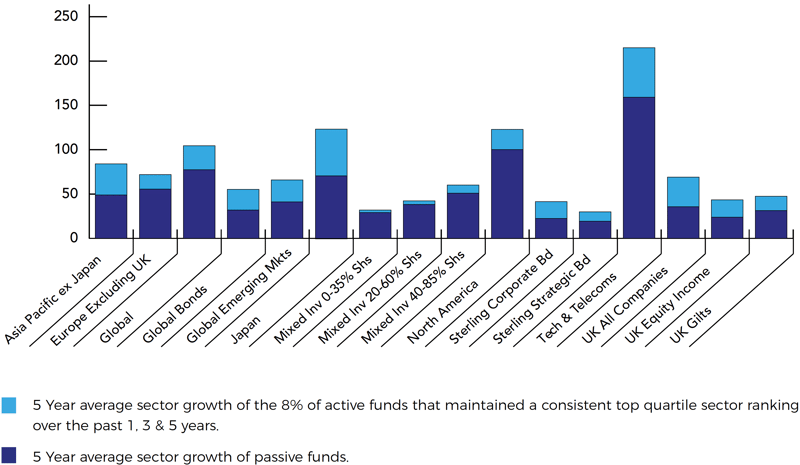

- Out of 2,950 funds analysed (active and passive) only 239 funds or 8% have maintained a continuous top 25% sector ranking over the last 5 years. We regard these funds as top performing.

- Only 4 out of the 239 top performing funds are passive investment funds, the remaining 235 are actively managed funds.

- 98% of top performing unit trust funds are active investment funds, less than 2% are passive.

Over the last 10 years passive funds have been heavily promoted to UK investors as a better alternative to active fund management.

We regularly see misleading information on this topic, and this has prompted our research team to complete a deep analysis into the performance and ranking of Passive and Active funds to understand where the real value lies for consumer investors.

We start this article with our summary findings, and then move onto the evidence.

Based on our research there is a place for passive investments funds, but active investing if done correctly will create better returns for investors and advisers. Active funds can cost more than active funds, but using better active fund managers that perform well within their particular sector greatly outweighs the cost savings from taking a passive lower cost approach.

For the purposes of this study we analysed all 2,950 main unit trusts funds across 36 sectors as defined by the official Investment Association.

Key Findings:

- In total there are 2,950 main unit trust funds classified under Investment Association with at least 1 years performance history. These funds are spread across 36 different sectors, such as North America, UK Equity, Japan, Asia, Corporate Bonds, Cash etc.

