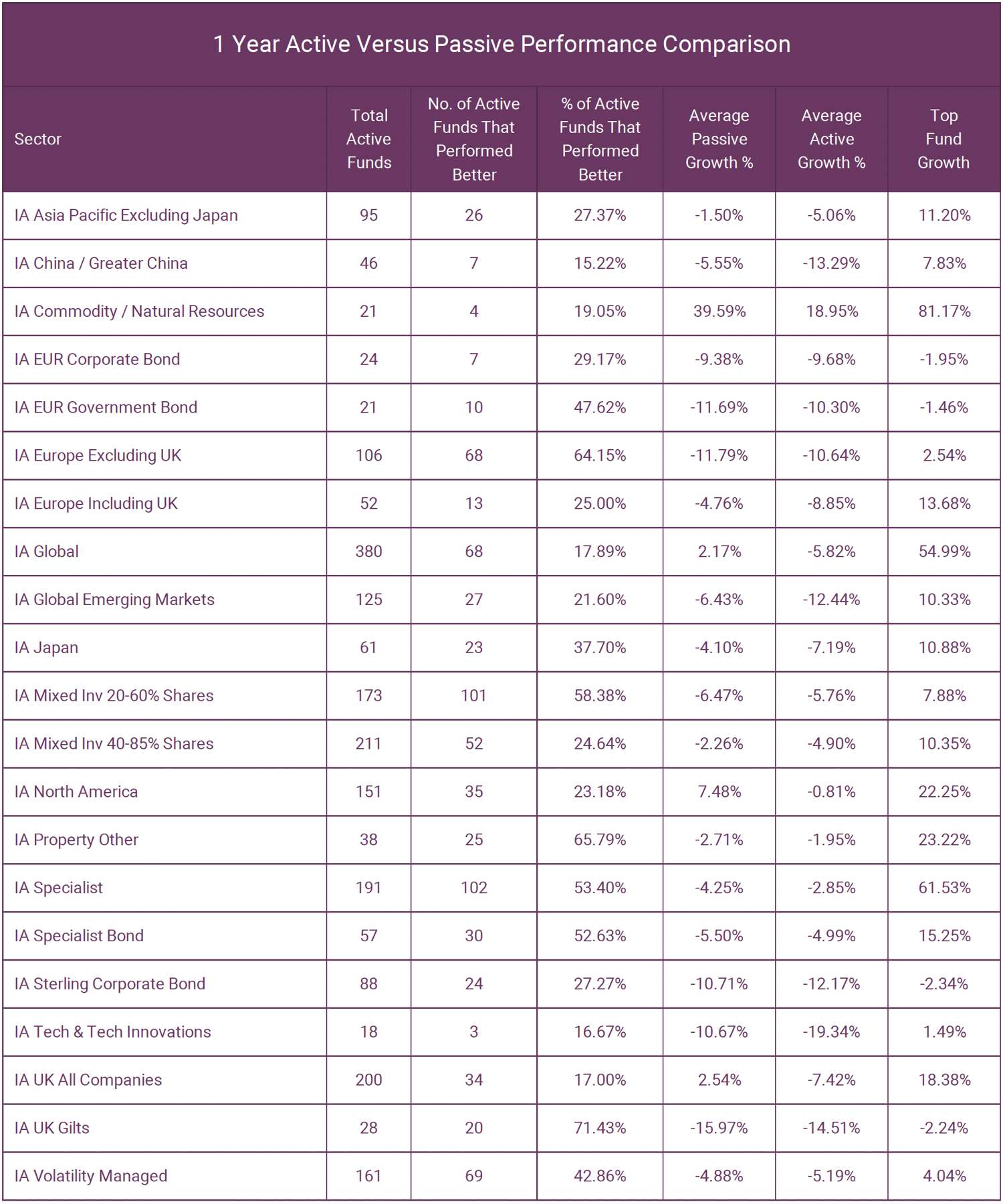

This analysis identified that over the recent 1 year period, passive funds averaged better performance in 14 of the 21 sectors. But over this period 748 (33%) of active funds outperformed the passive average with the highest returns in each sector coming from actively managed funds.

