- Half of St James’s Place Capital Value wiped out due to market fears

- Exit penalties scrapped from late 2025 for new clients only

- Existing clients outraged exit penalties will still apply

- If further fees are curtailed, will clients exit SJP?

St. James's Place (SJP), the UK's largest wealth manager and ‘restricted advice’ firm, has recently come under mass market scrutiny due to its charging structure and the imposition the FCA’s ‘Consumer Duty’ will have on their business model. As a result, SJP has been forced to reevaluate their fee model and has agreed to remove its controversial exit fees from late 2025 only for new clients from that point onwards.

Why Has The Value of SJP Plunged

‘SJP’ has agreed to scrap exit penalties for new investment bonds and pensions signed up from 2025. This will not apply to existing clients of SJP, nor will it apply to those clients that sign up between now and 2025. For existing clients and new clients up to 2025 exit penalties will still apply.

The move comes as part of the FCA's consumer duty, which aims to ensure fair treatment for investors. For St. James's Place and their investors, the proposed removal of exit fee will have far reaching implications. This recent development has raised questions about the company's long term sustainability based on its reliance on high fee income to fuel growth, reward shareholders, SJP unit trust fund managers, and its huge adviser network. The result has been a 50% drop in the PLC’s share price and overall capital value.

Why have recent events stimulated the market to have such a negative impact on a company that will be changing its policy in late 2025, nearly 2 years from now? Is it due to future decrease in fee income, or is the market’s perception that SJP will lose a significant proportion of its clients and/or its adviser distribution network.

In this article, we will explore the implications of recent developments, including Consumer Duty, and how these changes will impact new and existing St James’s Place clients.

Consumer Duty

The Consumer Duty is built upon a new Consumer Principle, known as Principle 12, which sets a high-level expectation for firms to act in a manner that delivers good outcomes for retail customers. The Consumer Duty outlines four specific outcomes that firms must strive to achieve in their interactions with customers.

They are (i) Product & Services - ongoing review of products and services to ensure they align with the needs, characteristics and objectives of their customers (ii) Price & Value - ongoing review of products and services to ensure they continue to offer fair value to customers (iii) Consumer Understanding -ensure clear and transparent communications, providing customers with accurate and understandable information about the risks, benefits and costs associated with products and services and (iv) Customer Support - Firms should offer assistance and support, addressing queries and concerns and ensuring customer have access to the necessary resources to make informed decisions.

Implications For St James’s Place

The FCA's focus on ensuring good outcomes for customers places a greater responsibility on firms to prioritise customer care and protection. This requires a cultural shift within organisations, with a renewed emphasis on customer-centricity and a commitment to delivering fair value and transparency.

With the FCAs consumer duty requiring all clients receive ‘fair value’, distinctly unfair practices such as penalty exit fees will no longer be allowed.

Despite the FCAs Consumer Duty, forcing SJP to amend their charging model, this will not benefit their existing clients who will continue to be liable for exit penalties should they leave. It will also not benefit any new investors before the changes are implemented towards the end of 2025. Therefore, any investors who invest in an SJP pension or bond product between now and the end of 2025 will be liable for an exit penalty all the way up to 2029 and 2031. In effect, the scrapping of the exit penalty is only relevant to any new investment after the end of 2025 when SJP implements their new charging model.

Ongoing Concerns About St James’s Place

For ten years Yodelar have reported on the poor performance, high charges, restricted limitations, poor FSCS protection, and high exit penalties imposed by St. James’s Place.

Lately we have been inundated with disgruntled SJP clients that have wanted for a number of years to pull away from SJP, but have been forced to stay due to such high exit penalties up to 6% of their investment value.

Our research has continued to show issues in the SJP value proposition which we cover below:

Performance - SJP’s range of funds when compared to other same sector funds continue to demonstrate poor performance compared to the rest of the sector, with a large proportion of their funds ranking in the worst 25% of their sector.