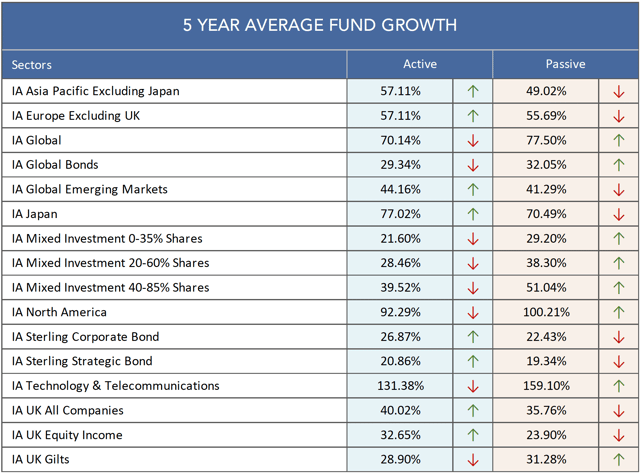

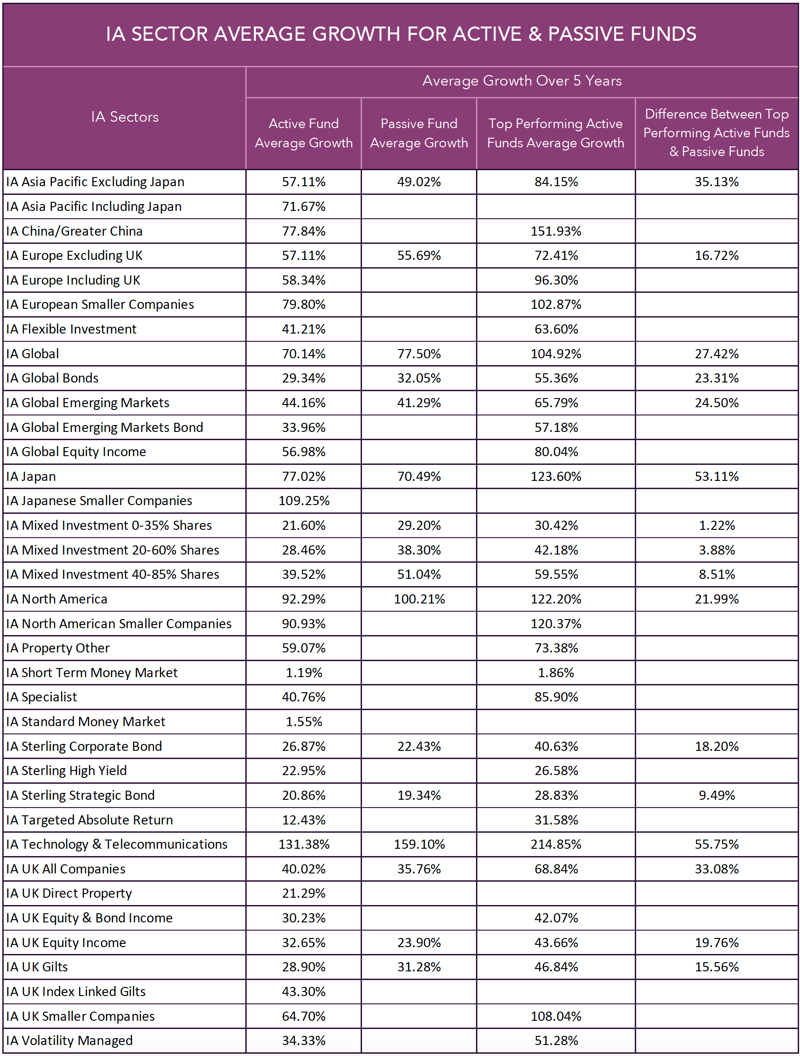

- Only 239 of the 2,950 funds are passive (funds that track indexes), and the rest are active (managed by fund managers who make real investment decisions).

- Passive funds are only present in 16 of the 36 investment sectors. Therefore investors that solely invest in passive unit trusts are limiting their exposure to 45% of investment opportunities and sectors.

- Out of 2,950 funds analysed (active and passive) only 239 funds or 8% have maintained a continuous top 25% sector ranking over the last 5 years. We regard these funds as top performing.

- Only 4 out of the 239 top performing funds are passive investment funds, the remaining 235 are actively managed funds.

- 98% of top performing unit trust funds are active investment funds, less than 2% are passive.

- Too many investors seem to regard the sector average as a good comparison metric. We find that more efficient investors prefer to compare their performance to the top 25% sector performing funds as their benchmark.

Why Are Passive Funds Popular?

A large proportion of investors are led by their adviser and/or direct marketing from fund supermarkets.

The main reason for the growth of passive funds over the years is not because they perform better, or that they are a better option for consumer investors, but because they are easily sold. The simplicity of saving money, is much easier to communicate to clients than the complexities of sector research and updated fund analysis.

Some advisers find it easier to promote the passive approach than complete the required research to advise clients efficiently based on factual information. Passive orientated advice firms may charge less for managing a passive portfolio, but they are doing less for their lower fee. Research orientated firms may use active and passive funds, but their research will justify the use of passive funds within the relevant sectors. Efficient advice firms will complete the required research to ensure their clients are invested efficiently, using the better funds/fund managers within the sectors suitable to their risk profile.

The 2 main misguided reasons investors wrongly opt for a complete passive strategy is the belief that lower cost equates to better returns/value and better all active funds underperform.

The Cost of Investing

Your reason for investing is firstly to grow your wealth, ‘not save money’. Granted, lower costs are better than higher costs, but receiving value should be the focus. The opportunity cost of opting for passive funds could be huge when ignoring the active fund managers that consistently produce top returns within their sector.

The vast majority of top performing funds are managed by an individual to produce results. Make sure your investment adviser can demonstrate how the better funds perform within the various sectors, and once established, review the costs. If it turns out the consistently better performing funds are lower cost passive funds, great.

Performance: Active or Passive

According to the promoters of passive investing, tracking the performance of a chosen market is cheaper, delivers better performance, and is more reliable than active funds, which rely on a fund manager to pick the stocks and manage the fund.

It is true that most active funds are more expensive, and it is also true that a large proportion of active fund managers underperform. However passive funds cannot come close to matching the performance of the better fund managers, which is a fact that is often lost in the active versus passive debate.

From an analysis of 2,950 unit trust and OEIC funds that have been classified by the Investment Association, only 8% of funds have been able to consistently perform in the top 25% of their sector over the past 1, 3 & 5 years. Of these consistently top performing funds, just 4 or 1.6% are passive, factually demonstrating the best performing investment funds are actively managed funds.

The 8% of funds that consistently deliver top performance equates to approximately 240 funds across 36 sectors, which is a significant number of funds, and double the number of passive unit trust funds listed by the Investment Association.

Is Passive Investing A Bubble Ready To Burst?