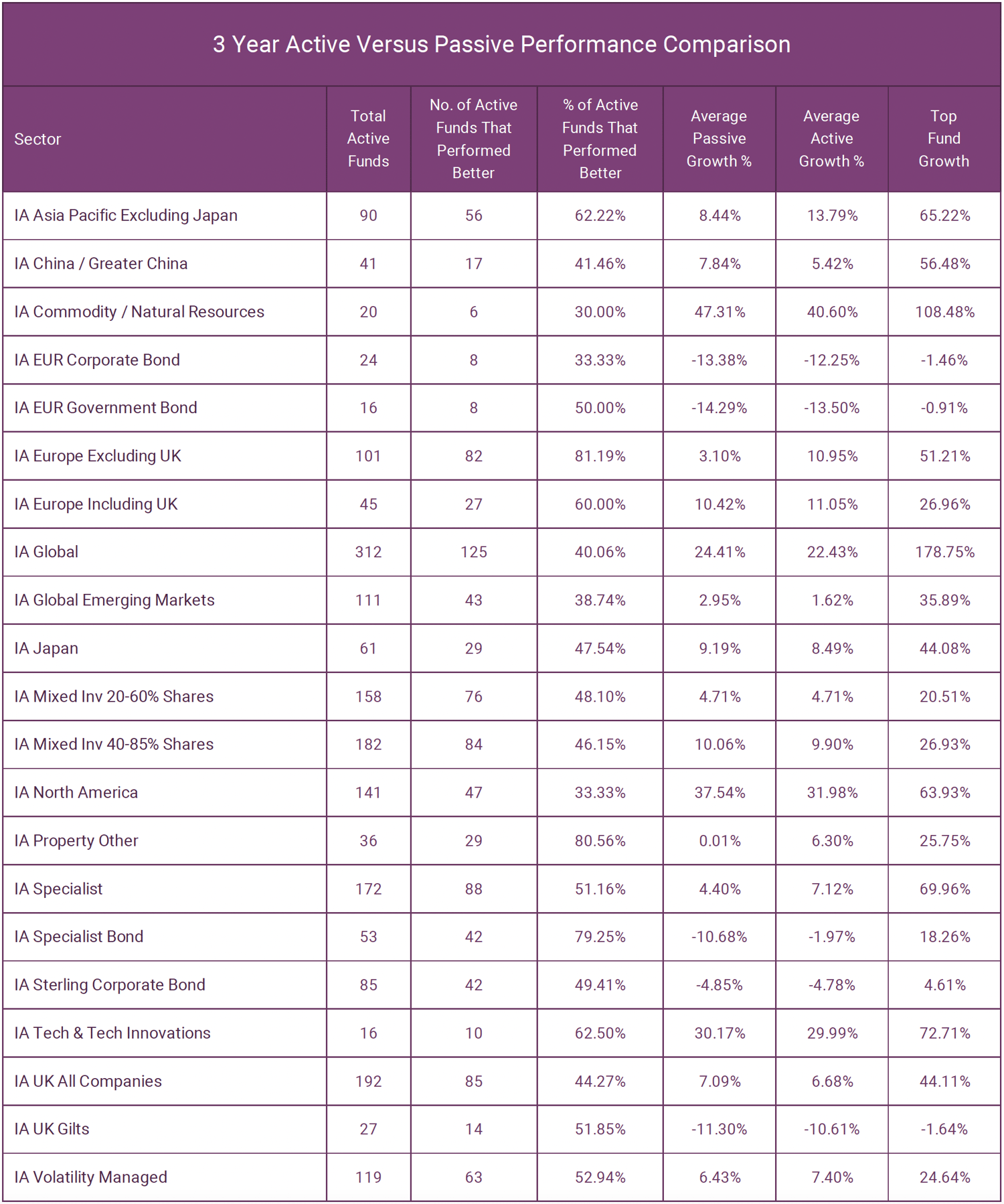

Over the past 3 year period, passive funds had higher average growth in 11 of the 21 sectors analysed. There was a rise in the number of active funds that outperformed this average with 49% of active funds returning higher growth than the 3 year average from their passive counterparts, with the top performance in each sector yet again coming from actively managed funds.

