Over the past several years Exchange-traded funds (ETFs) have grown to become one of the most popular investment products in the world. These baskets of stocks, bonds and other assets offer investors low costs, intraday trading and access to a vast range of different markets and sectors. Although some financial experts remain concerned about the dangers of ETFs, they continue to be hugely popular, with more than 3,000 ETFs now available to investors.

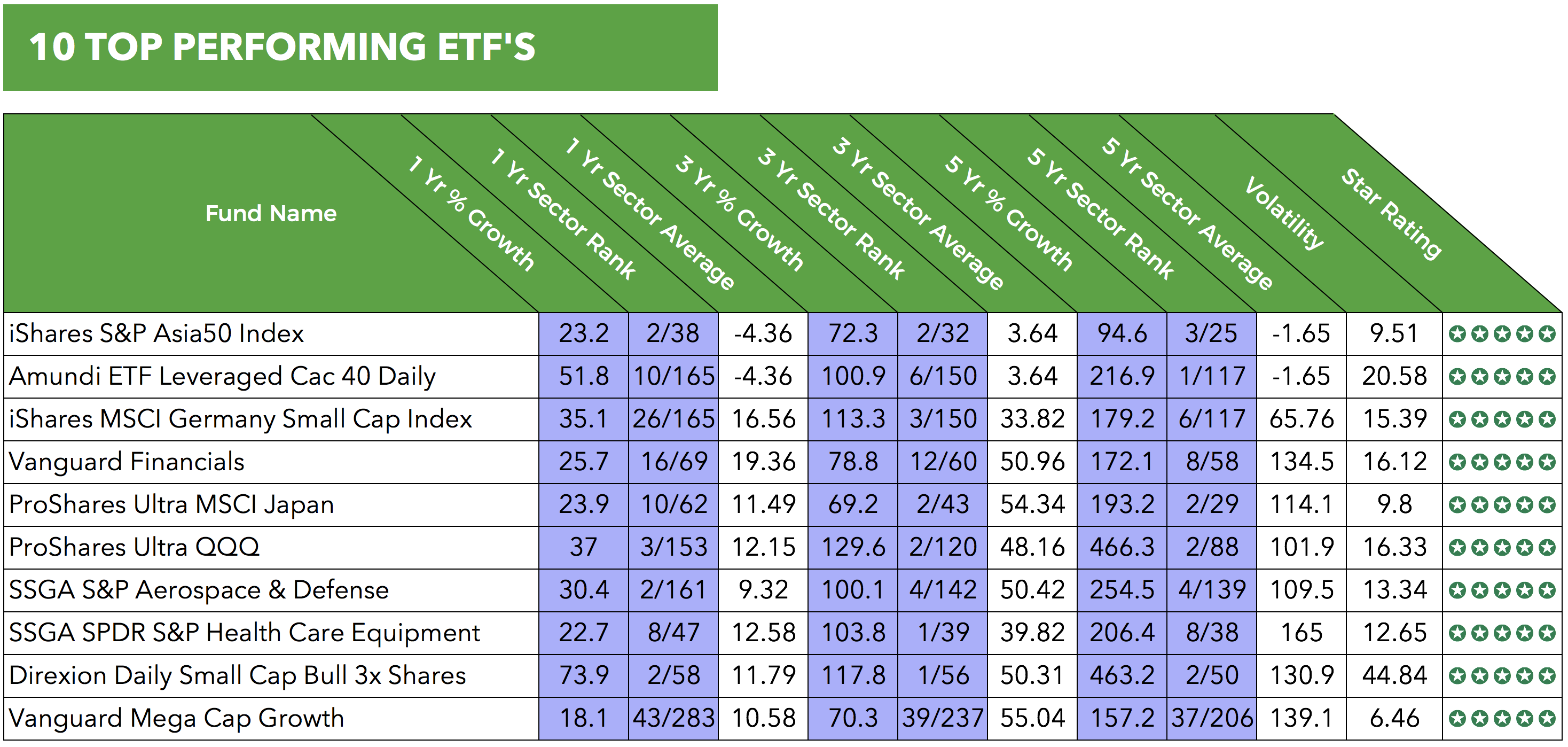

With numerous different types of ETF’s covering endless asset classes, understanding which to consider can be a complicated task. In this report, we list the 10 of the best performing ETFs from various sectors that have consistently outperformed at least 75% of competing same sector ETFs over the five year period up to November 2017.