According to Morningstar, in America there is now as much money invested in passive funds as there is in active funds. That’s a major turnaround, given that active funds controlled five times as much money in 2000.

Michael Burry, who was famously depicted in the movie ‘the big short’ for calling the collapse of the subprime market has said in reference to passive funds “Like most bubbles, the longer it goes on, the worse the crash will be,” adding that it will be “ugly” when the flows eventually reverse. Trillions of dollars are indexed to stocks, many of which see relatively thin trading on a daily basis. That presents a potential liquidity threat. “The theatre keeps getting more crowded,” says Burry, “but the exit door is the same as it always was.”

Burry is not the first to warn of a passive investing bubble. Morgan Stanley has previously argued the “exodus from active to passive funds may be reaching bubble-like proportions, driven by an exaggerated critique of active management”. Last year, billionaire bond manager Jeffrey Gundlach said passive investing had reached “mania status”, adding it would “exacerbate problems in the market because it’s herding behaviour”.

The Fall That Hit Passive Investors Hard

The risks with passive investing were clearly seen when the Japan market crashed 3 decades ago.

In the late 1980’s economic growth in Japan averaged 5%, largely driven by domestic demand. During this period, the Japanese market moved steadily upwards to unsustainable overvalued levels. In 1989 Japan accounted for up to 45% of global equity markets. For many passive investors seeking exposure outside the US, Japan accounted for nearly two thirds of the entire market. The Japanese market then suffered a significant drop when the ‘Japan Inc’ bubble burst in 1990 and investors who had chosen to invest passively suffered the full extent of this fall as their funds could do nothing but follow the market it tracked in a downward spiral.

When markets are volatile, passive funds are exposed to the full extent of this volatility. As a passive fund essentially tracks a market, if that market experiences a drop, so too will the passive fund. Whereas active fund managers are able to react to such movements and adjust the balance of their funds to mitigate risk during periods of volatility.

Is Active Investing, Actual Investing?

One of the consistently top performing fund management firms in the UK has coined the phrase, active investing is actual investing. Edinburgh based fund manager Baillie Gifford, stress that ‘actual’ investment requires a willingness to be different, to accept uncertainty and the possibility of being wrong.

Ultimately the firm feels investment management should not be all about processing power, trading and speed. Instead it should be about imagination, creativity and working constructively on behalf of clients with entrepreneurs and companies who have greater ideas than our own.

Baillie Gifford accepts that ‘passive’ index-tracking funds have their place for offering cheap stock market access and on average better results than active managers after fees. However, it does not believe investment decisions can be made on numbers alone using super computers and complex algorithms. They point out that this approach has little to do with the process of targeting and subsequently allocating capital to the innovative companies changing the world.

‘Passive investing has its benefits. Allocating capital with no reference to the underlying uses of that capital is certainly a low-cost way to gain market exposure, but it is not investing, in the purest sense,’ Dunbar said.

The Importance of Fund Selection When Investing In Active Funds

The term, ‘past performance is not a guarantee of future returns’ is synonymous with the fund management industry, and although the future performance of any fund or fund manager is never guaranteed, for the fund managers whose funds consistently excel, it is reasonable to assume they will replicate this level of performance going forward.

As investors, we can’t control fund performance, but we can control how efficiently we invest. We must make informed decisions based on facts, and to do this past performance must play a role as this is a vital metric for identifying quality, or the lack of.

With this in mind, why then would we invest in funds or fund managers that have a history of poor performance?

By excluding the active funds that consistently underperform we are left with a proportion of funds that consistently outperform and on average deliver significantly greater returns than passive funds. This approach makes the argument that on average, passive funds perform better than active funds redundant.

In any industry, there are those who perform better within their chosen discipline, and those that perform worse and this is certainly true with fund managers. By identifying those who consistently excel, investors are able to make more informed decisions that can improve the efficiency and performance of their portfolios.

Don’t Pick A Side, Their Is Value In Both

In recent years, there has been growing derision of the active fund market based on average performance and perceived lack of value when compared to lower cost passive funds. But much of this belief comes from limited information, and as identified in this report, the best active fund managers whose funds consistently excel, significantly outperform their passive counterparts.

It is vital that investors have an open mind and review all the facts before being limiting their options. Both of these types of funds have their merits, and both have their drawbacks but to exclude one or the other simply reduces your options. As investors, the funds you invest in should be chosen based on their quality not on whether they are active of passive, as for some, a mixture of both can be the most efficient strategy to achieve their investment objectives. For lower risk investors low cost passive funds can be the best option, whereas for growth seeking investors top performing active funds can be the most efficient way forward, or a mixture of both active and passive funds could be the best option.

For investors, our advice would be to keep your options open.