- Yodelar’s new range of Index portfolios have an average annual charge of just 0.16%

- There are 9 different risk options spread across multiple providers for maximum Government FSCS protection

- The portfolios offer advanced diversification with greater protection, lower costs and attractive growth opportunities

- When compared against 22 of the most popular, similar risk rated index portfolios, the Yodelar Index portfolios achieve better returns at lower cost

When it comes to low cost index tracker funds, too many investors invest in the same brand, and do not diversify across multiple brand names for increases protection. Furthermore many of the well known index funds are low cost in comparison to active funds, but high compared to other index funds.

For investors seeking portfolios that align with their key priorities of quality, convenience, and affordability, the choices available are often scarce. Our research detailed in this article has found that many of the top performing funds come at premium prices - readymade convenient portfolios typically lack quality, and low-cost portfolios lack diversification and often sacrifice on performance for low cost.

There is clear void of options available that meet the needs of UK investors. To assist investors interested in efficient low cost options Yodelar Investments has recently launched a new range of Index portfolios with an annual charge averaging 0.16%.

These 9 risk rated portfolios are comprised of high quality funds from several different fund management brands, each strategically weighted to optimise diversification and growth potential.

This new innovative range of Index Portfolios are the outcome of rigorous analysis, research and risk modelling and have the primary function of providing cost conscious investors with low-cost, globally diversified, top performing investment opportunities.

Expanding Our Selection of Quality Investment Choices

Yodelar Investments has established itself as a leading provider of diverse investment options with our Core and Ethical portfolios. The introduction of our innovative Index portfolios further enhances this selection, offering increased value and choice for investors in the UK.

Yodelar Core Portfolios

Our flagship Core portfolios are designed to achieve long-term outperformance by utilising a balanced selection of high-quality actively managed funds. Our meticulous and unbiased approach to fund selection ensures that our portfolios consist of funds with a proven track record of outperformance in their respective sectors. This strategic methodology has positioned our portfolios to capitalise on significant gains compared to broader indexes during bullish market conditions.

Yodelar ESG Portfolios

For more socially motivated investors we offer access to our range of ESG portfolios which exclusively use funds that have an A+ MSCI score for environmental, social, and governance criteria. Our ESG range allows values-based investing whilst also maintaining a strategic asset allocation model with growth-oriented objectives.

Yodelar Index Portfolios

After meticulous planning and analysis, our newly launched Index portfolios offer a diverse selection of funds from top fund management companies, covering a wide range of indexes and sectors. Each fund within these portfolios has been carefully chosen and strategically weighted to create 9 distinct risk-rated models. Our primary goal is to provide UK investors with cutting-edge, cost-effective, and growth-focused investment opportunities.

