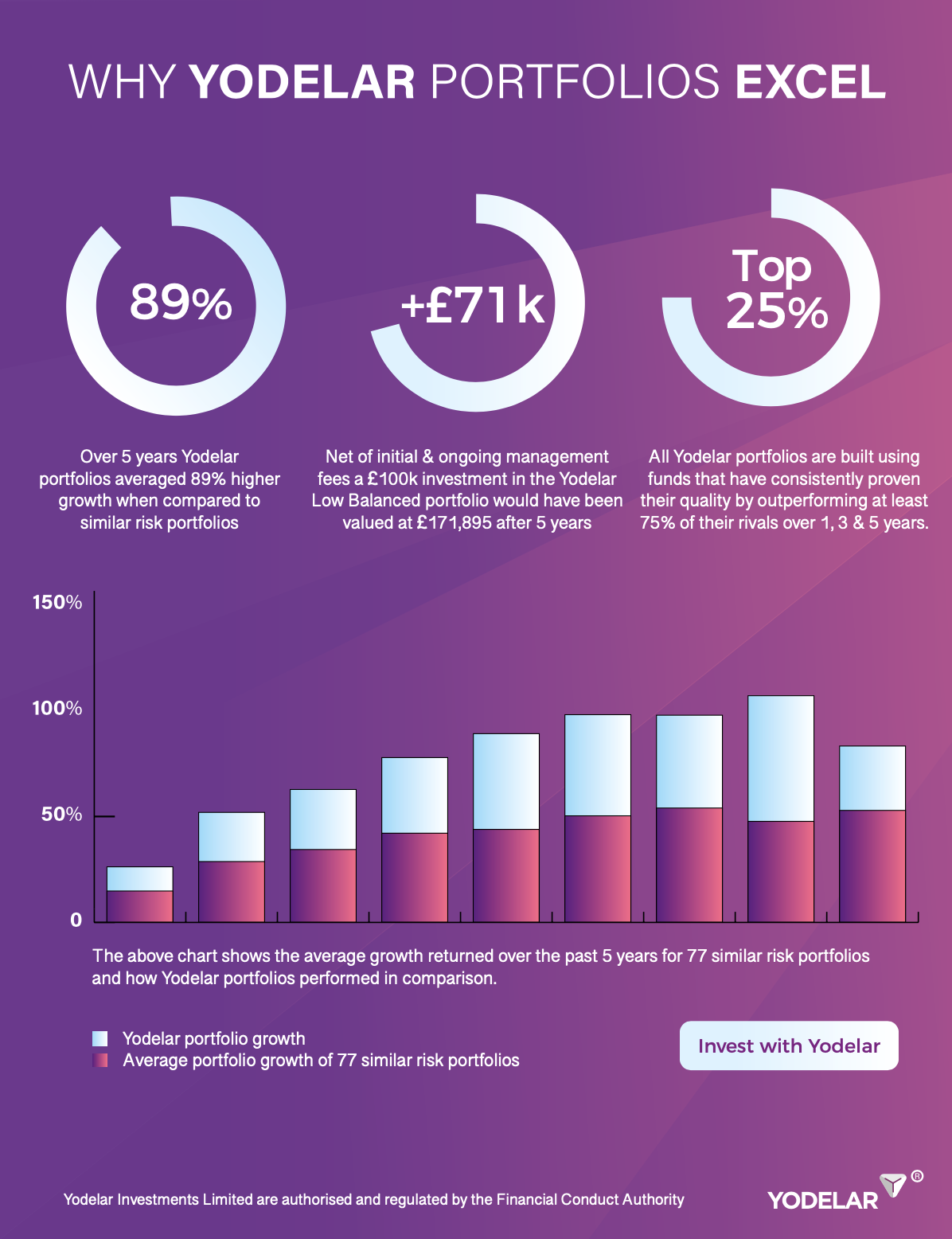

In this article we assess and highlight the stellar performance of the Yodelar Investments 10 risk based portfolios when compared to 77 other competitor portfolios including those offered by 7IM, Hargreaves Lansdown, St James's Place, True Potential, Smith & Williamson, Rowing Dartington, Nutmeg, Wealthify and more.