Price - SJP funds proposition, advice charges and fund charges are amongst the most expensive in the industry, when compared to all other same sector funds

Choice - SJP offers a small number of SJP funds equating to 0.7% of the industry, clients have little choice

Protection - Most SJP clients are unaware that within an ISA, Investment Account or SIPP product they are only protected under the Government’s Financial services Compensation Scheme (https://www.fscs.org.uk/) to a maximum value of £85,000. Some insurance products and personal pension products have full protection, but all must be checked.

Exit Penalties - St James’s Place is the only regulated firm in the UK that has continued to impose exit restrictions on clients.

St. James’s Place Exit Fee Controversy

St. James’s Place has built its business around a model that levies hefty exit fees on clients looking to move their pensions or bond investments early. These controversial withdrawal charges have made SJP hugely profitable but it has also left many of its customers feeling trapped.

Under SJP’s charging model, clients face exit penalties of up to 6% should they wish to transfer a pension or bond to another provider. As an example, if a client wished to move a £500,000 pension pot they would face a penalty fee of up to a staggering £30,000. No other financial firm in the UK imposes such punitive charges.

SJP has been accused of using this penalty to secure control of clients' investments for several years as a means to increase their ongoing revenue and boost their share price..

This penalty reduces by 1% for each year an investor remains with SJP until after 6 years, at which point, exit penalties would no longer apply. However, there is a caveat, if you make changes to your SJP pension or bond portfolio by adding more funds for example, then the exit penalty would once again apply.

SJP generally provides little or no discretion for waiving or reducing them, even for vulnerable customers experiencing changed life circumstances. Cases of people unable to access their pension pots early despite severe illness or job loss because of the exit penalties are common.

Some feel SJP uses the fees to trap investors. The charges disincentive moving to other providers that may offer better investment performance or service. High withdrawal costs also make some customers reluctant to seek ongoing financial advice as they feel chained to SJP.

Excessive exit fees effectively strip clients of flexibility and control over their own savings. This jars against the FCA’s principle of firms acting in consumers’ best interests. Critics argue it is an inherently unfair model, leaving SJP customers beholden to the firm through financial penalties long after they may wish to sever ties.

The St. James’s Place Model

SJP is a restricted wealth management firm, which means they only advise clients on their own in-house range of funds - limiting investors to just 0.7% of the available funds to UK investors. This restrictive wealth management approach in itself is not unique, but the partner adviser model they incorporate to grow their funds under management is.