Revolutionising Index Investing: Superior Performance At Lower Cost

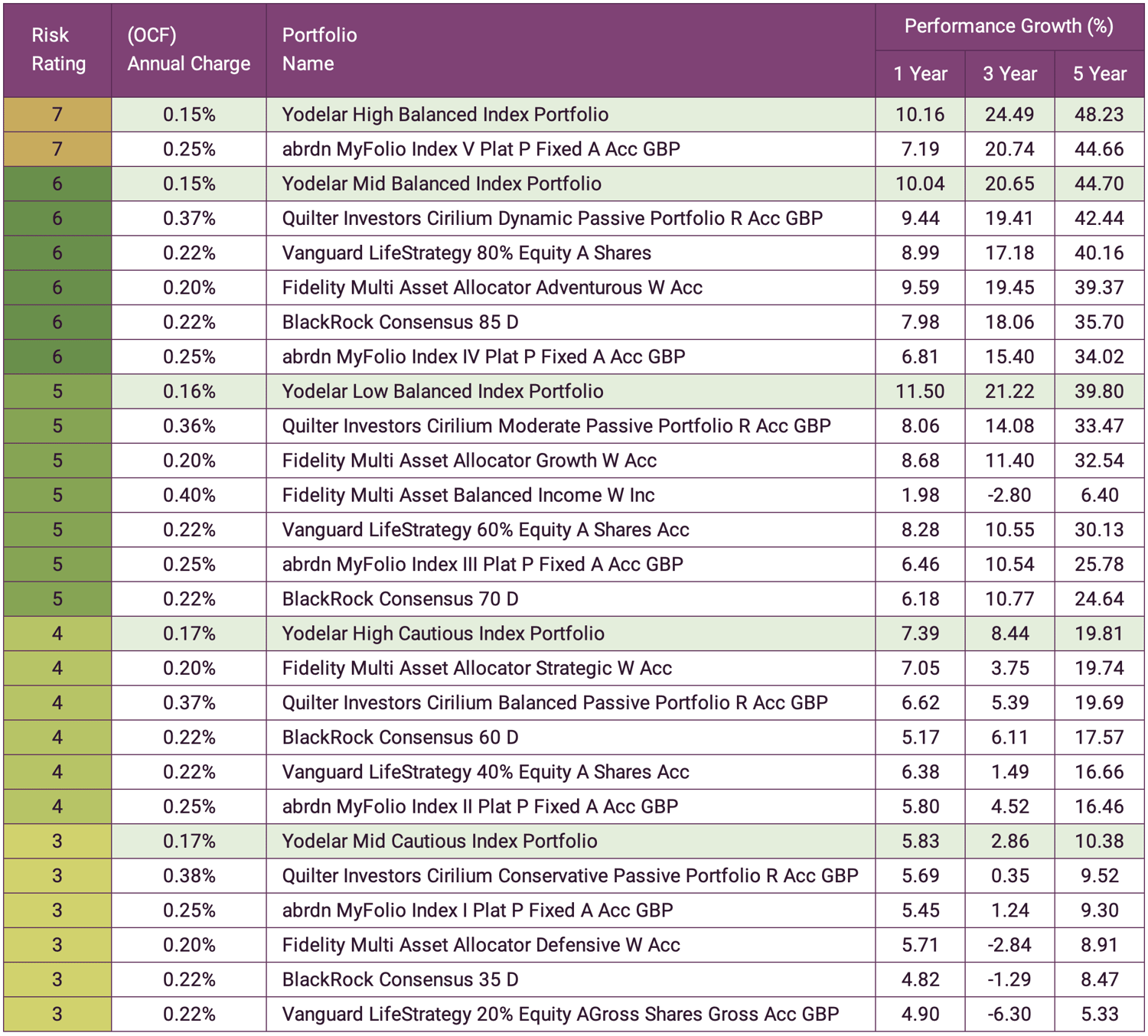

We analysed the costs and performance of 22 of the most popular index portfolios available to UK investors. The 22 portfolios manage a combined £44 billion of investor money and they range in risk levels from a risk averse 3 out 10 to a more adventurous 7 out of 10.

* The Yodelar Index portfolio performance is part simulated to reflect the weighted performance of the portfolios underlying holdings over the periods analysed. Past performance is not a reliable indicator of future performance.

*The value of the investments referred to above can go down as well as up and you may lose some or all the capital you invest. Unless we specifically agree otherwise, the information in this article is not a personal recommendation to you to invest. If you are in doubt about any investment, you should consult a FCA-authorised investment firm. The tax treatment of any investments depends on your personal circumstances, so you should seek professional tax advice where appropriate.

Displayed above is a comprehensive overview showcasing the performance of our innovative index portfolios, which is based on their weighted underlying fund performance. Additionally, it provides a comparison of their charges against those of alternative models with similar risk ratings. This comparison serves to underscore the superior quality and performance of our Index range, coupled with significant cost savings that is clearly evident.

More Resilient Investing At Lower Cost

Our new index portfolios range in cost from between 0.15% and 0.17%, which is considerably lower than the 0.26% average across popular alternative multi-asset index portfolios.