1. iShares S&P Asia50 Index

The iShares S&P Asia50 Index fund is a physical ETF that seeks to track the investment results of an index composed of 50 of the largest Asian equities. This fund holds a modest £300 million of investment but has consistently outperformed competing funds in the Global ETF Equity - Asia Pacific ex Japan sector. Over the recent 12 months this fund returned growth of 23.2%, which was the 2nd highest in its sector, and over five years it returned growth of 94,6%.

2. Proshares Ultra QQQ

Holding just over £400 million, the ProShares Ultra QQQ ETF has achieved exceptional growth of 466.3% over the recent five years. This fund seeks daily investment results, before fees and expenses, which correspond to two times (2x) the daily performance of the NASDAQ-100 Index. However, should the NASDAQ 100 Index suffer a downturn this fund would fall twice as hard which makes it a highly volatile investment option that should only be considered by high-risk investors.

3. Vanguard Financials

This popular passively managed ETF holds over £5.2 billion. It tracks the performance of the MSCI US Investable Market Index (IMI)/Financials 25/50. This fund has returned growth of 25.7% over the recent 12 months and 172.3% over the last 5 years, which was consistently among the best in its sector.

4. SSGA S&P Aerospace & Defense

The SPDR S&P Aerospace & Defense ETF seeks to replicate as closely as possible, before expenses, the total return performance of the S&P Aerospace & Defense Select Industry Index. This relatively small fund currently holds just over £158 million, but it has enjoyed consistent strong performance returning growth of 254.5% over the recent five years.

5. Direxion Daily Small Cap Bull 3X Shares

This high risk leveraged ETF seeks daily investment results, before fees and expenses, of 300% of the performance of the Russell 2000 Index. This fund has delivered exceptional growth of 73.9% in the recent 12 months and 463.2% over the last 5 years. However, it is an extremely volatile fund that is susceptible to substantial losses as well as significant gains and should be considered with extreme caution.

6. Vanguard Mega Cap Growth

Launched in December 2007, the Vanguard Mega Cap Growth fund has amassed over £2.4 billion in assets under management. This fund aims to track the performance of the CRSP US Mega Cap Growth Index, which represents approximately the top 70% of companies in the U.S. equity market. During the recent 12 months, this fund returned growth of 18.1%, which was better than 85% of competing funds in its sector, and over the last 5 years, it returned growth of 157.2%, which was better than 84% of same sector funds.

7. Amundi ETF Leveraged Cac 40 Daily

This synthetic ETF holds slightly over £11.5 million, which is very small in comparison to competing funds. This funds objective is to closely replicate the performance of the CAC 40 Leverage strategy Index, in Euros, whether the market trend is rising or falling. Over the recent 12 months, this fund returned growth of 51.9% and over five years it has returned an impressive 215.7%. However, it is a highly volatile fund, and its performance can fluctuate significantly.

8. ProShares Ultra MSCI Japan

The ProShares Ultra MSCI Japan seeks daily investment results, before fees and expenses, which correspond to two times (2x) the daily performance of the MSCI Japan Index. Over the recent five years this synthetic fund has returned impressive growth of 207.8%, and over the past 12 months, it has delivered growth of 23.9%.

9. iShares MSCI Germany Small Cap Index

The iShares MSCI Germany Small-Cap ETF seeks to track the investment results of an index composed of small-capitalisation German equities, and it has thrived in recent years. This year alone this fund has returned growth of 35.1% and over five years it delivered growth of 179.2%. However, this fund has experienced relatively high levels of volatility, and despite its performance, it holds a comparatively small £21.4 million of assets.

10. SSGA SPDR S&P Health Care Equipment

Launched in 2011, the SSGA SPDR S&P Health Care Equipment ETF holds just over £34 million of investor money. This fund seeks to provide investment results that, before fees and expenses, generally correspond to the total return performance of S&P Health Care Equipment Select Industry Index. This sector has enjoyed steady growth, and over the recent 12 months, this fund has returned growth of 22.7% and growth of 206.4% over the most recent five years.

There are many different types of ETFs, and each can carry different levels of risk. Some of the ETFs in this report are incredibly volatile and carry very high levels of risk. Although they have delivered exceptional growth, changing market conditions could also result in them experiencing significant losses.

Please note - The funds listed have consistently been among the best performers in their sectors over the recent five years. However, their inclusion should not be viewed as a recommendation to invest.