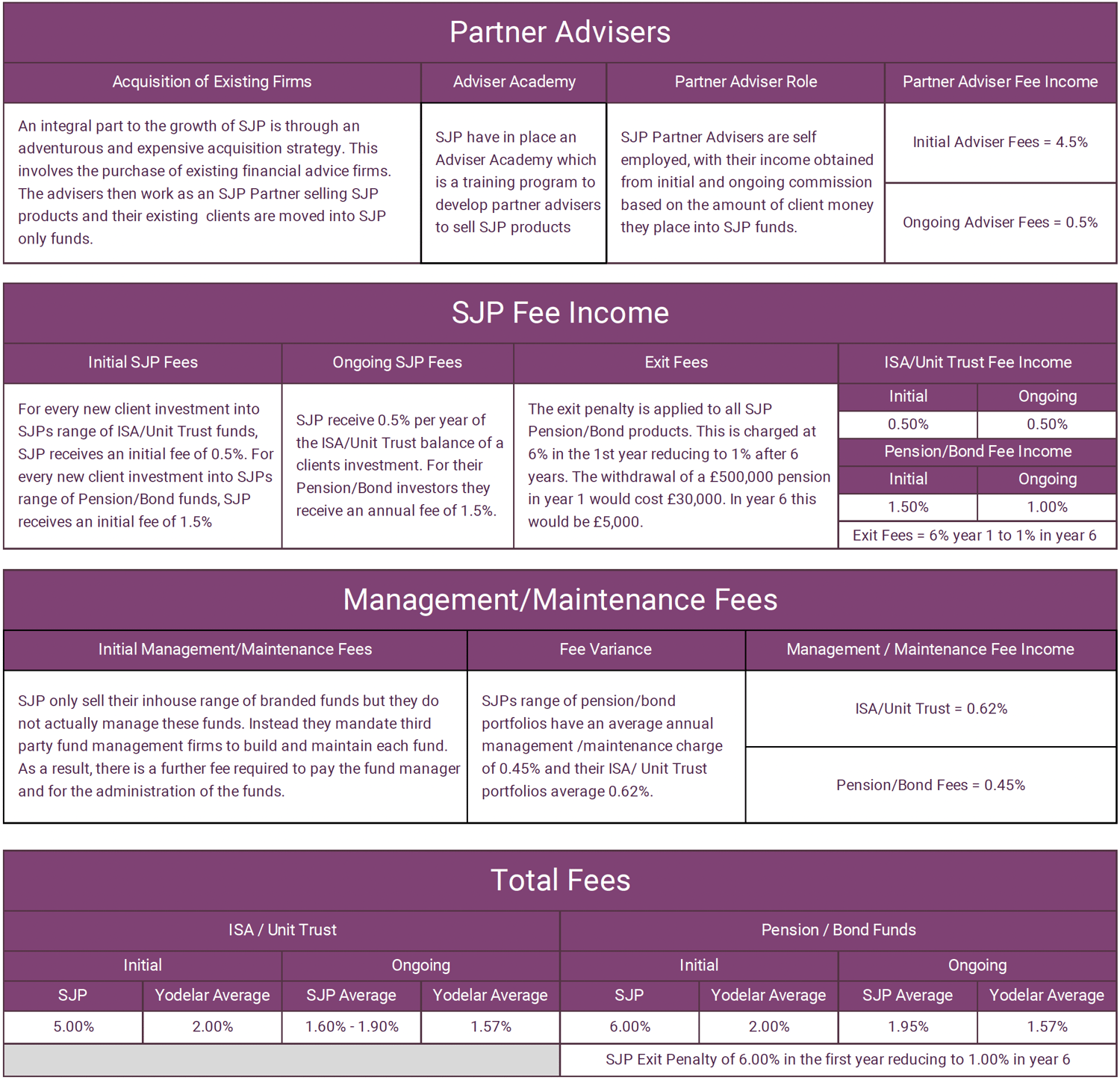

As the above table demonstrates, SJP relies upon a three tier charging structure to make their business model work, and ensure all parties are remunerated. This structure is inherently expensive for the consumer but for SJP it is also inflexible, with little room available to reduce costs to improve their value proposition for investors. As a consequence, the removal of exit penalties could have a far reaching impact on SJPs profitability and even their long term sustainability and share price.

SJPs Value Plummets By 51% In 6 Months

Over the past 6 months (up to 25th October 2023) SJPs value has declined by a whopping -51.27%. With the firm losing over half its value in just 6 months and the huge upheaval required to their business model to remain compliant, SJP could be in trouble.

Why The Scrapping of Exit Fees Could Harm SJP

Yodelar have reported for many years on the fundamental issues with SJP’s model that could potentially limit the firm's long term viability to more value orientated clients that require flexibility..

SJP has said the removal of their exit fee will cost the company £140 to £160 million by 2025. But in reality, it may be much more.

This proposed scrapping of SJP’s exit penalties is a much bigger issue for SJP than it may seem on the surface. The exit penalties provide SJP with security that their clients and funds under management are locked in/protected for a certain period of time, by significantly reducing the threat of client withdrawals.This supports the revenue stream SJP requires to grow and remain profitable.

The model chart shows that SJP has a distribution model that relies upon acquisition strategies to build its distribution salesforce to sell their funds and build their client base and funds under management.

SJP has been very successful with this approach. In 2020 they reached £100 billion in funds under management, and this year reached £156 billion with 900,000 clients representing a 56% increase in Funds Under Management in just 3 years. By 2025, they have targeted to reach FUM of £200 billion.

Their growth strategy works as long as they have an attractive financial proposition for their partner advisers. SJP remunerates partner advisers with a proportion of the initial fee charged with 4.5% upfront on all initial investments going to the adviser for any client they bring to SJP. This alone is a huge incentive, and one that is significantly greater than the industry average of 2.4% established by an FCA study.