We explore the processes employed by our investment committee to regularly assess and identify efficient funds and fund managers responsible for delivering competitive investment returns for Yodelar Investment clients.

Yodelar continues to assess the performance and quality of more than 100 fund managers, 70,000 funds and variants and more than 30,000 investment portfolios.

92% of investment funds lack consistency and underperform when compared to all other same sector funds. 9 out of 10 investment portfolios our research team analyse contain funds that rank among the worst 25% of their chosen investment sectors.

A large proportion of investors are not invested efficiently and are unaware that this is the case. A set proportion of fund managers consistently deliver top performance, and those investors aware of this continue to benefit from the expertise of such managers.

Our data enables us to identify, without prejudice, the proportion of top-quality investment opportunities currently available to UK investors. Yodelar Investments apply research, efficient strategies, and award-winning risk assessment processes to create and manage strategically balanced, risk-rated portfolios that provide investors with superior growth.

10 High-Quality Investment Portfolios

Each portfolio has been created to fit a particular risk profile. This is achieved by balancing the weighting of assets across each portfolio as determined by a process of asset allocation that is defined and regularly reviewed by Distribution Technology the leading risk profiling and asset allocation research company in the UK.

Lower risk portfolios hold a greater weighting in lower-risk assets such as cash or bonds but as the risk tolerance rises so too does the weighting in typically higher growth but riskier assets such as Japanese and emerging market equities.

Our investment approach ensures that the funds used to achieve the correct balance in each portfolio are among the consistently top performing funds available in each sector. These fund managers have been able to demonstrate over time that they are experienced within their sector or discipline.

Investment Portfolios Without Limitations

Our investment philosophy is to build efficient, top-performing portfolios by utilising funds and fund managers that have proven their quality by consistently outperforming approximately 75% of their peers. This philosophy removes any bias and emotional decision making that can be detrimental to a portfolio’s objectives.

Unlike some investment providers who are limited to a small selection of funds, Yodelar Investment portfolios are not restricted, but able to access funds across ‘Whole of Market’.

The balance of investments across different asset classes is the primary driver of portfolio returns, but the funds used to create the correct balance are essential to maximising portfolio growth and efficiency. We ensure all the funds we use to achieve this balance are consistently among the very best performers within their set asset class. Each fund selected is thoroughly evaluated by our investment committee and only the most suitable options are selected to be included in our portfolios.

Consistency is an important indicator of quality and success, and it is integral to our portfolio management system. Consistency demonstrated by investment funds that maintain a high sector ranking over continuous periods reflects the fund managers expertise and their ability to deliver competitive returns for clients over the medium to long term.

Maintaining Portfolio Efficiency

The Yodelar Investment Committee, who are responsible for the well being of client portfolios track and manage portfolio and fund performance via a process they refer to as their ‘traffic light system’. This is a 3-tiered fund grading model that promotes a pragmatic investment approach and ensures each portfolio continues to be scrutinised.

Green – Funds that have primarily maintained a level of performance that exceeds 75% of same sector funds over the recent 1, 3 & 5 year periods. Such funds are viewed as top performing within their associated investment sector or asset class and represent excellent investment opportunities.

Amber – Funds that have previously rated as green but recently experienced a decline in performance compared to other funds within the same sector. Amber funds can remain within the portfolio but are carefully monitored, typically over a 3-6 month period, to identify whether their performance has improved, remained stagnant or declined. If the fund’s performance has improved to a level that is better than 75% of competing same sector funds, it is returned to a green rating. If it remains stagnant, it will continue to receive an Amber classification for a period of up to 6 months. If no improvement is seen during this period, it will receive a red rating.

Red - The red traffic light signifies that some action is due. It may be that the fund is removed from a portfolio and replaced with a more suitable manager. Funds will be moved to a red rating if they continue to drop down the sector ranking over a 3-6 month period, or if they fail to improve six months after receiving an amber rating.

During each of these periods, our investment committee will maintain communication, and seek regular updates from the manager of each underlying fund.

Always Balanced

Against a constantly changing world, the most efficient investment outcome is often achieved using a blend of investments across many asset classes. A portfolio of diversified assets can shield a portfolio from the effects of market volatility, beat inflation, and provide long term capital growth as well as a regular income if required. Through our robust asset allocation and fund selection process we are able to offer 10 high-quality portfolios that have been suitably balanced for optimal results.