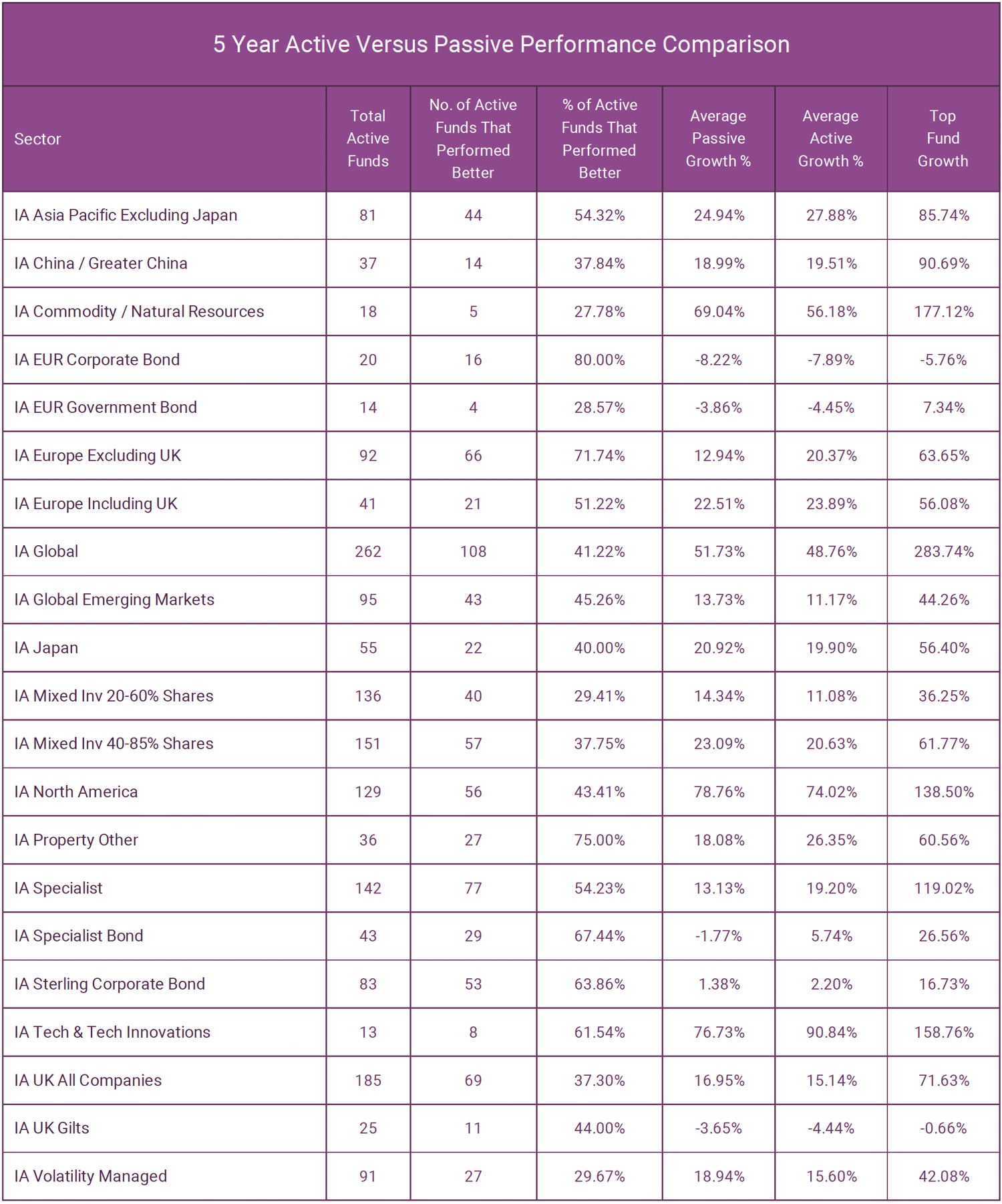

Again over 5 years, 11 of the 21 sectors had higher average returns from passive funds. Although the proportion of active funds to outperform passive funds dropped back down to 33% from 49% over 3 years, the difference in growth between the top performing active funds and their passive competitors widened significantly.

This analysis identifies that when we incorporate all active funds to determine their average growth this figure is consistently below that of the average from all passive funds. Which is a fact that is often used by proponents of passive funds to promote their status and devalue active funds. But to conclude that passive are better options than active based on this would be premature.

As we touched upon earlier, our league table identifies that the significant proportion of the funds available to UK investors are of poor quality and consistently underperform, and by identifying and excluding these funds the average returns from active funds increases dramatically. Therefore, by screening active funds for performance and excluding the serial under-performers investors are able to identify the most efficient actively managed funds which have consistently delivered higher returns than their passive rivals. When such steps are taken, averages no longer matter as quality will always be more likely to yield above average returns.

Identify the top performing funds - Download our latest best funds report

The Cost of Investing

One of the main attractions of passive investing is its low cost compared to the higher charges associated with actively managed funds. The reason passive funds are generally cheaper is because active funds are more expensive for fund management firms to maintain as they need to pay research analysts and portfolio managers, as well as additional costs due to more frequent trading. Whereas passive funds simply track a set index which is maintained by computers and complex algorithms with no hands on management or resources required.

Although cost is important, it is important to remember that your reason for investing is firstly to grow your wealth, not to save money. Naturally, lower costs are better than higher costs, but receiving value should be the focus. The opportunity cost of opting for passive funds could be huge when ignoring the active fund managers that consistently produce top returns within their sector.