SJP also pays the third party fund managers who manage and maintain their range of funds. For SJPs model to work profitably, they need to charge clients above market average upfront and ongoing fees.

Attaching an exit penalty to pension and bond products, which accounts for approximately 66% of the assets under their management, SJP have safeguarded their client retention and ongoing fee revenue for a period of time. Should this be taken away to meet the new regulatory standards, we would suspect further trouble for St James’s Place, and their distribution network.

St James’s Place Under Serious Pressure To Reform Entire Fee Model

The FCAs Consumer Duty has forced SJP to re-evaluate its charging model, removing exit charges for new clients by mid-2025 and simplifying fees for several of its advisory and administrative services.

The Financial Times recently reported that SJP executives have been warned by regulators that the proposed changes may not go far enough to meet the Duty's requirements.

As a result, senior managers have been asked to justify keeping exit fees for existing clients. Regulators have also raised concerns over whether SJP's high upfront advice costs are in customers' best interests and whether the company's structure might make it difficult for clients to stop paying advice fees in the future.

SJP has argued that scrapping exit fees for its existing clients may have a significant impact on its balance sheet.

A former employee told the FT that regulators have been pressuring SJP for almost a decade to overhaul its fee structure, as they considered it anti-competitive locking customers in, with some clients struggling to understand the fees they were paying.

The former employee told the FT: "The regulators always had questions about the structure, principally because they thought it disguised the true cost of advice to the customer."

An FCA spokesperson said: "We cannot comment on individual firms. The Consumer Duty sets higher and clearer standards of consumer protection in financial services. We recognise that some firms have needed to make significant changes to their business model to improve consumer outcomes, and we welcome where firms have done this.

SJP publicly boasts client retention rates in excess of 95%, but with 900,000 clients just 5% attrition equates to the loss of 45,000 clients each year based on their current model. Now remove the threat of exit penalties for their pension and bond clients and this number is likely to rise significantly.

The primary reason SJP would struggle to retain clients is due to their poor fund performance, with growth restricted due to associated costing and charges they need to apply for their model to remain profitable.

We have regularly reported the performance of St. James’s Place funds and their model portfolios. They have consistently ranked among the worst performers on the market, with significantly better performing and lower priced alternatives available elsewhere.

With their history of underperformance and high charges, the removal of exit penalties could prove to be a much more significant problem.

Access the full independent performance report for St. James’s Place

SJP Risk Losing Partner Advisers

The recent and upcoming upheaval to St. James’s Place and their charging model which could force SJP to reduce the amount of initial and ongoing fees they allocate for their partner advisers. If this was to happen, it would have a negative impact on the earnings potential of all 4,766 SJP partner advisers. Significant changes would put at risk their sales distribution model as the implications of a reduced income could force partner advisers to move away from SJP.

SJP Shareholders Face Growing Concerns

St. James’s Place PLC losing 51% of their value in just 6 months is astounding and is something that will be of serious concern for their shareholders.

There are real concerns that the company is now facing the most difficult period in its history. Earlier this year concerns began to grow regarding the implications of the FCAs then upcoming Consumer Duty. In July SJP announced that in response to the FCAs Consumer Duty they would cap certain product charges in advance of the roll-out in August. The cap will only benefit clients who have been with SJP for over 10 years, which currently represents just 7% of SJPs client base.

The cap has been criticised as having a very limited impact on a very small number of their investors but the cap will still cost SJP a huge £859 million to implement. SJP announced the cap on 27th July 2023 along with news that they had experienced a year on year drop in profit of 22%. Upon the announcement SJP shares plummeted, falling by 26% over the following week.

The fact that the product charge cap announced by SJP has proven so costly for them, while only impacting on a limited number of customers, demonstrates the market sensitivity to changes St James's Place may be forced to implement around their charging model.

When the full impact of the exit fee removal takes effect, SJP could find themselves much more exposed to the risks of client attrition, creating a pessimistic outlook for shareholders.