To ensure each portfolio remains suitably balanced, if necessary, we will rebalance the weighting of assets when required. Rebalancing is a critical component of investment management.

Over time different assets perform at varying levels of positive or negative growth. Therefore, their initial weighting will drift over time and vary within an investor’s portfolio. As a result, higher-risk markets such as Asian or Emerging Market equities may outperform lower risk asset classes such as corporate bonds resulting in a portfolio assuming a higher level of risk than initially intended.

All Yodelar Investment portfolios are continually monitored and rebalanced every quarter to mitigate risk, correct portfolio drift and ensure the asset allocation of each portfolio maintains maximum efficiency.

How do Yodelar Investment Portfolios compare?

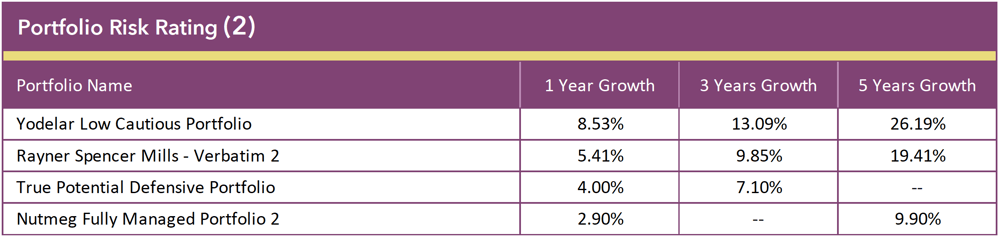

A proportion of the 77 portfolios analysed are from discretionary portfolio managers and are not widely recognised among investors.

However, Discretionary fund management services are widely used by UK financial advisers who utilise their convenient portfolio management service in order to invest and manage their clients’ money. Also included are portfolios from St. James’s Place as well as low-cost Robo advice firms Nutmeg and Wealthify.