As identified in this report, the vast majority of the top performing funds are actively managed. As such, we encourage you as an investor to make sure your investment adviser can demonstrate which funds are better performing within the various sectors net of costs.

The Importance of Fund Selection When Investing In Active Funds

The term, ‘past performance is not a guarantee of future returns’ is synonymous with the fund management industry, and although the future performance of any fund or fund manager is never guaranteed, for the fund managers whose funds consistently excel, it is reasonable to assume they will replicate this level of performance going forward.

As investors, we can’t control fund performance, but we can control how efficiently we invest. We must make informed decisions based on facts, and to do this past performance must play a role as this is a vital metric for identifying quality, or the lack of.

With this in mind, why then would we invest in funds or fund managers that have a history of poor performance? By excluding the active funds that consistently underperform we are left with a proportion of funds that consistently outperform and on average deliver significantly greater returns than passive funds. This approach makes the argument that on average, passive funds perform better than active funds redundant.

In any industry, there are those who perform better within their chosen discipline, and those that perform worse and this is certainly true with fund managers. By identifying those who consistently excel, investors are able to make more informed decisions that can improve the efficiency and performance of their portfolios.

Active or Passive: There Is A Place For Both

In recent years, there has been growing derision of the active fund market based on average performance and perceived lack of value when compared to lower cost passive funds. But much of this belief comes from limited information, and as identified in this report, the best active fund managers whose funds consistently excel, often outperform their passive counterparts net of fees.

The fact is, both have their advantages and disadvantages. But as an investor, it is vital to have an open mind and review all the facts before limiting your options. As investors, the funds you invest in should be chosen based on their quality not on whether they are active or passive. For many, a mixture of both will often prove to be the most efficient strategy to achieve the best outcomes.