Consisting of a blend of index-tracking funds, these portfolios benefit from exposure to a wide range of markets and the growth benefits each market offers - without the additional risks of poor fund management or market timing as Index funds never underperform the markets they track – a feat over 85% of active IA sector funds fail to achieve historically.

Also, as index funds do not require extensive manager research, their costs are significantly reduced. Our Index portfolios will have an average charge of just 0.16%, which is considerably lower than active model portfolios, and even lower than most index products currently on the market.

Our Index portfolios are optimised for today’s cost and risk-conscious investors. They may capture fewer peaks than our growth focused core portfolios during bull runs but they will mitigate losses when markets swing, and in the long term they will be well placed to outperform the vast majority of similar risk rated portfolios at a fraction of the cost.

Why The Yodelar Index Portfolios Have The Optimal Strategy

In recent years, the fund management industry has heavily marketed all-in-one global equity funds as a convenient, set-and-forget investment option. These funds track popular global indexes or combine multiple asset classes into a single fund. While convenient, this approach can increase risks and provide insufficient diversification for most investors.

All-in-one funds often heavily favor US stocks and tech companies focused on growth. These sectors, dominant in popular global benchmarks, can pose a significant risk of amplifying losses when previously soaring industries experience a downturn, as evidenced by the double-digit declines seen in global funds in 2022.

Achieving true diversification entails carefully balancing exposure across various geographic regions, company sizes, sectors, and growth rates. However, in the case of all-in-one funds, the focus tends to shift towards tracking mainstream indexes rather than prioritising diversification. This approach can leave cost-conscious investors vulnerable to risks such as fluctuations in US interest rates and volatility in tech stocks.

On the other hand, our index portfolios provide the ease of use similar to that of all-in-one funds, but with a deliberate emphasis on risk management and enhanced diversification. This innovative and meticulously crafted approach is designed to cater to investors across varying market conditions, offering secure and cost-effective Index fund options with genuine global diversification and risk assessment.

Enhanced FSCS Protection with Our Index Portfolios

In light of prominent fund collapses such as Neil Woodford's in 2019, safeguarding investor interests has become a paramount concern. The UK Government's Financial Services Compensation Scheme (FSCS) plays a crucial role in providing security by insuring investments up to £85,000 per provider in the event of unforeseen circumstances. However, it is important to note that many popular bundled products, like multi-asset funds, may limit protection as they are tied to a single provider, thus restricting overall coverage.

Our Index Portfolio range is intentionally constructed to maximise FSCS coverage by blending funds from multiple top-tier management brands across regions and assets. We understand that true diversification requires flexibility beyond convenient one-stop solutions. Carefully selecting specialised index tracking funds from various best-in-class providers enables us to spread and minimise risk.

Offering resilience in methodology and manager diversity, our Index Portfolios will help investors to maximise their protection under the FSCS - whilst also delivering quality returns at low cost.

Embracing the Benefits of Efficient Low-Cost Index Portfolios

Index funds take a different approach, simply replicating the performance of a specific market index rather than trying to outsmart it. Without the need for extensive manager research or trading teams, individual index funds can have fees as little as 0.1% per year - a fraction of most actively managed choices. Over long time horizons, these bottom-line savings compound to meaningfully boost overall returns.

Our new Index Portfolio range retains this significant cost advantage of index tracking while also optimising risk-return balance through intentional diversification across asset classes and global markets. Meticulous allocation modelling minimises volatility risk and creates opportunities for sustained, long-term growth - at a fraction of the cost of traditional active management options.

Summary

In summary, Yodelar's new Index Portfolio range offers investors a compelling combination of diversification, protection, and cost-effectiveness.

By strategically blending specialised index funds across asset classes and top providers, we've engineered an approach that aims to outperform both single-provider bundled products over the long run. With an average annual charge of just 0.16%, our Index Portfolios empower cost-conscious investors to keep more of their hard-earned returns while still benefiting from professional risk modelling and global diversification. For those seeking efficient growth at a truly exceptional value, Yodelar's innovative Index Portfolios represent a new standard in low-cost, resilient investing.