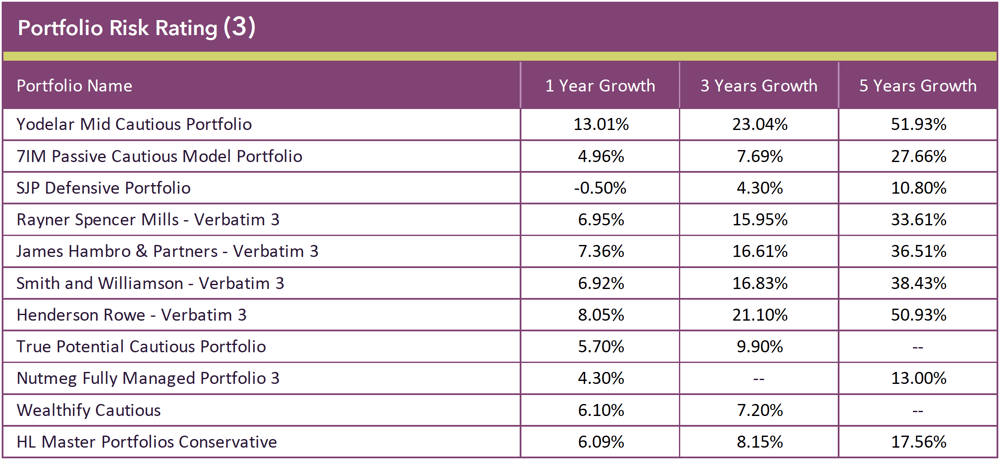

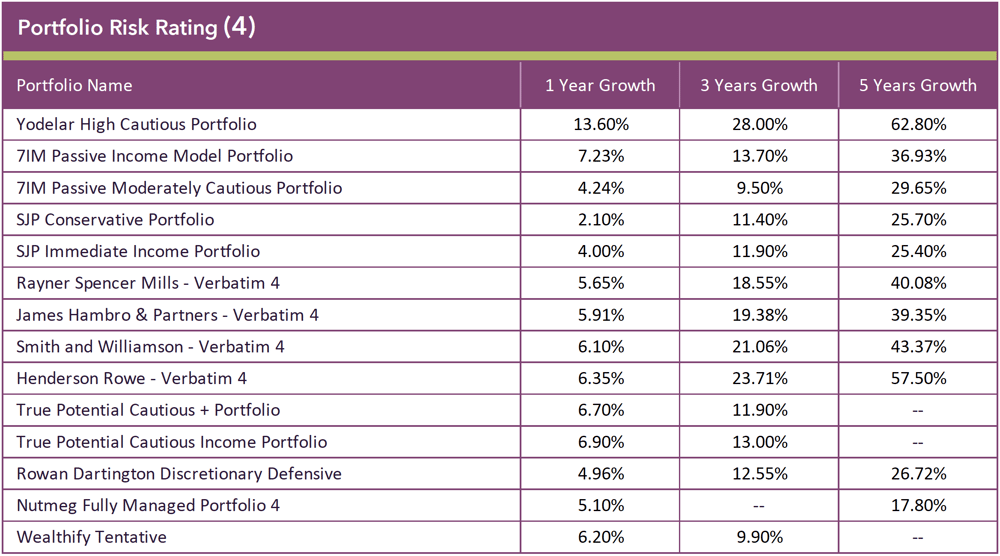

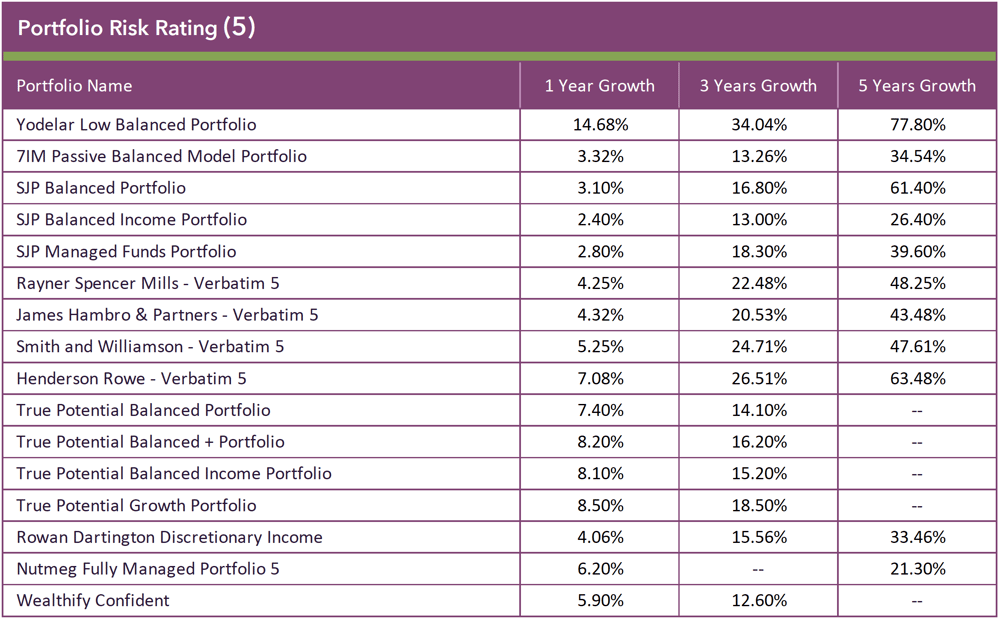

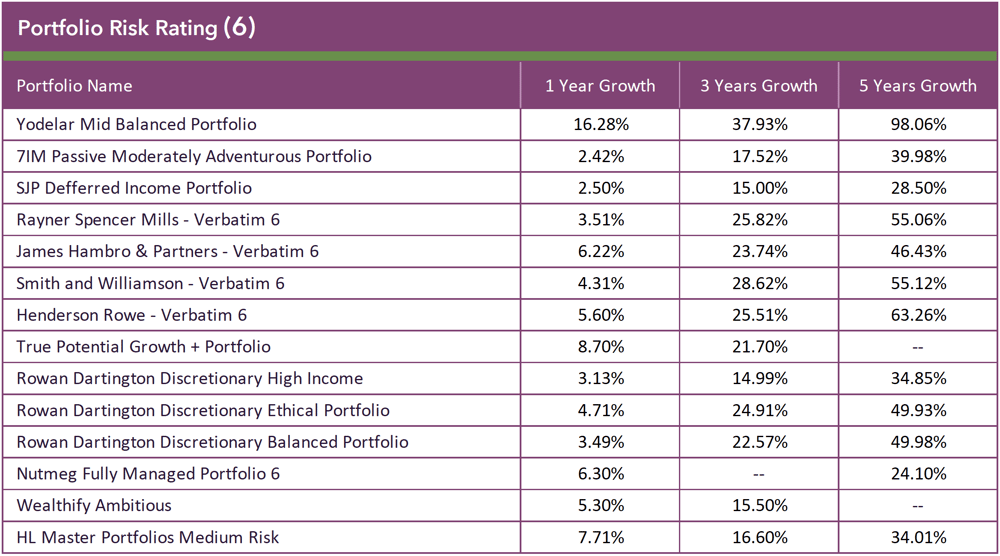

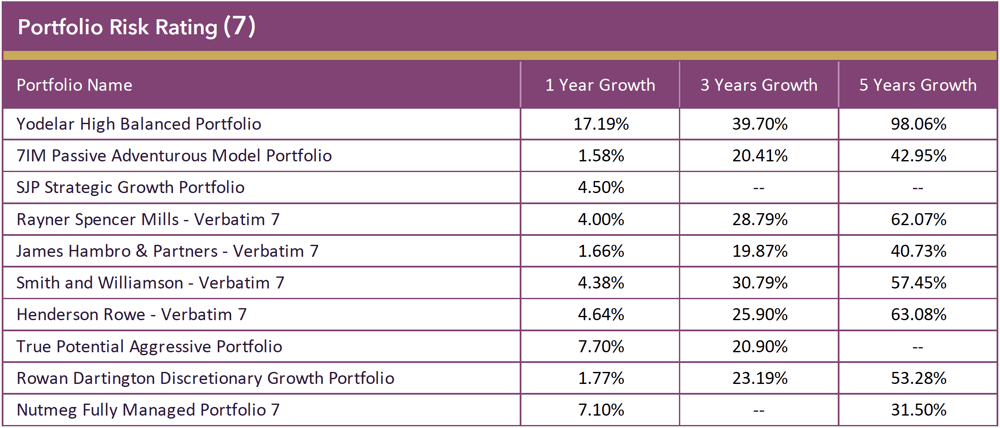

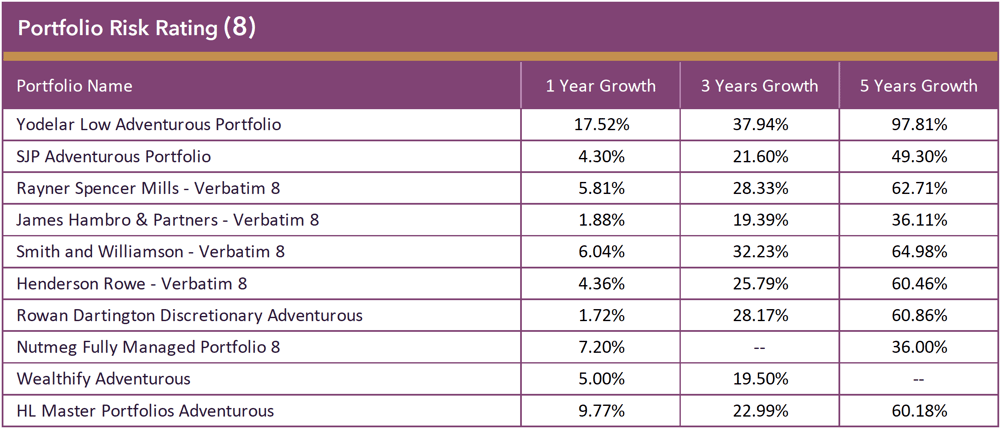

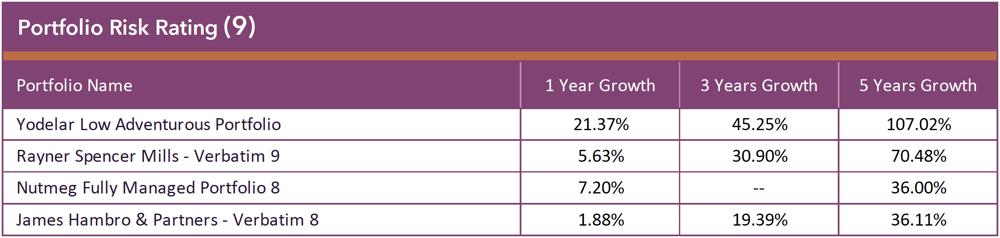

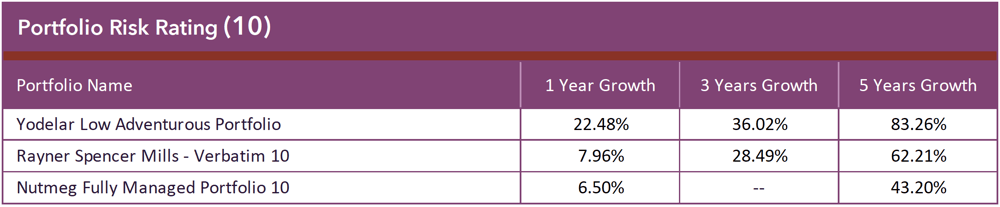

To make it possible to compare each portfolio’s performance they have been allocated a Distribution Technology risk rating of between 1 and 10.

Each of the 77 portfolios were analysed alongside a similar risk-rated Yodelar Investments portfolio. The following tables highlight that each Yodelar Investments portfolio returned considerably higher growth over the periods analysed.

This portfolio is entirely weighted in cash or money market investments. It is a very low-risk, low-growth investment portfolio and provides an alternative to a savings account.

Maintains a high weighting in cash while holding a strategic balance of bonds as well as UK, and European equities.

This portfolio maintains a high weighting in cash while holding a strategic balance of bonds as well as smaller amounts in property, UK, and European equities.

The High Cautious portfolio aims to deliver competitive returns while assuming a low to mid-range level of risk. This portfolio invests primarily in money market investments, government bonds, Sterling corporate bonds, and a mix of global bonds as well as Property. It can also contain small amounts of some high-risk investments such as equities held mainly in the UK and other developed markets.

Suited to a middle of the road investor who leans more towards caution than growth. This portfolio has the objective of consistently delivering above-average to high-end returns through a portfolio weighted across several diverse asset classes such as sterling corporate bonds, UK equities and North American equities.

For investors who are comfortable assuming a moderate level risk for the potential of greater returns. This mid-range portfolio is predominantly weighted in UK and US equities, but contains a balance of other assets that such as Emerging Markets and Japanese equities.

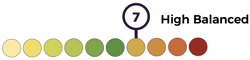

The High Balanced portfolio adopts a moderate to high-risk exposure. This high-mid range portfolio is predominantly weighted in UK, US & Asian equities.

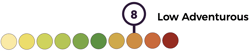

This portfolio focuses on high growth returns by investing in markets with higher risk exposure such as UK, overseas developed and emerging market equities. This portfolio will also contain a small amount of weighting in medium risk investments such as property and higher income types of global bonds.

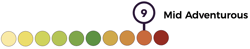

Approximately 40% of this portfolio is invested in emerging market funds and 25% in Asia Pacific equities. These markets offer significant growth potential but have a high risk of losses.

Approximately 60% of this portfolio is invested in emerging markets & 27% in Asia Pacific equities. This very adventurous portfolio follows a very high-risk approach with the aim of delivering very high returns while accepting the possibility of potentially large losses.

A Portfolio To Suit Every Investor

Risk and reward are intrinsically connected. The more risk you take on, the greater the potential reward. Conversely, as you strive for higher growth, the higher the possibility of loss.

There are multiple variations of names used by investment providers to identify the risk associated with their portfolios such as: defensive, cautious or conservative for lower-risk investors to aggressive or adventurous for higher risk investors. The range between risk can vary, and a mid-risk portfolio from one provider could carry the same level of risk as another provider’s high-risk portfolio, making it difficult to compare portfolio performance and suitability.

To ensure each client is aligned with their most suitable portfolio, we undertake a resolute process that includes risk assessments, cash flow analysis and suitability reports. Once undertaken, we can accurately identify the most suitable portfolio for each individual.

Our 10 portfolios range from the lowest risk 1 to the highest risk 10 based on criteria defined by Distribution Technology. These 10 portfolios have different objectives making them suitable investment solutions for a diverse range of investment profiles.